Overview

The fastest growing real estate markets are marked by rapid increases in property values and heightened demand. Cities such as Buffalo, NY, and Indianapolis, IN, are at the forefront of this trend, driven by robust economic growth and significant infrastructural development. This article underscores the impact of job creation and urban development initiatives in these cities, which are pivotal in driving demand. As investors recognize the potential in these emerging markets, property values are appreciating significantly, creating compelling opportunities for investment.

Introduction

In the dynamic realm of real estate, grasping the nuances of fast-growing markets is crucial for astute investors eager to seize emerging opportunities. As cities like Buffalo, NY, and Indianapolis, IN, ascend to prominence in 2025—propelled by economic revitalization and demographic shifts—the landscape brims with potential.

However, traversing this terrain necessitates a sharp awareness of the factors influencing property values, such as:

- Economic stability

- Infrastructure development

- Evolving buyer preferences

With trends like remote work and sustainability reshaping demand, investors must remain informed and adaptable to make strategic decisions in a landscape characterized by both opportunity and uncertainty.

This article explores the key characteristics, driving forces, and future outlook of these burgeoning real estate markets, providing insights that can guide investment strategies in an ever-evolving environment.

Understanding Fast-Growing Real Estate Markets

The fastest growing real estate markets are marked by rapid increases in property values, heightened demand for residences, and robust investment activity. These sectors typically emerge within the fastest growing real estate markets that are experiencing economic growth, population surges, or significant infrastructural development. For investors, grasping these dynamics is crucial for identifying and seizing emerging opportunities in the fastest growing real estate markets, with cities like Buffalo, NY, and Indianapolis, IN, at the forefront of growth projected for 2025.

Buffalo's revitalization efforts, coupled with job creation in sectors such as healthcare and technology, have positioned it as one of the fastest growing real estate markets. Similarly, Indianapolis benefits from a diverse employment base and ongoing urban development initiatives, placing it among the fastest growing real estate markets, making it an attractive destination for both residents and investors.

In Omaha, the demand for housing is bolstered by a varied employment base and an effective housing development process, establishing it as one of the fastest growing real estate markets. Statistics indicate that property values in these cities have seen substantial appreciation, with certain areas reporting increases exceeding 10% year-over-year. This trend mirrors a broader pattern observed across multiple sectors, particularly in the fastest growing real estate markets, where demand consistently outstrips supply.

Historical context is also significant; for instance, vacancy rates in the 1980s dipped to around 2.5% when mortgage rates doubled, illustrating the cyclical nature of the system.

Expert opinions further underscore the potential of the fastest growing real estate markets. Jessica Sawyer, the 2025 President of the Omaha Area Board of Realtors, notes that while buyers are adjusting to elevated mortgage rates, the overall market remains competitive, particularly for listings priced over $500,000. This sentiment reflects a common theme in the fastest growing real estate markets, where rising prices present challenges for first-time buyers but signal strong demand.

Moreover, recent developments highlight proposed housing policy changes aimed at tackling affordability issues, such as streamlining zoning processes and making federal land available for new construction. These initiatives, advocated by President Trump, could further stimulate growth in already dynamic sectors and are vital for understanding the evolving landscape of property.

In summary, the characteristics defining the fastest growing real estate markets encompass financial vitality, demographic shifts, and proactive policy measures. Investors should closely monitor these trends to make informed decisions in the ever-changing property environment.

Key Factors Driving Market Growth

The expansion of real estate sectors is influenced by several key elements, including economic stability, population dynamics, and infrastructure development. Economic indicators, particularly job creation and income levels, play a crucial role in shaping demand for residences. For instance, areas with robust employment opportunities tend to attract new inhabitants, thereby increasing both demand for residences and property values.

In 2025, the relationship between job creation and demand for residences is expected to be particularly pronounced. Regions that effectively generate employment opportunities will likely witness a surge in population influx, further driving the real estate market.

