Overview

The primary focus of the article titled "Understanding Residential Real Estate News: A Complete Tutorial for Investors" is to empower investors with crucial insights and strategies for navigating the complexities of the residential real estate market. By emphasizing the significance of grasping market trends, economic indicators, and demographic factors, the article enables investors to make informed decisions. This knowledge not only allows them to capitalize on opportunities but also to mitigate risks in a dynamic environment. Investors are thus equipped to engage with the market confidently and strategically.

Introduction

In the ever-evolving landscape of residential real estate, grasping the intricate dynamics that influence market trends is crucial for investors aiming to navigate both opportunities and challenges. Understanding the implications of demographic shifts and analyzing critical financial metrics can distinguish successful investments from costly missteps. As the market fluctuates, characterized by rising interest rates and shifting buyer preferences, it becomes essential to stay informed about key indicators and best practices.

This article explores the fundamentals of residential real estate news, the importance of various information sources, and the strategies investors can implement to thrive in a competitive environment.

Fundamentals of Residential Real Estate News

The field of residential real estate news is multifaceted, encompassing essential components such as trends, property values, and economic indicators that impact the housing landscape. For individuals involved in finance, understanding key concepts like 'appreciation,' 'depreciation,' and 'market cycles' is vital. These ideas not only assist in predicting changes in commerce but also empower stakeholders to make informed choices.

For instance, recognizing the distinction between a seller's environment and a buyer's environment can significantly influence investment strategies. In a seller's environment, characterized by high demand and limited supply, property values typically increase, presenting opportunities for appreciation. Conversely, in a buyer's environment, where supply exceeds demand, purchasers may encounter favorable conditions for negotiating lower prices, potentially leading to future profits as the market stabilizes.

Recent statistics reveal that 88% of homebuyers relied on property agents as their primary source of information during their home search, underscoring the importance of expert guidance in navigating these complexities. Furthermore, insights from industry leaders, such as Lawrence Yun, Chief Economist at the National Association of Realtors, emphasize the relevance of economic indicators. Yun noted that while the coldest January in 25 years may have impacted buyer engagement, high home prices and rising mortgage rates continue to challenge affordability, suggesting that investors should remain vigilant regarding market conditions.

Understanding cycles in the industry is crucial for residential property investment. These cycles, influenced by economic factors, dictate the timing of buying or selling properties. For example, during periods of economic expansion, property values generally appreciate, whereas recessions may lead to depreciation.

Individuals who can identify these cycles are better positioned to capitalize on opportunities and mitigate risks.

Recent trends in 2025 indicate a dynamic residential property sector, with key metrics suggesting potential outperformers in various local areas. Case studies, such as the examination of possible housing policy changes during the Trump administration, illustrate how external factors can influence economic conditions. The report speculated on the administration's approach to affordable housing, highlighting the need for streamlined zoning processes and the availability of federal land for new projects.

However, it also emphasized that without addressing labor supply issues in the construction sector, these measures may not effectively resolve the underlying challenges.

In summary, staying informed about residential real estate news is essential for investors. By understanding industry trends, economic indicators, and the implications of appreciation and depreciation, investors can make strategic decisions that align with their financial objectives. Zero Flux plays a crucial role in this process by providing tailored insights from over 100 diverse sources, ensuring that subscribers receive accurate information that enhances their engagement and equips them to navigate the complexities of the property sector effectively.

Key Sources of Residential Real Estate Information

Investors should leverage a diverse array of sources for residential real estate news to adeptly navigate the complexities of the industry. Key sources include:

- Industry Reports: Publications from organizations such as the National Association of Realtors (NAR) and PwC deliver comprehensive analyses of sector trends. The latest NAR report underscores significant changes in buyer demographics and preferences, which are crucial for understanding current economic dynamics. Additionally, the Deloitte Center for Financial Services conducted a survey revealing insights into investment priorities and anticipated shifts in commercial property fundamentals, underscoring the importance of varied information sources.

