Overview

Alternative real estate investments encompass a variety of non-traditional options, including:

- Property trusts

- Crowdfunding

- Specialized properties

These alternatives present distinct risk and return profiles compared to conventional investments. The growing popularity of these investment avenues is underscored by their potential for:

- Greater returns

- Diversification benefits

- Access to unique markets

However, it is crucial to understand their complexities for successful navigation in a shifting economic landscape. As investors seek to enhance their portfolios, recognizing the nuances of these investments will be key to making informed decisions.

Introduction

As traditional real estate investments encounter increasing market fluctuations and economic uncertainties, a new wave of opportunities arises in the realm of alternative real estate investments. This dynamic sector encompasses a diverse array of non-traditional assets, including:

- Real Estate Investment Trusts (REITs)

- Crowdfunding platforms

- Specialized properties such as data centers and student housing

With the market for these investments projected to grow significantly, savvy investors are exploring the unique risk and return profiles these alternatives offer. By tapping into niche markets and leveraging innovative strategies, alternative real estate investments present a compelling avenue for those looking to enhance their portfolios and adapt to the evolving landscape of real estate.

What Are Alternative Real Estate Investments?

Alternative real estate investments present a diverse array of non-traditional options that extend beyond the conventional realms of residential and commercial properties. This category includes assets such as property trusts (REITs), crowdfunding platforms, and specialized properties like data centers, student housing, and healthcare facilities. These allocations are characterized by unique economic dynamics, often leading to distinct risk and return profiles compared to traditional property investments.

As we look towards 2025, the sector for alternative property allocations is on a substantial growth trajectory. Notably, there has been a marked rise in large buyout transactions exceeding $500 million in enterprise value, which increased by 37 percent in value and 3 percent in count. This surge is reflective of a broader trend towards diversification in financial strategies, as investors aim to capitalize on alternative real estate investments and other emerging sectors that promise robust returns.

Recent trends indicate a valuation recovery in commercial real estate, particularly within sectors such as industrial and power-related real estate, specialized workspaces, and net-lease assets. These areas are projected to thrive over the next 10 to 15 years, making them attractive options for investors eager to explore alternative paths.

Successful examples of non-conventional property acquisitions include the development of multifamily and industrial assets in high-growth areas, alongside senior housing and hotel ventures. These strategies leverage existing relationships and favorable economic conditions to maximize returns, often enhanced through efficient asset management and environmental, social, and governance (ESG) initiatives. Furthermore, creative solutions for capital requirements through strong lender connections further underscore the advantages of alternative property ventures.

Key features of alternative real estate investments include their potential for greater returns, diversification benefits, and access to specialized sectors that may be overlooked by conventional investors. Insights from industry professionals emphasize the importance of understanding the specific dynamics of these ventures, as they can provide unique opportunities for wealth creation in a shifting economic landscape. As James Millon, President of US Debt & Structured Finance, notes, the realm of alternative investments is rich with opportunities for those prepared to navigate its complexities.

In summary, alternative real estate investments constitute a dynamic and expanding segment of the property sector, offering investors innovative options to meet their capital needs and achieve their financial goals.

