Overview

The article titled "Understanding Triple Net REIT: Benefits, Risks, and Market Trends" delves into the structure, advantages, and challenges inherent in investing in triple net REITs. These investment vehicles are particularly noteworthy for their ability to provide stable income through long-term leases, with tenants typically covering most expenses. However, it is crucial to acknowledge the associated risks, such as tenant defaults and market fluctuations. Therefore, strategic planning is essential in navigating the current economic landscape.

Investors must be aware that while triple net REITs offer appealing benefits, they are not without their challenges. Understanding these dynamics can significantly influence investment decisions. By recognizing the importance of thorough market analysis and risk assessment, investors can position themselves to capitalize on the potential of triple net REITs. In conclusion, a well-informed approach is vital for maximizing the advantages while mitigating the risks associated with these investment opportunities.

Introduction

Triple net REITs have emerged as a compelling investment vehicle, drawing significant attention for their unique structure and the promise of stable income. By shifting the burden of property expenses to tenants, these real estate investment trusts present a potentially lucrative opportunity for investors seeking reliability amidst market fluctuations. However, understanding the inherent risks and the evolving market landscape is crucial.

What challenges lie ahead for triple net REITs?

How can investors navigate the complexities of this specialized sector to optimize their returns?

These questions are essential for making informed investment decisions.

Define Triple Net REITs and Their Structure

Triple net REITs represent a specialized category of real estate investment entities focused on assets leased to tenants under long-term net leases. In this arrangement, tenants bear the responsibility not only for paying rent but also for covering taxes, insurance, and maintenance expenses. This unique structure significantly reduces the financial obligations of the landlord, leading to a stable income stream for the REIT. Typically, triple net REITs focus on acquiring commercial properties, including retail spaces, office buildings, and industrial facilities.

The characteristics of triple net REITs make them appealing to investors seeking reliable cash flow with minimized management duties. These trusts often exhibit resilience in fluctuating environments, as evidenced by their performance during economic uncertainties. For example, net-leased retail real estate investment trusts have shown remarkable stability, focusing on essential, non-discretionary retail sectors while fostering strong tenant relationships. Capright Triple-Net Retail Real Estate Investment Trusts have demonstrated resilience in Q1 2025, highlighting their ability to navigate challenging economic conditions.

Current statistics indicate that the sector for triple net REIT remains robust, with numerous investors recognizing their potential for consistent returns. Notable examples of successful triple net REIT investments include:

- Realty Income Corporation, which reported a total return of 6.19% and a stock price of $57.84

- Agree Realty Corporation, achieving a total return of 15.64% as of July 22, 2025

Understanding the structure and operational dynamics of a triple net REIT is essential for investors, as it directly impacts their risk and return profiles. A well-defined strategy aids in navigating shifting business conditions and economic cycles. As real estate specialist Kristopher C. Oxtal observes, "In a market characterized by uncertainty, net-leased retail real estate investment trusts continue to stand out as a model of resilience." He further emphasizes, "The result? In many cases, performance has exceeded expectations, backed by robust liquidity and a clear eye toward future opportunities." This insight underscores the critical importance of strategic planning when navigating the complexities of real estate investments.

