Overview

This article delves into navigating the commercial real estate collapse, offering strategic insights into:

- Market assessment

- Risk identification

- Mitigation strategies

It underscores the critical role of data analysis and understanding economic indicators, while also emphasizing the necessity of adapting to technological and regulatory changes. Such adaptability is essential for making informed investment decisions in a challenging environment characterized by high vacancy rates and shifting demand across various sectors. By leveraging these insights, investors can better position themselves to thrive amidst market volatility.

Introduction

In the ever-evolving landscape of commercial real estate, understanding market dynamics is crucial for investors aiming to navigate potential risks and capitalize on emerging opportunities. As vacancy rates fluctuate and economic indicators shift, a comprehensive assessment of current conditions becomes essential.

This article delves into the intricacies of the commercial real estate market in 2025, exploring key strategies for:

- Risk mitigation

- Trend monitoring

- Informed decision-making

By examining data-driven insights and industry trends, investors can position themselves to thrive in a competitive environment. This ensures they remain agile amidst the complexities of this dynamic sector.

Assess the Current Market Landscape

To effectively assess the current commercial real estate landscape, consider the following steps:

- Gather Data: Leverage reputable sources such as the National Association of Realtors, J.P. Morgan, and Deloitte to obtain the latest statistics on vacancy rates and rental prices. As of April 2025, vacancy rates in commercial property are reported at 15%, indicating elevated levels; however, certain sectors, particularly industrial, are experiencing a resurgence in demand.

- Analyze Trends: Identify patterns within the data. The industrial sector is expected to perform strongly in 2025, backed by a positive outlook for commercial real estate. In the meantime, retail, despite a 12% year-over-year drop in foot traffic, has succeeded in achieving a 3.2% growth due to strict conditions and limited supply.

- Evaluate Economic Indicators: Broader economic factors such as interest rates, inflation, and employment rates play a crucial role. With lower interest rates anticipated in 2025, liquidity may improve, fostering increased investment opportunities. Notably, the national rental sector is projected to grow by 5% in 2024, with renters allocating an average of 30% of their income to housing, as highlighted by Sharad Mehta.

- Identify Key Markets: Focus on geographic areas demonstrating positive trends. Markets like New York and Dallas have reported favorable net absorption rates, signaling a recovery in office leasing activity.

- Compile Insights: Summarize your findings into a concise report that outlines the current condition of the industry, emphasizing both opportunities and potential challenges. This report will function as a valuable reference for strategic planning, especially as the findings from the case study titled 'Economic Indicators and the Rental Sector' suggest that housing costs significantly influence the Consumer Price Index (CPI), further emphasizing the importance of understanding economic indicators in relation to the rental sector. Furthermore, it is essential to recognize that CRE valuations have decreased by an average of 42%, emphasizing the difficulties confronting the commercial property sector.

Identify Key Risks and Challenges

Identifying key risks and challenges in the commercial real estate market necessitates a multifaceted approach, concentrating on several critical areas:

- Economic Factors: It is essential to closely monitor economic indicators, particularly inflation rates and employment statistics. Elevated inflation can significantly increase financing costs, leading to a decrease in property values. As we move through 2025, inflation remains a pressing issue, influencing investor sentiment and economic dynamics. Notably, according to Deloitte, thirty-six percent of survey respondents currently adopt a more balanced approach to sustainability investment, targeting initiatives that yield modest financial returns while also meeting regulatory requirements.

- Industry Saturation: Assessing saturation levels across various sectors is crucial. Recent reports reveal that new supply has outpaced demand in specific regions, resulting in rising vacancy rates. This oversupply can pressure property values and rental income, making it imperative for investors to carefully evaluate local market conditions. It is noteworthy that industrial and manufacturing assets rank first in challenges faced, multifamily assets rank third, and hotel and lodging assets rank fifth in 2025.

- Regulatory Changes: Staying informed about potential shifts in zoning laws, tax policies, and environmental regulations is vital. Such changes can profoundly affect property values and financial strategies, particularly as municipalities adapt to evolving economic and environmental challenges, which could potentially lead to a commercial real estate collapse.

- Technological Disruptions: Recognizing the transformative impact of technology on the commercial real estate landscape is essential. The rise of remote work has altered the demand for office space, necessitating a reassessment of conventional financial strategies. Investors must consider how technology will continue to shape tenant needs and preferences moving forward.

- Climate Risks: Evaluating the implications of climate change on property values and insurance costs is critical. Properties located in flood-prone areas may face increased insurance costs and diminished demand, requiring a strategic approach to risk management and asset selection. A case study on financial strategies for sustainability initiatives highlights that the issuance of sustainability-linked bonds has remained robust, reflecting a growing commitment among real estate owners to finance sustainability initiatives despite the challenges posed by the current economic environment.

