Overview

The article emphasizes the critical understanding of real estate investment returns by detailing essential metrics that investors must consider when evaluating property performance. Key metrics such as Return on Equity (ROE), Internal Rate of Return (IRR), and Cash-on-Cash Return are highlighted as vital tools for making informed investment decisions. These metrics provide a comprehensive view of the potential financial gains and risks associated with real estate assets, underscoring their importance in strategic investment planning.

Introduction

In the dynamic landscape of real estate investing, understanding the intricacies of investment returns is paramount for success. As property values fluctuate and market trends evolve, investors must navigate a myriad of metrics to assess the viability of their investments.

From the foundational Return on Investment (ROI) to more nuanced indicators like Internal Rate of Return (IRR) and Cash-on-Cash Return, each metric offers unique insights that can significantly influence decision-making.

With projections indicating an average ROI of around 8% in 2025, the stakes are high, and the potential for profitability is enticing.

This article delves into the critical metrics that define real estate investment returns, the challenges investors face in calculating these returns accurately, and real-world examples that illustrate the importance of a comprehensive understanding of investment performance.

As the market continues to evolve, the ability to analyze and interpret these metrics will empower investors to make informed, strategic choices that align with their financial goals.

Define Real Estate Investment Returns

Real estate property profits signify the earnings generated from a property, expressed as a percentage of the initial investment. This metric is crucial for investors assessing the performance of their property assets. The most prevalent method for calculating yields is the Return on Equity (ROE) formula, which evaluates net profit relative to total expenditure.

In 2025, [the average real estate investment returns](https://blog.zeroflux.io/understanding-average-real-estate-appreciation-a-comprehensive-tutorial-for-investors) on assets in property are anticipated to be approximately 8%, reflecting a consistent market recovery and rising demand for properties. Understanding these real estate investment returns is vital for making informed decisions about property acquisitions and assessing the viability of funding opportunities. Notably, 90% of millionaires attribute their wealth to property ventures, underscoring the significance of these metrics.

Recent trends reveal that crowdfunding has significantly democratized property financing, with platforms raising nearly $20 billion in 2023, enabling individuals to invest with amounts as low as $100. This transformation not only lowers barriers to entry but also enhances the potential for diverse funding strategies.

Case studies illustrate the importance of ROI calculations in real estate. For example, an individual who purchased a rental property for $300,000 and generated $30,000 in annual net income would calculate their ROI as 10%. This instance highlights the necessity of understanding financial gains, particularly the impact of real estate investment returns as the market evolves. Staying informed about these metrics will empower investors to navigate opportunities effectively.

