Overview

Real estate business analytics systematically analyzes property market data to enhance decision-making processes, focusing on crucial metrics such as property values and market trends.

With the rapid advancements in technology, particularly big data and predictive modeling, real estate professionals are better equipped to navigate complexities.

These tools optimize investment strategies and enable effective responses to evolving market demands.

As the landscape shifts, leveraging these insights becomes imperative for informed investment decisions.

Introduction

In the dynamic realm of real estate, where every decision can significantly impact financial outcomes, the integration of business analytics has emerged as a game-changer. By systematically analyzing vast amounts of data, real estate professionals can uncover vital insights that inform their strategies and enhance decision-making processes.

This article delves into the evolution of real estate analytics, exploring its key components and highlighting its critical role in shaping investment strategies. As technology continues to advance, the ability to harness data effectively becomes paramount. Stakeholders can navigate market complexities and seize emerging opportunities with confidence.

Define Real Estate Business Analytics

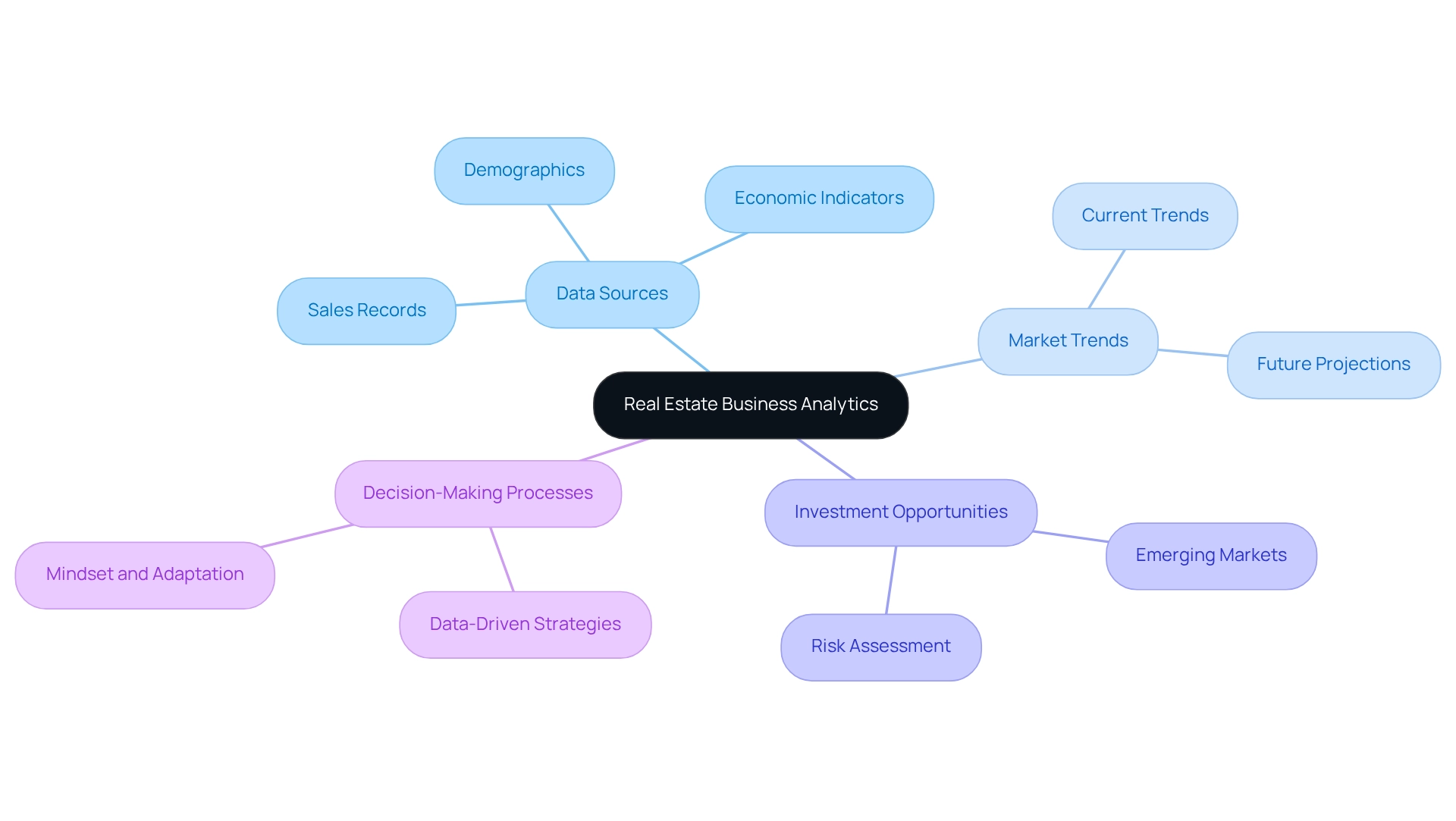

The analysis of the property market encompasses a systematic review of information pertinent to the sector, utilizing various metrics to enhance decision-making processes. This examination involves evaluating property values, identifying market trends, and revealing investment opportunities through quantitative methodologies. By leveraging data from diverse sources—such as sales records, demographic statistics, and economic indicators—real property professionals can extract actionable insights that inform their strategies and operations.

The rise of big data and advanced analytics tools has revolutionized market analysis, making data analytics an indispensable element of contemporary property practices. As we approach 2025, the integration of these tools is increasingly critical, empowering stakeholders to navigate complexities and optimize their decision-making processes effectively.

