Overview

Recent real estate news reveals a mixed market landscape for 2025. Home prices remain stagnant in certain regions, mortgage rates are elevated, and there is a gradual increase in housing inventory. These factors complicate the dynamics of buying and selling. The article underscores the influence of economic factors, demographic shifts, and technological advancements on current trends. Furthermore, it highlights a cautious optimism among industry stakeholders regarding future growth.

As we delve deeper, it becomes evident that these market conditions present both challenges and opportunities for investors. The interplay of stagnant prices and rising inventory could signal a shift in buyer behavior, prompting a strategic reevaluation of investment approaches. Are you prepared to adapt to these evolving dynamics?

In conclusion, understanding these trends is crucial for making informed investment decisions. By staying abreast of market developments and leveraging insights from industry experts, investors can position themselves for success in this complex landscape.

Introduction

As the real estate market navigates the complexities of 2025, it stands at a crossroads of challenges and opportunities. Fluctuating home prices and high mortgage rates create a cautious atmosphere, compelling both buyers and sellers to adapt to a landscape defined by shifting preferences and economic pressures.

- The rise of suburban living

- The increasing importance of sustainability

- Demographic changes reshaping housing demand

Moreover, technological advancements are revolutionizing transaction processes. Understanding the interplay of economic influences, investor challenges, and market trends will be crucial for stakeholders aiming to thrive in this evolving environment.

As the year unfolds, the real estate sector reflects a unique blend of resilience and transformation, inviting a closer examination of what lies ahead.

Current State of the Real Estate Market

In 2025, the real estate sector reveals a landscape marked by both stagnation and cautious optimism, as underscored by the latest real estate news. Home prices display a mixed bag of trends across various regions; while some areas are experiencing declines, others are witnessing modest increases. Notably, the National Association of Realtors reports a slight uptick in existing-home sales, although these figures still linger below pre-pandemic levels.

Elevated mortgage rates, currently ranging from 6.5% to 7%, pose a significant challenge for prospective purchasers, particularly first-time homeowners. This environment has cultivated a competitive trading landscape where inventory levels are gradually improving but continue to fall short of meeting demand, complicating the dynamics for both buyers and sellers.

Adding to this complexity, Kenon Chen from Clear Capital forecasts that home price growth will remain flat through June, following a recent quarter-over-quarter decline of 0.2%. However, year-over-year, home prices have appreciated by 4.7%, indicating some resilience in the sector. Furthermore, a recent survey highlights that 66% of tenants prioritize lease conditions and rental prices when selecting a rental property, emphasizing the importance of affordability in today’s market.

In terms of real estate transactions, it is noteworthy that 75% of seller's agents received payment from the seller, while 52% of agents representing purchasers were also compensated by the seller. This statistic sheds light on the financial dynamics at play in the current environment.

Builder confidence has notably declined due to economic uncertainties and rising material costs, exacerbated by tariffs. Despite this, there has been an increase in housing starts and completions, suggesting a positive shift in new construction. While builder confidence remains low, the uptick in new home inventory may provide more options for buyers, although ongoing challenges with construction costs and supply chain issues could hinder future growth.

As Greg McBride, chief financial analyst for Bankrate, aptly observes, 'The latest real estate news indicates that while housing activity this spring will likely increase relative to previous quarters, it still won’t be enough to blow anybody’s hair back.'

Overall, the current condition of the real estate sector in April 2025 reflects a complex interplay of factors, presenting both opportunities and challenges for industry stakeholders.

Emerging Trends in Housing Market Dynamics

Emerging trends in the housing sector for 2025 indicate a notable shift towards suburban living, primarily fueled by the normalization of remote work. Many purchasers are now prioritizing larger residences that offer designated office spaces, resulting in a heightened demand for properties in suburban and rural areas. This trend is underscored by the migration of over two million urban residents to suburban living between 2020 and 2022, as they seek more affordable housing options and a more relaxed lifestyle.

Suburbs have experienced a growth of 16% since 2000, while urban areas have only seen a 13% increase during the same timeframe. Furthermore, sustainability is becoming a pivotal consideration for homebuyers, with a growing number prioritizing energy-efficient homes. This shift aligns with broader societal trends towards environmental consciousness, as families seek properties that not only lower utility costs but also reduce their carbon footprint.

