Overview

The outlook for commercial real estate presents a mixed landscape, marked by sector-specific trends and challenges. Notably, the multifamily sector is stabilizing, whereas the office sector is grappling with high vacancy rates. This article underscores these dynamics by presenting data on net absorption and vacancy levels. Furthermore, it emphasizes the significant impact of rising interest rates and economic uncertainty. Investors are urged to adopt diversified strategies to effectively navigate these complexities.

Understanding these trends is crucial for making informed investment decisions. The data reveals that while some sectors show resilience, others require careful consideration. As the market evolves, the need for strategic adaptability becomes clear. Investors must remain vigilant and responsive to the shifting landscape.

In conclusion, the commercial real estate market is at a crossroads. By leveraging the insights provided in this article, investors can position themselves advantageously. The combination of sector analysis and economic indicators offers a roadmap for navigating the current challenges and seizing potential opportunities.

Introduction

The landscape of commercial real estate is experiencing a significant transformation, driven by evolving market dynamics and shifting tenant demands.

As sectors like multifamily housing stabilize, others, such as office spaces, grapple with high vacancy rates. This presents stakeholders with both opportunities and challenges.

What strategies can investors employ to navigate this complex environment, particularly in light of looming financing hurdles and a growing emphasis on sustainability?

Understanding these intricacies is essential for making informed decisions in the ever-changing realm of commercial real estate.

