Overview

The key differences impacting real estate investments between Net Operating Income (NOI) and Return on Investment (ROI) are fundamentally rooted in their focus and calculation methods.

- NOI measures the income generated by an asset after operating expenses.

- ROI assesses overall profitability by considering net gains relative to the initial investment.

This distinction is crucial for investors.

The article illustrates this difference by providing examples and formulas for each metric. It emphasizes that:

- NOI is essential for evaluating operational performance, providing a clear picture of an asset's ability to generate income.

- ROI encompasses a broader perspective that includes asset appreciation and market conditions, thereby offering a comprehensive view of investment performance.

Ultimately, understanding these metrics is vital for guiding informed investment decisions. By recognizing the specific roles that NOI and ROI play, investors can better strategize their approaches to real estate investments, ensuring they make decisions that align with their financial goals.

Introduction

Understanding the nuances of financial metrics is crucial for real estate investors aiming to optimize their portfolios. The comparison between Net Operating Income (NOI) and Return on Investment (ROI) reveals not only the mechanics of property performance but also the strategic decisions that can significantly impact profitability.

How do these two metrics differ in their implications for investment success? Which one should investors prioritize in their evaluations?

Delving into the intricacies of NOI and ROI offers valuable insights that can shape effective investment strategies and enhance overall financial outcomes.

