Overview

Commercial real estate projections are indispensable for investors, offering critical insights into future market performance. These insights encompass rental rates and occupancy levels, which are vital for evaluating potential returns on investment. Accurate forecasts empower informed decision-making and strategic investment choices. Data illustrates significant market growth and highlights the influence of various economic factors on these projections.

Investors must recognize that understanding these projections is crucial for navigating the complexities of the market. With the right data, they can make decisions that align with market trends, ultimately enhancing their investment outcomes. As the market continues to evolve, the ability to interpret these forecasts will distinguish successful investors from those who fall behind.

In summary, leveraging accurate commercial real estate projections is essential for maximizing investment potential. By staying informed and utilizing these insights, investors can position themselves strategically in a competitive landscape.

Introduction

Understanding the future landscape of commercial real estate is crucial for investors seeking to make informed decisions in a rapidly evolving market. Projections play a pivotal role in assessing potential returns and identifying lucrative opportunities. Therefore, the ability to accurately forecast factors such as rental rates and occupancy levels is indispensable. Amidst the complexities of economic indicators, interest rates, and demographic trends, investors must ask:

- How can they ensure their projections align with market realities?

This alignment is essential for mitigating risks and maximizing gains.

Define Commercial Real Estate Projections and Their Importance

Commercial real estate projections are critical predictions regarding the future performance of commercial properties, encompassing factors such as rental rates, occupancy levels, and overall demand. These forecasts, known as commercial real estate projections, are indispensable for investors, as they facilitate the evaluation of potential returns on investment and the identification of profitable opportunities. Accurate forecasts, especially those related to commercial real estate projections, can significantly influence decision-making processes, allowing investors to allocate resources effectively and mitigate risks associated with economic fluctuations.

For example, the U.S. commercial real estate market expanded from approximately $821 billion in 2011 to $1.16 trillion in 2019, reaching a valuation of $1.2 trillion in 2022. This remarkable growth underscores the importance of precise forecasts in shaping commercial real estate projections for investment strategies. A case study titled 'Profitability in Commercial Real Estate' illustrates that investors who align their decisions with accurate forecasts are more likely to meet their financial objectives.

Moreover, understanding commercial real estate projections empowers stakeholders to navigate the complexities of the commercial property landscape and make strategic investment choices that resonate with current market trends. As Jesse Jones aptly noted, property is foundational to wealth, while David Bitton emphasizes that informed investment decisions are crucial for success, highlighting the essential role of accurate forecasts in this sector.

Furthermore, with 88% of CRE executives anticipating revenue growth for their companies in 2025, the significance of these commercial real estate projections for future planning cannot be overstated.

