Overview

The commercial real estate market is poised for significant expansion, projected to reach approximately $25.79 trillion by 2025. This growth is underpinned by a compound annual growth rate (CAGR) of 2.22% from 2025 to 2029, primarily driven by the burgeoning industrial sector fueled by e-commerce demands. Such insights are critical for investors aiming to navigate the evolving landscape.

Supporting this projection, the article meticulously details performance metrics, vacancy rates, and demographic trends that influence market dynamics. These factors collectively illustrate the forces shaping the commercial real estate environment. Investors must consider how these elements interact to inform their strategies effectively.

In conclusion, understanding these market insights not only highlights the current state of the commercial real estate sector but also underscores the importance of adapting investment approaches in response to emerging trends. By leveraging this knowledge, investors can position themselves advantageously in a competitive market.

Introduction

The commercial real estate market is at a pivotal juncture, influenced by evolving economic conditions and shifting consumer preferences. Investors and industry stakeholders must navigate this complex landscape, where understanding key concepts and metrics is essential for making informed decisions.

With challenges such as rising vacancy rates and fluctuating interest rates looming, one must consider:

- How can we effectively gauge the market's trajectory?

- How can we seize opportunities amidst uncertainty?

Define Commercial Real Estate: Key Concepts and Terminology

Commercial real estate (CRE) pertains to assets utilized solely for business purposes, generating income through leasing or selling. Key concepts include:

-

Types of Commercial Real Estate: This includes office buildings, retail spaces, industrial properties, and multifamily housing. Each type has unique characteristics and market dynamics. For instance, office buildings currently face a 17.6% vacancy rate, with Class A office space reaching a 20% vacancy rate. In contrast, industrial real estate boasts a lower vacancy rate of 6.42%, with reports indicating a vacancy rate of just 4.6% as of February 2023, the second-lowest after the retail sector.

-

Investment Metrics: Important terms such as Net Operating Income (NOI), Capitalization Rate (Cap Rate), and Gross Rental Income (GRI) are essential for evaluating the profitability of CRE investments. The average cap rate for all asset types has soared since 2021 due to declining real estate values, indicating a significant shift in investment strategies.

-

Market Dynamics: Understanding how supply and demand, vacancy rates, and rental growth influence the size of the commercial real estate market is vital for making informed decisions. The retail sector has seen a rise in vacancies, with malls experiencing an 8.6% vacancy rate, while general retail stores accounted for 98% of net absorption in the past year, highlighting evolving consumer preferences.

-

Investment Share Insights for 2025: As of 2025, multifamily assets have surpassed office spaces as the primary investment target, indicating a considerable change in focus. Multifamily property owners experienced a 7.6% increase in value over the same period. The property sector is anticipated to keep changing, with office vacancy rates predicted to reach 19% based on CBRE projections.

Grasping these fundamental ideas and current language is crucial for navigating the intricacies of the business property sector and making strategic investment choices.

