Overview

2 Bell Drive in Ridgefield, NJ, represents a compelling investment opportunity, characterized by modern features and a strategic location. Currently leased to a reputable logistics company, this property promises stable returns, making it an attractive choice for savvy investors. The energy-efficient design of the property not only aligns with current market demands but also positions it favorably amidst the growing trend of e-commerce, which significantly drives the demand for commercial spaces. Furthermore, favorable demographic trends bolster its investment potential, enhancing the overall appeal of this asset. Investors should consider these factors as they evaluate their portfolios and seek opportunities that align with market dynamics.

Introduction

In the heart of Ridgefield, NJ, a modern industrial gem awaits discovery: 2 Bell Drive. Spanning over 83,000 square feet, this property is not merely a space; it embodies the future of logistics and sustainability. With high ceilings, energy-efficient systems, and a prime location near major highways, it stands as a testament to the evolving landscape of industrial real estate.

As businesses increasingly seek operational efficiency and eco-friendly solutions, the demand for properties like 2 Bell Drive continues to rise. This article delves into the unique features of this property, the economic trends propelling Ridgefield's growth, the demographic shifts favoring its appeal, and the associated risks and rewards of investing in this promising asset.

For savvy investors, understanding the dynamics at play could unlock significant opportunities in this thriving market.

