Overview

This article delves into the crucial distinctions between real estate crowdfunding and Real Estate Investment Trusts (REITs). It highlights that crowdfunding empowers individual investors to directly finance specific projects, whereas REITs involve acquiring shares in a company that manages a diversified portfolio of properties. This fundamental difference is underscored through an analysis of:

- Liquidity

- Investment structure

- Risk factors

- Potential returns

Such insights illustrate how each investment method caters to varying investor preferences and risk appetites, ultimately guiding readers in making informed investment decisions.

Introduction

Real estate investment has evolved dramatically, presenting diverse pathways for individuals to engage in this lucrative market. Among these, real estate crowdfunding and Real Estate Investment Trusts (REITs) stand out as two prominent options, each catering to different investor profiles and risk appetites.

- Crowdfunding democratizes access to specific real estate projects with lower entry barriers.

- REITs offer a more stable, dividend-driven investment approach.

However, these opportunities come with distinct risks and challenges. How can potential investors navigate these choices to align with their financial goals?

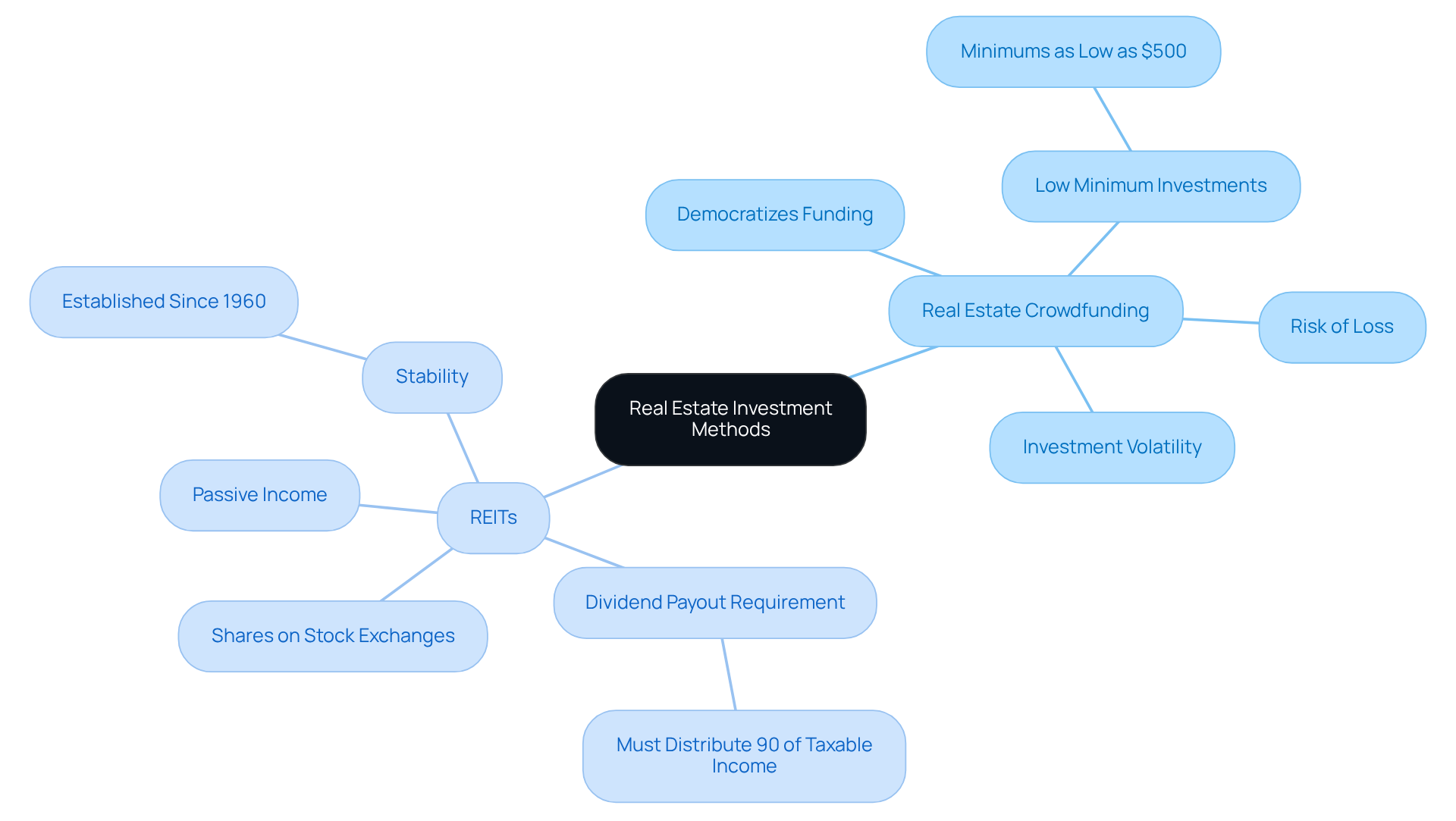

Define Real Estate Crowdfunding and REITs