Additionally, the rise of multi-generational living is reshaping market dynamics, as families strive to accommodate aging parents or adult children returning home. This trend is influencing the types of properties in demand, prompting developers to design homes that facilitate shared living spaces while preserving privacy.

As these dynamics evolve, they significantly impact new construction projects nationwide, with builders adapting to meet the changing preferences of buyers. The emphasis on energy efficiency and flexible living environments is expected to shape the property market in the coming years, reflecting a broader shift in how individuals view homeownership and communal living.

As noted by Don Fenley, addressing the housing shortage – given current conditions – remains a long-term challenge, underscoring the ongoing difficulties in meeting housing demand. Moreover, the current interest rate scenario, characterized by moderate fluctuations, presents both challenges and opportunities for homebuyers and sellers, further influencing market conditions.

Economic Influences on Real Estate Prices

In 2025, economic factors are critically influencing real estate prices. Inflationary pressures are significantly driving up construction costs, which directly affects home prices and makes affordability a critical concern for many purchasers. The Federal Reserve's current approach to interest rates complicates the landscape; elevated mortgage rates have effectively sidelined numerous potential buyers, resulting in a noticeable slowdown in home sales activity.

Moreover, tariffs imposed on imported construction materials have intensified these cost challenges, leading to a tighter housing supply. While certain sectors may experience price stabilization, others are likely to face continued upward pressure on prices due to constrained inventory levels. This dynamic raises important questions for stakeholders: how will these factors shape the market in the coming months?

A case study titled "Future of Construction Inflation Amid Policy Changes" highlights the uncertainty surrounding construction inflation, particularly in light of potential tariffs that could renew cost pressures. If such tariffs are implemented, the construction industry may experience a considerable increase in inflation, complicating the overall cost framework of property projects and potentially obstructing development initiatives.

According to Zero Flux, which has over 30,000 subscribers, understanding these dynamics is crucial for stakeholders. National inflation indices can be useful for comparing various selling price indices and input indices across firms, offering valuable context for the current economic conditions. This insight is essential for making informed investment decisions.

As Alisa Zevin, the economics editor for Engineering News-Record, observes, "The interaction between economic elements and construction expenses is crucial for grasping the wider implications for the property sector." As the industry navigates these economic influences, understanding the interplay between inflation, interest rates, and supply chain dynamics will be essential for stakeholders aiming to make informed decisions in this evolving landscape.