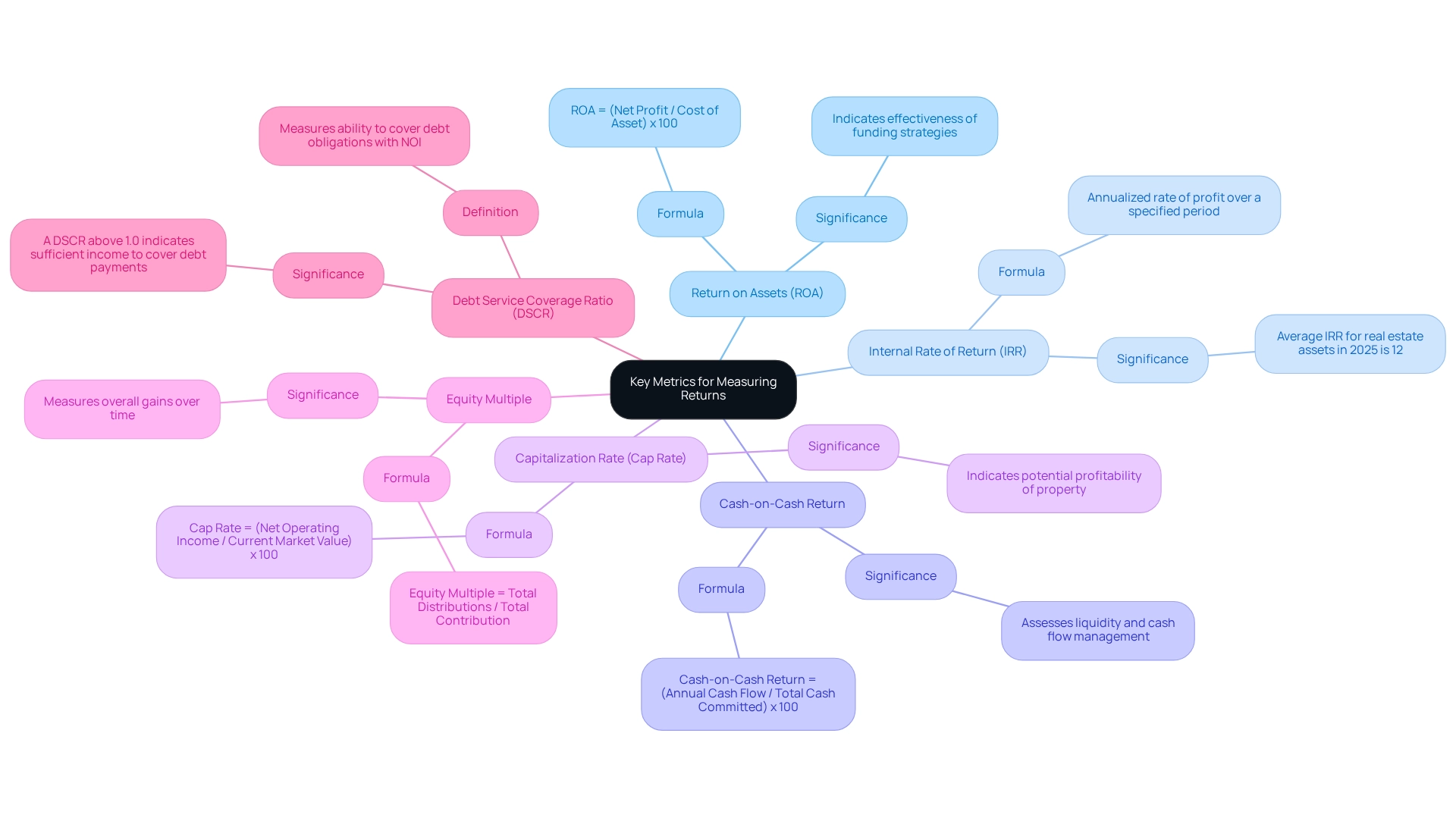

Explore Key Metrics for Measuring Returns

Multiple important metrics are crucial for assessing property asset gains, each providing unique perspectives on financial performance.

- Return on Assets (ROA): This fundamental metric computes the profit generated from an asset in relation to its expense, represented as ROA = (Net Profit / Cost of Asset) x 100. In 2025, understanding ROA is essential as it indicates the effectiveness of funding strategies in a competitive market.

- Internal Rate of Return (IRR): Representing the annualized rate of profit over a specified period, IRR accounts for all cash flows, making it particularly useful for comparing the profitability of various funding opportunities. Investors should note that the average IRR for real estate assets in 2025 is anticipated to be approximately 12%, suggesting strong market performance.

- Cash-on-Cash Return: This metric assesses the yearly pre-tax cash flow in relation to the overall cash committed, computed as Cash-on-Cash Return = (Annual Cash Flow / Total Cash Committed) x 100. It offers a clear view of the cash earnings produced by the asset, which is essential for evaluating liquidity and cash flow management.

- Capitalization Rate (Cap Rate): Indicating the anticipated rate of profit based on income generated, Cap Rate is calculated as Cap Rate = (Net Operating Income / Current Market Value) x 100. A greater cap rate indicates a possibly more lucrative opportunity, making it a crucial metric for individuals assessing property purchases.

