Overview

Investors must engage a Qualified Intermediary (QI) to facilitate a tax-deferred exchange, as this professional is pivotal in ensuring compliance with IRS regulations and executing the transaction effectively. The QI not only holds the proceeds from the sale but also guarantees adherence to legal requirements. This underscores their critical role in maximizing the advantages of tax deferral while mitigating the risks associated with non-compliance. By leveraging the expertise of a QI, investors can navigate the complexities of tax regulations with confidence, ultimately enhancing their investment strategies.

Introduction

A tax-deferred exchange, commonly known as a like-kind swap, presents a strategic opportunity for real estate investors to defer capital gains taxes, thereby amplifying their investment potential. Understanding the diverse array of professionals involved in this intricate process is essential, as each plays a pivotal role in ensuring compliance and maximizing benefits. Yet, the pressing question persists: what type of professional must an investor engage to adeptly navigate the complexities of a tax-deferred exchange? The answer could significantly influence the outcome of a transaction, underscoring the importance of informed decision-making in this financial landscape.

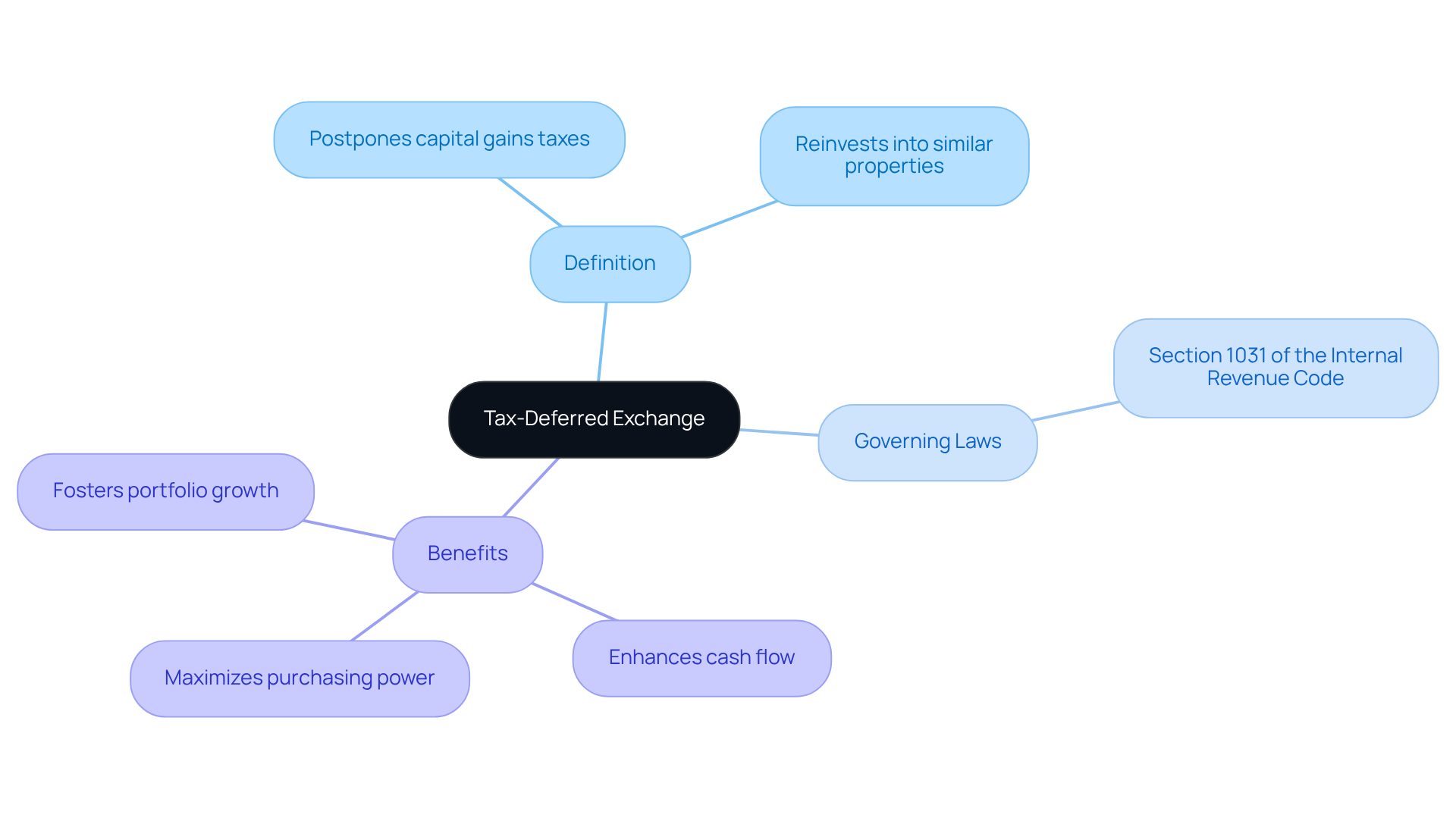

Define Tax-Deferred Exchange and Its Importance for Investors

A tax-deferred transaction, commonly known as a like-kind swap, empowers real estate participants to postpone capital gains taxes on the sale of an investment property by reinvesting the proceeds into another similar property.

Governed by Section 1031 of the Internal Revenue Code, this mechanism requires that the properties involved be held for investment or productive use in a trade or business.

The importance of tax-deferred transactions lies in their ability to enhance cash flow and investment opportunities. By allowing individuals to utilize their capital more effectively, these transactions eliminate the immediate tax obligations typically associated with property sales.

