Overview

A market analysis in real estate serves as a systematic evaluation of the factors influencing property values and market trends. This involves assessing comparable properties, economic indicators, and demographic trends. Such analysis is crucial for stakeholders, as it empowers informed decision-making regarding property transactions. By identifying fair pricing, investment opportunities, and understanding market dynamics, stakeholders can significantly impact their financial outcomes.

Introduction

In the intricate world of real estate, market analysis serves as a vital compass, guiding buyers, sellers, and investors through the maze of property transactions. This analytical approach systematically evaluates factors that influence property values and market trends, establishing fair market pricing while illuminating emerging investment opportunities. As the landscape shifts with evolving economic indicators and demographic trends, understanding these dynamics is crucial for making informed decisions.

From determining the right price for a property to identifying potential growth areas, market analysis is the cornerstone of success. It ensures that stakeholders navigate the complexities of the real estate market with confidence and clarity. By leveraging data and insights, investors can position themselves advantageously in a competitive environment. Are you ready to harness the power of market analysis to elevate your investment strategies?

Define Market Analysis in Real Estate

Real estate assessment is essential for understanding what is a market analysis in real estate, as it constitutes a systematic evaluation of the elements influencing property values and industry trends. This process involves analyzing comparable properties, often referred to as 'comps,' to ascertain the fair value of a specific property. A thorough assessment of the marketplace, known as what is a market analysis in real estate, takes into account various factors, such as location, property condition, recent sales data, and broader economic indicators. The significance of this evaluation cannot be overstated; it serves as a crucial resource for buyers, sellers, and investors, empowering them to make informed decisions regarding property transactions.

For example, recent data reveals that the median US asking rent increased by 0.8% year-over-year, reaching $1,987 in March 2024. This trend is essential for investors, as it reflects the evolving dynamics of rental markets, which can significantly impact property valuations and investment strategies. Moreover, a report published on May 6, 2025, underscores the importance of home staging in real estate transactions, demonstrating how effective presentation can enhance property appeal and influence buyer decisions. This underscores the necessity of incorporating qualitative factors into commercial evaluations, as staging can affect perceived value and, ultimately, the selling price of a property.

Statistics show that 35.4% of marketing decision-makers identify buyers' misconceptions of value as a significant barrier to generating quality leads. This emphasizes the need for accurate sector analysis, as understanding what is a market analysis in real estate can help clarify property values and inform potential buyers, thereby improving lead generation efforts. By identifying an ideal client and concentrating on them with tailored branding strategies, real estate professionals can enhance their outreach and effectiveness by understanding what is a market analysis in real estate.

In conclusion, sector analysis transcends mere numerical data; it represents a holistic approach that integrates various data points and insights to guide stakeholders through the complexities of the property landscape. As Nadia Evangelou, NAR Senior Economist, articulated at the 2025 Property Forecast Summit, understanding these dynamics is crucial for making informed decisions in the ever-evolving real estate sector.

