Overview

The article "Understanding the Retail Real Estate Market Report" delineates the critical components and importance of retail real estate market reports in shaping investment and business strategies. It elucidates that these reports furnish essential insights into rental and vacancy rates, sales performance, and demographic trends. Such data is indispensable for stakeholders aiming to make informed decisions in a swiftly changing retail landscape, influenced by factors like the growth of e-commerce and shifts in consumer behavior.

By comprehensively understanding these reports, investors can better navigate the complexities of the market. The insights gleaned from rental and vacancy rates, for instance, can highlight emerging opportunities or potential risks. Furthermore, sales performance data not only reflects current market conditions but also forecasts future trends, allowing for proactive strategy adjustments.

In conclusion, retail real estate market reports serve as invaluable tools for stakeholders. They not only provide a snapshot of the current market but also equip investors with the knowledge needed to anticipate changes, thereby enhancing their decision-making processes.

Introduction

The retail real estate landscape is experiencing a transformative shift, propelled by changing consumer behaviors and the growth of e-commerce. Retail real estate market reports have become essential tools for investors, developers, and retailers, providing a wealth of insights that illuminate current trends and future opportunities. As the market grows increasingly complex, stakeholders must consider:

- How can they effectively navigate these changes?

- How can they leverage data to make informed decisions?

Understanding the nuances of these reports is crucial for anyone aiming to thrive in this dynamic environment.

