Overview

This article delves into the significance and calculation of the Internal Rate of Return (IRR) in real estate investment, underscoring its role as a critical metric for evaluating the profitability of property ventures. By allowing investors to compare diverse financial opportunities through the lens of the time value of money, IRR emerges as an indispensable tool in the investment decision-making process. Various calculation methods, including manual calculations and Excel functions, are highlighted to facilitate informed decision-making.

Understanding IRR is crucial for investors seeking to maximize returns. How does one effectively calculate IRR? The article presents different methodologies that cater to varying levels of expertise, ensuring that both novice and seasoned investors can leverage this metric. This comprehensive approach not only enhances understanding but also empowers investors to make strategic choices that align with their financial goals.

In conclusion, the article emphasizes the importance of mastering IRR as a means to navigate the complexities of real estate investment. By incorporating these insights into their strategies, investors can enhance their ability to assess and capitalize on lucrative opportunities within the market.

Introduction

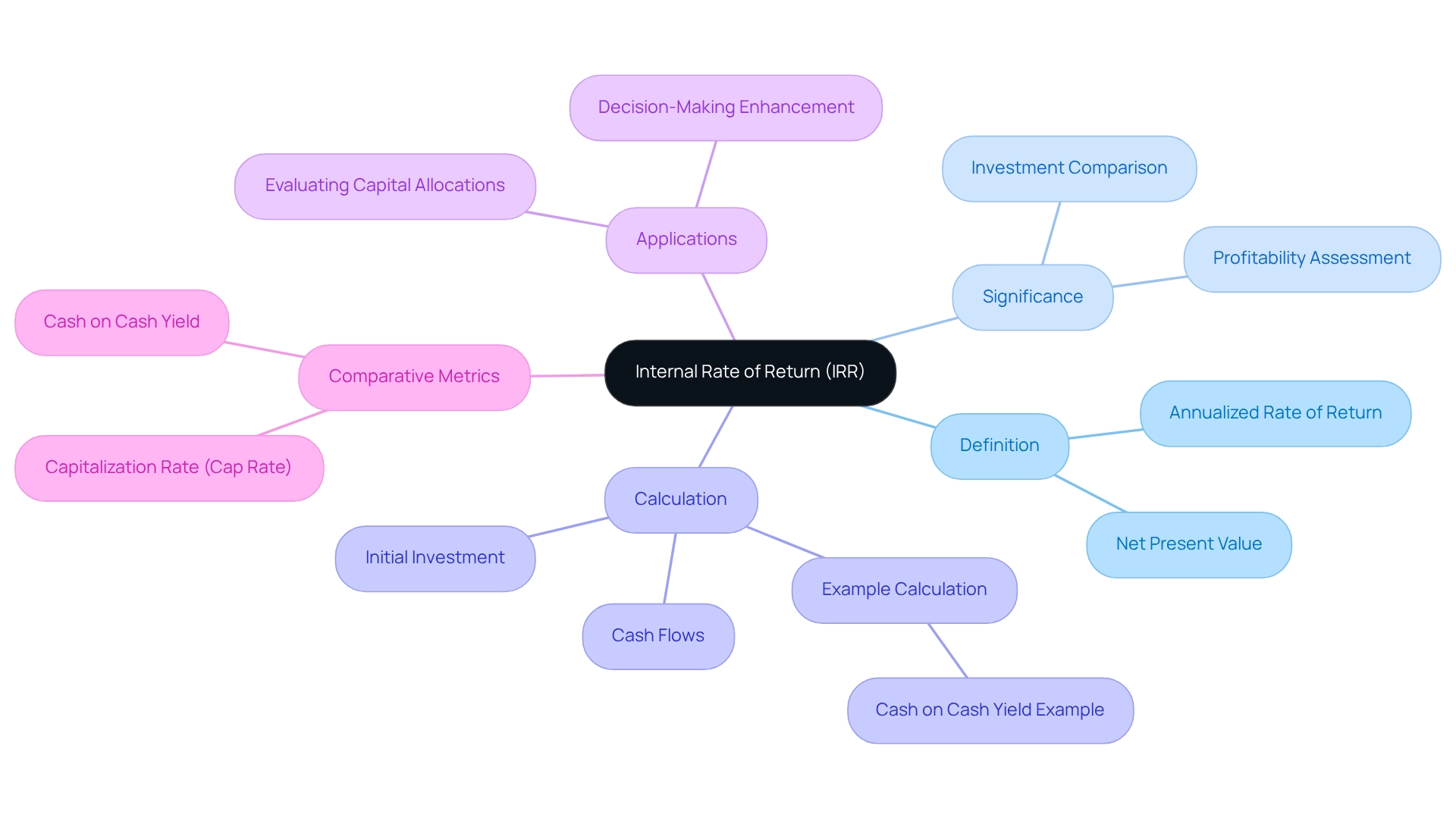

In the realm of real estate investment, the Internal Rate of Return (IRR) stands out as a pivotal metric that investors depend on to evaluate potential profitability and make informed decisions. By calculating the annualized rate of return at which the net present value of cash flows equals zero, IRR offers a nuanced understanding of investment performance, incorporating the essential element of time.

As the market evolves, grasping the intricacies of IRR becomes crucial for navigating the complexities of investment opportunities. This understanding allows investors to effectively compare various projects and align their strategies with financial goals.

This article delves into the significance of IRR in real estate, exploring its calculation methods, practical applications, and the vital distinctions between IRR and other investment metrics. Ultimately, it aims to guide investors toward smarter, more strategic choices in their portfolios.

What is Internal Rate of Return (IRR) in Real Estate?

The internal rate of return (IRR) in real estate serves as a crucial financial metric for investors assessing the profitability of potential property investments. It represents the annualized rate of return at which the net present value (NPV) of all cash flows—both incoming and outgoing—equals zero. In essence, IRR is the discount rate that equates the present value of future cash flows with the initial capital investment.

This metric proves particularly advantageous for comparing diverse financial opportunities, as it effectively incorporates the time value of money. For real estate investors aiming to optimize their returns, understanding IRR is not just beneficial; it is essential.

Grasping IRR is vital for evaluating the performance of capital allocations. For example, an investor who commits $300,000 to a property and generates $60,000 annually before taxes achieves a cash-on-cash yield of 20%. This straightforward calculation underscores the significance of the internal rate of return in assessing the viability of various projects, especially when comparing allocations with similar risk profiles.

