Overview

Commercial real estate interest rates today are shaped by a multitude of factors, including economic conditions, borrower credit quality, and property classification. These rates currently range from approximately 5.45% to 15.25%. Understanding these dynamics is not just beneficial; it is essential for making informed investment decisions.

Fluctuations in interest rates can significantly impact:

- Borrowing costs

- Real estate valuations

- Overall investment strategies

By grasping these insights, investors can navigate the complexities of the market more effectively.

Introduction

Understanding the nuances of commercial real estate interest rates is essential for investors navigating today's complex financial landscape. These rates, influenced by a myriad of factors such as:

- Economic conditions

- Borrower credit quality

- Property type

can significantly impact investment decisions and potential returns. With rates fluctuating between 5.45% and 15.25%, investors must ask: how can they strategically position themselves to capitalize on opportunities while mitigating risks? This article delves into the critical elements shaping interest rates and offers insights for making informed investment choices in a rapidly changing market.

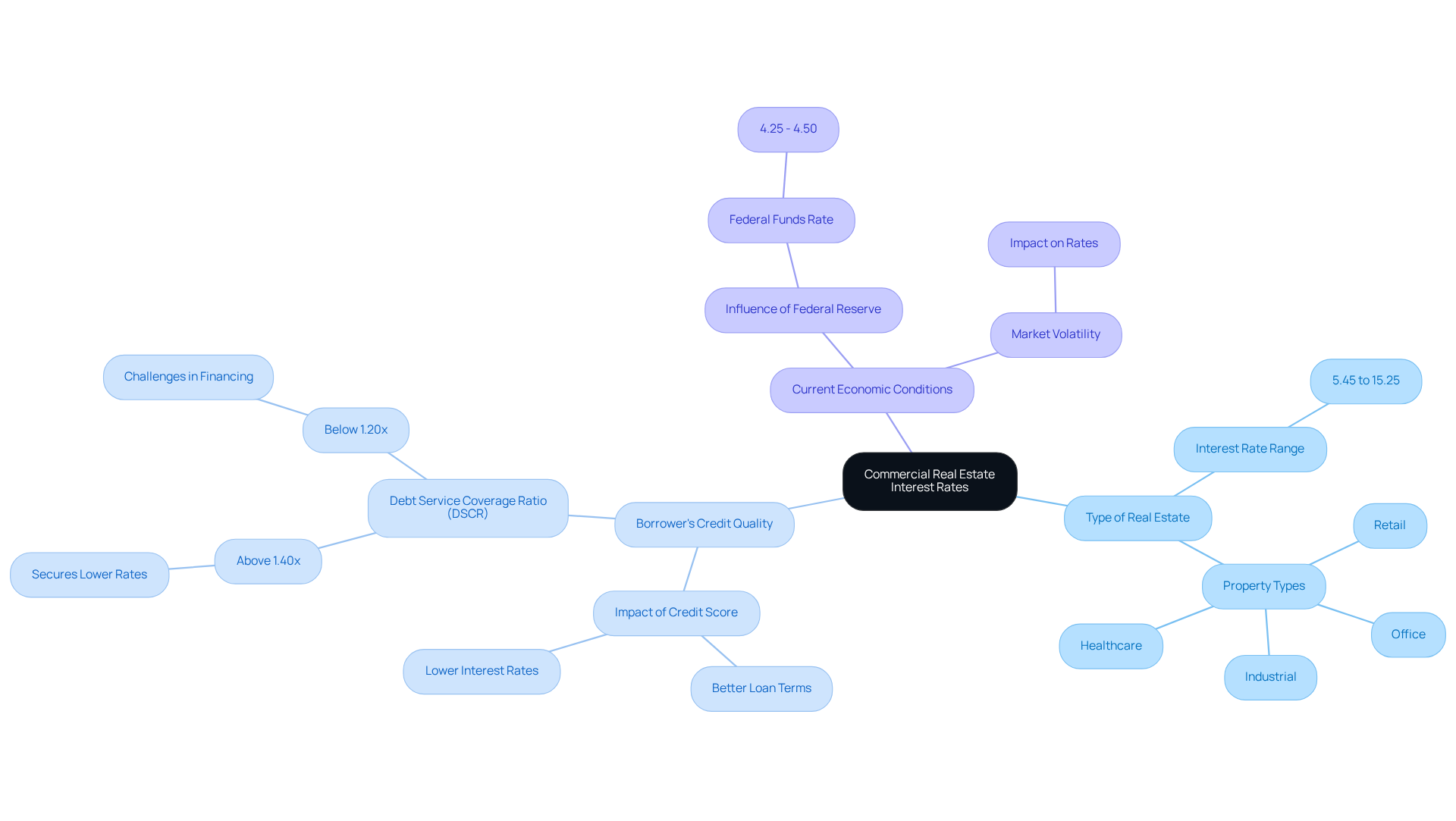

Define Commercial Real Estate Interest Rates

Interest charges for business real estate represent the cost of acquiring funds for the purchase or development of business assets, expressed as a percentage of the loan value. The fluctuations of commercial real estate interest rates today are influenced by several factors, including:

- The type of real estate

- The borrower's credit quality

- Current economic conditions

For instance, as of June 2025, commercial mortgage rates range from approximately 5.45% to 15.25%, reflecting the diverse risk profiles associated with different real estate types. Investors must grasp these figures, as they significantly impact financing costs and potential returns on investment (ROI).

A strong credit score can lead to more favorable loan terms, while assets with a debt service coverage ratio (DSCR) exceeding 1.40x have recently secured terms 0.20-0.35% lower than those merely meeting minimum qualifying ratios. Conversely, assets with a DSCR below 1.20x encounter difficulties in obtaining traditional financing. Additionally, the location of a property can cause variations of 0.25% to 0.75% in financing rates for otherwise comparable properties. Understanding these dynamics is crucial for making informed investment decisions considering the commercial real estate interest rates today.

