Overview

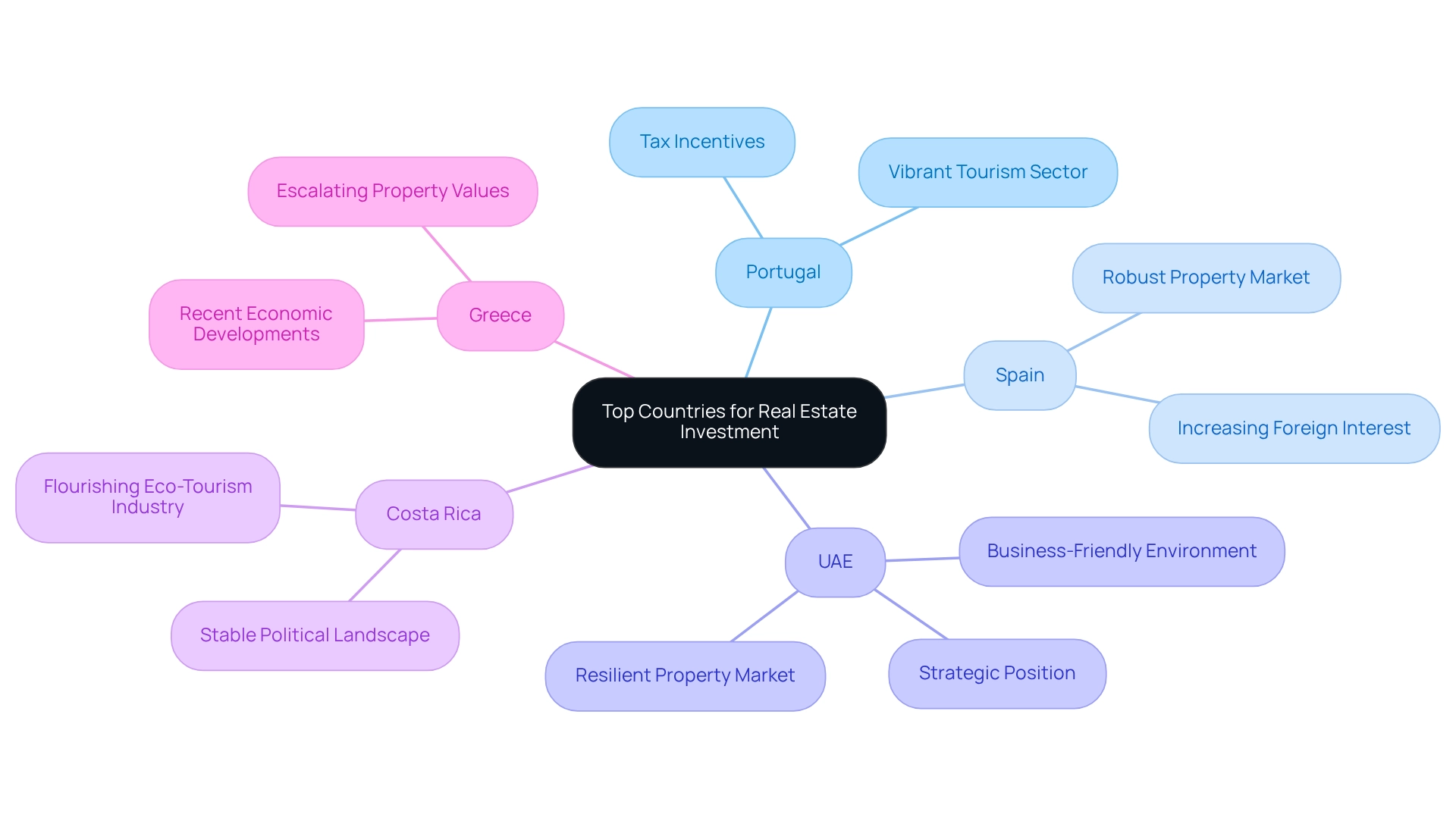

In 2025, the leading countries for real estate investment are:

- Portugal

- Spain

- the UAE

- Costa Rica

- Greece

Each of these nations presents unique advantages, including:

- Favorable tax incentives

- Economic stability

- Robust tourism sectors

These factors position them for growth, supported by:

- Strategic regulatory environments

- Positive demographic trends

For investors seeking lucrative opportunities in the evolving global property market, these destinations are particularly attractive. By understanding these insights, investors can make informed decisions that align with market dynamics.

Introduction

As the global real estate market evolves, 2025 presents a unique landscape shaped by transformative trends and emerging opportunities. Urbanization, technological advancements, and shifting demographics are driving investors to rethink their strategies, particularly in thriving markets like Portugal and Spain, where favorable policies attract foreign capital.

The rise of remote work has further influenced preferences, leading many to seek suburban and rural properties that offer a better quality of life. With the market projected to grow significantly, understanding the intricate interplay of economic stability, regulatory environments, and demographic shifts is essential for investors looking to navigate this dynamic terrain.

This comprehensive exploration of global real estate investment trends reveals the countries poised for success and the factors that will shape the future of property investment.