With over 30,000 subscribers, Zero Flux underscores the growing demand for data-driven insights within the property sector. As property developer Akira Mori articulates, "In my experience, in the property business, previous success stories are typically not relevant to new circumstances." He emphasizes the necessity for continual reinvention, stating, "We must continually reinvent ourselves, responding to changing times with innovative new business models." This perspective underscores the imperative for property experts to adapt their methodologies in light of evolving data analysis techniques.

Furthermore, a well-defined strategy and the right mindset are crucial for evaluating risks and achieving financial objectives in property investment, as illustrated in the case study titled 'Conclusion on Property Investment.' By concentrating on strategy and mindset, investors can maximize their potential risk-adjusted returns and adeptly navigate market complexities.

Current developments in property industry business insights for 2025 indicate a shift towards more cohesive and user-friendly insight platforms, enabling experts to utilize information more effectively.

Explore the Evolution of Real Estate Analytics

The evolution of property analysis stems from fundamental valuation techniques, where critical metrics such as location and size were paramount. However, with the advent of technology—particularly the internet and advanced information-gathering tools—the landscape of analysis has undergone significant transformation.

The 1990s marked a pivotal era with the introduction of Multiple Listing Services (MLS), revolutionizing information sharing and accessibility within the property sector. Today, the incorporation of artificial intelligence (AI) and machine learning (ML) has propelled data examination to new heights, facilitating predictive modeling and real-time data analysis.