As noted by Coldwell Banker Horizon Realty, "Our team of experienced agents is here to help you interpret these numbers, ensuring your assets align with your financial goals."

Looking ahead to 2025, the average internal rate of return for real estate investments is anticipated to reflect shifting market dynamics, with many investors concentrating on metrics that provide a clearer view of profitability. Case studies, such as 'IRR, CAP Rates & Cash On Cash,' illustrate that a comprehensive understanding of IRR can greatly enhance decision-making processes, empowering investors to make informed choices aligned with their financial objectives. Industry specialists emphasize that mastering these metrics is crucial for successfully navigating the complexities of property financing.

Moreover, the internal rate of return is particularly valuable for comparing projects of equivalent risk, reinforcing its importance in the investment evaluation framework. With over 30,000 subscribers, Zero Flux serves as a reliable source of insights, further accentuating the necessity of understanding IRR in today’s property market.

How to Calculate IRR: Methods and Examples

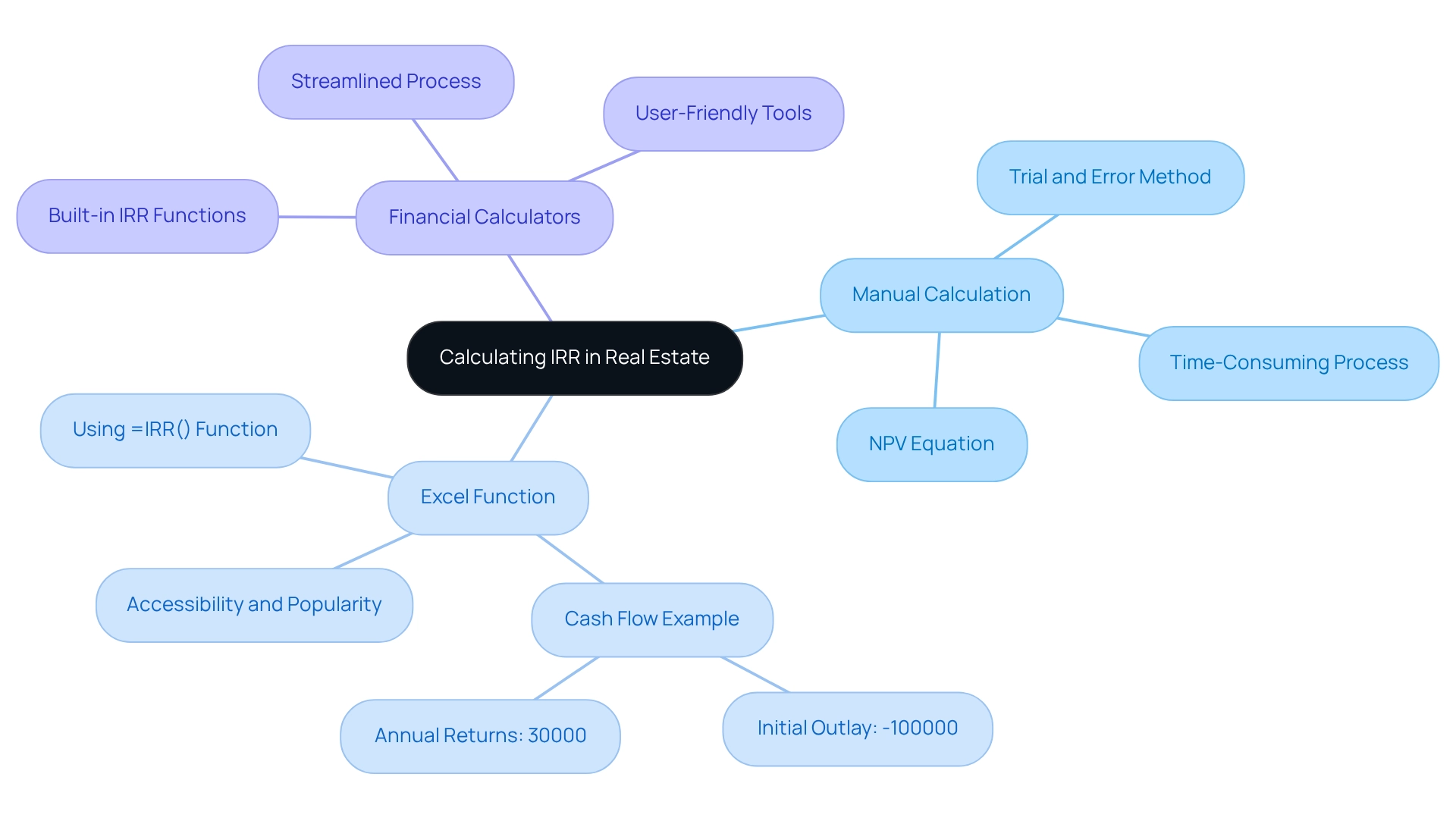

Determining the internal rate of return (IRR) in real estate can be accomplished through various efficient techniques, each tailored to different levels of expertise and available resources. Here are the primary methods:

-

Manual Calculation: This approach involves setting the Net Present Value (NPV) equation to zero and solving for the discount rate. It typically requires trial and error, which can be time-consuming, or the use of financial calculators designed for this purpose.

-

Excel Function: A favored choice among property investors, the

=IRR()function in Excel simplifies the calculation process. To utilize this function, enter the range of cash flows, starting with the initial outlay as a negative value followed by the anticipated cash inflows. This method is popular for its accessibility and ease of use, with a significant percentage of real estate investors relying on Excel for IRR calculations. -

Financial Calculators: Many financial calculators come equipped with built-in functions specifically for calculating IRR. These tools streamline the process, making it easier for users to obtain results without extensive manual calculations.

Consider a placement of $100,000 in a property, with expected annual returns of $30,000 over five years. To calculate the IRR using Excel, you would enter the cash flows as -100000, 30000, 30000, 30000, 30000, 30000 and apply the =IRR() function. This straightforward example illustrates how IRR can be calculated efficiently, providing investors with a clear metric for evaluating the profitability of their capital.

