Overview

Real estate investors face several key challenges that can significantly impact profitability and investment strategies.

- High financing expenses

- Regulatory changes

- Market volatility

- Supply chain disruptions

- Environmental concerns

For instance, rising interest rates complicate financial planning, while new zoning laws add layers of complexity to investment decisions. Additionally, demographic shifts such as aging populations and urbanization trends present both risks and opportunities within the real estate market. Understanding these dynamics is crucial for investors aiming to navigate the complexities of today’s environment.

Introduction

Navigating the real estate landscape in 2025 presents a myriad of challenges that investors must confront to safeguard their profitability and strategic positioning.

- From soaring financing costs

- Regulatory shifts

- Market volatility

The obstacles are as complex as they are critical. This article delves into the key issues facing real estate investors today, offering insights into how to effectively manage these hurdles.

As the market evolves, can investors adapt their strategies to not only survive but thrive amidst these pressing challenges?

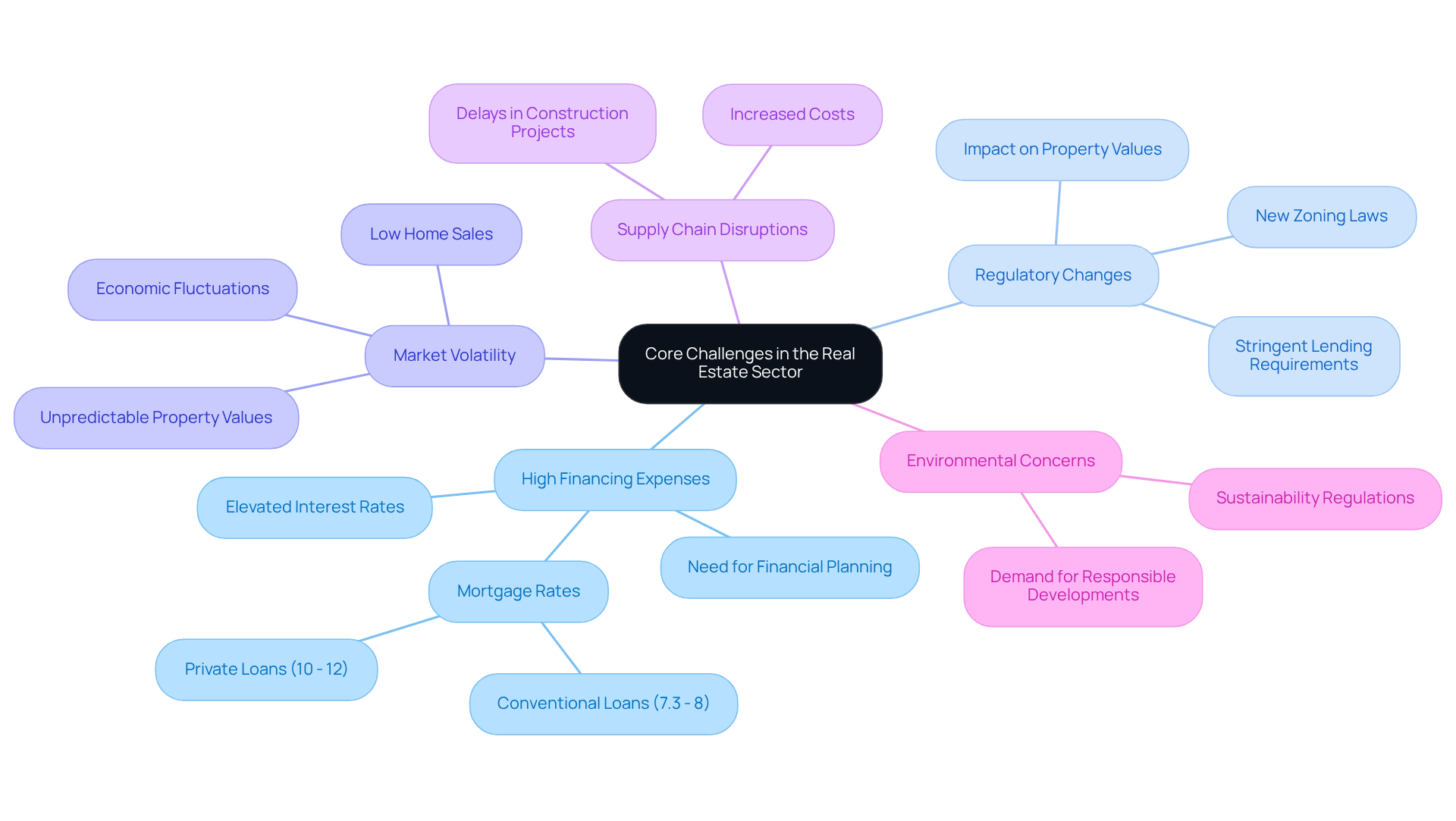

Identify Core Challenges in the Real Estate Sector

Investors in 2025 are confronting several core challenges that significantly impact their strategies and profitability.

-

High Financing Expenses: Elevated interest rates, projected to decrease slightly to 6.7% by year-end, have escalated borrowing costs, tightening profit margins for numerous investors. This trend is particularly concerning as mortgage rates for real estate range from 7.3% to 8% for conventional loans, with private loans soaring to 10-12%. Such high financing expenses necessitate meticulous financial planning and may deter potential capital placements.

-

Regulatory changes, such as new zoning laws and stringent lending requirements, are emerging as substantial hurdles that contribute to real estate problems in acquisition and development. Lenders may impose elevated rates in areas facing real estate problems, such as declining property values or unstable economic conditions, complicating the financial landscape. It is essential for investors to remain informed about local and federal policy shifts that could impact their projects.

-

Market Volatility: Economic fluctuations continue to generate unpredictable property values, complicating the assessment of viability for financial commitments. Current home sales remain remarkably low, despite a slight month-over-month increase, indicating that investors must navigate a landscape where market conditions can change swiftly, influencing their financial decisions.

-

Supply Chain Disruptions: Ongoing global supply chain issues are causing delays in construction projects and driving up costs. Investors need to factor these disruptions into their timelines and budgets, as they can significantly affect project feasibility and profitability.

-

Environmental Concerns: Increasing regulations related to sustainability and environmental impact are becoming more prevalent. As the demand for environmentally responsible developments grows, investors must navigate these complexities, as compliance can influence project feasibility and overall investment returns. Understanding these regulations is crucial for long-term success in the market.