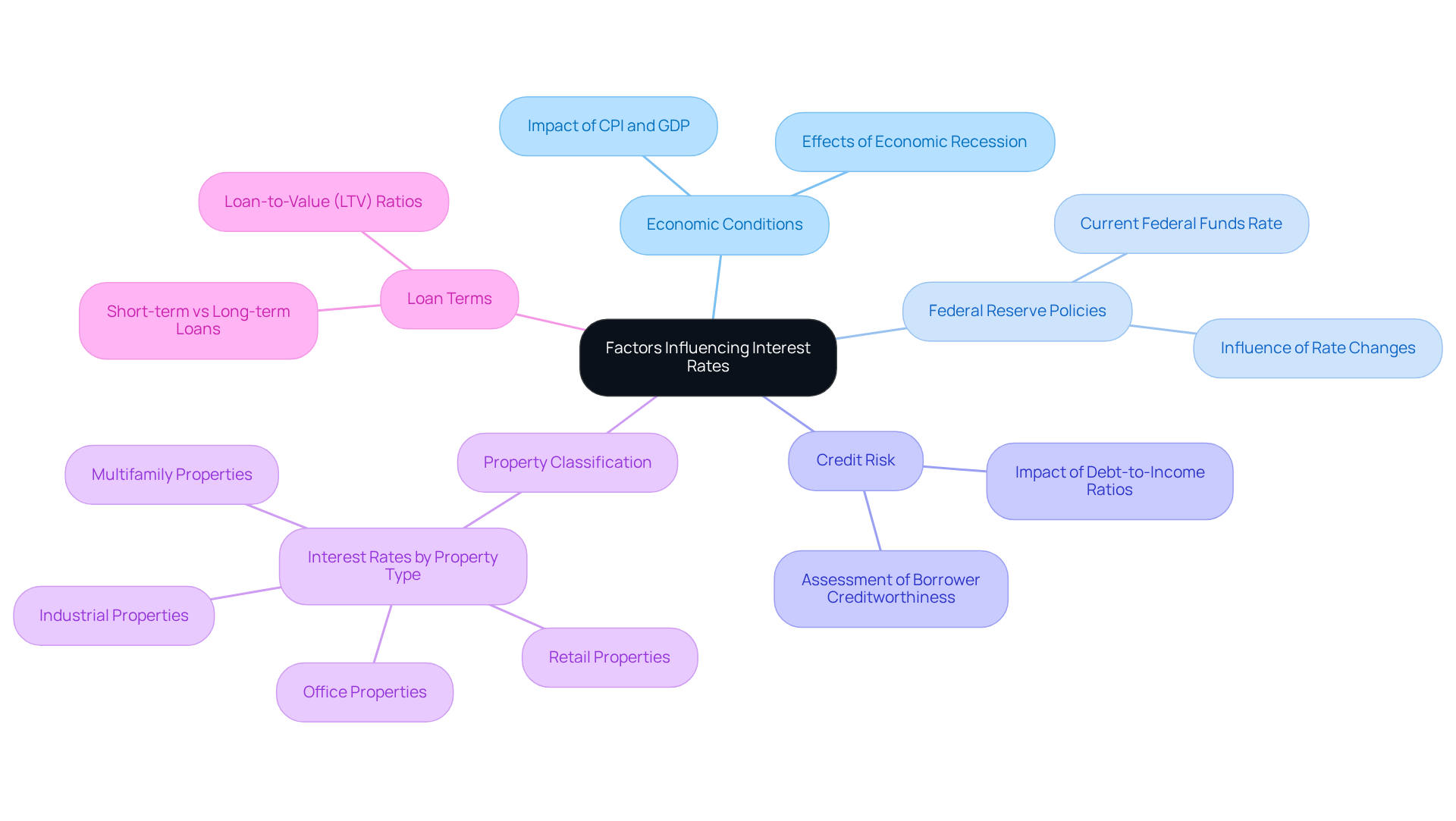

Explore Factors Influencing Interest Rates

Several key factors significantly influence commercial real estate interest rates:

-

Economic Conditions: The overall state of the economy is a primary factor influencing financial charges. In a flourishing economy, demand for loans rises, frequently resulting in elevated borrowing costs. Specific economic indicators, such as the Consumer Price Index (CPI) and Gross Domestic Product (GDP), play crucial roles in shaping the Federal Reserve's decisions. Conversely, during economic recessions, interest levels may decline as the Federal Reserve seeks to encourage borrowing and investment.

-

Federal Reserve Policies: The Federal Reserve's monetary strategy, especially its modifications to the federal funds level, has a direct influence on interest levels. For example, when the Fed increases interest levels, borrowing expenses generally rise, impacting all sectors, including the commercial real estate interest rates today. As of early 2024, the federal funds percentage was sustained between 4.25% and 4.50%, affecting the wider lending environment. Furthermore, the Fed's recent reductions in prices due to easing inflation demonstrate the dynamic nature of charges in response to economic conditions.

-

Credit Risk: Lenders assess the creditworthiness of borrowers, which plays a vital role in determining loan costs. Increased perceived risk linked to a borrower can result in higher interest charges, while reduced risk profiles may obtain more advantageous conditions. This assessment often includes factors such as credit history, financial stability, and debt-to-income ratios, which are critical in determining the risk level for lenders.

-

Property Classification: Interest percentages can differ greatly depending on the kind of business real estate. For instance, office buildings, retail spaces, and industrial properties each have distinct market demands and risk profiles, leading to different financing costs. As of May 2025, the commercial real estate interest rates today ranged from just over 5% to above 15%, reflecting these variances.

-

Loan Terms: The structure and duration of the loan also affect interest charges. Generally, shorter-term loans have lower costs compared to long-term loans, as they pose diminished risk for lenders. Moreover, the loan-to-value (LTV) ratio is essential; properties funded at lower LTVs can obtain terms 0.25-0.50% lower than those with higher ratios, highlighting the financial advantages of upholding a cautious LTV.

Understanding these factors is crucial for maneuvering through the intricacies of real estate financing, particularly in a market marked by volatility and shifting economic conditions.

