Overview

In 2025, medical condo investments are emerging as a compelling opportunity, driven by the increasing demand for healthcare services stemming from an aging population and a notable shift towards outpatient care. These investments not only promise stable long-term returns through predictable cash flow from extended leases but also demonstrate resilience in the medical sector, even during economic downturns. This combination makes them an attractive option for discerning investors.

The appeal of medical condo investments lies in their ability to provide consistent returns. With the healthcare sector's ongoing expansion, investors can expect reliable income streams, bolstered by long-term leases that enhance financial stability. Moreover, the sector's inherent resilience during economic fluctuations underscores its viability as a solid investment choice.

As you consider your investment strategy, the implications of these trends are clear: now is the time to explore opportunities within the medical condo market. By leveraging the insights presented, you can position yourself advantageously in a sector poised for growth, ensuring your portfolio remains robust in a changing economic landscape.

Introduction

As the healthcare landscape evolves, medical condos are emerging as a compelling investment avenue, capturing the attention of savvy investors. These properties not only provide a unique opportunity for medical professionals to own their practice space but also promise stable, long-term returns in a market characterized by rising demand for healthcare services.

However, with the increasing popularity of medical condos comes a critical question: what are the underlying factors driving this trend? Furthermore, how can investors navigate the potential challenges to maximize their returns? Understanding these dynamics is essential for making informed investment decisions.

Understand the Appeal of Medical Condos as Investment Opportunities

Medical condos are increasingly acknowledged as prime investment opportunities in the medical real estate sector. These properties, known as medical condos, specifically cater to medical professionals, allowing them to own their practice area while simultaneously generating rental income. This dual-use aspect is particularly appealing to investors seeking stable, long-term returns. The demand for medical services is on the rise, driven by an aging population and growing health requirements, further enhancing the attractiveness of these properties. According to the Association of American Medical Colleges, a projected physician shortage of 86,000 by 2036 underscores the escalating demand for healthcare services.

Investors are particularly drawn to the stability provided by long-term leases, typically spanning 10 to 15 years. These leases offer predictable cash flow and mitigate vacancy risks. Furthermore, the ongoing shift towards outpatient treatment and the expansion of healthcare services in suburban areas increase the desirability of medical condos as reliable investment options in 2025. With rental rate growth for healthcare office buildings averaging 3.8% annually since 2021 and vacancy rates remaining below 10% nationally, the healthcare unit market presents a compelling opportunity for investors looking to capitalize on the resilience and stability of healthcare-related properties.

Additionally, absorption for healthcare outpatient buildings reached 19 million square feet in Q4 2024, highlighting the growing demand for healthcare office space. This trend not only signals a robust market but also emphasizes the importance of strategic investment in healthcare real estate as a means to secure long-term financial success.

