Overview

This article delves into the critical understanding and management of the various risks associated with real estate investments. It emphasizes the necessity of recognizing economic conditions, market dynamics, and regulatory changes. Key risks—such as market, liquidity, and interest rate risks—are detailed, supported by strategies for effective risk management. These strategies include:

- Thorough due diligence

- Diversification

- Leveraging technology to enhance decision-making

By grasping these insights, investors can navigate the complexities of the real estate landscape with greater assurance.

Introduction

In the intricate world of real estate investment, understanding and managing risks is paramount for success. As economic conditions shift and market dynamics evolve, investors must navigate a landscape fraught with challenges, including fluctuating interest rates and the looming threats of climate change. With the stakes higher than ever, recognizing the nuances of market volatility, liquidity issues, and regulatory changes becomes essential for crafting a resilient investment strategy.

As 2025 approaches, staying informed and adaptable is not just advisable—it is critical for safeguarding investments and capitalizing on emerging opportunities. This article delves into the multifaceted risks facing real estate investors today and offers insights into effective strategies for risk assessment and management.

The Landscape of Real Estate Investment Risks

Real estate ventures inherently involve uncertainties that create investment risks, influenced by various factors such as economic conditions and regulatory changes. Investors face challenges like market fluctuations, liquidity issues, and unforeseen costs, making it crucial to recognize these risks as the foundation of a robust investment strategy.

In 2025, the landscape of real estate investment challenges is particularly shaped by economic circumstances. For instance, ongoing shifts in stakeholder preferences have led to significant value losses in office and retail properties. This volatility underscores the necessity for stakeholders to stay informed about current trends and adapt their strategies accordingly, as certain sectors are beginning to show signs of resilience amid these challenges.

Moreover, concerns regarding severe weather events and climate threats are gaining prominence, as they can directly impact property values and insurance costs. Investors must factor in these elements when evaluating potential opportunities, as they can substantially alter the investment risks associated with a property. The growing importance of environmental considerations in financial decisions cannot be overstated.

Statistics indicate that only 3% of participants from BiggerPockets plan to sell real estate, reflecting a prevailing mindset among investors to hold onto their properties despite economic fluctuations. This trend highlights the importance of understanding the broader economic landscape and its implications for real estate ventures, particularly during unpredictable times.

Expert insights further emphasize the need for caution in navigating fluctuations. Tom Leahy, Executive Director of MSCI Research, notes that potential housing policy changes under the Trump administration could complicate housing dynamics, particularly concerning immigration and labor supply in construction. While there is acknowledgment of the affordable housing deficit, proposed policies may inadvertently exacerbate the issue, further influencing risk levels for investors.

In summary, a comprehensive understanding of the key factors affecting real estate investment risks—such as economic conditions, market dynamics, and regulatory changes—is essential for making informed decisions in today's complex environment. Investors should proactively seek information and adjust their strategies to effectively mitigate these challenges.