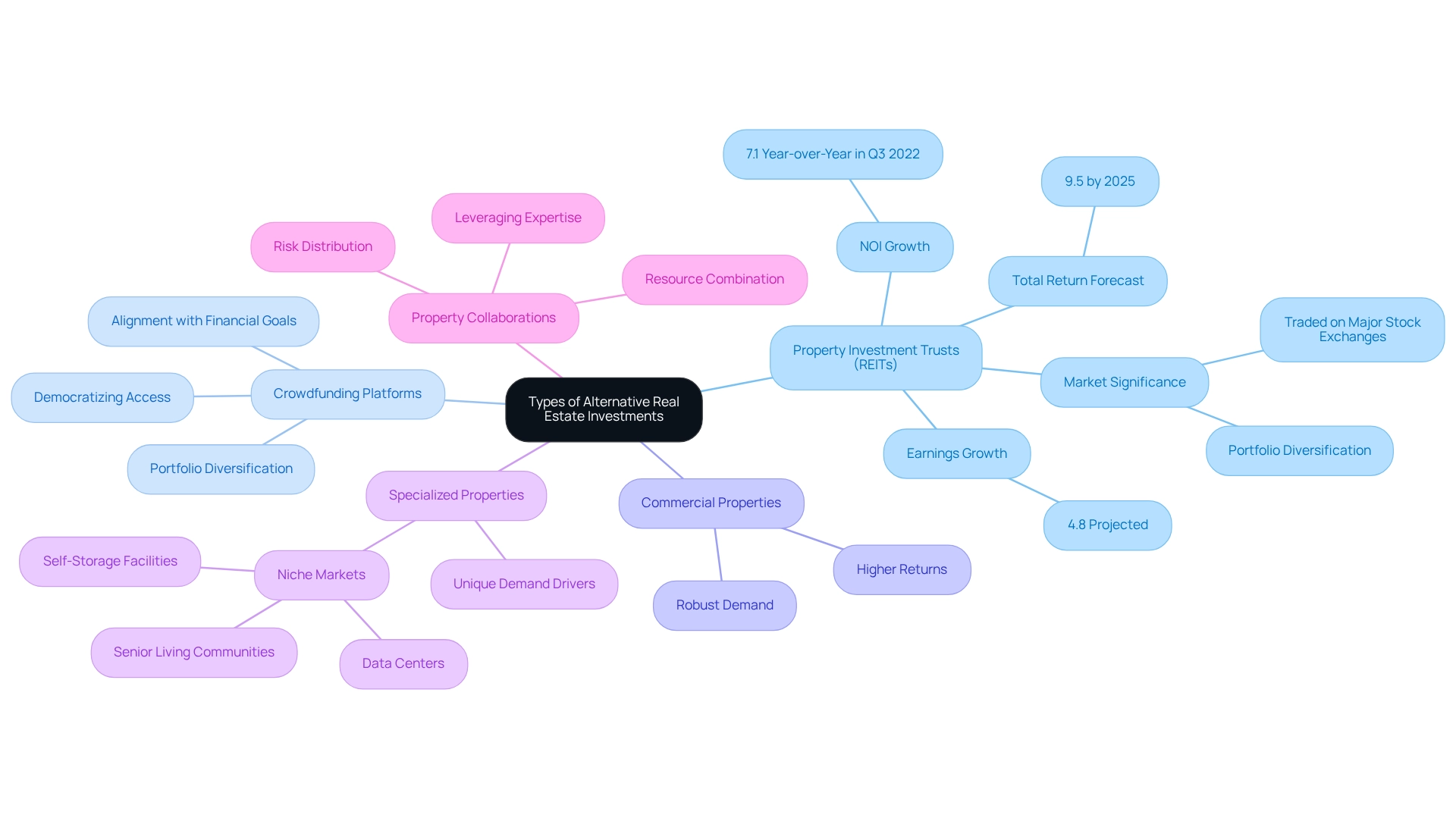

Types of Alternative Real Estate Investments

- Property Investment Trusts (REITs): REITs are firms that possess, manage, or fund income-generating properties across various property sectors. By acquiring shares in REITs, investors gain access to real estate sectors without the necessity for direct ownership. Analysts forecast a total return of 9.5% for REITs by 2025, aligning with long-term averages, while earnings growth is projected at 4.8%. This performance is supported by enhancing economic conditions, including lower new supply deliveries and a stable economy. Furthermore, Equity REIT same-store NOI increased by 7.1% year-over-year in Q3 2022, emphasizing the robust performance of these financial vehicles. NAREIT also includes companies and individuals who advise, study, and service the property sector, underscoring the significance of REITs in the broader market context. Additionally, REITs are traded on major stock exchanges, offering benefits such as competitive total returns and portfolio diversification.

- Crowdfunding Platforms: These innovative platforms enable numerous investors to combine their resources to fund larger property projects, democratizing access to investment opportunities for smaller investors. Current trends indicate a growing interest in crowdfunding for real estate, as it allows individuals to diversify their portfolios and invest in projects that align with their financial goals.

- Commercial Properties: Investments in commercial properties, such as office buildings, retail spaces, and warehouses, often yield higher returns compared to residential properties. The demand for these spaces remains robust, driven by economic growth and evolving consumer behaviors.

- Specialized Properties: Niche markets, including data centers, self-storage facilities, and senior living communities, are increasingly attractive to investors. These specialized properties benefit from unique demand drivers, making them an appealing addition to a diversified asset portfolio.

- Property Collaborations: By establishing partnerships, investors can combine their resources and distribute risks in larger property ventures. This collaborative method not only boosts funding potential but also enables participants to leverage each other's expertise and networks, fostering a more strategic funding environment.

