Overview

Capital calls in real estate signify requests from managers or general partners for additional funds from investors, extending beyond their initial commitments. These calls often arise due to unforeseen expenses or new investment opportunities that demand immediate attention. Understanding the significance of these capital calls is crucial for maintaining liquidity and achieving investment objectives.

Investors are contractually obligated to respond to such requests, as failure to do so may result in potential consequences, including ownership dilution or loss of voting rights. This underscores the necessity for investors to remain vigilant and proactive in their financial commitments.

Introduction

In the intricate world of real estate investing, capital calls emerge as a pivotal mechanism that can determine the success or failure of a project. As market conditions shift and unexpected expenses arise, fund managers often find themselves in need of additional capital from their investors, prompting these crucial requests. The implications of capital calls extend far beyond mere financial transactions; they encompass legal obligations, operational strategies, and the delicate balance of trust between investors and fund managers.

With the landscape of real estate continually evolving, particularly in the wake of inflationary pressures and rising construction costs, understanding the nuances of capital calls becomes essential for investors aiming to safeguard their interests and capitalize on emerging opportunities. As the dynamics of the market shift, the role of capital calls becomes increasingly significant, making it imperative for investors to navigate this complex terrain with knowledge and foresight.

Define Capital Call in Real Estate

What is a capital call in real estate refers to a financial request where a manager or general partner seeks additional resources from investors, extending beyond their original monetary commitment. Such requests typically arise in response to unforeseen expenses, operational costs, or new investment opportunities, which leads us to understand what is a capital call in real estate. Understanding what is a capital call in real estate is essential, as these capital requests are integral to private equity real estate contracts, enabling asset managers to maintain liquidity and foster project success.

Investors are contractually obligated to respond to these requests, as outlined in their partnership agreements, which relates to what is a capital call in real estate, ensuring that funds are available when necessary. Recent trends indicate that limited partners (LPs) are imposing stricter restrictions on funding requests, permitting them solely for specific purposes, such as follow-on investments or addressing essential expenses. This shift underscores the importance of understanding what is a capital call in real estate, as it is crucial for managing risk and optimizing cash flow within real estate investments.

As First National Realty Partners articulates, "With a deliberate emphasis on discovering exceptional, multi-tenanted properties well beneath intrinsic value, we aim to generate superior long-term, risk-adjusted returns for our stakeholders while developing robust economic assets for the communities we support." This perspective highlights how funding requests are pivotal in achieving these investment objectives.

For instance, Qapita's digital asset management tools illustrate how technology can streamline funding request processes, enhancing adherence and communication with stakeholders while optimizing cash flow for general partners. Beginning in 2025, understanding the nuances of funding requests will be crucial for investors navigating the complexities of the real estate market.