Identifying Key Risks in Real Estate Investments

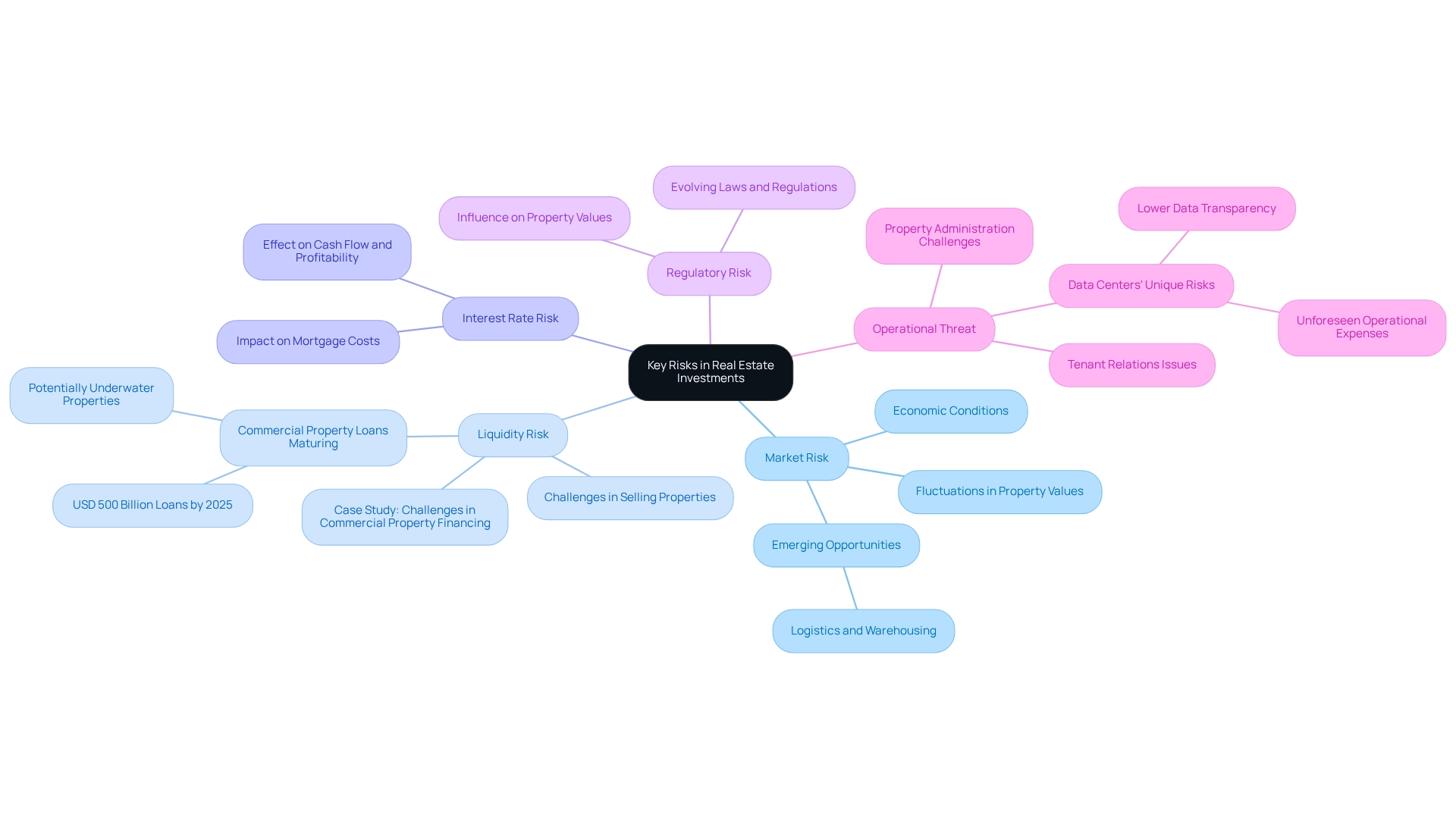

Key risks in real estate investments encompass several critical factors that investors must consider:

- Market Risk: This involves fluctuations in property values driven by broader economic conditions. As the digital economy continues to expand, asset classes such as logistics and warehousing facilities are emerging as prime opportunities, particularly in the next 12 to 18 months. However, stakeholders must remain vigilant about potential downturns that could impact property valuations. The newsletter gathers 5-12 selected real estate insights every day, offering useful information to assist investors in navigating these economic dynamics.

- Liquidity Risk: Investors often face real estate investment risks when attempting to sell properties quickly without incurring significant losses. The present economic dynamics highlight the real estate investment risks, particularly as nearly USD 500 billion in commercial property loans are set to mature in 2025, with many properties potentially underwater. This situation underscores the significance of grasping liquidity limitations in real estate ventures. A recent case study titled "Challenges in Commercial Property Financing" illustrates these concerns, emphasizing the need for stakeholders to navigate a challenging financing environment as market conditions evolve.

- Interest Rate Risk: Changes in interest rates can significantly impact mortgage costs and overall returns. As rates fluctuate, the cost of borrowing may rise, affecting cash flow and profitability for investors.

- Regulatory Risk: The real estate investment landscape is affected by evolving laws and regulations, which can influence property values and the viability of investments. Staying informed about regulatory changes is essential for reducing this threat.

- Operational Threat: This concern relates to the administration of properties, encompassing maintenance issues and tenant relations. Investors in data centers encounter distinct challenges, including reduced data transparency compared to conventional property types. Unforeseen expenses resulting from operational difficulties can diminish profit margins and influence overall financial performance.

Comprehending these challenges is essential for individuals seeking to navigate the intricacies of real estate investment risks efficiently. By staying updated on industry trends and potential obstacles, including insights from tech companies like JLL, which recently unveiled their own in-house large language model, JLL GPT, stakeholders can make more strategic choices and improve their financial results.