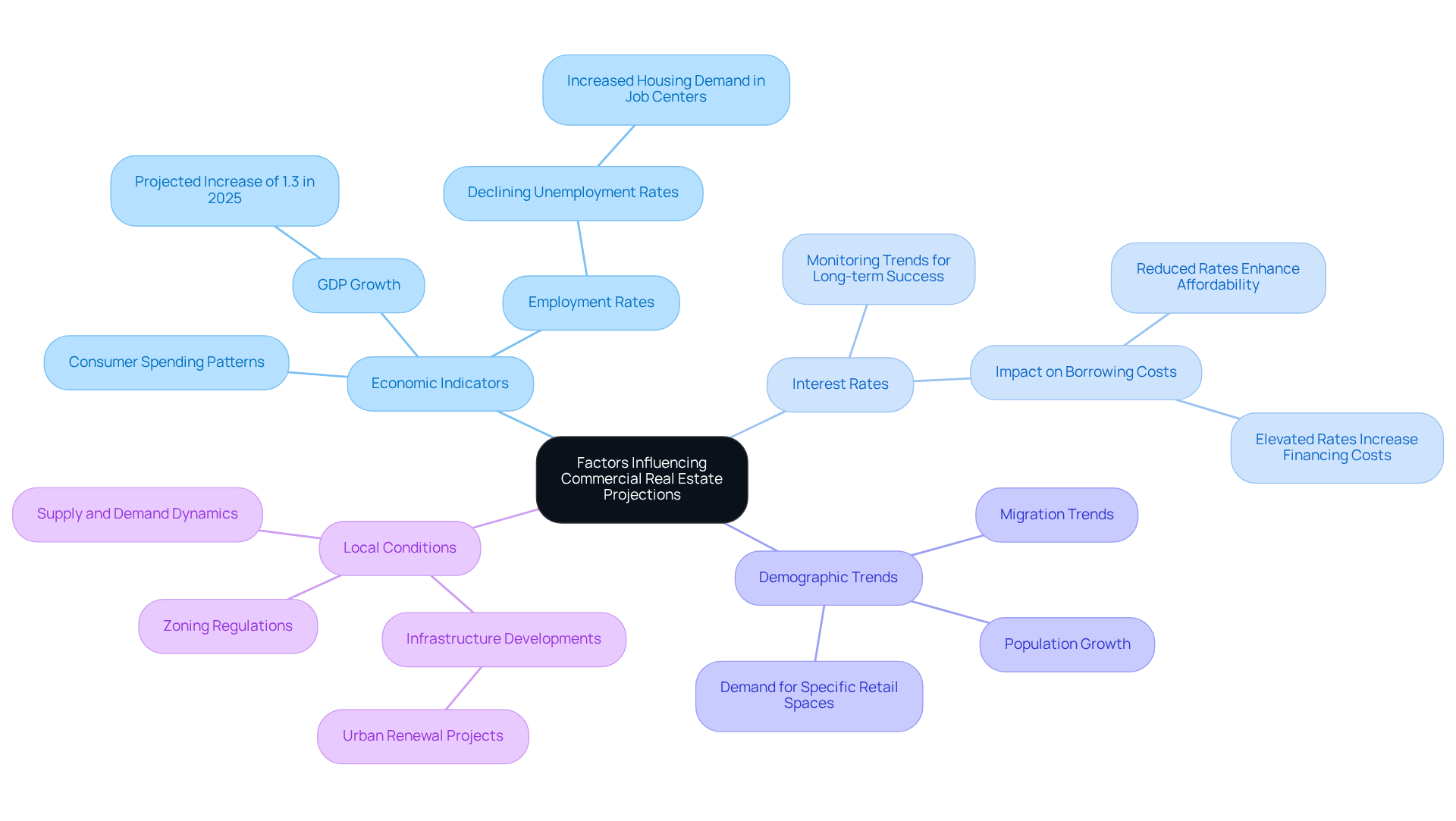

Analyze Key Factors Influencing Commercial Real Estate Projections

Multiple crucial elements influence commercial real estate projections, especially economic indicators, interest rates, demographic trends, and local conditions. Economic indicators, such as GDP growth, employment rates, and consumer spending patterns, are essential in assessing demand for business properties. For instance, a projected GDP increase of 1.3% in 2025, despite economic uncertainties, indicates possible resilience in the economy. Furthermore, the commercial real estate sector in the United States is anticipated to reach US$25.79 trillion by 2025, highlighting significant investment opportunities. The relationship between declining unemployment rates and heightened housing demand in developing job centers, especially in 2025, underscores the significance of labor dynamics.

Interest rates significantly influence borrowing costs, directly impacting investment decisions. Reduced interest rates enhance property affordability, thereby boosting demand, while elevated rates can dampen enthusiasm and raise financing costs. For example, fluctuations in interest rates have been shown to affect mortgage affordability and cash flow, making it crucial for investors to monitor these trends for long-term success.

Demographic changes, including population growth and migration trends, also play a crucial role in determining the demand for specific types of retail spaces. Regional economic conditions, including supply and demand dynamics, zoning regulations, and infrastructure developments, further enhance the precision of forecasts. Monitoring localized initiatives, such as urban renewal projects, can provide insights into emerging value and investment opportunities.