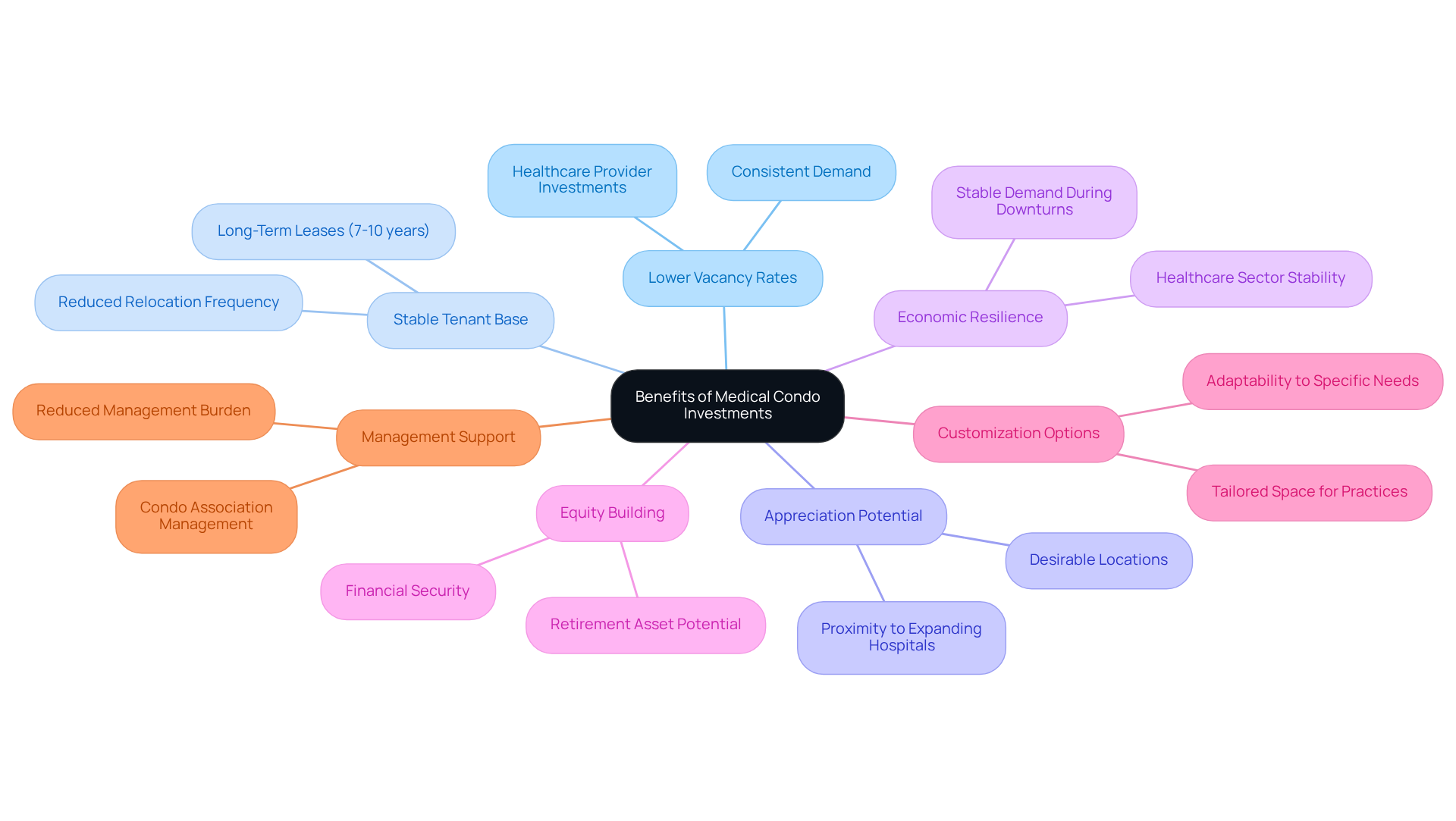

Examine the Unique Benefits of Medical Condo Investments

Investing in a medical condo presents distinct advantages that significantly enhance its attractiveness. Medical condos generally experience lower vacancy rates compared to traditional commercial properties. This is primarily because healthcare providers make substantial investments in their developments, leading to infrequent relocations. Consequently, this results in a more stable tenant base and reliable rental income for the medical condo, supported by an average office lease duration of 7-10 years.

Furthermore, healthcare units, such as medical condos, are noted for their potential to appreciate in value, particularly in desirable locations or near expanding hospital facilities. The resilience of the medical sector, as emphasized by an unidentified source stating, 'The medical field is recognized for its resilience, even during economic downturns,' adds to this stability, often maintaining demand even in challenging economic climates.

Owning a medical condo also allows healthcare practitioners to build equity over time, offering financial security and a potential retirement asset. Additionally, the ability to customize the space to meet specific practice needs, coupled with property management typically handled by a homeowners association, alleviates the management burden for investors. This positioning makes healthcare units a versatile investment option, especially as the demand for outpatient services and satellite clinics continues to rise with an aging population.

