Overview

This article underscores the critical role of mastering commercial real estate market data in informing strategic investment decisions. Understanding various data types, employing effective analytical tools, and interpreting market trends are indispensable for investors aiming to maximize returns and navigate potential risks in the ever-evolving real estate landscape.

As the market continues to shift, leveraging accurate data becomes not just beneficial, but essential for informed decision-making. Investors who grasp these insights will find themselves better equipped to seize opportunities and mitigate challenges, ultimately enhancing their investment strategies.

Introduction

Navigating the intricate world of commercial real estate requires more than just intuition; it demands a solid grasp of market data fundamentals. Investors stand to gain significant advantages by understanding various data types, credible sources, and key market indicators that shape investment landscapes.

However, with the ever-evolving nature of the market, how can one effectively interpret trends and integrate these insights into strategic investment decisions?

This article delves into mastering commercial real estate market data, equipping investors with the knowledge and tools necessary to thrive in a competitive environment.

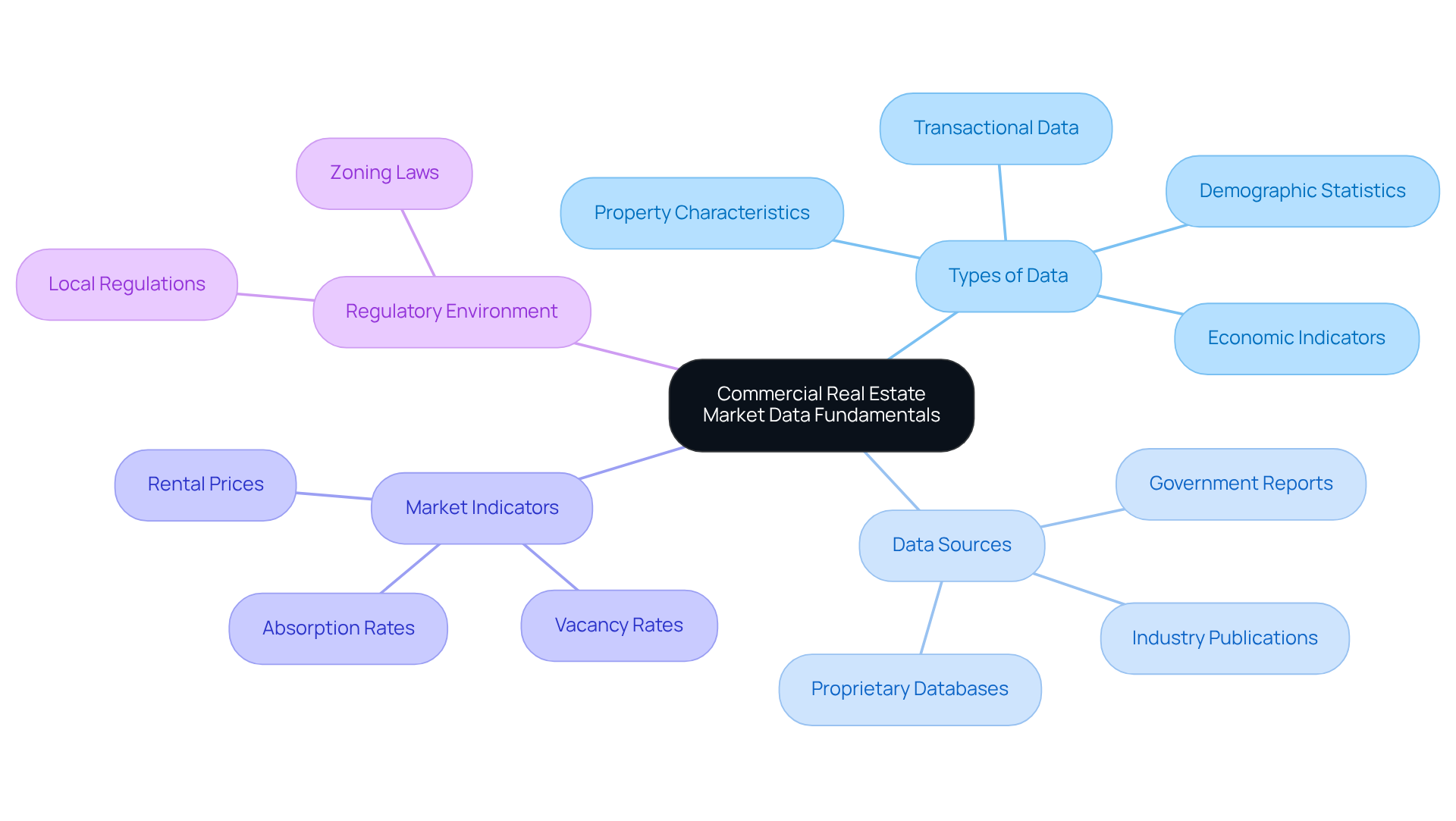

Understand Commercial Real Estate Market Data Fundamentals

To navigate the commercial real estate market data effectively, investors must grasp the fundamental components that shape the landscape. This understanding of commercial real estate market data is essential for informed decision-making and strategic investment.

-