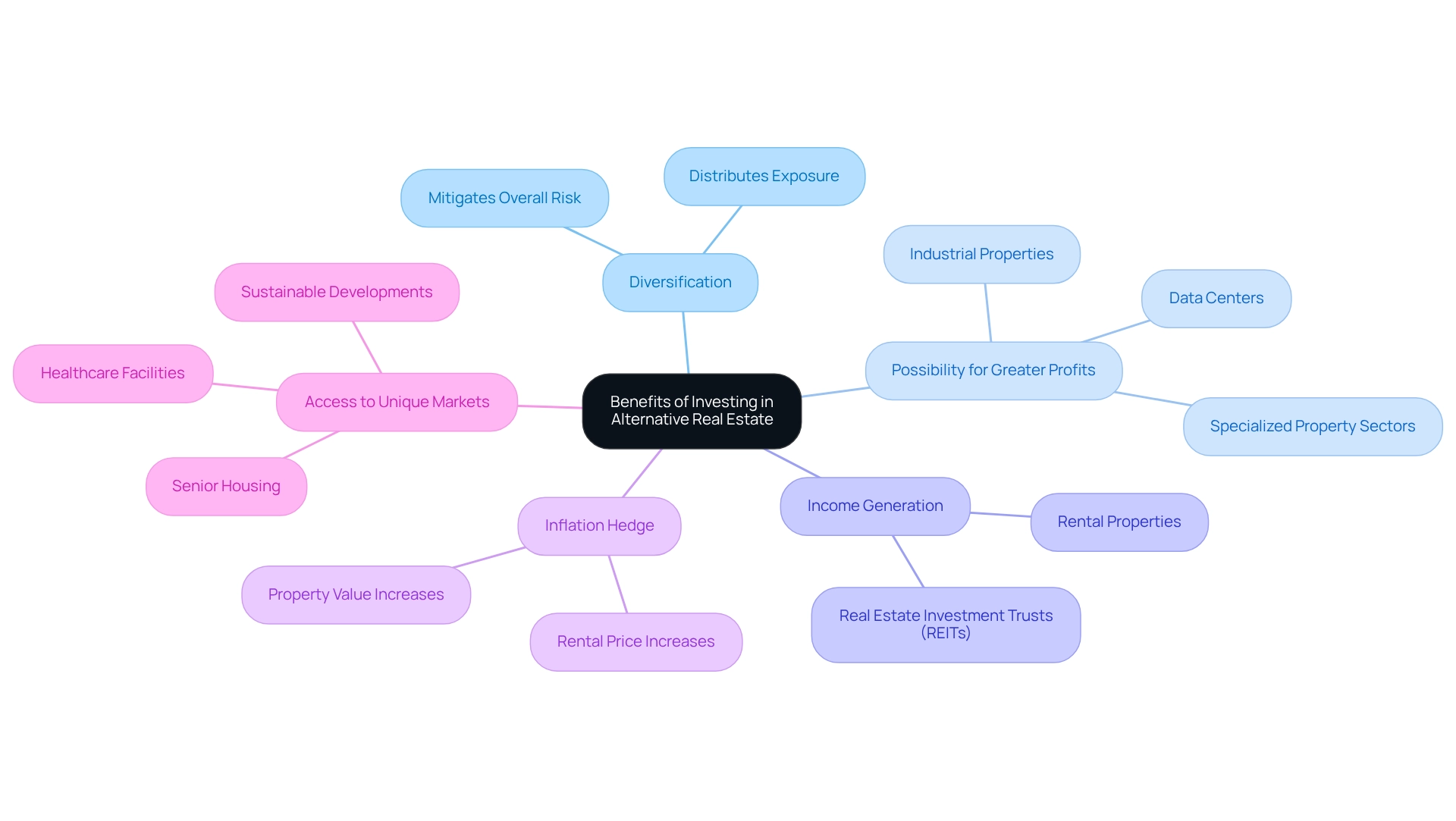

Benefits of Investing in Alternative Real Estate

- Diversification: Alternative real estate investments are essential for diversifying a portfolio, effectively mitigating overall risk by distributing exposure across various asset categories. This strategy is particularly beneficial in today’s unpredictable market, where conventional assets may lack the stability that investors seek.

- Possibility for Greater Profits: Numerous alternative opportunities, such as specialized property sectors, present the potential for greater profits compared to traditional property options. For example, sectors like industrial properties and data centers have demonstrated remarkable growth, attracting investors in search of lucrative prospects.

- Income Generation: Assets like Real Estate Investment Trusts (REITs) and rental properties are renowned for their capacity to generate consistent income streams. This feature is especially appealing to income-focused investors, as these assets can provide reliable cash flow, thereby enhancing overall portfolio performance.

- Inflation Hedge: Real property has historically served as a robust safeguard against inflation. As inflation rises, property values and rental prices typically increase, allowing investors to preserve their purchasing power and protect their assets from depreciation.

- Access to Unique Markets: Investing in alternative real estate investments unlocks access to unique markets and trends that may be unattainable through traditional financial channels. This includes opportunities in sectors such as healthcare facilities, senior housing, and sustainable developments, which are gaining momentum in the current funding landscape.

In 2024, the private equity sector is undergoing significant transformations, with a heightened emphasis on sustainable funding and environmental, social, and governance (ESG) factors. This trend underscores the importance of diversifying into alternative real estate investments, as these options align with evolving market demands and investor preferences. Additionally, Zero Flux compiles 5-12 selected property insights daily, providing investors with a wealth of information to navigate these trends effectively.

As noted by Michael Cembalest, the current economic landscape is influenced by various factors, including energy policies that can impact property ventures. Furthermore, understanding property ownership regulations, as highlighted in the case study 'Navigating State Property Ownership Rules,' is vital for investors considering alternative real estate investments across different states. Lastly, the potential impact of President Trump's tariffs on the U.S. economy and investors must also be factored in, as these elements may influence funding decisions within the alternative property sector.

