Overview

A higher cap rate signifies greater risk for real estate investors, as it frequently indicates diminished demand for a property. This situation can arise from factors such as:

- Elevated vacancy rates

- Declining rental prices

These conditions can result in lower cash flow and reduced profitability, underscoring the importance of thorough due diligence. Investors must navigate the complexities and potential challenges presented by high-cap-rate assets to make informed decisions. Understanding these dynamics is crucial for successfully managing investment strategies in a fluctuating market.

Introduction

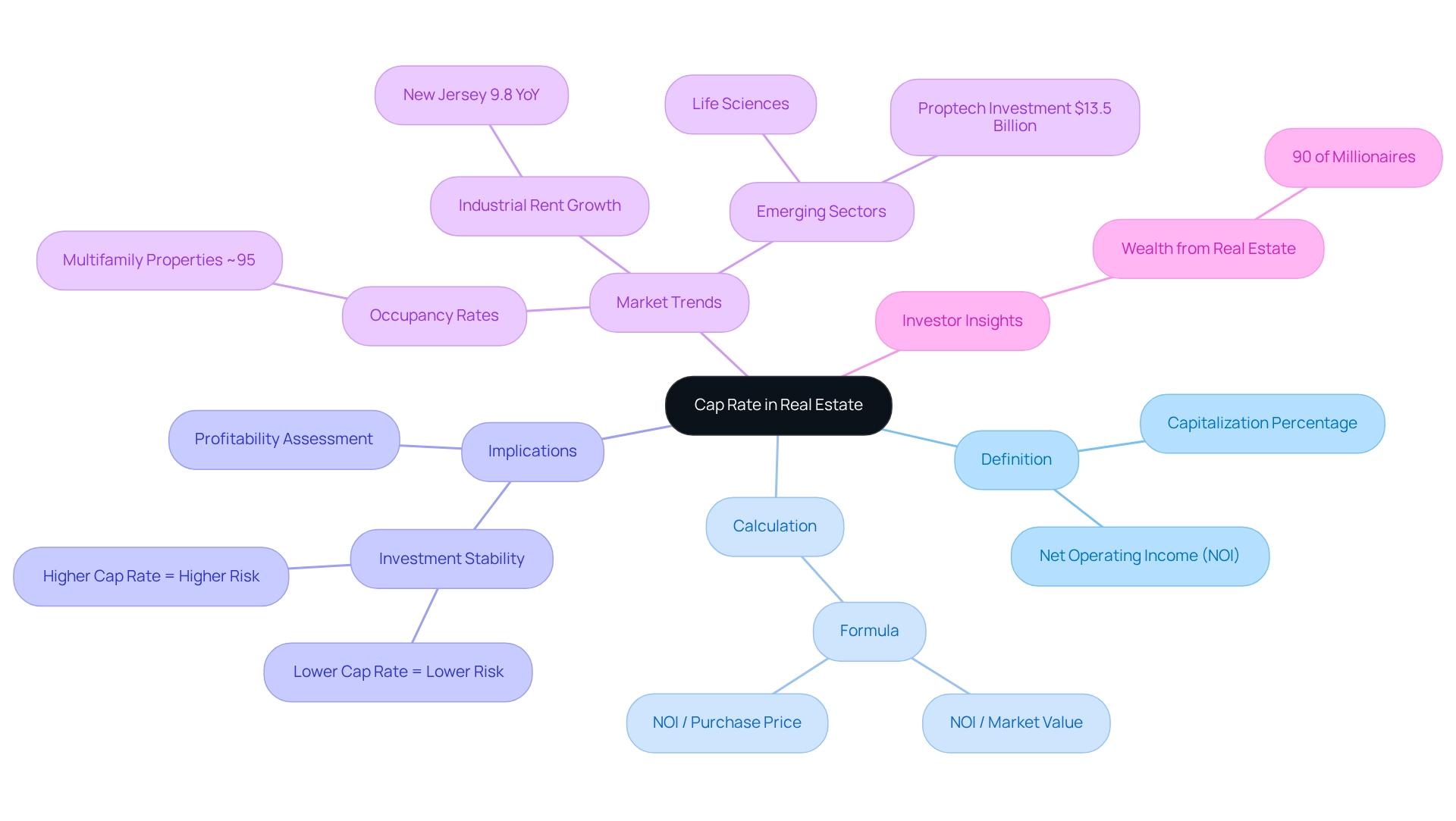

In the intricate world of real estate investment, the capitalization rate, or cap rate, serves as a pivotal tool for investors seeking to gauge potential returns on properties. This essential metric reflects not only the profitability of a property but also highlights the delicate balance between risk and reward. As the market landscape continues to shift, understanding cap rates becomes increasingly crucial for making informed investment decisions.

Investors must analyze risk factors associated with higher cap rates while examining the myriad of market influences that drive their variability. Navigating this complex web of economic indicators and trends is essential. With the stakes high and competition fierce, a thorough grasp of cap rates can be the key to unlocking successful investment strategies in an ever-evolving real estate market.

Define Cap Rate and Its Role in Real Estate

The capitalization percentage, or cap rate, serves as a fundamental metric in real estate investment, indicating the anticipated return on an asset. To determine this, you divide the net operating income (NOI) of the asset by either its current market value or the price it was purchased for. For instance, if a real estate asset generates an NOI of $100,000 and is appraised at $1,000,000, the capitalization percentage would be 10%. This metric allows stakeholders to evaluate the profitability of an asset in relation to its price, providing a quick overview of potential returns. Typically, a lower capitalization figure signifies a more stable investment with reduced risk, while a higher figure leads to the question of why a higher cap rate is riskier, suggesting the possibility of greater returns. Understanding capitalization rates is vital for investors aiming to make informed decisions regarding real estate purchases and effectively assess various investment options.