Real estate crowdfunding represents a revolutionary method that allows multiple contributors to pool their resources online, investing in real estate projects. This approach democratizes real estate funding, empowering individuals to seize opportunities that were once exclusive to affluent investors. Investors can choose specific projects to finance, often benefiting from reduced minimum contributions compared to traditional funding methods, with some platforms offering minimums as low as $500. However, it is crucial to acknowledge that crowdfunding investments can exhibit volatility, and there exists a risk of losing the entire investment if projects face delays or prove unprofitable.

Conversely, Real Estate Investment Trusts (REITs) are firms that own, manage, or finance income-generating properties. Investors can acquire shares of these companies on stock exchanges, akin to purchasing stocks. REITs provide a pathway for individuals to invest in large-scale, income-generating properties without the burden of direct ownership or management. They are mandated to distribute at least 90% of their taxable income as dividends, rendering them an attractive option for those pursuing reliable passive income. This requirement, coupled with their extensive history since 1960, adds a layer of stability and trustworthiness to REITs.

In summary, while both real estate crowdfunding vs REITs provide avenues for real estate investment, they do so through distinct mechanisms and frameworks, catering to diverse investor preferences and risk appetites. As of 2025, numerous funding platforms are operational, each presenting unique opportunities and risks. Furthermore, with inflation currently at 4.9%, dividend stocks such as those from REITs are increasingly appealing for generating income and outpacing inflation.