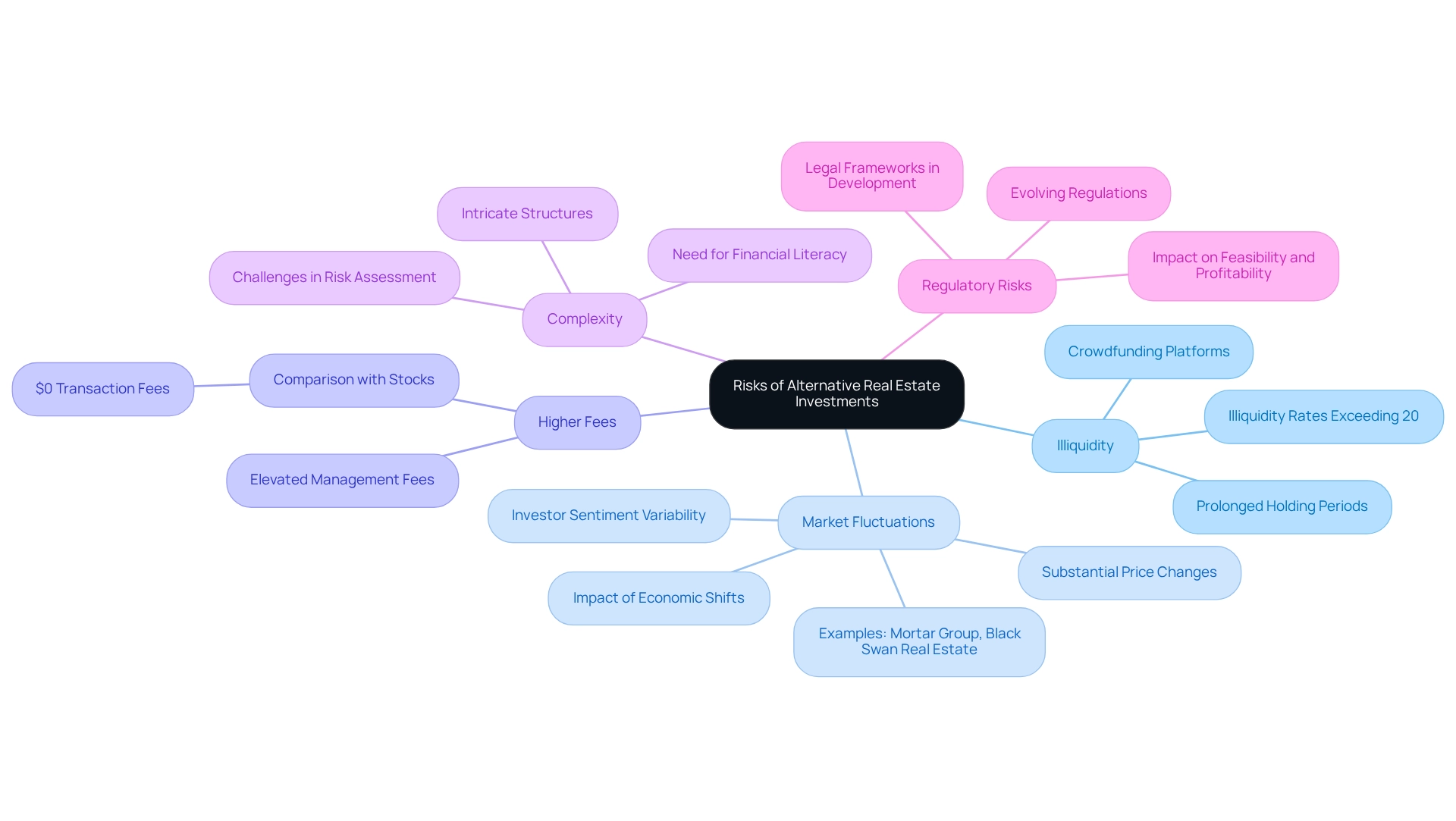

Risks Involved in Alternative Real Estate Investments

- Illiquidity: Numerous alternative real estate investments exhibit decreased liquidity compared to conventional assets, making it challenging to sell them swiftly. This illiquidity can lead to prolonged holding periods, which may not align with an investor's financial goals or timelines. For example, property crowdfunding platforms often require investors to allocate their funds for extended durations, exacerbating these illiquidity issues.

- Market Fluctuations: Alternative assets frequently face substantial price changes, negatively impacting returns. Recent trends indicate that economic shifts can result in unpredictable performance in sectors like real estate crowdfunding, where investor sentiment can rapidly change due to external factors. Recent news has highlighted funding opportunities with firms like Mortar Group and Black Swan Real Estate, illustrating both the potential and risks associated with alternative ventures in a volatile market.

- Higher Fees: Certain alternative assets may incur elevated management fees, significantly diminishing overall profits. Investors should be aware that these fees can vary considerably; for instance, while stocks are often traded with $0 transaction fees due to competition among discount brokers, alternative real estate investments may involve higher expenses. Understanding the fee structure is essential for assessing the potential net returns on capital.

- Complexity: The intricate structures of alternative assets can pose challenges for investors seeking to fully comprehend their associated risks and rewards. This complexity often necessitates a deeper level of financial literacy and due diligence, which can be a barrier for some investors.

- Regulatory Risks: The landscape of alternative property ventures is subject to evolving regulations that can affect their feasibility and profitability. Investors must remain informed about potential regulatory shifts that could influence their assets, particularly in fields such as crowdfunding, where legal frameworks are still developing.

In 2025, the risks associated with alternative real estate investments remain considerable. For instance, the illiquidity rates in these assets can be significantly higher than in conventional real estate, often exceeding 20% in certain situations. Financial experts emphasize the importance of conducting thorough due diligence and seeking professional advice before venturing into these alternative avenues.

As Kevin Voigt, a former financial writer for NerdWallet, noted, 'Stocks can trigger emotional decision-making,' underscoring the necessity for a disciplined approach in all financial strategies, including alternatives.

Prospective investors should remain vigilant and knowledgeable about the inherent risks, especially considering the current fluctuations that can greatly affect returns.