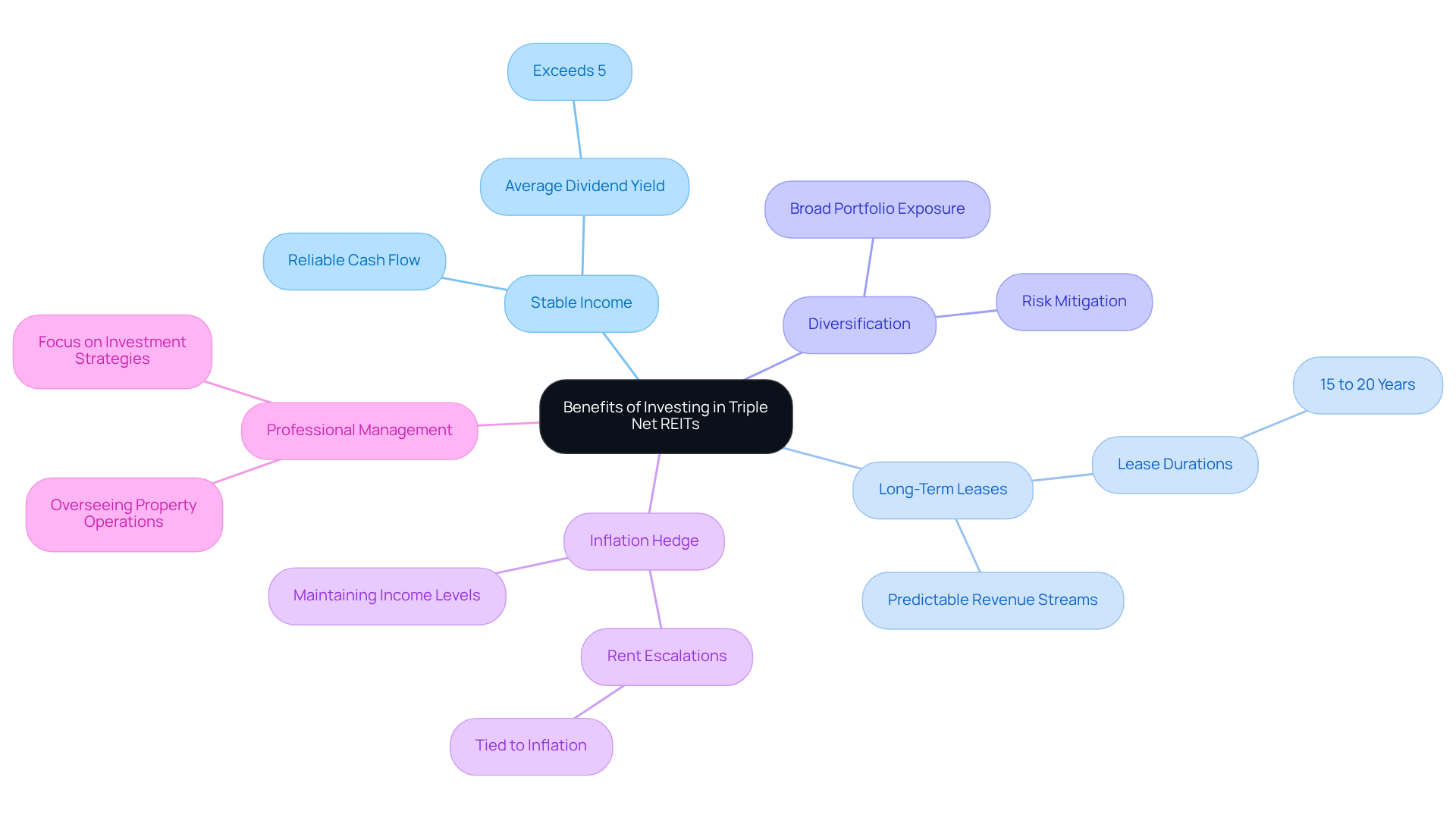

Explore the Benefits of Investing in Triple Net REITs

Investing in a triple net REIT offers significant advantages that are particularly appealing to income-focused investors.

-

Stable Income: NNN real estate investment trusts consistently deliver reliable cash flow, as tenants cover most property expenses. This makes them an attractive option for those seeking dependable income. Currently, the average dividend yield for triple net REIT investments exceeds 5%, providing a robust income stream for investors.

-

Long-Term Leases: Many NNN leases are structured for extended durations, often exceeding 15 to 20 years. This ensures predictable revenue streams and minimizes turnover risks. Such long-term stability is crucial for sustaining cash flow amidst variable market conditions.

-

Diversification: By investing across a variety of sectors, NNN REITs allow investors to broaden their portfolios without the complexities of direct real estate management. This diversification effectively mitigates risks associated with price fluctuations.

-

Inflation Hedge: Numerous leases feature rent escalations tied to inflation, protecting investors from the erosion of purchasing power over time. Financial analyst Seiya Tabuchi notes that typical triple net REITs sign initial lease terms of around 15 to 20 years, which helps in maintaining income levels during inflationary periods.

-

Professional Management: Investors reap the benefits of professional management teams that oversee property operations, allowing them to focus on broader investment strategies. Dane Bowler highlights that the sector is currently undervalued compared to historical averages, indicating substantial potential for capital appreciation as market conditions improve.

In summary, the combination of stable income, long-term leases, diversification, inflation protection, and professional management positions triple net REITs as a compelling investment choice for those focused on generating reliable income.

