Overview

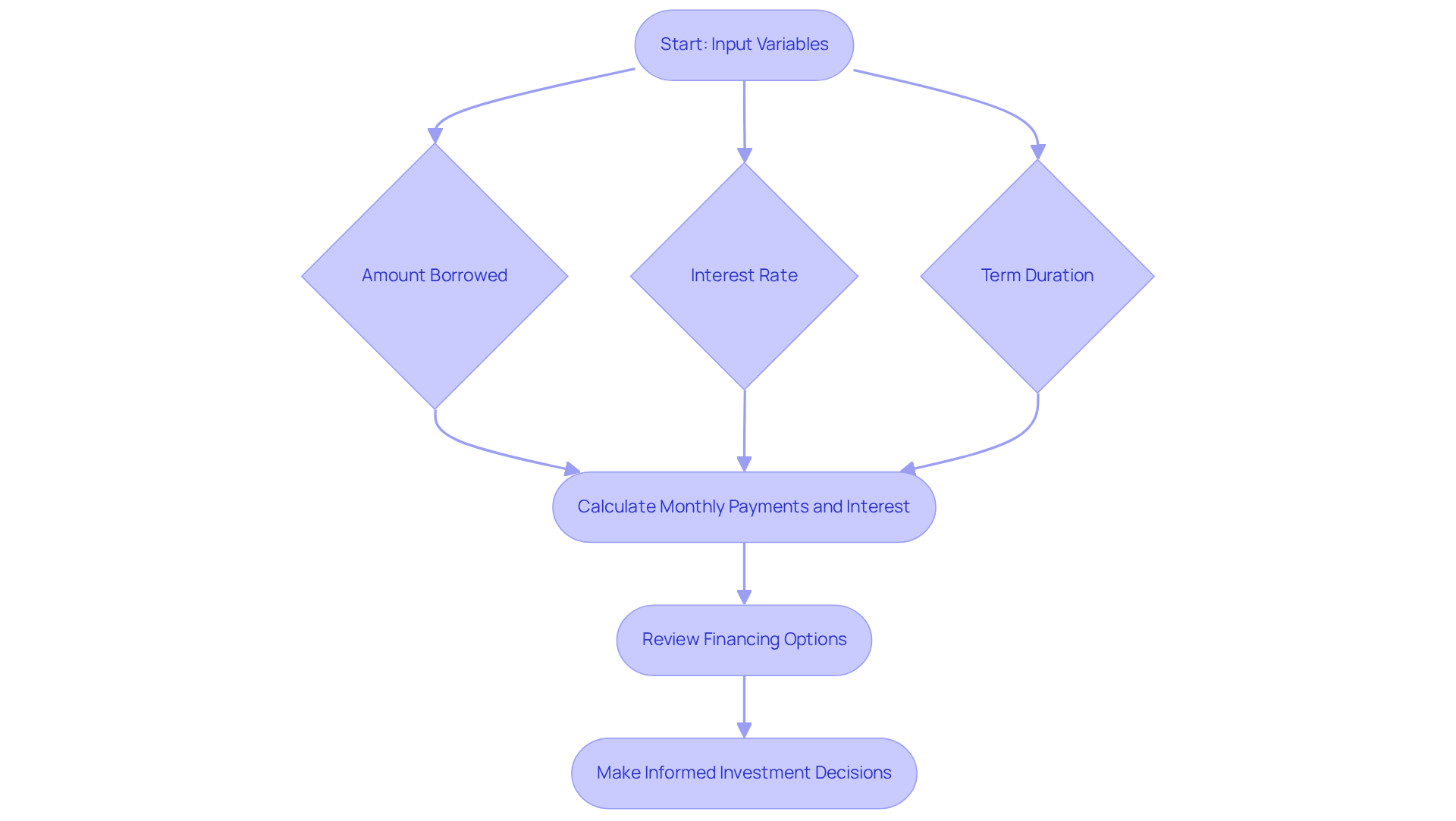

This article highlights the effective utilization of a commercial real estate loan rates calculator in four key steps, aimed at enhancing investment decisions. It begins by guiding users on how to input relevant data accurately. Following this, it emphasizes the importance of analyzing the results to gain valuable financial insights. Furthermore, it discusses the necessity of comparing various loan options to optimize financing choices. Ultimately, this equips users with the essential knowledge needed to make informed and strategic property investments.

Introduction

Navigating the world of commercial real estate financing can be daunting, particularly with fluctuating interest rates and varying loan terms. Here, a commercial real estate loan rates calculator emerges as an essential tool, providing clarity and precision to both investors and professionals. By mastering this calculator, users unlock the potential for informed decision-making and optimized investment strategies. However, with numerous variables at play, one must consider:

- How can they ensure they are maximizing the benefits of this powerful resource?

