Overview

The industrial real estate outlook for investors is increasingly positive. This optimism is driven by significant trends such as:

- E-commerce growth

- Supply chain optimization

- Sustainability initiatives

- Technological advancements

These elements collectively create a compelling narrative for the market's potential.

Demand for various industrial property types is on the rise, underscoring the importance of strategic investment considerations. Savvy investors should take note of these trends, as they indicate a robust market ripe for opportunity.

In summary, the convergence of these dynamics presents a promising landscape for investment. Investors are encouraged to leverage these insights in their strategies, ensuring they remain ahead in a competitive market.

Introduction

The industrial real estate sector is currently undergoing a transformative phase, significantly influenced by the rapid evolution of e-commerce and shifting supply chain dynamics. This presents investors with a unique opportunity to capitalize on emerging trends.

However, understanding the nuances of this market is crucial for achieving success.

How can one effectively navigate the complexities of industrial properties while making informed investment decisions that align with both current demands and future forecasts?

By exploring these dynamics, investors can position themselves advantageously in a competitive landscape.

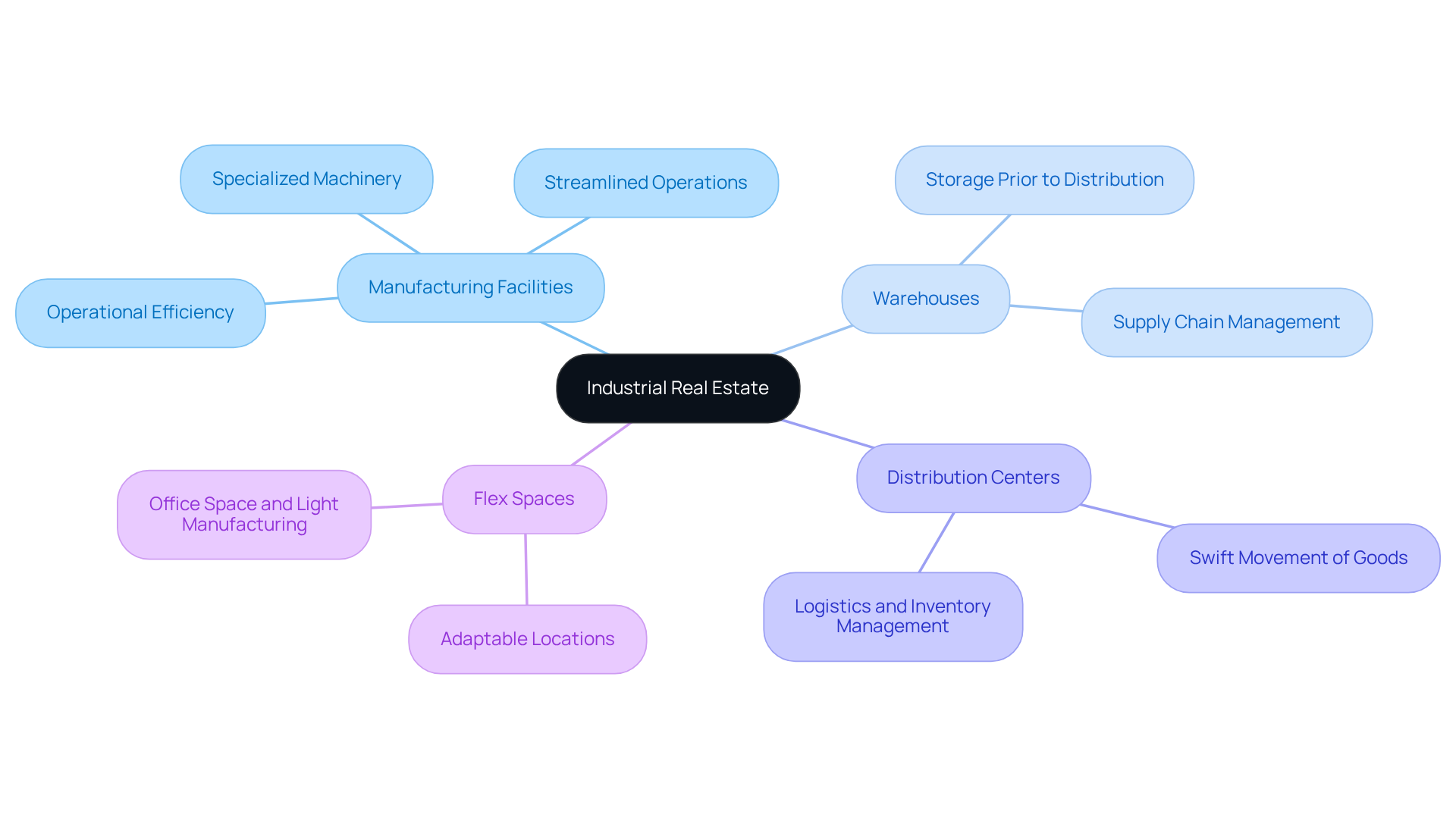

Explore the Fundamentals of Industrial Real Estate