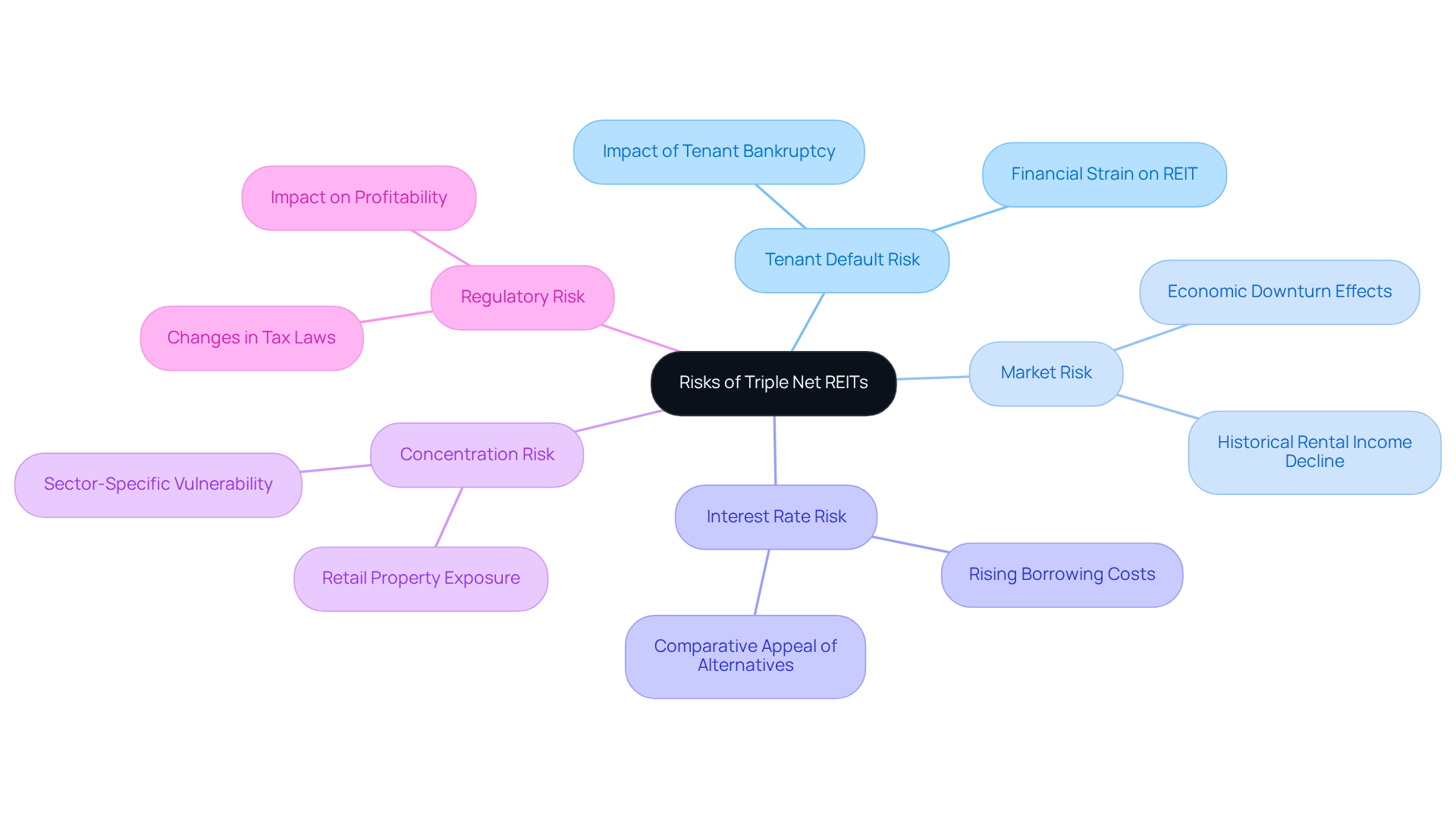

Assess the Risks Involved with Triple Net REITs

While Triple Net REITs present lucrative opportunities, they also entail specific risks that investors must consider:

-

Tenant Default Risk: A tenant's failure to fulfill lease obligations can significantly undermine the REIT's income and overall performance. Given that occupants in agreements with a triple net REIT bear responsibility for taxes, insurance, and maintenance, any default can impose substantial financial strain on the REIT. For instance, tenant bankruptcy can adversely affect both REIT income and asset value.