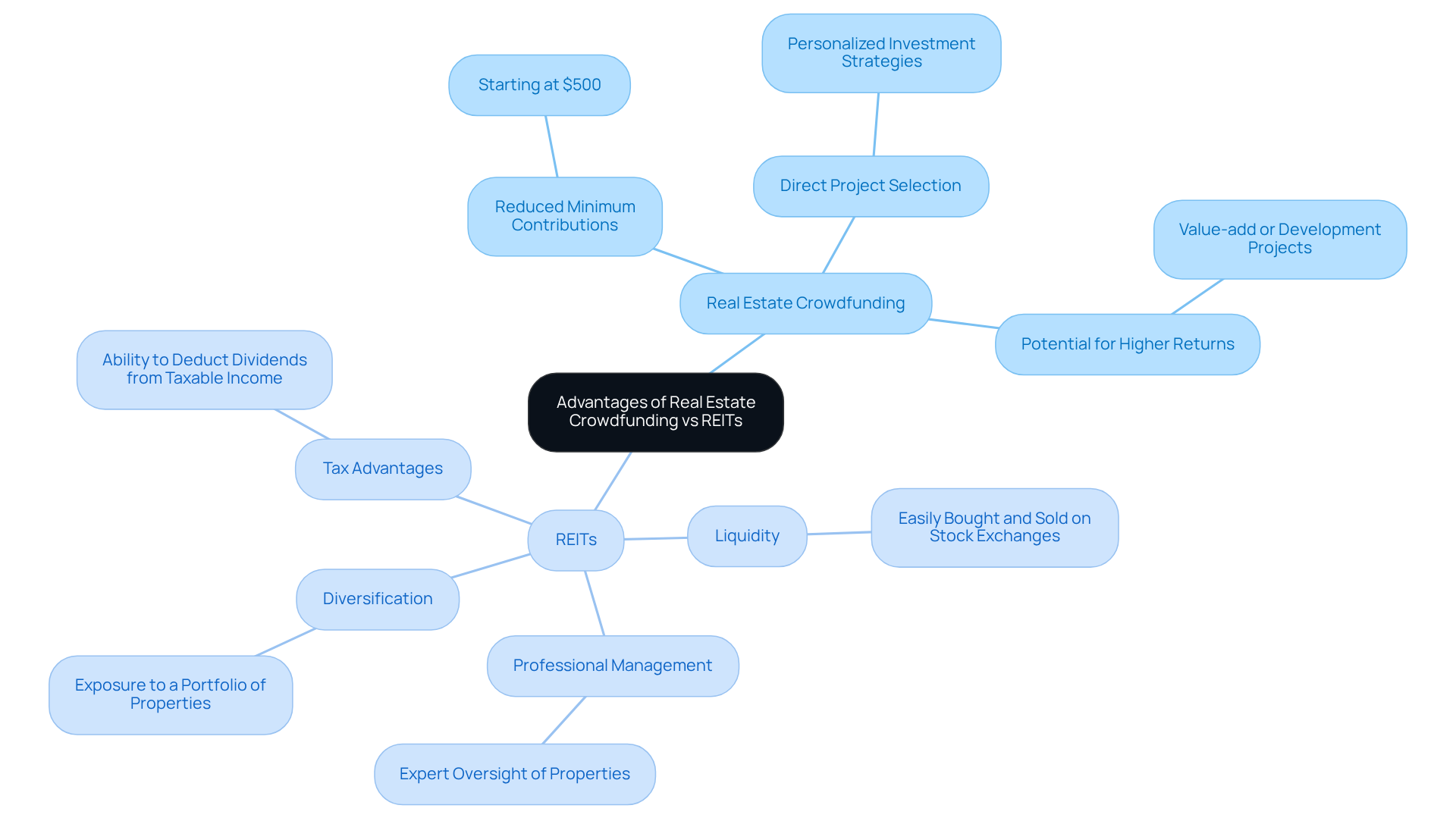

Explore the Advantages of Real Estate Crowdfunding and REITs

Real Estate Crowdfunding presents several advantages:

- Reduced Minimum Contributions: Numerous crowdfunding platforms allow contributions starting at $500, broadening access to real estate investments.

- Direct Project Selection: Investors have the opportunity to select specific projects to fund, enabling personalized investment strategies tailored to individual interests and risk tolerance.

- Potential for Higher Returns: Crowdfunding can yield higher returns, particularly in value-add or development projects, as investors can benefit from the appreciation of targeted properties.

In contrast, REITs offer their own unique benefits:

- Liquidity: Shares of publicly traded real estate investment trusts can be easily bought and sold on stock exchanges, providing greater liquidity compared to crowdfunding investments, which often entail longer lock-in periods.

- Professional Management: Real Estate Investment Trusts are managed by experts who oversee property acquisition, administration, and sale, relieving stakeholders of the operational responsibilities associated with direct property ownership.

- Diversification: Investing in a REIT allows individuals to gain exposure to a diversified portfolio of properties, thereby reducing the risks linked to investing in a single project.

- Tax Advantages: Real Estate Investment Trusts offer tax benefits, including the ability to deduct dividends from taxable income, enhancing overall returns for investors.

It is essential to note that many crowdfunding platforms require investors to be accredited, as defined by the SEC, while real estate investment trusts are accessible to all types of investors. Furthermore, real estate crowdfunding vs REITs offers greater transparency and lower entry amounts; however, it does not guarantee income and involves higher risks. For instance, Service Properties (SVC) has a share price of $8.52 and delivered a one-year total return of 43.6%, illustrating the potential performance of real estate investment trusts.

