Overview

The article underscores the critical importance and evolution of benchmarks in real estate, asserting their pivotal role in evaluating property performance and guiding investment decisions. It delineates the transformation of benchmarks from rudimentary metrics to a comprehensive array of performance indicators, including ESG factors. This evolution empowers investors to make informed choices that not only align with market standards but also reflect ethical considerations. By understanding these developments, investors can strategically navigate the complexities of the real estate market, ensuring their investment strategies are both effective and responsible.

Introduction

In the dynamic realm of real estate, benchmarks are indispensable tools that empower investors and analysts to navigate a complex landscape with confidence. These critical standards facilitate the assessment of property performance and enable strategic decision-making by comparing key financial indicators against established market norms. As the industry evolves, the importance of benchmarks has intensified, fostering transparency and accountability among stakeholders.

From traditional metrics like occupancy rates to modern considerations of environmental, social, and governance factors, the evolution of real estate benchmarks reflects a broader shift towards responsible investing. This article delves into the definition, significance, evolution, and various types of benchmarks, illustrating how they can enhance investment strategies and optimize performance in today's competitive market.

Define Benchmarks in Real Estate

In property management, a yardstick serves as a vital criterion for evaluating and comparing the performance of assets, collections, or market divisions. Common standards include various metrics such as:

- Average sale prices

- Rental income

- Occupancy rates

- Capitalization rates

These benchmarks in real estate serve as essential tools for investors and analysts, enabling them to assess the relative performance of property assets against market averages or specific criteria. By establishing these standards, stakeholders can create a benchmark in real estate that allows them to make informed decisions regarding property acquisitions, management strategies, and financial opportunities, ultimately enhancing their ability to navigate the complexities of the real estate landscape.

With over 30,000 subscribers, Zero Flux underscores the reliability of the information provided, highlighting the importance of utilizing standards in decision-making. As John Maxwell wisely stated, "Learn to say ‘no’ to the good so you can say ‘yes’ to the best," which underscores the critical role of standards in identifying optimal opportunities. Furthermore, the RealWealth Investment Club exemplifies how standards can streamline the financial process, granting members access to valuable resources and support, ultimately assisting them in making informed choices in today’s most dynamic markets.