Define Retail Real Estate Market Reports

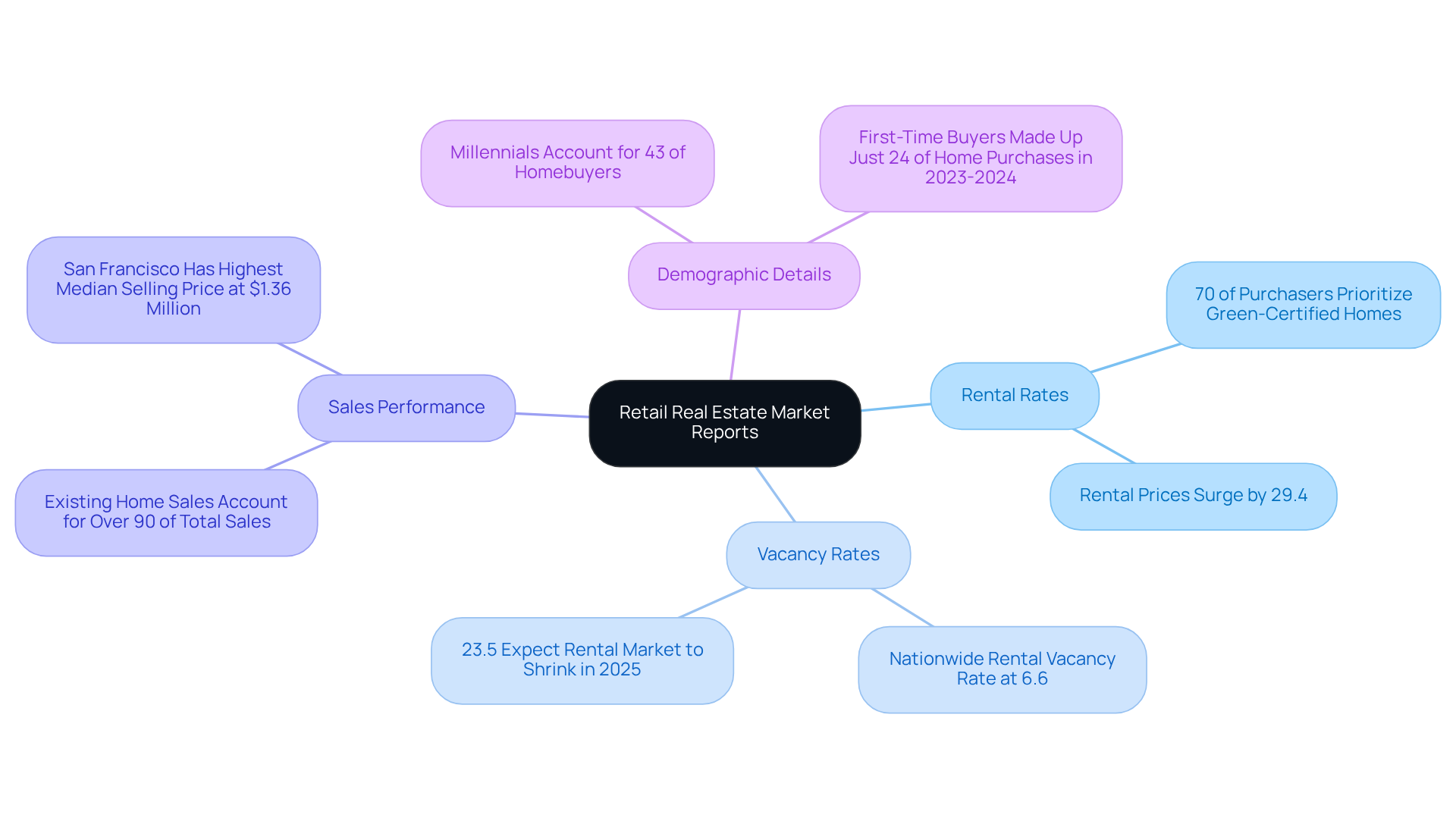

Commercial real estate analysis documents serve as comprehensive evaluations that deliver critical insights into the performance and trends of commercial properties. These documents encompass a broad spectrum of information, including:

- Rental rates

- Vacancy rates

- Sales performance

- Demographic details pertinent to commercial locations

By synthesizing data from diverse sources, they elucidate market dynamics and emerging developments that significantly influence the sales industry.

For instance, reports indicate that over 70% of purchasers prioritize green-certified homes, underscoring a growing trend toward sustainability that impacts property investments. This shift toward sustainability is poised to affect demand and rental rates for commercial spaces, making it imperative for investors to integrate these factors into their strategies. Furthermore, statistics reveal that rental prices have surged by 29.4% compared to pre-pandemic levels, reflecting intensified demand and affordability pressures. Such insights are invaluable for investors, developers, and real estate professionals, empowering them to make informed decisions regarding commercial property investments and management.

Expert perspectives underscore the significance of the retail real estate market report in navigating the complexities of the retail industry. The retail real estate market report functions not only as an indicator of current economic conditions but also as a forecasting tool for future developments, aiding stakeholders in strategizing effectively.

