Overview

The article titled "Understanding the Commercial Real Estate Bubble: A Complete Tutorial for Investors" delves into the critical factors contributing to commercial real estate bubbles and outlines the strategies that investors can implement to navigate these risks effectively.

It defines a commercial real estate bubble as a phenomenon characterized by inflated prices fueled by speculation and excessive demand. This underscores the necessity of grasping economic indicators, historical precedents, and investment strategies to mitigate risks and facilitate informed decision-making.

By understanding these elements, investors can better position themselves in the market.

Introduction

In the ever-evolving landscape of commercial real estate, the specter of market bubbles looms large, presenting both opportunities and challenges for investors. As property prices soar beyond sustainable levels—driven by speculation and excessive demand—understanding the intricacies of these bubbles becomes essential for safeguarding investments. Key concepts such as intrinsic value, speculation, and market volatility serve as critical touchpoints for navigating this complex environment.

With historical precedents revealing the perils of overvaluation, investors must remain vigilant in monitoring economic indicators and external influences that shape market dynamics. Are you aware of the subtle shifts that could impact your portfolio? As trends shift towards sustainability and technological integration, the future of commercial real estate presents a unique blend of potential growth and inherent risks. This makes informed investment strategies more crucial than ever, as the decisions you make today will shape your success tomorrow.

Defining the Commercial Real Estate Bubble: Key Concepts and Terminology

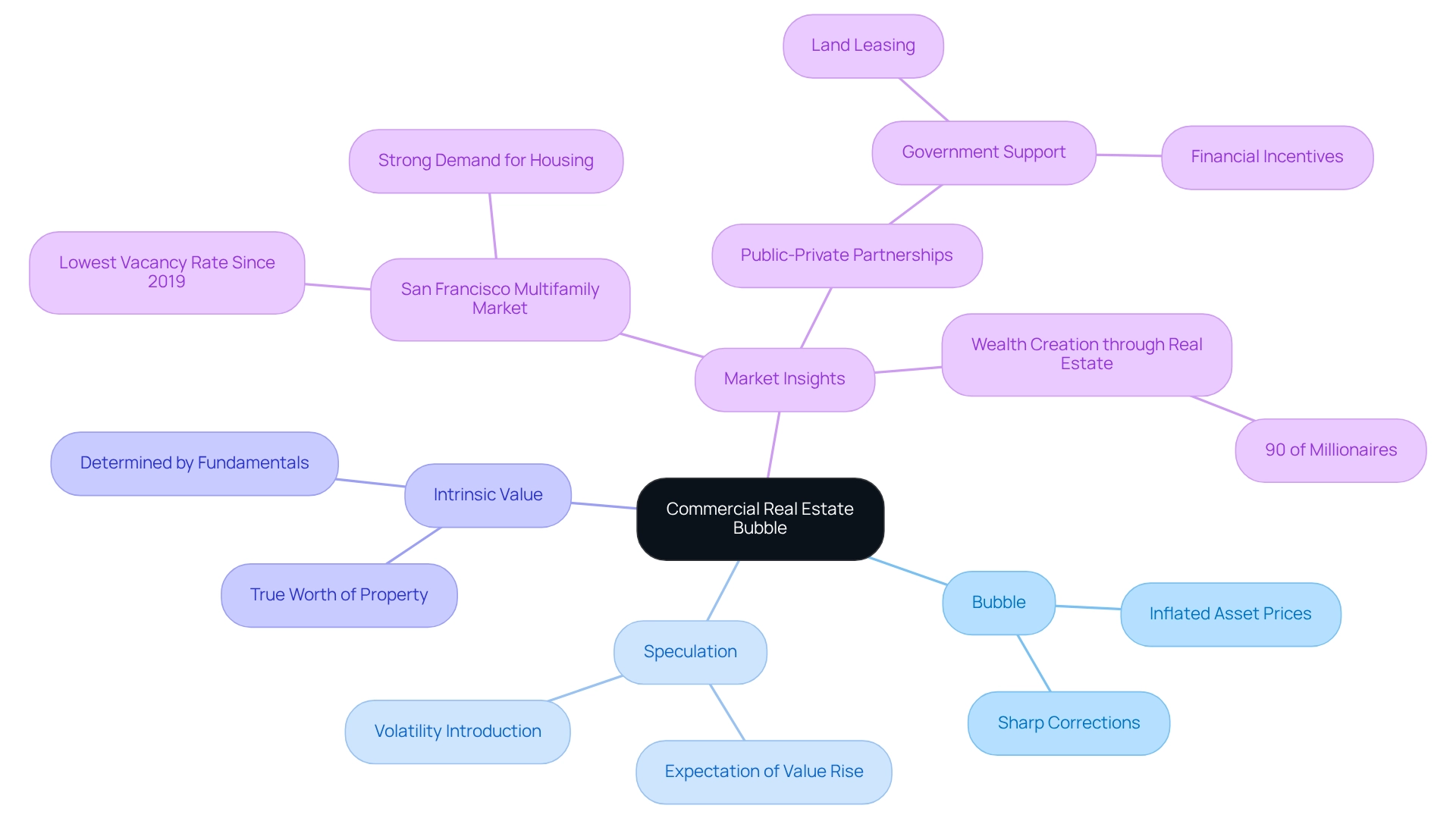

A significant increase in real estate prices that surpasses sustainable levels, primarily fueled by excessive demand and speculative behavior, characterizes a commercial real estate bubble. Understanding the following key terms is essential for investors:

- Bubble: This term refers to a situation where asset prices are inflated beyond their intrinsic value, often leading to a sharp correction when the bubble bursts.

