Overview

Real estate data providers can be evaluated based on their features, pricing, and information quality. Leading options such as:

- CoStar

- ATTOM Solutions

- CoreLogic

- Zillow

- Reonomy

each cater to distinct market segments. Understanding these providers' unique strengths and weaknesses, alongside their pricing structures and the quality of their data, is crucial for investors navigating a rapidly evolving real estate landscape. This knowledge empowers investors to make informed decisions, ultimately enhancing their investment strategies.

Introduction

In the rapidly evolving landscape of real estate, data providers play a pivotal role in guiding investors and industry professionals through the complexities of market dynamics. As we approach 2025, key players such as:

- CoStar

- ATTOM Data Solutions

- CoreLogic

- Zillow

- Reonomy

are carving out their niches, each offering unique strengths that cater to diverse needs within the sector. These providers deliver comprehensive property insights and advanced analytics capabilities, equipping users with the essential tools to make informed decisions amid shifting buyer preferences and technological advancements.

Understanding the strengths and weaknesses of each option is crucial for investors seeking to leverage data for strategic advantage. The demand for accurate and timely information surges in today's competitive environment, making it imperative for industry professionals to stay informed.

Overview of Leading Real Estate Data Providers

In 2025, the landscape of real estate data providers is defined by several key players, each offering unique advantages:

- CoStar: Renowned for its comprehensive commercial property database, CoStar provides detailed sales and lease comparables, property listings, and vacancy rates, establishing it as a primary resource for industry experts.

- ATTOM Solutions: As a prominent player among real estate data providers, ATTOM specializes in property information and offers valuable insights into property values, neighborhood trends, and comprehensive market analytics, essential for informed decision-making.

- CoreLogic: Recognized for its robust analytics, CoreLogic is among the top real estate data providers, offering detailed property information and risk assessment tools that aid investors in evaluating potential investments.

- Zillow: Although primarily recognized as a property marketplace, Zillow delivers substantial insights through its Zestimate algorithm, which assesses property values based on numerous market factors. Notably, Zillow forecasts a 2.6% growth in home values for 2025, indicating a slight increase in existing home sales—an essential consideration for investors.

- Reonomy: Concentrated on commercial property, Reonomy employs AI to provide access to insights from real estate data providers, enhancing the depth of property intelligence and ownership information available to users.

These real estate data providers cater to various market segments, from residential to commercial real estate, offering a range of information types and analytical tools that reflect the diverse needs of real estate investors and professionals in 2025. Moreover, with only 29.7% of Millennial renters currently able to purchase a home, the role of real estate data providers becomes increasingly vital in assisting investors to navigate the complexities of the market.

As Joy Aumann, a licensed realtor and founder of LUXURYSOCALREALTY.com, observes, "More buyers are prioritizing energy-efficient features like solar panels, high-performance insulation, and smart home automation." This shift in buyer preferences underscores the importance of leveraging information to understand market trends and consumer demands. Additionally, technology and sustainability are driving the evolution of the commercial property sector, making it imperative for information providers to adapt and present insights that reflect these changes.