By examining these interconnected elements, investors can cultivate a thorough understanding of the environment, including the commercial real estate projections such as the anticipated annual growth rate (CAGR) of 2.22% for the Business Property sector in the United States from 2025 to 2029. This knowledge empowers them to make more informed and strategic predictions in the ever-evolving business property domain.

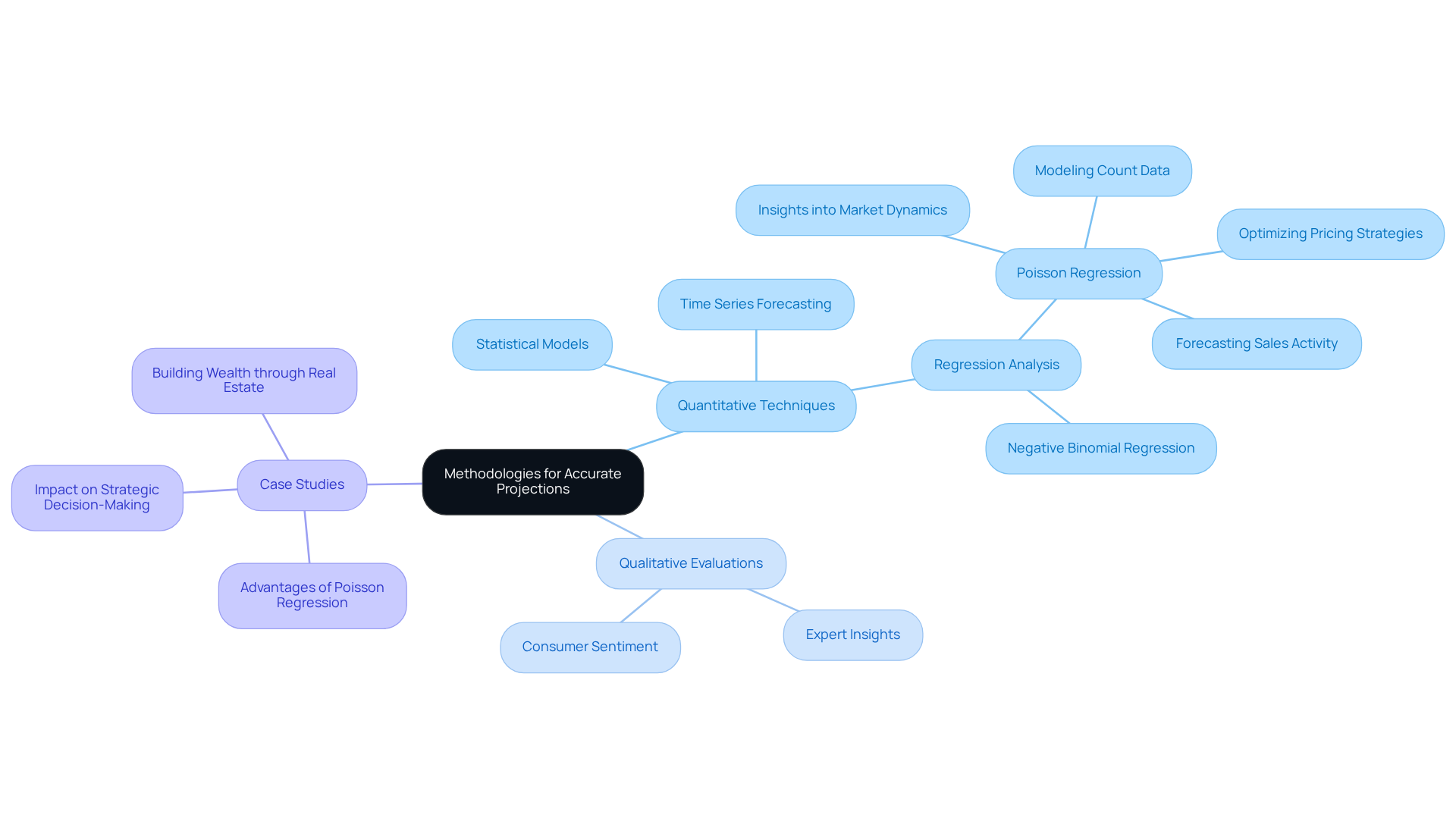

Explore Methodologies for Creating Accurate Projections

A blend of methodologies, including quantitative analysis, is essential for accurate commercial real estate projections. This approach leverages historical data and statistical models to predict future performance, employing techniques such as regression analysis and time series forecasting to uncover patterns and trends. Notably, Poisson regression is particularly effective for modeling count data, allowing for precise insights into property sales and inquiries. By analyzing key statistics derived from this model, investors can gain actionable insights that inform strategic planning.

In addition to quantitative techniques, qualitative evaluations—rooted in expert insights and consumer sentiment—offer crucial context to the numerical data. This dual approach ensures a comprehensive understanding of economic dynamics. Furthermore, market trend analysis emphasizes present circumstances and developing trends, enabling investors to enhance their forecasts based on real-time information.

Successful case studies illustrate the effectiveness of these methodologies. For instance, leveraging Poisson regression has enabled stakeholders to optimize pricing strategies and enhance marketing efforts, ultimately leading to improved operational efficiency. By combining these approaches, investors can significantly enhance the precision of their forecasts, particularly commercial real estate projections, facilitating more informed decision-making in the competitive environment of property investment.