Demographic Shifts and Their Impact on Real Estate

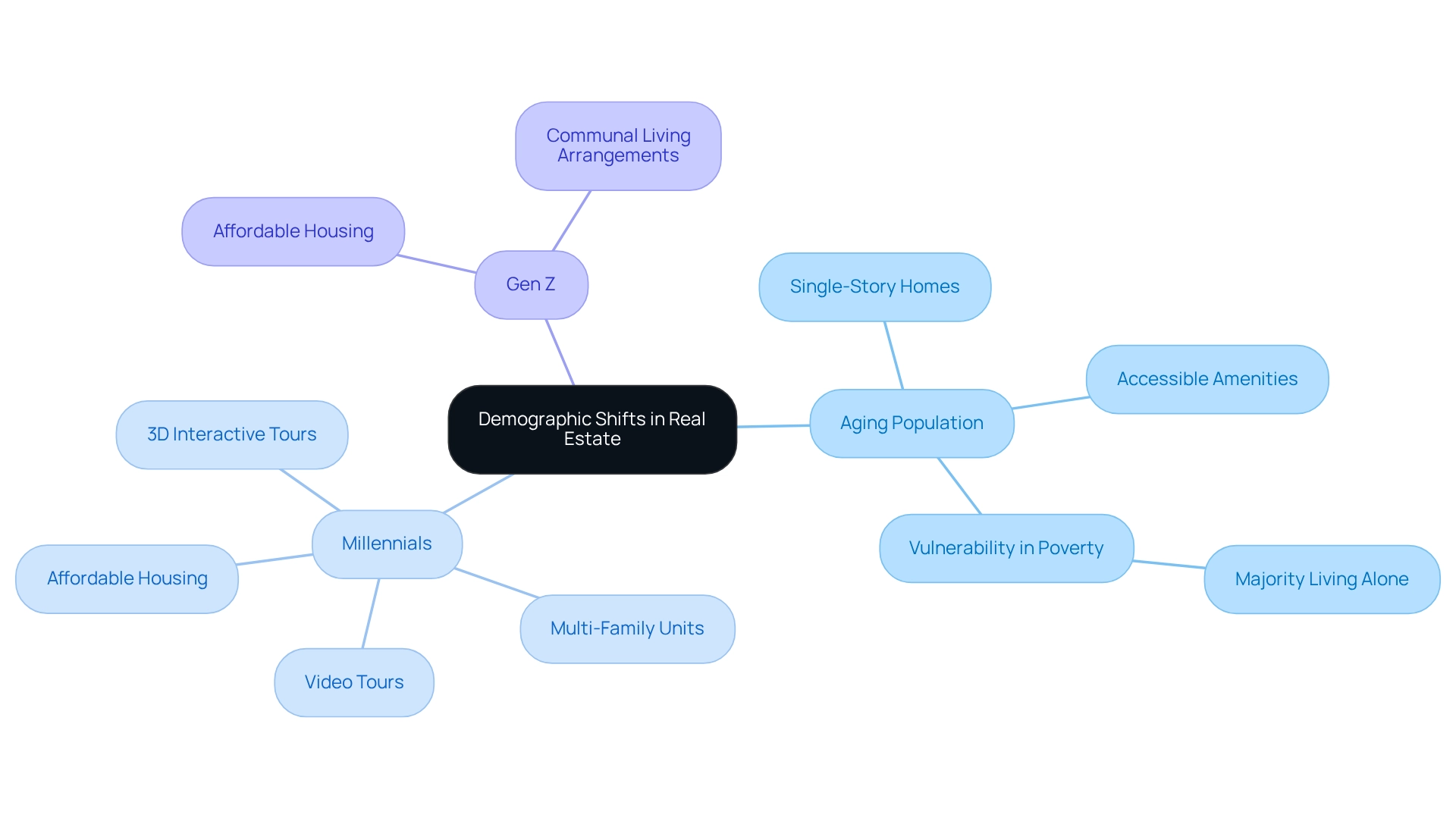

In 2025, demographic changes are significantly impacting the property market. The aging population is increasingly seeking single-story homes and communities equipped with accessible amenities, reflecting a substantial shift in housing demand. Statistics indicate that construction in the senior living sector has fallen to its lowest levels since the first quarter of 2014, highlighting the urgent need for more suitable housing options for older adults.

Moreover, a recent report from the Census Bureau revealed that a majority of older adults living in poverty in 2021 resided alone. This underscores the vulnerability of this demographic and the necessity for targeted housing solutions that address their specific living arrangements.

At the same time, millennials and Gen Z are entering their prime homebuying years, driving a surge in demand for affordable housing. In fact, 42% of purchasers reported receiving video tours from their realtors, while 37% experienced 3D interactive video tours. These developing techniques of property presentation are especially attractive to younger purchasers, indicating a change in marketing approaches within the housing industry.

This generation's preferences are also influencing the industry, as they increasingly favor multi-family units and rental properties, indicating a trend towards more communal living arrangements.

The growing diversity within the U.S. population further influences housing preferences, prompting developers and investors to adapt their strategies to meet these evolving consumer needs. As Tim Buchanan, CEO of Legend Senior Living, wisely observed, 'The optimism and great opportunity will be a cycle,' suggesting that grasping these demographic trends is essential for navigating the future of property. Overall, the interplay between an aging population and younger generations is reshaping the housing landscape, necessitating a responsive approach from industry stakeholders.

