Overview

The top real estate markets for investment in 2025 include:

- Fayetteville

- Raleigh

- Phoenix

- Atlanta

- Denver

- Omaha

- Columbia

- Johnson City

- Richmond

Each of these cities is distinguished by unique economic strengths and significant growth potential. Key factors such as rising property values, robust job markets, and favorable living conditions contribute to their appeal. These attributes make them attractive options for both seasoned investors and newcomers alike. As you consider your investment strategies, these insights will be crucial in navigating the evolving real estate landscape.

Introduction

As the real estate landscape evolves, identifying the most promising markets for investment becomes increasingly crucial. Investors seeking lucrative opportunities in 2025 can explore a range of dynamic locations that offer unique advantages, from robust economic growth to affordable housing options. However, with so many choices, the challenge lies in discerning which markets will truly thrive amidst shifting trends and potential risks. This article delves into the ten best real estate markets to invest in for 2025, providing insights that can guide strategic investment decisions and capitalize on emerging opportunities.

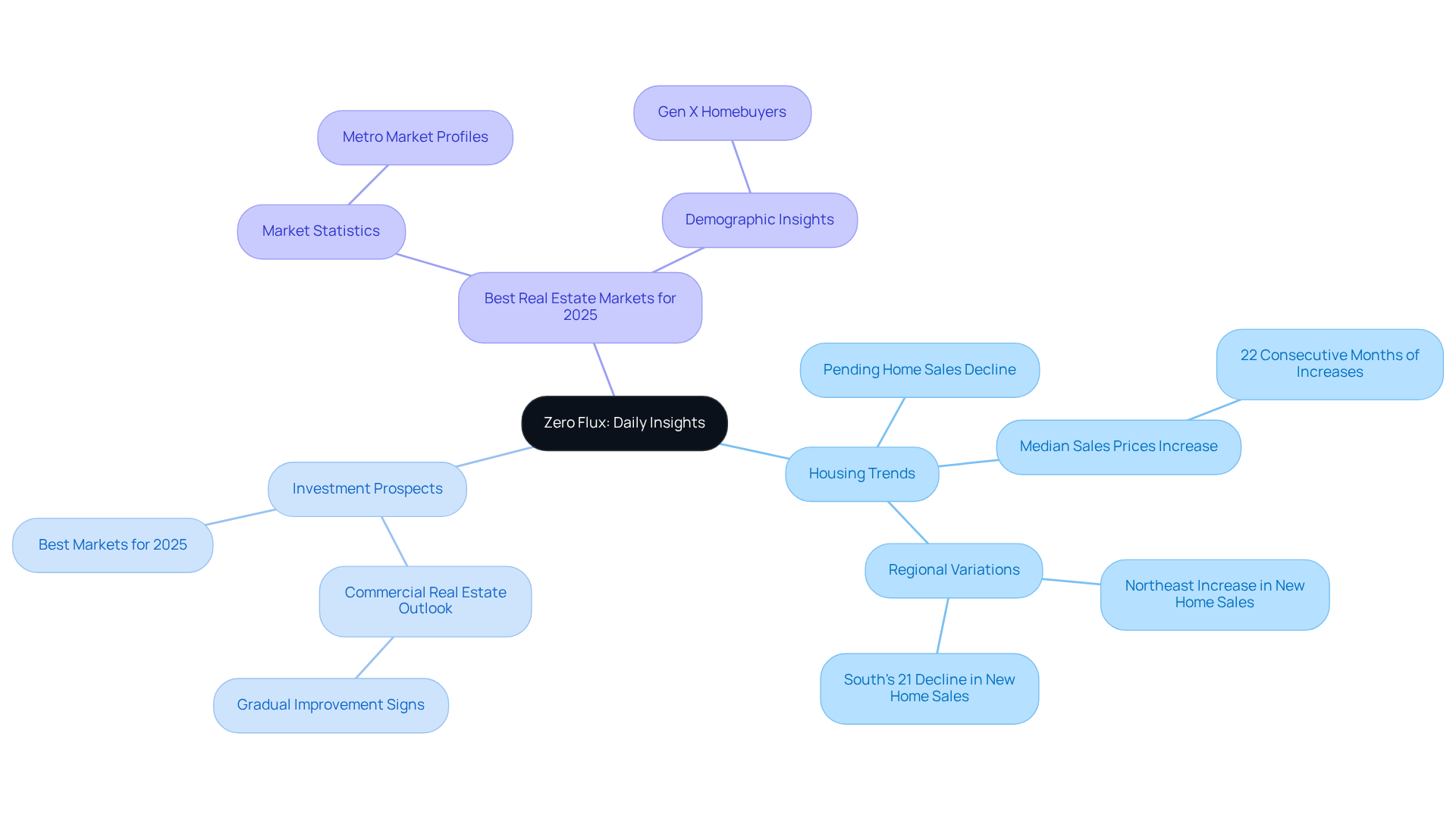

Zero Flux: Daily Insights on Real Estate Market Trends

Zero Flux stands as a specialized daily newsletter, meticulously curating essential real estate industry trends and insights from over 100 diverse sources. By emphasizing factual information devoid of opinions, it emerges as a vital resource for both industry professionals and enthusiasts. Subscribers receive a concise collection of 5-12 selected insights each day, covering topics such as:

- Housing trends

- Investment prospects

- The best real estate markets to invest in 2025

This unwavering commitment to data integrity establishes Zero Flux as a leading authority in real estate information dissemination, rendering it indispensable for navigating the complexities of the market.