Trustworthy financial news platforms, including Forbes and Bloomberg, provide timely updates on conditions related to residential real estate, encompassing insights into regulatory changes and economic factors affecting property. Recent analyses indicate that 88% of industry respondents intend to adopt digital technologies to enhance performance, reflecting a broader trend toward innovation in the sector. JLL's recent announcement of their internal large language model, JLL GPT, exemplifies how technology is being harnessed for space utilization dashboards and generating insights.

- Real Estate Platforms: Websites like Zillow and Redfin are invaluable for accessing data on property listings, sales history, and analytical trends. These platforms empower individuals to monitor price trends and uncover new opportunities in various neighborhoods.

- Local Area Reports: Local real estate agencies frequently release reports that highlight specific conditions in their regions. These localized insights can be particularly advantageous for individuals aiming to make informed decisions based on regional trends.

By broadening their information sources, individuals can gain a more nuanced understanding of economic dynamics, enabling them to make strategic decisions that balance short-term gains with long-term sustainability. This approach is increasingly vital as stakeholder pressure drives sustainability efforts within the sector, emphasizing the need for a comprehensive perspective on both current and future economic conditions. Furthermore, staying informed about evolving domestic and international regulations, as highlighted by the latest analysis from the PwC Deals team, is essential for individuals navigating this landscape.

Interpreting Market Trends and Indicators

To effectively interpret market trends, investors must concentrate on several key indicators that provide valuable insights into the dynamics of the real estate landscape:

- Price Trends: Analyzing historical price data is crucial for identifying upward or downward trends in specific markets. For instance, in 2025, the average price of residential properties has shown a steady increase, reflecting robust demand in major urban areas. Understanding these trends in residential real estate news enables investors to gauge the optimal timing for their transactions.

- Inventory Levels: Monitoring the number of homes available for sale is essential. As of April 2025, low inventory levels are common in many areas, indicating a seller's environment where competition among buyers drives prices higher. Conversely, elevated inventory levels may signal a buyer's environment, compelling sellers to adjust their pricing strategies to attract offers.

- Days on Market: This metric reveals how long properties remain listed before being sold. A reduction in the average days listed typically indicates heightened demand, suggesting that buyers are eager to acquire homes. Recent information shows that houses in sought-after areas are being sold within weeks, underscoring the urgency in these environments.

- Economic Indicators: Investors should also keep a close watch on broader economic factors such as interest rates, employment rates, and consumer confidence. Currently, the average 1-year mortgage rate in the United States stands at 2.6%, which continues to encourage home buying activity. These economic indicators significantly influence the housing sector, impacting both buyer behavior and pricing strategies.

- Sustainability Trends: It's important to note that sustainability is increasingly important to buyers, with a growing focus on eco-friendly homes and energy-efficient designs. This trend indicates a shift in buyer preferences that stakeholders must consider when examining industry dynamics.

By understanding and analyzing these indicators in residential real estate news, investors can make more informed decisions about the optimal timing for buying or selling properties, ultimately enhancing their investment strategies. Furthermore, case studies, such as the effect of home colors on property value, demonstrate how aesthetic selections can influence buyer perceptions and, consequently, property prices. For instance, experts agree that homes painted in soft whites tend to add the most value, with 85% of professionals supporting this view.

As Laura Madrigal, Home Improvement Content Specialist at Fixr.com, states, "By collaborating with industry experts and staying up-to-date on the latest trends, I provide homeowners with the knowledge they need to achieve their dream home." This emphasizes the complex nature of property investments, where both data trends and presentation play essential roles. 'Zero Flux's dedication to high-quality materials and its status as a prominent source of information in property matters further enable stakeholders to navigate these intricacies efficiently.