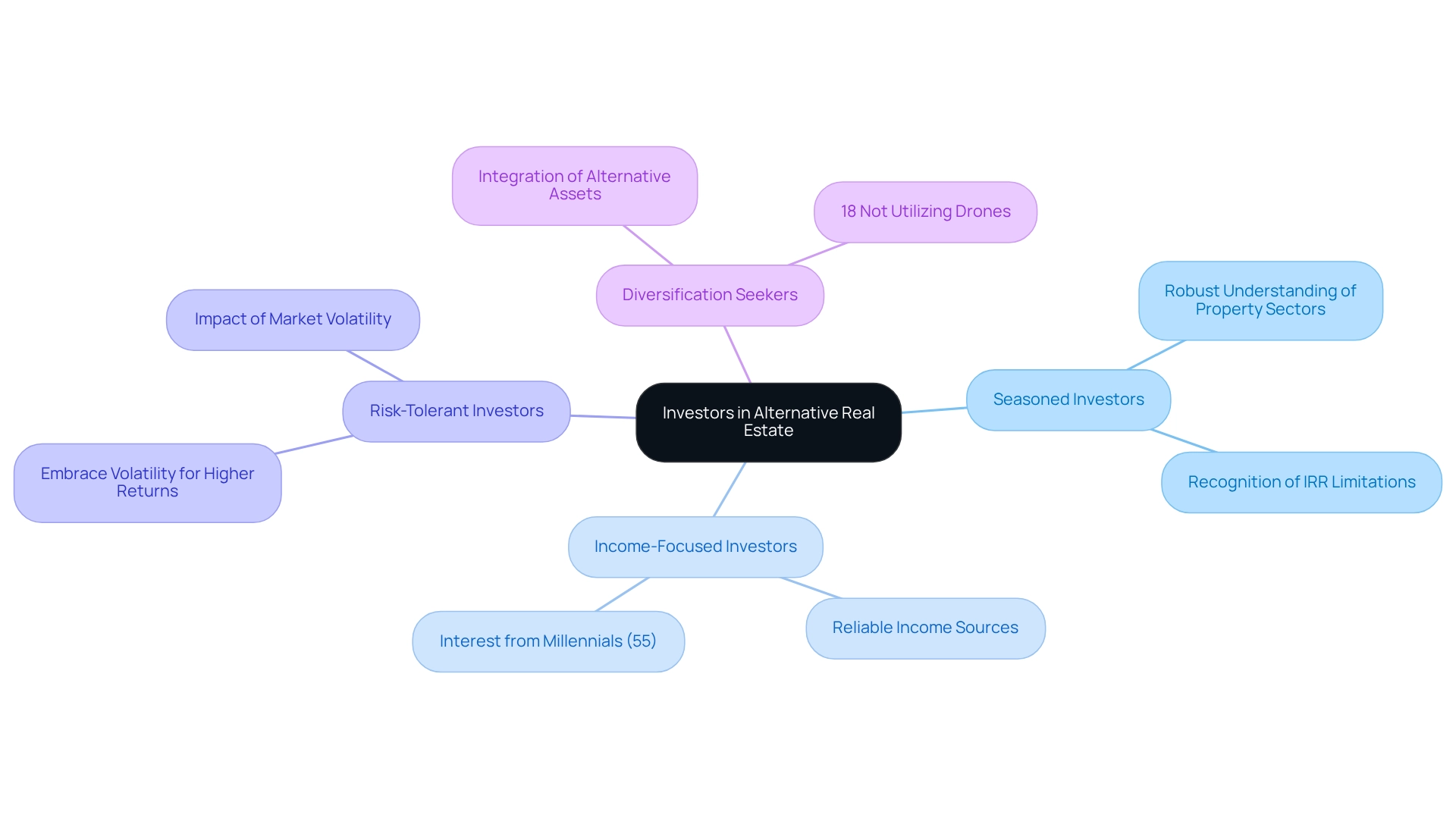

Who Should Consider Alternative Real Estate Investments?

- Seasoned Investors: Individuals with a robust understanding of property sectors often find alternative real estate investments appealing due to their inherent complexity and the potential for higher yields. These investors are typically well-versed in industry trends, enabling them to navigate the intricacies of alternative assets and make informed decisions that capitalize on unique opportunities. However, it is crucial for them to recognize the limitations of relying solely on Internal Rate of Return (IRR) for property comparisons, as emphasized by industry experts.

- Income-Focused Investors: For those seeking reliable income sources, alternative real estate investments such as Real Estate Investment Trusts (REITs) or rental units can be particularly beneficial. These options deliver consistent cash flow, appealing to investors who prioritize income generation alongside capital appreciation. The growing interest in these investments is highlighted by a Harris Interactive survey, revealing that 55% of millennials are eager to explore property options. This demographic shift could significantly influence market dynamics.

- Risk-Tolerant Investors: Individuals with a higher tolerance for risk may be more inclined to consider alternative opportunities, which often present the possibility of substantial returns. This group typically embraces volatility in exchange for the chance to achieve greater financial gains, making them ideal candidates for innovative property strategies. Market volatility can impact the profitability of these investments, with property values fluctuating based on location and economic conditions.

- Diversification Seekers: Investors aiming to expand their portfolios beyond traditional stocks and bonds should consider alternative real estate investments. By integrating assets such as commercial properties, crowdfunding opportunities, or niche markets, these investors can mitigate risk and enhance overall portfolio performance. Notably, 18% of members do not utilize drones, underscoring the evolving dynamics of property strategies and the technological factors influencing funding choices. The increasing enthusiasm for alternative real estate investments is further evidenced by recent trends, particularly the notable interest from millennials in property investing. This demographic transformation suggests an optimistic outlook for future property values, driven by supply and demand dynamics. As the industry evolves, understanding the characteristics of individuals best suited for alternative opportunities will be essential for navigating the complexities of property investing in 2025.

