Overview

This article's primary focus is to elucidate the significance and application of the Debt Service Coverage Ratio (DSCR) calculator in real estate, a vital tool for ensuring financial success. A DSCR exceeding 1 signifies that a property generates adequate income to meet its debt obligations, a crucial insight for making informed financing decisions. Throughout the article, detailed calculations and risk assessments support this assertion, underscoring the importance of understanding DSCR in the context of real estate investments.

Introduction

Navigating the complexities of real estate investment can indeed be overwhelming. However, one financial metric shines brightly for investors: the Debt Service Coverage Ratio (DSCR). This vital ratio not only assesses an asset's capacity to produce adequate income to fulfill its debt obligations but also significantly influences financing choices and investment strategies.

Despite its importance, many investors struggle with the effective calculation and interpretation of this crucial figure. What obstacles emerge when evaluating DSCR, and how can mastering its calculation lead to prosperous real estate endeavors?

Understand the Debt Service Coverage Ratio (DSCR)

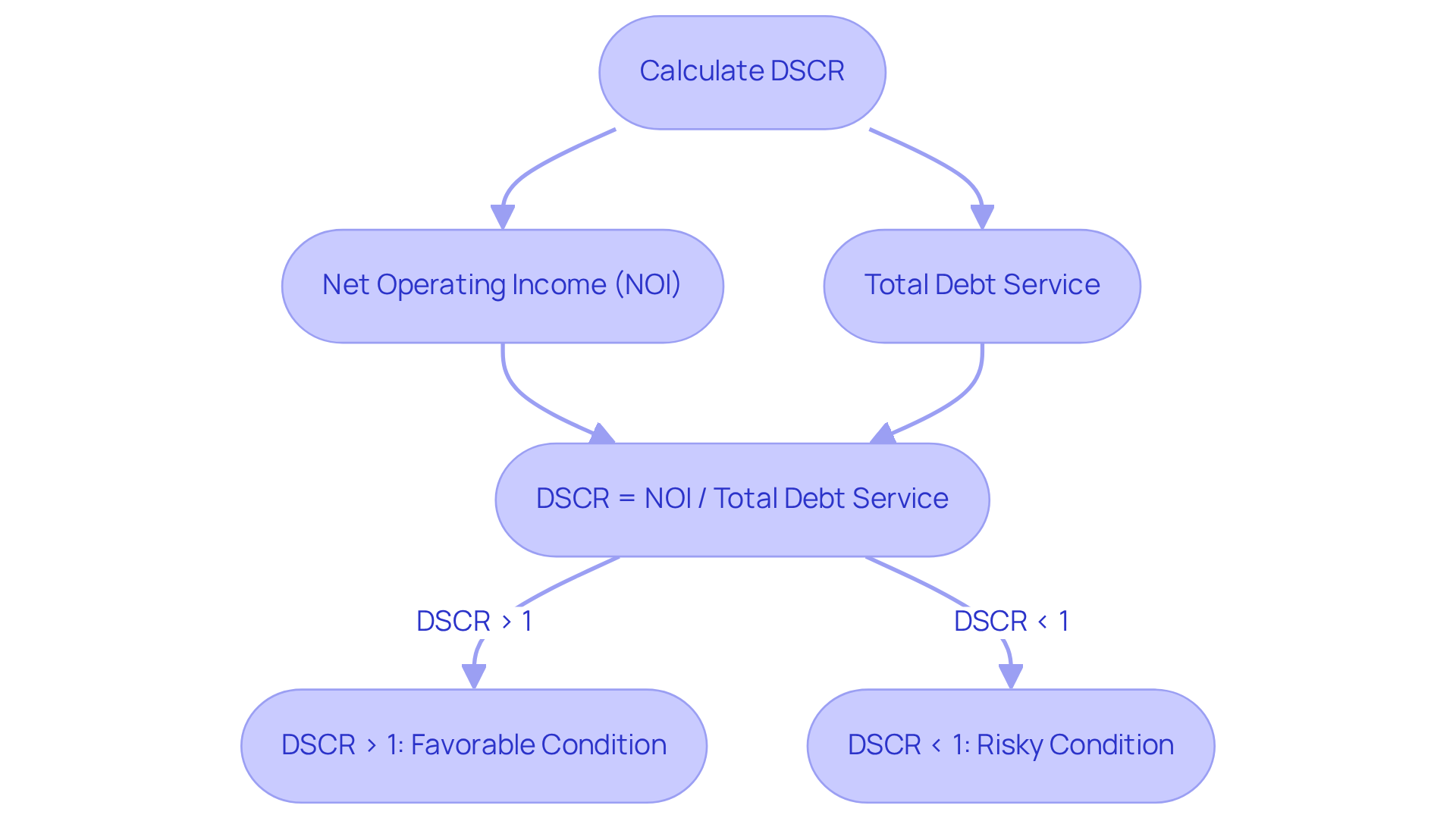

The dscr calculator real estate serves as a crucial financial indicator for evaluating a real estate asset's ability to generate sufficient revenue to meet its financial obligations. This ratio is calculated by dividing the net operating income (NOI) of the asset by the total debt service, which encompasses the total principal and interest payments owed on the loan. The formula is articulated as follows:

DSCR = Net Operating Income / Total Debt Service

A DSCR exceeding 1 signifies that the property produces more income than necessary to cover its debt payments, a favorable condition for both lenders and investors. Conversely, a DSCR below 1 suggests potential difficulties in meeting debt obligations, posing a risk to investors and lenders alike. Understanding the importance of the dscr calculator real estate ratio is crucial for making informed financing decisions in real estate investments.

Gather Necessary Financial Data for DSCR Calculation