The Role of Demographics in Real Estate Investment

Demographics play a crucial role in shaping the dynamics of residential real estate news. Key demographic factors that investors should closely monitor include:

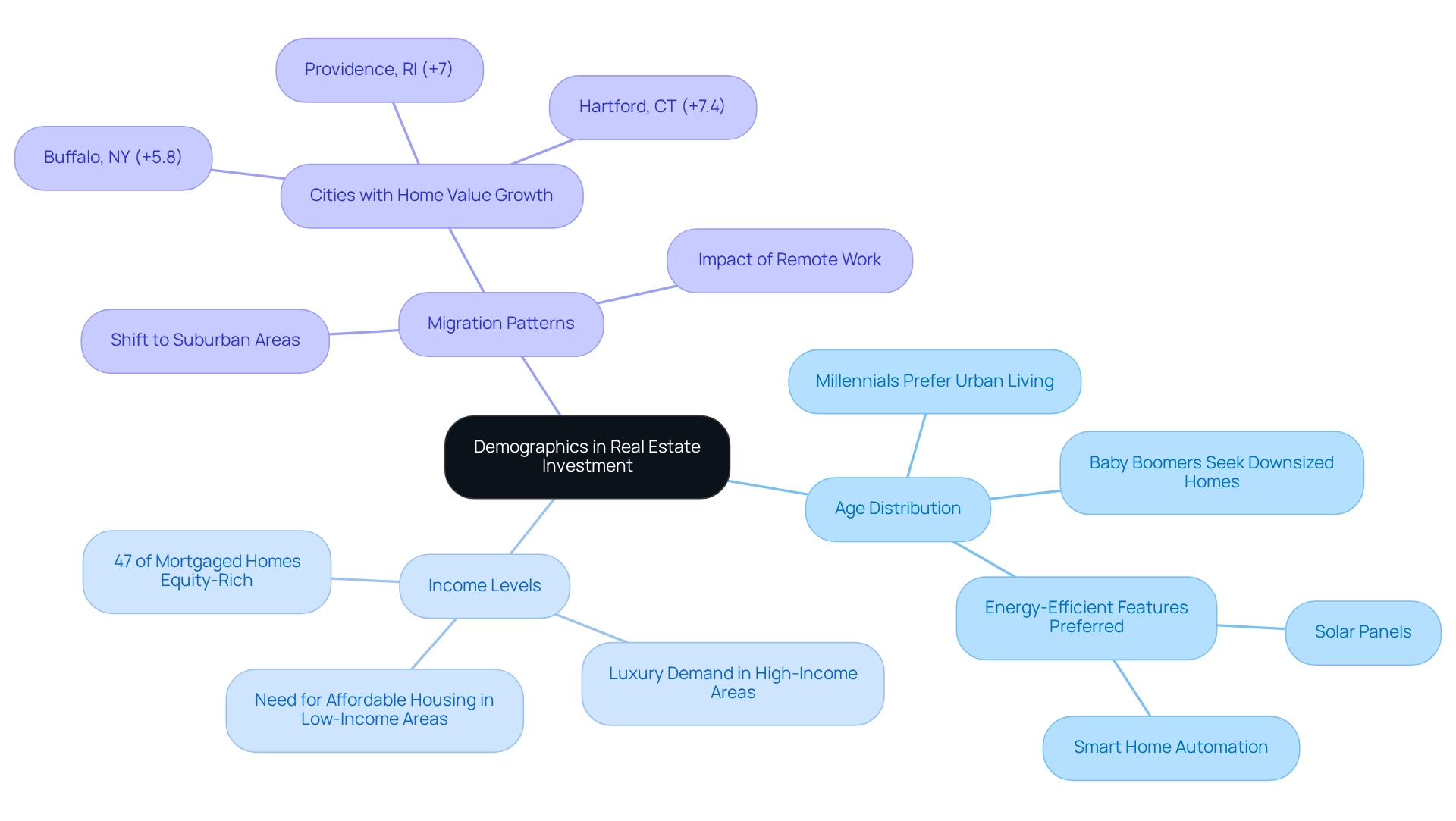

- Age Distribution: Different age groups exhibit distinct housing preferences. For instance, millennials often gravitate towards urban environments that offer vibrant lifestyles and amenities, while baby boomers typically seek downsized homes in quieter, suburban settings. This shift in preferences highlights the necessity for stakeholders to tailor their strategies according to the age demographics of specific regions.