Demographic trends also significantly impact the sector's growth. The migration of younger populations to urban centers represents a major shift that fuels demand for accommodation, as these individuals seek proximity to job opportunities and amenities. Moreover, local government policies that promote development and investment can greatly affect market trajectories.

For example, recent discussions regarding potential residential policy changes under the Trump administration highlight the importance of zoning reforms and the accessibility of federal land for residential projects. While these policies aim to facilitate development, they also raise concerns about labor shortages in construction due to immigration restrictions, complicating efforts to meet accommodation demand.

In addition to these factors, financial stability remains a cornerstone of accommodation demand. Experts emphasize that a stable financial environment fosters consumer confidence, leading to increased investment in real estate. As we move through 2025, the interplay between financial conditions and property demand will be crucial. Economists note that fluctuations in employment trends and income levels will directly impact property values and rental rates.

Notably, an increase of $13 per month in mortgage payments in February 2025 equates to nearly $7,200 more over a 30-year loan, underscoring the financial implications of economic stability on housing demand. Overall, understanding these dynamics is essential for investors aiming to navigate the evolving landscape of the fastest-growing real estate markets. It is also important to acknowledge that the study did not predict future changes in annual rent increases and home appreciation rates, which could influence investor expectations.

Finally, design trends for 2025 indicate a preference for soft or warm whites in primary living spaces, adding a modern touch to consumer preferences.