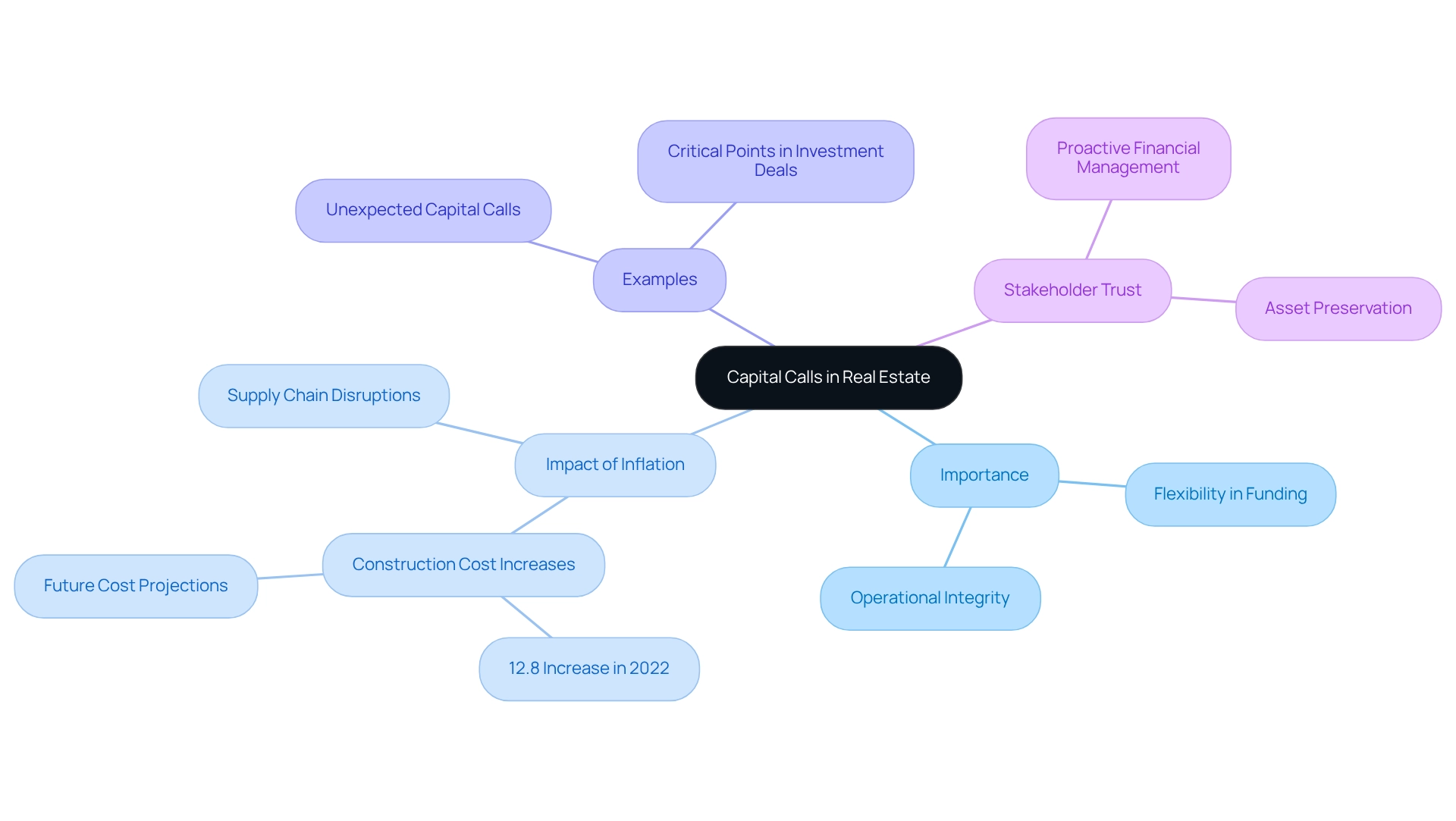

Contextualize the Importance of Capital Calls

Understanding what is a capital call in real estate is crucial, as capital requests are pivotal in real estate investments, granting managers the necessary flexibility to adapt to evolving market conditions and project demands. For example, unforeseen repairs or new market opportunities, especially considering the substantial challenges posed by inflation, may necessitate additional funding. The inflation surge in 2022, which reached a 40-year high, led to a staggering 12.8% increase in construction costs, underscoring the critical nature of funding requests for swift access to essential resources. This mechanism not only safeguards the operational integrity of the investment but also addresses what is a capital call in real estate, fostering trust between investors and fund managers by demonstrating proactive financial management. Timely funding requests can avert project delays and help ensure that investment objectives are achieved.

As Dan Handford, a General Partner, articulates, "Ultimately, as a GP myself, we are constantly making choices regarding our investments to ensure asset preservation for all LPs while also keeping returns as a secondary objective." This statement emphasizes the significance of fund requests in safeguarding stakeholder interests while adapting to unforeseen circumstances.

Furthermore, funding requests are typically not commonplace; in the context of investment agreements, understanding what is a capital call in real estate is crucial, especially during critical moments, such as when a deal is nearing completion. This careful approach enhances trust among stakeholders, indicating that asset managers are prudently managing financial requests. As the real estate landscape continues to evolve in 2025, understanding the dynamics of funding requests will remain essential for stakeholders aiming to navigate the complexities of the market effectively.