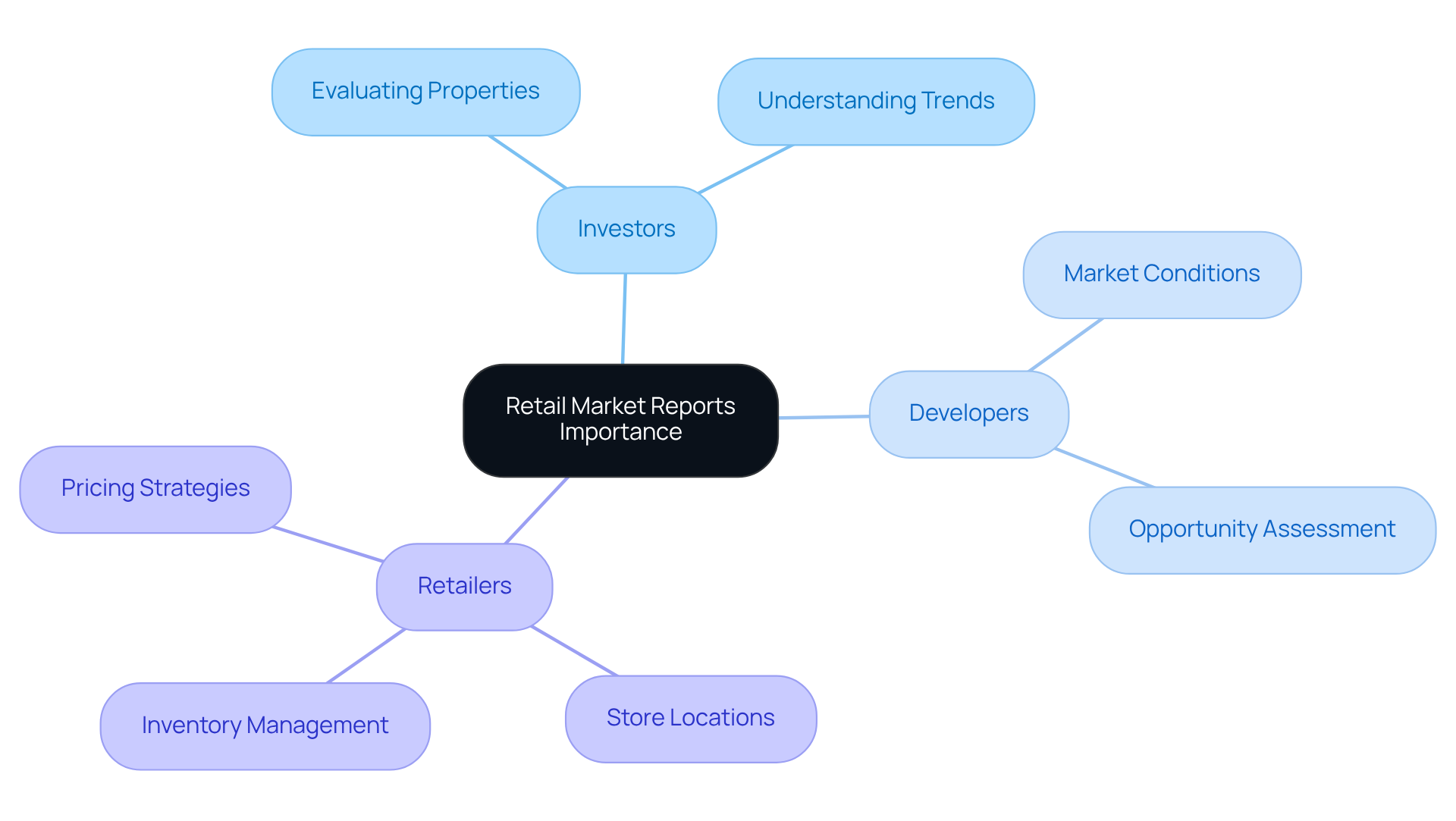

Contextualize the Importance of Retail Market Reports

The retail real estate market report serves as an essential instrument for investors, developers, and retailers, offering a thorough examination of conditions that aids in identifying both opportunities and risks. For instance, a shareholder looking to acquire commercial properties can leverage these documents to evaluate the viability of potential investments, informed by current industry trends and forecasts. Notably, shopping-center vacancy rates have reached a two-decade low at 5.4%, underscoring a favorable investment climate.

Retailers can utilize this data to make informed decisions regarding store locations, inventory management, and pricing strategies. In a landscape where 73% of customers now shop across multiple platforms, data-driven decision-making becomes imperative. These analyses are not merely tools; they illuminate the complexities discussed in the retail real estate market report. They assist in investment choices and shape business strategies, ensuring stakeholders remain competitive and adaptable to evolving industry dynamics, which is detailed in the retail real estate market report.

As Warren Buffett emphasizes, the most critical quality for an investor is temperament, not intellect. This underscores the necessity for informed, strategic decision-making that harnesses the insights provided by retail sector analyses.