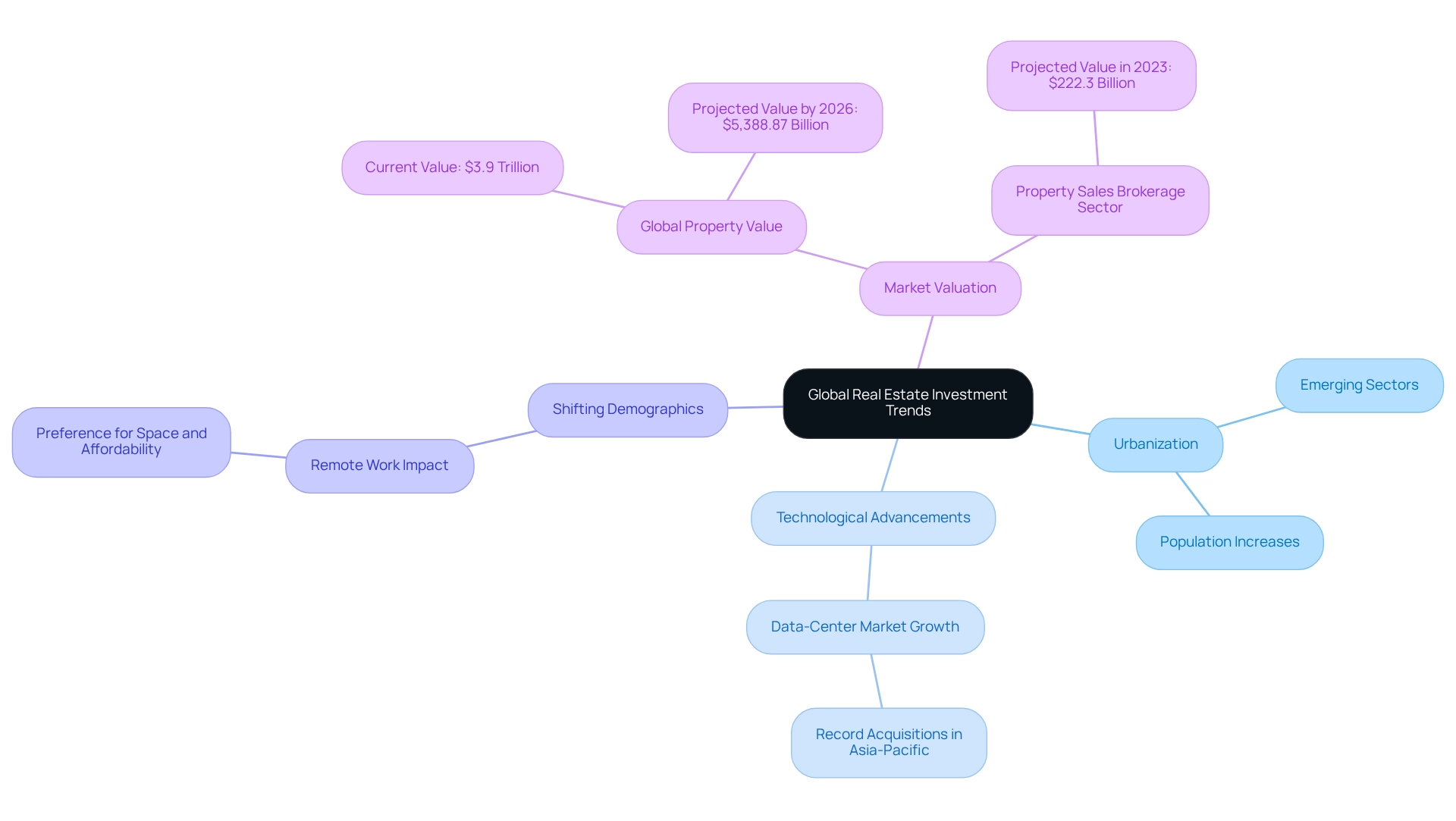

Understanding Global Real Estate Investment Trends

In 2025, the global property funding landscape is significantly influenced by pivotal trends such as urbanization, technological advancements, and shifting demographics. As urban areas continue to expand, investors are increasingly drawn to emerging sectors that exhibit substantial growth potential, fueled by factors like population increases and robust economic development. Notably, property accounts for nearly 17% of the U.S. GDP, underscoring its vital role in the economy.

The shift toward remote work has further transformed investment priorities, with many buyers now favoring suburban and rural properties that offer more space and affordability. This trend mirrors a broader desire for lifestyle changes, as individuals prioritize comfort and practicality over proximity to urban centers. Joy Aumann, a licensed realtor and founder of LUXURYSOCALREALTY.com, notes that this shift empowers buyers to focus on their needs rather than conventional location constraints.

Understanding these trends is essential for investors aiming to align their strategies with market demands and seize new opportunities. The global property sector, valued at over $3.9 trillion, is projected to grow significantly, nearing approximately $5,388.87 billion by 2026. Additionally, the Property Sales Brokerage sector is expected to reach $222.3 billion in 2023, highlighting the economic impact of real estate.

Moreover, the data-center market is witnessing a record year for acquisitions, particularly in the Asia-Pacific region, reflecting current trends and developments in the industry. The case study titled 'Property Market Size and Growth' emphasizes the economic significance of property and its growth potential, providing a solid foundation for the arguments presented. Staying informed about these current global property trends is crucial as urbanization continues to reshape the landscape.