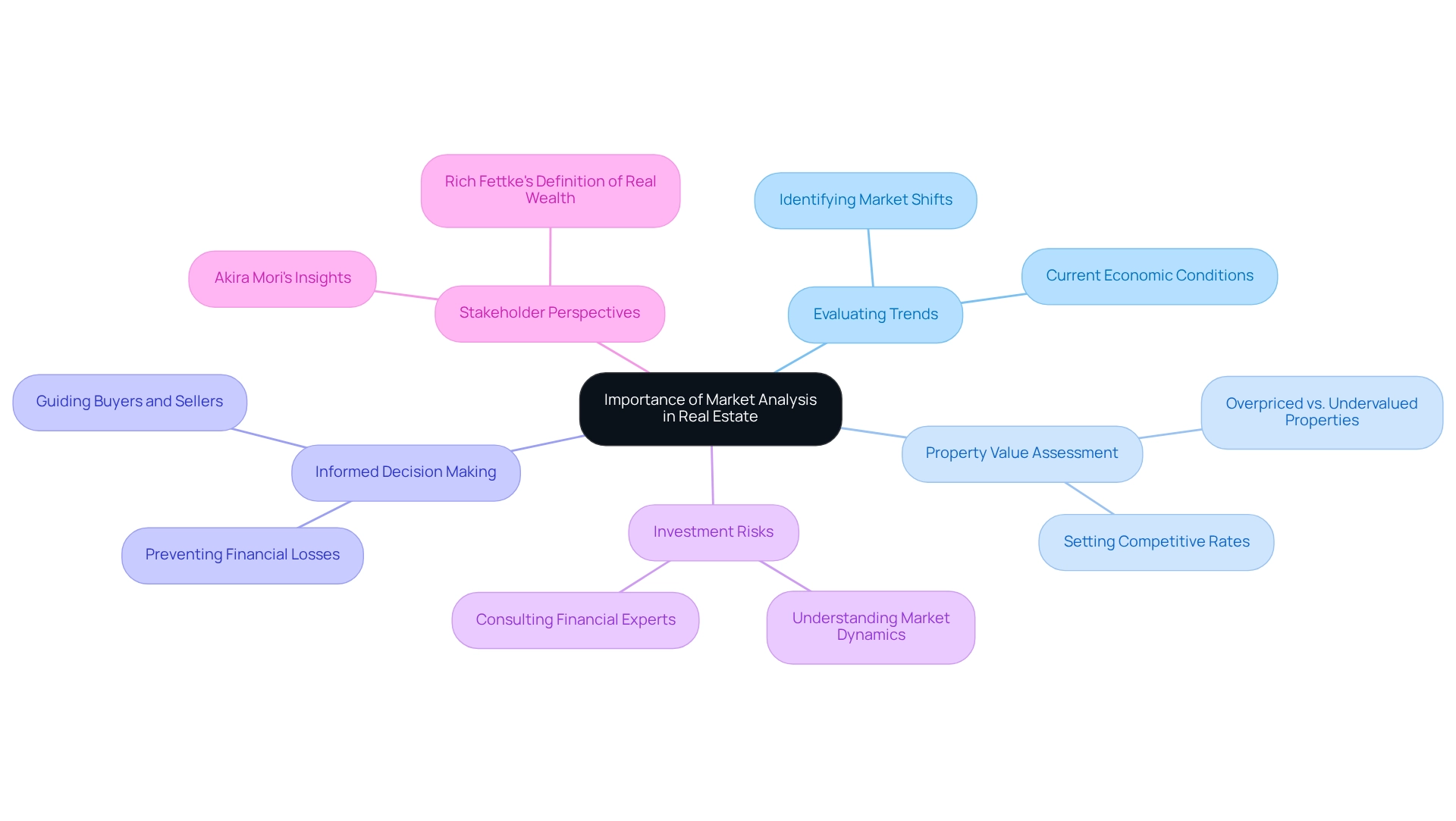

Explain the Importance of Market Analysis

Evaluating trends stands as a cornerstone of success in the real estate industry, offering essential insights into current economic conditions. This evaluation helps stakeholders understand what is a market analysis in real estate, enabling them to identify trends, assess property values, and make informed strategic decisions.

For instance, a comprehensive assessment of the industry can reveal whether a property is overpriced or undervalued, enabling sellers to set competitive rates while guiding buyers toward prudent investment choices. Furthermore, it aids investors in pinpointing emerging regions and potential growth sectors, ultimately maximizing their return on investment.

In 2025, the importance of understanding what is a market analysis in real estate is highlighted by the fact that informed decisions can prevent financial losses; stakeholders who ignore this essential process risk making uninformed choices. As property developer Akira Mori emphasizes, adapting to changing times with innovative business strategies is essential, highlighting the necessity for continuous industry evaluation.

Moreover, case studies, including Rich Fettke's perspective on authentic wealth, illustrate that property investment transcends mere monetary gain, emphasizing the lifestyle and freedom it can provide. This perspective aligns with the importance of understanding what is a market analysis in real estate, as grasping sector dynamics is vital for making informed investment decisions that fulfill both financial and personal goals.

Consulting financial experts is prudent to fully comprehend investment risks, further underscoring the need for thorough examination in making sound property investment choices. With over 30,000 followers relying on insights from Zero Flux, it is evident that many investors recognize the value of informed evaluation in navigating the complexities of the property sector.

Identify Key Components of Market Analysis

Key components of market analysis in real estate include:

- Comparative Market Analysis (CMA): This process evaluates recently sold properties that are similar in characteristics to estimate the value of a property. It serves as a foundational tool for pricing strategies and investment decisions.