Understand the Purpose of a Commercial Real Estate Loan Rates Calculator

A commercial real estate loan rates calculator is an indispensable resource for both investors and real estate professionals. This tool, as a commercial real estate loan rates calculator, effectively calculates monthly payments, interest expenses, and the overall affordability of borrowing by allowing users to input variables such as the amount borrowed, interest rate, and term duration.

For example, the average mortgage rate for a 5-year BANK loan stands at 5.86%, while a 7-year AGENCY loan averages 5.24%. This tool not only clarifies financing options but also equips users with the insights necessary to effectively use the commercial real estate loan rates calculator for making informed property investment decisions.

Real estate experts emphasize that utilizing a commercial real estate loan rates calculator can significantly simplify the decision-making process, ultimately leading to more advantageous investment outcomes. As Kristoffer Enger, CEO of Palmeras Property Development, observed, collaborating with financial brokers has expedited purchasing processes and enhanced profit margins.

Understanding the functions of the commercial real estate loan rates calculator, including the potential for balloon payments and the importance of terms, empowers investors to deftly navigate the complexities of commercial financing and refine their financial strategies.

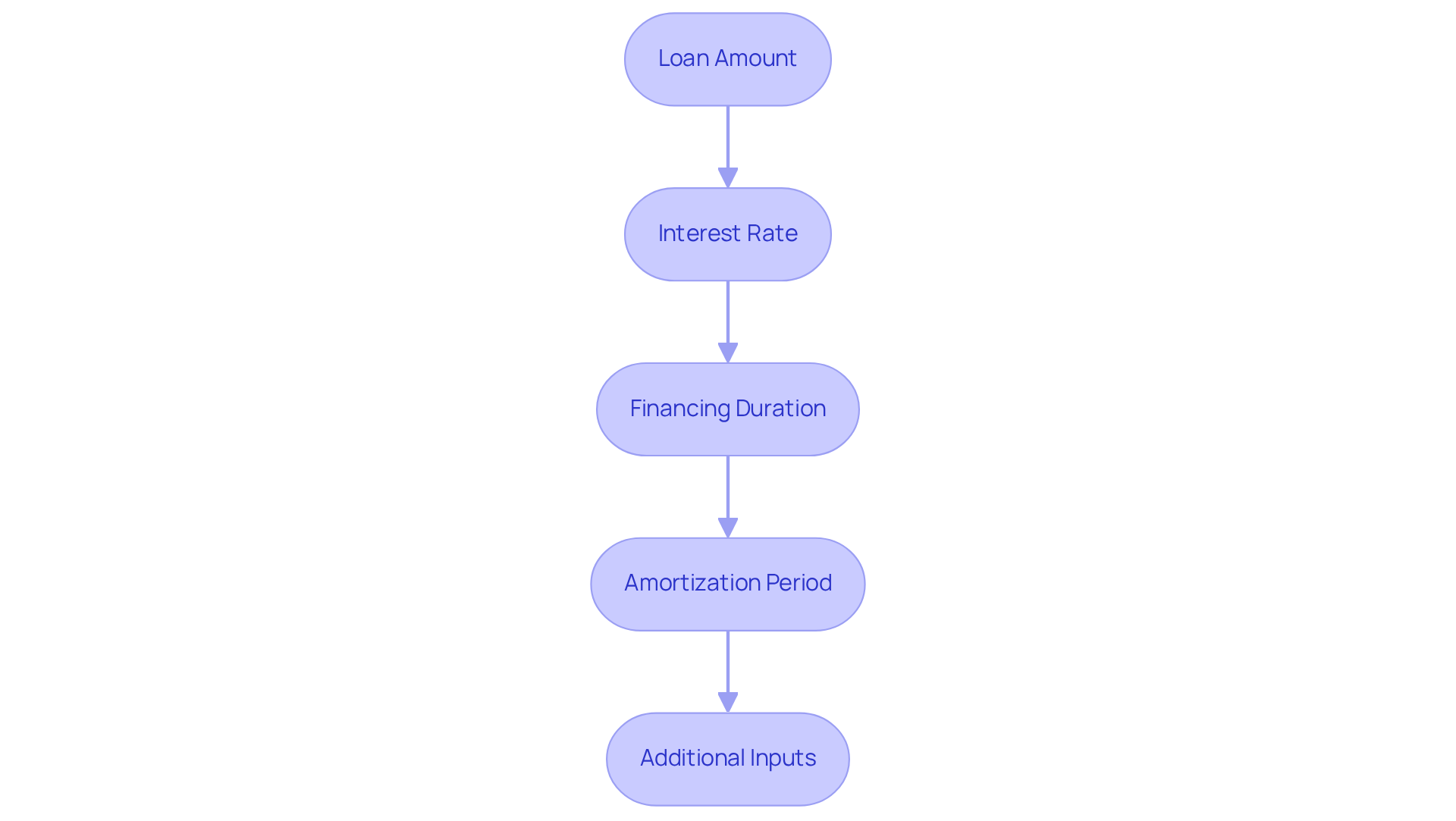

Input Relevant Data into the Calculator

To effectively utilize a Commercial Real Estate Loan Rates Calculator, follow these steps to input the necessary data:

- Loan Amount: Enter the total amount you wish to borrow, reflecting either the property's purchase price or the refinancing amount.

- Interest Rate: Input the annual interest rate provided by the lender. Current average rates for commercial financing are approximately 7.25% for a 10-year mortgage and 6.90% for a 30-year mortgage, but these can vary based on market conditions and your creditworthiness.

- Financing Duration: Indicate the duration of the financing, usually in years (e.g., 15, 20, or 30 years). This option will affect your monthly charges and the overall interest paid throughout the duration of the financing.

- Amortization Period: If applicable, enter the amortization period, which may differ from the loan term. This period determines how your payments are structured.

- Additional Inputs: Some computing devices may require extra information, such as property taxes, insurance, or HOA fees, to provide a comprehensive view of your monthly obligations.

By accurately entering this data into the commercial real estate loan rates calculator, you ensure that the tool yields precise and actionable results, aiding in your investment decisions.