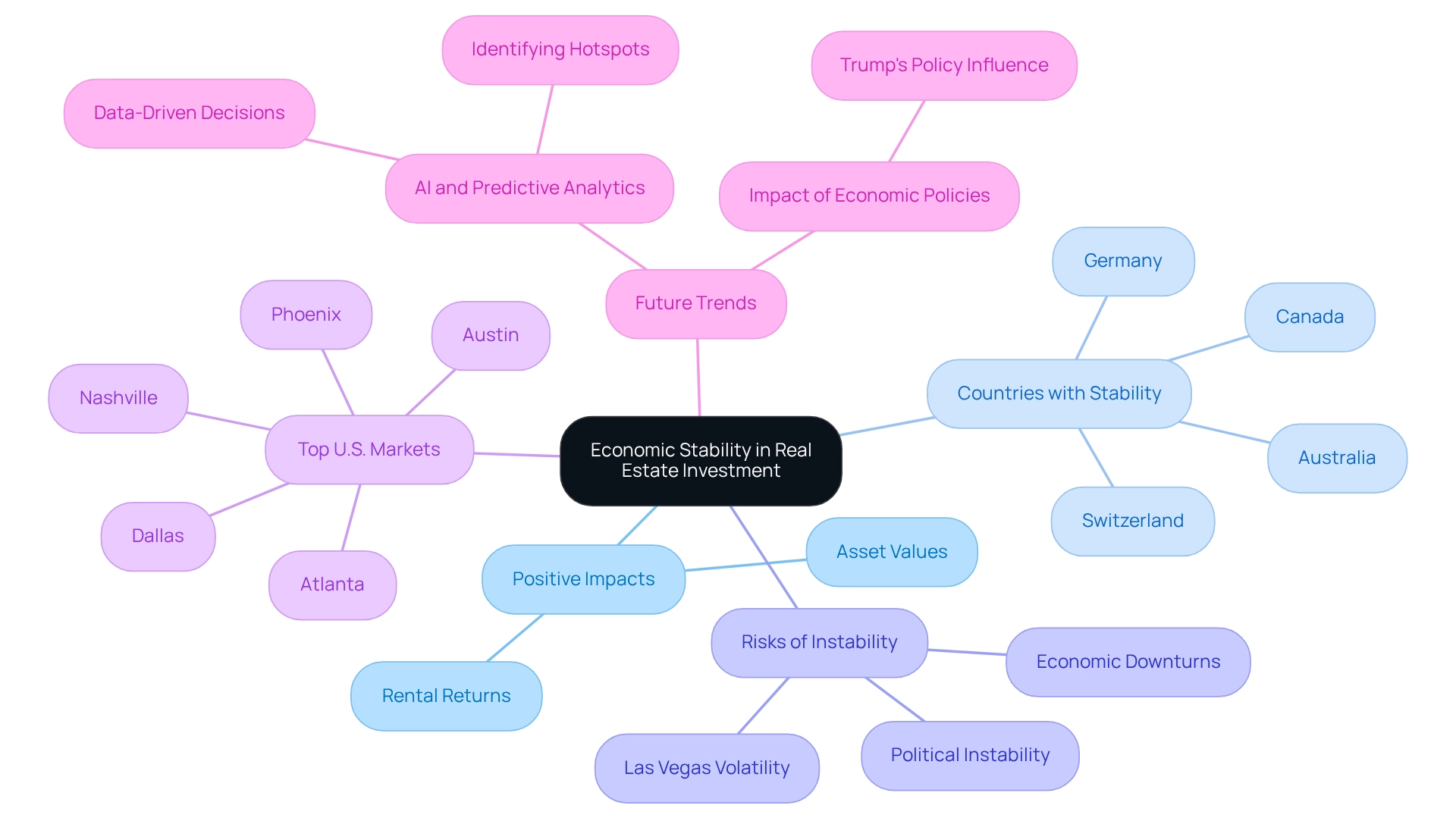

The Role of Economic Stability in Real Estate Investment

Economic stability serves as a cornerstone for successful property ventures, significantly impacting asset values and rental returns. Countries with robust economies are often viewed as the best destinations for real estate investment, attracting substantial foreign capital by offering a stable environment conducive to positive returns. For instance, Germany and Canada have consistently demonstrated resilience amidst economic fluctuations, establishing themselves as prime targets for investors seeking stability.

Conversely, nations facing political instability or economic downturns pose heightened risks, potentially leading to losses for investors. A recent analysis revealed that New Jersey experienced the fastest industrial rent growth at 9.8% year-over-year, underscoring how economic conditions can directly shape funding opportunities. Additionally, Las Vegas has been identified as the most volatile large housing market in the U.S., highlighting the risks associated with investing in less stable markets.

Moreover, the importance of economic stability extends beyond immediate gains; it plays a crucial role in shaping long-term financial strategies. Countries like Australia and Switzerland are recognized as top choices for real estate investment, thanks to their stable economies that attract significant foreign capital in property. Furthermore, leading areas for real estate funding in the U.S. include:

- Austin

- Dallas

- Nashville

- Atlanta

- Phoenix

These locations are increasingly appealing to investors.

The rise of AI-driven platforms is further transforming financial strategies, leveraging predictive analytics to assess economic stability and forecast industry trends. This data-driven approach empowers investors to make informed decisions, mitigating risk and identifying emerging hotspots before they reach saturation. As John Sim, Head of Securitized Products Research at J.P. Morgan, noted, "It’s clear that various elements of Trump's policy will influence the housing market," highlighting the necessity for investors to remain vigilant regarding economic policies that could impact their portfolios.

Understanding the relationship between economic stability and property acquisition is vital for optimizing returns and minimizing risks as we approach 2025 and beyond.