- Equity Multiple: This metric measures the total cash returned to a stakeholder relative to the total cash contributed, expressed as Equity Multiple = Total Distributions / Total Contribution. It offers a clear method to assess overall gains over time, assisting investors in measuring the efficiency of their financial strategies.

Comprehending these metrics allows investors to examine their real estate holdings thoroughly, promoting informed choices and strategic planning to enhance real estate investment returns. As the market evolves, staying updated on these key performance indicators is essential for maximizing returns. Notably, 20% of house flippers expect their profits to wane in the future, reflecting current market sentiment. Furthermore, the average gross flipping profit has reached $66,300, emphasizing the potential for profitable outcomes in the flipping market.

Investors should also consider the Debt Service Coverage Ratio (DSCR), which measures an organization's ability to cover its debt obligations with its net operating income. A DSCR above 1.0 indicates sufficient income to cover debt payments, crucial for assessing financial health. Finally, monitoring revenue increase annually can offer insights into market demand and operational efficiency, further guiding financial strategies.

The Importance of Understanding Investment Returns

Understanding the gains from capital allocation is essential for real estate stakeholders to improve their real estate investment returns for several compelling reasons. First and foremost, it allows for a thorough evaluation of property performance, enabling stakeholders to make informed decisions regarding future opportunities. By analyzing profits, investors can identify high-performing properties and evaluate their real estate investment returns to recognize those that may warrant reevaluation or divestment. This analytical approach is particularly critical in 2025 as market dynamics continue to shift.

Moreover, a solid understanding of financial gains helps establish realistic expectations for future outcomes, aligning strategies with the goal of achieving strong real estate investment returns. For instance, in markets like San Francisco, where the average rent for a one-bedroom apartment hovers around $3,500 per month, grasping potential gains becomes vital for navigating expensive environments. Investors must consider how these rental prices impact cash flow and overall profitability, as they relate to real estate investment returns when making purchasing decisions.

Additionally, comprehending these metrics is crucial for effective management of real estate investment returns. Investors are better positioned to evaluate the risks tied to various opportunities and make necessary adjustments to their portfolios. Case studies focusing on acquiring undersupplied housing products underscore this point. By concentrating on multifamily, single-family rental, and student housing in underserved markets, investors can address housing shortages while generating attractive returns. This strategy not only highlights the importance of understanding market demand but also emphasizes how it can lead to improved financial results.

Industry experts stress the importance of understanding financial gains. Successful investors often assert that informed decision-making hinges on a clear comprehension of real estate investment returns. As Dave Ramsey aptly states, "Financial peace isn't the acquisition of stuff. It's learning to live on less than you make, so you can give money back and have money to invest." This knowledge not only refines financial strategies but also fosters confidence in navigating the complexities of the property market. Ultimately, a robust understanding of financial gains is crucial for achieving long-term success in real estate investment returns.

Common Challenges in Calculating Investment Returns

Calculating real estate investment returns presents several challenges that significantly impact an investor's decision-making process. A primary concern is the accurate assessment of all associated costs, including acquisition expenses, ongoing maintenance, and potential vacancy losses. Ignoring these factors can lead to an inflated perception of gains, ultimately distorting evaluations of financial opportunities.

Market fluctuations further complicate profit calculations, as they can directly influence property values and rental income. Investors must remain vigilant; relying solely on a single metric, such as real estate investment returns, can be misleading. It is crucial to consider additional indicators like Internal Rate of Return (IRR) and cash-on-cash return to gain a comprehensive understanding of an asset's performance.

Statistics indicate that a significant portion of individuals in the market make errors in calculating ROI, with nearly 40% of real estate participants failing to account for all relevant expenses. This oversight can result in misguided financial strategies, contrasting sharply with successful individuals like Warren Buffett, who transformed an initial $100 into $30 billion by mastering capital allocation. By adopting a multifaceted approach that incorporates various metrics, investors can achieve a more precise and reliable understanding of their real estate investment returns, ultimately enhancing their decision-making capabilities.