- Speculation: This involves acquiring assets with the expectation that their value will rise, frequently disregarding their fundamental worth. Speculative investments can introduce volatility into the financial landscape, as they are often driven by trends rather than solid financial indicators.

- Intrinsic Value: This denotes the true worth of a property, determined by its fundamentals, including location, income potential, and prevailing economic conditions. Recognizing intrinsic value is crucial for investors to make informed decisions and avoid overpaying for assets.

Understanding these concepts is vital for identifying the signs of a commercial real estate bubble and its potential implications on investment strategies. For instance, recent studies have underscored the role of speculation in driving prices across various sectors, emphasizing the need for caution among investors. In the San Francisco multifamily sector, the low vacancy rate at the start of 2025 signals strong demand for multifamily housing, suggesting a favorable environment for investors. Additionally, it is noteworthy that 90% of millionaires have accrued wealth through property investments, underscoring the importance of grasping economic dynamics for potential wealth creation. Furthermore, robust public-private partnerships are essential for advancing affordable housing, with government support through land leasing and financial incentives playing a crucial role in stabilizing the market. By staying informed about these dynamics, investors can navigate the complexities of the commercial property landscape more effectively.

Historical Overview: Lessons from Previous Commercial Real Estate Bubbles

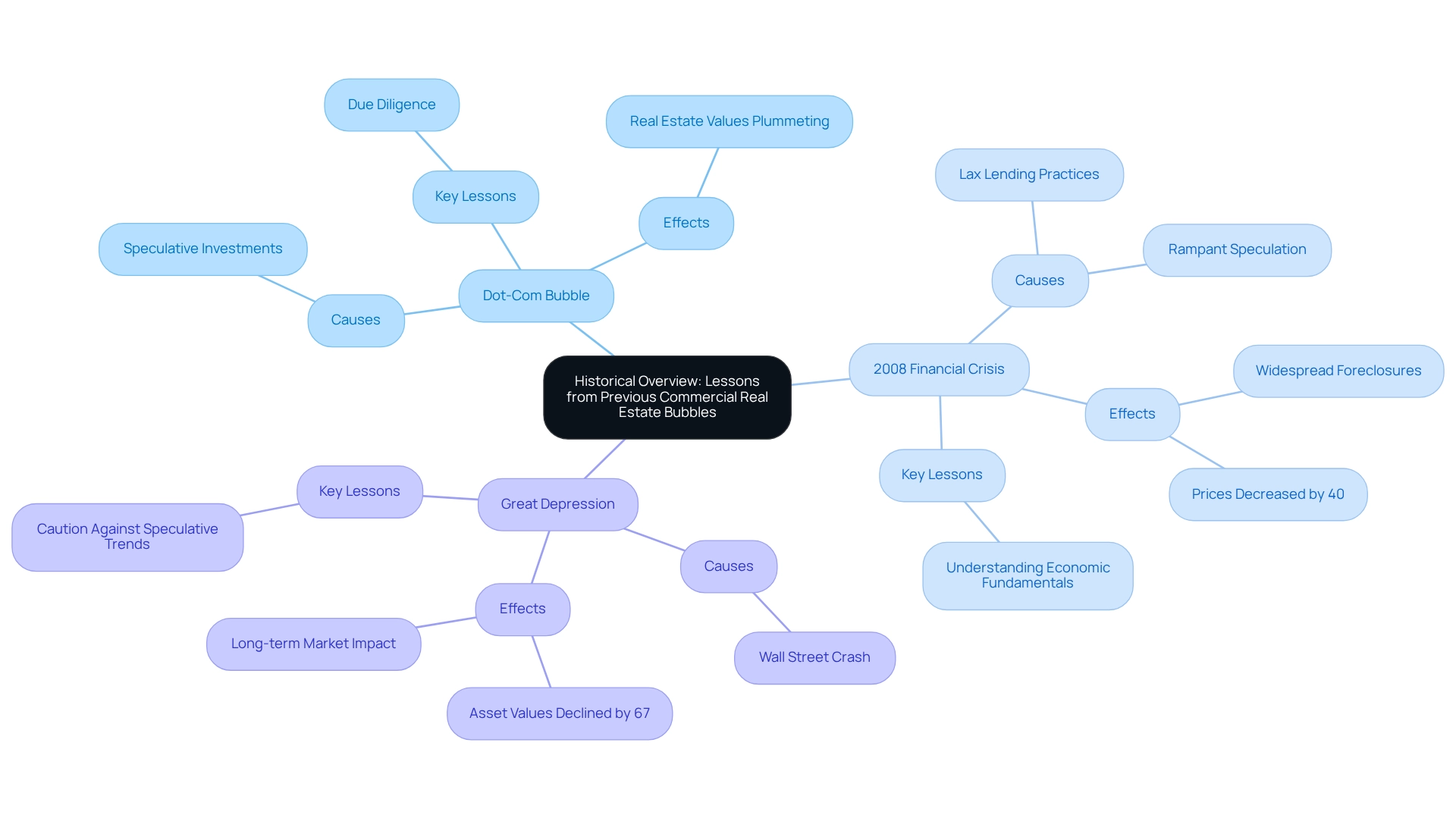

Historically, the commercial real estate bubble has been marked by rapid price surges followed by abrupt declines, often resulting in significant market corrections. Two notable examples illustrate this phenomenon:

-