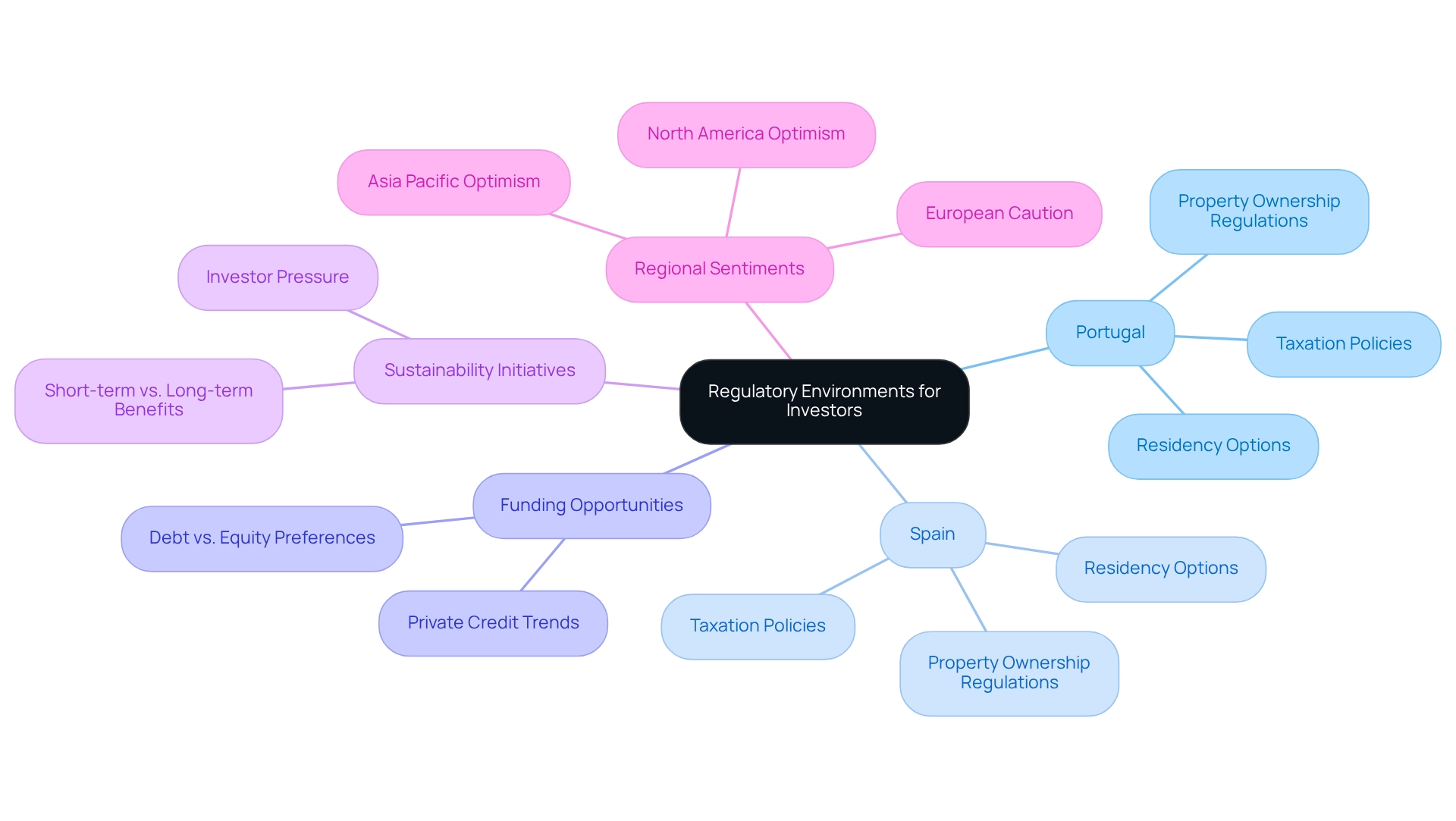

Evaluating Regulatory Environments for Investors

Navigating the regulatory environment is crucial for successful real estate ventures. Each nation presents a distinct array of regulations concerning property ownership, taxation, and foreign capital. For instance, Portugal and Spain are regarded as prime locations for real estate investment, offering residency options linked to property purchases that significantly enhance the appeal of these markets.

Conversely, certain regions may impose strict regulations that could limit funding opportunities. Investors must conduct thorough due diligence on local laws and consult legal professionals to ensure compliance and enhance their funding strategies. Tim Coy, a senior research leader in commercial real estate at Deloitte, underscores that investor pressure is propelling sustainability initiatives, highlighting the growing significance of sustainability in real estate funding decisions. Recent insights reveal that respondents from North America and Asia Pacific express greater optimism regarding improved leasing conditions compared to their European counterparts, emphasizing the importance of understanding regional differences.

Moreover, case studies indicate that while fundraising for real estate has encountered challenges due to low deal activity, the rise of private credit has shifted investor preferences towards debt over equity. This trend underscores the necessity for investors to remain informed about evolving regulatory frameworks and economic dynamics in the best countries for real estate investment, as these factors can profoundly influence investment decisions. By 2025, comprehending property ownership laws for foreign investors will be paramount, as regulations continue to evolve.

Engaging with regional specialists and leveraging data-informed insights will empower investors to adapt and seize new opportunities, ensuring they remain competitive in the global property sector. Furthermore, staying updated on the advantages of hard money loans can provide investors with alternative financing options to navigate the complexities of the industry.