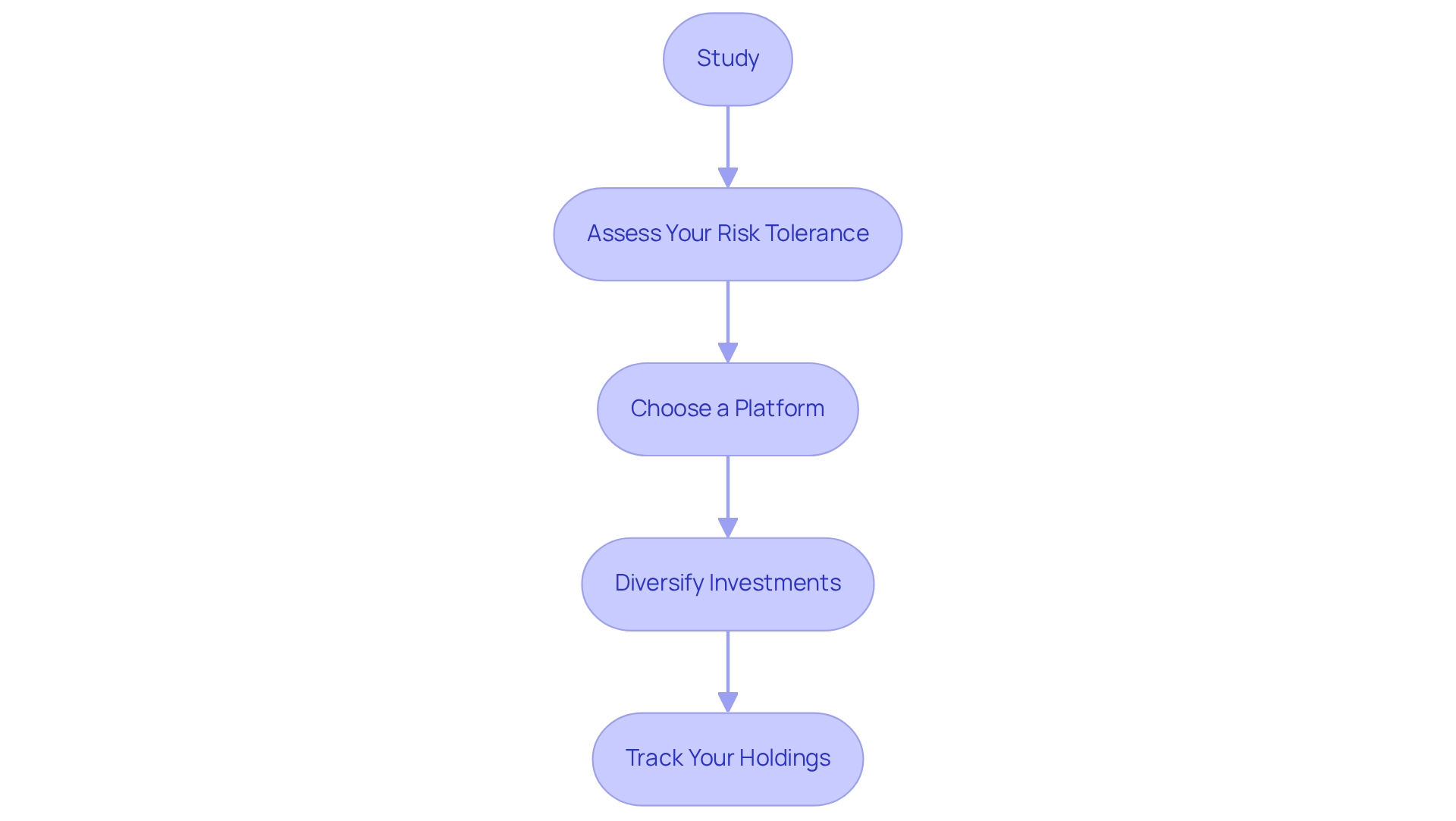

How to Get Started with Alternative Real Estate Investments

- Study: Begin by investigating various alternative real estate investments, including property crowdfunding, REITs (Real Estate Investment Trusts), and commercial assets. Understanding their distinct characteristics and economic dynamics is crucial for making informed decisions. For example, the commercial real estate sector is currently undergoing a shift from defensive to proactive strategies, driven by improving market sentiment and anticipated revenue growth in 2025.

- Assess Your Risk Tolerance: Evaluate your risk tolerance by considering factors such as your financial objectives, time horizon, and overall financial situation. This self-evaluation will assist you in selecting assets that align with your risk profile. Statistics reveal that a substantial portion of investors are becoming increasingly cautious, with many prioritizing stability over high-risk opportunities, reflecting a broader trend in the market.

- Choose a Platform: Opt for a reputable platform for investing in alternative property. Options include crowdfunding sites that facilitate fractional ownership or brokerage firms specializing in REITs. Ensure that the platform you select has a solid track record and provides transparency in its operations.

- To mitigate risk, consider diversifying your investments across various types of alternative real estate. This strategy not only distributes risk but also allows you to capitalize on different segments. For instance, investing in both residential and commercial properties can create a balanced portfolio that withstands economic fluctuations.

Track Your Holdings: Regularly evaluate the performance of your assets and stay informed about economic conditions. This ongoing assessment will enable you to make timely adjustments to your portfolio. Successful investors emphasize the importance of remaining engaged with market trends and adapting strategies accordingly. For example, as the commercial property sector evolves, aligning funding strategies with emerging trends—such as sustainability and technological advancements—can enhance long-term success. Additionally, the industry faces a significant workforce transition, necessitating strategies to attract younger talent, which is essential for future growth. As Val Srinivas, a senior research leader at the Deloitte Center for Financial Services, notes, effective research is vital in managing these changes.