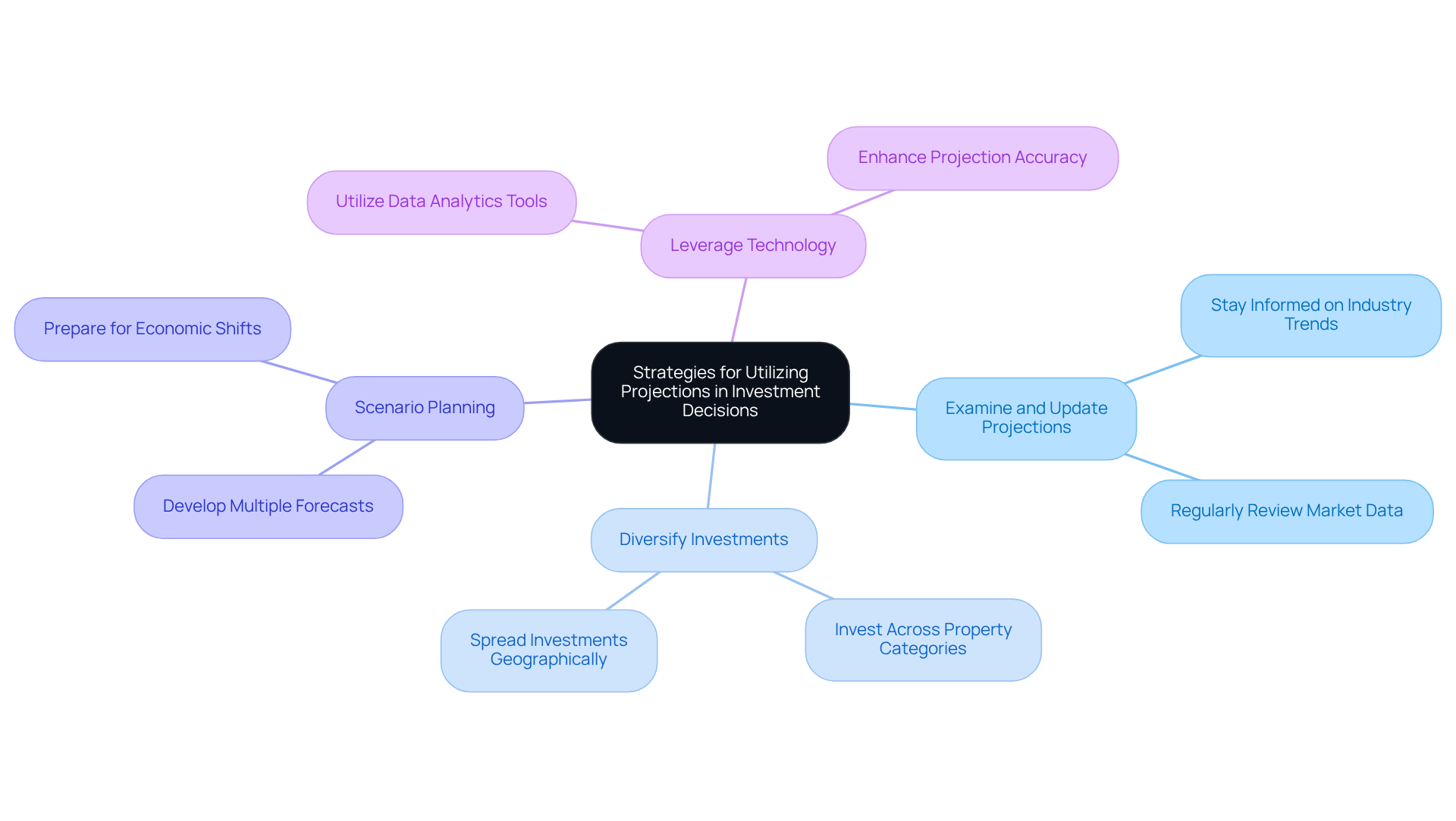

Implement Strategies for Utilizing Projections in Investment Decisions

To efficiently harness commercial real estate projections in their investment decisions, investors must adopt several essential strategies. First and foremost, consistently examining and updating commercial real estate projections in light of the latest industry information and trends is crucial for maintaining relevance and adaptability to changing circumstances. For instance, the average return for commercial real estate stands at approximately 9.5%, underscoring the potential for substantial gains. Furthermore, diversifying investments across various property categories and geographic regions can mitigate risks associated with fluctuations, thereby enhancing overall portfolio stability.

Moreover, engaging in scenario planning—developing multiple forecasts based on differing assumptions regarding economic conditions—enables investors to prepare for potential shifts in commercial real estate projections. Notably, the commercial property market exerts an economic influence of around $16 trillion, emphasizing the importance of informed decision-making. Additionally, leveraging technology and data analytics tools can significantly enhance the precision of commercial real estate projections and streamline the decision-making process.

As John Paulson aptly stated, "I still think buying a home is the best investment any individual can make," reflecting a wider sentiment towards real estate investment. By implementing these strategies, while remaining cognizant of the inherent risks, investors can make informed and strategic choices that align with the evolving dynamics of the market.

Conclusion

Mastering commercial real estate projections is crucial for making informed investment decisions that can lead to substantial financial success. These projections act as a roadmap, guiding investors through the complexities of the market by predicting future performance based on various economic indicators, interest rates, and demographic trends. By understanding and utilizing these forecasts, investors are better equipped to identify lucrative opportunities and mitigate potential risks.

Key arguments emphasized throughout the article highlight the importance of accurate commercial real estate projections in shaping investment strategies. The interplay of economic indicators, interest rates, and demographic shifts not only influences property demand but also impacts investment viability. Moreover, employing robust methodologies—including quantitative analysis and scenario planning—enhances the precision of these projections, allowing investors to adapt effectively to an ever-changing market landscape.

In summary, the significance of mastering commercial real estate projections cannot be overstated. Investors are urged to remain vigilant and proactive by continuously updating their forecasts and leveraging technology to enhance their decision-making processes. By embracing these practices, stakeholders can navigate the commercial real estate market with confidence, making strategic investments that align with future trends and ultimately drive success in their investment endeavors.