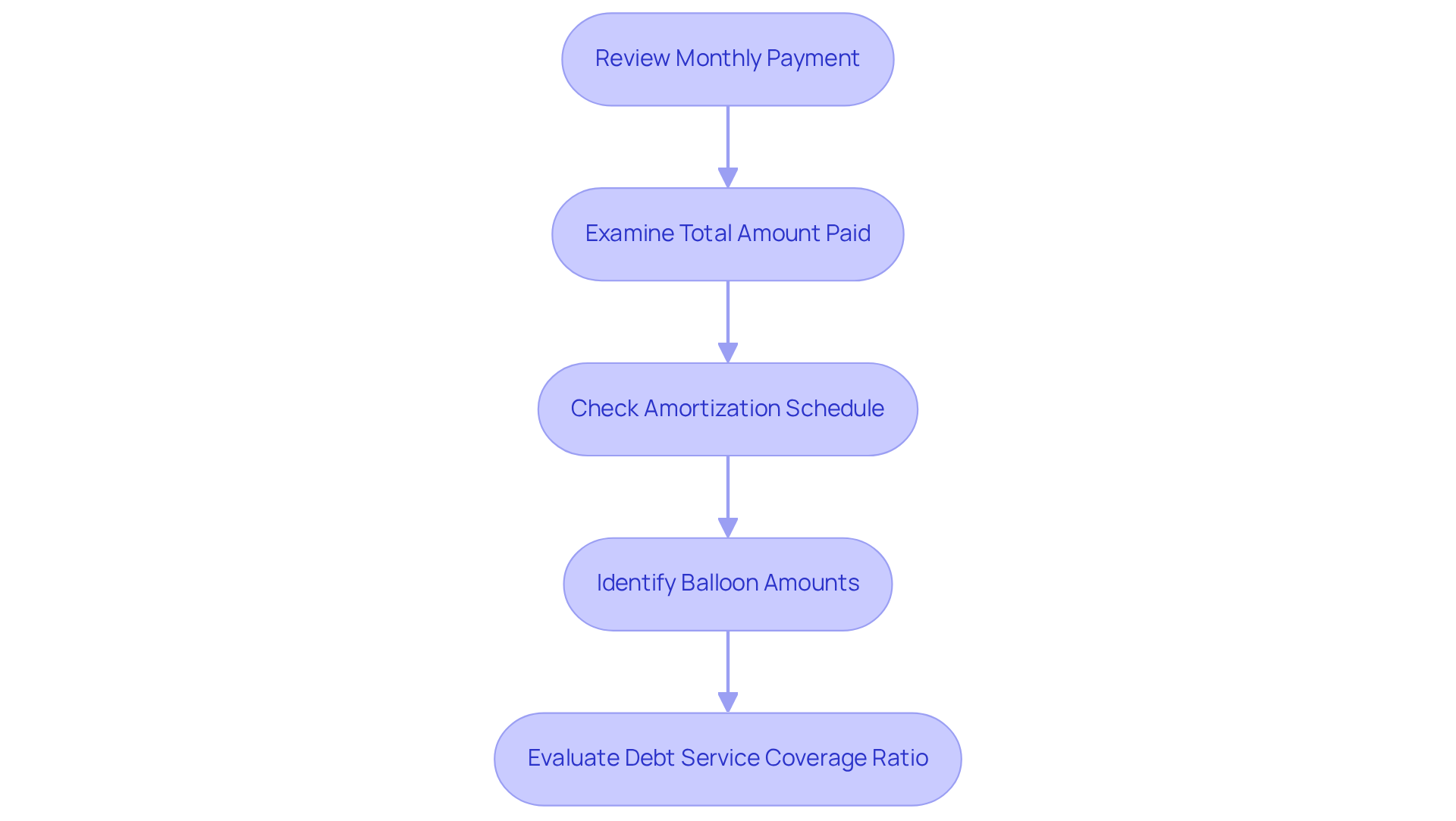

Analyze the Calculator Results for Investment Insights

Once you have inputted your data and received the results from the calculator, it’s time to analyze the output:

-

Monthly Payment: Review the estimated monthly payment. This figure is essential for budgeting and assessing if the financial assistance aligns with your financial plan. As real estate investor Louis Glickman wisely noted, "The best investment on Earth is earth," underscoring the importance of understanding your financial commitments.

-

Total Amount Paid: Examine the overall charges you will incur throughout the duration of the borrowing. This insight helps you understand the cost of borrowing and can significantly influence your decision on whether to proceed with the commercial real estate loan rates calculator. For context, mortgage rates reached their highest point at 7.79% in 2023, which greatly affects overall expense costs.

-

Amortization Schedule: If provided, examine the amortization schedule. This breakdown illustrates how much of each installment contributes to principal compared to interest, assisting you in understanding how swiftly you will accumulate equity in the property.

-

Balloon Amounts: If relevant, mention any balloon amounts owed at the conclusion of the financing period. Understanding these amounts can help you plan for future financial obligations.

-

Debt Service Coverage Ratio (DSCR): If the tool offers this metric, evaluate it to determine your capacity to meet payment obligations with your income. A DSCR greater than 1 indicates that your income exceeds your debt obligations, which is a positive sign for lenders. Currently, super-prime borrowers constituted 80.3% of those who secured a mortgage in 2024, reflecting a strong position in the market.

By carefully analyzing these results, you can gain valuable insights into the viability of your investment and make informed decisions. Remember, 90% of all millionaires achieve wealth through property ownership, emphasizing the significance of making informed investment choices based on numerical outcomes.