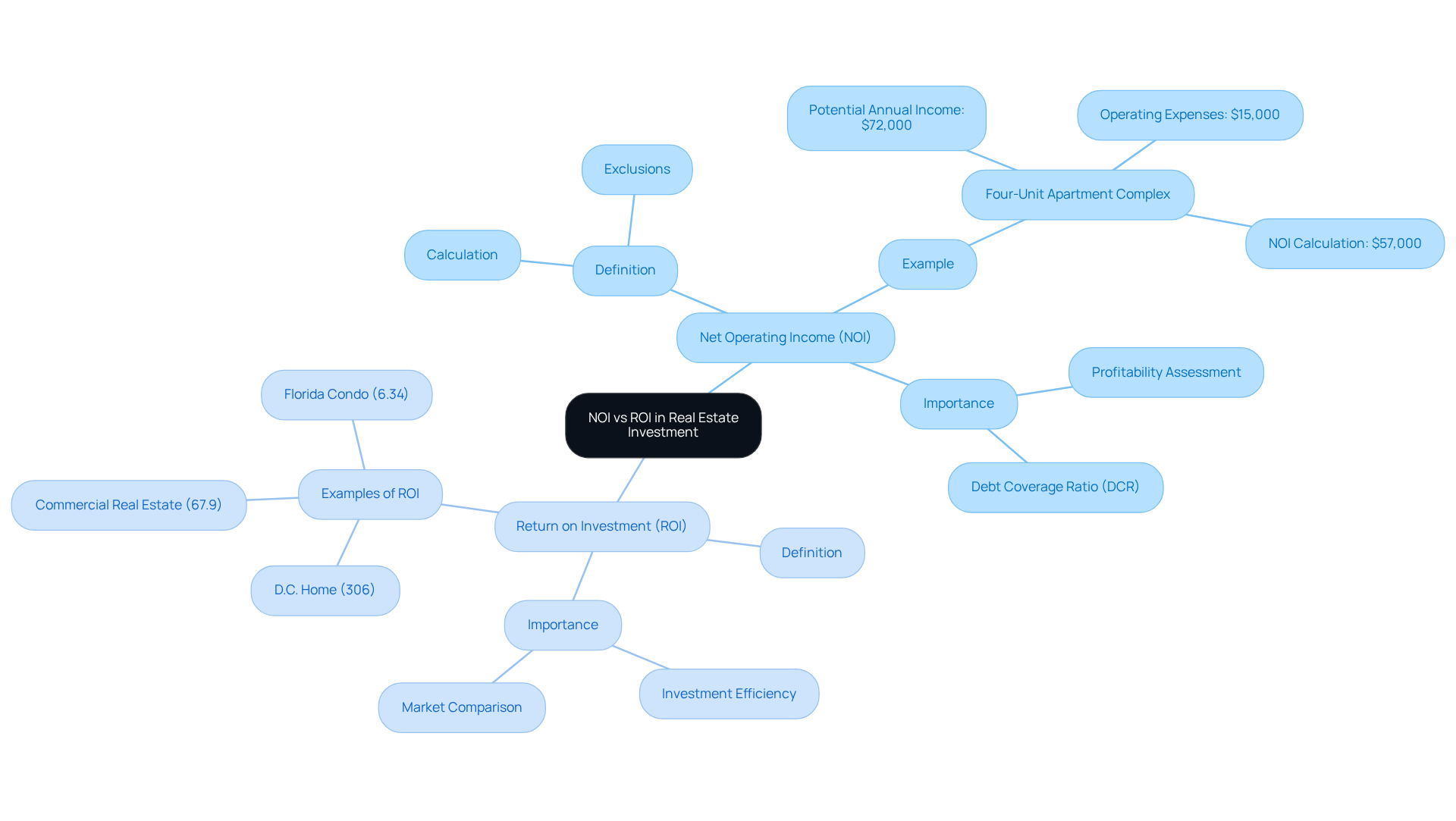

Define NOI and ROI: Core Concepts in Real Estate Investment

The comparison of NOI vs ROI highlights Net Operating Income (NOI) as a pivotal performance indicator, measuring the revenue generated by an asset after deducting all operating costs, including taxes, maintenance, and management fees. This figure offers a transparent view of an asset's profitability, deliberately excluding financing costs and taxes that may cloud true performance. In contrast, the evaluation of NOI vs ROI serves as a more expansive financial metric, assessing the efficiency of an investment by comparing net gains or losses to the initial outlay. ROI not only captures the income generated from the asset but also considers any appreciation in value, delivering a comprehensive assessment of investment performance.

For instance, the ROI for a typical D.C. home purchased in 2000 and sold in 2024 stands at an impressive 306%. In comparison, the average ROI for commercial real estate over a decade is approximately 67.9%. Additionally, the average Florida condo or co-op has achieved a 6.34% annual ROI from 2000 to 2024, illustrating the variability of ROI across different real estate types and locations. Grasping these concepts is crucial for investors intent on effectively evaluating the viability of their real estate ventures through the comparison of NOI vs ROI.

The importance of NOI vs ROI is highlighted by its role in determining whether an asset's income can sufficiently cover its operating expenses and debt obligations, making it a vital factor in investment decisions. Furthermore, NOI is instrumental in calculating the debt coverage ratio (DCR), a metric frequently employed by lenders to assess the financial health of an asset. A practical example of NOI calculation can be observed in a four-unit apartment complex generating $72,000 in potential annual rental income, with $15,000 in operating expenses, yielding an NOI of $57,000. This metric, also known as EBIT in other industries, highlights its relevance beyond the realm of real estate.