The Dot-Com Bubble (1997-2000): This era witnessed speculative investments in technology firms that inflated the valuations of numerous commercial assets. As technology shares soared, investors directed funds into property, anticipating continued growth. However, when the commercial real estate bubble burst, real estate values plummeted, exposing the risks of overvaluation fueled by speculation. Dave Liniger, founder of RE/MAX, noted that a reduction in mortgage rates could lead to an influx of homebuyers, potentially igniting another boom-and-bust cycle where home prices escalate once again.

-

The 2008 Financial Crisis: Triggered by lax lending practices and rampant speculation in the housing market, this crisis also impacted commercial real estate. The resulting bubble led to widespread foreclosures and a catastrophic crash, with prices plummeting significantly. In some areas, values decreased by as much as 40%, underscoring the system's vulnerability under unsustainable conditions. Additionally, the Great Depression (1929-1939) serves as a crucial case study, where the Wall Street crash caused asset values to decline by up to 67%. The repercussions of this crash affected real estate sectors until 1960, with recovery only beginning after World War II.

The insights gleaned from these historical events underscore the necessity for thorough due diligence, a solid understanding of economic fundamentals, and the ability to recognize signs of a commercial real estate bubble. Investors must remain cautious of the allure of quick profits, as history demonstrates that such trends can culminate in devastating losses. Furthermore, the occupancy rate—defined as the ratio of occupied housing units to total units—acts as a vital indicator of economic health; low occupancy rates often signal an oversupply of properties, complicating recovery efforts.

In reflecting on these past bubbles, it becomes clear that a systematic approach to investment, grounded in factual analysis and economic realities, is essential for navigating the complexities of commercial property. Moreover, with Ground Up Construction loans starting at 9.75%, current financing conditions significantly shape economic dynamics.