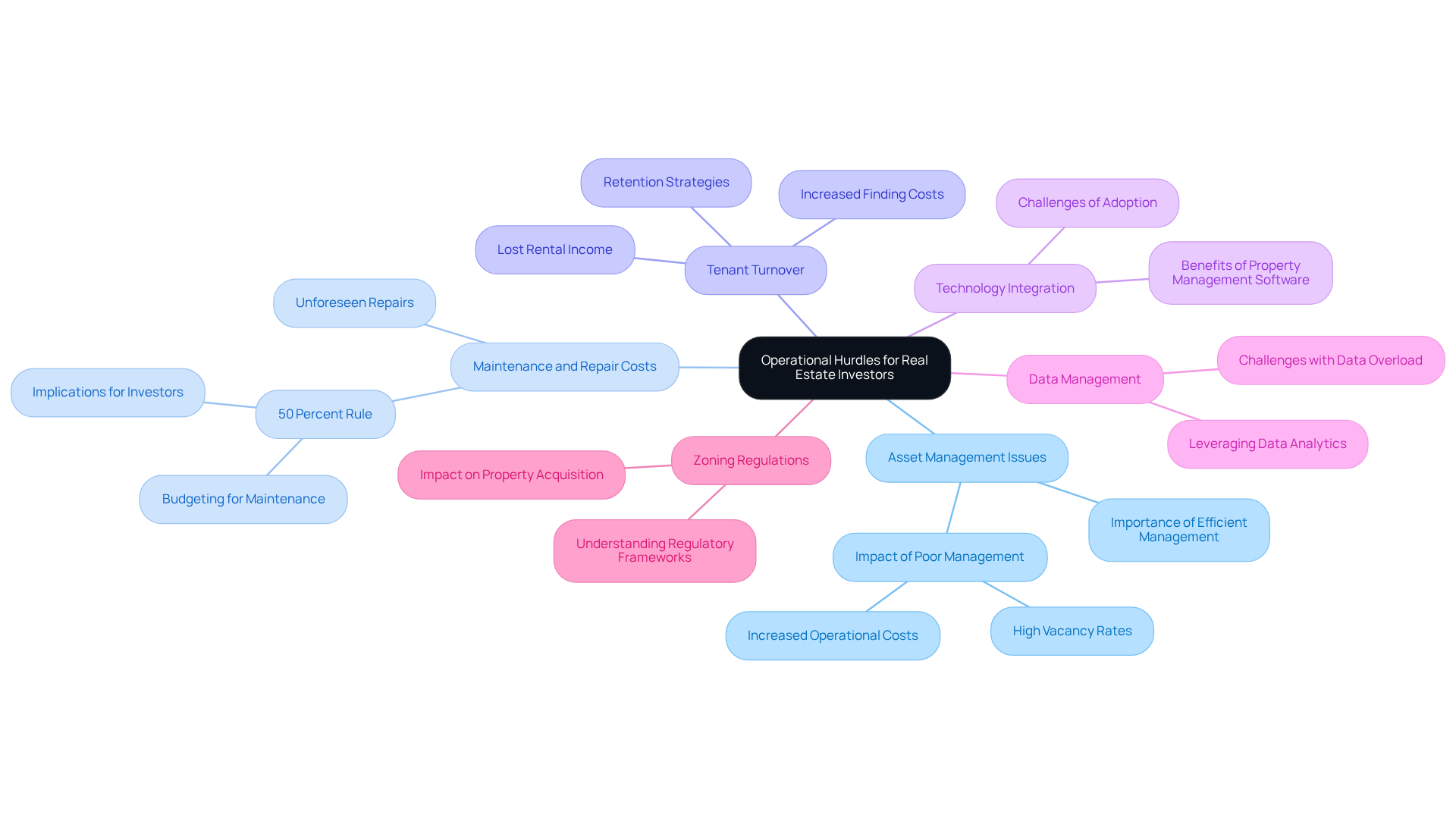

Examine Operational Hurdles for Real Estate Investors

-

Asset Management Issues: The efficient administration of assets is crucial for preserving value and ensuring tenant satisfaction. Poor management can lead to high vacancy rates and increased operational costs, which can significantly impact profitability. Understanding the nuances of asset management is essential for investors aiming to maintain a competitive edge in the market.

-

Maintenance and Repair Costs: Unforeseen repairs can strain budgets, particularly in older buildings. Investors must proactively plan for ongoing maintenance to avoid larger expenses down the line. The 50 Percent Rule suggests that for a property generating $1,500 in monthly rent, approximately $750 should be allocated for expenses, which can be saved for maintenance emergencies if not utilized. This guideline anticipates elevated expenses as it encompasses taxes and management charges, making it imperative for investors to comprehend its implications on budgeting.

-

Tenant Turnover: Elevated turnover rates can result in lost rental income and increased expenses associated with finding new tenants. Properties with high turnover can also incur higher average maintenance costs. Therefore, implementing effective tenant retention strategies is crucial for maintaining steady cash flow and minimizing disruptions.