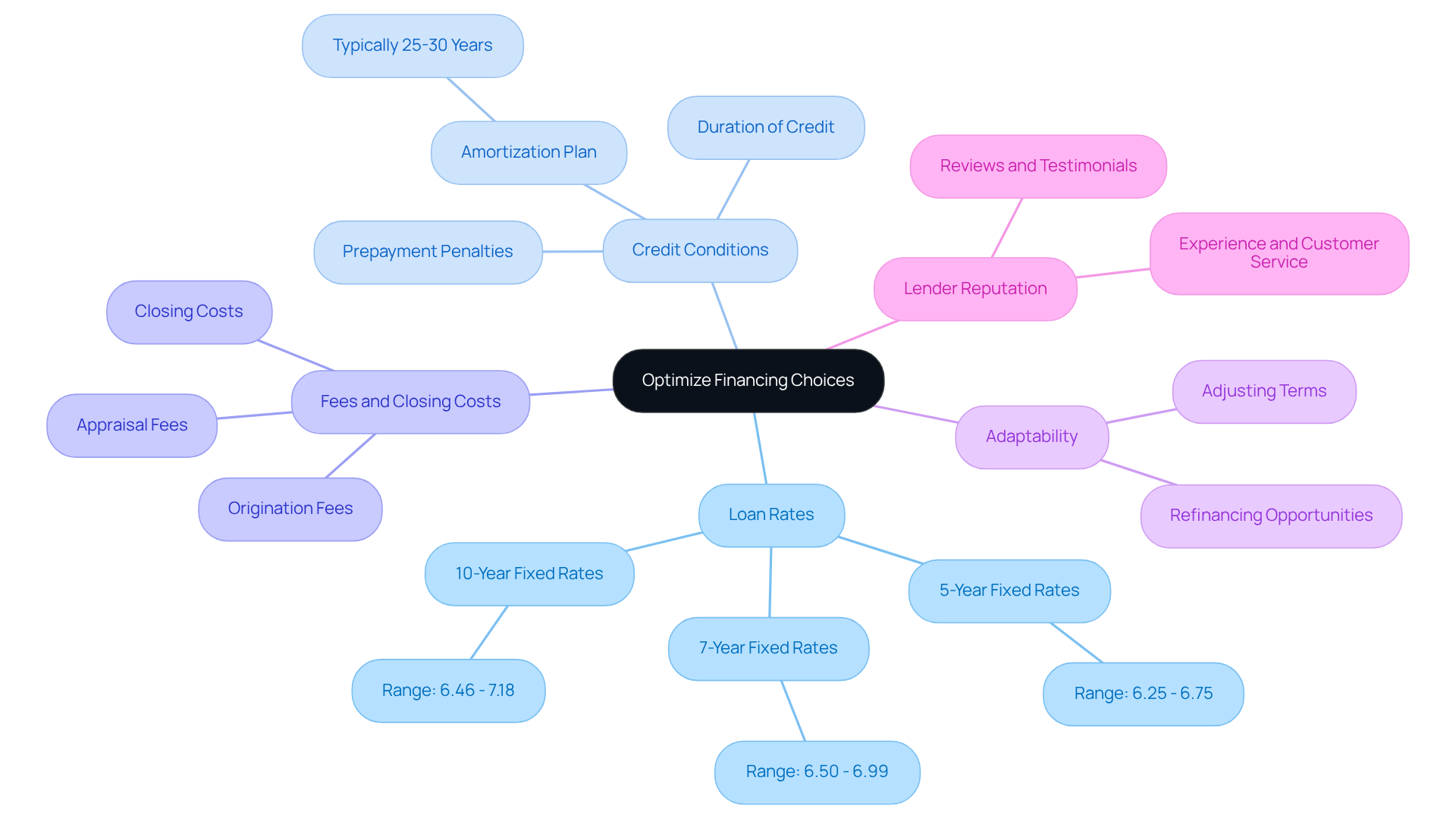

Compare Loan Options to Optimize Financing Choices

To optimize your financing choices after analyzing the results from the commercial real estate loan rates calculator, it is essential to effectively compare different loan options.

Loan Rates: Start by gathering quotes from various lenders to evaluate their loan rates. As of 2025, commercial mortgage rates for 5-Year Fixed products range from 6.25% to 6.75%, 7-Year Fixed products from 6.50% to 6.99%, and 10-Year Fixed products from 6.46% to 7.18%. Using a commercial real estate loan rates calculator can help you find a reduced rate that significantly lowers your total borrowing expense, making it crucial to compare options.

Credit Conditions: Next, evaluate the conditions offered by different lenders, including the duration of the credit and any prepayment penalties. While shorter borrowing periods may lead to higher monthly payments, they often result in lower total interest expenses over the duration of the debt, which can be beneficial for cash flow management. Furthermore, most credits typically include an amortization plan of 25-30 years.

Fees and Closing Costs: Additionally, consider any extra charges related to the mortgage, such as origination fees, appraisal fees, and closing costs. These expenses can accumulate and impact your overall financing costs, so it is vital to factor them into your calculations.

Adaptability: Assess the adaptability of each financing option. Some lenders may offer opportunities for refinancing or adjusting terms in the future, which can be advantageous if your financial situation evolves or if market conditions change.