Identifying the Drivers: Economic Indicators and Market Dynamics of a Bubble

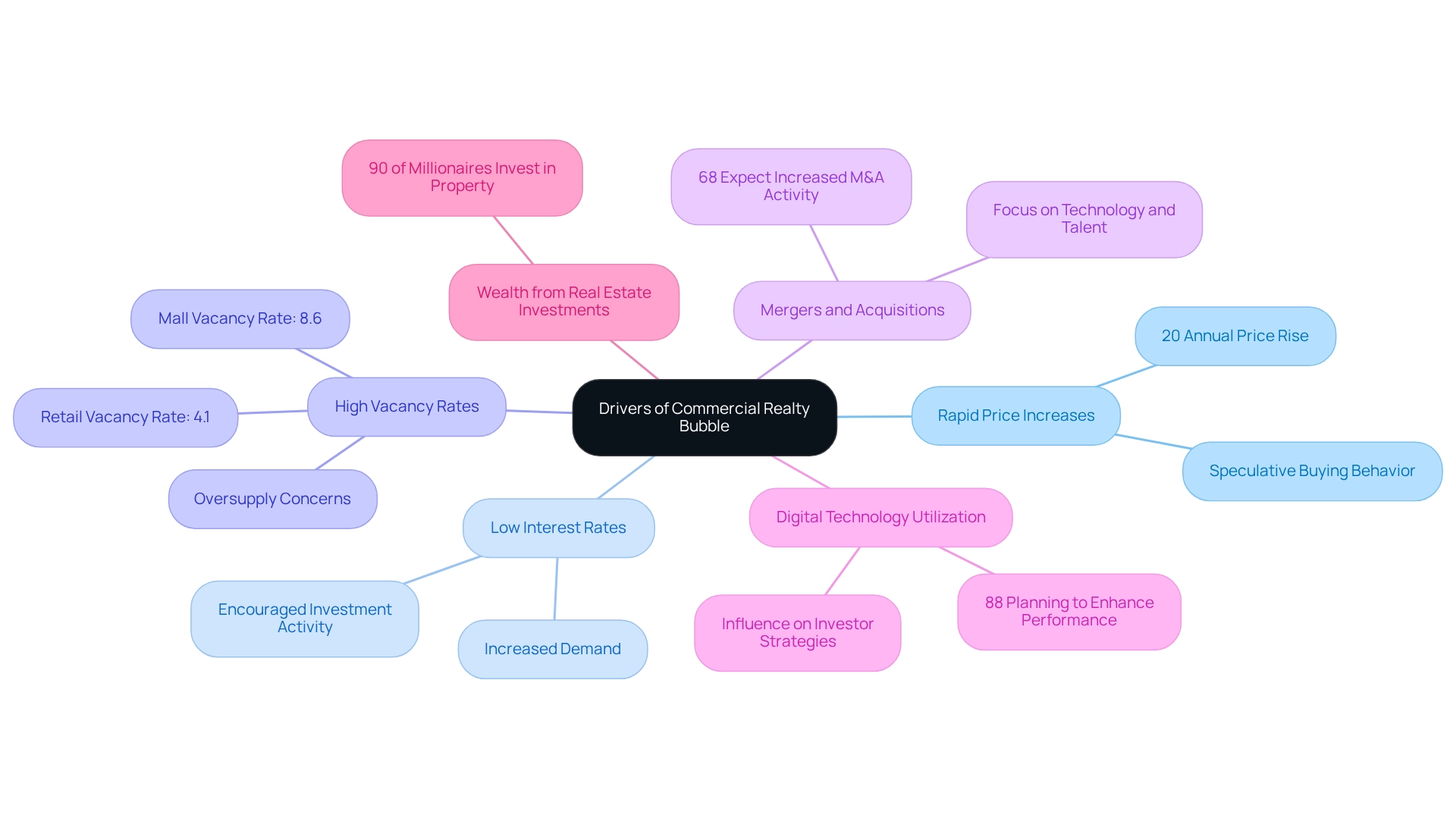

Key economic indicators signaling a potential commercial realty bubble include:

-

Rapid Price Increases: A significant and sustained rise in asset prices often indicates speculative buying behavior. Recent trends indicate that commercial real estate prices have soared, with certain regions experiencing rises of more than 20% annually. This rapid escalation can lead to unsustainable valuations, raising concerns about the potential for a commercial real estate bubble.

-

Low Interest Rates: The current environment of historically low interest rates has encouraged a surge in investment activity. With borrowing expenses at a minimum, more investors are entering the sector, driving up demand and consequently, real estate prices. This influx can lead to a false increase in values, further complicating economic dynamics.

-

High Vacancy Rates: While retail locations maintain the lowest vacancy rate at 4.1%, certain segments, such as malls, are facing an 8.6% vacancy rate. A rise in vacancies across different sectors can suggest an oversupply of real estate, which might result in price adjustments as demand decreases. Investors should carefully observe these signals to assess economic health and pinpoint possible situations related to a commercial real estate bubble. For example, the cap rates for multifamily assets remain at historical lows, averaging around 4.2% nationwide, indicating that institutional investors are significantly engaged, owning over 17% of rental units in major cities. This concentration can further intensify volatility in the financial arena.

Moreover, economic indicators like the expected rise in mergers and acquisitions within the commercial property sector indicate a change in approach among executives. After a decline in M&A activity in 2023, 68% of executives now expect to ramp up their M&A efforts over the next 12 to 18 months, focusing on enhancing technology capabilities and talent acquisition rather than merely expanding property portfolios. This change indicates a wider trend of adjusting to evolving economic circumstances and could affect future price stability.

Furthermore, with 88% of participants intending to utilize digital technologies to significantly enhance performance in the upcoming 12 to 18 months, it is evident that technology is essential in influencing investor strategies and economic dynamics.

By remaining aware of these financial indicators, investors can more effectively maneuver through the intricacies of the commercial property landscape and make more educated choices. As a reminder of the potential of property investments, it is worth noting that 90% of millionaires are affluent due to their investments in property, highlighting the significance of understanding industry trends and conditions.