- Financing Challenges: Understanding the implications of rising interest rates on borrowing expenses and returns on capital is crucial. As credit conditions tighten, investors should prepare for potential difficulties in securing financing, which could impact their purchasing capacity and overall strategy. Adjustments in pricing may lead to increased deal volumes as refinancing pressures mount.

By concentrating on these critical aspects, investors can navigate the complexities of the commercial property sector in 2025 more effectively, positioning themselves to make informed decisions amid the evolving risks that could lead to a commercial real estate collapse.

Implement Risk Mitigation Strategies

To effectively mitigate risks in commercial real estate investments, consider the following strategies:

- Diversify Investments: Broaden your portfolio by investing in various property types—such as retail, industrial, and multifamily—and across different geographic regions. This approach reduces exposure to price fluctuations and enhances overall stability.

- Conduct Regular Assessments: Continuously evaluate your portfolio's performance alongside current economic conditions. Conduct thorough due diligence before acquiring new properties to ensure informed decision-making. Notably, 61% of global respondents expect hurdle rates to further improve over the next 12 to 18 months, indicating a need for vigilant assessment of investment opportunities.

- Maintain Liquidity: Keep sufficient cash reserves to handle unexpected expenses or economic downturns. This liquidity is crucial for avoiding forced sales during unfavorable market conditions, allowing for more strategic decision-making.

- Invest in Technology: Leverage property management software and data analytics tools to improve operational efficiency and enhance decision-making capabilities. Insights from the case study titled "Investment Priorities in Real Estate" reveal a shift towards leveraging technology for growth, underscoring its importance in risk mitigation.

- Strengthen Relationships with Stakeholders: Cultivate strong connections with lenders, tenants, and local government officials. A robust network can offer critical support and information during challenging times, helping you navigate potential obstacles more effectively. As noted, "accelerated upskilling and reskilling initiatives have remained a top three response for the past two years," highlighting the importance of continuous improvement in skills and knowledge.

- Implement Sustainable Practices: Invest in energy-efficient upgrades and sustainable building practices. These initiatives not only reduce operating costs but also attract environmentally conscious tenants. The function of digital twins in attaining net-zero cities illustrates a creative strategy for sustainability in property, aligning with the increasing need for sustainable solutions.

By adopting these strategies, investors can better position themselves to navigate the complexities surrounding the commercial real estate collapse in 2025 and beyond.