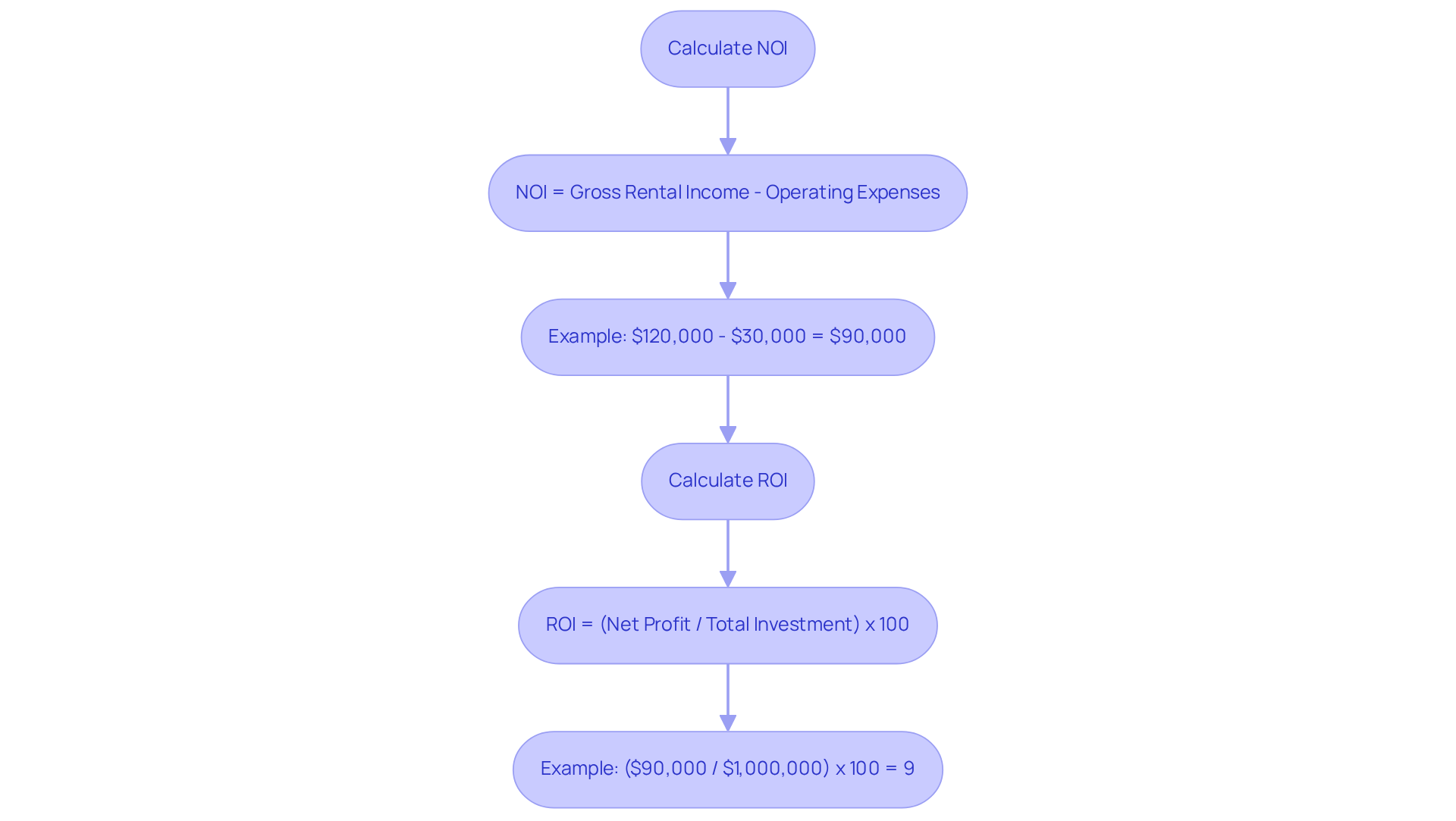

Calculate NOI and ROI: Formulas and Practical Examples

To calculate Net Operating Income (NOI), apply the formula: NOI = [Gross Rental Income - Operating](https://coastlineequity.net/insights/coastline-equity-blog/understanding-net-operating-income-noi-a-vital-tool-for-real-estate-investors) Expenses. For example, if a property generates $120,000 in gross rental income and incurs $30,000 in operating expenses, the calculation yields: NOI = $120,000 - $30,000 = $90,000. Understanding the concept of NOI vs ROI is crucial for real estate investors, as it plays a pivotal role in assessing asset profitability. Moreover, it is instrumental in calculating the capitalization rate, which evaluates an asset's profitability relative to its overall cost.

For Return on Investment (ROI), the formula is: ROI = (Net Profit / Total Investment) x 100. Assuming the same property has a total investment cost of $1,000,000 and generates a net profit of $90,000, the ROI calculation would be: ROI = ($90,000 / $1,000,000) x 100 = 9%. These calculations highlight a key distinction between NOI vs ROI: while NOI emphasizes operational efficiency by considering income and expenses, ROI provides a broader perspective on overall profitability.

Furthermore, external factors, such as interest rates, can significantly influence borrowing costs and, consequently, ROI. A well-defined long-term strategy is essential for navigating market fluctuations and maximizing returns. Investors should also consider local market trends, which can guide informed decision-making, ensuring that the calculations of NOI vs ROI accurately reflect the realities of the investment landscape.