Consequently, by deferring taxes, investors can reinvest the entirety of their proceeds, thereby maximizing their purchasing power and fostering portfolio growth.

Identify Key Professionals Involved in Tax-Deferred Exchanges

To facilitate a tax-deferred transaction successfully, it is important to understand what type of professional an investor must use to conduct a tax-deferred exchange, as each plays a critical role. These include:

-

Qualified Intermediary (QI): A neutral third party who holds the proceeds from the sale of the relinquished property and facilitates the purchase of the replacement property. The QI guarantees adherence to IRS regulations, making them vital for the successful implementation of the transaction. Typically, they charge approximately $700 to $1,100 per transaction for standard delayed trades, underscoring the financial implications of their role.

-

Real Estate Agent/Broker: A professional well-versed in deferred tax transactions, assisting individuals in finding suitable substitute properties and negotiating deals. Their negotiation skills are invaluable for securing favorable terms in transactions.

-

Tax Consultant or CPA: A certified public accountant or tax expert who provides advice on the tax consequences and ensures that participants understand their responsibilities and potential advantages. This guidance is particularly crucial, given that an estimated $100 billion in real estate assets were transferred through 1031 transactions in 2019, highlighting the importance of informed decision-making.

-

Real Estate Lawyer: A lawyer specializing in property law who can navigate legal complexities and prepare essential documents to protect stakeholders' interests throughout the transaction process.

-

Financial Advisor: A specialist who assesses the financial aspects of the transaction, helping investors make informed choices regarding their portfolios. Their expertise is especially relevant in the context of fluctuating economic conditions that may affect the occurrence of similar transactions.