Industrial real estate encompasses facilities specifically designed for manufacturing, warehousing, distribution, and logistics. Unlike residential or commercial real estate, these spaces are typically not accessible to the public and prioritize operational efficiency. As Henry Ford aptly stated, 'Quality means doing it right when no one is looking,' underscoring the critical importance of maintaining high standards in these facilities.

The primary types of industrial properties include:

- Manufacturing Facilities: Structures where goods are produced, often equipped with specialized machinery to enhance production efficiency. Frank Bunker Gilbreth, Sr. noted that needless motions result in significant waste, highlighting the necessity for streamlined operations in these environments.

- Warehouses: Expansive spaces dedicated to storing goods prior to distribution, crucial for effective supply chain management.

- Distribution Centers: Facilities optimized for the swift movement of goods, playing a vital role in logistics and inventory management.

- Flex Spaces: Adaptable locations that can fulfill various roles, including office space and light manufacturing, addressing diverse business requirements.

Understanding these fundamentals allows investors to identify assets that align with their financial strategies and respond efficiently to the industrial real estate outlook. Zero Flux's unwavering commitment to data integrity and sourcing information from over 100 diverse outlets ensures that the insights provided are both reliable and well-informed. As the commercial real property sector continues to evolve, understanding the industrial real estate outlook is vital for making informed investment choices. Positive feedback from subscribers underscores the clarity and precision of the information presented, reinforcing the value of these insights.