External Influences: How Policy and Global Trends Shape the CRE Market

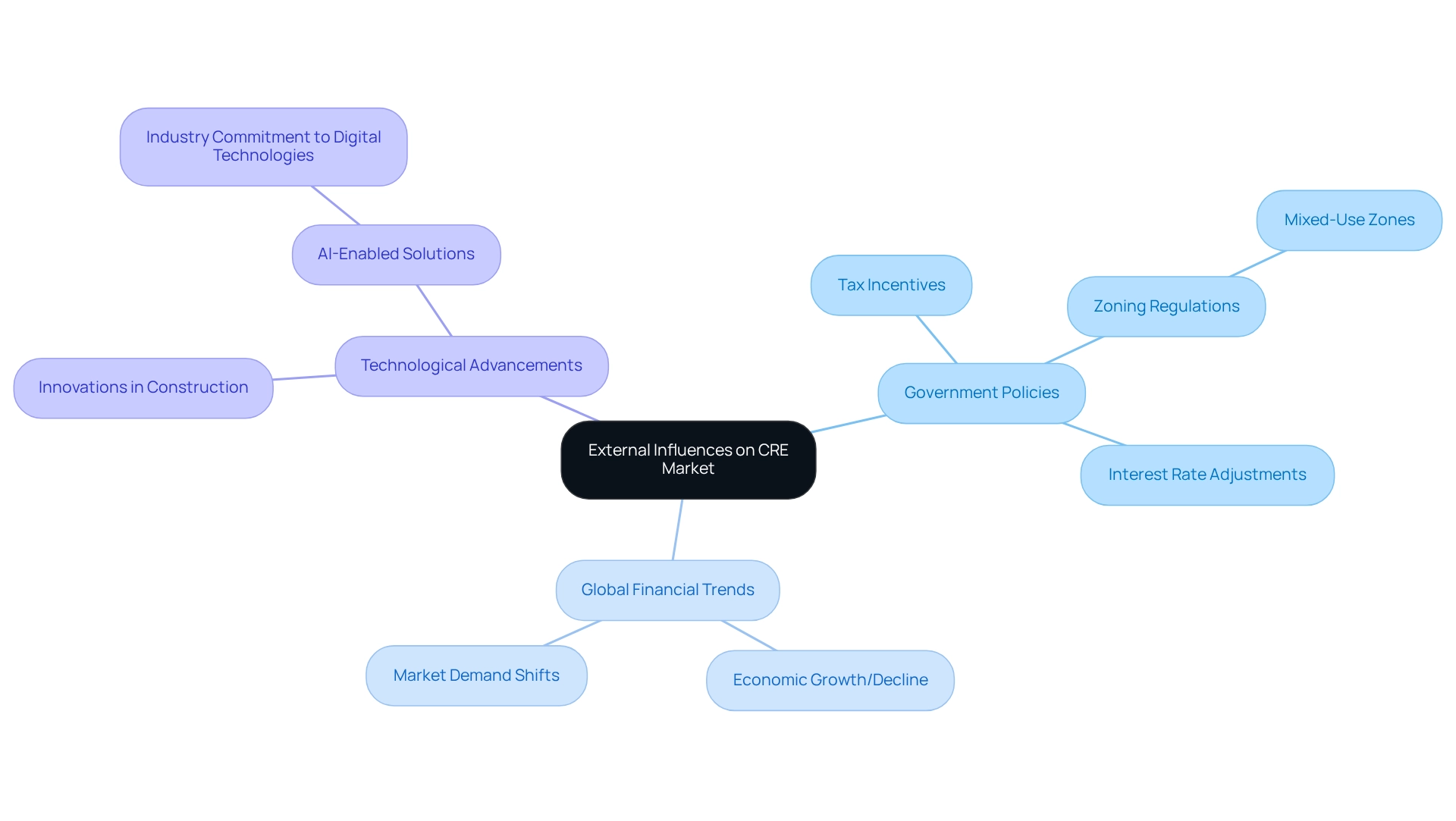

External factors significantly influence the commercial real estate bubble, impacting both asset values and investment strategies. Among these factors, government policies are pivotal. Tax incentives, zoning regulations, and interest rate adjustments directly affect the appeal and valuation of real estate.

For instance, favorable zoning laws in mixed-use areas can enhance real estate desirability, leading to increased prices fueled by heightened foot traffic and business opportunities. As Thomas McCoy observes, "Properties located in areas with favorable zoning regulations, such as mixed-use zones with vibrant commercial activity, may be perceived as more desirable and command higher prices due to access to amenities, foot traffic, and business opportunities."

Additionally, global financial trends exert a strong influence on commercial property. Economic growth or decline in major economies can shift demand for the commercial real estate bubble, thereby affecting local markets. Looking ahead to 2025, optimism is growing regarding revenue growth and transaction activity within the sector, indicating a potential revival.

Moreover, technological advancements are reshaping the commercial property landscape. Innovations in construction techniques and property management systems are not only creating new opportunities but also presenting challenges for investors. The integration of AI-enabled solutions is becoming increasingly prevalent, with a remarkable 97% of industry professionals committed to leveraging digital technologies to enhance performance over the next 12 to 18 months.

To navigate the complexities of the commercial property landscape effectively, investors must remain vigilant and well-informed about these external factors. Understanding how government policies and global economic trends interact with local economic dynamics is essential for making informed investment decisions. Furthermore, Zero Flux compiles 5-12 selected property insights daily, providing subscribers with a comprehensive and data-informed approach to grasp these dynamics.

The research expertise of professionals like Tim Coy at Deloitte enhances the firm's ability to deliver informed insights into economic dynamics, further aiding investors in their decision-making processes.