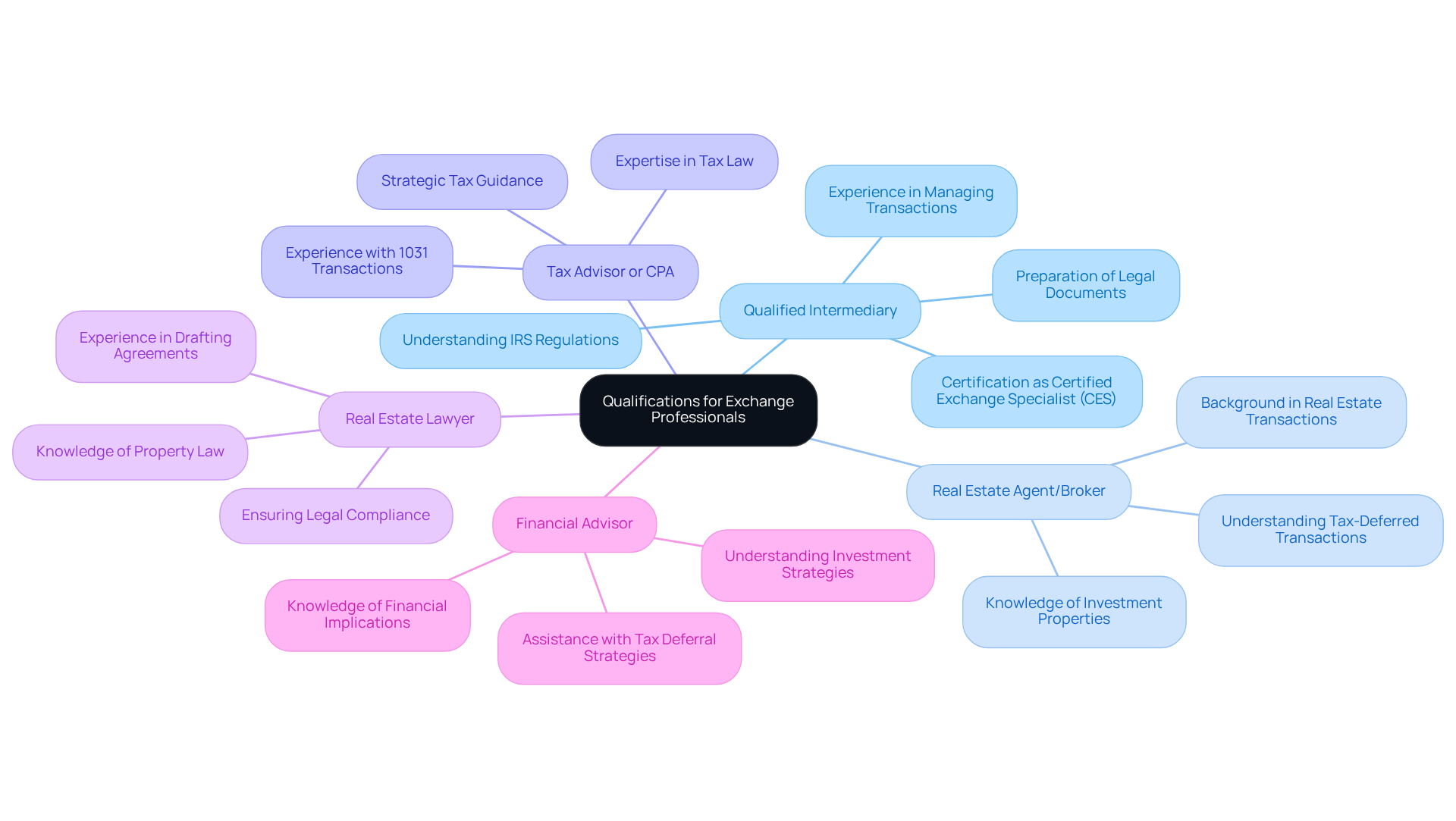

Outline Qualifications and Expertise Required for Exchange Professionals

To effectively facilitate a tax-deferred exchange, professionals must possess specific qualifications and expertise:

- Qualified Intermediary: A Qualified Intermediary (QI) must have a comprehensive understanding of IRS regulations governing like-kind transactions and substantial experience in managing such dealings. Certification as a Certified Exchange Specialist (CES) is often advantageous, as it demonstrates a commitment to industry standards and best practices. Furthermore, QIs are tasked with preparing legal documents for the property transfer process, ensuring adherence to all required regulations.

- Real Estate Agent/Broker: A proficient real estate agent or broker should have a robust background in real estate transactions, particularly those involving investment properties. Understanding the complexities of tax-deferred property transactions is crucial for assisting clients efficiently, particularly in knowing what type of professional must an investor use to conduct a tax-deferred exchange.