In 2025, the average capitalization ratio varies by asset type, reflecting current market dynamics and investment trends. For example, multifamily rental properties achieved an impressive occupancy level of approximately 95% in 2022, underscoring their attractiveness in the current market landscape. Moreover, New Jersey experienced the fastest industrial rent increase at 9.8% year-over-year, highlighting the shifting dynamics that can influence capitalization rates. As the real estate industry evolves, particularly with emerging sectors such as life sciences and proptech—where proptech investment reached $13.5 billion—staying informed about capitalization metrics and their implications becomes essential for effective investment strategies. Notably, 90% of millionaires attribute their wealth to real estate investments, emphasizing the necessity of grasping capitalization metrics for those engaged in investing.

Analyze the Risk Factors Associated with Higher Cap Rates

Investors often wonder why a higher cap rate is riskier, as higher capitalization percentages are frequently linked to greater risk due to various underlying factors. A high capitalization often signals reduced demand for a specific type or area, leading to the question of why is a higher cap rate riskier, as it suggests that the market perceives the investment as less appealing. This perception can arise from high vacancy levels, which directly influence cash flow and overall profitability.

For instance, multifamily rental assets experienced an occupancy level of around 95% in 2022, underscoring the importance of maintaining high occupancy to preserve asset value. Moreover, the fact that assets encumbered with higher operating costs or declining rental prices tend to exhibit increased cap rates raises the question of why is a higher cap rate riskier, indicating a potential for lowered returns. Economic factors, including rising interest rates or regional economic downturns, can further amplify these risks, raising the question of why is a higher cap rate riskier, which makes it imperative for individuals to conduct thorough due diligence before investing in high-capital-return assets.

Notably, the shift in capitalization percentages for Portland multifamily real estate from Q2 2023 to Q3 2024 was 0.00%, suggesting market stability that stakeholders should consider in their assessments, especially in understanding why a higher cap rate is riskier as they evaluate the balance between the potential for greater returns and the likelihood of facing significant challenges.

For example, emerging sectors in commercial real estate, such as life sciences, have shown resilience with average asking rents on the rise, while also highlighting the necessity for stakeholders to adapt to market changes driven by technological advancements and sustainability. The performance of this sector emphasizes the importance of recognizing how specific market dynamics can influence capitalization rates, leading to the question of why is a higher cap rate riskier for real estate owners and investors.

Furthermore, they must remain vigilant regarding vacancy levels, as these can significantly impact capitalization rates and investment attractiveness. Monitoring and addressing vacancy levels is essential for sustaining and enhancing the value of real estate properties, as noted by industry professionals. Additionally, potential changes to the 1031 exchange, corporate tax rates, and rent control legislation could affect property valuations and cash flow strategies, adding another layer of complexity to the investment landscape. By understanding these complexities, investors can make more informed decisions in navigating the real estate market.

Examine Market Influences on Cap Rate Variability

Cap values are dynamic, shaped by a variety of market factors that demand attention. Key elements such as interest levels, economic growth, and localized market conditions play crucial roles. For instance, increasing interest levels typically elevate borrowing expenses, prompting financiers to seek greater capitalization returns, leading to a discussion on why a higher cap rate is riskier to offset the added risk.

Economic indicators like GDP growth and unemployment levels significantly influence market sentiment and housing demand. In a thriving economy, competition for prime properties often leads to reduced capitalization ratios, while economic downturns can result in increased capitalization ratios as investors adopt a more cautious approach, prompting the question of why a higher cap rate is riskier, especially since recent research underscores the inverse relationship between household formation rates and capitalization ratio forecasting strategies, suggesting that markets with lower household formation may yield superior investment outcomes. This highlights the importance of demographic trends in influencing cap performance.

Furthermore, as interest levels fluctuate, their impact on capitalization rates becomes increasingly evident, with expert evaluations indicating why a higher cap rate is riskier in leading to a more pronounced expansion of capitalization. Notably, CBRE Econometric Advisors reports that less competitive Class C spaces are facing pressured pricing, with cap estimates averaging in the low teens, illustrating how specific market segments are affected by these dynamics, which raises the question of why a higher cap rate is riskier for individuals aiming to navigate the complexities of real estate investment.

By remaining informed about current economic conditions and their effects on capitalization metrics, investors can make more strategic decisions that align with market realities. Additionally, the research on household formation and capitalization strategy performance reveals a significant inverse relationship, reinforcing the notion that demographic factors are pivotal in determining investment results. As market conditions evolve, the decreasing coefficient observed in cap rate studies indicates that investors must stay vigilant and adaptable to shifting signals in the market.

Conclusion

Understanding the capitalization rate is paramount for real estate investors aiming to navigate the intricacies of property investment. This crucial metric not only sheds light on potential returns but also underscores the inherent risks linked to various investment opportunities. By comprehending how cap rates are calculated and the market dynamics that influence them, investors can make informed decisions that align with their financial aspirations.

Higher cap rates often signify increased risk, arising from factors such as diminished demand and elevated vacancy rates. Investors must remain vigilant in their analyses, taking into account the economic landscape and local market conditions that can affect property performance. The capacity to assess these risks effectively enables investors to weigh the potential for higher returns against the likelihood of challenges, thereby fostering more strategic investment choices.

Moreover, cap rates are subject to fluctuations driven by interest rates, economic growth, and demographic trends. Staying attuned to these influences empowers investors to adapt their strategies in response to shifting market conditions. As the real estate landscape continues to evolve, a robust understanding of cap rates will serve as an invaluable tool for unlocking successful investment strategies, ultimately leading to more informed and profitable decisions in an increasingly competitive market.