Overview

The Sitzer lawsuit emerged from a class-action complaint initiated by home sellers against the National Association of Realtors (NAR) and prominent real estate brokerages. This lawsuit asserts that mandatory fees paid to buyer agents inflate overall costs and stifle competition. The resolution of this case, which encompasses a substantial settlement and modifications to payment structures, is poised to enhance transparency in real estate transactions. It will facilitate negotiable fees, ultimately transforming real estate practices and delivering significant benefits to consumers by reducing overall costs.

Introduction

The Sitzer lawsuit represents a pivotal moment in the real estate industry, directly challenging long-standing commission structures that many contend inflate costs for home sellers. As a class-action complaint unfolds against the National Association of Realtors and major brokerages, it raises critical questions about market fairness and consumer rights.

What implications will the outcomes of this lawsuit have on the future of real estate transactions? How will stakeholders adapt to a landscape where negotiation and transparency take center stage?

These questions are essential for understanding the evolving dynamics of the market.

Explore the Origins and Key Issues of the Sitzer Lawsuit

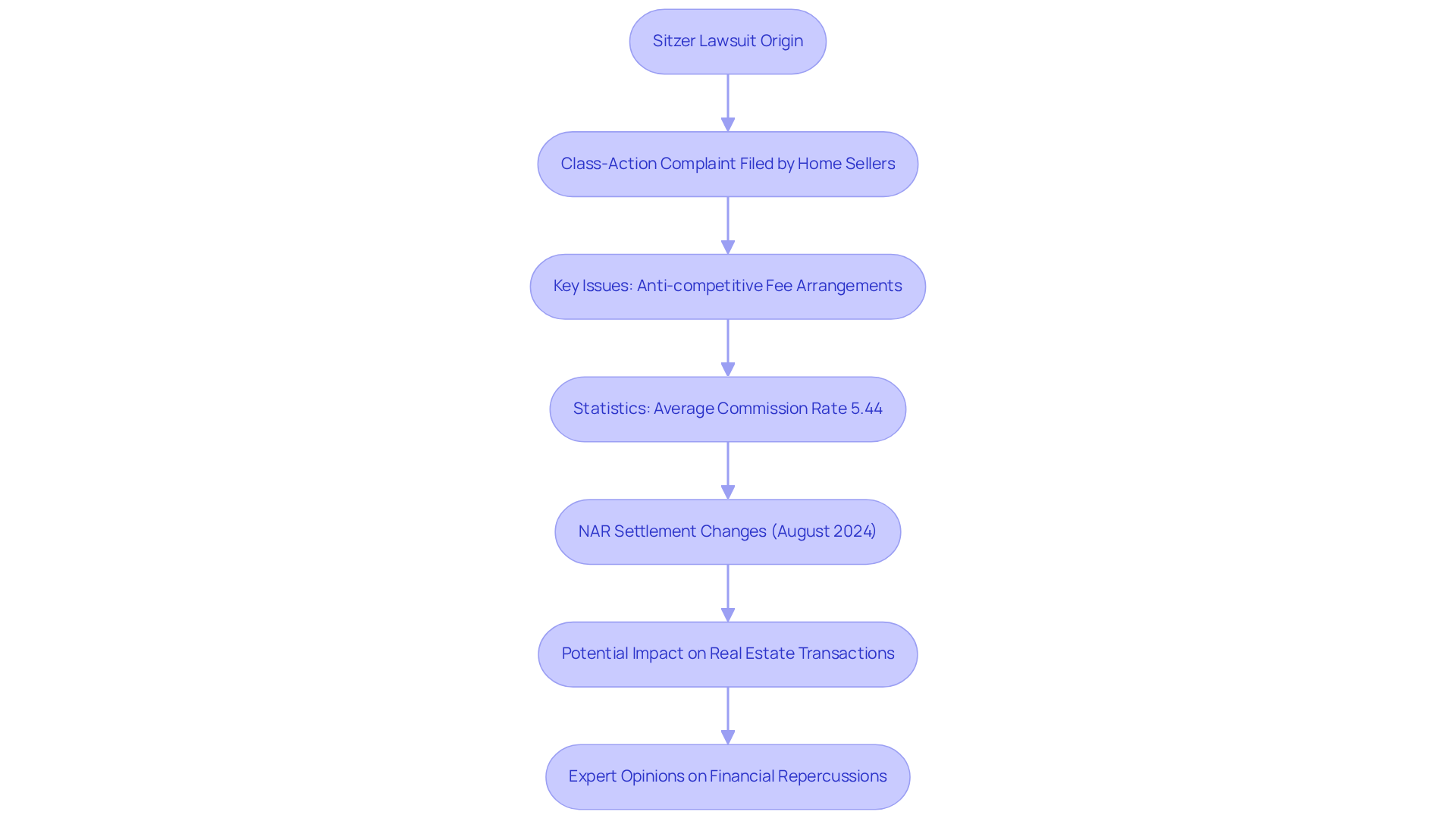

The lawsuit known as the Sitzer lawsuit originates from a class-action complaint filed by home sellers against the National Association of Realtors (NAR) and various major real estate brokerages. Plaintiffs assert that the existing fee arrangement, which often obligates sellers to pay the buyer's representative a fee, is anti-competitive and inflates overall costs. Central issues involve the enforcement of cooperative compensation regulations mandating sellers to provide fees to buyer agents, which the plaintiffs argue leads to artificially inflated rates.