Monitor Trends and Adjust Strategies

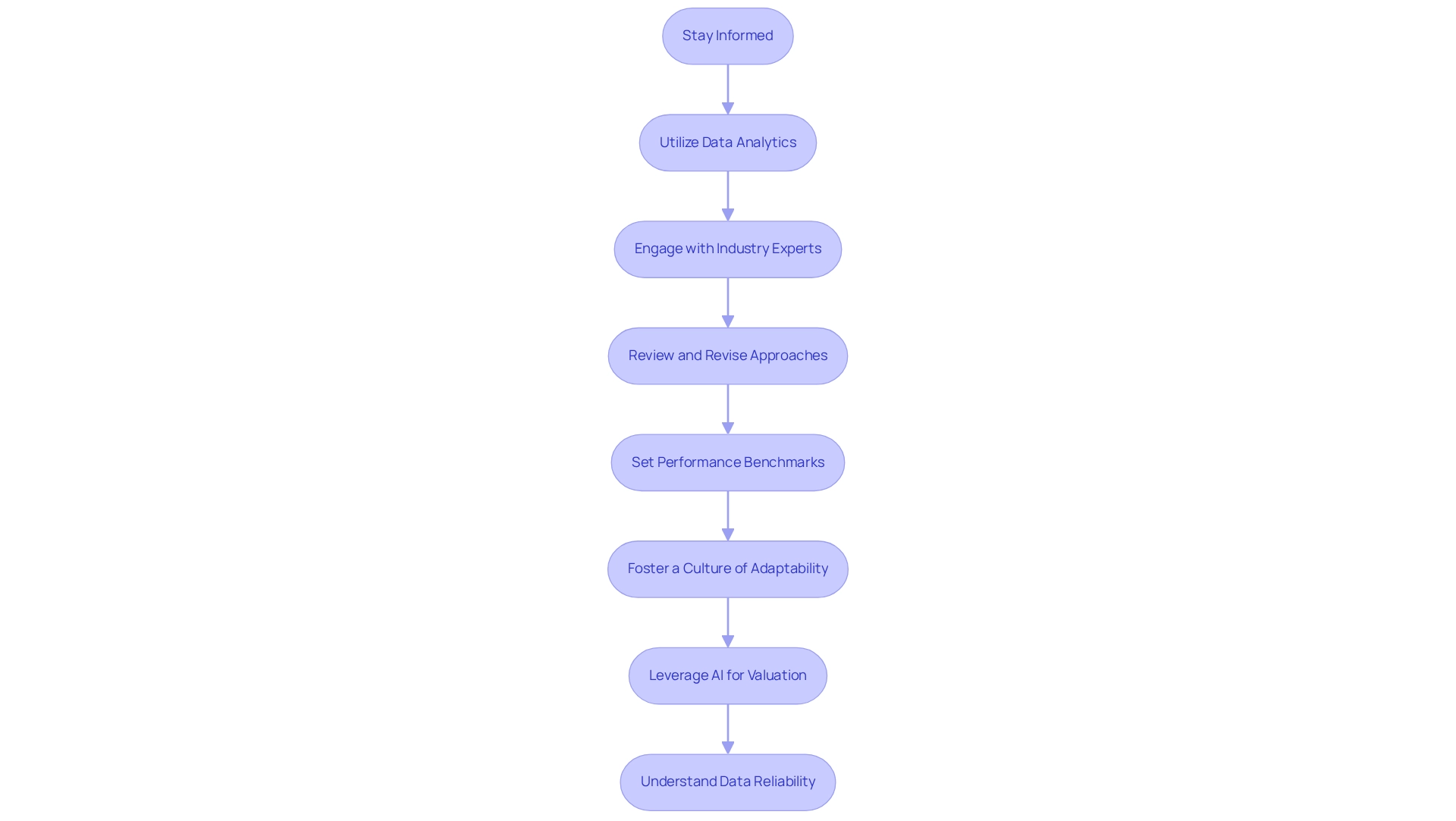

To effectively monitor trends and adjust your strategies, consider the following approaches:

- Stay Informed: Regularly engage with industry reports, subscribe to newsletters, and follow analysts to remain updated on the latest developments. Resources such as Zero Flux provide valuable insights into industry dynamics, ensuring you are well-informed.

- Utilize Data Analytics: Implement data analytics tools to track performance metrics and industry trends. Tools such as Tableau and Power BI can provide interactive dashboards that highlight emerging opportunities and potential risks, enabling informed decision-making. Additionally, utilizing advanced regression analysis tools like Python libraries (

Pandas,NumPy,Scikit-learn) and R packages (Tidyverse,ggplot2) can further enhance your analytical capabilities. - Engage with Industry Experts: Participate in conferences, webinars, and networking events to gain insights from industry leaders and peers. Interacting with specialists can provide new viewpoints on present industry conditions and strategies.

- Review and Revise Approaches: Regularly evaluate your financial strategies based on performance and economic indicators. Be prepared to pivot your approach as necessary, such as shifting focus from one property type to another in response to market shifts.

- Set Performance Benchmarks: Establish clear performance standards for your assets. Regularly evaluate whether you are meeting these benchmarks and adjust your strategies accordingly to enhance performance.

- Foster a Culture of Adaptability: Encourage a mindset of flexibility within your financial team. Embracing change and being willing to experiment with new strategies can lead to innovative solutions and improved outcomes in a dynamic market.

- Leverage AI for Valuation: Consider integrating AI-driven property valuation tools, which can deliver estimates with a mere 3% error margin. This precision is crucial for buyers, sellers, and agents, as it significantly improves valuation accuracy and reduces disputes.

- Understand Data Reliability: When analyzing data, remember that confidence intervals typically provide a 95% confidence level for parameter estimates. This statistic underscores the reliability of the data being analyzed, reinforcing the importance of data-driven decision-making in real estate investments.

Conclusion

Understanding market dynamics is essential for success in the ever-evolving commercial real estate landscape. By analyzing key factors such as vacancy rates, sector performance, and economic indicators, investors can make informed decisions and identify promising investment opportunities. Utilizing reputable data sources provides a clearer picture of market trends and conditions.

Recognizing risks—including economic fluctuations, regulatory changes, and technological advancements—is crucial for protecting investments. A robust risk assessment framework enables investors to navigate potential challenges while capitalizing on emerging trends. Moreover, the increasing emphasis on technology and sustainability underscores the necessity for a proactive investment strategy.

Implementing effective risk mitigation strategies is vital for long-term success. Diversifying portfolios, maintaining liquidity, and building strong relationships with stakeholders can enhance resilience in a volatile market. Additionally, leveraging technology in property management improves operational efficiency and aligns with evolving tenant demands.

As the commercial real estate market continues to shift, it is imperative for investors to monitor trends and adjust strategies accordingly. Staying informed through data analytics and industry engagement empowers investors to adapt to changing conditions and seize opportunities.

Ultimately, success in commercial real estate hinges on a thorough understanding of the market, awareness of risks, and the ability to execute sound strategies. By focusing on these key elements, investors can position themselves for sustainable growth in a competitive environment.