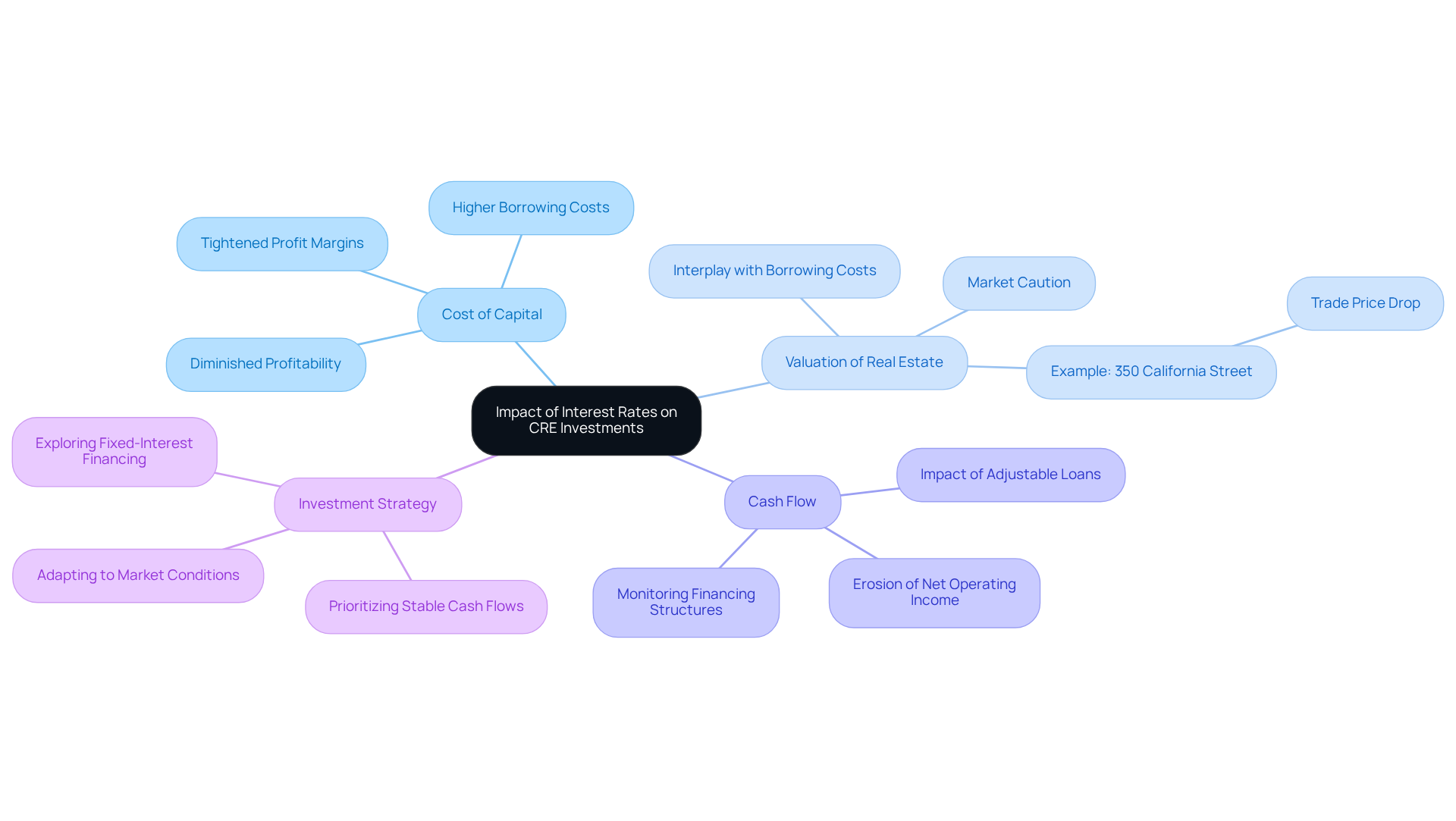

Analyze the Impact of Interest Rates on CRE Investments

Commercial real estate interest rates today play a pivotal role in shaping CRE investments through several key mechanisms.