Top Fastest Growing Real Estate Markets in 2025

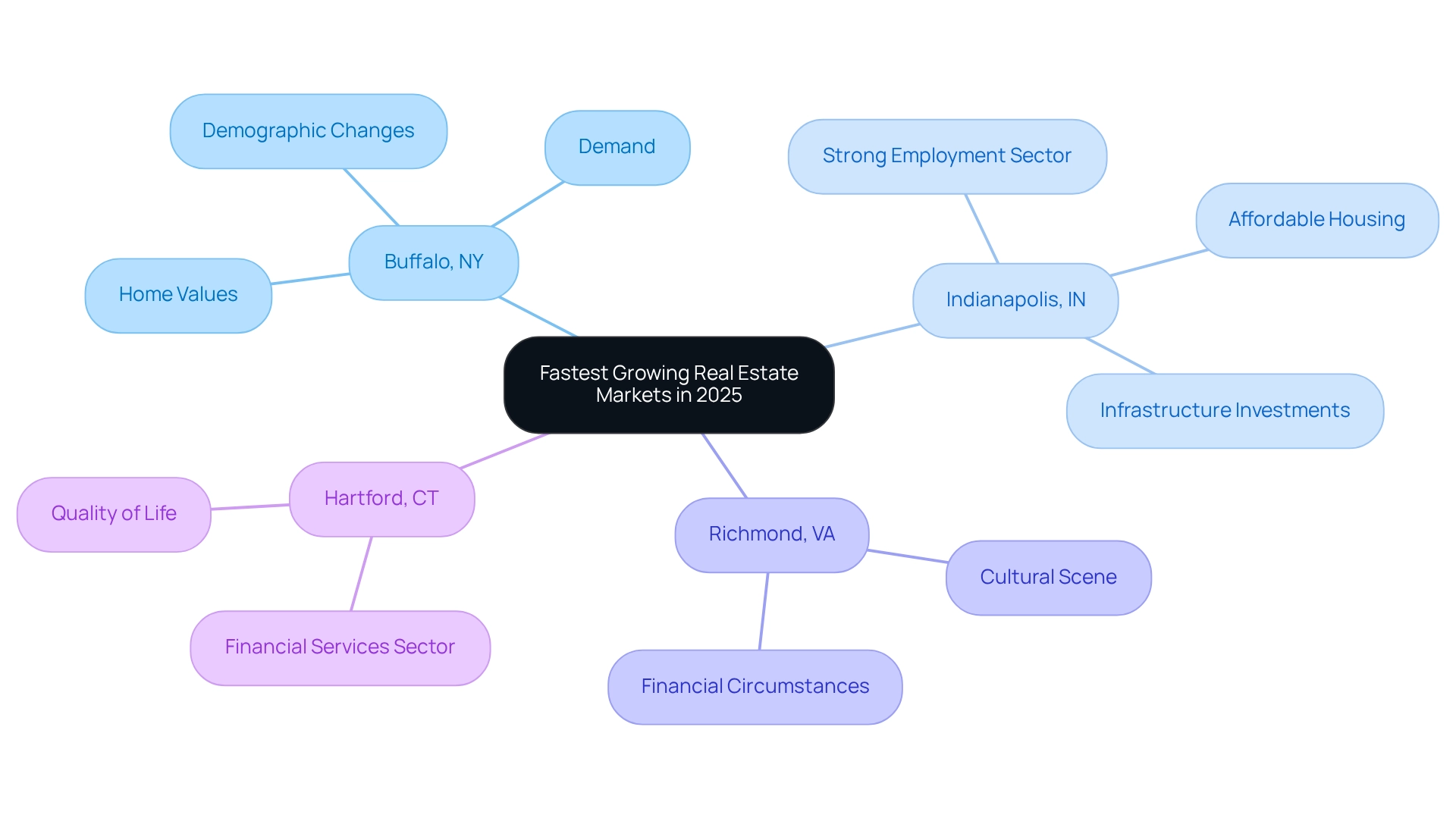

In 2025, several U.S. areas are emerging as the fastest growing real estate markets, with Buffalo, NY, and Indianapolis, IN, leading the charge. Both cities have demonstrated remarkable increases in home values and demand, establishing them as prime targets for investors. Buffalo's real estate sector is anticipated to experience a notable increase, with property values climbing consistently due to a blend of financial rejuvenation and demographic changes.

Recent statistics reveal that homes in Buffalo are selling faster than ever, reflecting a robust demand expected to persist throughout the year.

Indianapolis also showcases impressive growth, fueled by a strong employment sector and an influx of new residents seeking affordable housing alternatives. The city's strategic investments in infrastructure and community development have further bolstered its appeal, positioning it as a key player in the investment landscape.

Other significant areas include Richmond, VA, and Hartford, CT, both undergoing swift expansion driven by advantageous financial circumstances and a high quality of life. Richmond's vibrant cultural scene and Hartford's financial services sector are attracting new residents and investors alike, contributing to their upward trajectory.

Expert insights indicate that these sectors will continue to flourish, with analysts emphasizing the significance of local financial conditions and demographic trends in propelling the fastest growing real estate markets. John Sim, Head of Securitized Products Research at J.P. Morgan, observes, "It’s clear that numerous aspects of Trump's policy will influence the housing sector," highlighting the broader economic context affecting these areas.

The dedication to data integrity and a fact-based approach in examining these sectors has proven vital for making informed investment choices. This is exemplified by Zero Flux's rigorous sourcing of information, which enhances the reliability of insights provided to investors.

As investors aim to capitalize on these opportunities, understanding the unique dynamics of each sector will be essential. The case studies of Buffalo and Indianapolis illustrate how focused investments and strategic planning can yield substantial returns in the fastest growing real estate markets as they evolve in 2025. Relevant tags such as housing sector, home prices, and economy further emphasize the critical factors influencing these growth trends.

Emerging Trends Impacting Real Estate Growth

Emerging trends such as remote work, sustainability, and technological advancements are profoundly transforming the environment of property development. The shift towards remote work has driven a notable increase in demand for homes in suburban and rural areas, as individuals prioritize space and affordability over urban living. This trend is reflected in the statistics, with many buyers now seeking properties that accommodate home offices and larger living areas.

As Scott Bridges, senior managing director at PennyMac, notes, "Getting pre-approved will give you a much clearer understanding of your budget and what you can afford; it shows sellers that you’re a qualified buyer and it strengthens your offers." This insight highlights the significance of grasping budget limitations in the present economic context.