The distinct benefits of real estate crowdfunding vs REIT cater to various investor needs. Therefore, it is crucial for prospective investors to thoughtfully consider these advantages. Additionally, seeking advice from a tax expert before investing in REITs or collective funding is recommended to effectively manage the financial implications.

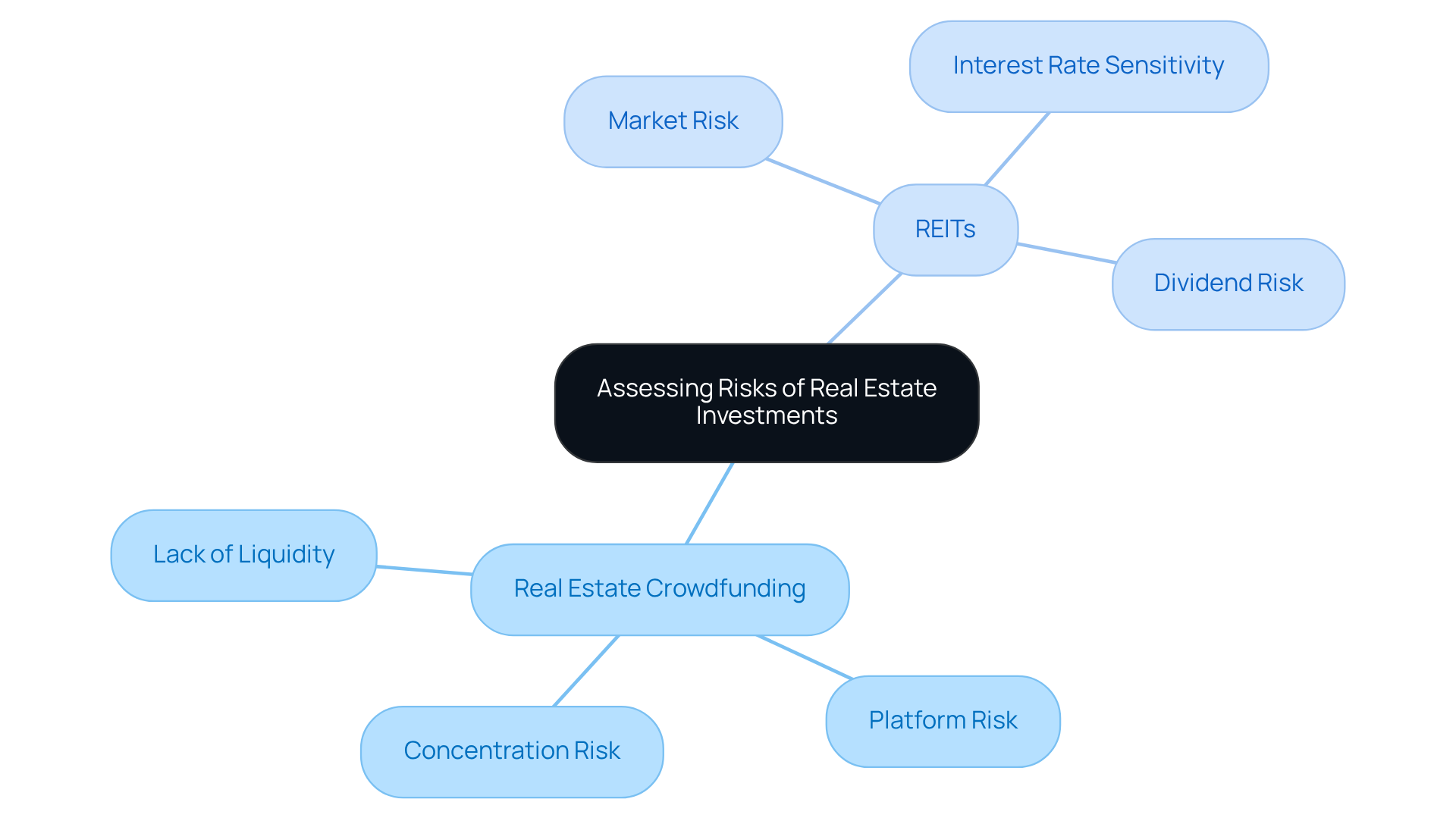

Assess the Risks of Real Estate Crowdfunding and REITs

Investing in Real Estate Crowdfunding presents several noteworthy risks.