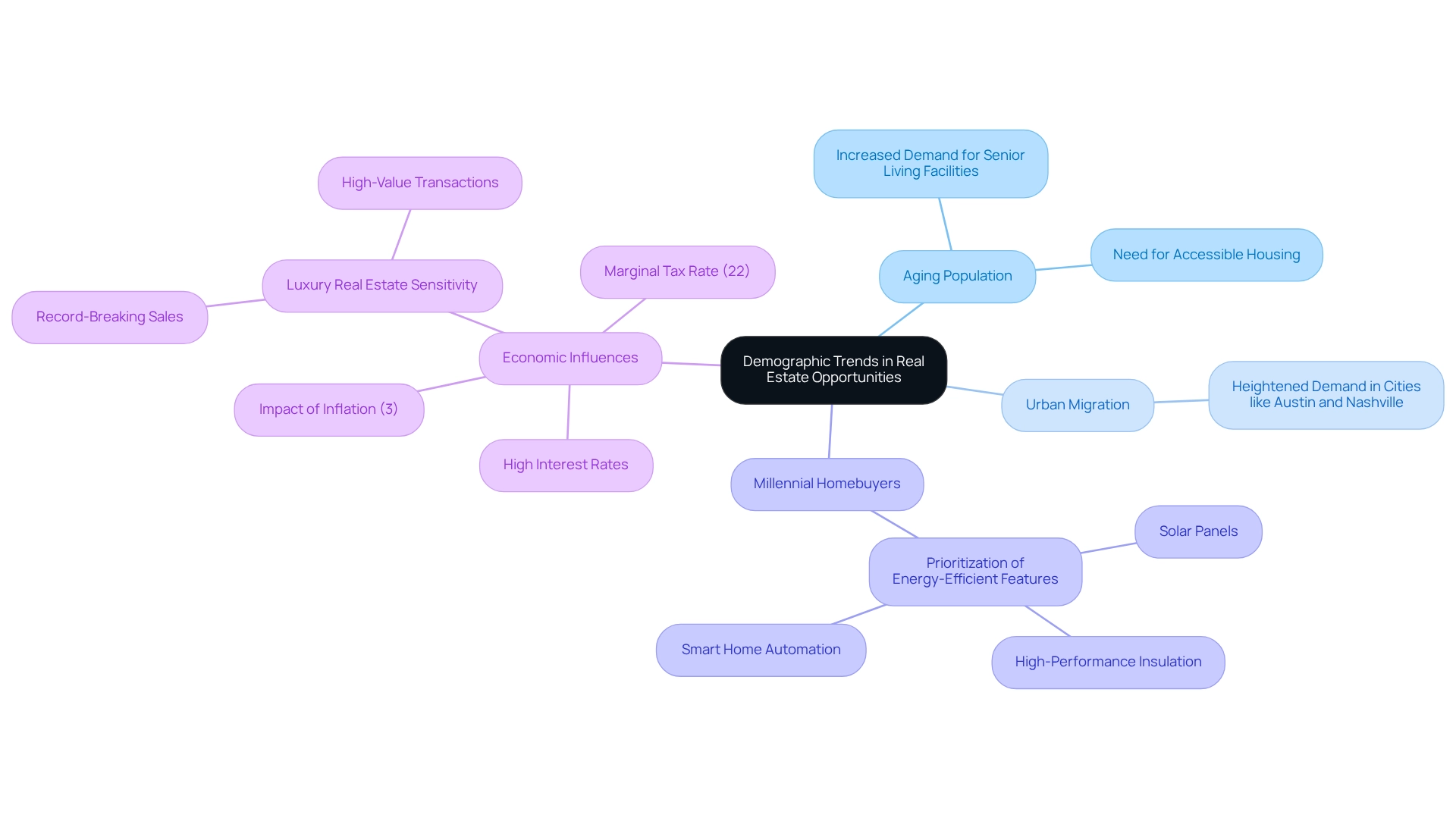

Demographic Trends Shaping Real Estate Opportunities

Demographic trends are pivotal in shaping real estate opportunities in 2025. Factors such as aging populations, urban migration, and the increasing presence of millennials as homebuyers significantly influence market dynamics. Cities like Austin and Nashville, which feature a burgeoning young demographic, are witnessing heightened demand for housing.

In contrast, regions with aging populations are poised to experience a surge in the need for senior living facilities, reflecting a shift in housing requirements. Investors must closely examine demographic data to identify areas exhibiting favorable trends. The impact of an aging population is particularly significant; as this demographic expands, there will be an increased demand for accessible housing and specialized care facilities. This shift presents not only challenges but also new opportunities for funding.

Expert insights emphasize that understanding these demographic changes is essential for aligning financial strategies with consumer demands. As noted, "More buyers are prioritizing energy-efficient features like solar panels, high-performance insulation, and smart home automation," highlighting a shift in consumer preferences that investors must consider.

Moreover, the property sector in 2025 is expected to be influenced by elevated interest rates and economic trends, potentially dampening demand, especially among first-time purchasers. This scenario underscores the importance of adjusting financial strategies to the evolving environment, ensuring that approaches are guided by thorough demographic analysis. Additionally, the luxury real estate sector's sensitivity to economic fluctuations, characterized by record-breaking sales and high-value transactions, adds complexity to the financial landscape.

Investors should also be cognizant of the marginal tax rate of 22% and a general inflation rate of 3%, as these factors could impact their financial decisions. By focusing on these trends, investors can navigate the intricacies of the financial landscape more effectively and seize new opportunities.

Country #1: Overview of Investment Potential

In 2025, Portugal emerges as a premier destination for property acquisition, driven by a confluence of factors that create a favorable financial landscape. The nation's flourishing tourism sector, a vital contributor to its economy, is complemented by enticing tax incentives for foreign investors. This robust environment is further enhanced by a burgeoning expatriate community, which elevates the demand for residential properties.

A standout feature of Portugal's allure is the Golden Visa program, allowing investors to obtain residency through property purchases. This initiative not only grants access to the European market but also offers a pathway for those looking to diversify their portfolios. The program presents several advantages, including:

- The ability to live and work in Portugal

- Visa-free travel within the Schengen Area

- The potential for family reunification

The program has demonstrated its efficacy, attracting substantial foreign capital, particularly in urban hubs like Lisbon and Porto, where property values have experienced remarkable appreciation.

In 2025, cities such as Lisbon and Porto are expected to continue their upward trajectory in real estate prices, establishing them as prime targets for both short-term rental opportunities and long-term investments. The trend of urbanization is significant, with 66.5% of Portugal's population residing in urban areas, underscoring a strong demand for housing in metropolitan regions.

Moreover, Portugal's strategic positioning as a gateway between Europe, Africa, and the Americas, bolstered by trade agreements with countries like the US, UK, China, and Brazil, enhances its attractiveness for cross-border investments. This geographic diversification enables investors to explore undervalued assets, further cementing Portugal's reputation as a lucrative market.

As the real estate landscape evolves, the impact of tourism on property acquisition is pivotal. The influx of tourists not only stimulates demand for short-term rentals but also contributes to the overall appreciation of property values. Case studies reveal that regions with high tourist traffic have yielded significant returns on investment, making them ideal for discerning investors.

John Sim, Head of Securitized Products Research at J.P. Morgan, notes, "It’s clear that many elements of Trump's policy will affect the housing sector," highlighting the importance of understanding policy implications for investors. The potential housing policy shifts under Trump could have complex ramifications for the housing sector, particularly concerning immigration and labor supply in construction. While Trump aims to tackle the affordable housing crisis, his policies may inadvertently worsen the issue by limiting labor supply in construction.

The overall influence of these policies on housing demand and supply remains uncertain, underscoring the necessity for investors to remain informed.

In conclusion, Portugal's combination of a robust tourism industry, favorable investment policies, and the Golden Visa program positions it among the top countries for real estate investment in 2025. Investors looking to capitalize on these opportunities will find a dynamic environment poised for growth.

