Overview

The article emphasizes mastering real estate investment programs for success by highlighting key fundamentals, strategy development, market analysis, and effective property management practices. It outlines essential steps such as:

- Understanding types of real estate assets

- Conducting thorough market research

- Implementing tenant screening processes

These elements are crucial for informed decision-making and achieving investment goals, ultimately guiding readers to enhance their investment strategies.

Introduction

In the dynamic world of real estate, a profound understanding of the fundamentals is paramount for anyone aspiring to invest successfully. Grasping the various types of investments and mastering key terminology lays the groundwork for a fruitful journey. As aspiring investors navigate the complexities of market analysis, property evaluation, and effective management practices, they must cultivate a comprehensive strategy tailored to their unique goals.

This article explores essential steps and best practices designed to empower investors, enabling them to make informed decisions, mitigate risks, and ultimately excel in the competitive real estate landscape.

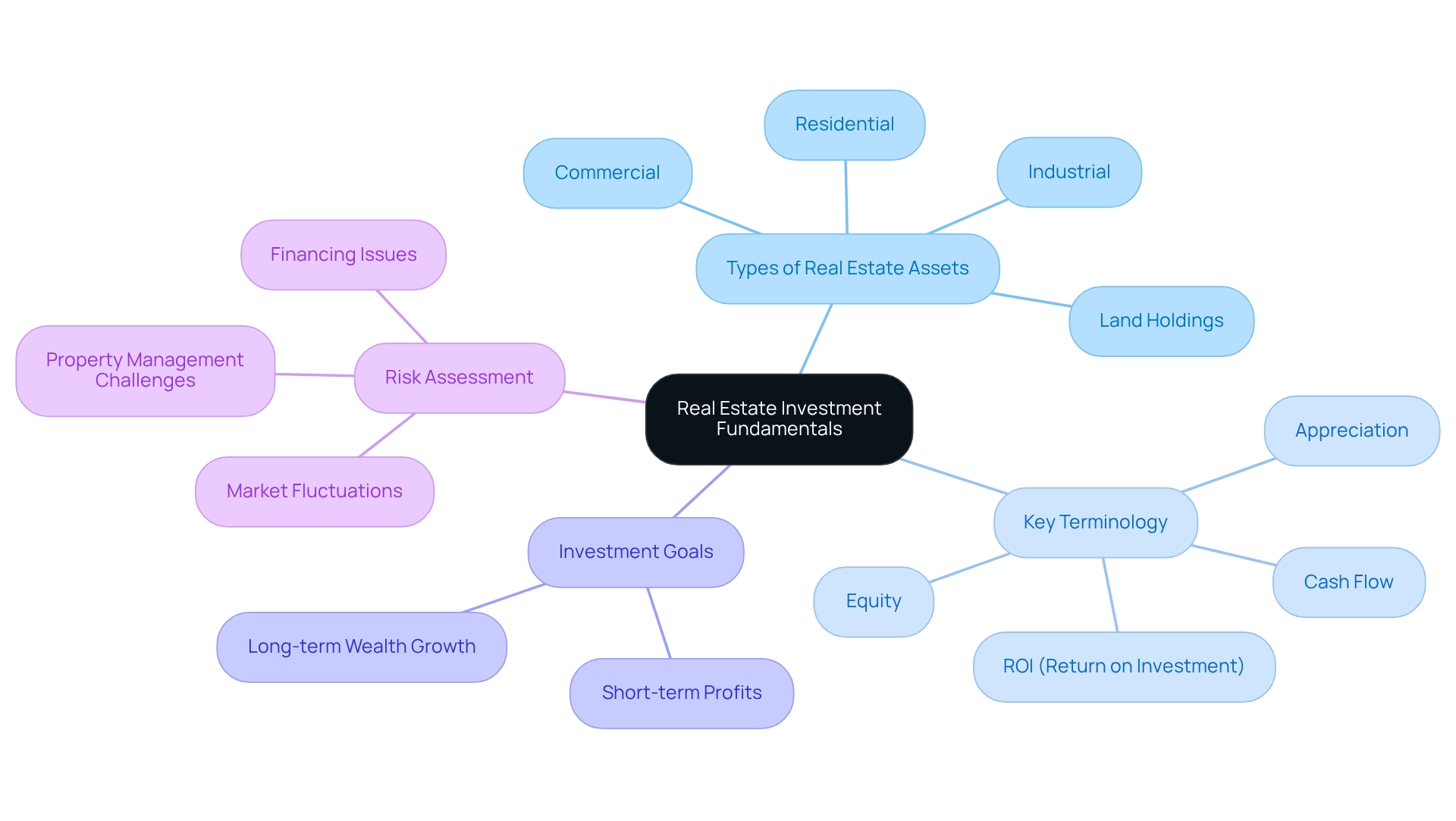

Understand Real Estate Investment Fundamentals

To master real estate investing, begin by familiarizing yourself with these essential fundamentals:

-

Types of Real Estate Assets: Understand the various categories, including residential, commercial, industrial, and land holdings. Each type possesses unique characteristics and potential returns that can significantly impact your investment strategy.

-

Key Terminology: Learn essential terms such as ROI (Return on Investment), cash flow, equity, and appreciation. A solid grasp of these terms will enhance your ability to communicate effectively and comprehend financial analyses, paving the way for informed decision-making.

-

Investment Goals: Clearly define your investment objectives. Are you pursuing short-term profits through buying and selling real estate, or are you focused on long-term wealth growth via rental earnings? Your goals will fundamentally shape your investment strategy, guiding your choices.

-

Risk Assessment: Recognize the risks associated with real estate investing, including market fluctuations, property management challenges, and financing issues. Understanding these risks is crucial for developing a robust financial strategy that can withstand market volatility.

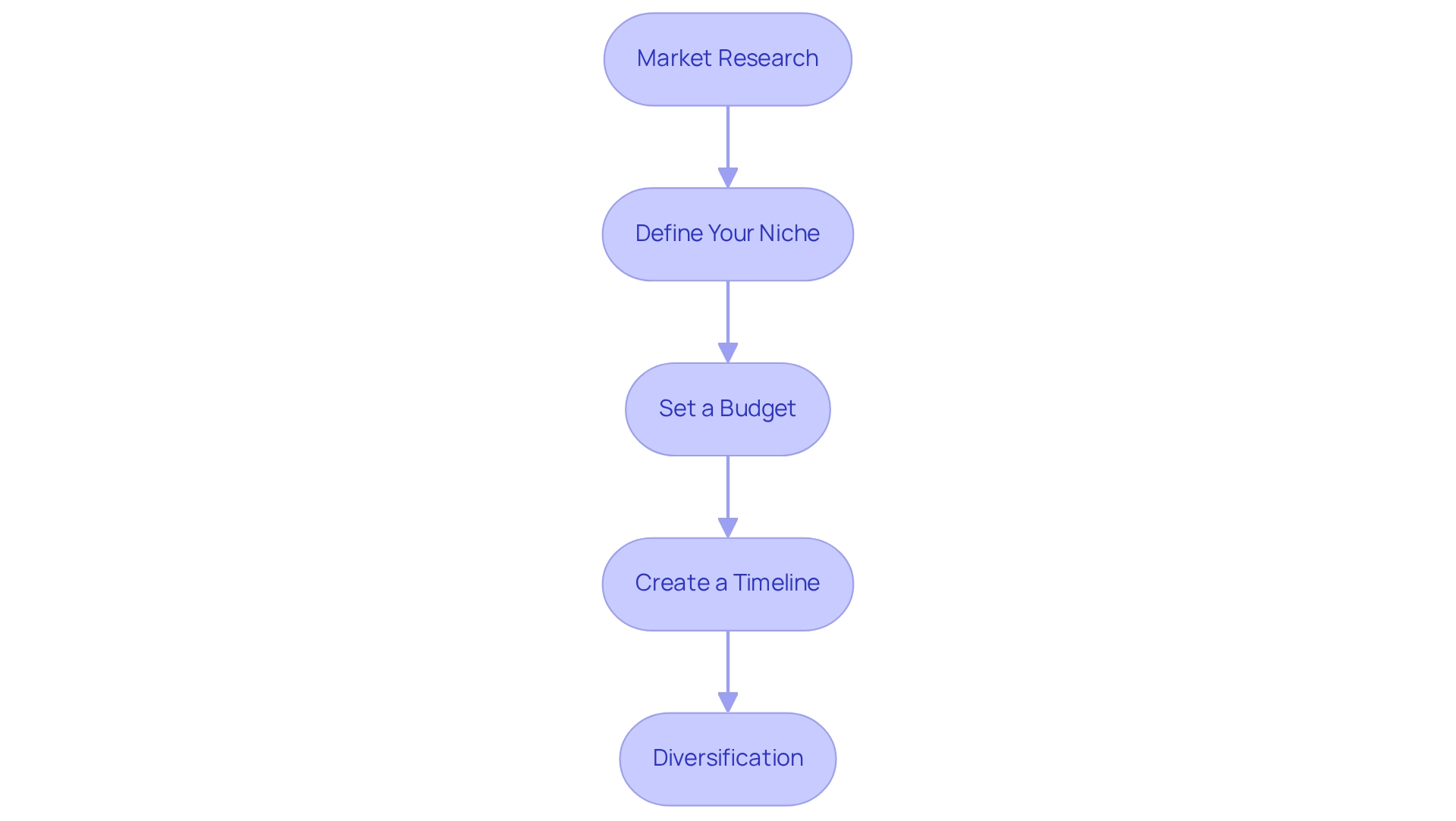

Develop a Comprehensive Investment Strategy

To develop a robust investment strategy, consider the following essential steps:

-

Market Research: Begin by analyzing current market trends, including supply and demand dynamics, economic indicators, and demographic shifts. Utilize resources like Zero Flux to stay updated on the latest insights that can inform your decisions.

-

Define Your Niche: Identify a specific area of focus within your real estate investment program that aligns with your interests and expertise. This could be single-family homes, multi-family units, or commercial spaces—select a niche that resonates with you.

-

Set a Budget: Determine how much capital you can allocate to your financial activities. Consider not only the purchase cost but also renovation expenses, management fees, and potential unforeseen costs that may arise.

-

Create a Timeline: Establish a schedule for your financial objectives, whether that means acquiring your first asset within a year or building a portfolio over five years. A defined timeline will help you stay accountable and effectively measure your progress.

-

Diversification: Plan to diversify your investments across various asset types and locations. This strategy is crucial for spreading risk and enhancing potential returns, ensuring a balanced approach to your investment portfolio.