Recent analyses indicate that both contributions generated a 15% IRR over three years, highlighting the potential returns achievable through effective financial strategies. Understanding the IRR in real estate is essential for stakeholders, as it serves as a key indicator of performance. As Mike Hinckley, founder of Growth Equity Interview Guide, emphasizes, a solid educational background, such as an MBA from Wharton, can significantly enhance one's grasp of these financial metrics.

However, it is crucial to recognize that IRR should be considered alongside other metrics to form a comprehensive financial strategy. As emphasized in the case study titled 'Conclusion on the Use of IRR,' while IRR is a valuable tool for evaluating project profitability, its limitations necessitate a broader analytical approach. This ensures informed decision-making that aligns with long-term financial goals.

Furthermore, findings from MRI Software's Voice of the Facility Manager 2025 Report highlight current trends and challenges in the property funding landscape, which may influence IRR calculations and considerations.

The Importance of IRR in Real Estate Investment Decisions

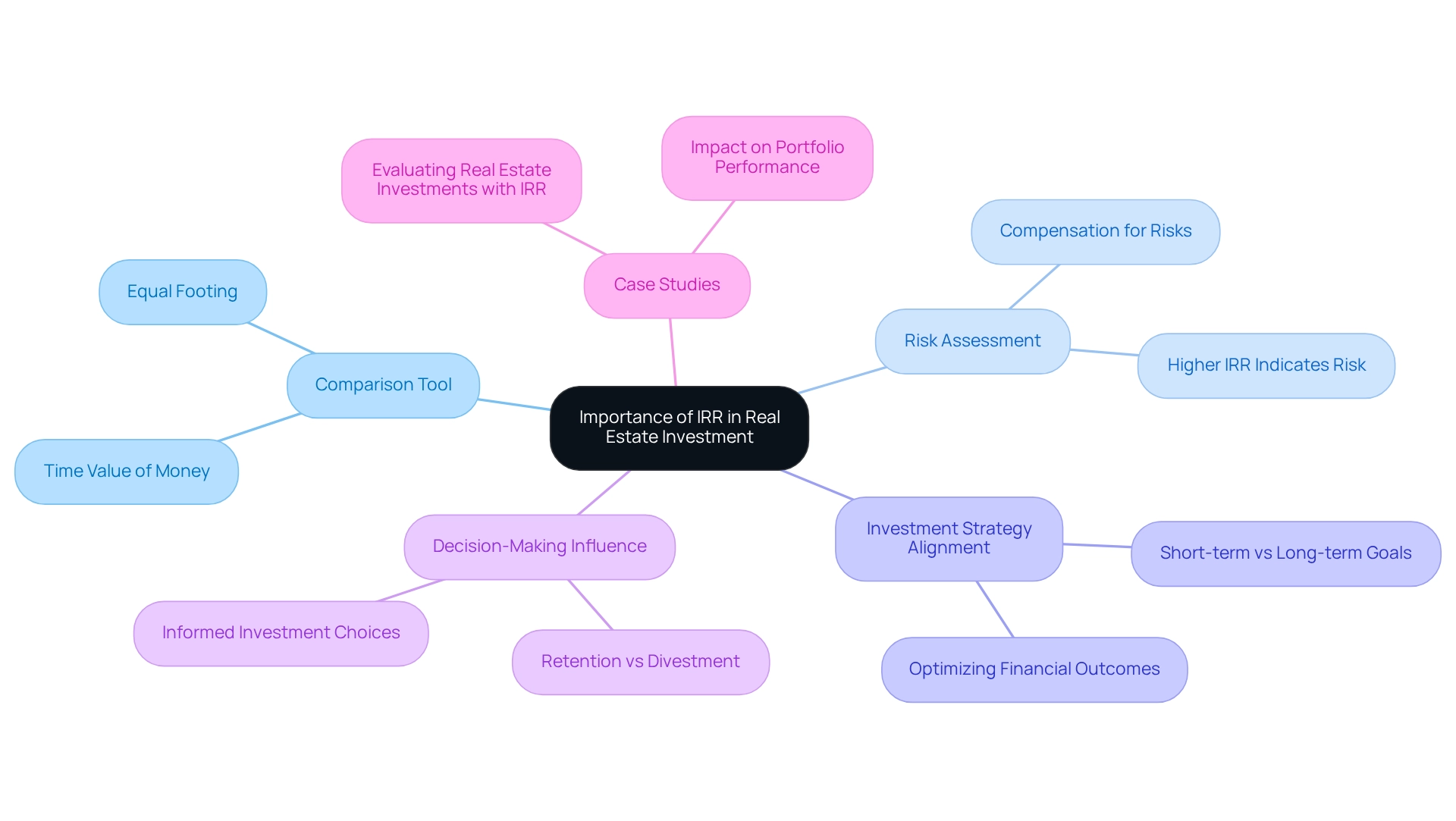

The Internal Rate of Return (IRR) serves as a pivotal metric in real estate investment decisions for several compelling reasons.

-

Comparison Tool: Expressed as a percentage, IRR allows investors to evaluate various investment opportunities on an equal footing by factoring in the time value of money. This facilitates a more accurate comparison of potential returns across different properties or projects, enhancing decision-making.

-

Risk Assessment: A higher IRR often signifies a potentially more profitable opportunity; however, it may also indicate increased risk. Investors can utilize the internal rate of return in real estate to assess whether the expected returns sufficiently compensate for the associated risks, making it an essential component of risk assessment in property investments.

-

Investment Strategy Alignment: Understanding IRR empowers investors to tailor their strategies to their financial objectives, whether they are pursuing short-term profits or aiming for long-term stability. This strategic alignment is crucial for optimizing financial outcomes.

-

Influence on Decision-Making: In 2025, a significant percentage of investors are utilizing IRR as a key tool for risk evaluation in property, reflecting its growing importance in the industry. By calculating the internal rate of return in real estate, investors can make informed decisions about whether to retain or divest properties based on anticipated profitability.

-

Case Studies: Real estate investors frequently apply IRR to assess the appeal of property acquisitions. For instance, when considering new acquisitions or evaluating existing holdings, IRR calculations help determine the viability of continuing to invest in a property versus reallocating capital elsewhere. This analytical approach aids in making strategic decisions that can significantly impact overall portfolio performance. A notable case study titled 'Evaluating Real Estate Ventures with Internal Rate of Return' illustrates how investors employ IRR to evaluate the attractiveness of property acquisitions based on expected returns.