- Tax Advisor or CPA: A qualified tax advisor or CPA must be well-versed in tax law, especially concerning capital gains and real estate taxation. Their experience with 1031 transactions is vital for offering precise and strategic guidance, ensuring clients optimize their tax deferral advantages.

- Real Estate Lawyer: A real estate lawyer should have knowledge in property law and experience in drafting and reviewing agreements related to property transactions and transfers. Their role is essential in ensuring adherence to legal requirements throughout the transaction process.

- Financial Advisor: A knowledgeable financial advisor should have a solid understanding of investment strategies and the financial implications of real estate transactions, particularly in relation to tax deferral strategies. Their perspectives can assist clients in managing the intricacies of investment choices related to property swaps.

In choosing a Qualified Intermediary, it is essential for participants to carry out comprehensive due diligence, taking into account aspects like the QI's experience, transparency, and adherence to tax regulations. To qualify for tax deferral, investors must be aware of the essential timelines involved in 1031 transactions, such as the 45-day identification phase and the 180-day transfer period, as well as what type of professional must an investor use to conduct a tax-deferred exchange. Furthermore, understanding the implications if the QI faces financial difficulties is crucial for protecting one's investment. As Karen E. Kennedy emphasizes, choosing a QI that offers experience and transparency is essential for safeguarding hard-earned investment capital.