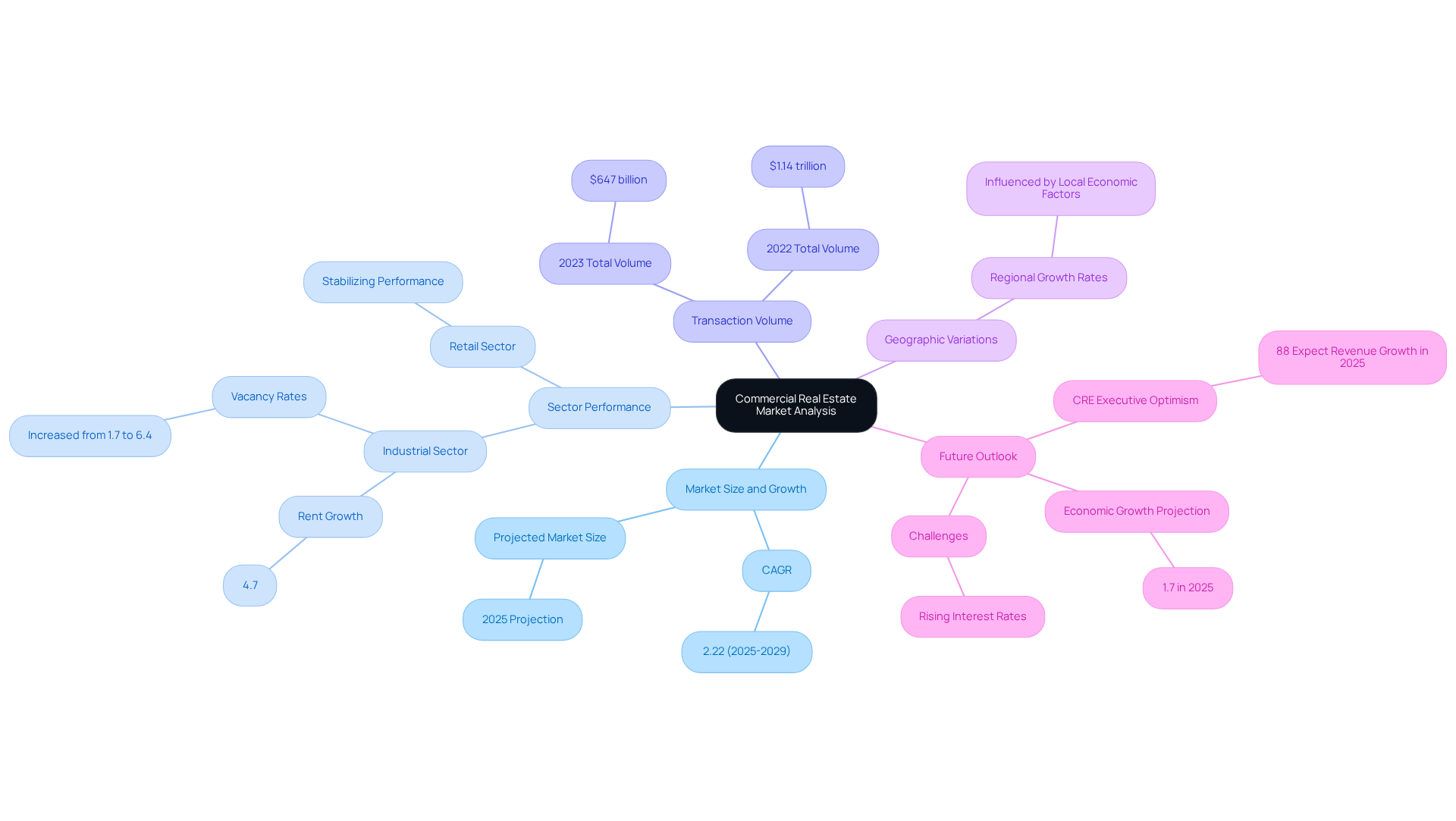

Analyze Current Market Size and Growth Trends in Commercial Real Estate

In 2025, the size of the commercial real estate market in the U.S. property sector is projected to reach approximately $25.79 trillion, reflecting a compound annual growth rate (CAGR) of 2.22% from 2025 to 2029. Key trends shaping this landscape include the following:

- Sector Performance: The industrial sector is experiencing significant growth, primarily driven by the surging demands of e-commerce and logistics, with rent growth reaching 4.7%. However, this sector is also facing rising vacancy rates, which have increased from 1.7% to 6.4%. In contrast, the retail sector is stabilizing, adeptly navigating various challenges while maintaining steady performance.

- Transaction Volume: The total dollar volume of commercial real estate transactions in 2023 was $647 billion, a marked decline from $1.14 trillion in 2022. This reduction indicates essential adjustments in response to shifting economic conditions.

- Geographic Variations: Growth rates are not uniform across regions, influenced by local economic factors, demographic shifts, and urbanization trends. For example, areas with robust logistics infrastructure are witnessing heightened demand, while others may encounter stagnation due to economic constraints.

Moreover, 88% of CRE executives expect their firms' revenues to increase in 2025, signaling optimism in the economy. The U.S. economy is anticipated to grow by 1.7% in 2025, creating a favorable environment for business property growth. However, rising interest rates are escalating borrowing costs, which may dampen demand from businesses and investors, presenting challenges for the sector.

Overall, the property sector is adapting to new circumstances, emphasizing areas that align with current consumer behaviors and economic forecasts.