Analyze the Current State of Commercial Real Estate

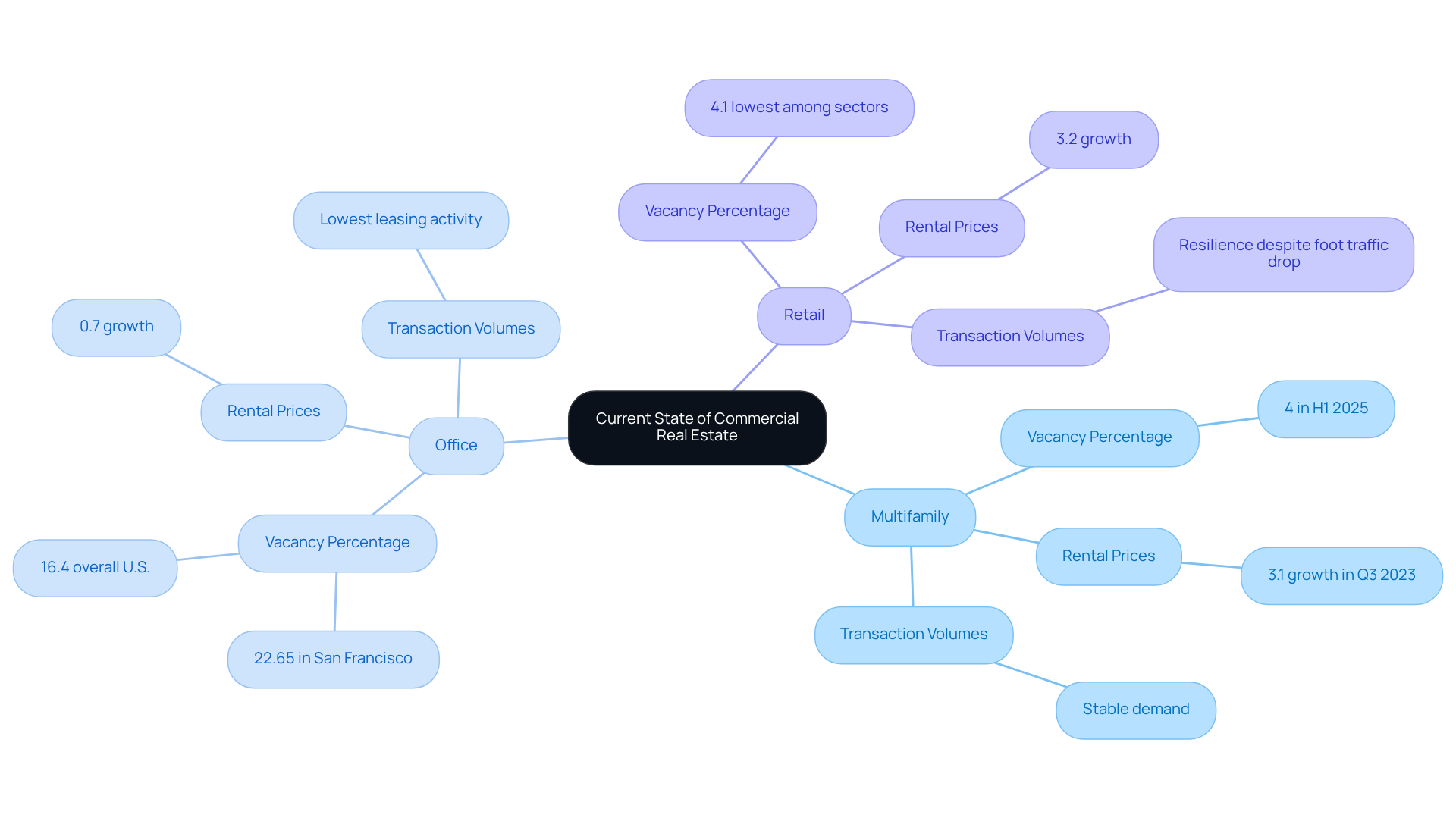

To effectively analyze the current condition of commercial real estate, it is essential to examine key performance indicators that influence the outlook for commercial real estate, such as:

- Vacancy percentages

- Rental prices

- Transaction volumes

As of mid-2025, the multifamily sector is stabilizing, evidenced by a 46% increase in net absorption and an overall vacancy level of nearly 4% in H1 2025, reflecting robust rental demand. In contrast, the office sector is encountering difficulties, with deliveries expected to hit a 13-year low and a vacancy level of 22.65% in cities such as San Francisco. The overall U.S. office space availability remains at 16.4%. Furthermore, rental prices are under pressure, with the office sector experiencing the lowest rent growth at just 0.7%.

In the retail sector, despite a 12% drop in foot traffic year-over-year, rental prices have demonstrated resilience, reaching a growth rate of 3.2% due to strict conditions and limited supply. Leveraging information from trustworthy sources like CBRE and J.P. Morgan will offer deeper insights into sector performance across various areas, including retail, industrial, and office spaces. Furthermore, it is essential to take into account the obstacles encountered by the commercial property sector, such as the expected drop in asset values and the looming financing difficulties, which impact the overall outlook for commercial real estate, with $600 billion in loans maturing each year until 2028.

This foundational analysis is crucial for understanding the broader market context and preparing for emerging trends. As investors navigate these complexities, recognizing the implications of these insights can inform their strategic decisions about the outlook for commercial real estate in a fluctuating market.