Lender Reputation: Finally, investigate the reputation of each lender. Seek out reviews and testimonials from other borrowers to ensure you select a reliable and trustworthy lender. A lender's experience and customer service can significantly influence your borrowing experience.

By thoroughly comparing these factors, you can use a commercial real estate loan rates calculator to evaluate loans ranging from $1,500,000 to over $10,000,000, enabling you to make an informed decision that aligns with your financial objectives and maximizes your investment potential.

Conclusion

Utilizing a commercial real estate loan rates calculator is essential for anyone navigating the complexities of property investment. This powerful tool simplifies the calculation of monthly payments and interest, equipping investors with the insights needed to make informed financial decisions. By effectively leveraging the calculator, users can clarify their financing options and enhance their investment outcomes.

This guide has outlined the critical steps to master the commercial real estate loan rates calculator. From understanding its purpose and inputting relevant data to analyzing the results and comparing loan options, each stage plays a vital role in optimizing financing choices. Key insights, such as the importance of the debt service coverage ratio and the impact of varying loan rates, underscore the necessity of thorough analysis in securing favorable financing.

Ultimately, the significance of mastering a commercial real estate loan rates calculator cannot be overstated. As the landscape of real estate financing continues to evolve, the ability to accurately assess and compare loan options is crucial for achieving investment success. Embracing this tool can lead to more strategic financial decisions, empowering investors to maximize their potential in the competitive world of commercial real estate.