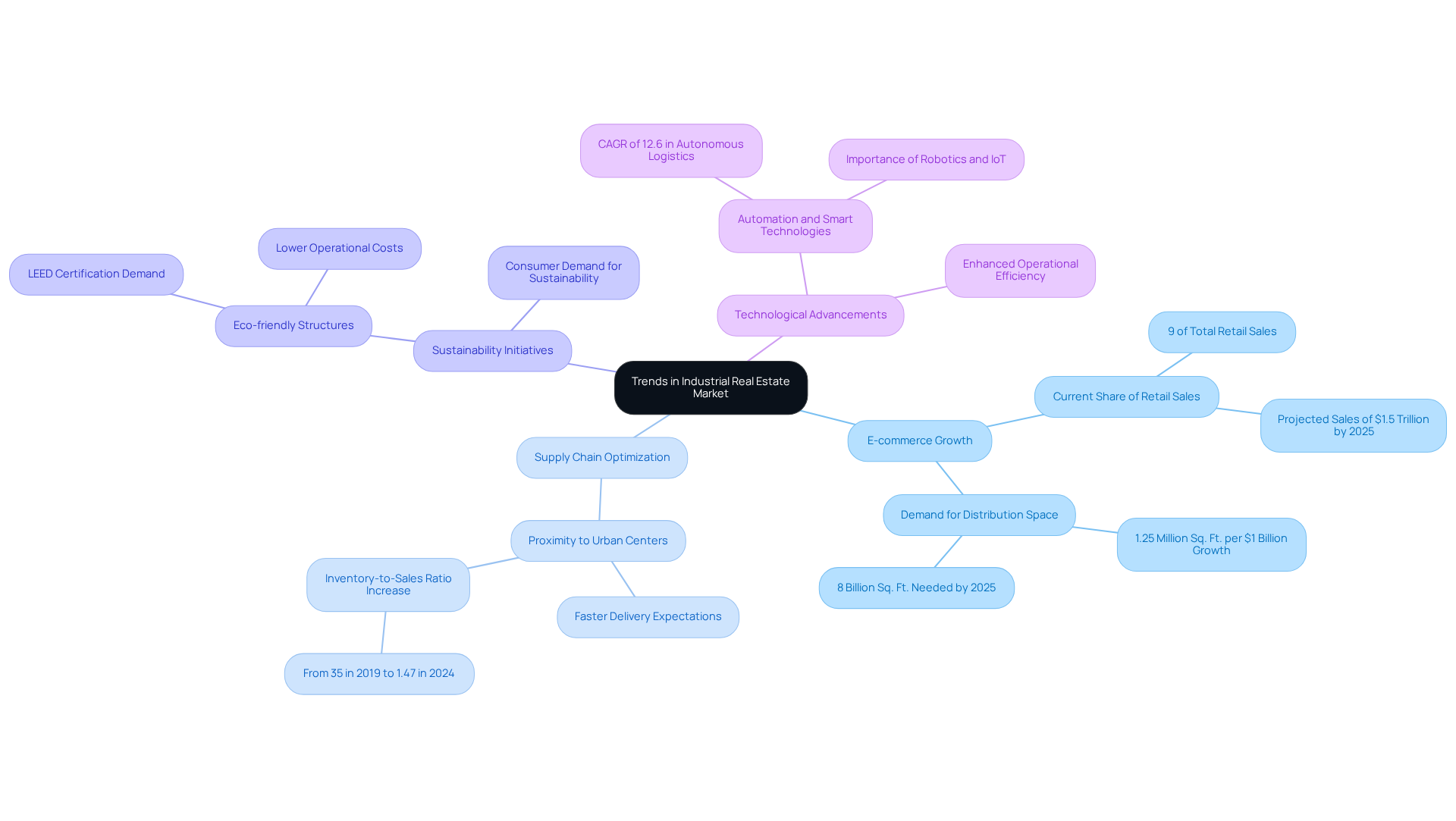

Analyze Current Trends Shaping the Industrial Real Estate Market

The industrial real estate market is currently shaped by several pivotal trends that investors should closely monitor:

-

E-commerce Growth: The surge in online shopping has led to a dramatic increase in demand for warehouse and distribution spaces. E-commerce now accounts for nearly 9% of total retail sales in the U.S. For every incremental $1 billion increase in e-commerce sales, an additional 1.25 million square feet of distribution space is required. This trend is anticipated to persist, with online sales forecasted to hit $1.5 trillion by 2025, necessitating 8 billion square feet of additional commercial space.

-

Supply Chain Optimization: Companies are reevaluating their supply chains to improve efficiency, resulting in heightened demand for strategically situated commercial properties. Proximity to urban centers is becoming crucial, as consumers increasingly expect faster delivery times. The inventory-to-sales ratio has risen from 35 in 2019 to 1.47 in 2024, indicating that businesses are maintaining larger stockpiles to prevent supply disruptions.

-

Sustainability Initiatives: There is a growing emphasis on sustainable practices within the manufacturing sector. Investors are prioritizing eco-friendly commercial structures that align with contemporary environmental standards, reflecting a broader trend towards sustainability in property development. This shift is driven by consumer demand for environmentally responsible practices and the need for compliance with evolving regulations. LEED-certified warehouses are increasingly sought after for their lower operational costs and enhanced energy management.

-

Technological Advancements: Automation and smart technologies are revolutionizing manufacturing operations. Facilities equipped with advanced infrastructure, such as robotics and IoT capabilities, are becoming increasingly desirable. The global autonomous logistics market is projected to grow at a CAGR of 12.6%, underscoring the importance of automation in enhancing operational efficiency and reducing costs.