- Economic Indicators: Factors such as employment rates, interest rates, and overall economic growth are essential in shaping financial dynamics and influencing property values. For example, a strong employment environment often correlates with increased housing demand. According to John Sim, Head of Securitized Products Research at J.P. Morgan, "The wealth effect from borrowers with substantial home equity and/or equity growth should sustain positive home price growth, though at a very subdued pace."

- Demographic Trends: Analyzing population growth, age distribution, and income levels is vital for predicting housing demand. As of 2022, 66.1% of families possessed their main residence, emphasizing the significance of comprehending demographic changes in the sector.

- Location Analysis: The value of a property is heavily influenced by its location. Assessing neighborhood characteristics, available amenities, and accessibility can provide insights into potential appreciation or depreciation in property values.

- Economic Conditions: Grasping current supply and demand dynamics is crucial for recognizing saturation and predicting price changes. For instance, 2% of For Sale By Owner (FSBO) sellers reported challenges in attracting potential buyers, suggesting competitive conditions. Furthermore, the incorporation of technology in property practices, as emphasized in a case study on REALTORS®, demonstrates how communication techniques and data examination tools are developing, further improving sector evaluation.

Understanding what is a market analysis in real estate is essential to creating a complete overview of the property sector, allowing investors and experts to make educated choices based on accurate information and trends. Utilizing comprehensive data sources, such as State Housing Statistics from NAR, reinforces the data-driven approach that Zero Flux advocates.

Discuss Applications of Market Analysis in Real Estate

Market evaluation plays a vital role in various facets of real property, particularly in understanding what is a market analysis in real estate, serving as a fundamental instrument for informed decision-making. Key applications include:

-

Property Valuation: Real estate professionals and valuers leverage industry research to precisely assess property worth for transactions, acquisitions, or refinancing. This essential process ensures fair pricing and maximizes investment returns.

-

Investment Choices: Investors utilize industry analysis to identify profitable opportunities and evaluate potential returns on investment. By examining trends and data, they can make strategic decisions that align with industry dynamics. Perspectives from industry leaders, such as Jeff Smith and Kathy Feucht, underscore the significance of these evaluations for successful strategic planning in 2025.

-

Market Entry Strategies: Developers and companies rely on analysis to evaluate new regions, ensuring their projects align with local demand and economic conditions. This strategic approach mitigates risks associated with entering unfamiliar territories.

-

Risk Evaluation: Understanding industry trends and conditions empowers stakeholders to recognize and reduce risks linked to property investments. This proactive approach is crucial in a variable environment, especially as the commercial property sector is expected to rebound significantly in the upcoming 12 to 18 months.

-

Pricing Strategies: Sellers employ industry research to set competitive pricing that attracts buyers while maximizing their profits. This data-driven method is vital in a sector where pricing can greatly influence consumer interest, and what is a market analysis in real estate serves as a crucial resource guiding various property-related activities, from purchasing and selling to investing and developing. As emphasized in the National Association of Realtors' quarterly economic forecast, which acts as a valuable resource for real estate professionals to anticipate trends, staying attuned to insights is essential for effectively adjusting strategies in 2025. Furthermore, the newsletter aims to empower research with relevant housing data, reinforcing the importance of data-driven decision-making in market analysis.

Conclusion

In the realm of real estate, market analysis is not merely a tool; it is the very foundation upon which informed decisions are built. By systematically evaluating property values, market trends, and economic indicators, stakeholders navigate the complexities of the market with confidence. From comparative market analysis to understanding demographic shifts, each component plays a crucial role in painting a comprehensive picture of the real estate landscape.

The importance of market analysis extends beyond mere numbers; it empowers buyers, sellers, and investors alike to make strategic choices that maximize returns and minimize risks. As the market evolves, staying attuned to trends and data becomes essential for success. The insights gained from thorough market analysis not only inform pricing strategies but also guide investment decisions and market entry strategies, ensuring that stakeholders are well-equipped to seize opportunities.

As the real estate sector continues to adapt to changing dynamics, leveraging market analysis remains vital. It serves as a compass, directing actions and strategies in an ever-fluctuating environment. Embracing this analytical approach enables stakeholders to make sound decisions that align with both financial goals and personal aspirations, ultimately leading to a more prosperous and informed real estate journey.