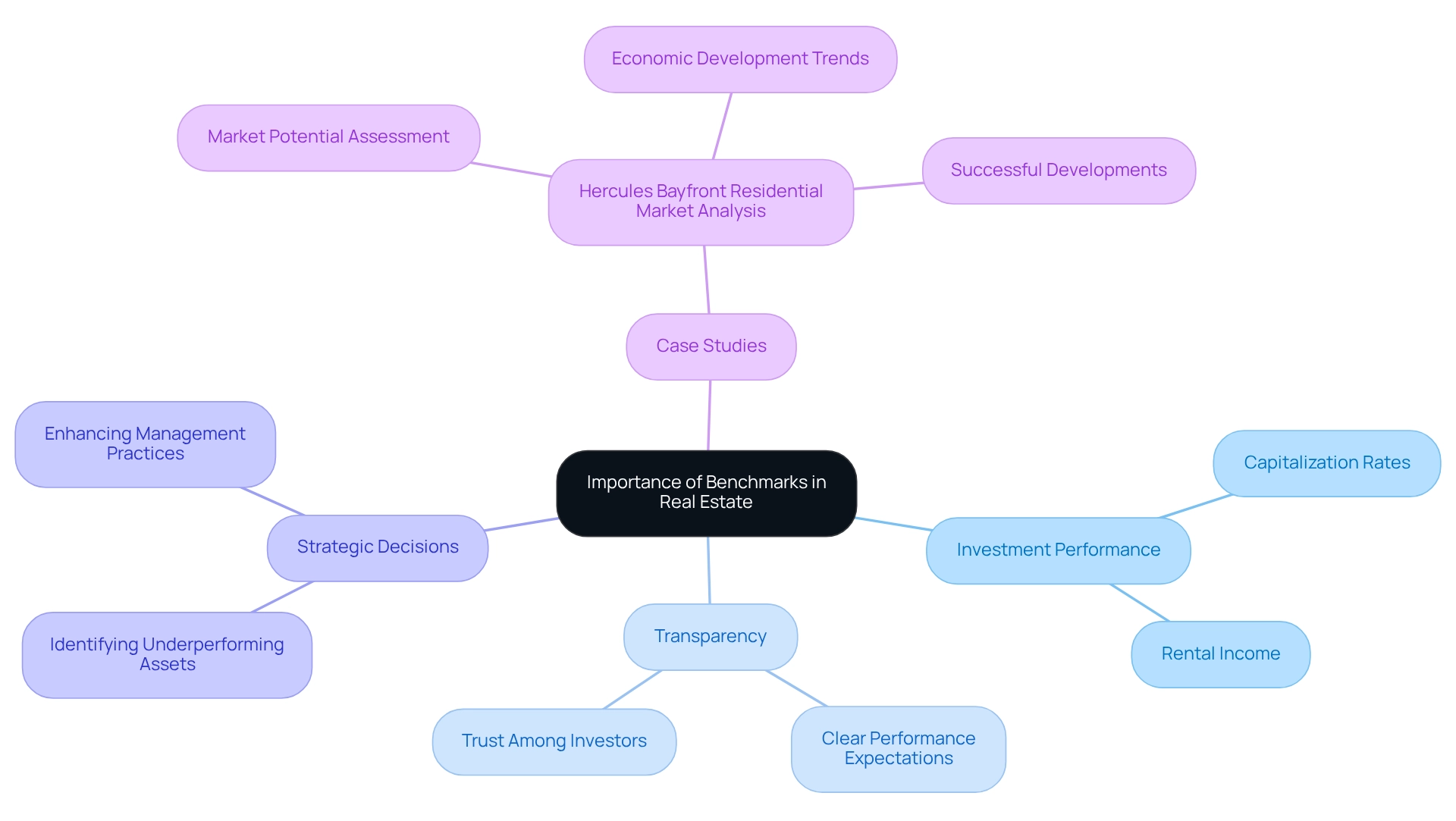

Explain the Importance of Benchmarks in Real Estate

Benchmarks serve a crucial function in the property sector as a benchmark in real estate, providing a structured framework for evaluating investment performance. They enable investors to compare essential financial indicators—such as capitalization rates and rental income—against established industry standards or similar properties. This comparative analysis is vital for identifying underperforming assets, enhancing management practices, and informing strategic decisions.

As we look ahead to 2025, the importance of these standards has only intensified, fostering greater transparency and accountability in property transactions and building trust among investors and stakeholders. Standards, in particular, enhance transparency by establishing clear performance expectations, allowing investors to assess whether properties meet or exceed the benchmark in real estate. For example, properties that consistently underperform relative to their standards may necessitate a reevaluation of management or operational strategies to boost performance.

Case studies, such as the Hercules Bayfront Residential Market Analysis conducted by Anderson Pacific in collaboration with RCLCO, underscore the impact of standards on property performance evaluation. For over 12 years, Anderson Pacific has partnered closely with RCLCO on all its entitlement and development projects across California, leveraging RCLCO's market insights and analytics. This analysis not only evaluated market potential but also guided strategic discussions with partners, culminating in successful developments. The American Society of Landscape Architects' awards committee notably recognized the innovative blend of approaches for economic revitalization within the plan, highlighting the broader implications of standards in property. By leveraging these standards, investors can make informed decisions that lead to enhanced outcomes in their portfolios.

Trace the Evolution of Real Estate Benchmarks

The development of a benchmark in real estate has undergone significant transformation over the last several decades. Initially, standards were limited to basic metrics such as occupancy rates and rental income. However, as the real estate landscape evolved into a more intricate and competitive arena, the necessity for sophisticated standards became increasingly apparent. Today, these standards encompass a wide array of performance indicators, including environmental, social, and governance (ESG) factors, reflecting the growing emphasis on sustainability and responsible investing.

Technological advancements and enhanced data analytics have further accelerated this evolution, enabling the establishment of more granular benchmarks that facilitate detailed comparisons across various property types and geographic regions. For instance, the incorporation of advanced metrics allows investors to assess not only financial performance but also the broader impact of their contributions on communities and the environment.