Fayetteville, Arkansas: A Rising Star in Real Estate Investment

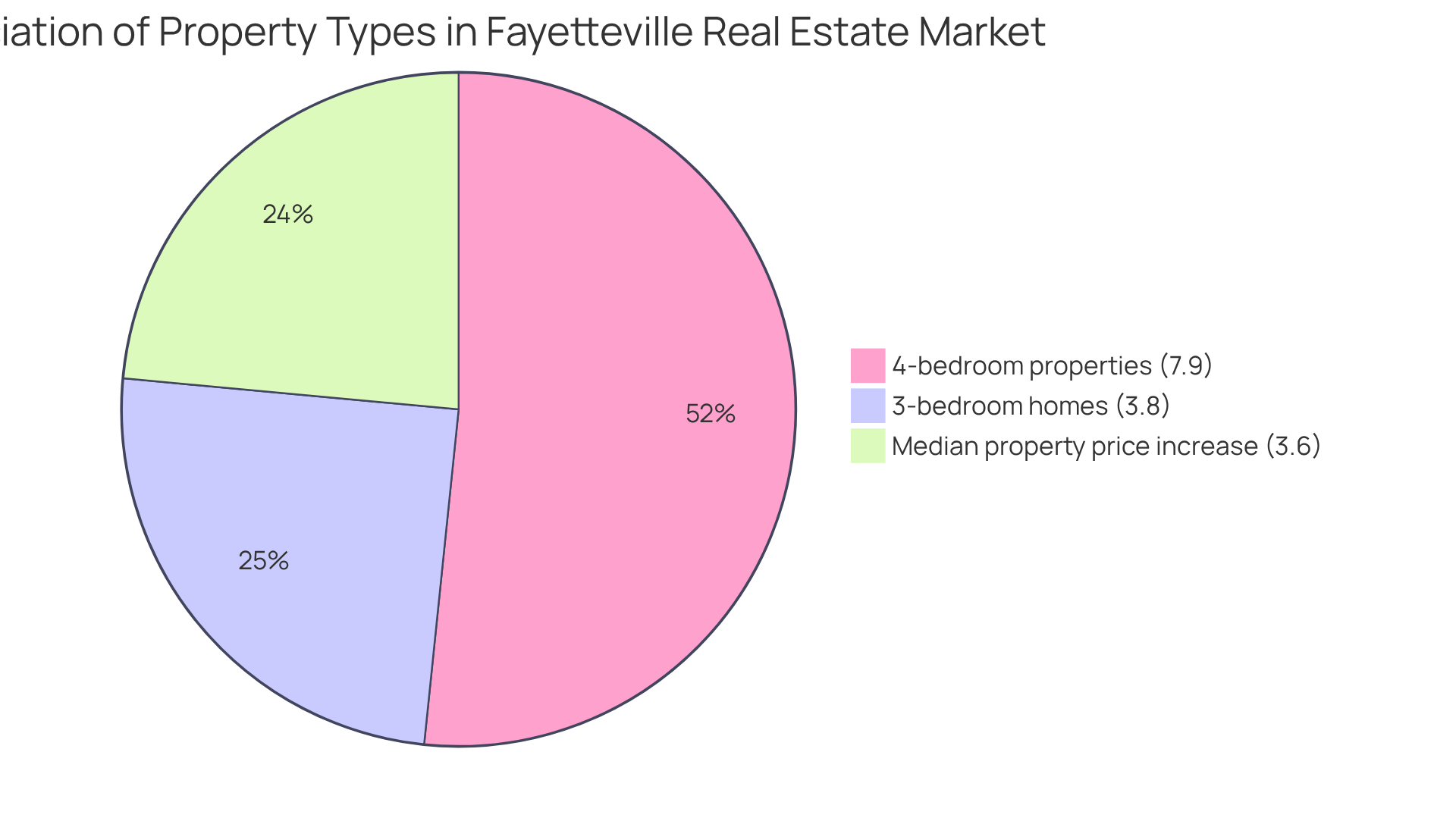

Fayetteville, Arkansas, is rapidly establishing itself as a pivotal hub for real estate investment in the near future. As of May 2025, the median property price reached $387,178, reflecting a 3.6% increase from the previous year. This upward trajectory signifies a robust real estate market, characterized by demand consistently outpacing supply. The city's economy, underpinned by strong education and healthcare sectors alongside a steadily increasing population, presents a compelling case for investors in search of lucrative opportunities.

In addition to its economic strengths, Fayetteville offers a relatively affordable housing market compared to national averages, broadening accessibility for a diverse range of investors. The median sold values across various property types indicate significant appreciation, with:

- 3-bedroom homes appreciating by 3.8% to $337,300

- 4-bedroom properties have seen a notable increase of 7.9% to $528,000

As of May 31, 2025, there are 339 homes available in Fayetteville, suggesting a competitive environment. The median price per square foot stands at $212, further illustrating the area's pricing dynamics.

Real estate experts emphasize that the combination of a vibrant local economy and favorable conditions makes Fayetteville one of the best real estate markets to invest in 2025. With a typical property value of $369,449 and a 1-year Zillow Property Value Index change of +2.7%, the sector is poised for continued appreciation, making it an attractive option for both seasoned investors and newcomers alike. Furthermore, Fayetteville is currently classified as a seller's market, underscoring the competitive landscape that potential investors must navigate.