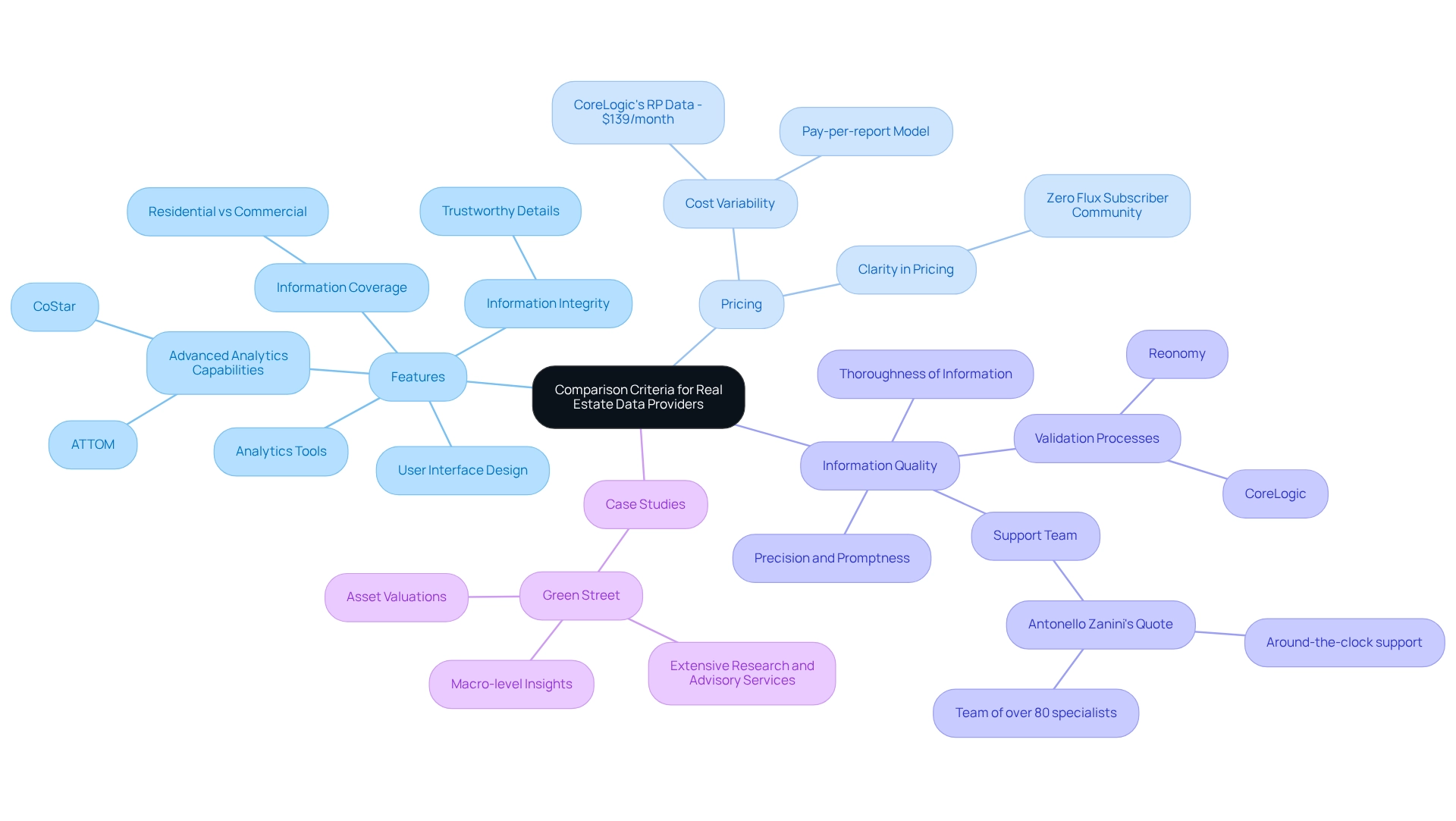

Comparison Criteria: Features, Pricing, and Data Quality

When evaluating real estate data providers, several critical criteria should guide your decision-making process:

- Features: Examine the specific functionalities offered by each real estate data provider, such as information coverage (residential versus commercial), analytics tools, and user interface design. While specific mentions of CoStar and ATTOM were made regarding advanced analytics capabilities, it is essential to verify such claims with credible sources. Zero Flux highlights the significance of information integrity, ensuring that any assertions regarding features are supported by trustworthy details.

- Pricing: The cost of real estate information services can vary widely. Some providers, like CoreLogic's RP Data, charge around $139 per month, while others may adopt a pay-per-report model. Understanding the pricing structure in relation to the features provided by real estate data providers is essential for effective budgeting and resource allocation. Zero Flux's subscriber community appreciates clarity in pricing, which aids in making informed decisions.

- Information Quality: The precision, promptness, and thoroughness of the information are crucial for making informed investment choices. Providers recognized for their stringent information validation processes, such as CoreLogic and Reonomy, are among the leading real estate data providers ensuring high-quality details. As Antonello Zanini emphasizes, 'Around-the-clock support from a team of over 80 specialists' enhances the reliability of the information, underscoring the importance of quality in real estate investments. This aligns with Zero Flux's commitment to presenting factual information without opinions, further reinforcing the importance of information quality.

In addition to these criteria, consider case studies like Green Street, which is renowned for its extensive research and advisory services. Their emphasis on macro-level insights and asset valuations illustrates how a provider's distinctive method of analysis can significantly impact investment strategies. By evaluating characteristics, pricing, and information quality, investors can make informed decisions that match their specific requirements in the dynamic property market.

Provider Profiles: Strengths and Weaknesses of Each Option

CoStar

- Strengths: CoStar is widely recognized for its extensive commercial data and robust analytics tools, establishing itself as a primary resource for industry professionals. Its strong market reputation is supported by a commitment to delivering high-quality insights that facilitate informed decision-making. Notably, CoStar's recent acquisition of Matterport and partnership with eXp Commercial underscore its dedication to enhancing technological capabilities and expanding service offerings, which is anticipated to significantly improve user experiences and bolster customer retention.

- Weaknesses: However, CoStar's higher pricing structure may deter smaller businesses, thereby limiting accessibility for some potential users.