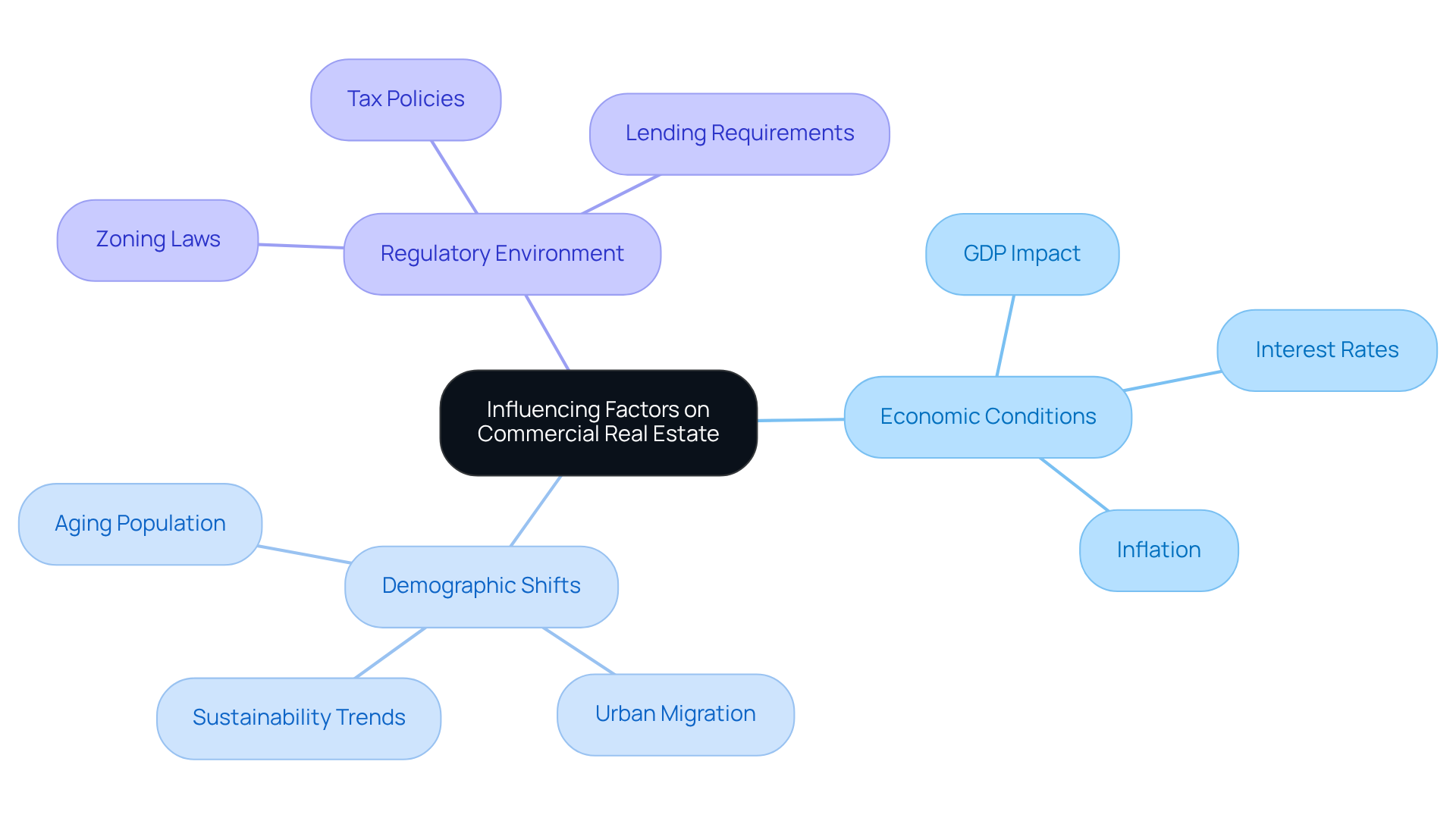

Examine Influencing Factors: Economic, Demographic, and Regulatory Impacts

Several key factors influence the commercial real estate market:

-

Economic Conditions: Economic growth, interest rates, and inflation directly impact investment decisions and property values. For instance, a slight contraction in U.S. GDP in Q1 2025 has implications for leasing and investment trends. Notably, the business real estate sector contributed $2.5 trillion to U.S. GDP in 2024, underscoring its significance in the economy.