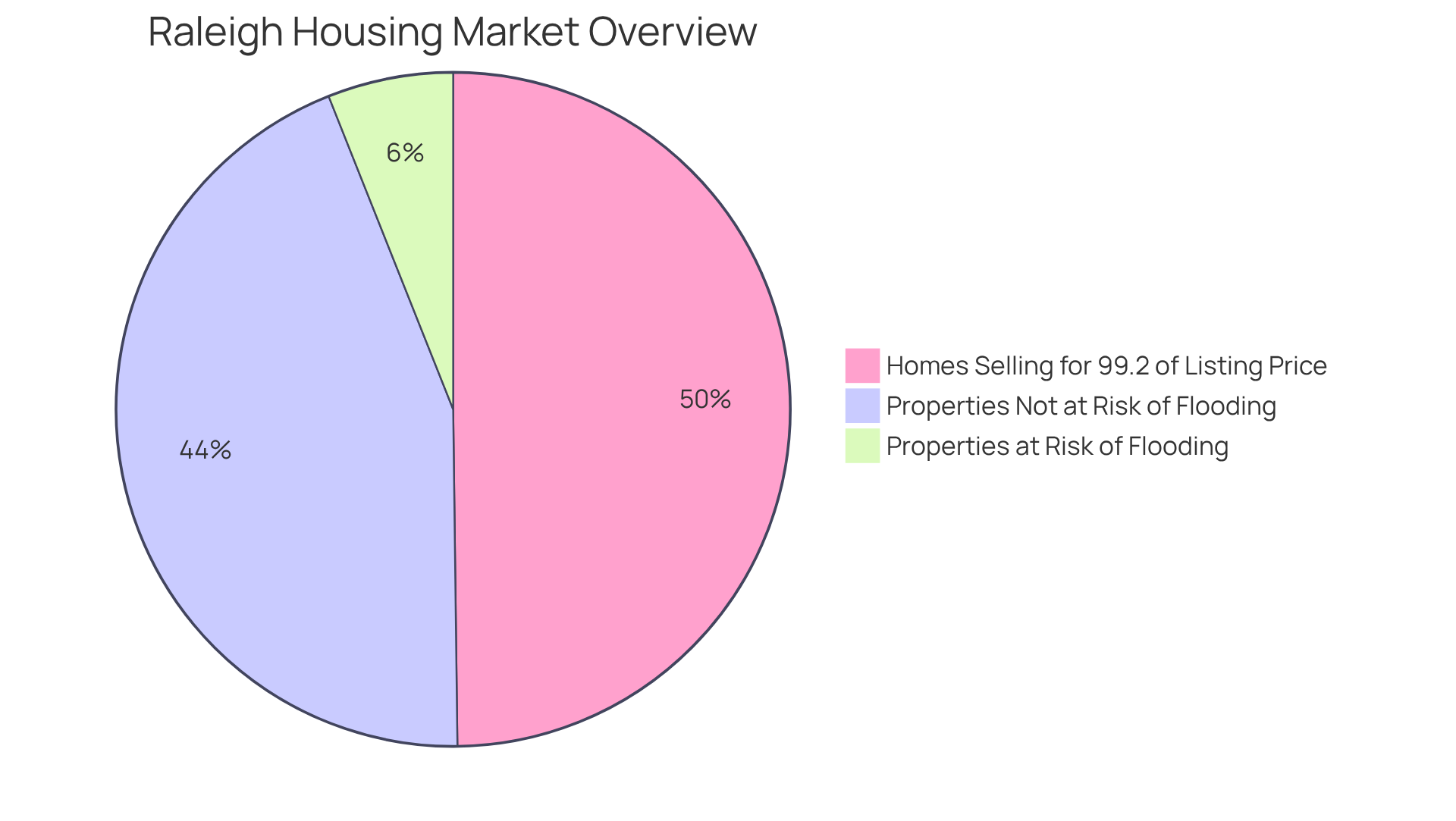

Raleigh, North Carolina: Economic Growth Fuels Housing Demand

Raleigh, North Carolina, is currently experiencing notable economic growth, a crucial factor driving housing demand. The average property value in the city stands at approximately $448,206, reflecting a modest decrease of 1.9% over the past year. In May 2025, the median sale value of a residence reached $445,000, indicating a slight increase compared to the previous year. Despite the overall dip in average home value, the ongoing influx of specialists from the tech and research sectors is anticipated to stabilize and ultimately enhance home values.

Residences in Raleigh are presently selling for 99.2% of their listing price, showcasing robust demand in the area. Moreover, with only 2.5 months of housing inventory available, Raleigh's market is characterized as balanced, supported by a strong job sector and a diverse array of housing options. However, investors should also be mindful that 12% of properties are at risk of severe flooding over the next 30 years.

Overall, Raleigh is among the best real estate markets to invest in 2025, as it is poised for recovery and growth, underpinned by the city’s strong economic fundamentals.