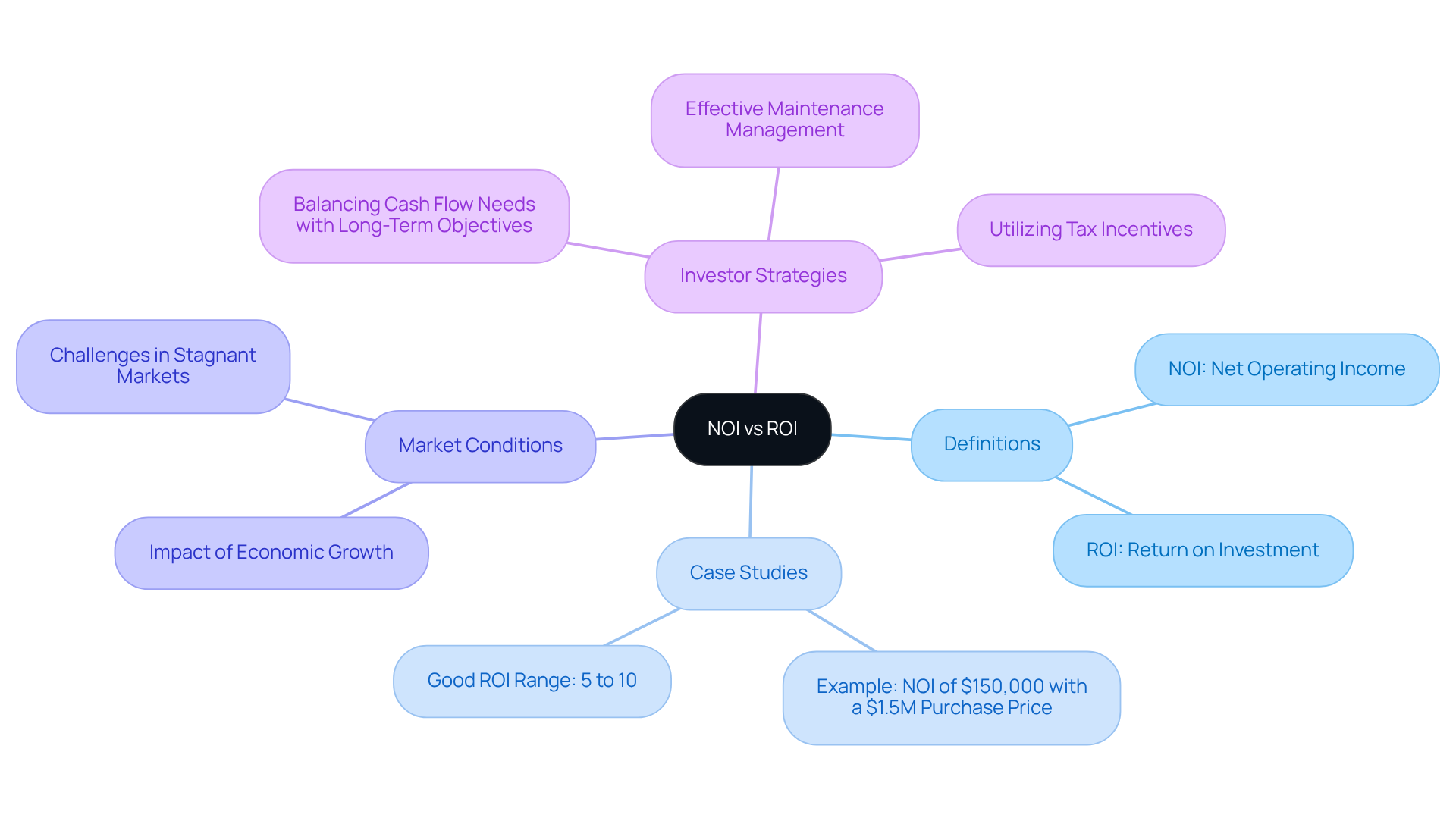

Evaluate NOI and ROI: Impacts on Investment Decisions

Net Operating Income (NOI) serves as a critical metric for investors evaluating a real estate asset's operational performance and cash flow potential. A higher NOI indicates a more profitable asset, making it appealing to those seeking stable income streams. In contrast, Return on Investment (ROI) provides a broader assessment of a project’s effectiveness, encompassing elements such as asset appreciation and current market conditions. For instance, an asset with a lower NOI may still generate a high ROI if it appreciates significantly over time. This dual understanding of NOI vs ROI empowers investors to make informed decisions, effectively balancing immediate cash flow needs with long-term investment objectives.