-

Technology Integration: Embracing new technologies for asset management and marketing can be challenging yet is essential for remaining competitive in the industry. Many investors face difficulties during this transition; however, utilizing property management software can streamline operations and enhance efficiency, ultimately improving overall performance.

-

Data Management: Investors frequently grapple with managing vast amounts of data related to market trends, tenant information, and financial performance, which can hinder decision-making. By leveraging data analytics tools, investors can gain valuable insights that inform their strategies and enhance their financial outcomes.

-

Zoning Regulations: As we look towards 2025, the impact of zoning regulations on property acquisition remains significant. Restrictive rules can limit available properties and affect financial potential. Understanding these regulations is crucial for navigating the complexities of real estate. Overall, addressing these operational challenges is vital for overcoming real estate problems and achieving success in the competitive real estate landscape.

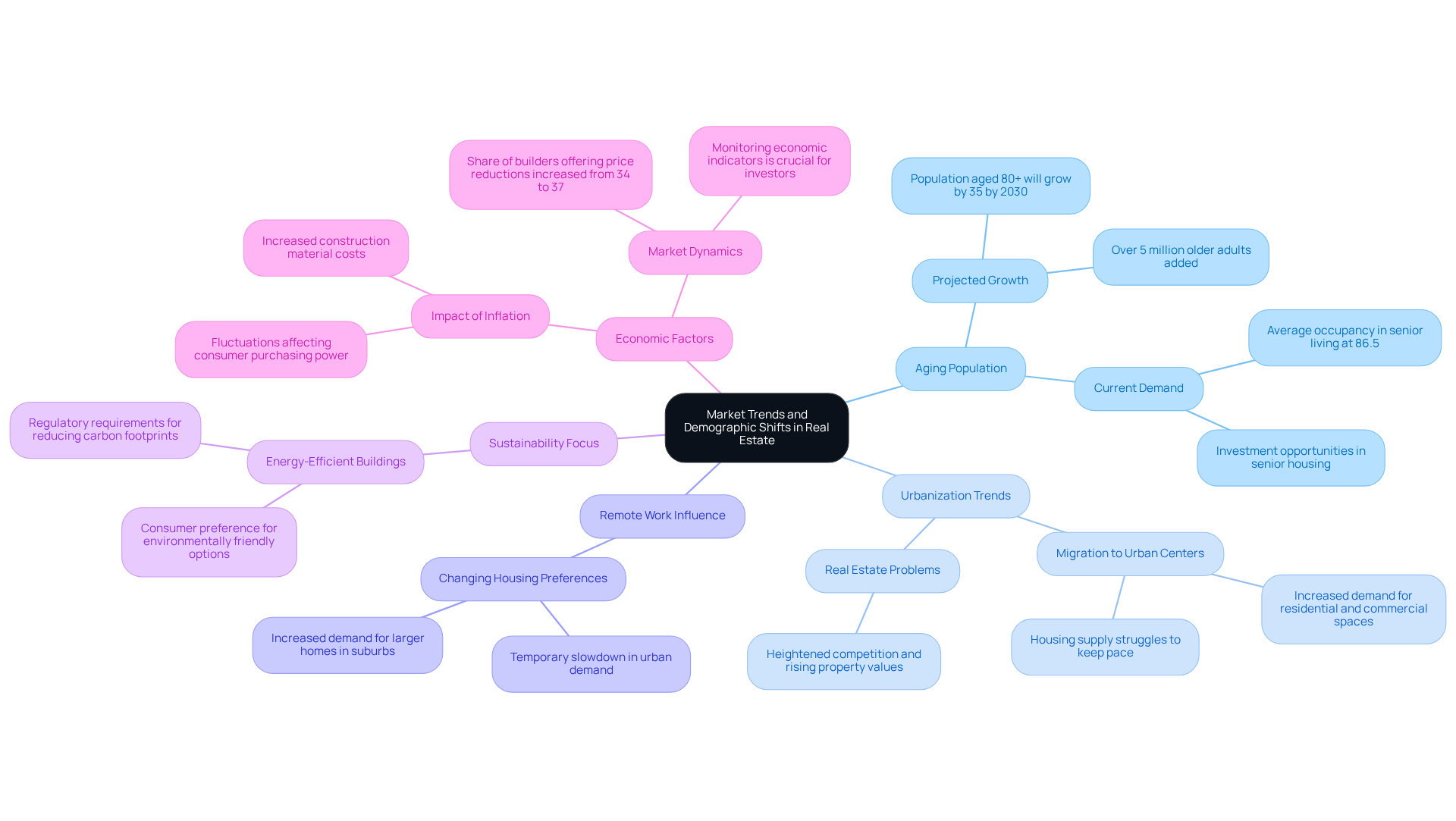

Analyze Market Trends and Demographic Shifts Impacting Real Estate

-

Aging Population: The aging population is significantly reshaping the housing market, leading to a surge in demand for senior housing and accessible living options. By 2030, the population aged 80 and older is projected to grow by 35%, adding over 5 million older adults. Currently, the average occupancy in the senior living industry stands at 86.5%, indicating robust demand for specialized housing. This trend presents substantial investment opportunities in senior living facilities, addressing real estate problems that savvy investors should not overlook.

-

Urbanization Trends: Urbanization trends complicate the landscape as more individuals migrate to urban centers, driving demand for both residential and commercial spaces. This shift is evident in cities experiencing real estate problems, where housing supply struggles to keep pace with the influx of residents. Consequently, heightened competition and rising property values are becoming the norm, leading to various real estate problems. Are you positioned to capitalize on these urban dynamics?

-

Remote Work Influence: The rise of remote work has transformed housing preferences, with many individuals seeking larger homes in suburban areas. This trend reshapes demand dynamics, as suburban markets experience increased interest, while urban areas may see a temporary slowdown in demand. Investors must adapt to this evolving landscape of real estate problems to maximize their opportunities.