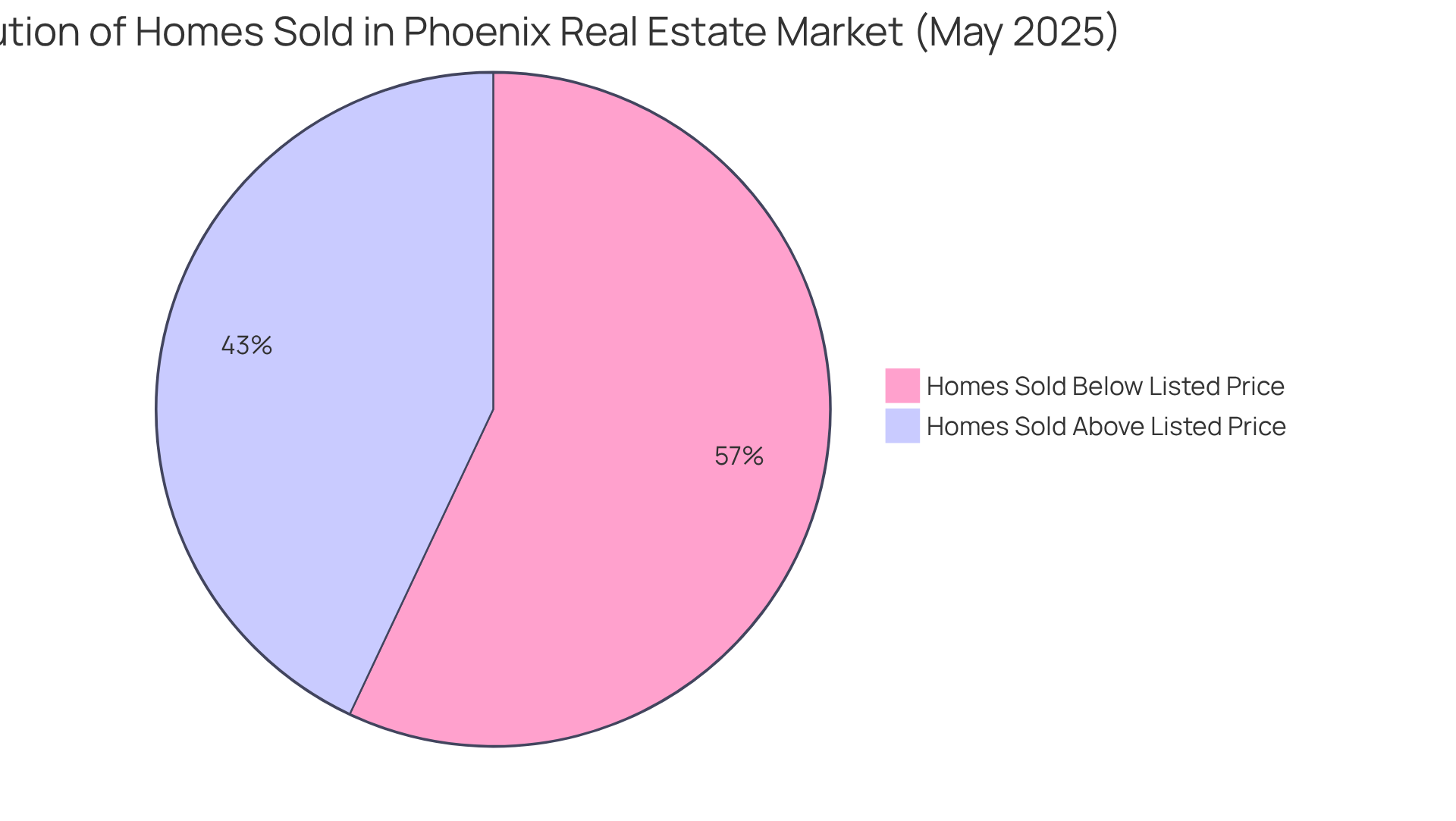

Phoenix, Arizona: Thriving Market Driven by Population Growth

Phoenix, Arizona, is witnessing a robust real estate sector, significantly propelled by its rapid population growth. As of May 2025, the median housing cost reached $456,920, marking a 1.8% increase from the previous year. The city's appeal lies in its warm climate, diverse job opportunities, and relatively affordable living costs, positioning it as an attractive destination for new residents. With a strong employment landscape and a low unemployment rate of approximately 3.2%, the demand for housing is on the rise, positioning Phoenix among the best real estate markets to invest in 2025 for investors seeking substantial growth potential.

Recent trends reveal that:

- 57% of residences sold in May were below the listed amount.

- 865 properties sold above the listed price, underscoring the competitive nature of the market.

The average per capita income in Phoenix stands at $48,727, and the median household income is $77,041, providing a solid economic foundation for prospective investors. However, the city does face challenges, including a poverty rate of 14.27%. As the population continues to expand, the demand for housing in Phoenix is anticipated to remain strong, establishing it as one of the best real estate markets to invest in 2025.