In summary, the internal rate of return in real estate serves not only as a benchmark for comparing opportunities but also as a crucial tool for evaluating risks and aligning strategies with financial objectives. Its role in property funding decision-making is underscored by its extensive application among investors, highlighting its importance in navigating the complexities of the market. However, it is essential to note that IRR is based on estimations and assumptions, and investors should consider unique risk profiles and external variables that may impact actual returns.

Furthermore, other indicators such as Net Present Value (NPV), Vacancy Rate, and Operating Expense Ratio (OER) can also be employed to assess property ventures, offering a more comprehensive perspective of the market landscape.

IRR vs. Other Investment Metrics: Understanding the Differences

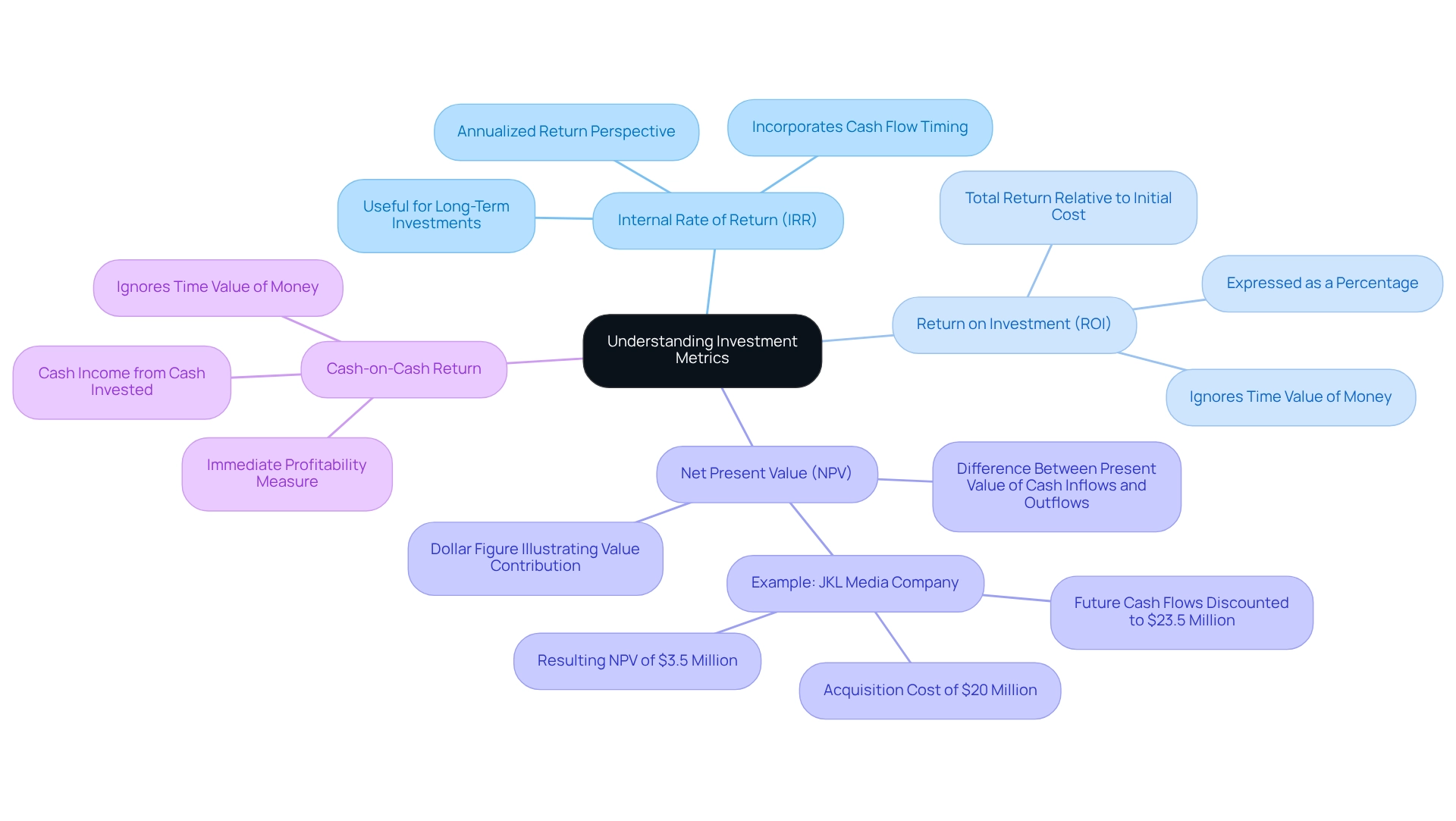

When evaluating real estate investments, it is essential to grasp the distinctions between Internal Rate of Return (IRR) and other key metrics to make informed decisions:

-

Return on Investment (ROI): ROI quantifies the total return on an investment relative to its initial cost, expressed as a percentage. However, it does not account for the time value of money, which can lead to misleading conclusions about the profitability of long-term financial commitments. In contrast, the internal rate of return real estate offers an annualized return that incorporates the timing of cash flows, providing a more nuanced perspective on a venture's performance over time.

-

Net Present Value (NPV): NPV evaluates the profitability of a venture by calculating the difference between the present value of cash inflows and outflows. This metric produces a dollar figure, illustrating how much value an asset is anticipated to contribute. While NPV is beneficial for grasping the total value produced, the internal rate of return real estate provides a percentage return, enabling simpler comparisons among different opportunities.

-

Cash-on-Cash Return: This metric assesses the cash income generated from the cash invested in a property, offering a straightforward measure of immediate profitability. Unlike IRR, cash-on-cash return does not consider the time value of money, making it less appropriate for evaluating long-term assets. The internal rate of return real estate, by considering the timing of cash flows, provides a more comprehensive perspective on the potential returns of a financial commitment over its lifespan.

Recent case studies illustrate these differences effectively. For instance, in a scenario involving JKL Media Company, the estimated future cash flows from a potential acquisition were discounted to a present value of $23.5 million, while the acquisition cost was $20 million, resulting in an NPV of $3.5 million. This example highlights how NPV can signify intrinsic value, while the internal rate of return real estate provides a percentage return that represents the efficiency of the venture over time.