These trends collectively suggest a robust outlook for commercial real property, making it an appealing sector for investors eager to capitalize on the evolving landscape.

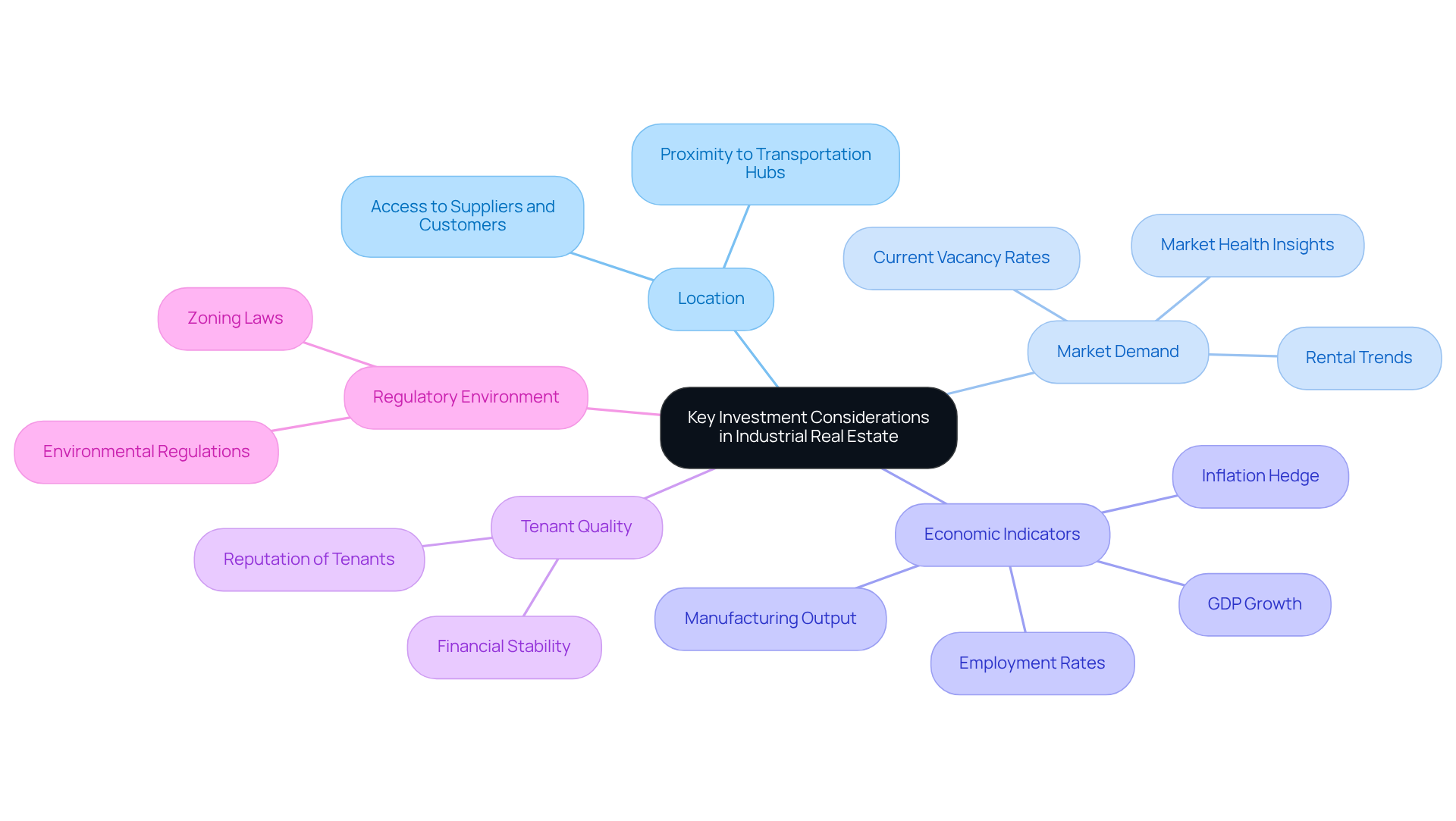

Evaluate Key Investment Considerations and Economic Indicators

Investors in industrial real estate must meticulously assess several key factors to optimize their investment strategies:

- Location: Proximity to transportation hubs, suppliers, and customers is essential for enhancing operational efficiency and reducing logistics costs.