Types of Data: Investors should familiarize themselves with various data types, including transactional data, property characteristics, economic indicators, and demographic statistics. Each type is vital for producing thorough insights based on commercial real estate market data. For instance, comprehending the median sales price of current homes—predicted to decrease to $380,000 by the end of 2023—can guide investment strategies by highlighting potential fluctuations in the sector.

-

Data Sources: Identifying credible data sources is essential. Government reports, industry publications, and proprietary databases provide a wealth of information. Notably, the commercial real estate market data in the U.S. indicates that the sector is anticipated to reach approximately $25.79 trillion by 2025, with a forecasted annual growth rate of 2.22% from 2025 to 2029. This underscores the importance of utilizing diverse sources to enhance the reliability of insights.

-

Market Indicators: Recognizing key market indicators such as vacancy rates, rental prices, and absorption rates is vital. Current statistics indicate that the rental vacancy rate for homes in the southern United States was 7.8% in Q2 2023, while office vacancies rose to 16.5% post-pandemic. Comparing these figures with historical data can illustrate trends and their implications for investors.

-

Regulatory Environment: Understanding local regulations and zoning laws is crucial for assessing property values and potential opportunities. Awareness of these elements can significantly impact decision-making in specific areas, particularly as the commercial real estate sector adapts to evolving requirements.

By mastering these fundamentals, investors can establish a strong foundation for analyzing commercial real estate market data and making informed, strategic investment choices.