Sustainability has also emerged as a critical factor influencing purchasing decisions. Buyers are increasingly inclined to invest in energy-efficient homes and properties that incorporate sustainable practices, reflecting a broader societal shift towards environmental responsibility. This growing emphasis on sustainability is not just a passing trend; it is becoming a fundamental expectation among consumers.

Technological advancements are further altering the estate market. The integration of smart home features and the adoption of digital transaction processes are revolutionizing how properties are marketed and sold. Investors must stay abreast of these innovations, as they not only enhance the buyer experience but also streamline operations for real estate professionals.

However, it is essential to consider the financial challenges facing buyers, as more than 80% of borrowers are currently 100 basis points or more out-of-the-money. Additionally, potential government-sponsored enterprise privatization could lead to higher mortgage rates, further dampening housing demand. This context is crucial for understanding the changing economic environment.

As we approach 2025, comprehending these trends is crucial for navigating the changing economic environment. Industry leaders stress the significance of adjusting to these changes, as they will greatly influence investment strategies and economic dynamics in the upcoming years. Additionally, the introduction of a new discussion point referred to as 'movers and shakers' emphasizes areas that demonstrate substantial year-over-year enhancement and are anticipated to draw institutional investor attention, particularly in the fastest growing real estate markets, offering valuable insights for individuals aiming to take advantage of emerging opportunities.

The case study on builder confidence illustrates the challenges faced by the construction sector amid economic uncertainty and rising material costs due to tariffs. Despite some rises in housing starts and completions, builders are facing considerable challenges that may result in a slowdown in new construction and influence the overall housing supply in the area.

Investment Opportunities in Growing Markets

Investing in the fastest growing real estate markets presents numerous opportunities, including the potential for significant returns and the diversification of investment portfolios. However, investors must remain vigilant regarding the inherent risks, such as market volatility and fluctuating financial conditions. In 2025, financial growth is anticipated to bolster household formation, thereby increasing the demand for apartments and rental properties, particularly in developing neighborhoods.

To navigate these challenges, investors can implement various strategies. Focusing on emerging neighborhoods can yield substantial rewards, as these areas frequently experience rapid appreciation and heightened demand. Moreover, investing in rental properties or engaging in real estate investment trusts (REITs) can provide a consistent income source while mitigating risks associated with direct property ownership.

For instance, cities like Nashville and Phoenix are currently recognized as among the fastest growing real estate markets due to their robust financial indicators and appealing quality of life. Nashville's vibrant music scene and burgeoning tech industry, combined with Phoenix's favorable climate and population growth, position these cities as prime candidates for investors seeking growth opportunities. Economic indicators suggest that these cities will continue to flourish, making them prime targets for investment.

However, potential risks loom on the horizon. Economic strategies, such as those proposed by the Trump administration, could lead to rising inflation and elevated mortgage rates, potentially dampening demand for residences. The administration's residential policies, particularly regarding immigration and labor availability in construction, could exacerbate existing challenges in the industry. For example, while proposals to simplify zoning procedures might assist in addressing the affordable housing shortfall, a decrease in immigration could worsen labor shortages in the construction sector.

Furthermore, ongoing changes in working habits and population movement trends favoring the Sun Belt may introduce additional uncertainties into the economy. As Richard Barkham, Global Chief Economist, notes, while growth in 2025 may ignite a new property cycle, it is crucial to remain aware of these potential risks. Successful investors will need to stay informed and adaptable, leveraging expert insights and case studies to make strategic decisions in this dynamic landscape.

Future Outlook for Fast-Growing Real Estate Markets

The future perspective for the fastest growing real estate markets is decidedly positive, with continued demand anticipated across various regions. However, this landscape is not without its challenges; rising interest rates and potential economic downturns may influence growth trajectories. Recent data reveals that over 47% of mortgaged homes were equity-rich by Q4 2024, indicating a robust foundation for homeowners.

Nevertheless, the typical interest rate lock-in effect for conventional mortgage borrowers reached $47,800 in November 2024, which could deter new purchasers and dampen activity in the sector.