Challenges Facing Real Estate Investors Today

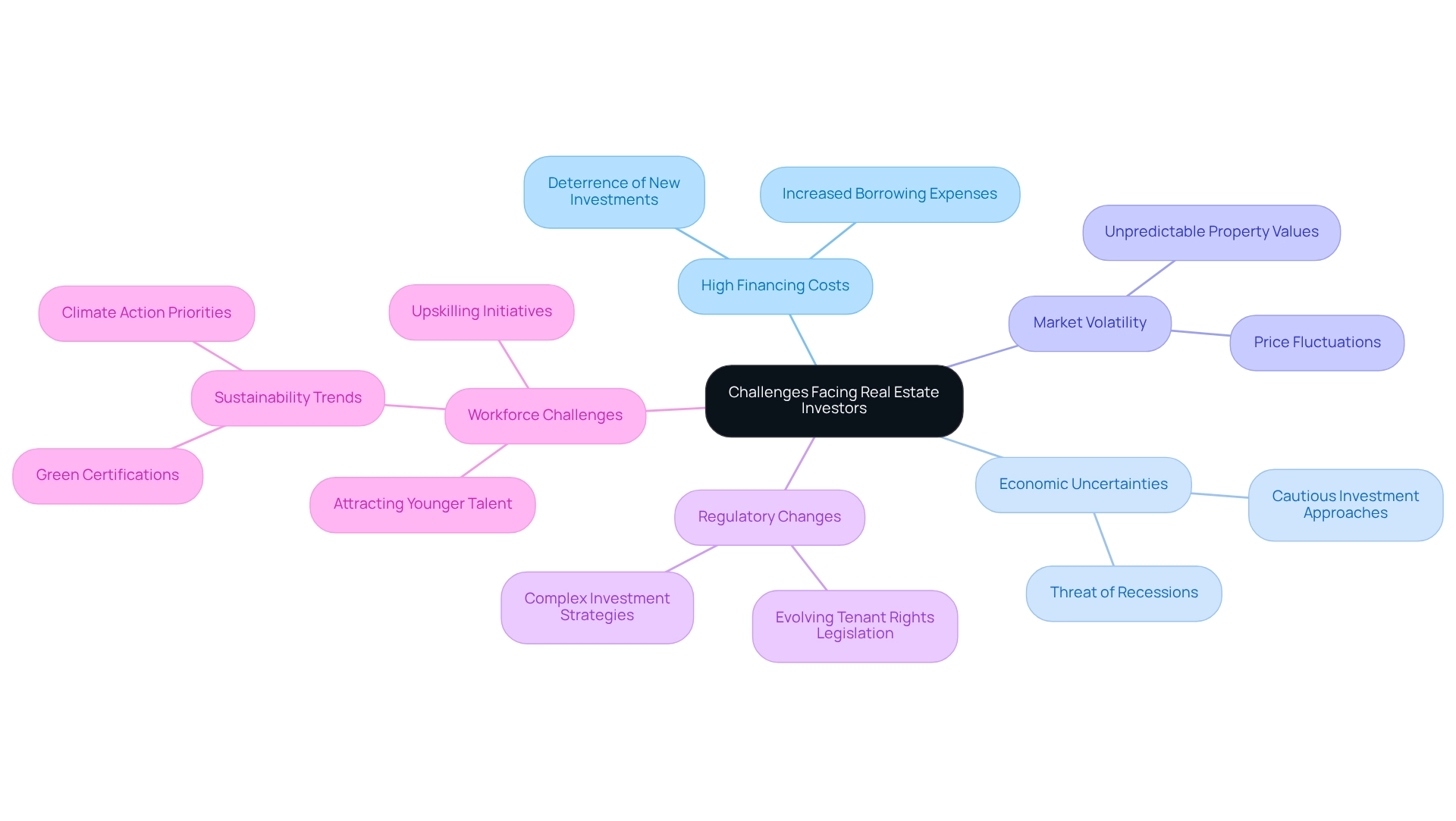

In 2025, property investors navigate an environment marked by significant challenges, primarily driven by elevated financing costs and price fluctuations. The sustained high interest rates have increased borrowing expenses, potentially deterring investments in new properties. This financial strain is further exacerbated by economic uncertainties, including the looming threat of recessions, leading to a more cautious approach among investors.

Investors are now tasked with the delicate balance of managing risk versus return in a landscape where property values are increasingly unpredictable. Moreover, the property sector faces evolving regulatory frameworks and tenant rights legislation, which add layers of complexity to investment strategies. Investors must stay vigilant and adaptable to these changes to protect their interests and seize opportunities.