As property investors navigate current market trends, understanding these metrics—especially the distinctions between internal rate of return real estate, ROI, and NPV—grows increasingly significant. Financial analysts emphasize that although the internal rate of return real estate is a powerful tool for assessing performance, it should be utilized alongside other metrics to achieve a comprehensive perspective on potential returns. Moreover, as highlighted by Herbert Kierulff, "This article explains the problems with NPV and IRR, describes how MIRR works, and demonstrates how MIRR deals with weaknesses in NPV and IRR."

Furthermore, Zero Flux gathers 5-12 selected property insights daily, offering subscribers useful information that enhances their comprehension of these financial metrics. This dedication to quality material not only enriches the knowledge base of property investors but also fosters greater interaction with the newsletter.

Applying IRR in Real Estate: Case Studies and Practical Examples

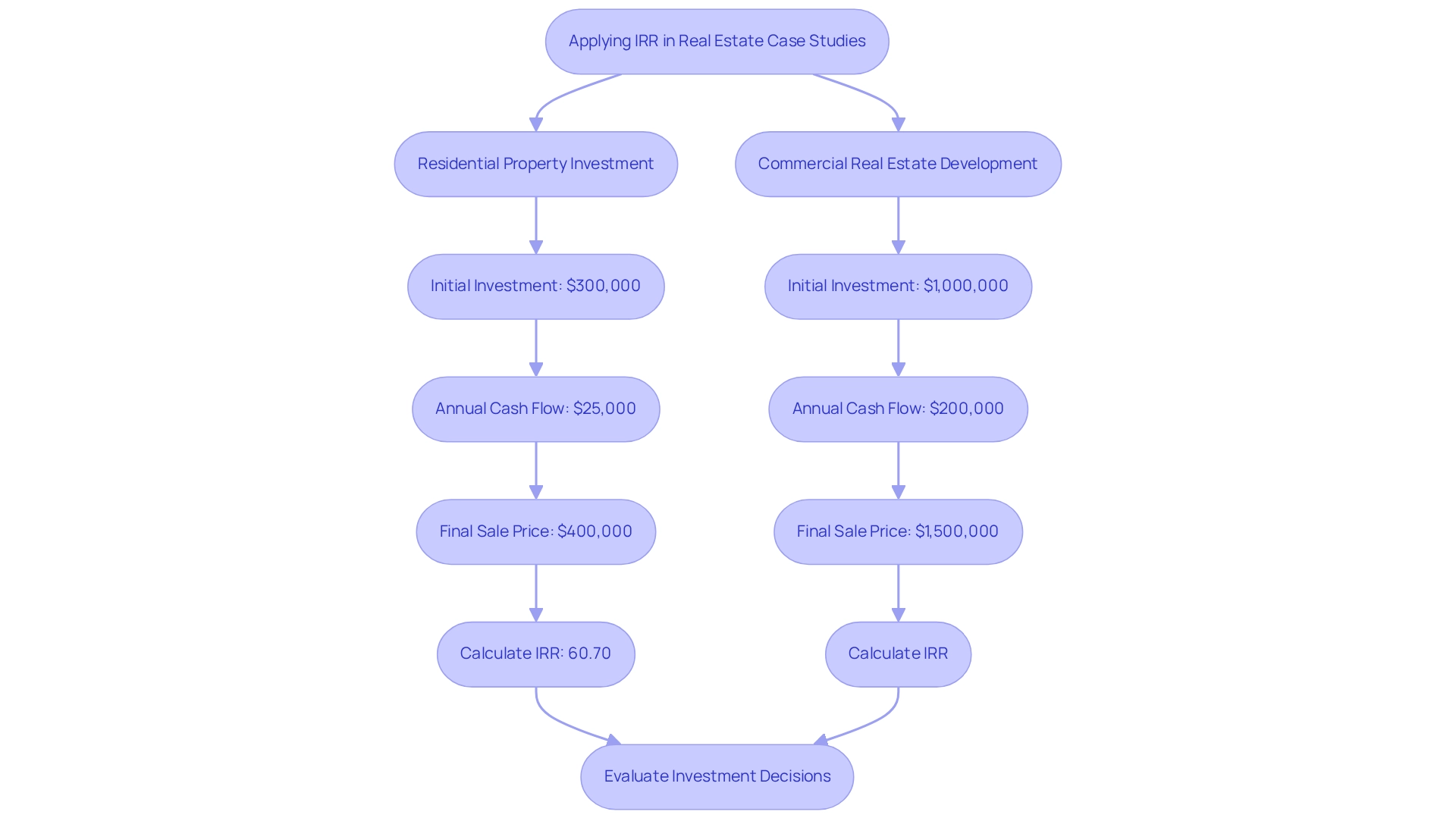

To illustrate the application of Internal Rate of Return (IRR) in real estate ventures, let us examine the following case studies:

-

Residential Property Investment: An investor purchases a rental property for $300,000, anticipating an annual rental income of $25,000 over a 10-year span. After a decade, the property is sold for $400,000. By calculating the internal rate of return for real estate—which is significantly influenced by projected cash flow from the sale (60.70%)—the investor can evaluate whether this venture aligns with their return expectations and how it compares to alternative opportunities in the market.

-

Commercial Real Estate Development: A developer invests $1 million in a commercial project, expecting to generate cash flows of $200,000 annually for five years, followed by a sale of the property for $1.5 million. The internal rate of return calculation for real estate will enable the developer to assess whether the projected returns meet their funding criteria and risk tolerance, providing a clear framework for decision-making. This aligns with the insights of Benjamin Gbolahan Ekemode, who emphasizes the importance of understanding the real estate acquisition decision-making framework.

These examples underscore the importance of the internal rate of return in real estate as a critical metric for evaluating the feasibility of ventures, empowering investors to make informed choices based on anticipated cash flows and overall returns. Furthermore, it is essential to recognize potential pitfalls in financial analysis, such as the limitations of decile analysis, which can lead to misleading conclusions. Additionally, comparing IRR with metrics like Cash On Cash Yield can provide a broader understanding of returns on capital.

For example, an investor who allocates $300,000 into a deal and receives $60,000 annually before taxes achieves a cash on cash yield of 20%. While this figure does not account for appreciation, it offers a different perspective on returns. The relevance of IRR extends beyond property, as illustrated in various funding scenarios, such as a venture capital firm evaluating a biotech startup's IRR of 25% before deciding to invest, indicating strong growth potential.