-

Sustainability Focus: Sustainability is becoming a focal point in real estate development, with a growing emphasis on energy-efficient buildings. Driven by consumer preferences for environmentally friendly options and regulatory requirements aimed at reducing carbon footprints, this shift influences both new constructions and renovations. Are you ready to invest in the future of sustainable real estate?

-

Economic factors, including fluctuations like inflation and uncertainty, directly impact consumer purchasing power and investment strategies, leading to various real estate problems. Investors must remain vigilant, monitoring economic indicators to navigate these challenges effectively. For instance, as inflation rises, the cost of construction materials increases, potentially squeezing profit margins for new developments. Furthermore, the share of builders providing price reductions increased from 34% to 37% in June 2025, indicating the competitive characteristics of the housing sector. Understanding these economic factors is crucial for making informed investment decisions and addressing real estate problems in the current market landscape.

Conclusion

Navigating the complexities of real estate investing in 2025 presents a myriad of challenges that significantly influence strategies and outcomes. Investors must remain acutely aware of:

- High financing costs

- Regulatory changes

- Market volatility

- Supply chain disruptions

- Environmental concerns

These factors collectively shape the investment landscape. Understanding these core issues is essential for making informed decisions and achieving success in a competitive market.

Key insights from the analysis emphasize the importance of:

- Effective asset management

- Proactive maintenance planning

- Tenant retention strategies

Additionally, leveraging technology and data analytics can enhance operational efficiency and decision-making. With demographic shifts, urbanization trends, and sustainability becoming increasingly relevant, investors must adapt their strategies to capitalize on emerging opportunities while mitigating risks associated with economic fluctuations.

Ultimately, the real estate market in 2025 requires a proactive and informed approach. Investors are encouraged to stay updated on market trends, regulatory changes, and shifting consumer preferences. By embracing these insights and addressing the outlined challenges, investors can position themselves for success and navigate the evolving landscape of real estate investing effectively.