Explore Emerging Trends Influencing the Market

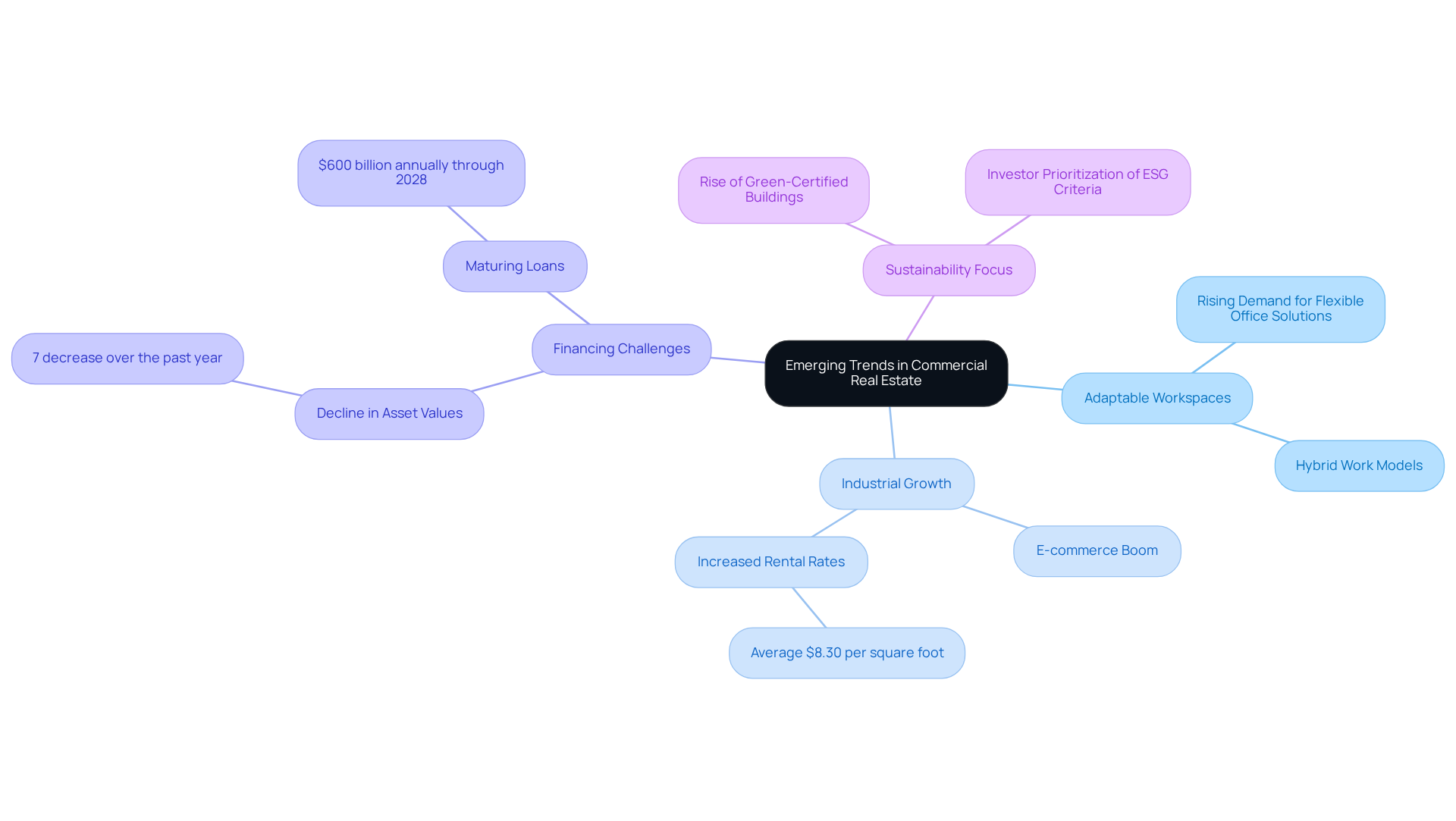

The transformations in the commercial property landscape in 2025 contribute to the outlook for commercial real estate, especially with the rising demand for adaptable workspaces. As hybrid work models gain traction, businesses are actively seeking office environments that can accommodate varying occupancy levels and collaborative needs. This shift is evident in the increasing interest in flexible office solutions, which not only cater to diverse tenant requirements but also foster a more dynamic work culture.

Concurrently, the industrial sector is flourishing, propelled by the e-commerce boom that necessitates the establishment of additional logistics and distribution centers. The demand for logistics hubs has surged, leading to a notable increase in rental rates for industrial properties, averaging $8.30 per square foot nationally. This growth underscores the essential role of logistics in supporting the supply chain and fulfilling consumer demands.

However, the outlook for commercial real estate reveals considerable challenges, with asset values declining by 7% over the past year. Furthermore, a looming financing challenge is anticipated, with $600 billion in loans maturing annually through 2028, amounting to a staggering total of $2.3 trillion. These factors highlight potential risks that stakeholders must navigate in the evolving outlook for commercial real estate.