Navigating Risks: Challenges and Pitfalls of Investing in a Bubble

Investing during a commercial real estate bubble involves substantial risks that can significantly impact investor returns. Key concerns include:

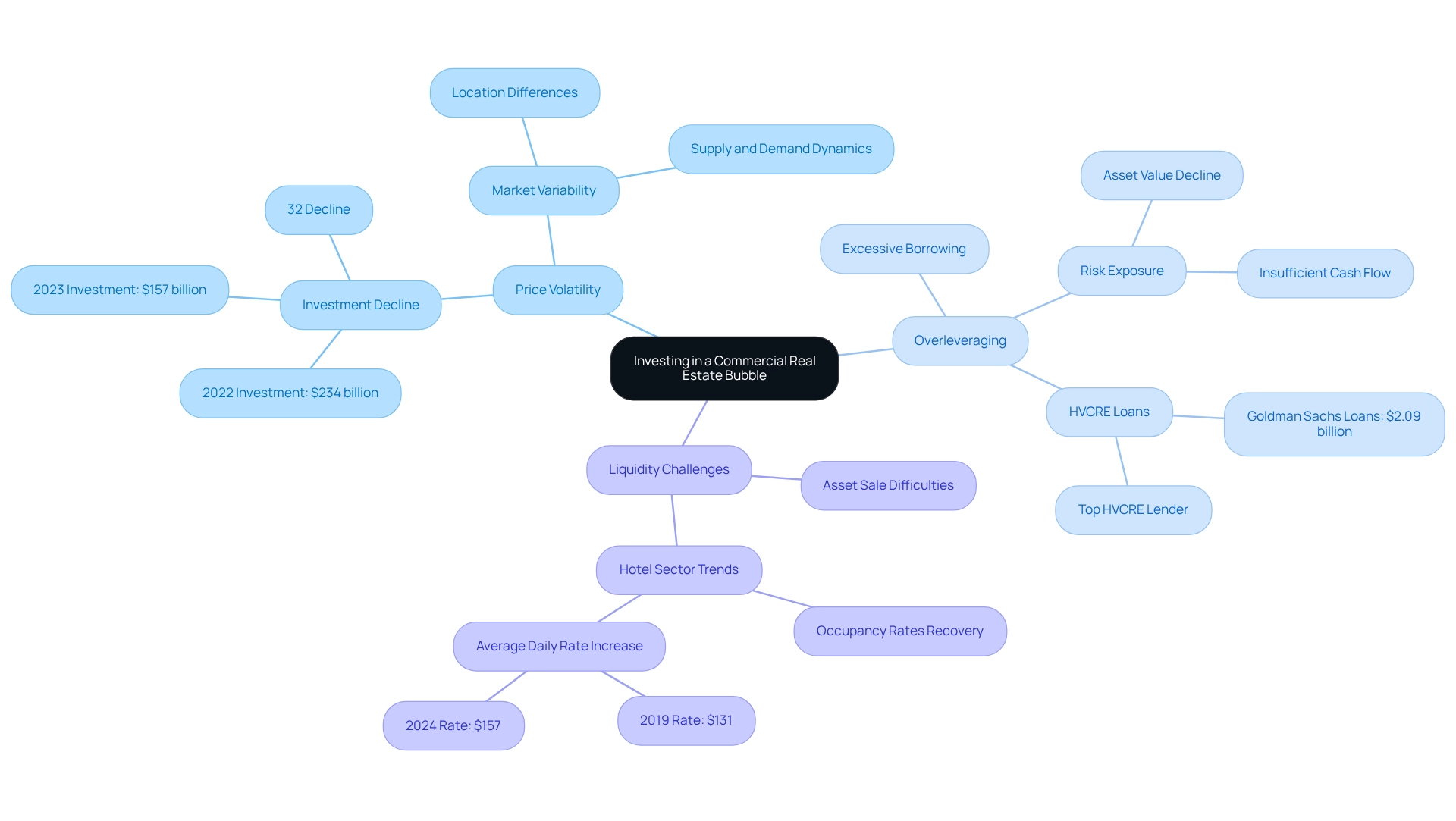

- Price Volatility: The commercial real estate sector is marked by dramatic price fluctuations. For instance, investment in multifamily properties plummeted from $234 billion in 2022 to $157 billion in 2023, representing a staggering 32% decline. Such volatility can lead to considerable losses for investors caught in the wrong economic cycle. Additionally, commercial real estate markets vary by location, presenting different supply and demand dynamics that investors must carefully consider.

- Overleveraging: Many investors may resort to excessive borrowing to finance their acquisitions, amplifying their risk exposure. Overleveraging can leave investors vulnerable, particularly if asset values decline or if cash flow becomes insufficient to meet debt obligations. Goldman Sachs remains the leading HVCRE lender, with $2.09 billion in total HVCRE loans as of June 30, underscoring the importance of understanding financing risks in this context.