Recent statistics indicate that the national average commission rate is around 5.44%, with 39 states witnessing commission increases from 2024 to 2025. This section delves into the specifics of the complaint, including legal arguments rooted in antitrust laws and the broader implications for market competition and consumer rights in property transactions. Notably, the NAR settlement changes effective August 2024 are pivotal, as they directly relate to the ongoing ramifications of the Sitzer lawsuit.

Additionally, insights from case studies such as 'Negotiability of Real Estate Commissions' and 'Changes in Realtor Fee Payment Structure' will be referenced to demonstrate how the lawsuit's outcomes could impact real estate transactions. Industry experts, including Trent Seigfried and Dave Liniger, have expressed concerns regarding the potential financial repercussions of untying rate structures, which could lead to a decrease in earnings estimated at $20 to $30 billion annually. Furthermore, there is a growing concern that first-time homebuyers may be excluded from professional representation due to these changes in fee structures.

The implications of this case extend beyond the immediate parties involved, affecting home sellers and buyers nationwide as they navigate the complexities of real property transactions.

Analyze the Settlement Outcomes and Their Implications for Stakeholders

The resolution of the Sitzer lawsuit, which concluded in late 2024, resulted in significant alterations to payment structures in real estate transactions. The National Association of Realtors (NAR) consented to a $418 million payment and implemented new policies that eliminate the automatic inclusion of purchase representative fees in listings. This change is expected to enhance transparency, enabling purchasers to negotiate fees directly with their representatives.

As of August 17, 2024, the new regulations necessitate that purchasers and their representatives reach an agreement on compensation arrangements prior to viewings, which may encompass flat fees, hourly rates, or percentage-based payments. This change is anticipated to foster a more competitive atmosphere, urging representatives to actively demonstrate their value to clients.

Statistics reveal that the typical buyer representative fee has experienced a slight decrease, falling from 2.45% to 2.36% annually following the settlement. Interestingly, properties valued under $500,000 saw a modest rise in fees, whereas luxury residences encountered a more substantial decline. Approximately 54% of representatives believe their clients are exerting more effort to discuss fees, indicating a shift in buyer-representative dynamics.

The consequences of these modifications extend to various parties, including property representatives, purchasers, and sellers. Real estate professionals may face pressure to adjust their compensation structures, with 75% expressing concerns about decreasing commission rates over the next five years, and 51% anticipating a drop within the next 12 months. Conversely, consumers are likely to benefit from improved transparency and the ability to negotiate terms that align with their financial interests. Most home sellers continue to pay buyer's representative compensation, suggesting that traditional practices still retain some influence in the market.

In summary, the NAR settlement signifies a transformative moment in the real estate sector, particularly due to the implications of the Sitzer lawsuit, reshaping the landscape of representative compensation and buyer-representative relationships. Stakeholders must navigate these changes thoughtfully to leverage new opportunities while addressing the challenges that arise from this evolving environment.