By following these steps and leveraging insights from successful investors, you can adeptly navigate the complexities of alternative property ventures, all while benefiting from the commitment to quality content that Zero Flux provides.

Are Alternative Real Estate Investments Right for You?

- Evaluate Your Financial Goals: Begin by clearly defining your long-term financial objectives. Understanding whether alternative real estate investments align with these goals is crucial. If your goal is to attain significant capital growth over time, alternative properties, which often carry greater risk and extended durations, may be appropriate. Conversely, if prompt cash flow is a priority, conventional options might be more suitable. As Jay Serpe, Global Head of Alternative Investments, notes, there are signs of a valuation recovery in commercial real estate (CRE), which may influence your decision-making regarding alternative real estate investments.

- Consider Your Investment Horizon: Assess whether you are seeking short-term gains or long-term growth. Alternative assets typically necessitate a longer commitment due to their inherent complexities and market dynamics. For instance, investing in growth equity and venture capital can expose you to future technology advancements, but these endeavors often require patience as they develop. Recent trends indicate that enterprise spending on AI and automation is projected to rise, suggesting potential long-term benefits for investors willing to wait. This aligns with the case study emphasizing that capital allocation fosters innovation, generating chances for greater future returns.

- Evaluate Your Knowledge: A strong comprehension of real estate sectors and funding strategies can greatly improve your opportunities for success with alternative real estate investments. If you possess knowledge in assessing market trends and financial indicators, you may manage these assets more efficiently. J.P. Morgan's internal team embodies this method by performing comprehensive analyses and on-site assessments of managers' business frameworks, ensuring knowledgeable financial choices. This best practice highlights the significance of thorough research in the funding process.

- Consult a Financial Advisor: If you find yourself unsure about your financial options, seeking advice from a financial advisor can offer valuable insights. An advisor can assist you in assessing your financial objectives and determining if alternative real estate investments are suitable for you. As Chuck Mohler, a lead consultant at Eagle Corporate Advisors, emphasizes, diversification and professional management are crucial elements of a successful financial strategy. Engaging with an expert can clarify your options and guide you toward making informed decisions tailored to your financial landscape. Moreover, the revised FAI Certificate Program introduced on January 10, 2024, underscores the significance of education and knowledge in making informed financial choices.