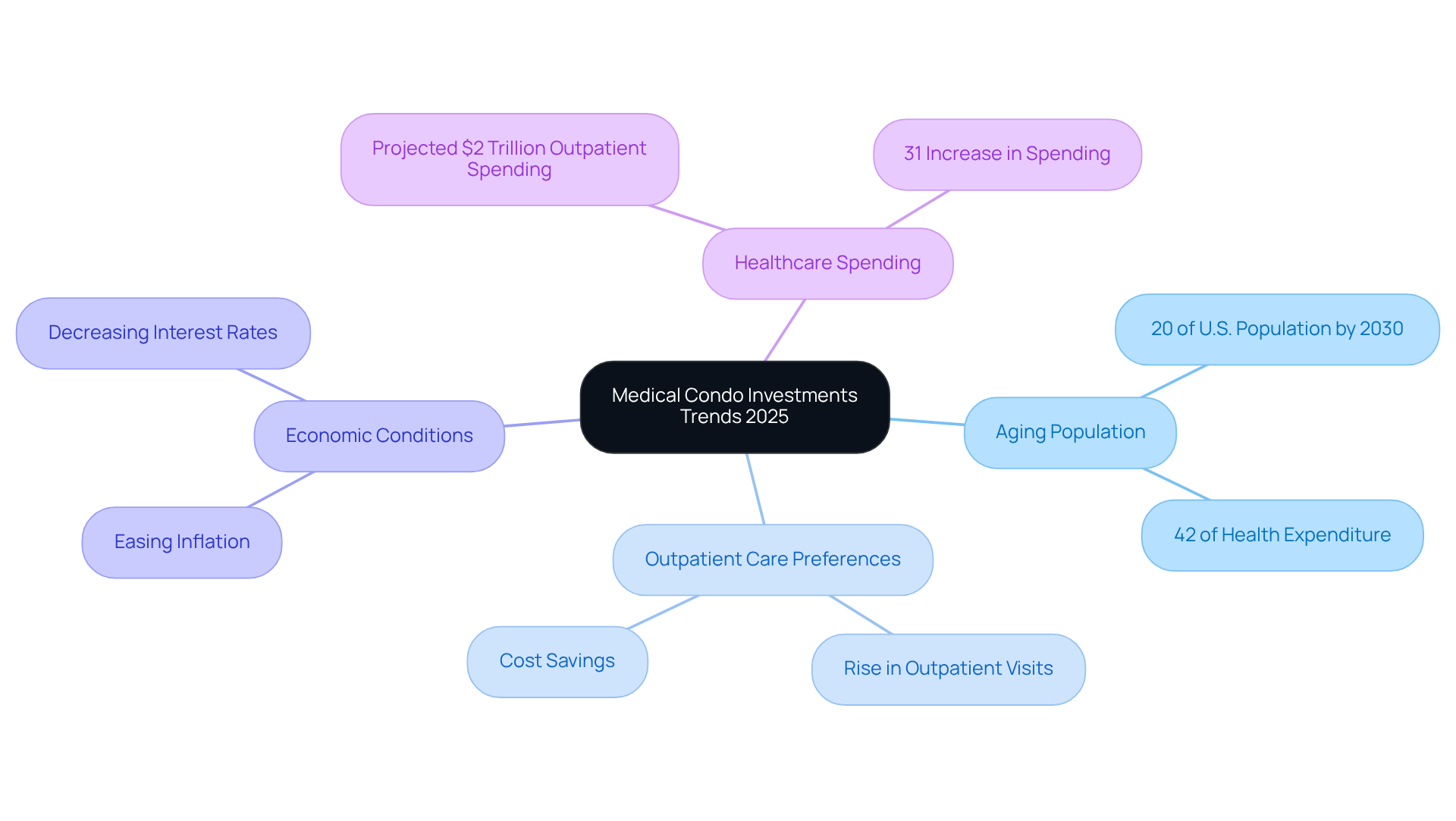

Analyze Current Market Trends Favoring Medical Condo Investments

Several compelling market trends are shaping the landscape for medical condo investments in 2025. A primary factor is the aging population, driving a greater demand for medical services. By 2030, individuals aged 65 and above will constitute 20% of the U.S. population, significantly impacting spending trends in medical services. In fact, outpatient healthcare spending is projected to surge by 31%, reaching nearly $2 trillion, primarily driven by this demographic shift as more individuals seek accessible and convenient care options.