Limitations of IRR: What Investors Need to Know

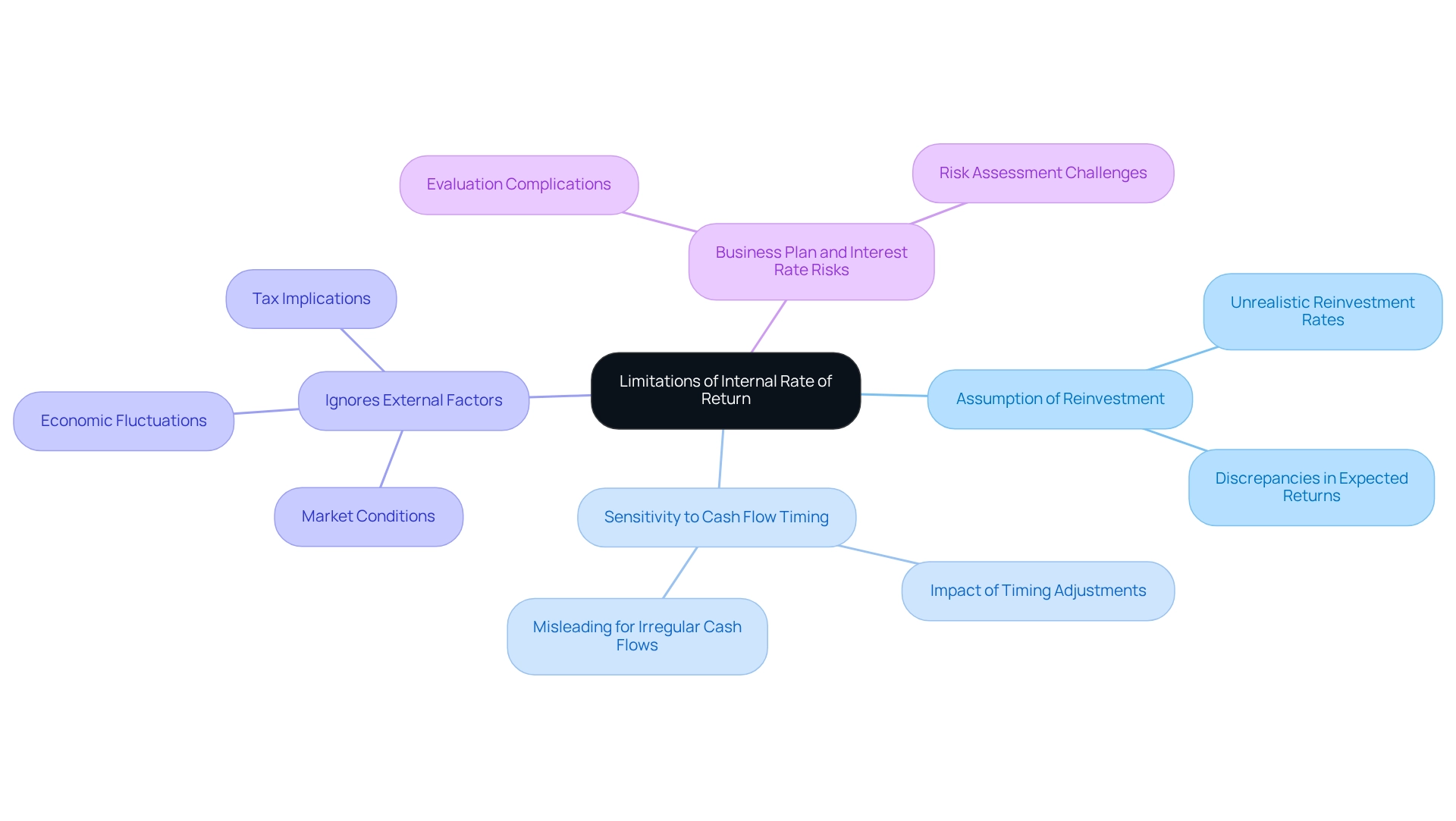

While the Internal Rate of Return (IRR) is widely regarded as a valuable metric for assessing the profitability of real estate investments, it is essential to recognize its limitations:

-

Assumption of Reinvestment: One of the primary criticisms of IRR is its assumption that all cash flows generated by the investment are reinvested at the same rate as the IRR itself. This assumption can be unrealistic, as actual reinvestment rates may vary significantly, leading to discrepancies in expected returns.

-

Sensitivity to Cash Flow Timing: The IRR calculation is highly sensitive to the timing of cash flows. Even minor adjustments in the timing of cash inflows or outflows can result in substantial variations in the calculated IRR. This sensitivity can mislead investors, particularly in projects with irregular cash flow patterns.

-

Ignores External Factors: Another critical limitation of IRR is its failure to account for external factors that can influence the performance of the asset. Market conditions, economic fluctuations, and tax implications are all factors that can significantly influence the overall success of a financial endeavor. Relying solely on IRR may lead investors to overlook these crucial elements.

-

Business Plan and Interest Rate Risks: Furthermore, IRR does not sufficiently consider business plan risk and interest rate risk, which can further complicate the evaluation of opportunities.

For property investors, comprehending these constraints is essential to understanding the internal rate of return in real estate. For instance, a case study involving a multifamily property venture may illustrate how an attractive IRR can mask underlying risks associated with market downturns or changes in local economic conditions. Moreover, Michael Belasco, founder of Firm Ridge Properties, highlights that the internal rate of return in real estate is an extremely valuable and useful metric to help assess profitability. However, it is not effective at directly conveying risk, cash flow profile, and absolute profitability; it should be utilized alongside the other metrics mentioned here, as well as others, to evaluate property opportunities.

As the property landscape changes in 2025, the difficulties related to using IRR for financial decisions continue to be relevant. Investors must navigate these complexities to make informed choices that align with their financial goals. Staying updated on various metrics, including IRR, is essential, as emphasized by the Zero Flux newsletter, which aggregates 5-12 selected property insights daily, offering valuable information for industry experts.