Statistics indicate that the global property sector is projected to reach approximately $5,388.87 billion by 2026, with a compound annual growth rate (CAGR) of 9.6%. This growth underscores the potential for lucrative investments, yet it also highlights the necessity for investors to be well-informed and strategic in their decision-making processes. The challenges posed by high financing costs and market volatility must be navigated carefully to capitalize on this growth.

A pertinent case study illustrates the workforce challenges within commercial property, where a significant portion of the workforce is nearing retirement. Companies increasingly struggle to attract and retain younger talent, who prioritize values such as climate action and work-life balance. As Sharad Mehta, Editor at Zero Flux, observes, "Over 70% of buyers now consider sustainability and green certifications when purchasing a home."

This shift necessitates that property organizations align their practices with the expectations of the next generation, emphasizing the importance of upskilling initiatives to bridge the skills gap and ensure a robust talent pipeline.

As the industry evolves, it is crucial for investors to remain informed about the latest real estate news, leveraging data-driven insights to navigate the complexities of property investment effectively.

Leveraging Technology and Data for Real Estate Insights

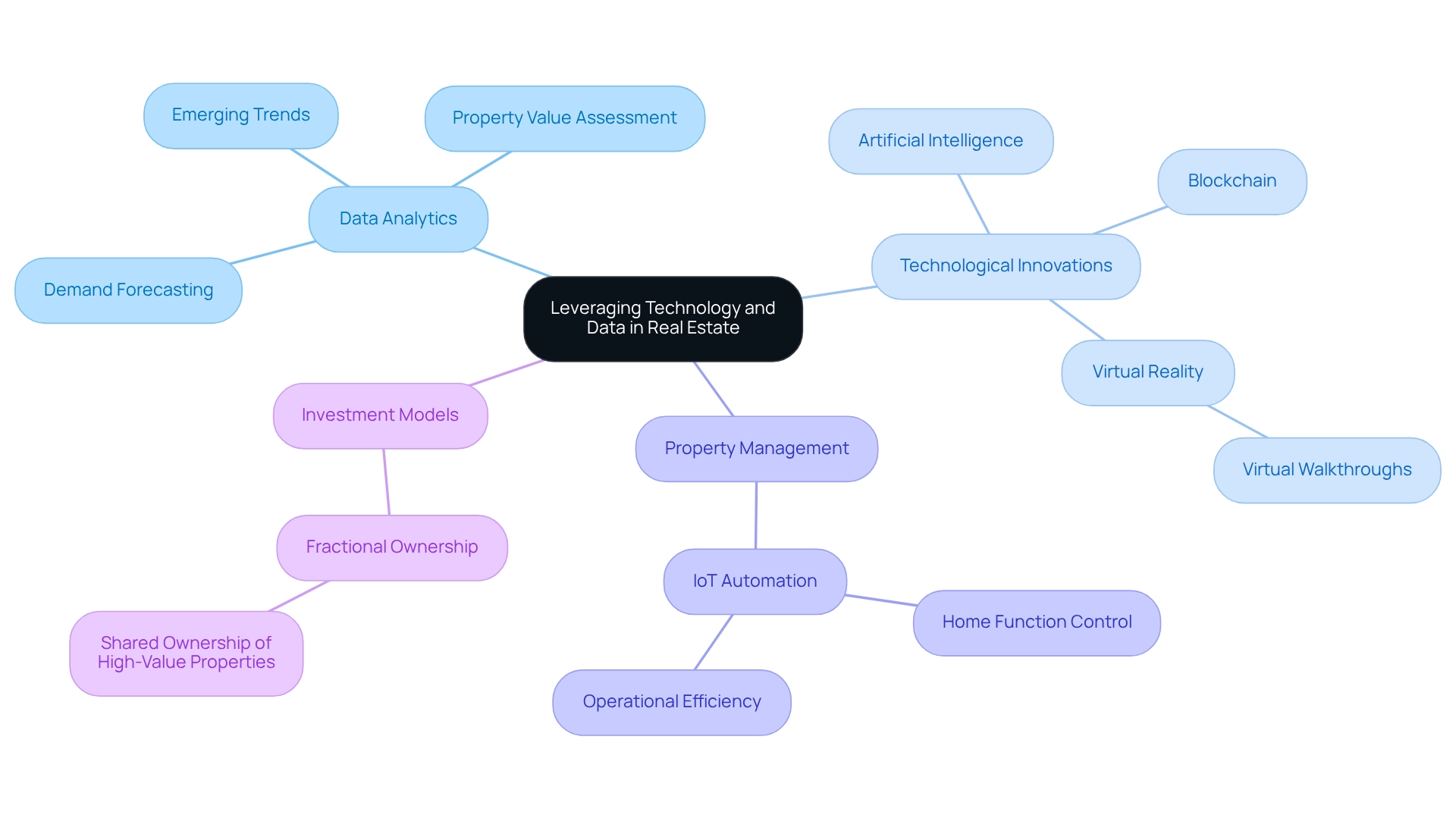

In 2025, the integration of technology and data analytics is essential for real estate professionals aiming to stay competitive. Platforms like Zero Flux deliver curated insights that empower investors to make informed decisions grounded in real-time data. Advanced analytics tools are increasingly employed to identify emerging trends, assess property values, and forecast future demand, enabling stakeholders to navigate the complexities of the industry effectively.

Technological advancements such as artificial intelligence, blockchain, and virtual reality are revolutionizing property management. These innovations automate routine tasks and enhance customer engagement. For instance, IoT devices are transforming property management by automating and controlling various home functions, which not only enhances operational efficiency but also boosts property value.

Furthermore, the emergence of fractional ownership models allows shared possession of high-value properties at a reduced cost, making property investment more attainable. As noted by Sotheby, the industry is enhancing property viewing experiences by providing a virtual walkthrough option for Android and iPhone users equipped with VR headsets. As the sector adopts these innovations, property professionals can elevate their operations, enhance client experiences, and make data-informed choices that align with the latest real estate news.

The case study titled 'Technological Transformation in Property' illustrates how embracing these trends allows property professionals to enhance operations and improve client experiences. The ongoing technological transformation underscores the necessity for investors to leverage these tools to optimize their strategic planning and investment outcomes.