The shift towards outpatient care is particularly noteworthy, with outpatient visits per capita rising from 1,900 in 2010 to a projected 2,500 by 2025, up from 2,300 visits per capita recorded in 2020. This trend reflects a growing preference for outpatient facilities, increasingly recognized as cost-effective alternatives to traditional hospital settings. For instance, patients can save an average of 59% on procedures performed in ambulatory surgical centers compared to hospitals, further driving demand for these facilities.

Furthermore, favorable economic conditions, including easing inflation and decreasing interest rates, enhance the appeal of healthcare property investments. These factors make funding more attainable for investors, positioning healthcare apartments as a profitable opportunity in the current market.

As the health sector adjusts to these demographic changes and consumer preferences, medical condos are poised to play an essential role in addressing the needs of an aging population. Significantly, individuals aged 65 and older are projected to account for 42% of health expenditure, underscoring the importance of this group in stimulating demand for health-related properties. The integration of outpatient care facilities within residential and retail districts is expected to continue, providing investors with strategic opportunities to capitalize on this evolving landscape.

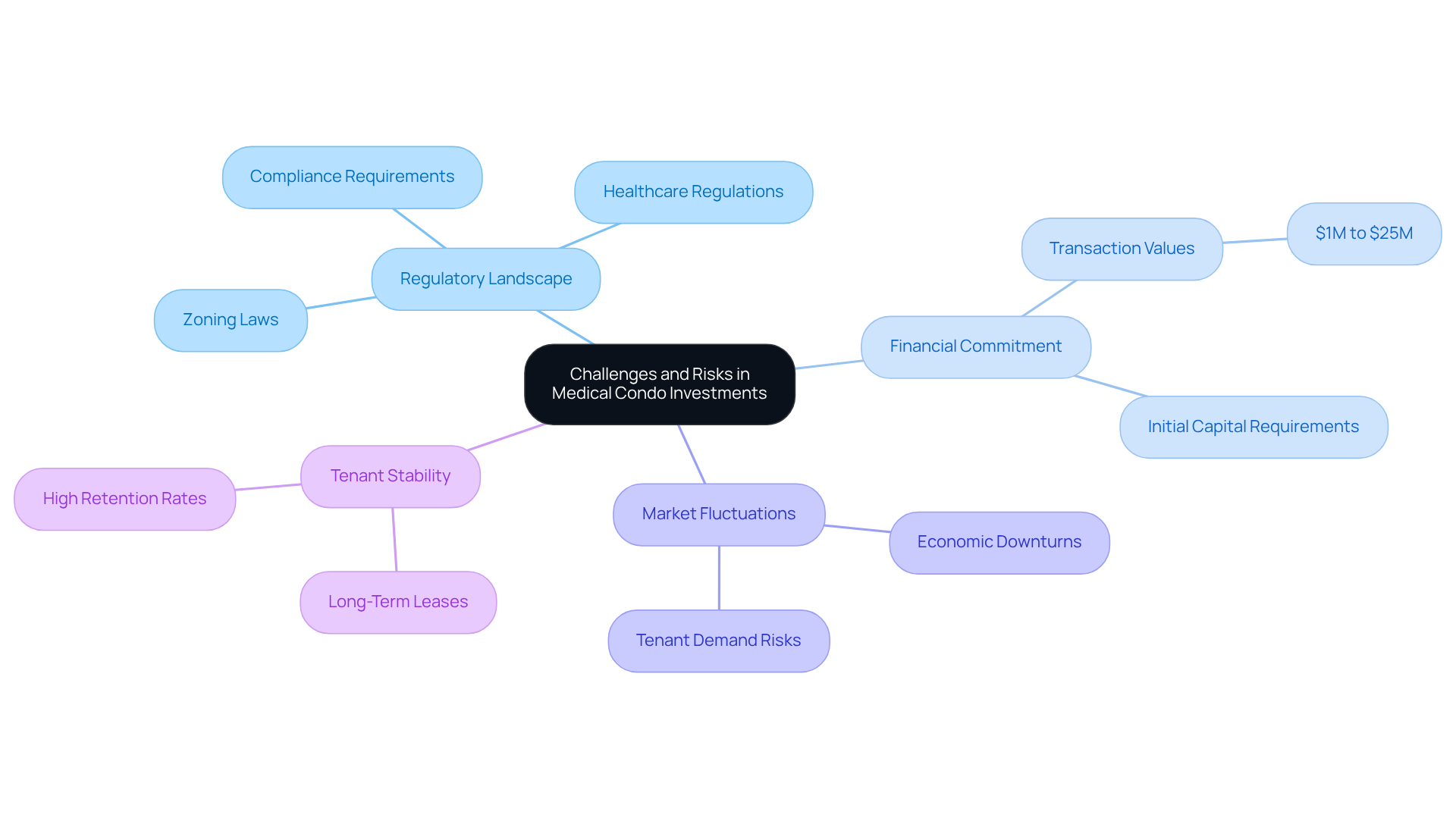

Consider Challenges and Risks in Medical Condo Investments

Investing in a medical condo offers a spectrum of advantages, yet it also comes with significant challenges and risks. A primary concern lies in the intricate regulatory landscape governing medical real estate, which frequently undergoes changes. Investors must skillfully navigate various zoning laws, healthcare regulations, and compliance requirements, all of which can substantially affect the feasibility of their investments. Additionally, the initial capital requirements for acquiring healthcare units can be considerable, with transaction values in Alliance's portfolio ranging from $1 million to $25 million, underscoring the financial commitment involved.