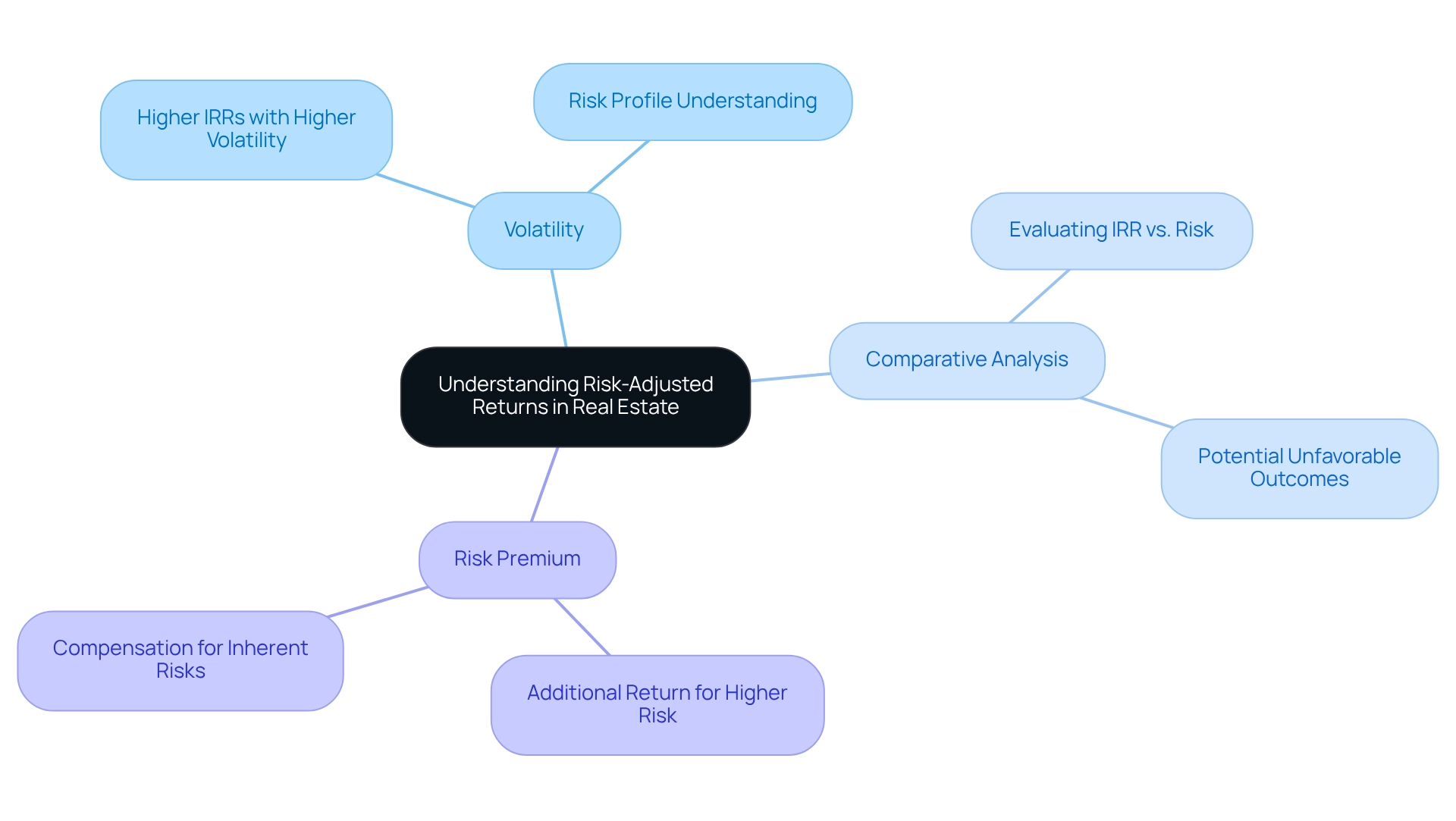

Risk-Adjusted Returns: Enhancing Your Understanding of IRR

Risk-adjusted returns are essential for evaluating the internal rate of return on real estate ventures, as they assess the return relative to the risk undertaken. Investors should concentrate on several key aspects:

-

Volatility: Investments characterized by higher volatility may yield elevated IRRs; however, they also entail greater risk. A comprehensive understanding of a financial asset's risk profile is crucial for making informed decisions that align with one's financial objectives.

-

Comparative Analysis: When evaluating various financial opportunities, it is vital to consider both the IRR and the associated risks. A seemingly attractive higher IRR may not be beneficial if it is accompanied by disproportionately higher risk levels, potentially leading to unfavorable outcomes.

-

Risk Premium: Investors typically seek a risk premium, representing the additional return anticipated for assuming higher risk. This concept is critical for determining whether an asset's IRR adequately compensates for its inherent risks.

In the sphere of property, understanding these factors can significantly enhance financial strategies. For instance, since its inception in 1978, private commercial real estate (CRE) has demonstrated notable resilience, remaining largely uncorrelated with major asset categories like stocks and bonds. This characteristic underscores the importance of incorporating property into a diversified portfolio, as evidenced by case studies that affirm property as a vital component alongside traditional assets such as stocks and bonds.

Moreover, expert insights emphasize that while past performance does not guarantee future results, the combination of current income from rental payments and appreciation in asset value has historically driven the performance of property investments. As noted by The Accordant Team, "While past performance is no guarantee of future returns, the combination of current income from rent payments plus appreciation in the residual value of the assets has been the primary driver behind the asset class's track record of performance." By evaluating the internal rate of return in real estate with a focus on risk factors, investors can navigate the complexities of the property market more effectively and make decisions that align with their financial goals.

Furthermore, Zero Flux's commitment to data integrity and its acquisition from a diverse range of reliable sources enhance the credibility of these insights, establishing it as an indispensable resource for property investors.