-

Market Risk: Economic downturns can adversely influence property values and rental rates, leading to diminished revenues for triple net REITs. Historical data reveals that during economic slowdowns, rental income often declines, which can impact cash flow and dividend payouts. For example, shares of the triple net REIT NNN have fallen by over 15% since their 52-week highs, highlighting the potential volatility during market fluctuations.

-

Interest Rate Risk: Rising interest rates can elevate borrowing costs for triple net REITs, making alternative investments more attractive and potentially reducing demand for their shares. As interest rates increase, the allure of REIT dividends may wane in comparison to other income-generating assets. Currently, NNN offers a dividend yield of 5.74%, surpassing the peer group average of 4.86%, yet increasing rates could diminish this appeal.

-

Concentration Risk: Certain triple net REITs may maintain a concentrated portfolio within specific sectors or tenants, which heightens their susceptibility to sector-specific downturns. For example, a REIT with heavy investments in retail properties may find its performance disproportionately affected by a decline in consumer spending.

-

Regulatory Risk: Changes in tax laws or regulations impacting real estate can significantly affect the profitability of triple net REITs. For instance, shifts in tax policy could modify the tax advantages that render these investments attractive, thereby influencing overall returns for investors.

Understanding these risks is crucial for investors considering triple net REITs. They must weigh potential benefits against the inherent uncertainties within the industry.