While healthcare condos generally demonstrate greater stability compared to other commercial properties, they are not exempt from market fluctuations. Economic downturns can still impact tenant demand, posing risks to profitability. Nevertheless, healthcare office buildings (MOBs) are viewed as a relatively recession-resistant asset category, which can mitigate some of these risks. Furthermore, the unique needs of healthcare tenants often necessitate ongoing investments in property enhancements and maintenance, further influencing overall returns. High retention rates for healthcare tenants contribute to the stability of these investments, as they typically enter into long-term leases, resulting in lower turnover rates compared to traditional office properties.

Understanding these challenges is crucial for investors aiming to penetrate the medical condo market, as it equips them with the knowledge to devise informed strategies that mitigate risks and enhance potential returns. As one real estate professional aptly stated, "Navigating the regulatory risks in healthcare real estate is crucial for ensuring long-term success in this sector.

Conclusion

The rising popularity of medical condo investments in 2025 signifies a substantial shift in the real estate landscape, specifically addressing the evolving needs of the healthcare sector. These properties not only empower medical professionals to own their practice locations but also provide investors with a reliable source of income through long-term leases. As the demand for healthcare services escalates—driven by demographic changes and a growing preference for outpatient care—medical condos emerge as a resilient investment choice.

This article has explored the key advantages of medical condo investments, including:

- Lower vacancy rates

- Potential for property appreciation

- Capacity for healthcare practitioners to build equity

Ongoing trends, such as an aging population and favorable economic conditions, further enhance the appeal of these properties. While challenges such as regulatory complexities and initial capital requirements exist, the stability and consistent demand within the healthcare sector render medical condos a compelling option for investors.

In light of these insights, potential investors must weigh the unique benefits and risks associated with medical condo investments. By effectively navigating the regulatory landscape and comprehending market dynamics, investors can position themselves to capitalize on the surging demand for healthcare facilities. Engaging with this opportunity not only bolsters the healthcare industry but also secures a promising financial future in a continually evolving market.