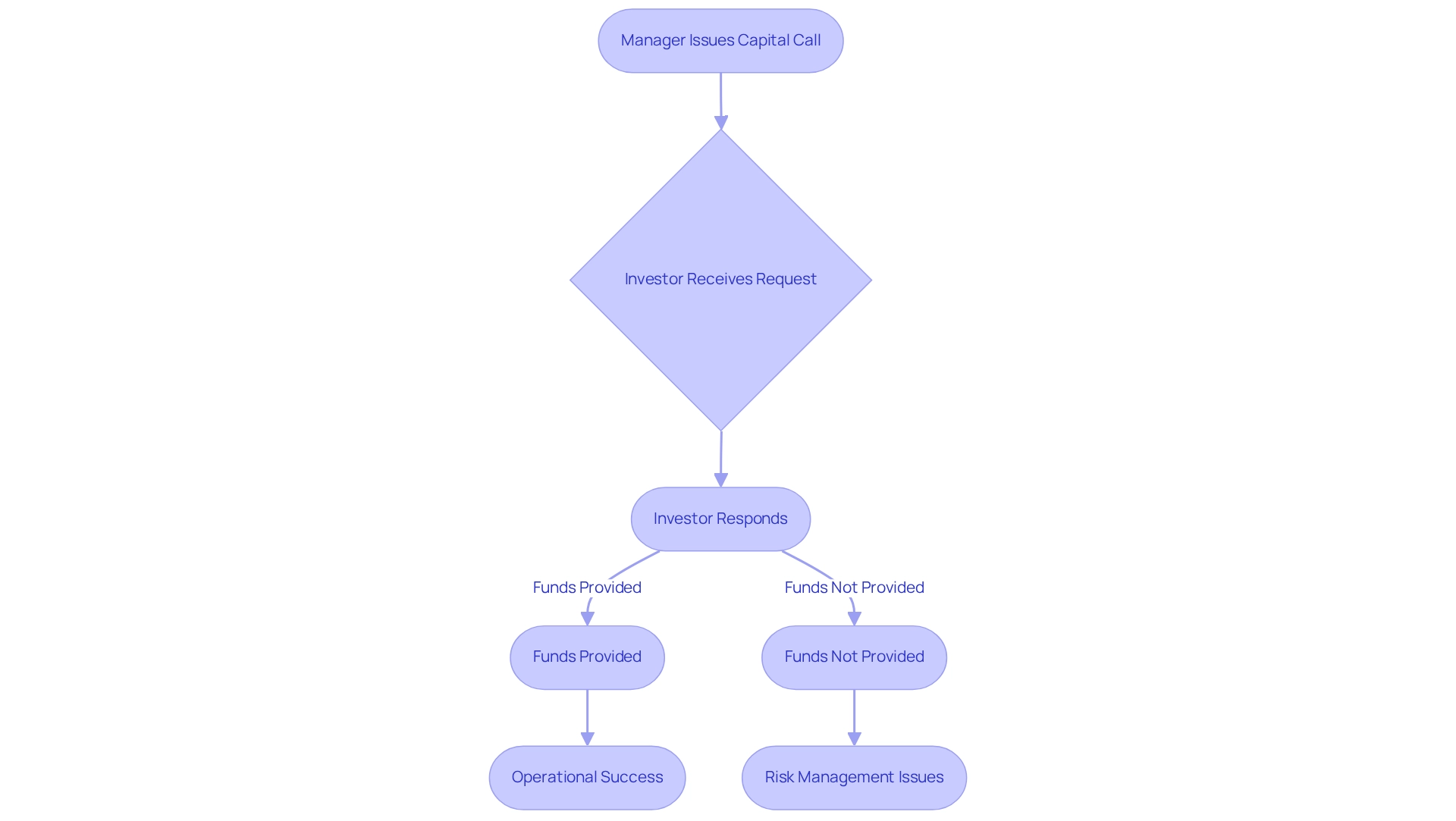

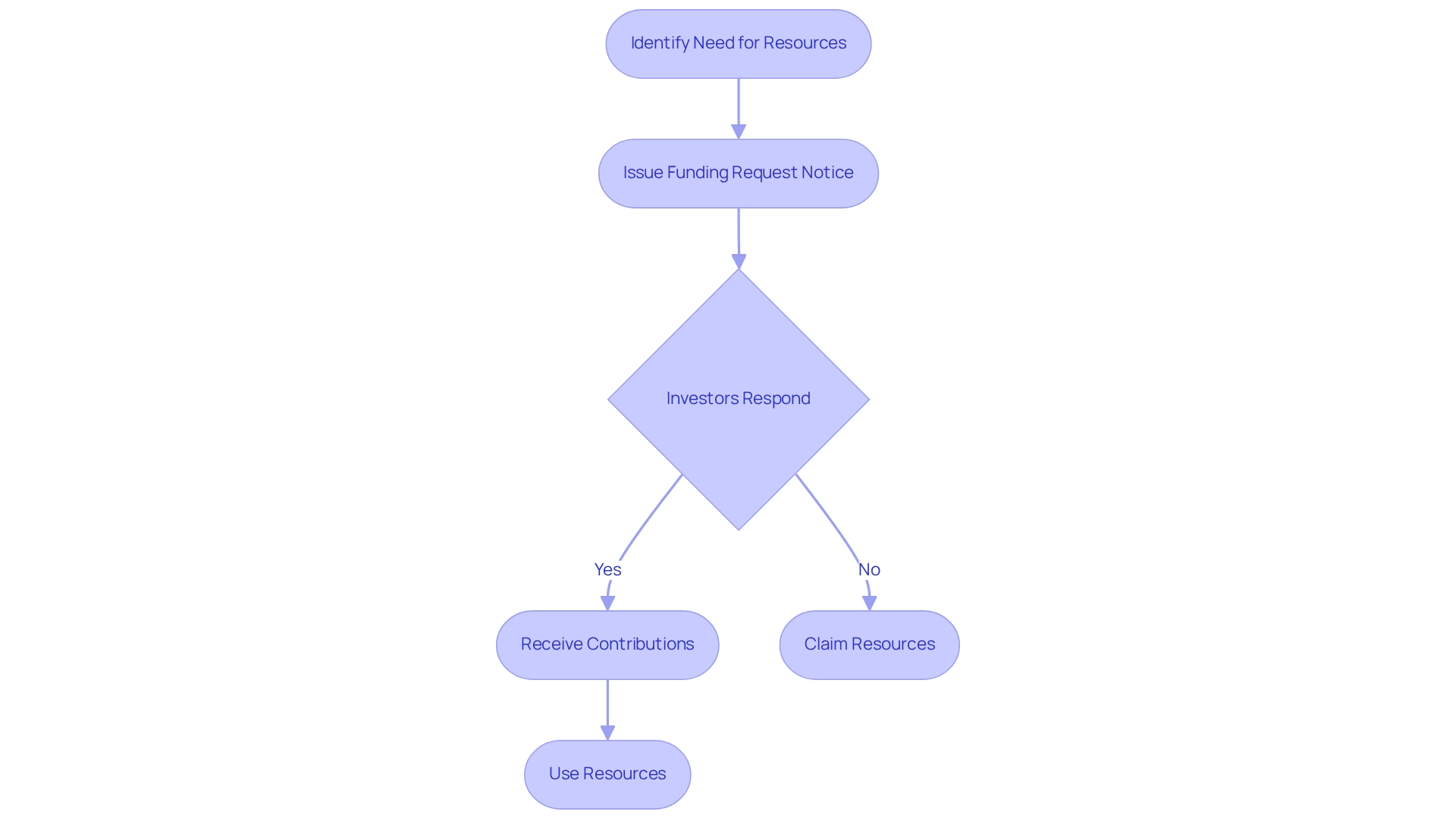

Outline the Capital Call Process and Management

The financial request procedure commences when a manager identifies the necessity for additional resources, often due to rising operational expenses or emerging investment opportunities. Upon recognizing this need, the manager issues a formal funding request notice to investors, specifying the required amount, the rationale for the request, and the deadline for contributions. Investors are expected to respond promptly, supplying the requested resources within the designated timeframe. Failure to respond can lead to significant consequences, as some syndicators may have the authority to claim all or a substantial portion of an LP's resources if they do not address funding requests, underscoring the critical importance of timely action.

Effective management of funding requests hinges on several best practices, including clear communication and transparency regarding the intended use of resources. This transparency is vital for maintaining stakeholder trust and ensuring compliance with the terms outlined in the partnership agreement. Fund managers frequently leverage funding lines of credit to bridge financing gaps until backers fulfill their commitments, thereby ensuring that projects remain on course.

Statistics reveal that the average acquisition fee for a sponsor involved in a $50 million transaction is approximately $1.5 million, highlighting the financial stakes tied to funding requests. Moreover, expert insights emphasize that financial requests are crucial to the operational efficiency of private equity, necessitating precise timing and strategic planning.