- Income Levels: The income distribution within a community significantly influences housing demand. Areas with higher income levels tend to see a surge in demand for luxury properties, whereas regions with lower income levels may experience an increased need for affordable housing options. Comprehending these income dynamics can assist individuals in recognizing profitable opportunities across different sectors. Notably, over 47% of mortgaged homes were equity-rich in the fourth quarter of 2024, indicating a strong financial position for many homeowners, which can further influence demand for various housing types.

- Migration Patterns: Monitoring migration trends is crucial for identifying new opportunities. Recent data indicates a continued shift from major urban centers to suburban areas, driven by factors such as remote work flexibility and a desire for more space. For example, cities such as Buffalo, NY (+5.8%), Providence, RI (+7%), and Hartford, CT (+7.4%) have reported significant home value growth, indicating that these regions are becoming more appealing to homebuyers and stakeholders alike.

Furthermore, the recent case study named "New Home Starts and Completions" emphasizes that although single-family building starts and completions rose month-over-month in February, yearly declines raise concerns about a possible slowdown in the housing sector. This information is essential for stakeholders to evaluate as they navigate current economic conditions.

By examining these demographic patterns, including the notable rise in equity-rich properties, individuals can strategically position themselves to take advantage of changing market opportunities. Furthermore, expert opinions emphasize the importance of understanding how age distribution affects housing demand, particularly as younger buyers prioritize energy-efficient features like solar panels and smart home automation, aligning with their preferences for modern amenities.

In summary, a comprehensive analysis of demographic trends not only helps in recognizing potential investment hotspots but also improves an individual's capability to make informed choices based on residential real estate news in a swiftly evolving property market.

Financial Metrics and Analysis for Investors

To effectively evaluate real estate investments, investors must be well-versed in several essential financial metrics:

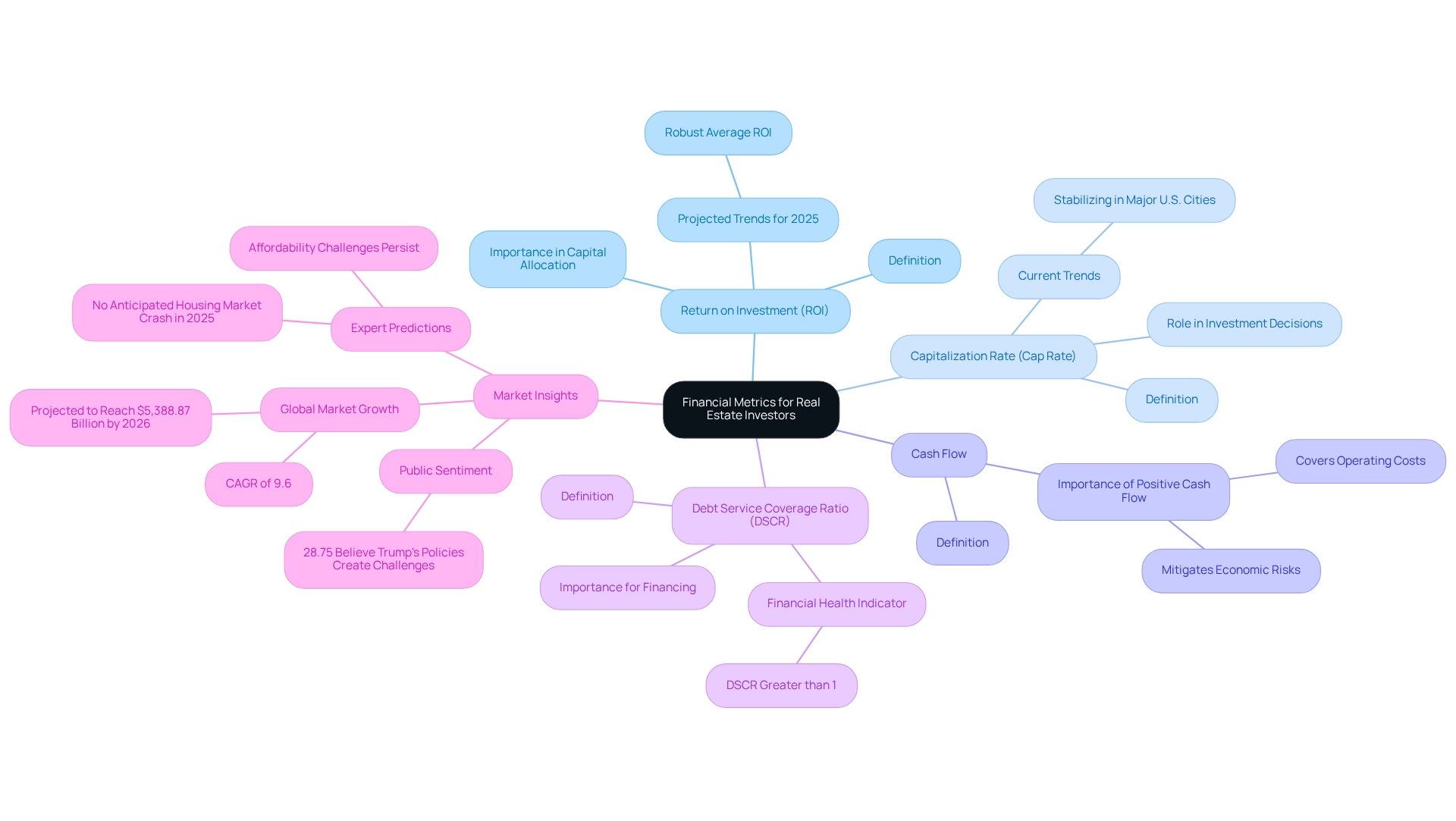

- Return on Investment (ROI): This critical metric measures the profitability of an investment relative to its cost, allowing investors to assess the efficiency of their capital allocation. In 2025, the average ROI in residential real estate is projected to remain robust, reflecting ongoing demand for housing despite market fluctuations.

- Capitalization Rate (Cap Rate): The Cap Rate indicates the expected rate of return on a property based on its income-generating potential. Current trends in residential real estate suggest that Cap Rates for properties in major U.S. cities are stabilizing, offering individuals clearer expectations for their returns. Understanding these rates is vital for making informed investment decisions.

- Cash Flow: This metric represents the net income generated by a property after all expenses are deducted. Positive cash flow is essential for sustaining an investment, as it ensures that the property can cover its operating costs and provide a return to the investor. Investors should target properties that consistently produce positive cash flow to mitigate risks linked to economic fluctuations.

- Debt Service Coverage Ratio (DSCR): The DSCR measures a property's ability to cover its debt obligations, indicating its financial health. A DSCR greater than 1 suggests that a property generates sufficient income to meet its debt payments, which is crucial for securing financing and maintaining investment stability.

According to residential real estate news, experts do not foresee a housing sector crash in 2025 due to substantial homeowner equity, which offers a more balanced perspective of the outlook. Moreover, with 28.75% of Americans believing that Trump's policies will generate difficulties and uncertainty for the American property sector, comprehending these views is essential for stakeholders.

By mastering these metrics, investors can navigate the complexities of the property sector and make informed choices that align with their financial objectives. As the worldwide property sector is expected to reach $5,388.87 billion by 2026, growing at a CAGR of 9.6%, understanding these financial indicators will be increasingly vital for seizing emerging opportunities. Furthermore, keeping informed about advancements impacting property, as emphasized in the case study titled 'Current Developments for the Property Industry,' is crucial for tackling new trends and challenges in the field.

Navigating Challenges in the Residential Market

Investors in the housing sector encounter a range of challenges that can significantly influence their investment strategies and outcomes. Key challenges include:

- Market Volatility: The residential real estate market is subject to fluctuations that can affect property values and investment returns. For instance, as of early 2025, the average rate for a 30-year fixed mortgage stood at 6.84%, a figure that has remained above 6.5% for over five months. This ongoing elevated rate contributes to price fluctuations, making it crucial for stakeholders to remain alert and adaptable to abrupt shifts in trading conditions. Selma Hepp, chief economist for CoreLogic, emphasizes that the current market conditions, characterized by unaffordability and the lock-in effect, will likely keep many sellers inactive, complicating the environment for purchasers and stakeholders alike.