Future Predictions for the Real Estate Market

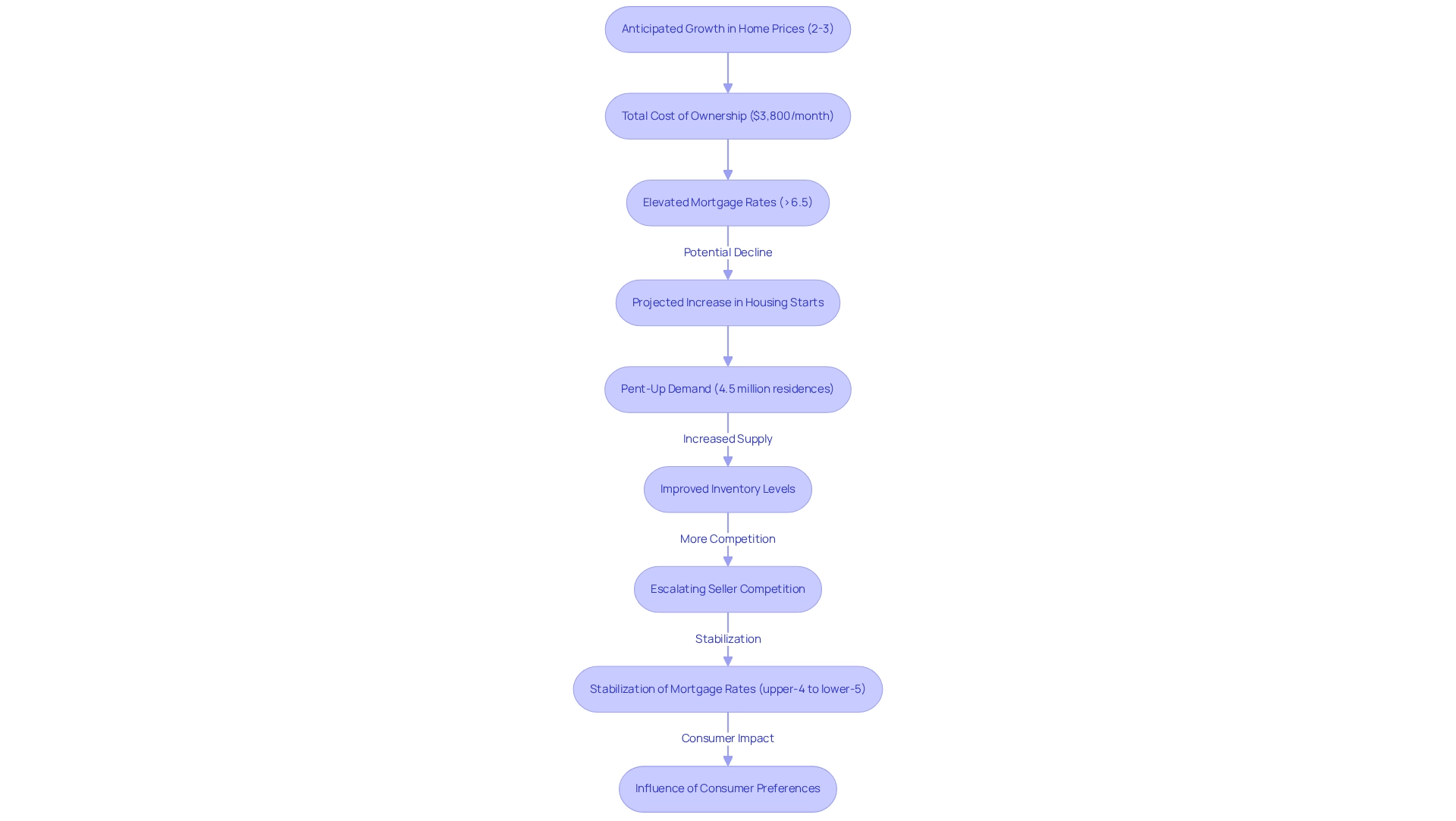

As we look toward 2025, the real estate market is set for moderate growth. According to the latest real estate news, home prices are anticipated to rise by approximately 2% to 3%. With the total cost of ownership for a median-priced single-family home nearing $3,800 per month, this information provides crucial financial context for prospective purchasers and investors. Despite the persistent challenge of elevated mortgage rates, which have remained above 6.5% for several months, recent reports bring optimism. A gradual decline in these rates could invigorate purchasing activity, presenting new opportunities.

The Mortgage Bankers Association (MBA) projects that housing starts will increase in 2025 and 2026. This uptick indicates a response to the anticipated pent-up demand for housing, which may reach 4.5 million residences. As inventory levels improve, competition among sellers is likely to escalate, creating more favorable conditions for buyers. This shift may lead to a stabilization of mortgage rates, with expectations of returning to a more normal range of upper-4% to lower-5%. Such changes could significantly influence economic dynamics, as rapid decreases in rates may trigger a surge in demand.

Furthermore, ongoing shifts in consumer preferences and demographic trends will continue to shape the landscape. Scientific studies indicate that views of the outside world can positively impact mental and physical health, potentially influencing buyer decisions regarding property locations and features, such as homes with better views or outdoor spaces. Investors who stay informed through the latest real estate news and remain adaptable will be best positioned to capitalize on these emerging opportunities, effectively navigating the complexities of the evolving real estate market.

Conclusion

The real estate market in 2025 presents a dynamic interplay of challenges and opportunities. Stakeholders are navigating fluctuating home prices, high mortgage rates, and shifting buyer preferences. Notably, the rise of suburban living—driven by remote work and a desire for larger homes—highlights a significant transformation in housing demand. Sustainability is becoming a priority for buyers seeking energy-efficient homes, while demographic shifts, including an aging population and the preferences of younger generations, further complicate the landscape.

Economic influences, particularly inflation and rising construction costs, continue to impact affordability and housing supply. Investors are facing heightened challenges from high financing costs and market volatility, which necessitates a strategic approach to capitalize on emerging opportunities. Meanwhile, technology is playing a crucial role in enhancing market insights and operational efficiency, enabling real estate professionals to adapt effectively to changing conditions.

Looking ahead, moderate growth is anticipated. Potential improvements in mortgage rates and increased housing starts are expected to stimulate buyer activity. As inventory levels rise and competition among sellers intensifies, the market may become more favorable for prospective buyers. Ultimately, those who remain informed and adaptable will be best positioned to thrive in this evolving real estate environment, taking advantage of the trends and changes shaping the future of housing.