-

Cost of Capital: Higher borrowing costs arise from increased loan charges, which can diminish the overall profitability of investments. Investors must carefully evaluate their expected returns against these elevated costs, as the profit margin tightens.

-

Valuation of Real Estate: The interplay between borrowing costs and real estate valuations is crucial. As prices rise, borrowing expenses escalate, often resulting in lower real estate values. This shift occurs as potential buyers reevaluate their purchasing power, fostering a more cautious market atmosphere. For instance, the disclosed trade price for 350 California Street in San Francisco fell to a mere 20% of its original asking price in 2020, illustrating how fluctuations in borrowing costs can profoundly affect real estate valuations. As Andrew Carnegie famously remarked, "Ninety percent of all millionaires become so through owning real estate," underscoring the necessity of comprehending these dynamics.

-

Cash Flow: Current assets financed with adjustable loans are particularly vulnerable to rising borrowing costs. Increased monthly payments can erode net operating income, adversely affecting overall cash flow. Investors must remain vigilant in monitoring their financing structures to mitigate these risks.

-

Investment Strategy: In light of shifting interest levels, investors may need to recalibrate their strategies. In an environment of rising commercial real estate interest rates today, it becomes essential to prioritize properties with stable cash flows. Additionally, exploring fixed-interest financing options can safeguard against future increases, allowing investors to secure lower costs and maintain predictable expenses.

Understanding these dynamics is vital for navigating the complexities of the current property market, especially as market conditions evolve and interest levels fluctuate.