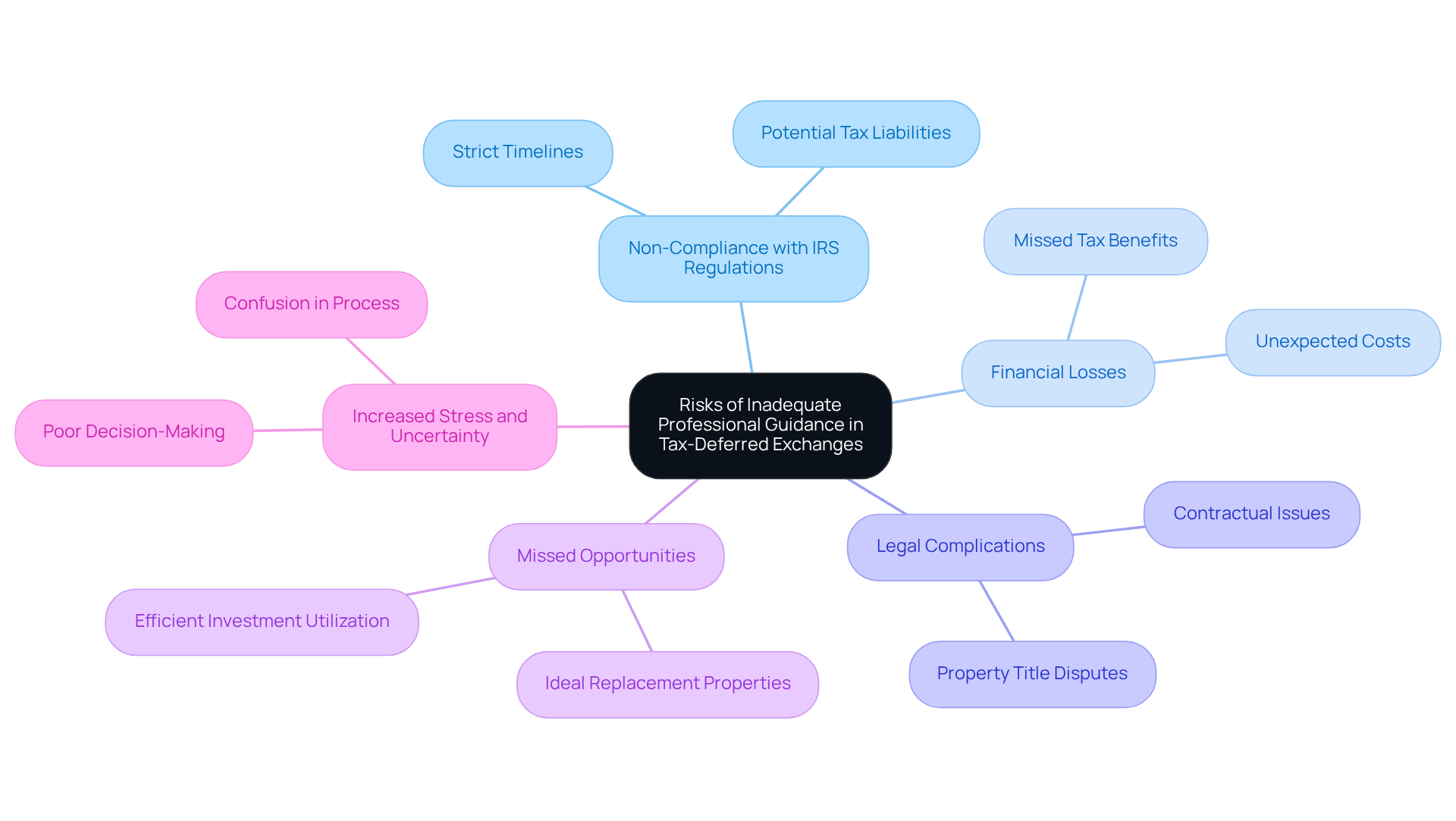

Examine Risks of Inadequate Professional Guidance in Tax-Deferred Exchanges

Inadequate professional guidance in tax-deferred exchanges can expose investors to significant risks, including:

-

Non-Compliance with IRS Regulations: Adhering strictly to IRS timelines and requirements is essential. Investors must identify a replacement property within 45 days of selling their relinquished property and finalize the transaction within 180 days. Failure to comply can disqualify the transaction, resulting in immediate capital gains tax liabilities that can severely impact an investor's financial standing.

-

Financial Losses: Poorly organized transactions often lead to financial setbacks. Investors may miss out on valuable tax benefits or incur unexpected costs, diminishing the overall profitability of their investments. As highlighted in a case study on the drawbacks and dangers of 1031 transactions, insufficient planning can result in considerable financial losses.

-

Legal Complications: Without proper legal counsel, individuals risk facing disputes related to property titles, contracts, or other legal matters. Such complications can disrupt the transaction process and lead to costly delays.

-

Missed Opportunities: Insufficient guidance can restrict individuals from recognizing ideal replacement properties or utilizing their investments efficiently. This oversight can stifle portfolio growth and limit potential returns.

-

Increased Stress and Uncertainty: Navigating the complexities of a tax-deferred transaction without professional support can create confusion and anxiety, detracting from the overall investment experience. Investors may find themselves overwhelmed by the intricacies of the process, leading to poor decision-making. As Daniel Osman, CPA, emphasizes, 'A 1031 exchange can be an incredible tool for real estate investors to reduce their tax liability,' which raises the question of what type of professional must an investor use to conduct a tax-deferred exchange.

Conclusion

A tax-deferred exchange, particularly under Section 1031 of the Internal Revenue Code, serves as a strategic tool for real estate investors to defer capital gains taxes while reinvesting in similar properties. This mechanism not only enhances cash flow but also opens up new investment opportunities, allowing investors to maximize their capital and drive portfolio growth without facing immediate tax liabilities.

The article highlights the essential roles played by various professionals in facilitating a successful tax-deferred exchange:

- Qualified Intermediaries who ensure compliance with IRS regulations

- Real estate agents

- Tax consultants

- Lawyers

- Financial advisors

Each professional brings unique expertise that is critical to navigating the complexities of such transactions. The importance of choosing qualified and experienced individuals cannot be overstated, as their guidance can significantly influence the success of the exchange and the investor's financial outcomes.

In conclusion, the significance of professional guidance in tax-deferred exchanges cannot be overlooked. Investors must prioritize due diligence when selecting their advisors to mitigate risks such as non-compliance, financial losses, and legal complications. By understanding the qualifications and roles of these professionals, investors can better position themselves to leverage the benefits of tax-deferred exchanges, ultimately fostering a more robust and profitable investment strategy. Embracing this knowledge empowers investors to make informed decisions, ensuring that they harness the full potential of their real estate investments.