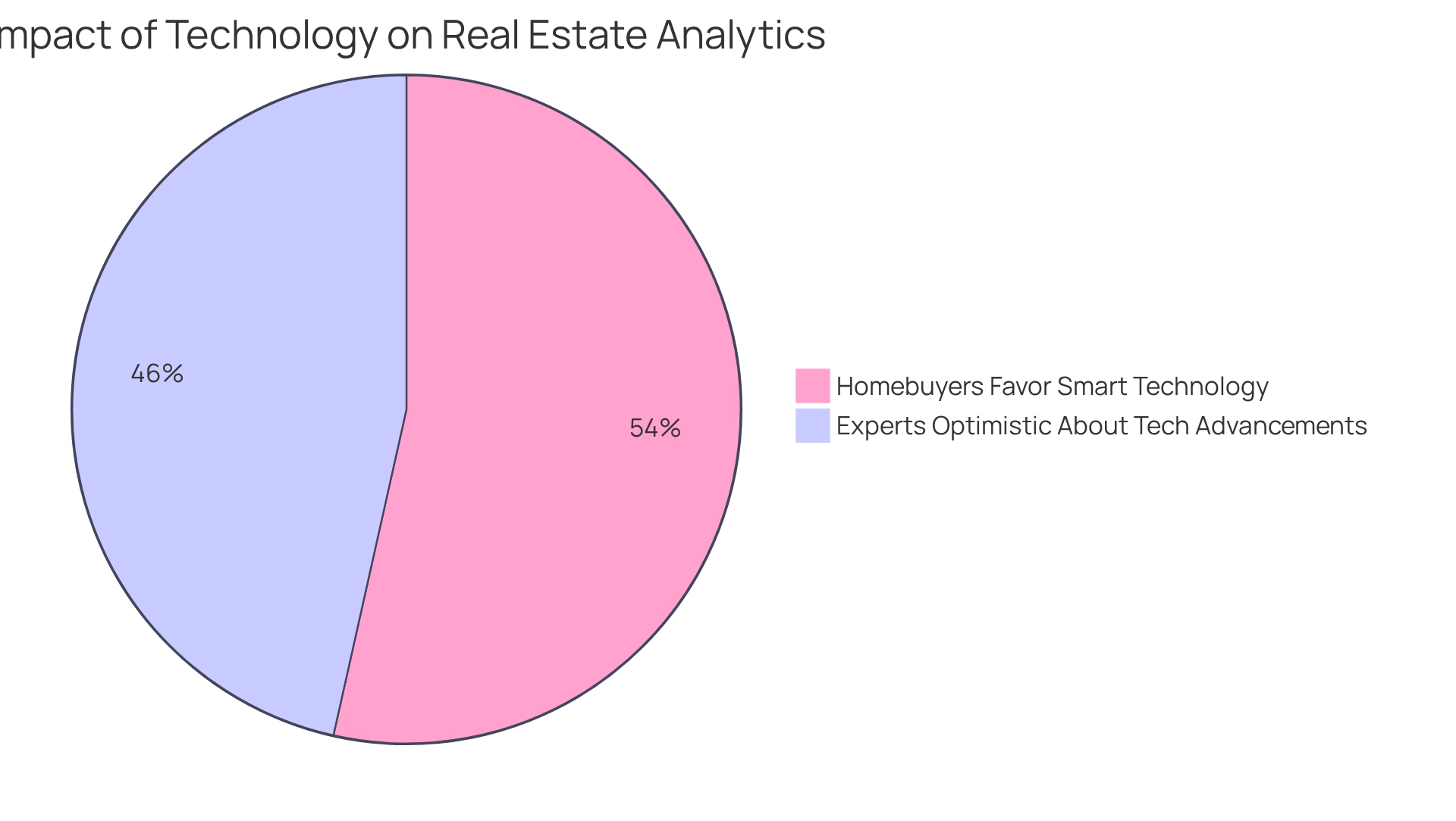

This technological progress in real estate business analytics empowers property professionals to make informed decisions, anticipate market shifts, and refine investment strategies. Notably, 71.25% of industry experts assert that these advancements in real estate business analytics will usher in positive changes and growth within the sector.

Additionally, comprehending consumer behavior has become increasingly vital. A case study reveals that 82% of homebuyers favor properties equipped with smart technology features. This insight underscores the importance of aligning services with market demands, illustrating how real estate business analytics can shape strategic choices in a fiercely competitive environment.

As the total worth of the U.S. property market exceeds $3.9 trillion, the role of real estate business analytics becomes even more critical. Furthermore, the S&P CoreLogic Case–Shiller Home Price Indices serve as a crucial resource for tracking repeat-sales house prices, further emphasizing the importance of information in market analysis.