The interplay between NOI vs ROI is particularly evident in various case studies. Investors frequently discover that assets producing steady rental income can enhance their ROI, particularly when analyzing the NOI vs ROI in terms of efficiently managing maintenance expenses. For example, an asset with an NOI of $150,000 and a purchase price of $1.5 million results in a 10% ROI, highlighting the concept of NOI vs ROI and how operational efficiency directly impacts overall returns. This example aligns with the understanding that a good rate of return for commercial real estate generally falls between 5% and 10%.

Moreover, the influence of market conditions on the metrics, specifically NOI vs ROI, cannot be overstated. As highlighted in the case study 'Impact of Market Conditions on ROI,' economic growth or downturns can significantly affect the comparison of NOI vs ROI in commercial real estate. In fast-growing markets, properties may experience both high NOI and ROI, highlighting the importance of understanding the dynamics of NOI vs ROI, while stagnant markets may challenge investors in achieving desired returns. As remarked by industry specialists, balancing the metrics of NOI vs ROI is essential for successful financial strategies. Statements from experienced investors underscore the significance of comprehending both NOI and ROI: "The best purchase on earth is earth," emphasizing the intrinsic value of real estate as a tangible asset that can appreciate over time.

Ultimately, a comprehensive understanding of how NOI vs ROI influences cash flow potential and shapes investor behavior is vital for navigating the complexities of real estate markets. By utilizing these insights, investors can create strategies that align with their financial objectives, ensuring a robust approach to real estate.

Compare NOI and ROI: Advantages, Limitations, and Use Cases

When comparing NOI vs ROI, Net Operating Income (NOI) stands out for its focus on operational performance, providing a clear lens through which to assess an asset's income-generating potential. However, it falls short by not factoring in financing costs or taxes—elements that can significantly influence overall profitability. The comparison of NOI vs ROI shows that while Return on Investment (ROI) offers a broader perspective, it can be misleading if evaluated in isolation. High returns may stem from market appreciation rather than true operational efficiency.

When considering use cases, the analysis of NOI vs ROI is particularly valuable for evaluating rental properties and commercial real estate. In contrast, the comparison of NOI vs ROI is often employed to assess overall performance, including property flipping and long-term holdings. By grasping these nuances, investors can make informed decisions about which metric aligns best with their investment strategy. Ultimately, understanding these metrics empowers investors to navigate the complexities of real estate investments more effectively.

Conclusion

Understanding the distinction between Net Operating Income (NOI) and Return on Investment (ROI) is essential for real estate investors aiming to enhance their financial acumen. NOI provides a focused view of an asset's operational profitability, while ROI offers a broader perspective that encompasses overall investment performance, including appreciation and market conditions. Recognizing how these metrics function and their implications for investment strategies is crucial for making informed decisions in the real estate market.

Key insights illustrate that:

- NOI serves as a vital indicator of an asset's ability to generate income after covering operating expenses.

- ROI encompasses a wider array of factors, including initial investment and market growth.

The practical calculations presented demonstrate how both metrics can guide investors in evaluating property performance and aligning their financial goals. Furthermore, the impact of external market conditions on these metrics emphasizes the necessity for a strategic approach to investment analysis.

In conclusion, a comprehensive understanding of NOI and ROI empowers investors to assess the viability of their real estate ventures. It encourages a balanced approach to managing both immediate cash flow and long-term growth. By leveraging these insights, investors can navigate the complexities of the real estate landscape more effectively, ensuring that their strategies align with their financial objectives and ultimately leading to more successful investment outcomes.