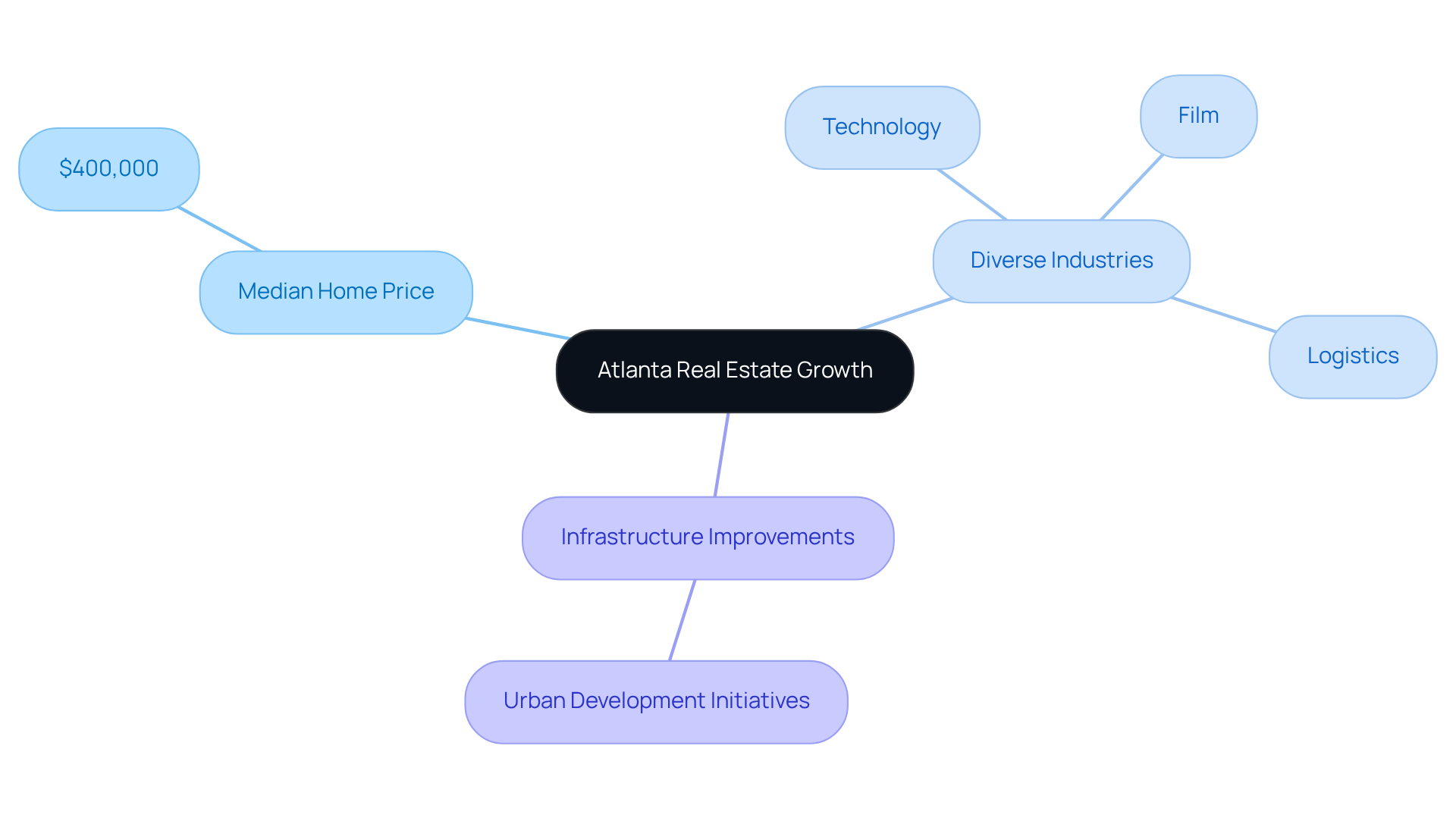

Atlanta, Georgia: Diverse Economy Supports Real Estate Growth

Atlanta, Georgia, presents a diverse economy that underpins robust real estate growth. The city's median home price stands at approximately $400,000, indicative of a steady appreciation trend. With significant industries such as technology, film, and logistics, Atlanta draws a wide array of professionals, thereby driving housing demand. Furthermore, the city's ongoing infrastructure enhancements and urban development initiatives significantly bolster its investment attractiveness. This makes Atlanta one of the best real estate markets to invest in 2025.

Denver, Colorado: Lifestyle and Job Market Attract Investors

Denver, Colorado, stands out as a premier choice for real estate investors, fueled by its appealing lifestyle and strong job market. As of 2025, the median sale price of a property in Denver hovers around $610,000, indicating a competitive landscape. The city’s vibrant culture, plentiful outdoor activities, and a swiftly expanding tech sector significantly boost its attractiveness.

With job opportunities on the rise—evidenced by a 12% increase in homes going under contract compared to previous months—the demand for housing is expected to grow, reinforcing Denver's position as one of the best real estate markets to invest in 2025. Analysts highlight that lifestyle factors, including walkability and access to amenities, increasingly shape investor decisions.

As Amanda Snitker, Chair of the DMAR Market Trends Committee, aptly notes, "Listings must now earn buyer attention through thoughtful preparation, realistic pricing, and compelling presentation," making Denver an intriguing area to watch.