Country #2: Key Investment Highlights

Spain emerges as a prime destination for property investors in 2025, showcasing a robust recovery in its housing sector. This resurgence is particularly evident in coastal regions and major urban centers like Barcelona and Madrid. The Spanish government's Golden Visa initiative, akin to Portugal's, significantly boosts foreign investment by offering residency to those who invest in property, thereby enhancing the sector's appeal to international buyers.

The rental sector in Spain is thriving, driven by a surge in tourism and a growing expatriate community, creating enticing opportunities for investors seeking consistent rental income. As we approach the end of 2024, housing costs in Spain are projected to increase by 2% to 3%, indicating a positive trend for property values.

Moreover, the coastal real estate market is witnessing notable patterns, with demand propelled by both local and foreign buyers looking for holiday homes and investment assets. This trend is further supported by the ongoing recovery of the Spanish property sector, expected to continue into 2025, as evidenced by various recovery statistics. Investment highlights for Spain in 2025 emphasize operational excellence and sustainability, as companies are driven to integrate decarbonization efforts into their property strategies.

This approach not only aligns with climate objectives but also enhances financial performance, making properties more appealing to environmentally conscious investors. As Antonio de la Fuente aptly notes, simplistic, short-term measures like rent controls will only worsen the supply situation and deter the necessary funding to develop new housing.

In summary, the combination of favorable regulations, a recovering economy, and a vibrant rental sector positions Spain as one of the top countries for real estate investment in 2025, particularly in Barcelona and Madrid, where property funding trends are expected to flourish. The insights provided in this analysis are supported by Zero Flux's commitment to delivering reliable property information, ensuring that investors are well-informed about the dynamics of the Spanish sector.

Country #3: Why Invest Here?

The United Arab Emirates (UAE), with Dubai at the forefront, consistently ranks among the top countries for real estate investment in 2025. This dynamic city stands out as an exceptional choice for global investors, thanks to its strategic geographical location, tax-free environment, and outstanding infrastructure. The proactive economic diversification strategy of the UAE government, moving away from oil dependency, has catalyzed substantial investments in sectors such as tourism, technology, and property.

The legacy of Expo 2020 continues to influence the property market, driving demand for both residential and commercial spaces. Areas like Jumeirah Beach Residence (JBR) exemplify this trend, offering a blend of picturesque waterfront living and urban convenience. JBR features 40 towers that accommodate both residential and hotel units, reinforcing its reputation as a prime investment location.

The allure of coastal living, coupled with the vibrancy of city life, positions JBR as a premier destination for real estate investment, particularly within Dubai.

Looking ahead to 2025, the UAE is poised to remain a leading country for real estate investment, with its sector expected to thrive due to a growing population and a steady influx of expatriates. Investors are advised to verify the licensing of local agents with the Dubai Land Department (DLD) and the Real Estate Regulatory Agency (RERA) to navigate the market effectively. Additionally, developing well-defined value creation strategies, leveraging AI technology and alternative data, will be crucial for outpacing competitors.

With the Emerging Trends in Real Estate® report now in its 46th year, insights into economic dynamics are more accessible than ever, empowering investors to make informed choices.

Dubai's lack of property taxes, combined with its expanding population, positions it as a prime location for real estate investment, offering unique advantages for those seeking high returns. As the industry evolves, staying attuned to emerging trends and financial opportunities will be vital for success in this ever-changing landscape.