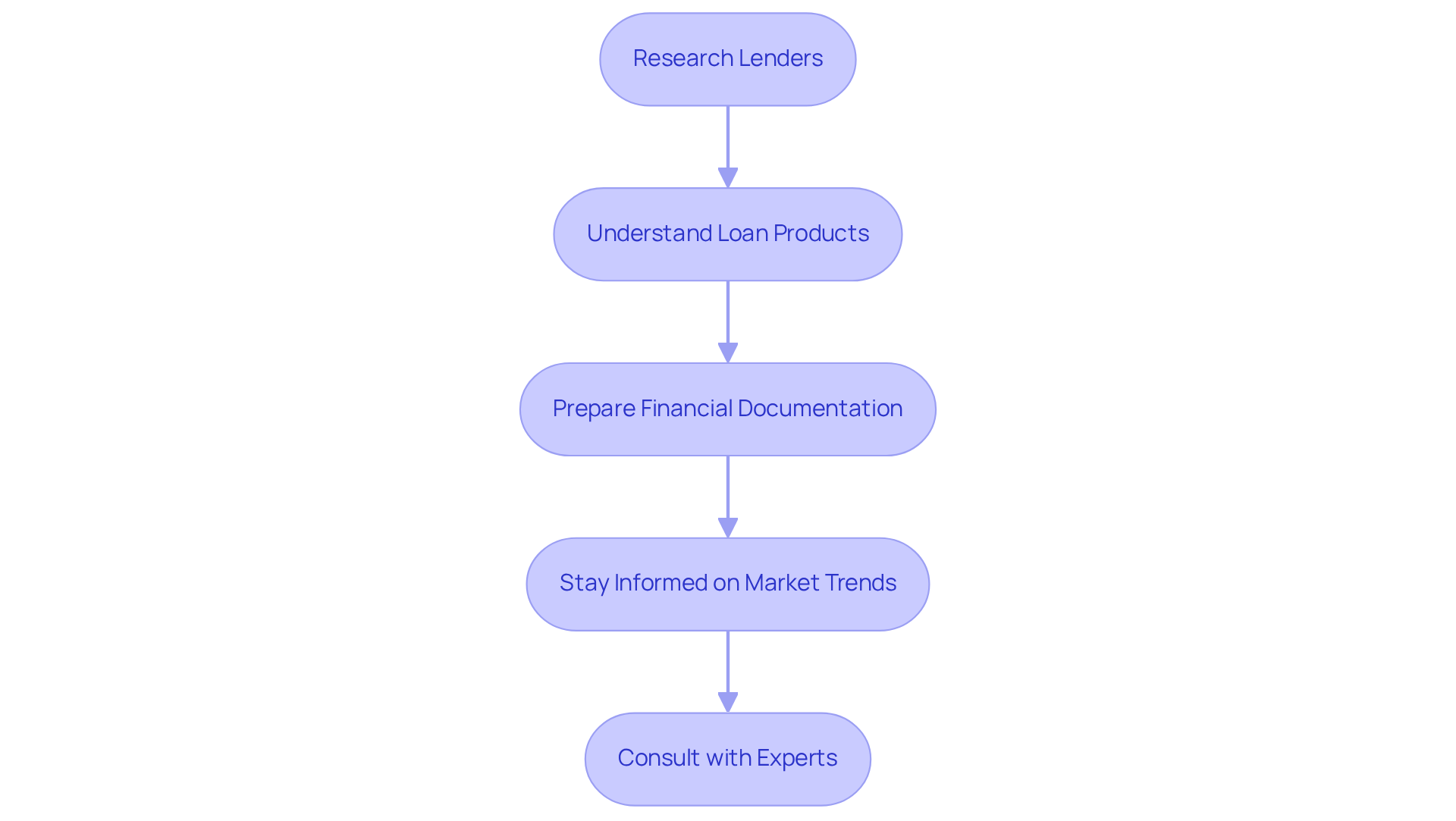

Navigate the Current CRE Financing Landscape

To effectively navigate the current commercial real estate financing landscape, consider the following steps:

-

Research Lenders: Identify a range of lenders, including banks, credit unions, and private equity firms. Each may offer different terms and conditions, making it essential to evaluate options carefully.

-

Understand Loan Products: Familiarize yourself with various loan products available, such as fixed-rate, adjustable-rate, and bridge loans. Each type has its own advantages and disadvantages, depending on your investment strategy.

-

Prepare Financial Documentation: Lenders will require comprehensive financial documentation, including income statements, tax returns, and credit history. Being well-prepared can expedite the approval process.

-

Stay informed on market trends by keeping abreast of commercial real estate interest rates today and other economic indicators that may influence financing options. This knowledge can help you time your financing decisions effectively, especially as the Federal Reserve's recent rate cuts have lowered the benchmark rate to 4.5%. Notably, 88% of CRE executives expect revenue increases in 2025, indicating a potentially favorable environment for financing.

-

Consult with Experts: Engaging with financial advisors or real estate professionals can provide valuable insights and assist you in navigating complex financing scenarios. Their expertise is particularly beneficial in a landscape where 20% of outstanding commercial mortgages, totaling $957 billion, are set to mature in 2025, creating refinancing challenges for many investors. For instance, despite a 7% decline in property values over the past year, the 2025 Commercial Real Estate Market Outlook suggests that many executives remain optimistic about revenue growth, underscoring the importance of strategic financing.

Conclusion

Understanding the intricacies of commercial real estate interest rates is essential for investors aiming to navigate today's dynamic market. The fluctuations in these rates, influenced by factors such as economic conditions, credit risk, and property classification, can significantly affect financing costs and investment potential. Grasping these elements empowers investors to make informed decisions that align with their financial goals.

Key insights from this exploration reveal that interest rates are shaped by a multitude of factors, including the Federal Reserve's monetary policies and the overall economic climate. Higher interest rates can lead to increased borrowing costs, impacting cash flow and real estate valuations. Additionally, the type of property and the borrower's creditworthiness further influence the terms of financing, underscoring the need for careful analysis and strategic planning.

Ultimately, staying informed about current trends in commercial real estate interest rates and understanding the broader economic landscape is crucial for successful investment. By proactively researching financing options and consulting with industry experts, investors can position themselves to capitalize on opportunities while mitigating risks associated with fluctuating interest rates. Embracing these strategies will not only enhance investment outcomes but also contribute to a more resilient approach in a competitive market.