- Lack of Liquidity is a primary concern; crowdfunding contributions are typically illiquid, meaning that once funds are committed, they may be tied up for extended periods, making it challenging to access capital.

- Additionally, Platform Risk plays a crucial role in the success of collective funding efforts. The reliability of the platform is paramount—if it fails, investors risk losing their capital.

- Furthermore, Concentration Risk is significant, as many crowdfunding investments focus on a single project, increasing the potential for loss if that project underperforms.

Conversely, Real Estate Investment Trusts (REITs) also carry inherent risks.

- Market Risk is prevalent, as REITs are subject to market fluctuations; their share prices can be influenced by broader economic conditions, interest rates, and investor sentiment.

- Moreover, Interest Rate Sensitivity is a factor to consider. REITs can be vulnerable to changes in interest rates, which may affect their borrowing costs and, consequently, their profitability.

- Lastly, Dividend Risk should not be overlooked. Although real estate investment trusts are recognized for distributing dividends, there is no guarantee that these payments will be maintained, particularly during economic downturns.

Individuals must carefully evaluate the distinct risks presented by real estate crowdfunding vs REIT. This underscores the importance of comprehensive research and risk assessment before allocating funds.

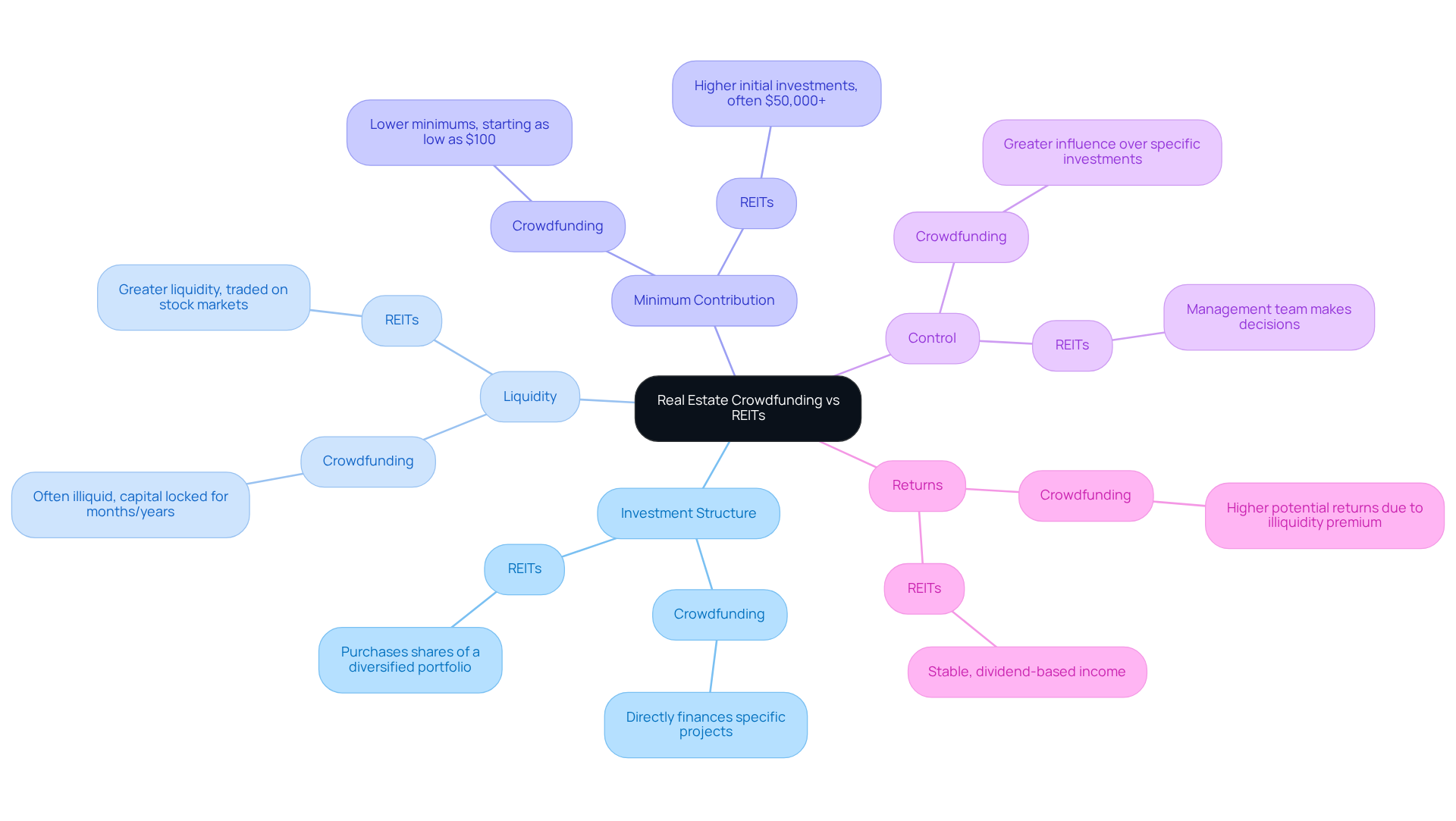

Compare Real Estate Crowdfunding and REITs: Key Differences and Suitability

When comparing Real Estate Crowdfunding and REITs, several key differences emerge that are crucial for investors to understand:

-

Investment Structure: The discussion of real estate crowdfunding vs REIT highlights that crowdfunding enables individuals to directly finance specific projects, while REITs involve purchasing shares of a firm that manages a diversified portfolio of properties.

-

Liquidity: REITs provide greater liquidity since they can be traded on stock markets. In contrast, crowdfunding methods are often illiquid, with capital typically locked in for months or even years.

-

Minimum Contribution: Crowdfunding platforms generally have lower minimum contribution requirements, making them accessible to a broader range of participants compared to REITs, which may necessitate larger initial investments.

-