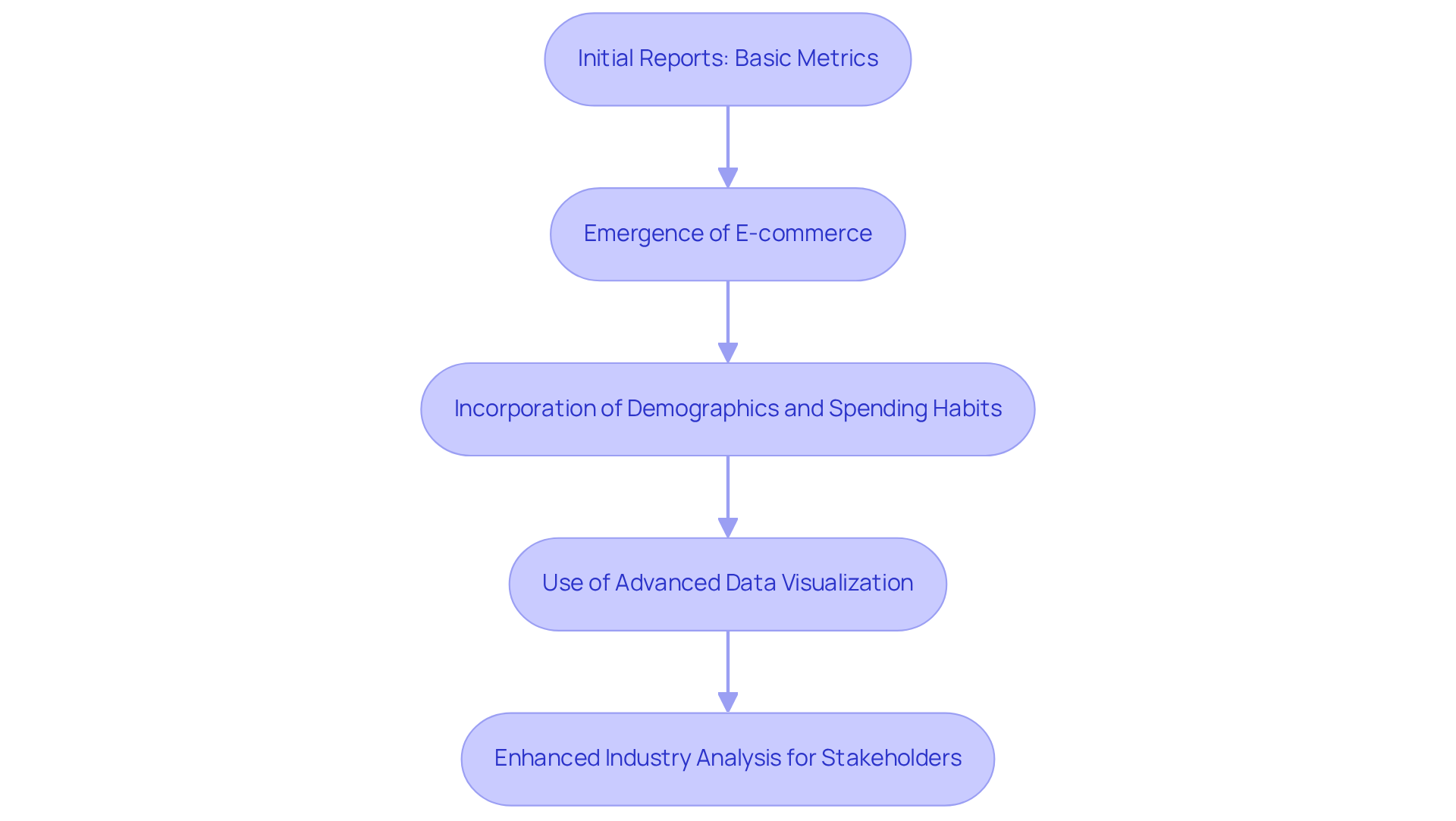

Trace the Evolution of Retail Real Estate Market Reports

The retail real estate market report illustrates the development of market analysis in commercial real estate, exemplifying the increasing complexity of the shopping industry and the necessity for advanced evaluation. Initially, these reports primarily highlighted basic metrics such as occupancy rates and rental prices. However, the rise of e-commerce and shifting consumer behaviors has necessitated a broader approach. The retail real estate market report now encompasses extensive data sets, including:

- Demographic changes

- Consumer spending habits

- Technological impacts on business operations

With e-commerce projected to account for 24% of worldwide sales by 2025, incorporating online shopping trends has become essential. Sophisticated analytics and data visualization tools are now employed to present insights in a more accessible and actionable format, capturing the dynamic nature of the commercial sector. This transformation not only enhances the significance of industry analyses but also empowers stakeholders to make informed decisions in an increasingly digital landscape.