Sustainability remains a crucial focus for investors, who are increasingly prioritizing properties that align with environmental, social, and governance (ESG) criteria. The trend toward eco-friendly property investment is unmistakable, as buildings designed with sustainability in mind are becoming more attractive to both renters and investors. By 2025, it is expected that green-certified buildings will constitute a significant portion of new commercial developments, reflecting a broader commitment to sustainable practices within the industry.

To effectively navigate these evolving trends, industry professionals must remain informed through comprehensive reports and analyses that highlight the latest developments and insights in commercial property. By understanding these dynamics, stakeholders can better position themselves to seize emerging opportunities in the market.

Identify Challenges and Strategies for Investors

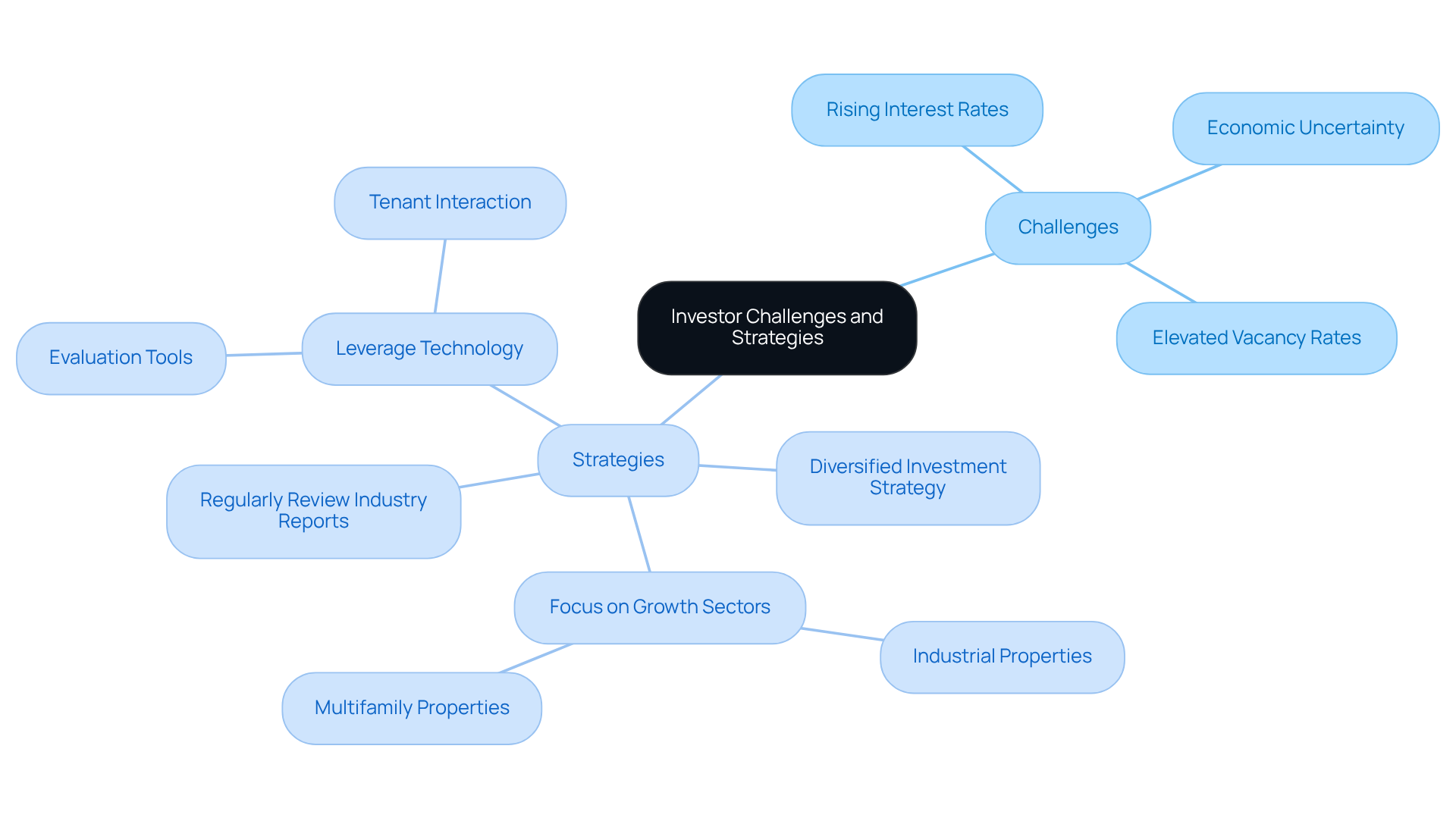

In 2025, the outlook for commercial real estate presents significant challenges for investors, primarily driven by rising interest rates and economic uncertainty. These elements contribute to elevated vacancy rates in specific sectors, particularly office spaces, which can threaten profitability.

To adeptly navigate this landscape, investors must adopt a diversified investment strategy, focusing on sectors poised for growth, such as industrial and multifamily properties. Furthermore, leveraging technology for evaluation and tenant interaction is essential, as it enhances decision-making and operational efficiency.

Regularly reviewing industry reports and adjusting strategies in response to current economic indicators and trends will empower investors to make informed choices about the outlook for commercial real estate in this dynamic environment.

As Andrew Carnegie famously stated, "Ninety percent of all millionaires become so through owning real estate," highlighting the critical importance of strategic investment even amidst adversity.

Additionally, Zero Flux's commitment to delivering clear and precise insights from over 100 diverse sources aids investors in cutting through the information overload that is prevalent in the industry.

Leverage Data-Driven Insights for Informed Decision-Making

To effectively harness data-driven insights, investors must adopt advanced analytics tools that facilitate the assessment of market conditions and property performance. Key metrics to track include:

- Net operating income (NOI), essential for understanding profitability.