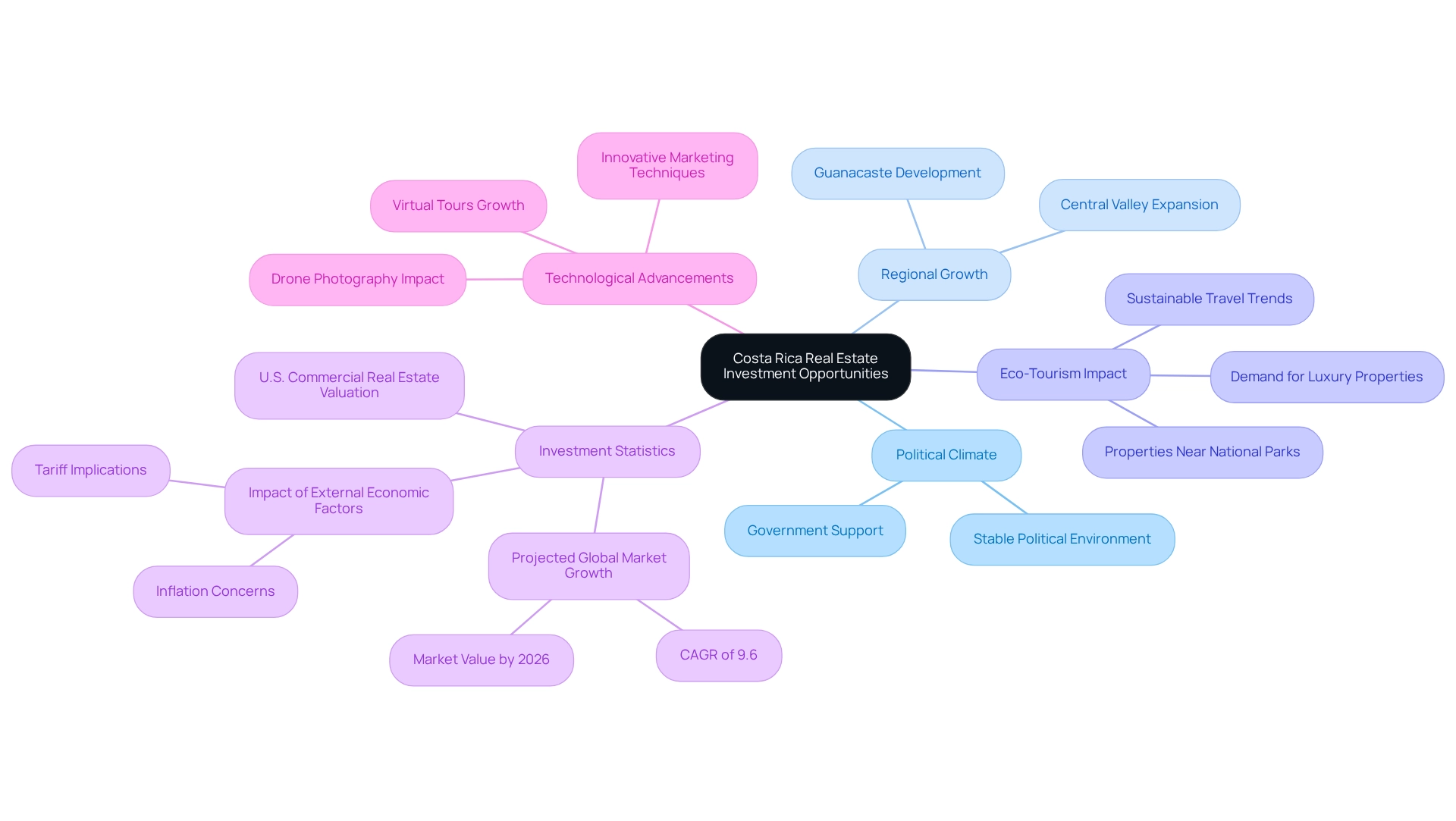

Country #4: Market Conditions and Opportunities

Costa Rica is swiftly establishing itself as one of the premier countries for real estate investment, particularly in the luxury and eco-tourism sectors for 2025. The nation’s stable political climate, highlighted by the Supreme Electoral Tribunal’s directive to President Rodrigo Chaves to avoid political strife, bolsters its reputation as an attractive destination for both domestic and international investors. Regions such as Guanacaste and the Central Valley are experiencing remarkable growth, driven by an influx of expatriates and retirees who are captivated by the country’s exceptional quality of life.

Investors are presented with favorable property prices and a burgeoning rental market, especially in the vacation rental segment, marking Costa Rica as one of the best countries for real estate investment. The eco-tourism surge is particularly significant; it not only enhances the allure of Costa Rica’s breathtaking landscapes but also stimulates demand for luxury properties that appeal to environmentally conscious travelers. This trend is evidenced by the increasing interest in properties offering unique experiences, such as those situated near national parks or pristine beaches.

Statistics indicate that Costa Rica ranks among the top countries for real estate investment, with a property investment environment poised for expansion. Forecasts predict a robust increase in property values, fueled by the eco-tourism sector. As the global property market is projected to reach approximately $5,388.87 billion by 2026, with a compound annual growth rate (CAGR) of 9.6%, Costa Rica stands out as a lucrative opportunity for discerning investors. Additionally, the U.S. commercial property sector maintains a strong valuation at around $1.2 trillion, providing a valuable context for Costa Rica’s position within the broader global landscape.

Furthermore, expert opinions suggest that 36.25% of individuals believe that external economic factors, including inflation and tariffs, could negatively impact recovery in 2025, as noted by Sharad Mehta. Nevertheless, Costa Rica’s unique attributes and resilience in the face of global challenges solidify its status as a prime location for real estate investment. With the right strategies, investors can leverage the expanding eco-tourism trend and the luxury real estate market, ensuring promising returns in the coming years.

Moreover, technology is transforming property marketing, with innovative approaches enhancing sales and funding opportunities in Costa Rica.