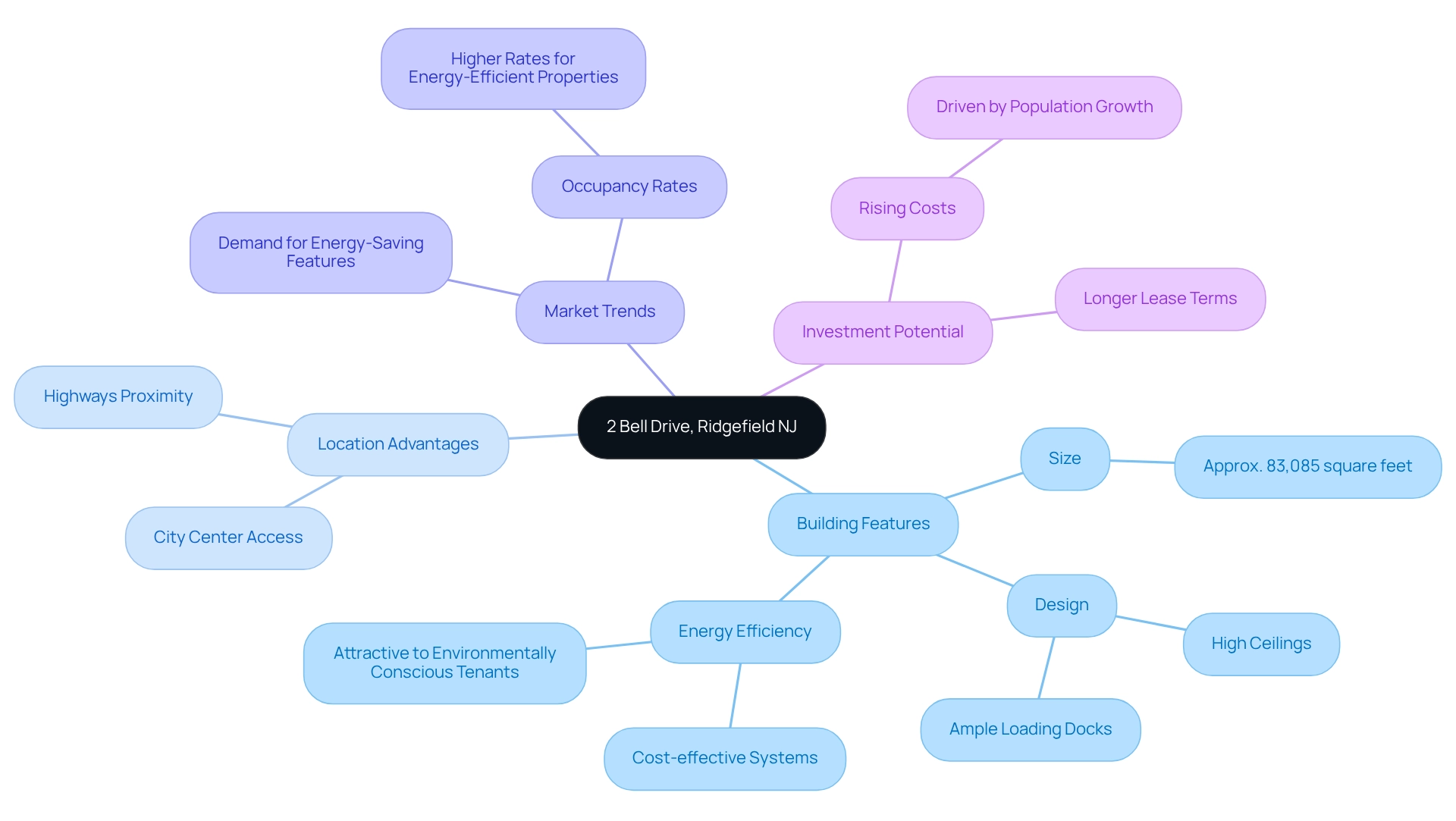

Explore the Unique Features of 2 Bell Drive, Ridgefield NJ

2 Bell Drive Ridgefield NJ is a contemporary commercial building that encompasses approximately 83,085 square feet. Constructed in 2017, it boasts high ceilings, ample loading docks, and a strategically advantageous location that enhances its logistical benefits. Currently leased to KW International, a third-party logistics company, this property is particularly well-suited for businesses requiring substantial operational space. The building's design features energy-efficient systems, making it not only cost-effective but also attractive to environmentally conscious tenants. Its proximity to major highways and city centers further positions it favorably for distribution and storage activities, rendering it an ideal investment opportunity.

Recent trends indicate a growing demand for commercial spaces equipped with energy-saving features, reflecting a broader shift towards sustainability in real estate. Industry specialists highlight that contemporary industrial assets are increasingly recognized for their potential to yield significant returns, especially at 2 Bell Drive Ridgefield NJ. The investment landscape is further bolstered by data showing that properties with energy-efficient designs, particularly 2 Bell Drive Ridgefield NJ, tend to achieve higher occupancy rates and longer lease terms, making it a compelling choice for discerning investors.

As Barbara Corcoran aptly noted, real estate markets can rebound significantly after downturns, underscoring the resilience of investments such as this one. Additionally, the adage that 'the best time to buy a home is always five years ago' serves as a poignant reminder of the urgency in capitalizing on investment opportunities. J. Paul Getty's insights on rising real estate costs due to an expanding population with investment potential further accentuate the necessity for properties such as 2 Bell Drive Ridgefield NJ. Furthermore, leveraging debt in real estate can serve as a powerful strategy for investors seeking to finance their acquisitions, making this property an attractive prospect in the current market.