Omaha, Nebraska: Affordable Market with Steady Growth

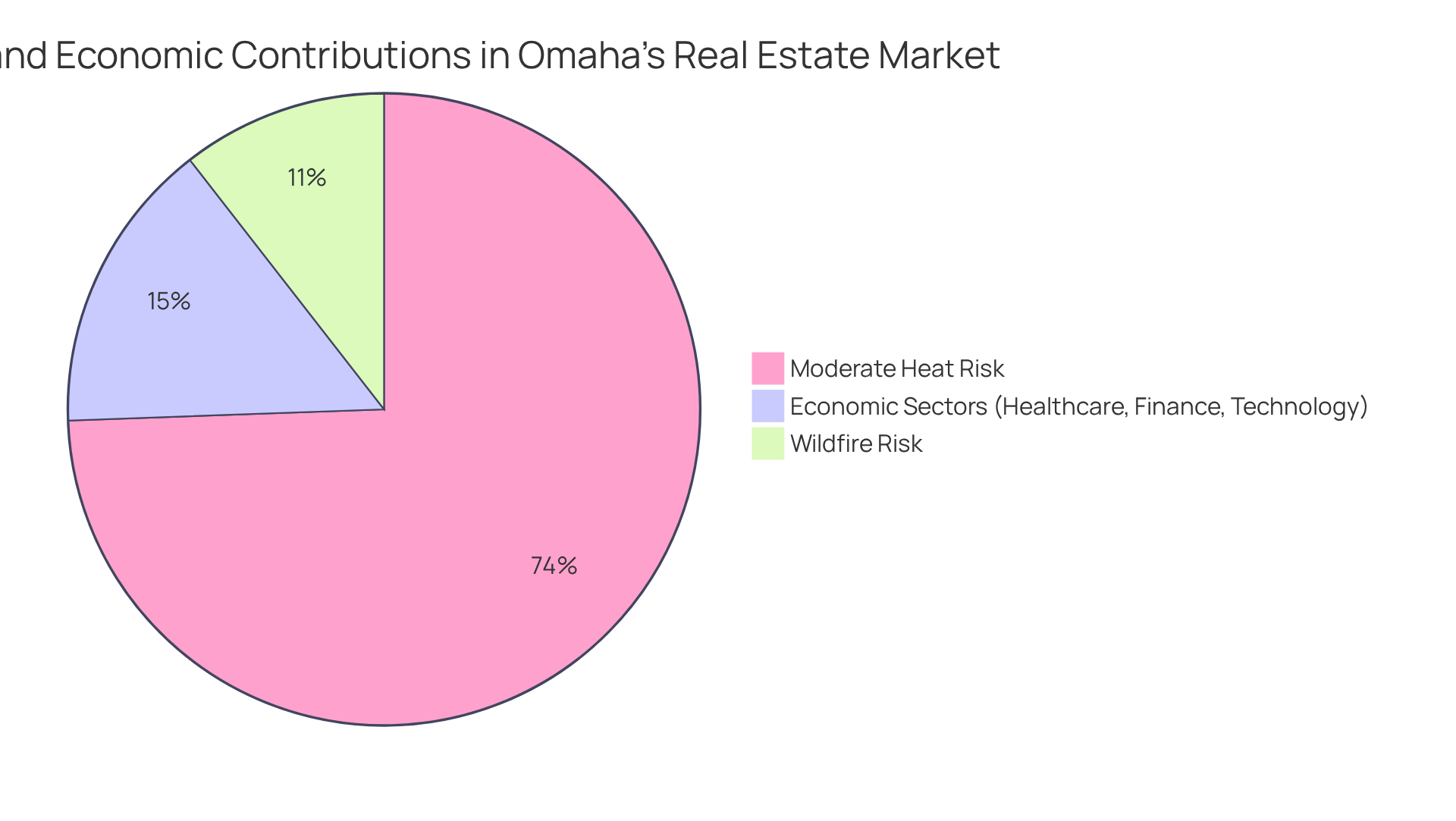

Omaha, Nebraska, is emerging as a noteworthy affordable market with consistent growth. As of June 2025, the median listing price stands at approximately $340,500, making it accessible for both first-time homebuyers and investors. The average property value in Omaha is reported at $294,010, reflecting a 2.6% increase over the past year. This upward trend is bolstered by the city's diverse economy, which encompasses healthcare, finance, and technology sectors, thereby supporting a stable housing market.

Recent trends indicate a significant rise in inventory, with 2-bedroom homes experiencing a remarkable 333.3% increase in availability in May. As the demand for affordable housing escalates, Omaha is considered among the best real estate markets to invest in 2025. Properties in Omaha typically enter agreements in approximately 20 days, underscoring a dynamic market environment. However, potential investors should remain vigilant regarding risk factors; notably, 99% of properties are at moderate risk of heat, and 14% face wildfire risk over the next 30 years.

This balanced perspective on the economic dynamics reinforces Omaha's appeal as a strategic option for real estate investments. With its combination of affordability, growth potential, and diverse economic foundations, Omaha is among the best real estate markets to invest in 2025, attracting savvy investors looking to capitalize on emerging opportunities.

Columbia, Missouri: Strong Rental Market and Economic Stability

Columbia, Missouri, is rapidly establishing itself as a robust rental market characterized by economic stability and growth. As of June 2025, the average rental price in Columbia stands at approximately $1,300, which is an impressive 35% lower than the national average. This affordability positions Columbia as an attractive option for both investors and renters alike. The presence of the University of Missouri significantly contributes to sustained rental demand, drawing a consistent influx of students and faculty. This demographic ensures a reliable tenant base, bolstering the area's economic resilience.

Moreover, Columbia's economic landscape benefits from a diverse employment sector and ongoing development initiatives, further enhancing its appeal for property investment. Real estate experts are optimistic about the city's potential, noting that the combination of rising asset values and a stable rental environment positions Columbia among the best real estate markets to invest in 2025. With home prices having surged by 52% over the past four years, the gap between rental costs and homeownership expenses is narrowing, making renting an increasingly viable option for many residents. As Columbia continues to evolve, it remains one of the best real estate markets to invest in 2025 for investors seeking promising opportunities.