To effectively calculate the Debt Service Coverage Ratio (DSCR), it is crucial to gather specific financial data:

-

Net Operating Earnings (NOI): This figure represents the total revenue generated from the asset after deducting operating expenses. Include all income sources, such as rent and additional fees, while subtracting costs like maintenance, property management, and taxes. A robust NOI is essential, as it directly influences the calculations made with the dscr calculator real estate for the debt service coverage ratio. Industry specialists highlight that using a dscr calculator real estate, a debt service coverage ratio of at least 1.25 is viewed as a strong standard, signifying adequate net cash flow to meet financial obligations and unforeseen costs.

-

Total Debt Service: This encompasses all principal and interest payments due on the property loan. If multiple loans are involved, sum the payments for each to arrive at a comprehensive total. While the present average total financial obligations for real estate investments can vary, it is essential to use a dscr calculator real estate to comprehend your responsibilities and sustain a healthy coverage ratio. For instance, a business with a net operating profit of $100,000 and total debt service of $60,000 would have a calculated DSCR of approximately 1.67.

-

Asset Valuation: Understanding the current market worth of the asset assists in evaluating its revenue potential and related risks. This valuation can also inform your investment decisions and financing strategies.

-

Market Comparables: Researching similar properties in the area provides valuable context for expected income and expenses, refining your calculations. This comparative analysis can highlight trends and benchmarks that are critical for accurate forecasting.

-

Caution on Common Errors: Be aware that miscalculating the debt service coverage ratio can lead to significant financial misjudgments. It is crucial to consult various documents to accurately determine principal repayments, as these amounts are not always reflected in standard financial statements.

By meticulously gathering this data, you will be well-prepared to use the dscr calculator real estate to compute the debt service coverage ratio precisely, ensuring a solid foundation for your investment decisions.