Identify Key Components of Real Estate Business Analytics

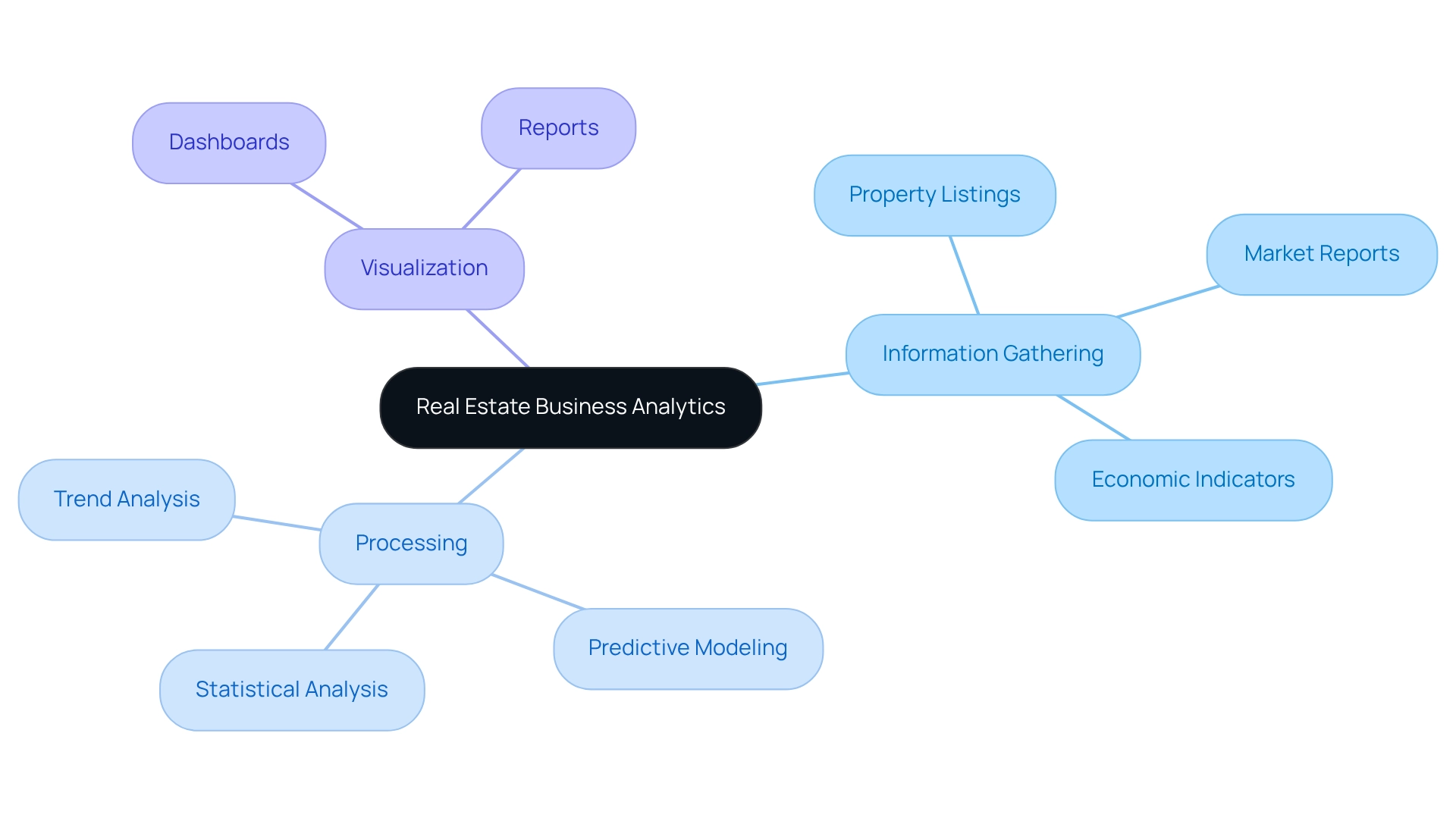

Essential elements of real estate business analytics encompass information gathering, processing, and visualization. Data collection is a systematic endeavor, drawing from diverse sources such as property listings, market reports, and economic indicators. This foundational step is vital for constructing a comprehensive dataset that mirrors current market dynamics. Notably, the Standard & Poor's CoreLogic Case–Shiller Home Price Indices provide invaluable historical data, calculated from January 1987 to the present, serving as a guide for effective information gathering techniques in real estate analytics.