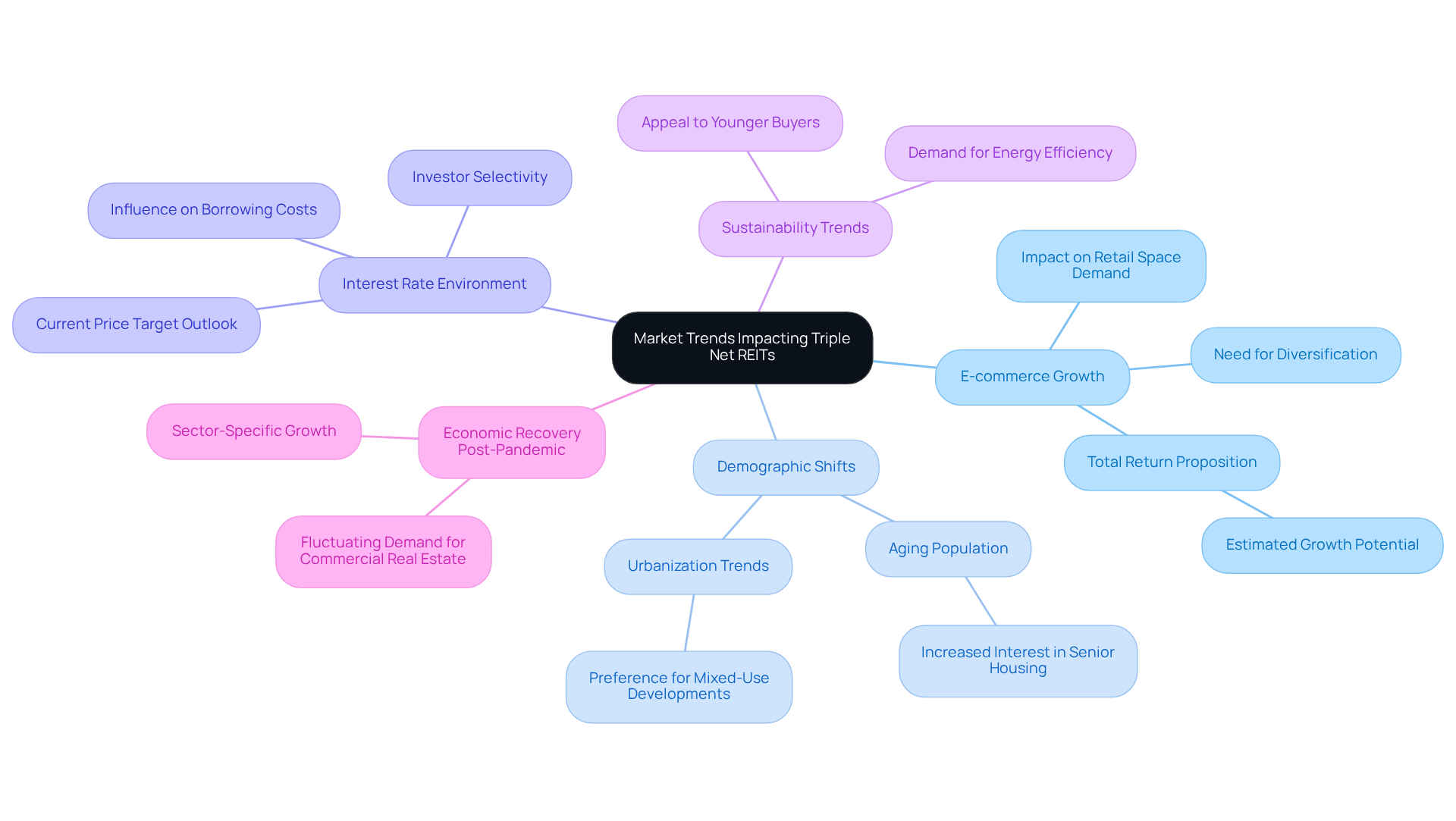

Analyze Market Trends Impacting Triple Net REITs

Several market trends currently impact Triple Net REITs:

-

E-commerce Growth: The rise of online shopping has significantly altered the demand for retail space, particularly affecting NNN investment trusts focused on traditional retail locations. As consumers increasingly prefer e-commerce, many brick-and-mortar retailers are reassessing their physical footprints, resulting in higher vacancy rates in certain retail segments. This transition necessitates that triple net REITs diversify their portfolios to include assets that cater to e-commerce logistics and distribution centers. According to industry analysts, the total return proposition for the sector is estimated at 9% to 12%, indicating substantial growth potential in this area.

-

Demographic Shifts: Changes in population dynamics, such as an aging population and urbanization trends, are reshaping the demand for various real estate categories. For instance, the aging Baby Boomer demographic is driving increased interest in senior housing and healthcare-related real estate, while younger generations gravitate towards urban living and rental options. This demographic evolution compels investors to consider properties that align with these shifting preferences, including mixed-use developments that cater to diverse lifestyles. Seiya Tabuchi notes that "the market will recognize the outsized total return that the sector provides relative to its risk and bid up shares to a more appropriate level."

-

Interest Rate Environment: The prevailing interest rate climate plays a crucial role in influencing borrowing costs and investor appetite for REITs. As interest rates rise, financing costs increase, potentially dampening investment activity in the commercial real estate sector. Investors may become more selective, focusing on assets with stable cash flows and long-term leases to mitigate risks associated with rising borrowing costs. The average price target for triple net REITs is currently $43.75, reflecting a cautious outlook in this environment.

-

Sustainability Trends: There is an increasing emphasis on sustainability and energy efficiency within the real estate sector. Properties that integrate green building practices and energy-efficient technologies are becoming more appealing to tenants, especially among younger buyers who prioritize sustainability. Triple net REITs that proactively adopt these practices may enhance their asset values and tenant retention rates, positioning themselves advantageously in a competitive market. Analysts suggest that properties with sustainable features are likely to experience heightened demand as consumer preferences evolve.

-

Economic Recovery Post-Pandemic: As economies recover from the pandemic, the demand for commercial real estate is expected to fluctuate. While some sectors, such as industrial and logistics, may witness robust growth due to increased e-commerce activity, others, particularly traditional retail and office spaces, may continue to face challenges. Investors must remain vigilant and adaptable, monitoring economic indicators and consumer behavior to make informed decisions regarding their investments in triple net REITs. Case studies, such as Realty Income's strategic acquisitions, illustrate how companies are effectively navigating these changes.

Conclusion

Triple net REITs present a distinctive investment opportunity, characterized by a structure that shifts significant financial responsibilities to tenants. This arrangement not only provides a steady income stream for investors but also minimizes the complexities typically associated with property management. By focusing on long-term leases and a diverse portfolio, triple net REITs have become increasingly attractive to those seeking reliable returns in a fluctuating market.

The article highlights several key benefits of investing in triple net REITs:

- Stable income generation

- Long-term lease agreements

- Professional management

- Diversification

- Hedge against inflation

However, it is essential to consider inherent risks, such as:

- Tenant default

- Market volatility

- Interest rate fluctuations

These risks can significantly impact overall performance.

In light of current market trends—such as the growth of e-commerce and demographic shifts—investors are encouraged to remain vigilant and adaptable. The landscape of triple net REITs is evolving; those who strategically align their investment choices with these trends may uncover substantial opportunities. By understanding both the benefits and risks, investors can make informed decisions that capitalize on the enduring appeal of triple net REITs while navigating the complexities of the real estate market.