- Liquidity Challenges: During a downturn, the ability to sell assets can diminish significantly, trapping investors in unfavorable situations. This is especially evident in the hotel sector, where occupancy rates have yet to return to pre-pandemic levels, despite an increase in average daily rates from $131 in 2019 to $157 in 2024. This trend highlights the potential for profitability while also emphasizing the challenges of liquidity in a fluctuating market.

To effectively navigate these risks, investors should prioritize thorough due diligence, maintain conservative leverage ratios, and develop robust exit strategies. Understanding the dynamics of price fluctuations and the potential for excessive borrowing is crucial for making informed investment choices in the commercial property sector, particularly as the risk of a commercial real estate bubble may emerge with the approaching difficult economic circumstances.

Investment Strategies: How to Safeguard Your Portfolio in a Bubble Environment

To effectively safeguard your portfolio during a commercial real estate bubble, consider implementing the following strategies:

-

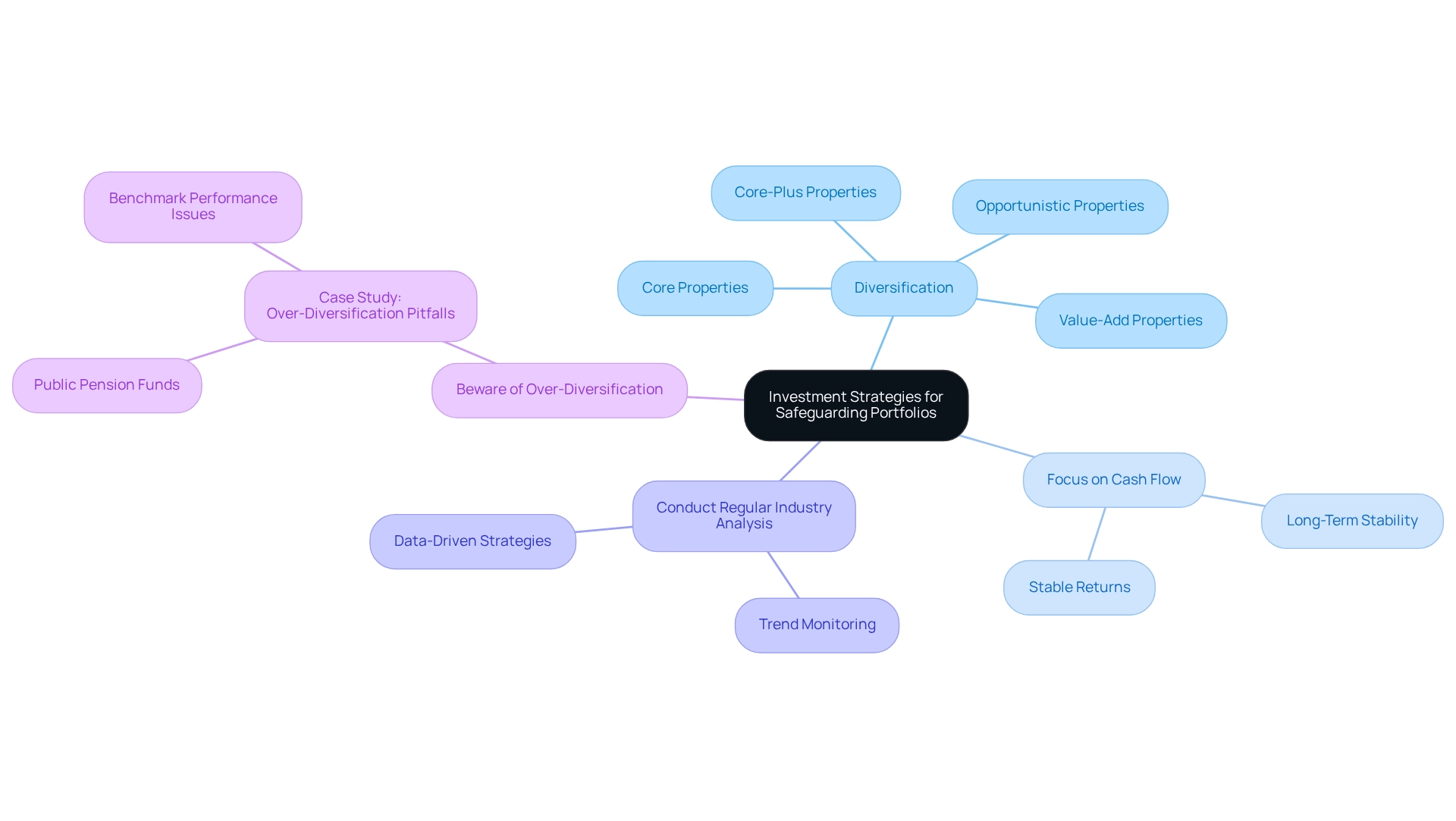

Diversification: It is crucial to spread investments across various property types—such as Core, Core-Plus, Value-Add, and Opportunistic properties—and geographic locations. This method not only reduces risk but also takes advantage of various economic dynamics. By ensuring that a decline in one sector does not disproportionately impact your overall portfolio, you enhance resilience. As noted by economist Harry Markowitz, "This groundbreaking idea showed that risk isn't only about individual investments, but also about how those investments interact within a portfolio."