Following data collection, information processing employs various analytical methods, including:

- Statistical analysis

- Predictive modeling

- Trend analysis

to extract meaningful insights from the gathered information. This stage transforms raw data into actionable intelligence, empowering professionals to identify patterns and forecast future trends. As Marian Wright Edelman wisely stated, "Don’t feel entitled to anything you didn’t sweat and struggle for," underscoring the importance of diligence and strategy in achieving success within the property sector.

Furthermore, information visualization is crucial in rendering complex details accessible and comprehensible. Effective visualization techniques, often manifested through dashboards or comprehensive reports, illuminate key insights and trends, thereby facilitating informed decision-making. Collectively, these elements empower property professionals to leverage real estate business analytics to analyze market conditions, evaluate investment opportunities, and make data-informed choices that enhance their competitive edge in an increasingly data-driven industry. Additionally, Zero Flux's commitment to data integrity, exemplified in the case study titled 'Commitment to Data Integrity,' underscores the significance of reliable information in property analysis. This dedication to high-quality content not only fosters subscriber engagement but also positions Zero Flux as a leading authority in property information distribution.

Examine Applications in Investment Strategies

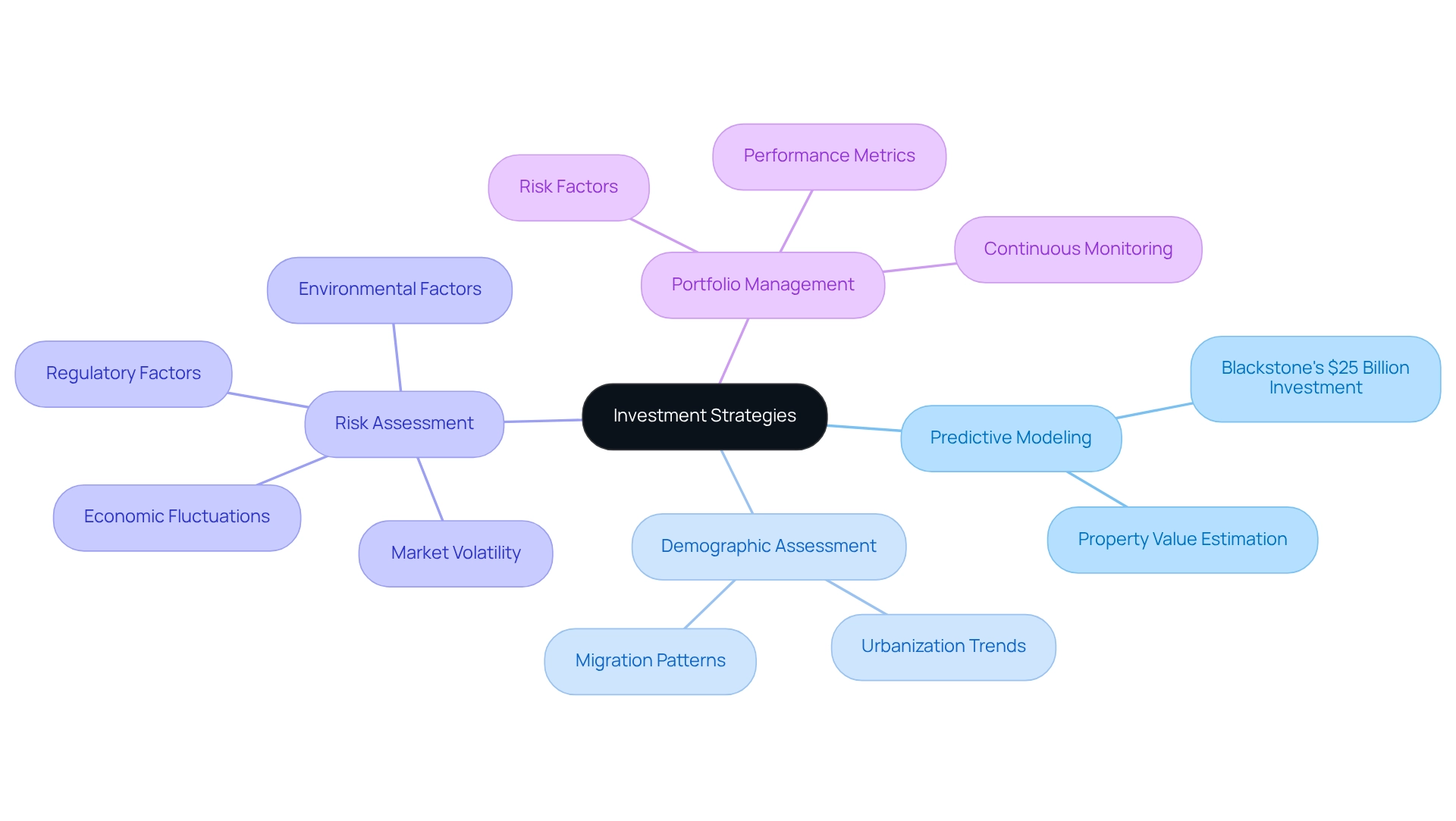

Real estate business analytics is crucial for forming investment strategies, offering insights that facilitate informed decision-making. For example, predictive modeling estimates property values by analyzing historical data and current market trends, enabling investors to pinpoint high-potential properties. A notable instance is Blackstone's strategic investment of $25 billion in logistics properties, where predictive data analysis was instrumental in identifying emerging e-commerce corridors. By scrutinizing consumer behavior data alongside transportation networks, Blackstone made data-informed decisions, achieving annual returns exceeding 20%. This underscores the effectiveness of predictive analysis in shaping investment strategies.

Furthermore, demographic assessment enhances investment strategies by revealing shifts in population and economic conditions, such as the increasing urbanization and migration trends toward metropolitan areas. These trends direct investors to emerging markets poised for growth. Companies like Zillow and Redfin employ advanced data analysis to refine their property valuation models, empowering investors to make educated decisions. Additionally, real estate business analytics is vital for optimizing portfolio management by assessing performance metrics and risk factors, ensuring that investment strategies align with market realities. As Nikhil Sable, a Data Analyst, emphasizes, risk assessment encompasses market volatility, economic fluctuations, regulations, and environmental factors—each critical to predictive analytics.