- Market Demand: Analyzing local market conditions, including current vacancy rates and rental trends, provides insights into potential returns and overall market health. As of 2025, vacancy rates in commercial real property are expected to remain consistent, making it essential for investors to grasp these dynamics for informed decision-making.

- Economic Indicators: Tracking essential metrics like GDP growth, employment rates, and manufacturing output is crucial, as these indicators reflect the industrial sector's health and can significantly affect financial outcomes. Real estate is often viewed as a hedge against inflation, underscoring the importance of these economic indicators in maintaining purchasing power.

- Tenant Quality: Evaluating the financial stability and reputation of prospective tenants is critical for mitigating risks associated with vacancies and ensuring consistent cash flow.

- Regulatory Environment: A comprehensive understanding of zoning laws and environmental regulations is essential, as these elements can greatly influence land usability and overall financial potential.

Incorporating insights from case studies illustrates the emotional rewards and challenges of property ownership, reinforcing the importance of these considerations. By thoughtfully evaluating these factors, investors can align their strategies with financial goals and effectively navigate the changing environment of commercial real property. As Louis Glickman aptly stated, "The finest allocation of resources on Earth is land," emphasizing the lasting worth of property as a strategic investment.

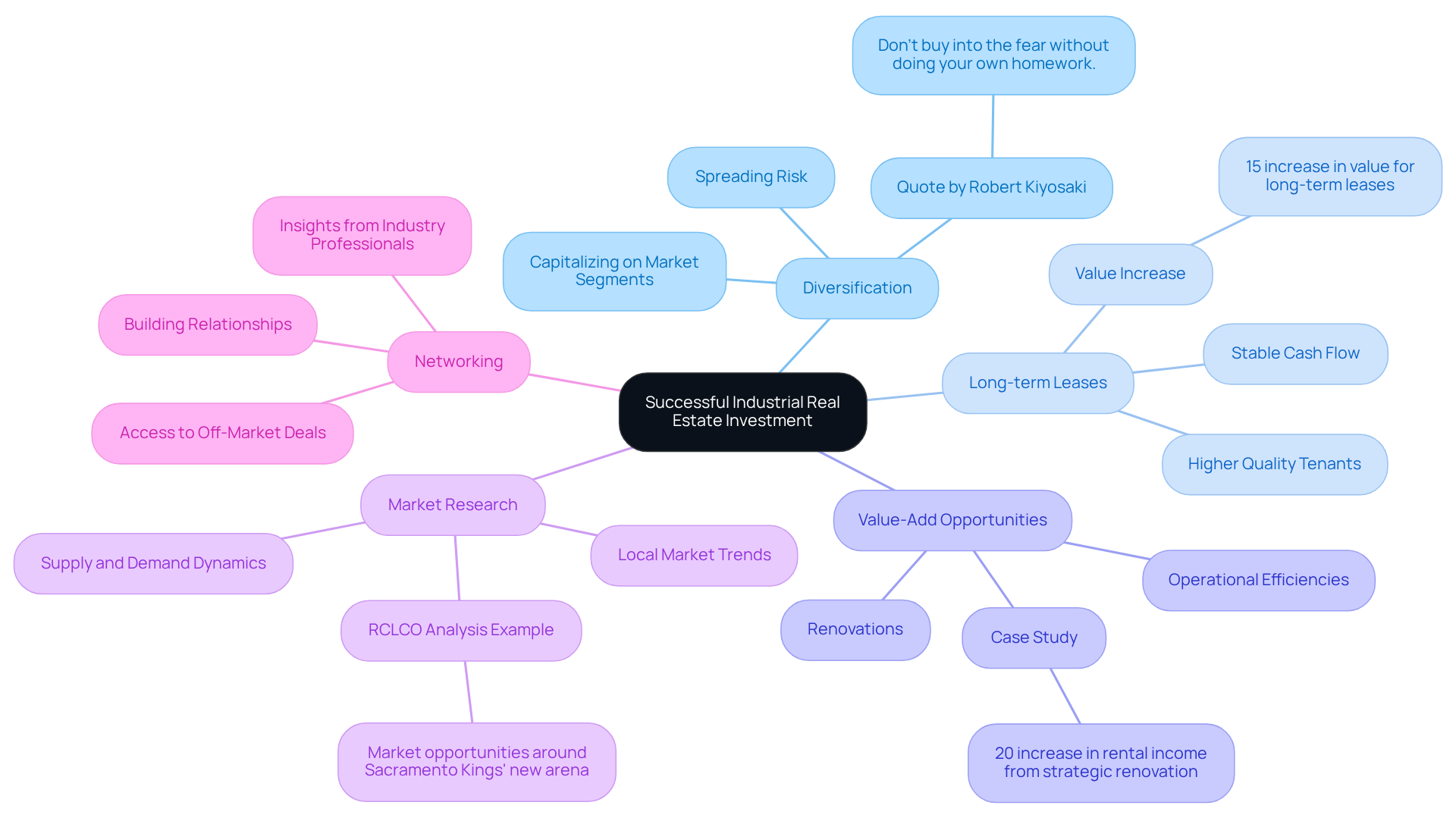

Implement Strategies for Successful Industrial Real Estate Investment

To achieve success in industrial real estate investment, consider the following strategies:

-

Diversification: Investing in a variety of industrial property types is crucial for spreading risk and capitalizing on different market segments. A diversified portfolio can mitigate the impact of market fluctuations and enhance overall returns. As Robert Kiyosaki noted, "don’t buy into the fear without doing your own homework," emphasizing the importance of informed investment choices.

-

Long-term Leases: Properties with long-term tenants are essential for ensuring stable cash flow and minimizing turnover costs. Statistics suggest that buildings with leases extending beyond five years tend to attract higher-quality tenants, which can result in increased value over time. For instance, assets with long-term leases have been shown to experience a 15% increase in value compared to those with shorter leases.