ATTOM Data Solutions

- Strengths: ATTOM Data Solutions excels in providing comprehensive property data and strong analytics capabilities, catering effectively to a diverse range of real estate needs. Its extensive database is particularly valuable for investors seeking detailed market insights.

- Weaknesses: On the downside, ATTOM may lack certain niche information compared to more specialized providers, which could pose a drawback for users with specific requirements.

CoreLogic

- Strengths: CoreLogic is esteemed for its high-quality data and effective risk assessment tools, making it a reliable choice for investors focused on risk management and property valuation.

- Weaknesses: However, its pricing can be complex and may not always be transparent, potentially complicating the decision-making process for users.

Zillow

- Strengths: Zillow distinguishes itself with its user-friendly interface and widespread popularity among consumers, rendering it an accessible platform for those interested in residential real estate. Homes.com has recently emerged as the second most visited residential portal in the US, highlighting the competitive landscape in this sector.

- Weaknesses: Its primary focus on residential information may not adequately serve commercial users, thereby restricting its relevance for investors in that sector.

Reonomy

- Strengths: Reonomy excels in commercial real estate data and harnesses AI-driven insights to provide users with valuable market intelligence, appealing to tech-savvy investors.

- Weaknesses: Conversely, its offerings in residential information are limited, which may restrict its usefulness for those looking to analyze the residential market.

Market Insights

As Chris noted, "The second quarter is typically slower due to the timing of industry conferences. We expect acceleration in the third and fourth quarters, driven by our expanded sales force and strategic focus on rooftops and pricing." This sentiment reflects the anticipated market trends that investors should consider when evaluating information sources.

Choosing the Right Provider: Recommendations Based on User Needs

Choosing the right real estate data providers requires careful evaluation of various factors tailored to specific user needs. Here are key recommendations:

- For Commercial Real Estate Professionals: CoStar and Reonomy are exceptional choices due to their extensive databases and advanced analytics capabilities, making them indispensable tools for those focused on commercial properties.

- For Residential Investors: Zillow and ATTOM Data Solutions stand out as excellent options, offering intuitive interfaces and a wealth of residential information that streamlines the investment process. Notably, ATTOM provides frequent updates and personalized solutions, enhancing its value for users seeking timely and tailored insights.

- For Analytics-Focused Analysts: CoreLogic excels in delivering high-quality information and robust risk assessment tools, making it ideal for those engaged in comprehensive market analyses.

- For Budget-Conscious Users: It is crucial to compare pricing models among providers. Seek those that offer flexible payment options or tiered subscriptions to ensure you find a solution that aligns with your budget.

As we look toward 2025, the landscape of real estate data providers continues to evolve, emphasizing accuracy, breadth, and timeliness. For instance, PropertyShark has gained traction among real estate firms for its user-friendly features and up-to-date sales information, particularly its comparable sales analysis tool, which aids users in making informed decisions. However, it is essential to recognize that some regions may have limited public information available, potentially restricting its effectiveness in certain markets.

With virtual home tours surging by over 300% since 2020, the demand for comprehensive data solutions has never been higher. Investors should prioritize suppliers that not only meet their immediate needs but also adapt to the evolving trends of the property market. By leveraging insights from seasoned investors, such as those who have successfully utilized Ratespot for mortgage and property rate comparisons, users can navigate their options more effectively and select a provider that aligns with their strategic goals. The comprehensive data offering from Ratespot has proven invaluable; as one verified buyer stated, "I had the opportunity to make use of Ratespot's data offering to conduct research and compare real estate and mortgage rates, and I must say, it exceeded my expectations.

Conclusion

The landscape of real estate data providers has become increasingly pivotal for investors and industry professionals navigating the complexities of the market. Providers such as CoStar, ATTOM Data Solutions, CoreLogic, Zillow, and Reonomy each offer unique strengths, catering to various segments of the industry. Understanding the specific features, pricing structures, and data quality of these providers is essential for making informed decisions that align with individual investment strategies.

By evaluating the strengths and weaknesses of each provider, investors can tailor their choices to meet their specific needs—whether in commercial or residential real estate. As buyer preferences shift towards sustainability and technological integration, the role of data providers becomes even more critical. They must not only deliver accurate and timely insights but also adapt to the evolving dynamics of the market.

Ultimately, the right data provider empowers investors to make strategic decisions that enhance their competitive edge. As the demand for comprehensive data solutions continues to rise, selecting a provider that aligns with both current market trends and personal investment goals is essential for success in the ever-changing real estate landscape. In this environment, staying informed and leveraging high-quality data will be key to navigating the complexities of real estate investments effectively.