As the property landscape evolves, investors must continuously monitor and refine their predictive models. Statistics reveal that buyers often make decisions within the first eight seconds of viewing a property, highlighting the necessity of timely and accurate data in shaping investment choices. Moreover, decision support tools evaluate various scenarios and propose strategies aligned with investment goals, further enhancing the efficacy of data analysis in real estate. By integrating robust real estate business analytics into their strategies, investors can adeptly navigate the complexities of the market and seize emerging opportunities.

Conclusion

The integration of business analytics into real estate has fundamentally transformed the landscape, enabling professionals to make data-driven decisions that significantly enhance their investment strategies. By systematically analyzing market data, stakeholders can identify trends, assess property values, and uncover new opportunities, establishing analytics as an indispensable tool in today's dynamic market. The evolution of real estate analytics—from basic valuation methods to advanced AI-driven predictive modeling—demonstrates the profound impact of technology on decision-making processes.

Key components such as data collection, processing, and visualization empower real estate professionals to derive actionable insights and navigate market complexities effectively. The importance of these elements is underscored by the increasing reliance on data integrity, ensuring that the information guiding decisions is both accurate and reliable. Real-world applications, such as Blackstone's strategic investments, illustrate how predictive analytics can lead to significant financial success, highlighting the necessity for investors to continuously adapt and refine their strategies.

As the real estate market continues to evolve, embracing business analytics is not merely beneficial—it is essential for achieving a competitive advantage. By leveraging data effectively, real estate professionals can not only respond to current market demands but also anticipate future trends, ensuring sustainable growth and success in an increasingly intricate industry. The future of real estate lies in the hands of those who can harness the power of analytics to drive informed decisions and seize emerging opportunities.