A study conducted by Pantheon indicates that investors in diverse private equity portfolios can redirect a significant portion of unfunded commitments to public markets, mitigating the risk of failing to meet their obligations. This study supports the strategy of balancing cash reserves with public market investments to optimize returns while effectively managing funding commitments. In summary, knowing what is a capital call in real estate is essential for ensuring liquidity and facilitating timely investments in the ever-evolving real estate landscape.

Examine Legal and Regulatory Aspects of Capital Calls

The partnership contract, which delineates the rights and responsibilities of both management and stakeholders, answers what is a capital call in real estate. Legally, fund managers possess the authority to request additional funds, which is referred to as what is a capital call in real estate, as specified in these agreements, while investors are obligated to comply. Understanding what is a capital call in real estate is crucial, as noncompliance with a funding request can lead to severe repercussions, including ownership dilution, loss of voting rights, or potential legal action. Furthermore, regulatory authorities enforce guidelines that dictate the communication and execution of funding requests, ensuring fairness and transparency for investors.

As we move into 2025, regulatory guidelines surrounding funding requests are becoming increasingly stringent, emphasizing the need for clarity and compliance in communication. Investors must stay informed about these evolving regulations to protect their interests and make educated decisions. A representative case study illustrates a stakeholder's commitment of $100,000, which encompassed several funding requests over time. This example underscores the gradual nature of investment and the importance of effective cash flow management, as the stakeholder's remaining commitment fluctuated with each funding request. Understanding what is a capital call in real estate is essential for addressing financial shortfalls while awaiting resources, as it highlights the critical role of contribution requests in the investment process. Moreover, it is imperative for stakeholders to understand the responsibilities associated with contribution requests before making financial commitments. Industry specialists indicate that backers typically have about ten days from receiving a financial request to transfer resources to the designated investment vehicle. However, this responsibility may vary depending on the financial pool, underscoring the necessity for participants to be prepared for what is a capital call in real estate to ensure they can meet their commitments without jeopardizing their investment standings.

Analyze Financial Implications of Capital Calls

Understanding what is a capital call in real estate is essential, as it poses significant financial implications for both asset managers and investors. For investment managers, these calls serve as a vital resource for acquiring necessary financing without incurring debt, thereby preserving the equity structure of the investment. This strategy not only mitigates financial risk but also bolsters the fund's capacity to seize emerging opportunities.

For stakeholders, the response to funding requests can profoundly affect cash flow and overall returns. A failure to meet a financial request may result in diminished ownership, which reduces both influence in decision-making and potential gains, as limited partners may relinquish certain rights if they do not comply. Conversely, participating in financial requests can elevate a stakeholder's role within the investment vehicle, particularly if the additional resources contribute to favorable project outcomes.

Investors typically have about 10 days from the receipt of a funding request to transfer their funds to the investment, underscoring the necessity for prompt responses. Moreover, technological solutions such as Vyzer are streamlining the management of funding requests, helping stakeholders stay informed and prepared.

Grasping these financial dynamics is essential for investors looking to navigate their investment strategies effectively, especially in understanding what is a capital call in real estate to ensure they are ready to respond and maximize their returns.

Conclusion

In the realm of real estate investing, capital calls represent a critical mechanism that can significantly influence the trajectory of a project. They enable fund managers to solicit additional funds from investors when faced with unforeseen expenses or opportunities, ensuring that liquidity is maintained and operational integrity is preserved. Governed by partnership agreements, capital calls establish the framework for investor obligations and the legal implications of non-compliance.

The increasing complexity of market conditions, particularly in light of inflation and rising construction costs, underscores the importance of understanding capital calls for investors. By navigating these requests with foresight and preparation, investors can safeguard their interests and maintain their influence within the investment. Furthermore, the integration of technology in managing capital calls enhances transparency and communication, fostering trust between fund managers and investors.

Ultimately, the effective management of capital calls is essential for optimizing returns and ensuring that investment objectives are met. As the real estate landscape continues to evolve, being well-versed in the dynamics of capital calls empowers investors to make informed decisions and successfully navigate the challenges and opportunities that lie ahead. Embracing this knowledge not only enhances individual investment strategies but also strengthens the overall health of the real estate market.