Analyze Economic Trends Supporting Investment in Ridgefield

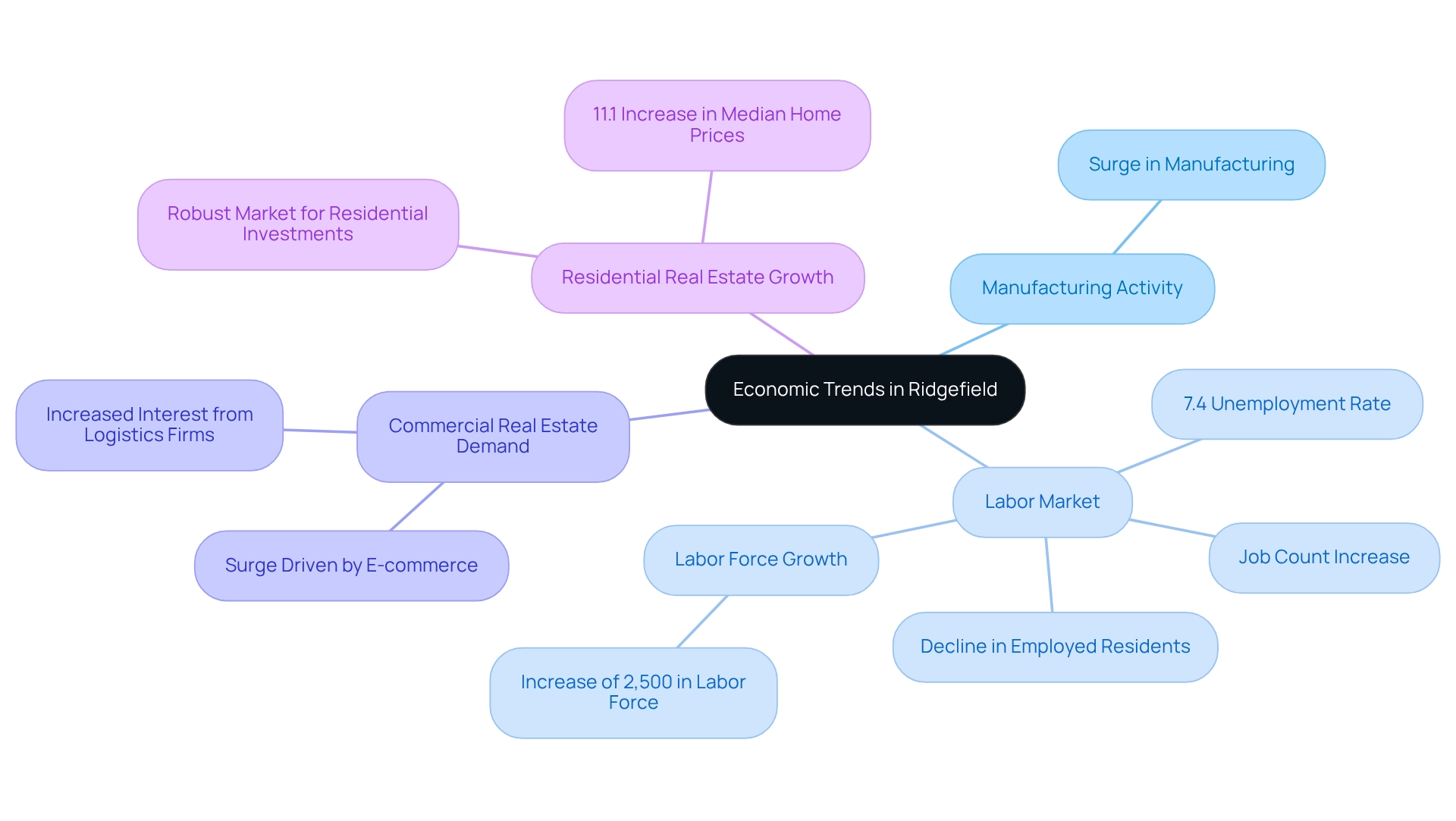

A town in New Jersey is witnessing a vibrant economic landscape, marked by a notable surge in manufacturing activity. Currently, the unemployment rate is at 7.4%, slightly above the national average, yet indicative of a recovering job market. This improvement is highlighted by recent labor force dynamics, which show an increase in job counts despite a decline in the number of employed residents, suggesting a transitional phase within the local economy. The demand for commercial space has surged significantly, largely driven by the e-commerce sector, which increasingly relies on effective distribution hubs. This trend is evident in the heightened interest in commercial real estate, as logistics firms seek to optimize their operations in response to changing consumer behaviors.

Moreover, the residential real estate market is flourishing, with median home prices escalating by 11.1% over the past year. This growth not only signals a robust market that supports residential investments but also enhances the appeal of commercial properties. As the area continues to adapt to these economic changes, the combination of rising demand from businesses and increasing property values presents an attractive opportunity for investors. The evolving economic environment, characterized by industrial activity and the influence of e-commerce, positions this location as a strategic choice for individuals looking to capitalize on its growth potential.