Analysts predict that while some sectors may experience a slowdown, others are poised to thrive due to strong fundamentals. For instance, the Sunbelt region is expected to maintain its resilience, bolstered by significant population growth and diversification of industries. This trend underscores the necessity for adaptability among investors, who must remain vigilant in navigating these shifting conditions.

Moreover, the expansion of mansion taxes across states like New York, New Jersey, and California could further reshape investment strategies. These regulations may influence rental management and property acquisition decisions, making compliance essential for landlords and investors alike. As Ryan noted, "They will need to comply with these new regulations which may impact their decision to rent or influence how they manage rental properties overall."

In light of these dynamics, investors should contemplate both long-term and short-term strategies. A recent case study contrasting long-term home buyers with short-term investors highlights that timing is less critical for long-term buyers, while short-term investors must be cautious of purchasing at price peaks, particularly as we approach potential economic changes. This adaptability is vital, especially given the evolving landscape shaped by rising interest rates and regulatory changes.

In general, expert forecasts indicate that although the property sector will face challenges, opportunities for expansion remain, particularly in the fastest growing real estate markets that continue to attract new inhabitants and enterprises. 'Zero Flux's commitment to quality content enhances subscriber engagement and establishes it as a leading authority in property information, making it essential for investors to stay informed and flexible to capitalize on these changing trends.

Local Market Dynamics: A Closer Look

Local economic dynamics play a crucial role in determining the success of real estate investments. Key factors such as neighborhood demographics, local economic conditions, and community amenities significantly impact property values and demand. For example, a city may experience overall growth; however, certain neighborhoods might face challenges due to elevated crime rates or inadequate infrastructure.

Moreover, the coldest January in 25 years (January 2025) may have influenced buyer behavior, as severe weather conditions can deter potential homebuyers and affect activity in the sector.

Recent data indicates that single-family building starts rose by 11.4% month-over-month in February 2025. However, annual decreases suggest a potential slowdown in the real estate sector, underscoring the importance of localized analysis. Investors are encouraged to conduct thorough evaluations of local markets to uncover promising opportunities while avoiding potential pitfalls. Experts recommend that prospective buyers prioritize affordability and flexibility in their home searches, while sellers should aim to price competitively and ensure their homes are in optimal condition.

Expert opinions emphasize the importance of understanding neighborhood demographics. As Keith Gumbinger, vice president at HSH.com, notes, "While rates have been firmly stuck above 6.5% for over five months, experts are hopeful for some improvement over the year." This perspective highlights the necessity for investors to remain adaptable and informed about local conditions.

Additionally, the National Association of Realtors (NAR) has recently published updated housing statistics that provide insights into local conditions, including demographic profiles of home buyers across various metropolitan statistical areas (MSAs). Such data equips real estate professionals with the knowledge needed to navigate market complexities effectively. By grasping these nuances, investors can make more strategic decisions that lead to favorable long-term outcomes, ultimately enhancing their investment portfolios.

Conclusion

Fast-growing real estate markets present a compelling opportunity for investors willing to navigate their complexities. Key cities like Buffalo, NY, and Indianapolis, IN, exemplify how economic revitalization, demographic shifts, and infrastructural development can drive significant appreciation in property values. With a robust job market and increasing demand for housing, these areas are poised for continued growth in 2025, making them prime targets for investment.

Understanding the factors influencing these markets—such as economic stability, evolving buyer preferences, and emerging trends like remote work and sustainability—is crucial for making informed investment decisions. Investors must remain adaptable, leveraging insights from expert analyses and local market dynamics to identify the most promising opportunities. The interplay between policy changes, market conditions, and demographic trends will further shape the landscape, underscoring the need for a strategic approach.

As the real estate environment evolves, staying informed about market shifts and potential risks will be essential. While challenges such as rising interest rates and regulatory changes may impact growth trajectories, the outlook remains optimistic for those who can navigate these dynamics effectively. By focusing on emerging neighborhoods and understanding local conditions, investors can position themselves to capitalize on the wealth of opportunities that fast-growing real estate markets have to offer in the years ahead.