Identify Key Components of Retail Market Reports

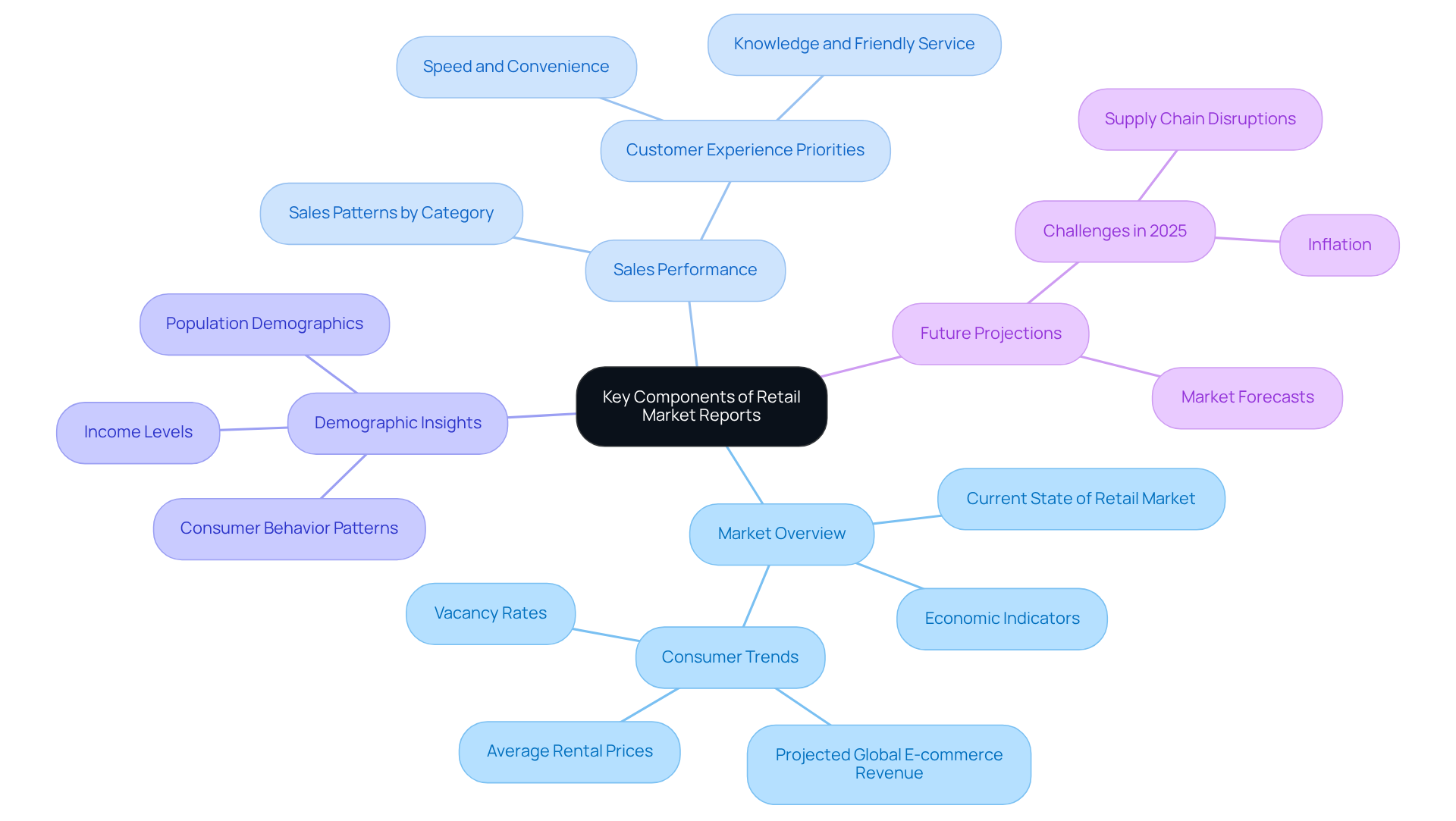

Key components of retail real estate market reports typically include:

-

Market Overview: A summary of the current state of the retail market, encompassing economic indicators and consumer trends. The global commercial e-commerce revenue is projected to reach $13.89 trillion by 2032, underscoring the significant growth in online shopping. The retail real estate market report includes detailed statistics on average rental prices and vacancy rates across various commercial sectors and geographic areas. By 2025, rental prices are expected to fluctuate based on regional demand and economic circumstances, while vacancy rates will reflect ongoing changes in consumer behavior and business strategies.

-

Sales Performance: The retail real estate market report examines sales patterns for different commercial categories, assisting stakeholders in assessing demand. Notably, 80% of Americans prioritize speed, convenience, knowledge, and friendly service in their customer experience, which can significantly influence sales performance.

-

Demographic Insights: The retail real estate market report includes demographic insights, which provide information on population demographics, income levels, and consumer behavior patterns that impact market performance. As Tony Hsieh noted, "Your brand is not what you sell; it's the experience you deliver," emphasizing the importance of understanding consumer needs.

-

Future Projections: Future projections in the retail real estate market report include forecasts based on current data trends, providing insights into potential market shifts and opportunities. For example, challenges such as supply chain disruptions and inflation are anticipated to impact the retail sector in 2025.

By understanding these components, stakeholders can better interpret the data and make informed decisions, leveraging insights from case studies on effective multi-channel marketing and the impact of employee training on customer experience.

Conclusion

The retail real estate market report stands as an indispensable resource for stakeholders navigating the intricacies of the commercial property landscape. By offering comprehensive insights into rental and vacancy rates, sales performance, and demographic trends, these reports empower investors, developers, and retailers to make informed decisions that resonate with current market dynamics. The focus on sustainability and the influence of e-commerce further underscore the necessity for strategic thinking in this rapidly evolving sector.

Key arguments presented in the article highlight the transformative nature of retail market reports, illustrating their evolution from basic metrics to sophisticated analyses that encompass a broad spectrum of data. The report's capacity to forecast future trends and pinpoint opportunities is vital, especially in an environment where consumer behavior and technological advancements are reshaping the retail landscape. With shopping-center vacancy rates at historic lows and the emergence of multi-channel shopping, grasping these insights is crucial for maintaining a competitive advantage.

Ultimately, leveraging the insights provided by retail real estate market reports is not merely beneficial but essential for stakeholders aiming to excel in a complex and swiftly changing marketplace. By adopting data-driven decision-making and remaining attuned to emerging trends, investors and retailers can navigate challenges adeptly and seize opportunities that arise, ensuring their strategies align seamlessly with the future of retail.