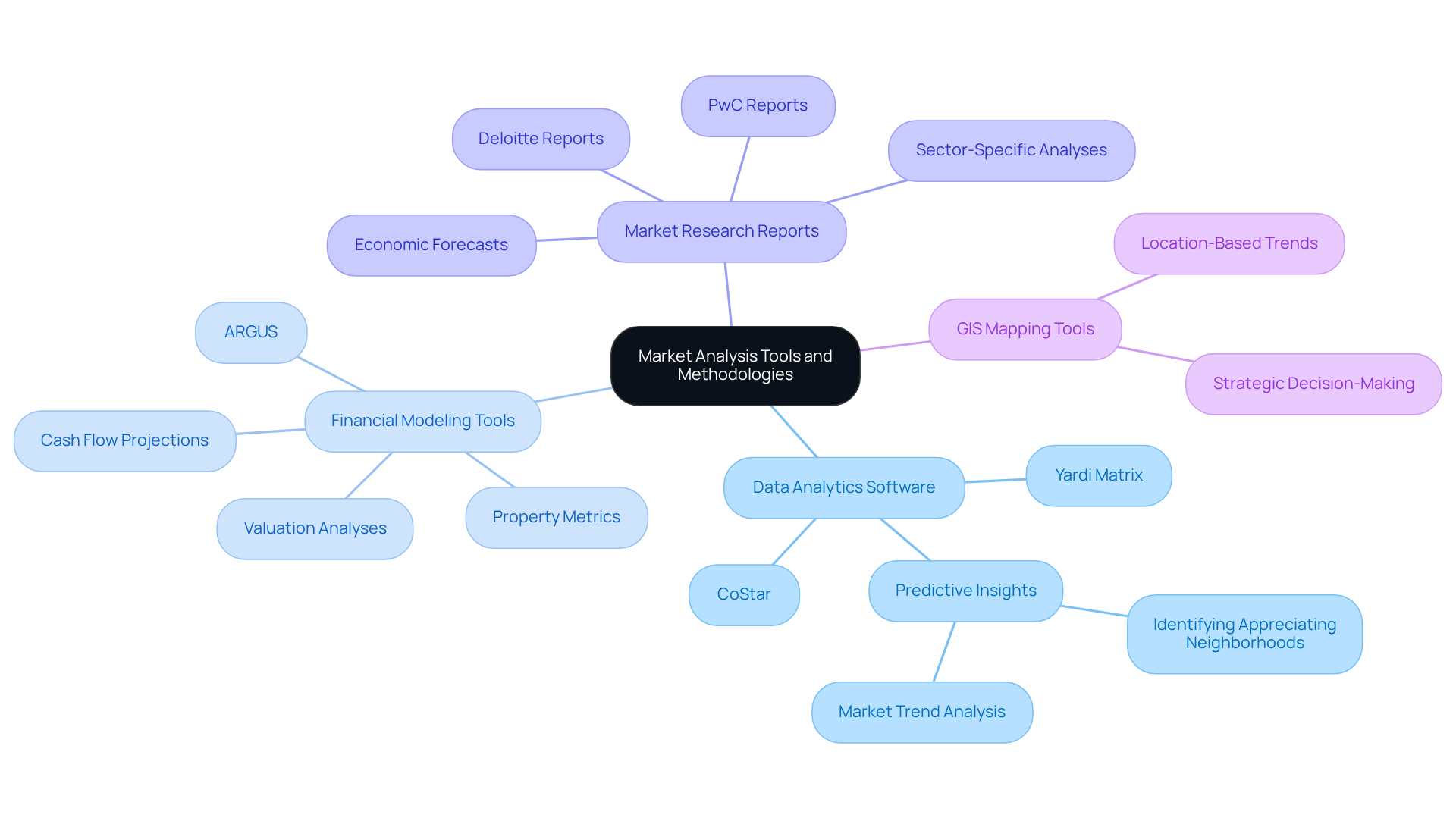

Utilize Effective Tools and Methodologies for Market Analysis

Investors should leverage a diverse array of tools and methodologies to conduct a comprehensive analysis of the industry. Key recommendations include:

- Data Analytics Software: Platforms like Yardi Matrix or CoStar provide access to extensive commercial real estate data and analytics. These tools deliver insights into market trends, property performance, and competitive analysis by utilizing commercial real estate market data, enabling informed decision-making. Real estate analytics software offers predictive insights to identify appreciating neighborhoods, which is crucial for investors aiming to make informed choices.

- Financial Modeling Tools: Financial modeling software such as ARGUS or Property Metrics is essential for assessing potential returns and risks. These tools facilitate the creation of detailed cash flow projections and valuation analyses, which are vital for evaluating investment viability.

- Market Research Reports: Regular consultation of industry reports from reputable sources like Deloitte and PwC is advisable. These reports provide valuable insights into industry trends, economic forecasts, and sector-specific analyses, assisting investors in staying ahead of shifts. Real estate is often regarded as a safeguard against inflation, as its values typically rise during inflationary periods, underscoring the importance of comprehensive analysis in the sector.

- GIS Mapping Tools: Geographic Information Systems (GIS) should be utilized to visualize information geographically. This approach aids in identifying location-based trends and opportunities, thereby enhancing strategic decision-making.

By employing these tools and methodologies, investors can significantly enhance their market analysis capabilities through the utilization of commercial real estate market data, leading to more strategic and informed choices. As Andrew Chen states, "Real estate analytics software assists professionals in utilizing information to maximize profitability, minimize risks, and achieve a competitive advantage." It is also crucial to select software that integrates seamlessly with existing systems to avoid common pitfalls. Ultimately, the strategic use of these tools is expected to improve decision-making and enhance investment strategies.