- Financing Issues: High interest rates can severely limit borrowing capacity and impact cash flow. Investors must navigate these financing challenges by exploring various options, including adjustable-rate mortgages or alternative lending sources. The persistent high mortgage rates highlight the importance of understanding their implications on investment potential, as they directly affect investors' ability to secure financing.

- Regulatory Changes: The real estate landscape is continually evolving, with new laws and regulations that can influence property management and investment strategies. Remaining knowledgeable about local regulations is essential for compliance and can provide a competitive edge in the industry.

- Competition: The demand for desirable properties has intensified, leading to increased competition and rising prices. Investors need to devise unique strategies to differentiate themselves, such as targeting emerging neighborhoods or leveraging technology for property management. The case study titled "Housing Market Predictions for 2025" indicates that while many prospective homebuyers chose to wait for a more favorable market in 2024, rising home prices and tight supply suggest that 2025 will remain challenging for buyers. This competitive environment necessitates that investors stay proactive and innovative in their approaches.

Recognizing these challenges enables individuals to develop proactive strategies that mitigate risks and enhance their investment results. By comprehending these dynamics, including the significance of evaluating personal financial circumstances when contemplating property investments, individuals can more effectively navigate the complexities highlighted in residential real estate news in 2025.

Staying Informed: Best Practices for Investors

To thrive in the competitive landscape of residential property, individuals must adopt several best practices:

- Regularly Read Market Reports: Subscribing to industry newsletters, such as Zero Flux, is essential for staying informed about the latest trends and forecasts. This approach not only keeps stakeholders informed but also assists them in recognizing new prospects in the industry. Notably, 37% of stakeholders are currently focusing on industrial and logistics properties, underscoring the importance of understanding various market segments.

- Connect with Industry Experts: Building relationships with property agents, brokers, and other stakeholders is vital. Networking can lead to valuable insights and opportunities that may not be publicly available. By 2025, the impact of networking on investment success is expected to be even more pronounced, as collaboration emerges as a key driver of growth in the industry. For tailored statistics specific to your location, consider checking out Altos, the source of the data referenced above.

- Attend Workshops and Seminars: Participating in educational events enhances knowledge and skills related to real estate investing. These gatherings provide a platform for learning from specialists and sharing experiences with colleagues, significantly enhancing investment strategies. For instance, findings from a recent case study on the rental sector reveal that a substantial portion of the population consists of renters, with millennials representing the largest demographic. Key factors influencing rental decisions include lease terms and location, which are essential for stakeholders to understand.

- Utilize Technology: The integration of AI tools in real estate is anticipated to accelerate by 2025, making it crucial for stakeholders to leverage analytics platforms for effective access to data and industry insights. For example, tech-savvy Gen Z buyers are 130% more likely to schedule property showings that feature virtual tours, emphasizing the necessity of adopting innovative technologies in marketing and sales strategies.

By implementing these practices, investors can deepen their understanding of market dynamics and make informed decisions, positioning themselves for success in a rapidly evolving environment.

Conclusion

Understanding the complexities of the residential real estate market is vital for investors aiming to seize opportunities and mitigate risks. This article underscores the importance of grasping the fundamentals of market trends, demographic shifts, and financial metrics that shape investment strategies. By staying informed on various sources of real estate information—from industry reports to local market analyses—investors can make data-driven decisions that align with their financial goals.

Key indicators such as price trends, inventory levels, and economic factors play a crucial role in shaping market dynamics. Moreover, recognizing the impact of demographics and evolving buyer preferences enables investors to identify emerging markets and adapt their strategies accordingly. As challenges like market volatility and financing issues continue to pose risks, implementing best practices—including networking and leveraging technology—will be essential for navigating the competitive landscape.

Ultimately, the ability to interpret market signals and adjust strategies in response to changing conditions will distinguish successful investors from those who struggle. By fostering a proactive approach and remaining engaged with the latest developments in residential real estate, investors can enhance their potential for success in an ever-evolving market.