-

Demographic Shifts: Changes in population dynamics, such as an aging population and urban migration, significantly influence the demand for various types of business real estate. The rise of remote work has notably increased demand for suburban office spaces, as companies seek flexible work environments that cater to a dispersed workforce. Furthermore, over 70% of homebuyers consider sustainability when making purchasing decisions, with green-certified structures generally securing sale prices 15% higher than their non-certified counterparts. This trend is poised to shape commercial real estate development, as properties meeting these criteria become increasingly sought after. Additionally, CBRE forecasts a 5-10% reduction in leasing volume for 2025, indicating shifting dynamics within the industry.

-

Regulatory Environment: New zoning laws, tax policies, and lending requirements can significantly impact market conditions. As 2025 progresses, regulatory changes are expected to transform the investment landscape, potentially affecting how and where properties are developed and financed. For example, the recent GOP tax legislation approved in July 2025 includes clauses that could assist the estate sector, further influencing investment strategies.

These factors collectively shape the size of the commercial real estate market, making it essential for investors and industry experts to remain attuned to current demographic trends and regulatory shifts.

Forecast Future Trends: Projections for the Commercial Real Estate Market

Looking ahead, several trends are poised to shape the commercial real estate market significantly.

-

Continued Growth in the Industrial Sector: The industrial sector is set for sustained growth, primarily driven by the ongoing expansion of e-commerce and the increasing demand for logistics and distribution facilities. In 2024, industrial construction starts totaled 236 million square feet, reflecting robust activity in this segment. Notably, e-commerce-related leasing accounted for 35% of new industrial space leases, underscoring the sector's resilience and adaptability.

-

Growth Projections for 2025: Projections indicate that the industrial sector will continue to flourish in 2025, with demand for specialized facilities such as data centers, cold storage, and EV battery plants on the rise. CBRE forecasts a 5% increase in leasing volume by the end of 2025, influenced by a construction slowdown and shifting occupier sentiment. Despite facing challenges such as elevated development expenses and regulatory barriers, the potential economic advantages of these specialized assets are drawing considerable attention from investors and communities alike.

-

Expert Insights on Industrial Sector Growth: Industry experts emphasize that the demand for industrial buildings, particularly near key trade corridors like the U.S.-Mexico border, is expected to increase due to evolving trade policies. This trend is anticipated to create new opportunities for developers and investors, especially in markets such as San Antonio, Austin, and Dallas-Fort Worth.

-

Technological Integration: The incorporation of technology in real estate management and leasing processes is set to enhance operational efficiency and tenant experiences. Companies are increasingly prioritizing adaptable, technology-enabled spaces to meet evolving research and operational needs, particularly in sectors like life sciences. Notably, 88% of respondents plan to use digital technologies to improve performance over the next 12 to 18 months.

-

Sustainability Focus: A growing emphasis on sustainability and ESG (Environmental, Social, and Governance) factors will continue to influence investment strategies and property development. The issuance of sustainability-linked bonds reached US$66 billion in 2023, demonstrating a broader commitment to environmentally responsible practices within the business property sector.

These trends collectively indicate a dynamic landscape for the commercial real estate market, particularly within the industrial sector, as it adapts to changing consumer behaviors and technological advancements.

Conclusion

Understanding the complexities of the commercial real estate (CRE) market is essential for navigating its current landscape and making informed investment decisions. This article has explored the fundamental concepts of CRE, examined the current size and growth trends, and analyzed the various economic, demographic, and regulatory factors influencing the market. By grasping these elements, stakeholders can better position themselves within this evolving sector.

Key insights discussed include:

- The significant growth within the industrial sector

- The shifting dynamics in office and retail spaces

- The impact of economic conditions on property values and investment strategies

Additionally, the article highlighted the importance of understanding market metrics such as:

- Vacancy rates

- Cap rates

- Transaction volumes

These metrics are crucial for evaluating investment opportunities. As the CRE market adapts to changing consumer behaviors and technological advancements, staying informed about these trends is vital for success.

As the commercial real estate landscape continues to evolve, it is imperative for investors, developers, and industry professionals to remain vigilant and adaptable. Embracing sustainability, leveraging technology, and understanding demographic shifts will play a crucial role in shaping future investment strategies. By actively engaging with these trends and insights, stakeholders can seize new opportunities and navigate the complexities of the CRE market effectively.