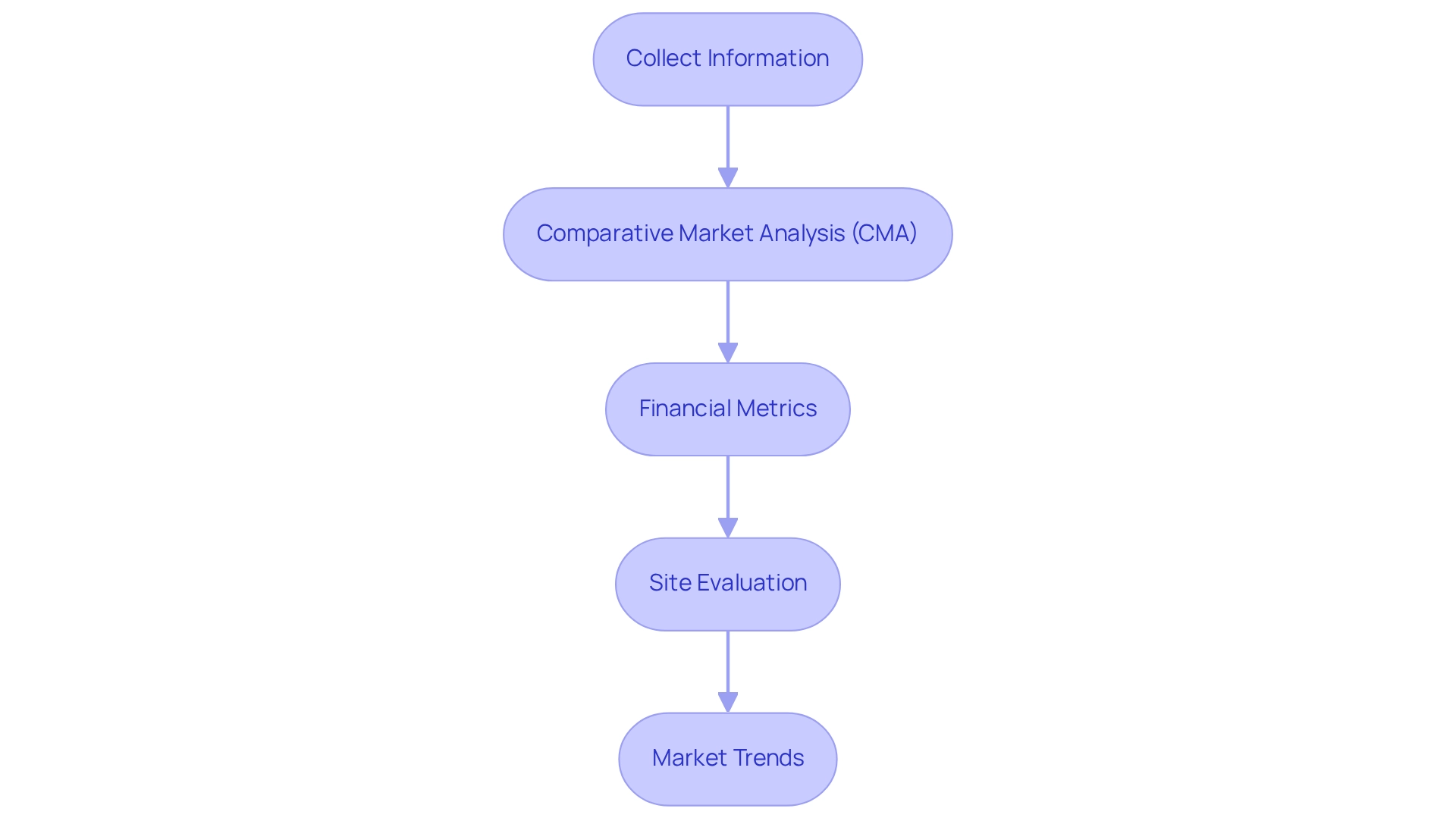

Conduct Market Analysis and Property Evaluation

To effectively analyze the market and evaluate properties, it is essential to follow these steps:

-

Collect Information: Leverage a variety of sources to gather comprehensive data on real estate values, rental rates, and industry trends. Online real estate platforms and local area reports are invaluable tools that can provide critical insights.

-

Comparative Market Analysis (CMA): Conduct a thorough CMA by comparing similar properties within the area to ascertain fair market value. Scrutinize recent sales, current listings, and the conditions of the assets involved.

-

Financial Metrics: Calculate essential financial metrics such as cash flow, cap rate (capitalization rate), and cash-on-cash return. These metrics are vital for evaluating the potential profitability of your financial commitments.

-

Site Evaluation: Undertake a comprehensive assessment of the site to identify any necessary repairs or enhancements. This evaluation will assist in estimating renovation costs and assessing the overall condition of the investment.

-

Market Trends: Remain vigilant about broader market trends, including economic conditions, interest rates, and demographic shifts. These factors can significantly impact real estate values and rental demand, making it crucial for informed decision-making.