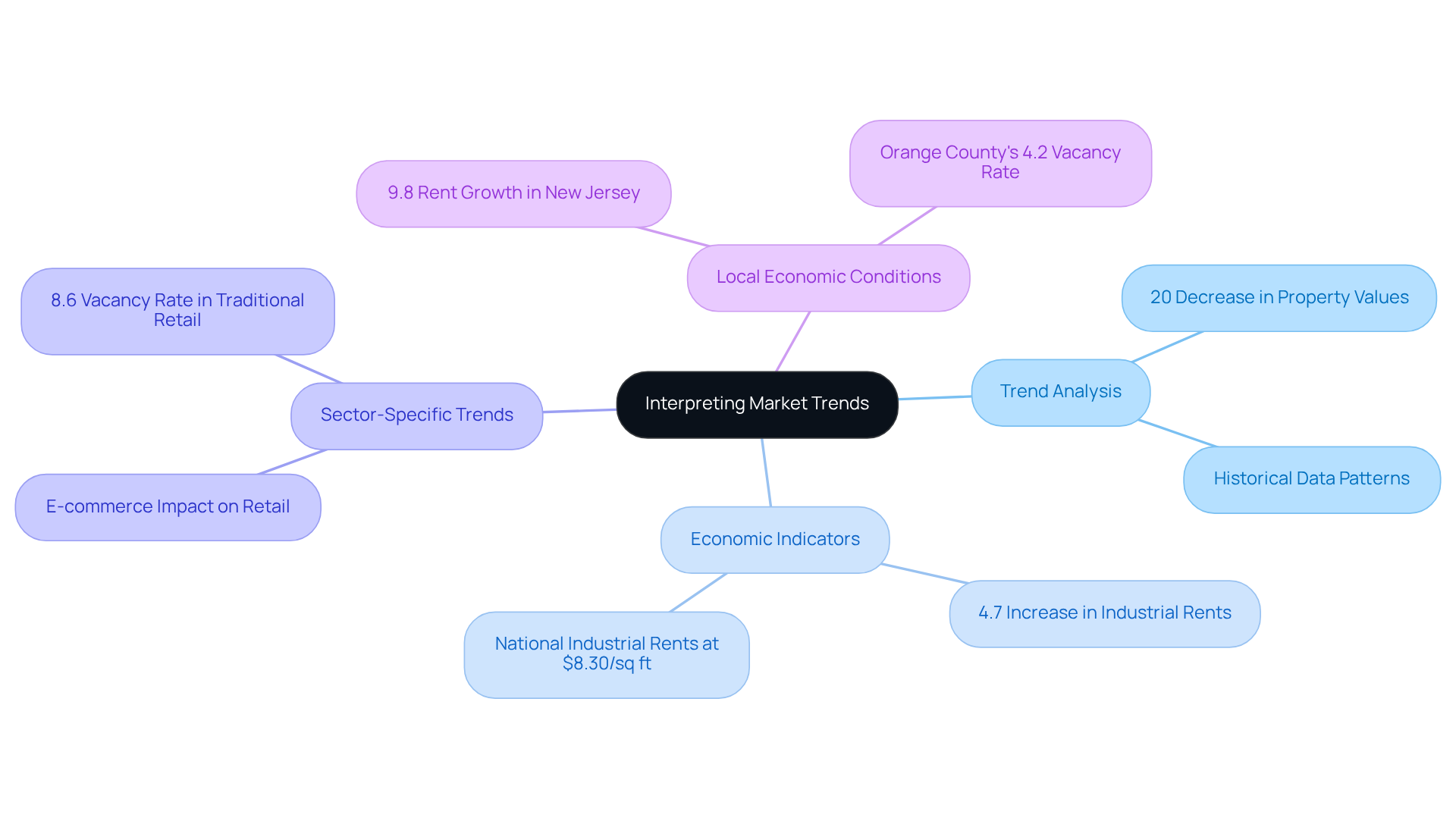

Interpret Market Trends to Identify Opportunities and Risks

To effectively interpret market trends, investors should adopt the following strategies:

- Trend Analysis: Regularly analyze historical data to identify patterns in property values, rental rates, and occupancy levels. Recognizing that commercial real estate market data indicates property values have decreased by 20% over the past two years can offer insights into possible recovery phases.