Calculate the DSCR Using the Collected Data

To calculate the Debt Service Coverage Ratio (DSCR) using your financial data, follow these steps:

-

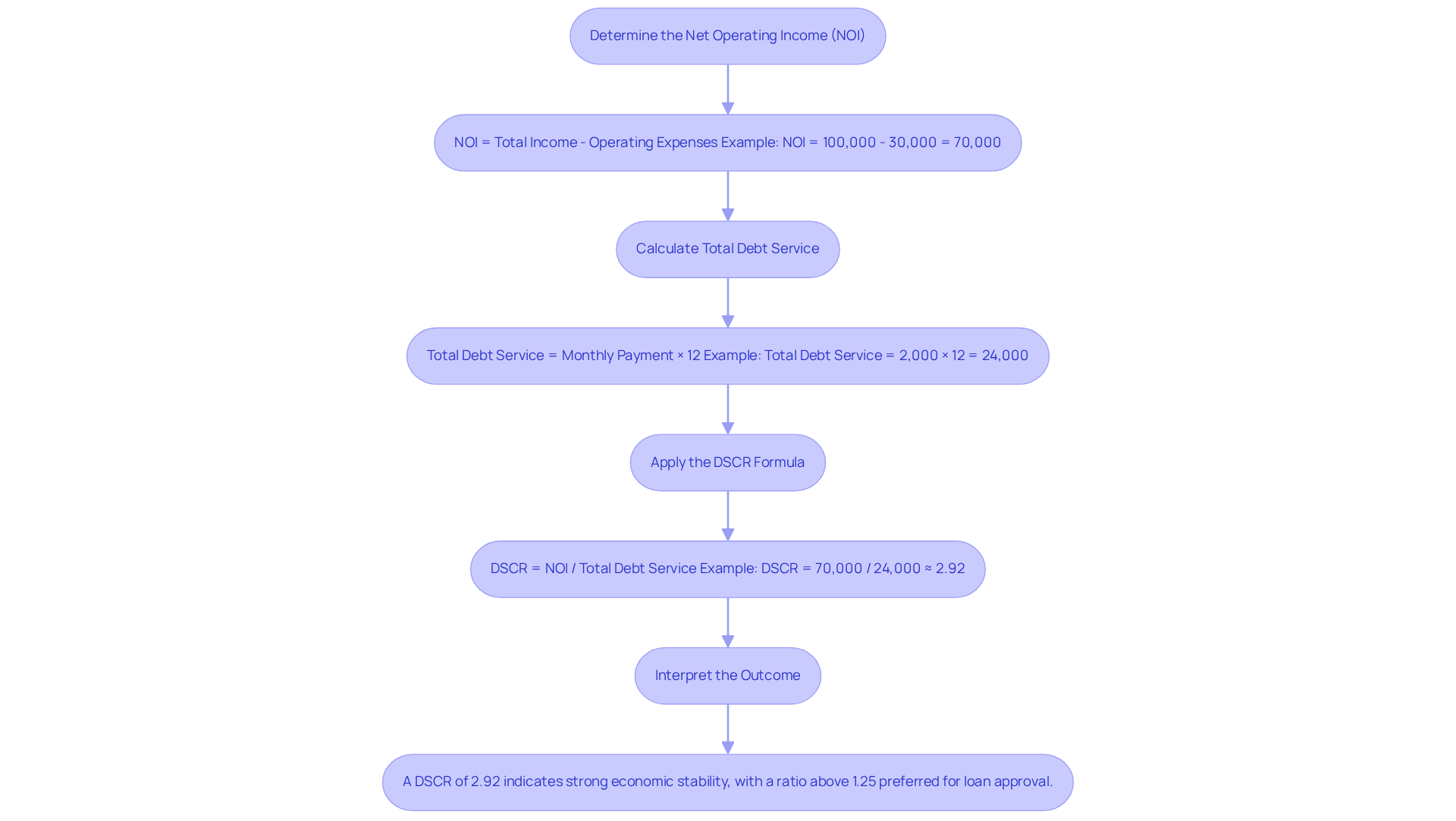

Determine the Net Operating Income (NOI): Calculate the NOI by subtracting operating expenses from total revenue. For instance, if your total income is $100,000 and your operating expenses are $30,000, the calculation would be:

NOI = Total Income - Operating Expenses

NOI = 100,000 - 30,000 = 70,000 -

Calculate Total Debt Service: This involves summing all principal and interest payments. For example, if your monthly mortgage payment is $2,000, the annual total debt service would be:

Total Debt Service = Monthly Payment × 12

Total Debt Service = 2,000 × 12 = 24,000 -

Apply the DSCR Formula: Insert your values into the DSCR formula:

DSCR = NOI / Total Debt Service

Using the previous examples:

DSCR = 70,000 / 24,000 ≈ 2.92 -

Interpret the Outcome: A debt service coverage ratio of 2.92 signifies that the asset produces almost three times the revenue required to meet its financial commitments, indicating robust economic stability. Numerous lenders favor a minimum debt service coverage ratio of 1.20 to 1.25 for loan approval, with a ratio exceeding 2.00 regarded as very strong. This metric is essential for evaluating the feasibility of real estate investments, as it indicates the property's capacity to produce adequate cash flow to satisfy financial commitments, which can be assessed using a dscr calculator real estate. According to industry standards, a debt service coverage ratio greater than 1.25 is optimal for securing favorable loan terms, as it demonstrates a strong ability to manage debt.

Interpret the DSCR Results for Financing Decisions

Understanding the dscr calculator real estate is crucial for making informed financing decisions in real estate. Here’s a breakdown of the implications of your DSCR results:

-

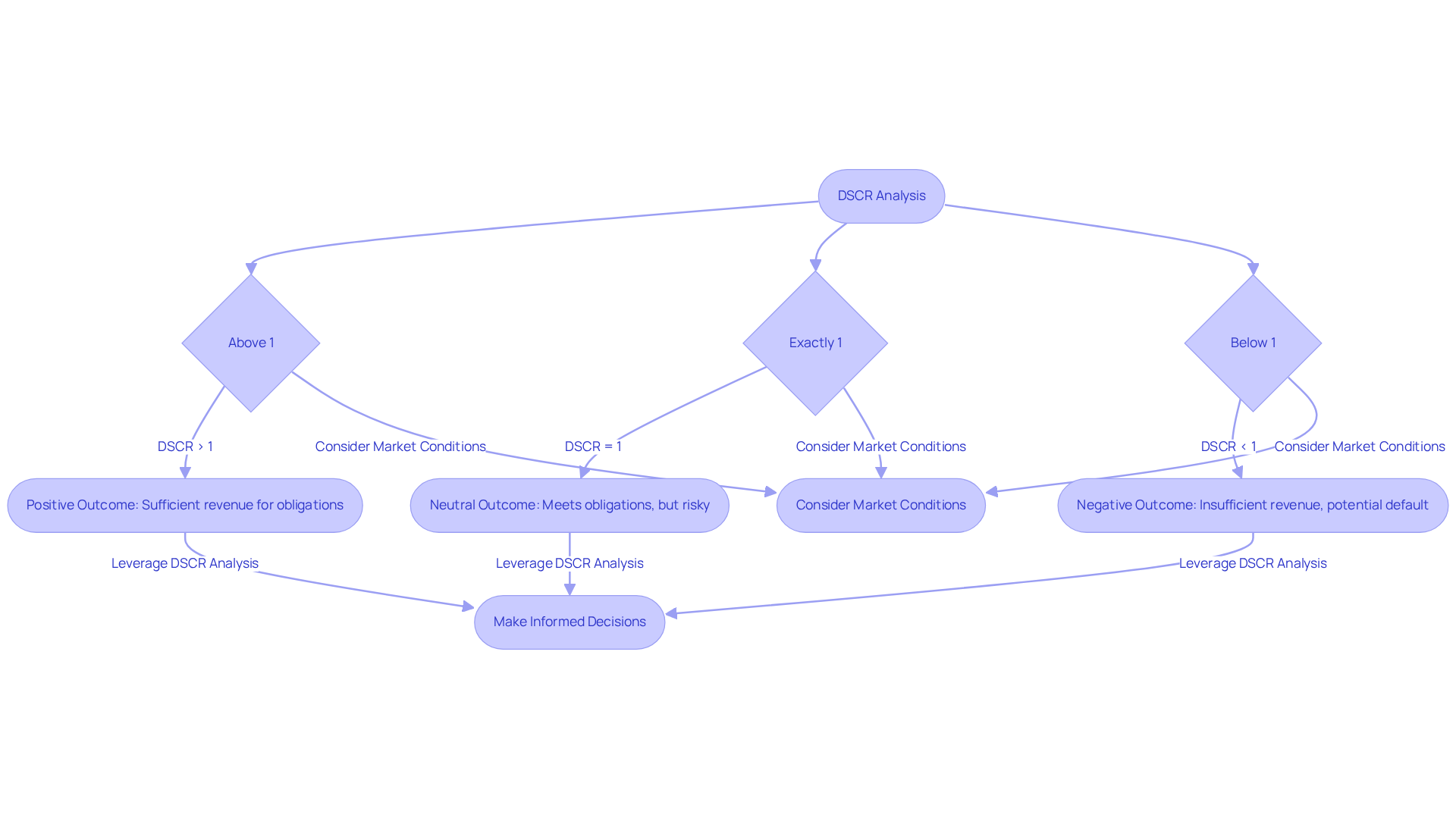

A ratio exceeding 1 demonstrates that the asset generates sufficient revenue to meet its financial commitments, a factor generally viewed positively by lenders. For instance, an asset with a debt service coverage ratio of 1.25 produces 25% more than necessary to fulfill its obligations, indicating a reduced risk profile for lenders. This aligns with common DSCR requirements for loans, typically ranging from 1.2 to 1.5.

-

A ratio of exactly 1 signifies that the asset merely meets its financial obligations. While this is technically acceptable, it leaves little room for error. Lenders may consider this a riskier investment, potentially resulting in higher interest rates or stricter loan terms. As commercial real estate broker Jeff Brandon notes, "A debt service coverage ratio of 1.0 shows a company produces sufficient cash to meet its payment obligations, but it offers no buffer for unforeseen costs."

-

A ratio below 1 indicates that the asset fails to generate enough revenue to cover its debt commitments, raising concerns for both lenders and investors. For example, a property with a debt service coverage ratio of 0.8 reflects significant financial strain, suggesting it may not be a viable investment. Ratios under 1.00 can signal potential financial difficulties.