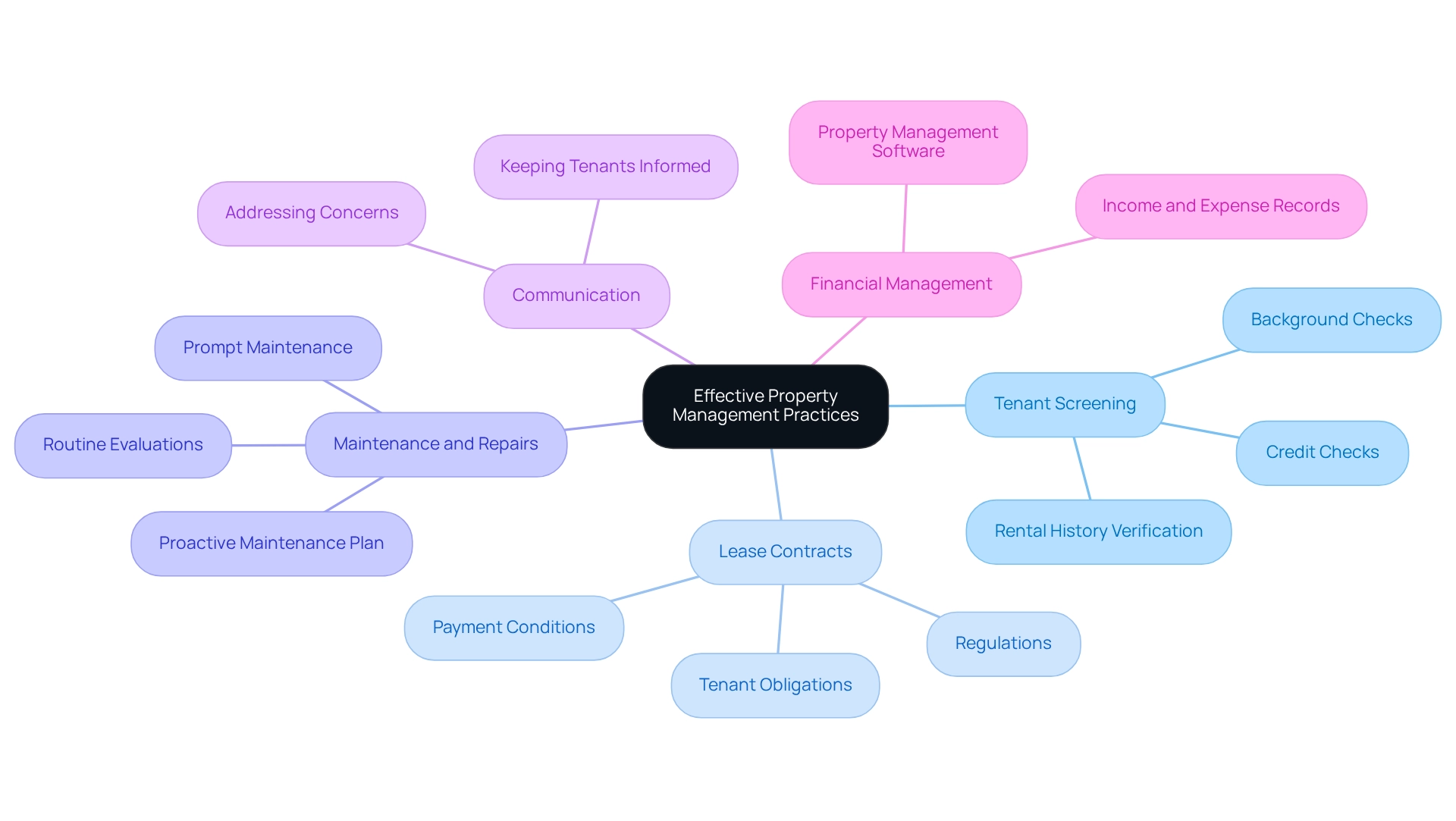

Implement Effective Property Management Practices

To implement effective property management practices, consider the following strategies:

-

Tenant Screening: Develop a thorough tenant screening process to ensure the selection of reliable tenants. This should encompass background checks, credit checks, and rental history verification, ultimately safeguarding your investment.

-

Lease Contracts: Formulate clear and detailed lease contracts that delineate tenant obligations, payment conditions, and regulations. This clarity helps prevent misunderstandings and disputes, fostering a harmonious rental experience.

-

Maintenance and Repairs: Establish a proactive maintenance plan to address issues before they escalate. Routine evaluations and prompt maintenance not only improve tenant satisfaction but also support the overarching goals of your real estate investment program.

-

Communication: Maintain open lines of communication with tenants. Swiftly addressing their concerns and keeping them informed about developments or changes in the real estate investment program enhances trust and satisfaction.

-

Financial Management: Keep precise records of all income and expenses associated with your assets. Utilizing property management software can streamline financial tracking and reporting, ensuring you remain informed about your investment performance.

Conclusion

Understanding the fundamentals of real estate investment is crucial for aspiring investors aiming to navigate the complexities of the market successfully. By familiarizing oneself with various types of investments, mastering key terminology, and clearly defining investment goals, individuals can establish a strong foundation for their investing journey. Moreover, recognizing potential risks and developing a comprehensive investment strategy tailored to one’s unique circumstances is essential for long-term success.

Conducting thorough market analysis and property evaluations further enhances an investor's ability to make informed decisions. By gathering data, performing comparative market analyses, and assessing financial metrics, investors can identify promising opportunities and mitigate potential pitfalls. Additionally, effective property management practices play a pivotal role in maintaining the value of investments and ensuring tenant satisfaction.

Ultimately, excelling in real estate investing requires a combination of knowledge, strategic planning, and diligent execution. By embracing these essential steps and best practices, investors can confidently navigate the competitive landscape, make informed decisions, and achieve their financial goals. The journey may be challenging, but with the right approach, the rewards can be substantial.