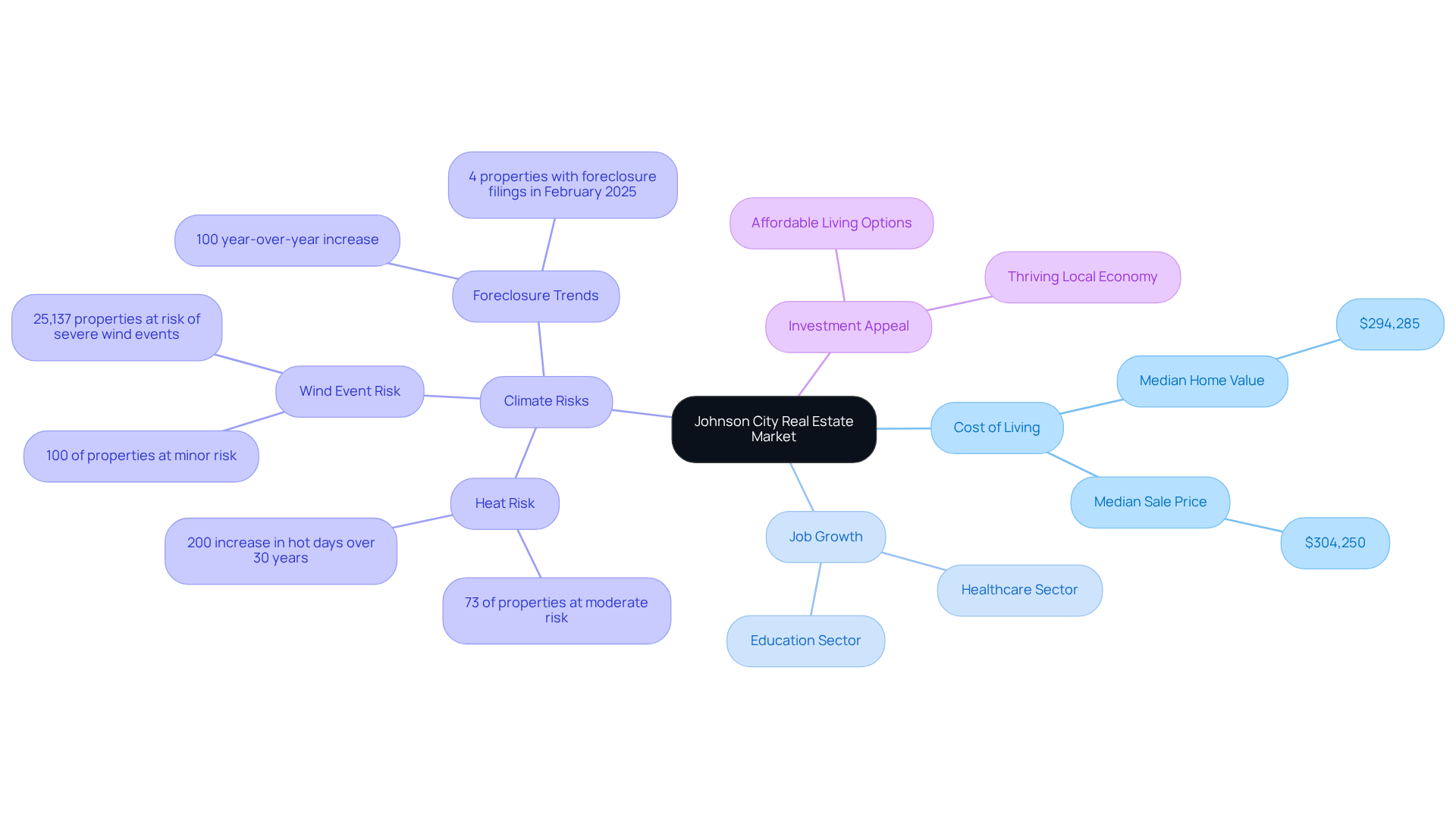

Johnson City, Tennessee: Low Cost of Living and Job Growth

Johnson City, Tennessee, is considered one of the best real estate markets to invest in 2025, due to its low cost of living and robust job growth. With a median home value of approximately $294,285—significantly below the national average—this area presents an appealing choice for both purchasers and investors. The expansion of the city's healthcare and education sectors is driving job creation and increasing housing demand. Notably, the median sale price stands at $304,250, offering a clearer perspective on the pricing dynamics.

However, investors should also consider the long-term implications of climate factors, as 73% of properties are projected to face moderate heat risk over the next 30 years due to rising 'feels like' temperatures. Additionally, February saw 4 properties with foreclosure filings, marking a 100% year-over-year increase, which may indicate shifts in industry stability. Furthermore, 100% of properties in Johnson City are at minor risk of severe wind events over the next three decades.

As more individuals seek affordable living options, Johnson City is emerging as one of the best real estate markets to invest in 2025. The local economy continues to thrive, with a projected 200% increase in the number of hot days over the next 30 years, further enhancing the area's appeal for real estate investment.