Assess the Broader Impact on Real Estate Practices and Market Dynamics

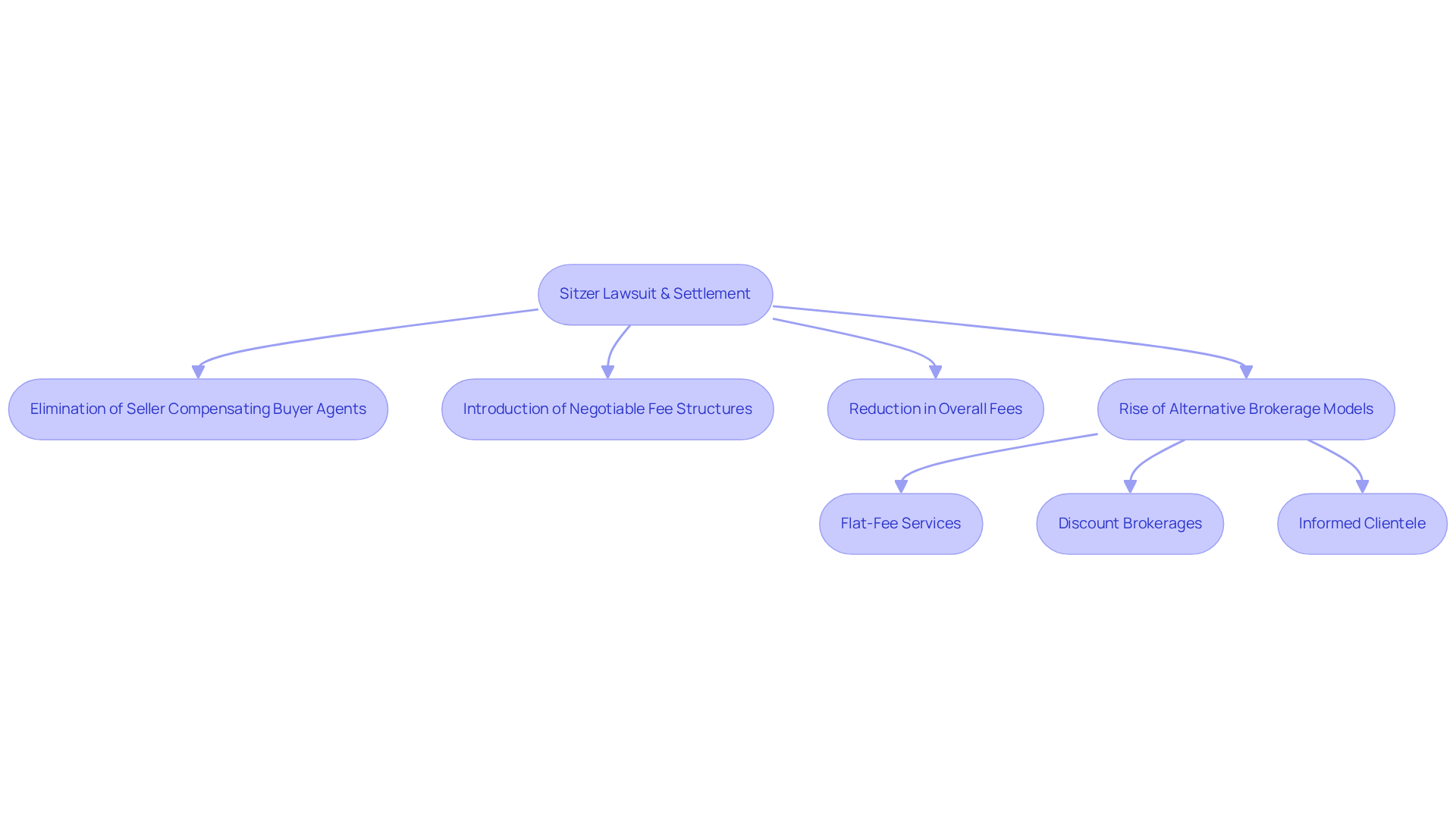

The Sitzer lawsuit, along with its subsequent settlement, is poised to significantly transform real property practices and market dynamics. By eliminating the obligation for sellers to compensate buyer representatives, the settlement fosters a transition toward more transparent and negotiable fee structures. This pivotal change is expected to result in a reduction of overall fees, benefiting consumers and reshaping the competitive landscape among real estate agents. For example, fees on a $400,000 home could potentially drop from $24,000 (6%) to as low as $8,000 (2%), representing a substantial cost saving for sellers. Industry experts anticipate that commissions may decrease by 25% to 50% in the long run, driven by enhanced transparency and competition, further underscoring the importance of the Sitzer lawsuit.

As consumers gain a clearer understanding of their rights and options, we may observe a rise in alternative brokerage models, such as flat-fee services and discount brokerages, which offer more competitive pricing structures. This shift is already manifesting, as numerous representatives adapt to the new landscape by providing flexible agreements with no minimum length required, empowering purchasers to negotiate fees directly.

Moreover, the requirement for purchasers to establish written agreements with their agents before visiting properties enhances accountability and enables consumers to negotiate fees directly. This newfound responsibility may cultivate a more informed clientele, ultimately transforming traditional practices within the real estate sector. However, it is crucial to acknowledge that first-time purchasers may face challenges related to initial expenses due to the new fee structure, necessitating careful budgeting. The implications of these changes related to the Sitzer lawsuit are profound, as they not only affect commission structures but also influence how agents operate and how consumers interact with the market. The $418 million settlement amount agreed upon by the NAR highlights the significance of these changes and their potential impact on the industry.

Conclusion

The Sitzer lawsuit marks a pivotal moment in the real estate industry, challenging long-standing practices surrounding commission structures and compensation. By addressing the anti-competitive nature of seller-paid buyer representative fees, this case has opened the door for significant changes that promote transparency and consumer choice in property transactions.

Key points throughout the article illuminate the lawsuit's origins, the implications of the settlement, and the potential transformations in real estate practices. The National Association of Realtors' settlement, which includes a substantial financial payout and new regulations, aims to reshape the dynamics between buyers and their representatives. As the industry adapts to these changes, there is an expectation of reduced commission rates alongside the emergence of more flexible fee arrangements, ultimately benefiting consumers.

The broader implications of the Sitzer lawsuit extend beyond immediate financial adjustments; they signal a shift towards a more competitive and equitable real estate market. Stakeholders—including agents, buyers, and sellers—must navigate this evolving landscape thoughtfully. They should embrace the opportunities for innovation while remaining mindful of the challenges that may arise. As the real estate sector continues to adapt, it is essential for all parties involved to stay informed and proactive in leveraging these changes to their advantage.