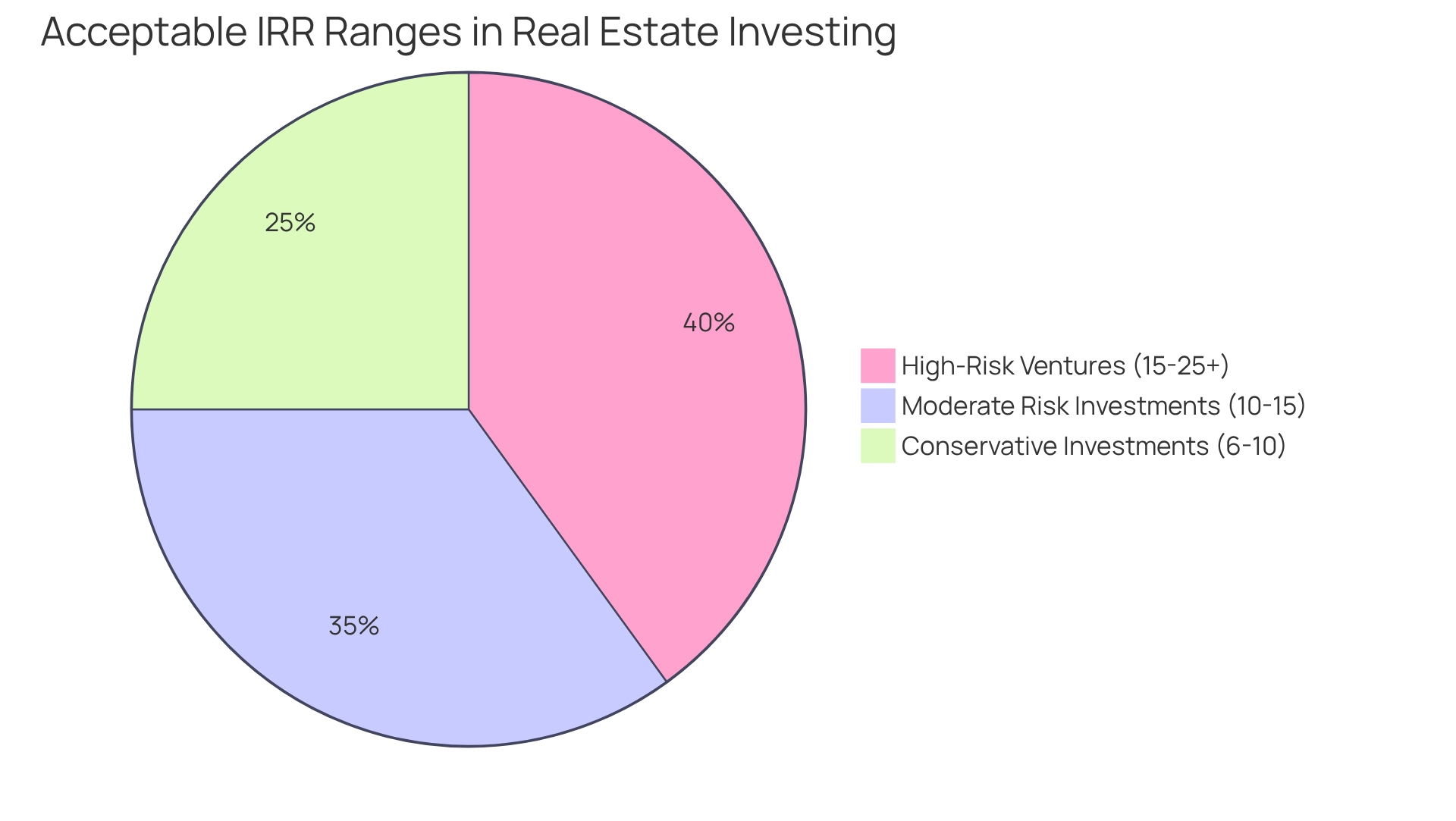

What is a Good IRR in Real Estate Investing?

Establishing what defines a 'good' internal rate of return (IRR) for real estate investments is influenced by multiple factors, including market conditions and the specific type of asset. Generally, acceptable IRR benchmarks can be categorized as follows:

-

Conservative Investments: For low-risk investments, an IRR ranging from 6% to 10% is typically deemed acceptable. These assets often encompass stable, income-generating properties that deliver consistent cash flow with minimal fluctuation. For instance, the Class D monthly return for December 2017 was 8.44%, illustrating a concrete example of acceptable returns in this category.

-

Moderate Risk Investments: Investments that carry a moderate level of risk, such as stabilized properties, usually yield an IRR between 10% and 15%. This range indicates the potential for growth while still preserving a degree of safety in the financial commitment.

-

High-Risk Ventures: Opportunistic endeavors, which may involve development projects or properties in need of significant rehabilitation, often target an IRR of 15% to 25% or even higher. These financial commitments are characterized by their potential for substantial returns, albeit with heightened risk.

Ultimately, the definition of a good IRR is subjective, varying based on the investor's risk tolerance and overall portfolio strategy. The internal rate of return in real estate serves as a crucial metric that estimates the potential growth rate of a property over its holding period, considering projected cash flows. Investors frequently utilize the IRR metric to compare different properties and assess long-term yield, although it assumes a stable rental environment and similar property characteristics.

As noted by Zero Flux, "It’s a complicated formula, so most investors use the IRR function in Excel to calculate the ratio."

In 2025, acceptable IRR ranges continue to reflect these trends, with cautious financial commitments maintaining their lower thresholds while high-risk opportunities remain appealing for those willing to navigate the associated uncertainties. Comprehending these standards is essential for investors seeking to make informed decisions in the evolving property market. The case study on the internal rate of return in real estate further emphasizes its importance, illustrating how the IRR estimates the potential growth rate of an investment property and providing clarity on its application in real estate investing.

Conclusion

The Internal Rate of Return (IRR) stands as an essential tool for real estate investors, offering a robust framework for assessing the profitability of diverse investment opportunities. By factoring in the time value of money, IRR facilitates a nuanced comparison of potential returns across various projects, rendering it indispensable in investment decision-making. Mastering the calculation and application of IRR empowers investors to align their strategies with financial objectives while effectively evaluating risks.

Nevertheless, it is vital to recognize the limitations inherent in IRR. Its dependence on assumptions regarding cash flow reinvestment and its sensitivity to timing can result in misleading conclusions if considered in isolation. Therefore, investors are advised to analyze IRR in conjunction with other metrics such as:

- Net Present Value (NPV)

- Return on Investment (ROI)

- Cash-on-Cash Return

to cultivate a comprehensive perspective of their investment landscape.

Ultimately, a well-rounded grasp of IRR, encompassing its calculation methods and practical applications, equips investors to adeptly navigate the complexities of the real estate market. By leveraging this metric alongside a thorough examination of market conditions and risk profiles, investors can make informed decisions that not only optimize returns but also enhance their overall investment strategy. As the real estate landscape continues to evolve, mastering IRR will remain pivotal for those striving to achieve sustainable growth and profitability within their portfolios.