-

Focus on Cash Flow: Prioritize investments in assets that generate consistent rental income. Cash flow assets, particularly Core and Core-Plus investments, provide stable returns during economic downturns, making them a safer option in turbulent environments. This focus on cash flow not only secures income but also supports long-term investment stability.

-

Conduct Regular Industry Analysis: Staying informed about current trends is essential. Regularly analyze data on cash flow properties and emerging investment opportunities to proactively adjust your strategy. This practice empowers you to respond to market shifts and make informed decisions that align with your investment goals. Furthermore, leveraging technology can transform your approach to portfolio diversification, offering tools that enable data-driven investment strategies.

-

Beware of Over-Diversification: While diversification is important, be cautious of over-diversification. A case study titled "Over-Diversification Pitfalls" highlights how some large funds, particularly public pension funds in the US, have faced criticism for managing overly complex portfolios with excessive numbers of assets, many of which have overlapping characteristics. These funds often fail to beat their benchmarks, illustrating that over-diversification can dilute performance and lead to inefficiencies in investment strategies.

By employing these strategies, investors can navigate the complexities of a commercial real estate bubble more effectively, ensuring their portfolios remain resilient against potential downturns.

Looking Ahead: Future Trends and Recovery Scenarios in Commercial Real Estate

Looking ahead, several key trends are poised to significantly impact the future of commercial property.

-

Increased Demand for Flexible Spaces: The shift towards remote work has fundamentally transformed the landscape of office space demand. Companies are now prioritizing flexible and adaptable environments that can support hybrid work models. This trend is exemplified by the rising popularity of co-working spaces and short-term leases, catering to businesses seeking operational flexibility.

-

Sustainability Focus: As environmental concerns gain prominence, investors are increasingly drawn to real estate that adheres to sustainability criteria. This focus not only aligns with corporate social responsibility objectives but also enhances long-term asset value. Properties that incorporate green building practices and energy-efficient technologies are likely to achieve higher occupancy rates and command premium rents.

-

Technological Integration: The adoption of smart building technologies is becoming essential for enhancing operational efficiency and tenant experiences. Features such as automated energy management systems and advanced security measures are appealing to tenants and help reduce operational expenses for building owners.

-

Future Trends in Commercial Realty: Recent insights suggest a robust recovery in the commercial sector, particularly in the industrial segment, which has shown solid performance. Retail spaces are also expected to experience steady growth as consumer behaviors evolve in the post-pandemic landscape. Notably, the current share of upscale and upper midscale accommodations stands at 42.3%, indicating a significant segment for investors to consider.

-

Financing Outlook: Supporting this optimistic outlook, a recent Deloitte survey revealed that 68% of participants believe financing will be less expensive, and 69% anticipate it will be easier to secure. This favorable funding environment could further stimulate investment opportunities in the industry.

-

Case Studies on Future Trends: Recent mergers and acquisitions within the commercial property sector highlight a strategic shift, with 68% of executives planning to increase M&A activity to bolster organizational capabilities rather than merely expanding property portfolios. This trend underscores the importance of adaptability in a rapidly changing environment. Furthermore, the growing skills gap in the commercial real estate sector emphasizes the necessity for companies to reskill and upskill their workforce to meet the demands of new technologies and evolving market needs. Understanding these trends is crucial for investors aiming to navigate the complexities of the commercial real estate landscape effectively.

Conclusion

The commercial real estate landscape presents a myriad of opportunities and challenges, particularly in the context of market bubbles. Understanding fundamental concepts—such as intrinsic value, speculation, and market volatility—is essential for navigating this complex terrain. Historical precedents serve as a stark reminder of the dangers posed by unsustainable price escalations, emphasizing the necessity for diligent monitoring of economic indicators and market dynamics.

As the market continues to evolve, external influences, including government policies and global economic trends, will undoubtedly shape investment strategies. The integration of technology and an increasing emphasis on sustainability further complicate the landscape; however, they also unveil new avenues for growth. Investors are urged to remain vigilant and informed, employing strategies such as:

- Diversification

- Cash flow focus

- Regular market analysis

to safeguard their portfolios against potential downturns.

Looking ahead, trends such as heightened demand for flexible spaces and a shift towards sustainable practices are poised to define the future of commercial real estate. By comprehending these dynamics and adapting investment strategies accordingly, investors can position themselves for success in an ever-changing market. Ultimately, the decisions made today will significantly impact future outcomes, underscoring the importance of informed and strategic investment practices in this dynamic sector.