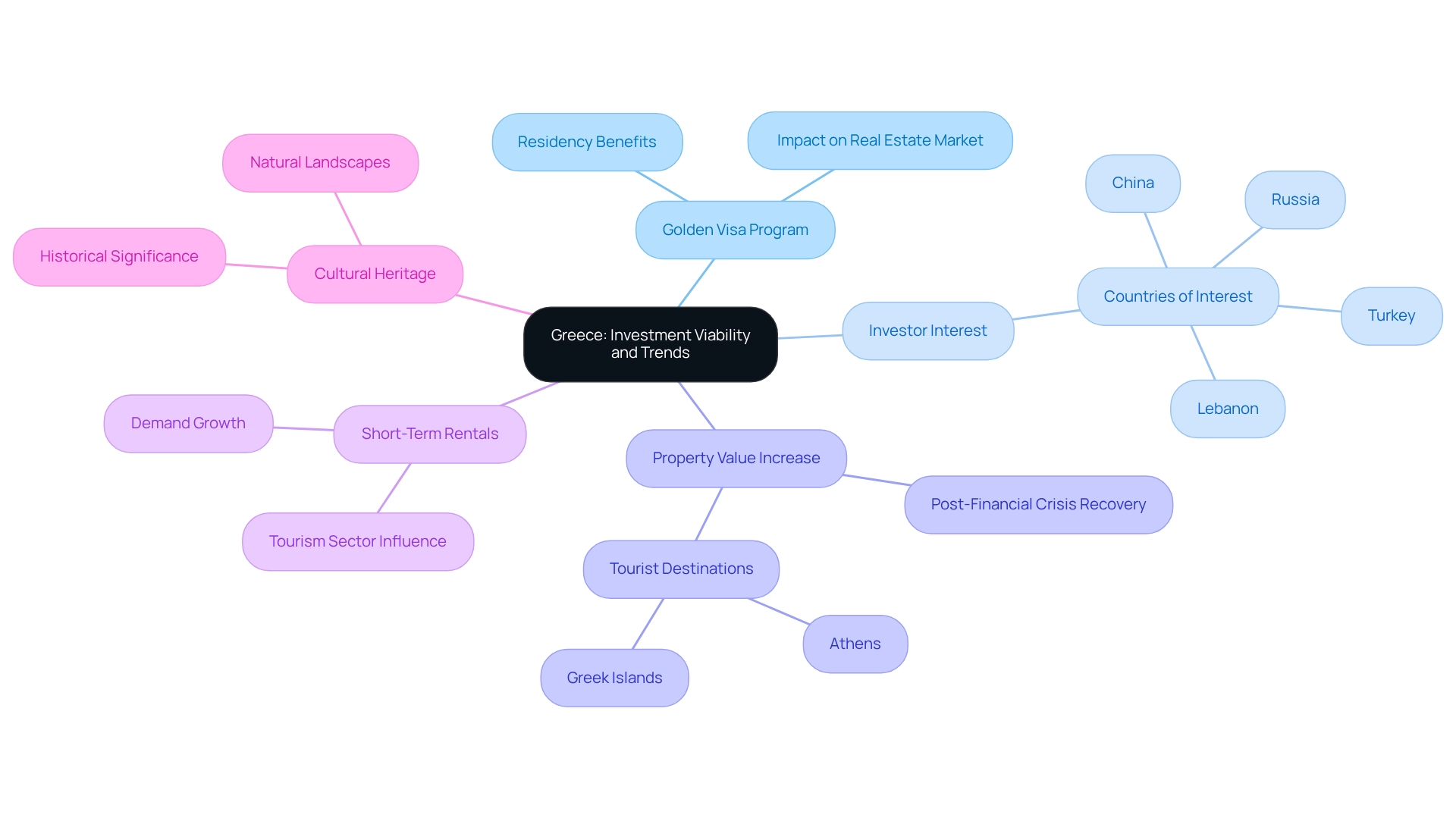

Country #5: Investment Viability and Trends

Greece is emerging as one of the premier destinations for real estate investment in 2025, largely propelled by its Golden Visa program, which grants residency to international investors. This initiative has sparked considerable interest, evidenced by a significant uptick in applications from countries such as China, Turkey, and Russia. As of December 31, 2021, a total of 28,767 residence permits have been issued to investors and their families, highlighting the popularity and effectiveness of the Golden Visa program.

Importantly, British and American citizens are also eligible to apply for the Golden Visa, provided they meet the necessary criteria.

The recovery of the Greek economy post-financial crisis has led to a notable increase in property values, particularly in sought-after tourist destinations like Athens and the enchanting islands. The demand for short-term rentals is escalating, fueled by a vibrant tourism sector that shows no signs of slowing down. This trend presents lucrative opportunities for investors eager to capitalize on rental income in one of the best countries for real estate investment.

Furthermore, Greece's rich cultural heritage and stunning natural landscapes not only enhance its allure but also establish it as a prime location for long-term investment opportunities in real estate.

As we look to 2025, the Golden Visa program continues to play a pivotal role in shaping the Greek property market, offering investors a pathway to residency while simultaneously driving property demand. The benefits of the program extend beyond residency; it fosters a conducive environment for investment, positioning Greece as a top choice for those looking to diversify their property portfolios. Julia Georgules, Head of Americas Research & Strategy, underscores the significance of this program, stating, "Let’s talk about the opportunities that Greece presents for investors looking to expand their horizons.

Summary of the Top 10 Countries for Real Estate Investment

In 2025, the leading countries for real estate investment include Portugal, Spain, the UAE, Costa Rica, and Greece, each presenting distinct advantages for discerning investors. Portugal is particularly notable for its favorable tax incentives and vibrant tourism sector, positioning it as an attractive destination for both residential and commercial ventures. Spain boasts a robust property market, buoyed by a recovering economy and increasing foreign interest, especially in urban centers like Madrid and Barcelona.

The UAE continues to be a prime location due to its strategic position and business-friendly environment, with Dubai's property market showcasing resilience and growth potential. Costa Rica draws investors with its stable political landscape and flourishing eco-tourism industry, while Greece's recent economic developments and escalating property values present lucrative opportunities, particularly in sought-after tourist destinations.

When making investment decisions, it is crucial to consider factors such as economic stability, regulatory frameworks, and demographic trends. According to Deloitte's global property outlook survey, 88% of respondents plan to leverage digital technologies to enhance performance in the next 12 to 18 months, indicating a shift towards technology-driven investment strategies. Moreover, characteristics of the digital economy, along with logistics and storage facilities, are expected to provide substantial opportunities for property owners and investors in the coming months.

Amber Schiada, Head of Work Dynamics Research, Americas, emphasizes the evolution of hybrid work and workplace policies, which will influence commercial property strategies in 2025 and beyond. By aligning investment strategies with these insights and focusing on the most promising countries for real estate investment—those demonstrating economic resilience and growth potential—investors can significantly enhance their chances of success in the competitive global property market.

Zero Flux, a specialized daily newsletter that curates essential property market trends and insights from over 100 diverse sources, serves as an invaluable resource for investors navigating these complexities. With a subscriber base exceeding 30,000, Zero Flux's commitment to data integrity and sourcing from credible outlets positions it as a leading authority in the dissemination of real estate information.

Conclusion

The landscape of global real estate investment in 2025 is defined by transformative trends and emerging opportunities that are reshaping investor strategies. Key factors such as urbanization, technological advancements, and shifting demographics are driving demand for residential and commercial properties in promising markets like Portugal, Spain, the UAE, Costa Rica, and Greece. Each of these countries offers unique advantages, including:

- Favorable tax incentives

- Vibrant tourism sectors

- Strategic geographic locations

- Stable political climates

These factors make them appealing destinations for both foreign and domestic investors.

Understanding the interplay between economic stability and regulatory environments is crucial for maximizing returns and minimizing risks. Investors are increasingly leveraging data-driven insights and AI-driven platforms to make informed decisions in this dynamic market. Additionally, staying attuned to demographic shifts, such as the aging population and the rise of remote work, allows investors to align their strategies with evolving market needs, ensuring they capitalize on opportunities as they arise.

As the global real estate market continues to grow, projected to reach approximately $5.4 trillion by 2026, the importance of informed investment strategies cannot be overstated. By focusing on countries that demonstrate resilience and growth potential, investors can significantly enhance their chances of success in this competitive landscape. In this ever-evolving terrain, resources like Zero Flux provide invaluable insights, empowering investors to navigate complexities and seize opportunities in the promising world of real estate investment.