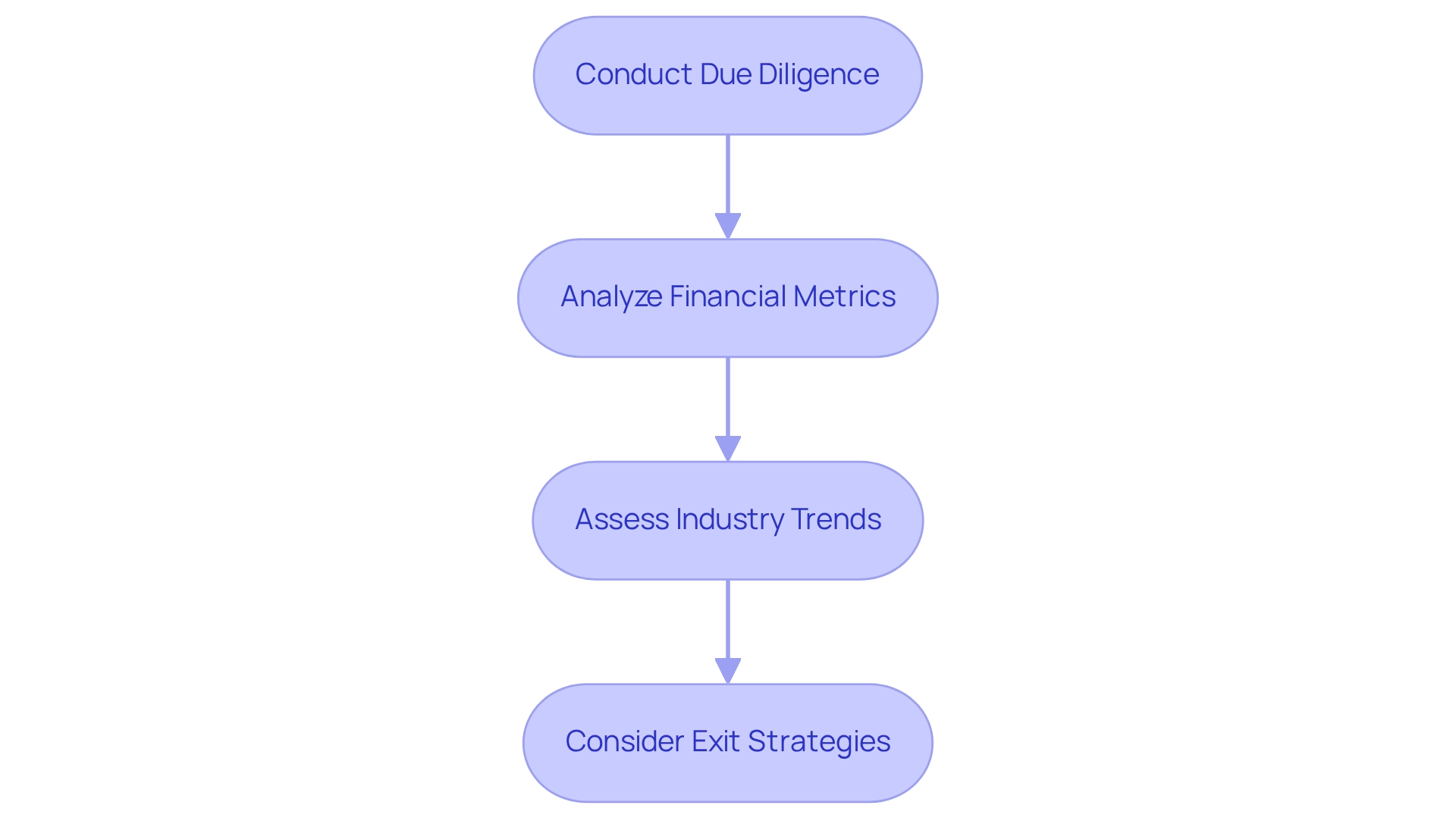

Assessing the Risks of Alternative Real Estate Investments

- Conducting due diligence is paramount when exploring alternative real estate investments. This process demands meticulous research into market conditions, property valuations, and the capabilities of management teams. Key aspects of legal due diligence encompass title searches, property surveys, and local compliance checks. Effective due diligence not only minimizes risks but also uncovers potential opportunities, ultimately guiding investors toward informed decisions that support long-term profitability in alternative real estate investments. As John VanDuzer states, "Financial due diligence is the process of reviewing a property’s financial information before purchasing it or investing in it."

- Analyze Financial Metrics: A critical aspect of evaluating any venture is the analysis of key financial metrics. Investors should concentrate on indicators such as cash flow, return on equity (ROE), and capitalization rates (cap rates). These metrics provide crucial insights into the potential performance of the asset, allowing for a clearer understanding of its financial viability.

- Assess Industry Trends: Keeping informed about broader industry trends is vital for any investor. Economic indicators, demographic shifts, and local demand-supply dynamics can significantly affect financial results. For instance, a comprehensive market analysis that examines local demand and supply factors, along with recent sales and property value trends, can enhance an investor's ability to make informed choices and understand a property's competitive standing in the market.

- Consider Exit Strategies: Having a well-defined exit plan is essential for managing assets effectively. Investors must comprehend how and when they can convert their assets into cash if needed. This foresight not only prepares investors for potential market fluctuations but also ensures they can capitalize on favorable conditions when they arise.

Where to Find Information on Alternative Real Estate Investments

- Online funding platforms such as Yieldstreet and CrowdStreet are at the forefront of alternative real estate investments, granting investors access to a diverse range of options. These platforms empower individuals to invest in property projects that may not be available through traditional channels, often featuring lower minimum funding requirements, thereby making them accessible to a broader audience.

- Industry Reports: Reputable organizations like PwC and J.P. Morgan publish comprehensive annual reports that illuminate emerging trends within the real estate sector. These reports are indispensable for investors, offering data-driven insights into economic dynamics, financial strategies, and forecasts that can significantly aid in decision-making.

- Real Estate Blogs and Forums: Engaging with online communities via blogs and forums serves as a valuable source of practical advice and shared experiences. Investors can glean insights from the successes and challenges faced by others, informing their own financial strategies.

- Financial News Outlets: Staying informed through reliable financial news sources is crucial for tracking trends and opportunities within the financial landscape. These outlets deliver timely updates on economic indicators, regulatory changes, and other factors that can influence the real estate market.

- Emerging Trends: Recent industry reports reveal a rising interest in short-term rentals, which present higher income potential due to the ability to charge premium rates per night. This trend underscores the importance of adapting financial strategies to capitalize on shifting market demands.

- Case Studies: The integration of property technology (PropTech) is revolutionizing how investors formulate exit strategies. For instance, employing PropTech tools can streamline property management and transaction processes, leading to more efficient and effective financial outcomes. A notable case study illustrates that leveraging PropTech can enhance efficiency and effectiveness in executing exit strategies, ultimately resulting in superior financial results. Investors who adopt these technologies are likely to experience improved returns on their investments.

- Expert recommendations are vital for navigating the complexities of alternative real estate investments. As real estate professional Anthony Hitt articulates, "To be successful in real estate, you must always and consistently put your clients’ best interests first. When you do, your personal needs will be realized beyond your greatest expectations." Industry professionals frequently share insights on optimal platforms and strategies, equipping investors to make informed decisions that align with their financial aspirations. Additionally, readers may find value in the complimentary Ultimate Guide to Higher ROI, which provides strategies to maximize rental income.

Conclusion

Exploring alternative real estate investments unveils a realm of opportunities that transcend traditional property markets. These investments—such as REITs, crowdfunding platforms, and specialized properties—present unique risk and return profiles that can significantly bolster an investor's portfolio. With projections indicating substantial market growth, the allure of these alternatives lies in their potential for higher yields, diversification benefits, and access to niche markets often overlooked by conventional investors.

However, it is crucial to approach these opportunities with a comprehensive understanding of the associated risks, including illiquidity, market volatility, and regulatory changes. By conducting thorough due diligence and assessing personal investment goals alongside risk tolerance, investors can adeptly navigate the intricacies of alternative real estate. The burgeoning interest in these investments, particularly among millennials and risk-tolerant investors, highlights a transformative shift in the market landscape, poised to redefine the future of real estate investing.

In conclusion, alternative real estate investments present a compelling avenue for those ready to adapt to evolving market dynamics. By embracing innovative strategies and staying informed about emerging trends, investors can unlock the potential of this dynamic sector, positioning themselves for long-term success in a transforming economic environment. Now is the opportune moment to explore these avenues and consider how they can align with individual financial goals and investment strategies.