-

Value-Add Opportunities: Recognizing assets that can be improved through renovations or operational efficiencies is essential to boosting their value. A recent case study highlighted how a strategic renovation of an industrial facility led to a 20% increase in rental income.

-

Market Research: Staying informed about local market trends and economic conditions is vital for identifying emerging opportunities. Investors should regularly analyze data on supply and demand dynamics to make informed decisions. RCLCO's analysis of market opportunities around the Sacramento Kings' new arena illustrates the importance of understanding local developments.

-

Networking: Building relationships with industry professionals, including brokers, property managers, and fellow investors, can provide valuable insights and access to off-market deals. Engaging with a network of experts can lead to better investment opportunities and strategic partnerships.

By implementing these strategies, investors can effectively navigate the complexities of the industrial real estate outlook and position themselves for long-term success.

Conclusion

Understanding the industrial real estate landscape is crucial for investors aiming to make informed decisions in a rapidly evolving market. This sector, encompassing manufacturing, warehousing, distribution, and logistics, presents unique opportunities that differ significantly from traditional real estate investments. By grasping the fundamentals and current trends, investors can navigate the complexities of this market with confidence.

Key insights highlighted in the article include:

- The substantial growth of e-commerce

- The importance of supply chain optimization

- The increasing emphasis on sustainability and technology within the industrial sector

These trends not only shape market demand but also dictate the strategic considerations that investors must account for, such as location, tenant quality, and economic indicators. Furthermore, practical strategies for investment success are outlined, including:

- Diversification

- Long-term leasing

- Thorough market research

As the industrial real estate market continues to expand, seizing the moment requires both awareness and action. Investors are encouraged to stay informed about emerging trends and to develop robust strategies tailored to their financial goals. By doing so, they can effectively leverage the opportunities presented by this dynamic sector, ensuring long-term success in their investment endeavors.