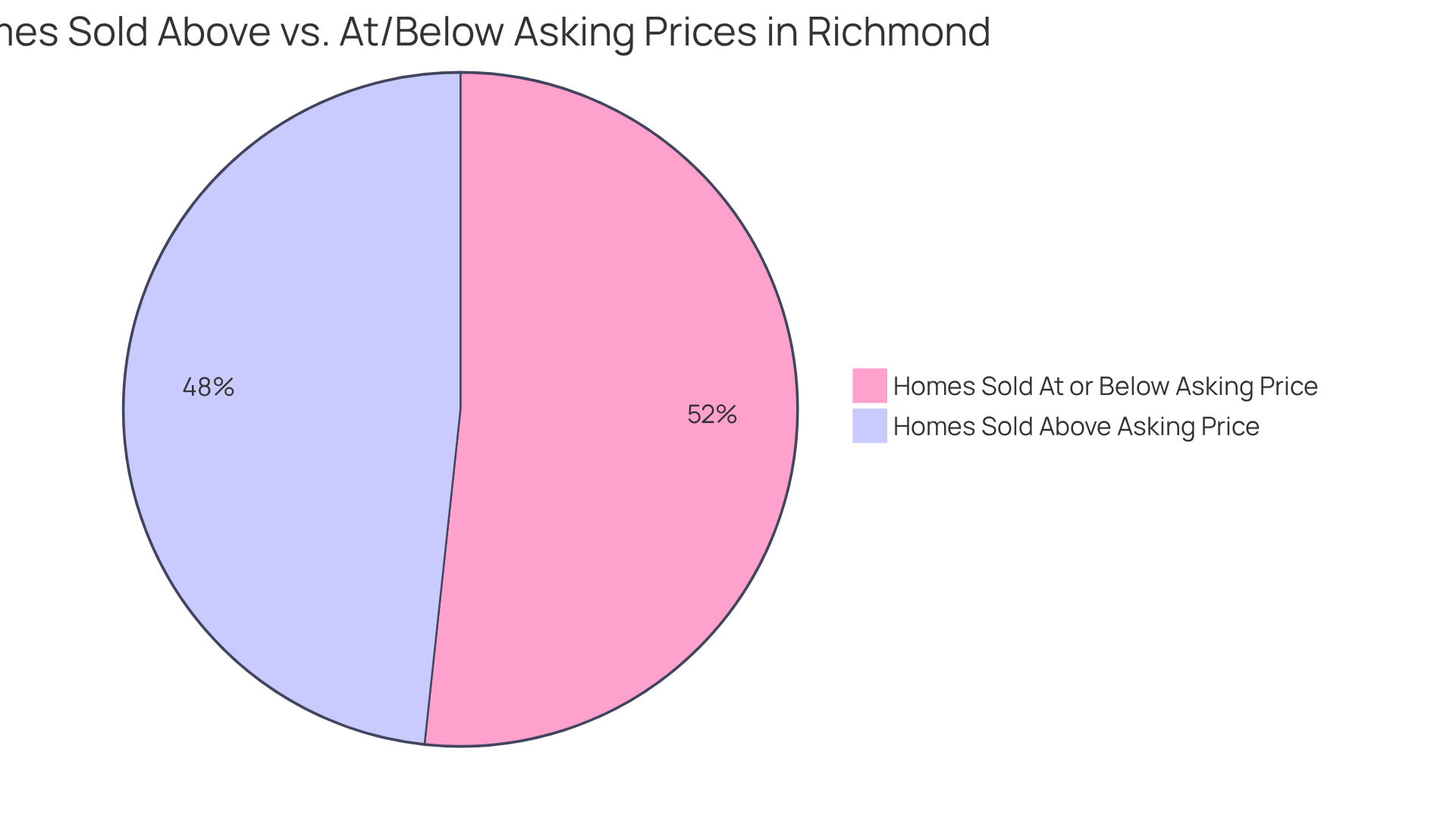

Richmond, Virginia: Revitalization Efforts Enhance Investment Appeal

Richmond, Virginia, is currently experiencing a remarkable revitalization, making it an increasingly appealing destination for real estate investment. The median residence value in the area stands at approximately $350,000, indicative of a competitive market that has witnessed a notable 9.6% year-over-year increase as of early 2024. This upward trajectory is bolstered by ongoing urban development initiatives and a robust employment sector, particularly within the healthcare and technology industries, driving both population growth and heightened demand for housing.

The sale-to-list price ratio of 102.8% underscores the high demand, revealing that properties frequently sell for above their listing prices. This trend is further illustrated by the fact that 48.3% of homes sold in Richmond surpassed their asking prices, reflecting strong buyer interest. As Richmond continues to evolve, it is becoming one of the best real estate markets to invest in 2025, presenting promising opportunities for growth. The projected modest appreciation in the housing market, combined with an influx of residents from higher-priced areas, makes Richmond one of the best real estate markets to invest in 2025 for savvy investors looking to capitalize on emerging trends.

Conclusion

Investing in real estate in 2025 offers a wealth of opportunities across diverse markets, each distinguished by unique strengths and growth potential. This article highlights ten cities that stand out for their favorable conditions, including Fayetteville, Raleigh, and Phoenix, among others. These locations exemplify the various factors contributing to a thriving real estate environment, from economic growth and job creation to affordable housing and strong rental markets.

Key insights reveal that cities like Fayetteville and Raleigh benefit from robust economic foundations, whereas others like Phoenix and Atlanta capitalize on population growth and diverse economies. Furthermore, emerging markets such as Omaha and Columbia showcase affordable options paired with steady appreciation, making them appealing for both seasoned investors and newcomers seeking promising investments. Each city's distinct characteristics underscore the necessity of thorough market analysis when considering investment opportunities.

As the real estate landscape continues to transform, investors are encouraged to remain informed about market trends and opportunities. By leveraging insights from reliable sources, such as Zero Flux, and understanding the dynamics of each market, investors can make informed decisions that align with their financial objectives. The potential for growth in these highlighted markets not only presents lucrative investment opportunities but also contributes to the broader economic landscape, positioning 2025 as a pivotal year for real estate investment.