- Capitalization figures that aid in evaluating anticipated returns.

Notably, the typical internal rate of return (IRR) for property assets ranges from 10% to 20%, establishing a benchmark for investment performance. Additionally, absorption rates can indicate demand trends, particularly as office property values have declined by 14% over the past year, presenting potential opportunities for strategic acquisitions.

By analyzing these indicators, investors can identify trends and make informed decisions regarding property acquisitions and dispositions. Furthermore, leveraging predictive analytics can help forecast future economic conditions and tenant demand, enabling proactive investment strategies. For instance, the life sciences sector has experienced an average asking rent increase of 4.1%, demonstrating how analytics can inform investment decisions.

Utilizing resources such as commercial real estate databases and research reports can provide essential data to support these strategies. Engaging with platforms that deliver real-time data enhances the ability to respond swiftly to market fluctuations, ensuring that investors remain competitive in a rapidly evolving landscape.

Conclusion

The future of commercial real estate in 2025 is shaped by a complex interplay of trends and challenges that demand careful analysis and strategic planning. Understanding the current state of the market—characterized by varying performance across sectors, from the stabilizing multifamily sector to the struggling office space—is crucial for stakeholders aiming to navigate this evolving landscape effectively.

Key insights reveal that:

- The industrial sector thrives amid e-commerce growth.

- The demand for flexible workspaces rises.

- Significant challenges persist, including:

- Declining asset values

- Looming financing issues

Investors must adopt diversified strategies, leveraging technology and data-driven insights to make informed decisions that align with market dynamics. By focusing on metrics such as net operating income and capitalization rates, stakeholders can better position themselves to capitalize on emerging opportunities.

Ultimately, the commercial real estate market in 2025 presents both risks and rewards. As the industry adapts to changing demands and economic pressures, a proactive approach that embraces sustainability and innovation will be essential. Stakeholders are encouraged to remain informed and agile, ensuring they can effectively respond to shifts in market conditions and seize the potential that lies ahead.