- Economic Indicators: Monitor key economic indicators such as employment rates, GDP growth, and interest rates. These factors greatly affect commercial real estate market data; for instance, a 4.7% increase in industrial rents over the past year indicates a robust sector despite wider economic challenges. National industrial in-place rents averaged $8.30 per square foot, further illustrating the current economic dynamics.

- Sector-Specific Trends: Pay attention to trends within specific sectors (e.g., retail, office, industrial) as they may respond differently to economic conditions. The rise of e-commerce has transformed the retail landscape, leading to increased demand for logistics and warehousing spaces, while traditional retail faces an 8.6% vacancy rate. This shift highlights the importance of adapting investment strategies to sector-specific developments.

- Local Economic Conditions: Evaluate local economic dynamics, including supply and demand, to identify areas with growth potential. New Jersey's industrial sector has experienced a remarkable 9.8% rent growth year-over-year, which is well-supported by the commercial real estate market data indicating strong local demand. As Andrew Carnegie observed, "Ninety percent of all millionaires achieve this by possessing property," emphasizing the importance of comprehending local economic conditions.

By mastering trend interpretation using commercial real estate market data, investors can strategically position themselves to seize opportunities and effectively navigate potential risks in the evolving landscape.

Integrate Market Insights into Investment Strategies for Maximum Returns

To maximize returns, investors should seamlessly integrate market insights into their investment strategies by following these key steps:

-

Strategic Planning: Establish a clear investment strategy that aligns with market insights. This involves setting financial objectives, evaluating risk appetite, and recognizing target sectors through comprehensive data examination. For instance, understanding macroeconomic conditions and supply-demand fundamentals can significantly guide strategic decisions. Notably, 78% of investors plan to increase their stake in the seniors sector by 2025, reflecting the critical importance of adapting strategies to demographic trends.

-

Portfolio Diversification: Leverage financial insights to diversify your portfolio across various asset classes and geographic locations. This approach not only mitigates risks but also enhances overall returns. Alternative property sectors have demonstrated higher annualized returns compared to traditional properties, making them an attractive option for diversification. The case study on Senior Housing Financing Trends illustrates favorable conditions for senior housing opportunities, as rents are increasing faster than in other commercial real estate sectors, despite new construction reaching a 16-year low.

-

Timing Allocations: Utilize trends in the economy to time your allocations effectively. Entering a sector during a downturn can yield substantial returns when conditions improve. Historical data indicates that most returns on capital arise during downturns, frequently unnoticed at the time, emphasizing the significance of strategic timing. As Robert Kiyosaki highlights, wealth management encompasses sustaining a positive cash flow through intelligent financial choices, which is vital during economic changes.

-

Continuous Monitoring: Regularly assess and modify your financial strategy based on evolving industry insights. Staying informed about fluctuations in the economy allows for timely adjustments, ensuring that your portfolio remains aligned with current trends and opportunities.

By integrating these commercial real estate market data insights into their investment strategies, investors can enhance their decision-making processes and achieve maximum returns, ultimately positioning themselves for long-term success in the commercial real estate landscape.

Conclusion

Mastering the intricacies of commercial real estate market data is essential for investors who seek to make informed and strategic investment decisions. By comprehending the fundamental components of market data, leveraging effective tools, and interpreting trends, investors can position themselves to capitalize on opportunities while mitigating risks in a dynamic landscape.

Key insights include:

- The necessity of familiarizing oneself with various types of data.

- Utilizing credible sources.

- Recognizing market indicators that influence investment strategies.

Furthermore, employing advanced analytical tools and methodologies can significantly enhance market analysis, allowing for a more nuanced understanding of economic conditions and sector-specific trends. Regularly monitoring these factors and integrating insights into investment strategies is crucial for maximizing returns and achieving long-term success.

Ultimately, the ability to navigate and interpret commercial real estate market data empowers investors to make strategic choices that align with market dynamics. By adopting a proactive approach and remaining adaptable to changes, investors can not only safeguard their investments but also thrive in an evolving market. Embracing these best practices will lead to informed decision-making and a competitive edge in the commercial real estate sector.