Control: Participants in crowdfunding enjoy greater influence over their investment choices, often knowing the specific property they are funding. Conversely, REIT stakeholders rely on the management team to make decisions on their behalf.

-

Returns: Crowdfunding may offer higher potential returns, especially in development projects, due to the illiquidity premium that compensates participants for committing their capital. In contrast, REITs provide more stable, dividend-based income, as they are legally required to distribute at least 90% of profits to shareholders.

In terms of suitability, real estate crowdfunding vs REIT may attract investors seeking higher returns and willing to accept increased risks, particularly following its rise in popularity after the 2012 JOBS Act. On the other hand, REITs may be more appealing for those prioritizing liquidity and passive income through dividends. Ultimately, the choice between real estate crowdfunding vs REIT as investment options will depend on individual goals, risk tolerance, and personal preferences.

Conclusion

Real estate crowdfunding and REITs represent two distinct avenues for investors seeking to engage with the real estate market. Crowdfunding democratizes investment opportunities by allowing individuals to fund specific projects with lower entry barriers, while REITs offer a more traditional approach, providing liquidity and stability through shares in professionally managed portfolios. Understanding these fundamental differences is essential for making informed investment decisions.

The advantages and risks associated with each investment method are critical to consider. Real estate crowdfunding can yield higher returns and greater control over individual projects, yet it also presents liquidity challenges and concentration risks. Conversely, REITs deliver a reliable income stream through dividends and professional management, albeit with exposure to market fluctuations and interest rate sensitivity. Ultimately, the choice between these two options hinges on an investor's risk tolerance, investment goals, and preference for either hands-on involvement or passive income.

In a landscape where investment options continue to evolve, thorough research is vital for investors to consider their unique financial situations. Whether opting for the potential high rewards of crowdfunding or the stability offered by REITs, aligning investment choices with personal objectives and risk profiles is key. Informed decision-making will pave the way for successful real estate investments in 2025 and beyond.