-

Consider Market Conditions: Always contextualize your DSCR results within the broader market landscape. A solid debt service coverage ratio in a declining market may still carry risks, while a lower DSCR in a booming market might be more acceptable. Understanding these dynamics is vital for accurate risk assessment. For example, an asset with a strong DSCR may face challenges if the market experiences downturns.

-

Make Informed Decisions: Leverage your DSCR analysis to inform your financing strategies. This could involve determining whether to pursue a loan, seek additional investment, or reconsider the asset entirely. Understanding the implications of your investment decisions can significantly be aided by using a DSCR calculator real estate, ensuring that your strategy aligns with your financial objectives. For instance, if a property generates an annual income of $120,000 with operating expenses of $50,000, resulting in a DSCR of 1.08, it may warrant further investigation before proceeding with financing.

Conclusion

Mastering the Debt Service Coverage Ratio (DSCR) calculator is indispensable for anyone aiming to excel in the real estate market. Understanding how to accurately assess an asset's capacity to generate income sufficient to meet its debt obligations empowers investors to make informed decisions that profoundly influence their financial success. The DSCR serves as a pivotal metric, steering both investment strategies and financing options.

In this article, we have thoroughly examined the key components of the DSCR, including the calculation process and the requisite financial data. From determining the Net Operating Income (NOI) to comprehending total debt service, each step is crucial in deriving a reliable DSCR value. Moreover, interpreting the results within the context of market conditions enables investors to effectively gauge risk and make strategic financing decisions that align with their financial objectives.

Ultimately, leveraging the DSCR calculator not only enhances the capability to evaluate potential investments but also empowers investors to navigate the complexities of real estate financing. By prioritizing a robust DSCR, individuals can position themselves for success, ensuring their investments are both viable and profitable over time. Embracing this knowledge and applying it diligently can lead to informed choices that pave the way for sustainable growth in the real estate sector.