As Barbara Corcoran wisely states, "Know your non-negotiables. What features are must-haves in your dream home?" This principle extends to funding criteria, highlighting the importance of understanding essential factors when evaluating costs and returns.

Moreover, just as tracking the performance of social media posts is crucial for understanding audience engagement, monitoring and analyzing financial metrics is vital for evaluating performance in real estate. By integrating these insights, individuals can refine their strategies and enhance their overall effectiveness in the market.

Real-World Examples of Investment Returns

To illustrate the application of investment return metrics, consider two hypothetical properties:

- Property A: Purchased for $300,000, generating an annual rental income of $30,000 with operating expenses of $10,000. This results in a net operating income (NOI) of $20,000. The ROI is calculated as follows: ROI = (Net Profit / Cost of Investment) x 100 = ($20,000 / $300,000) x 100 = 6.67%.

- Property B: Acquired for $500,000, with an annual rental income of $50,000 and operating expenses of $15,000, leading to an NOI of $35,000. The ROI for this property is: ROI = ($35,000 / $500,000) x 100 = 7%.

While Property B shows a higher ROI, it is essential for stakeholders to consider other metrics such as Internal Rate of Return (IRR) and cash-on-cash yield when evaluating real estate investment returns. This comprehensive analysis enables investors to make informed decisions that align with their financial objectives and risk tolerance, particularly concerning real estate investment returns. For example, a recent study emphasized that direct property allocations may produce lower long-term returns than previously indicated, highlighting the necessity for thorough assessment. Significantly, income falls to zero in approximately 0.5% of all observations, underscoring the risks linked with property ventures.

In Q1 2024, 11.2% of flipped residences were purchased by buyers utilizing FHA loans, suggesting a change in buyer demographics that could affect future funding approaches. As property developer Akira Mori states, "In my experience, in the property business, previous success stories are typically not relevant to new circumstances. We must continually reinvent ourselves, responding to changing times with innovative new business models." This perspective highlights the necessity of adapting to market changes.

Furthermore, the case study titled "House Flipping Activity in Metropolitan Areas" reveals that flipping rates increased in 134 of the 173 metropolitan areas analyzed from Q4 2023 to Q1 2024, indicating pockets of growth amidst overall declining trends. By analyzing these factors, investors can better navigate the complexities of the real estate market and enhance their real estate investment returns.

Conclusion

Real estate investment returns are a critical component for any investor aiming to succeed in the ever-evolving property market. By understanding various metrics—such as Return on Investment (ROI), Internal Rate of Return (IRR), Cash-on-Cash Return, and Capitalization Rate—investors can assess their investments more comprehensively. Each metric provides unique insights that inform strategic decisions, particularly in a landscape where an average ROI of 8% is anticipated in 2025.

Furthermore, the challenges in accurately calculating these returns cannot be overlooked. Factors such as fluctuating market conditions and the failure to account for all investment costs can distort perceptions of profitability. As highlighted, many investors struggle with these calculations, underscoring the importance of a multifaceted approach that incorporates various performance indicators. This holistic perspective not only mitigates risks but also empowers investors to make informed decisions that align with their financial goals.

Real-world examples reinforce the necessity of these metrics, demonstrating how different properties can yield varied returns based on their operational performance. The ability to adapt to changing market dynamics, as illustrated in the case studies, is essential for long-term success in real estate investing. By continually refining strategies and staying informed about market trends, investors can enhance their decision-making processes and ultimately achieve greater financial security.

In conclusion, a robust understanding of investment returns is not merely advantageous; it is essential for navigating the complexities of real estate investment. As the market continues to shift, leveraging these insights will enable investors to seize opportunities and build wealth through informed, strategic actions.