This shift in benchmarking practices is essential for adapting to the dynamic nature of the benchmark in real estate market. As Robert Kiyosaki aptly stated, "People with leverage have dominance over people with less leverage," underscoring the critical role of leverage in investment strategies. Additionally, Rich Fettke's perspective on true wealth, as articulated in the case study 'Real Wealth and Freedom,' emphasizes that genuine wealth encompasses both the financial means and the freedom to live life on one's own terms. This reinforces the narrative regarding the importance of evolving standards to align with financial independence.

Moreover, data such as RealtyMogul's offer of up to $250 for every investor who registers on their platform illustrate the tangible benefits of advanced standards in real estate investing. The continuous enhancement of standards ensures that industry professionals can navigate complexities effectively, making informed decisions that align with both their financial objectives and ethical considerations. It is crucial to acknowledge that the quotes included in this article represent the opinions of the individuals and do not constitute investment advice.

Identify Key Characteristics and Types of Real Estate Benchmarks

Real estate standards can be classified into various unique types, each fulfilling specific roles that enhance decision-making and performance assessment. Effective standards share key characteristics such as relevance, reliability, and comprehensiveness, which are essential for accurate evaluations. The primary types of benchmarks include:

- Market Standards: These standards indicate average performance metrics across specific markets or property types, such as average rental rates or sales prices. They provide a foundational understanding of market dynamics.

- Property-Specific Standards: Customized for distinct properties, these standards evaluate performance according to unique traits, including location, size, and property type. This specificity enables a more nuanced assessment of financial potential.

- Portfolio Standards: Investors overseeing various properties use these standards to assess overall portfolio performance in relation to market averages or particular financial objectives. This holistic view is crucial for strategic asset management.

- ESG Standards: With the increasing focus on sustainable investing, these standards evaluate properties according to environmental and social criteria. They demonstrate the growing significance of ethical funding methods in the property sector.

Understanding these categories and their traits allows property professionals to utilize the benchmark in real estate effectively, guiding investment approaches and operational choices. For instance, data points obtained from these standards can indicate potential for rent hikes, which is crucial for acquisition due diligence. This connection underscores the importance of having clear performance indicators in place, as highlighted by industry experts. Furthermore, case studies, such as those analyzing property agent performance metrics, illustrate how sales metrics and client satisfaction indicators function as standards for evaluating effectiveness in the market. By evaluating these metrics, agents can identify areas for improvement, ultimately enhancing their overall effectiveness. As Ellie Perlman, Founder and CEO of Blue Lake Capital, states, 'With the appropriate standards established, you’ll always understand how your assets compare, which acts as a benchmark in real estate, even in the private property sector.' By implementing the right benchmarks, investors can ensure they are well-informed about their investments, supported by the comprehensive insights provided by Zero Flux, which compiles 5-12 handpicked real estate insights daily.

Conclusion

In the realm of real estate, benchmarks are vital tools that empower investors and analysts to navigate the complexities of the market with confidence. By providing clear standards for measuring performance, benchmarks facilitate informed decision-making, enabling stakeholders to compare key financial indicators against established norms. This structured framework not only highlights the relative performance of properties but also fosters transparency and accountability, essential in today's investment climate.

The evolution of real estate benchmarks reflects a broader shift towards responsible investing, incorporating traditional metrics alongside modern considerations such as environmental, social, and governance factors. This transformation is crucial for adapting to the dynamic nature of the industry, as enhanced data analytics and technological advancements have refined benchmarks, allowing for more detailed assessments across diverse property types and geographical regions.

Understanding the different types of benchmarks—from market and property-specific benchmarks to ESG benchmarks—equips real estate professionals with the knowledge necessary to optimize their investment strategies. By leveraging these benchmarks effectively, investors can identify underperforming assets, guide strategic decisions, and ultimately drive better outcomes for their portfolios.

The significance of benchmarks in real estate cannot be overstated. They enhance performance evaluation and align investments with ethical considerations, paving the way for sustainable growth in the industry. As the market continues to evolve, embracing the power of benchmarks will be essential for stakeholders aiming to achieve long-term success and make informed, responsible investment choices.