Examine Demographic Shifts Favoring Ridgefield as a Destination

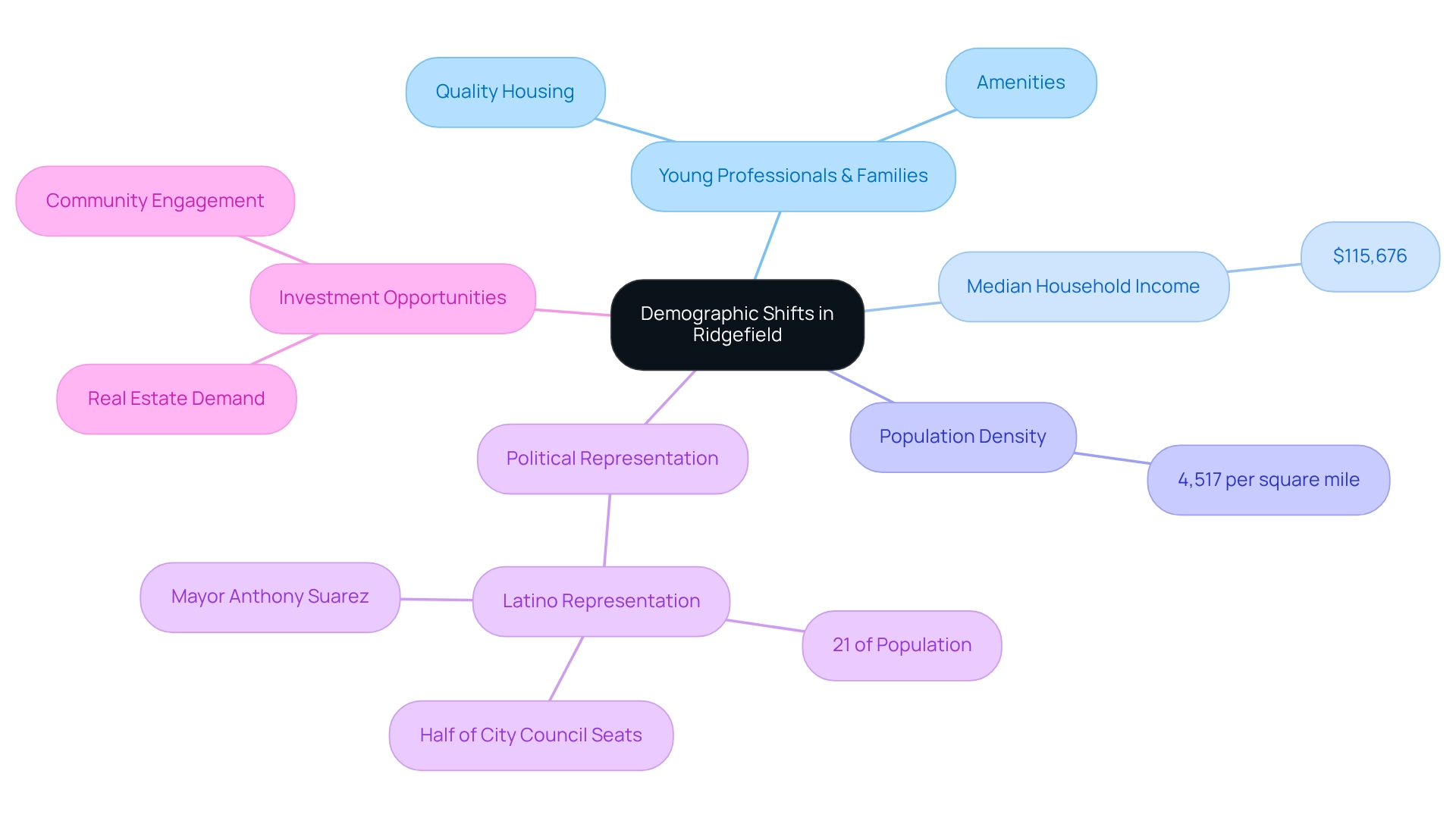

The region is witnessing significant demographic shifts, characterized by an increasing influx of young professionals and families. With the median household income now at $115,676, this reflects a burgeoning affluent population that actively seeks quality housing and amenities. Additionally, a population density of 4,517 per square mile signifies a vibrant community that effectively supports local businesses. This influx is bolstered by an excellent school system and recreational facilities, rendering the area an attractive destination for families.

Notably, Latinos constitute 21 percent of Ridgefield's population yet hold half of the City Council seats and the mayoralty. Mayor Anthony Suarez emphasizes this representation: "Latinos comprise just 21 percent of Ridgefield, N.J.'s population, but they make up half the City Council, and have the mayoralty." This substantial political representation highlights the community's engagement and inclusivity, which can positively influence investor perceptions.

These demographic trends suggest a sustained demand for both residential and commercial real estate, enhancing the investment allure of 2 Bell Drive Ridgefield NJ. Investors should consider these insights as they navigate opportunities in this evolving market.

Assess Risks and Rewards of Investing in 2 Bell Drive

Investing in 2 Bell Drive Ridgefield NJ offers a compelling mix of opportunities and challenges. The property is currently leased to a reputable tenant, KW International, which guarantees a steady income stream—an attractive feature for potential investors. Additionally, the industrial sector is experiencing significant growth, largely driven by the rise of e-commerce, further enhancing the property's value.

However, investors must remain vigilant regarding potential risks. Market fluctuations and shifts in tenant demand could adversely affect rental income. Moreover, broader economic factors, such as interest rates and regulatory changes, can influence the investment landscape. Therefore, thorough due diligence is essential to mitigate these risks associated with 2 Bell Drive Ridgefield NJ. By doing so, investors can capitalize on the substantial rewards that 2 Bell Drive Ridgefield NJ offers.

Conclusion

The exploration of 2 Bell Drive unveils a property that not only meets the current demands of the industrial sector but also embodies the future of sustainable logistics. Its impressive size, energy-efficient systems, and strategic location position this modern industrial gem to attract businesses seeking operational efficiency. The leasing of this property to KW International further solidifies its appeal, guaranteeing a steady income stream for investors.

Ridgefield's dynamic economic landscape, fueled by the surge in e-commerce and a recovering job market, enhances the attractiveness of investing in this area. The rising demand for industrial spaces, coupled with the concurrent growth in residential property values, indicates a robust market ripe for investment opportunities. As demographic shifts favor the community, with an influx of young professionals and families, the demand for both commercial and residential properties is poised to increase, amplifying the overall investment potential.

However, as with any investment, careful consideration of the associated risks is essential. While 2 Bell Drive presents numerous rewards, including a strong tenant and a growing market, potential investors must remain vigilant about market fluctuations and economic changes. By conducting thorough due diligence, investors can harness the opportunities presented by this promising asset, positioning themselves favorably in the evolving landscape of Ridgefield's industrial real estate.