Effective Risk Assessment and Management Strategies

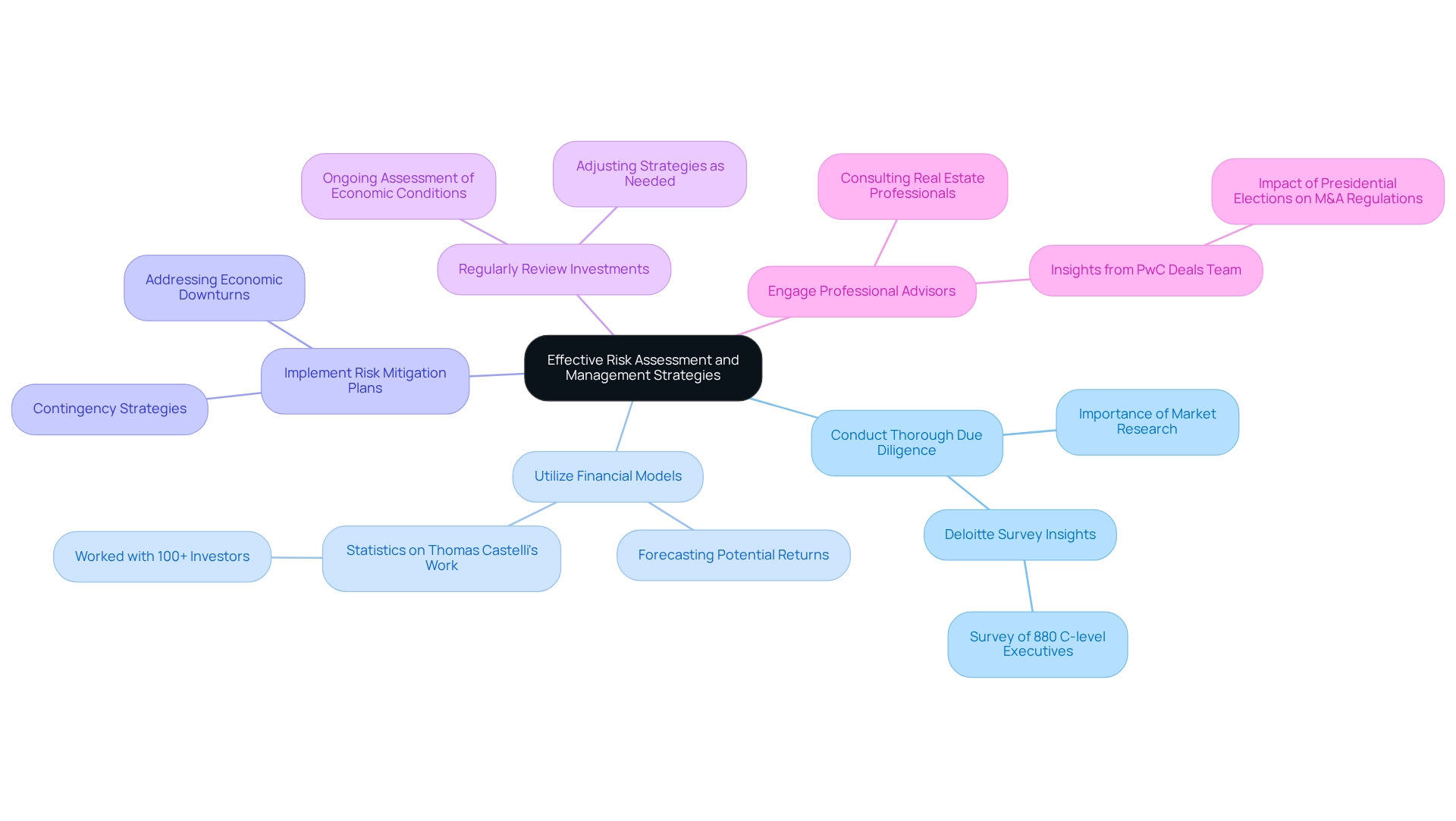

To effectively manage risks in real estate investments, investors must adopt a comprehensive approach that encompasses several key strategies.

-

Conduct Thorough Due Diligence: Researching market conditions, property history, and potential risks is essential before making any financial commitment. A recent survey conducted by the Deloitte Center for Financial Services, which involved over 880 C-level executives in commercial real estate, underscores the significance of due diligence in identifying growth opportunities and technology strategies that can influence funding choices. As Dave Meyer from BiggerPockets aptly states, "Understanding the data behind your investments is crucial for making informed decisions."

-

Utilize Financial Models: Financial modeling is vital for forecasting potential returns and assessing exposure. This method allows individuals to simulate various scenarios and comprehend the financial implications of their decisions. Statistics reveal that Thomas Castelli has worked individually with more than 100 real estate investors, highlighting the effectiveness of financial modeling in enhancing financial outcomes by providing a clearer perspective of potential benefits.

-

Implement Risk Mitigation Plans: Developing contingency strategies to address various real estate investment risks, such as economic downturns and unexpected expenses, is crucial. Investors should prepare for potential challenges by detailing specific measures to adopt in response to adverse circumstances, thereby safeguarding their assets.

-

Regularly Review Investments: Ongoing assessment of economic conditions and property performance is essential for adjusting strategies as needed. This proactive approach enables individuals to respond swiftly to market changes, ensuring their financial strategies remain relevant and effective.

-

Engage Professional Advisors: Consulting with real estate professionals, financial analysts, and legal experts can provide invaluable insights and guidance. Their expertise aids individuals in navigating complex regulatory environments and making informed decisions that align with their financial objectives. For instance, a recent study from the PwC Deals team on the impact of presidential elections on M&A regulations illustrates how external factors can influence financial strategies and the management of uncertainties.

By implementing these strategies, individuals can better prepare for uncertainties and protect their assets, ultimately enhancing their chances of success in the ever-evolving real estate sector.

Mitigating Risks Through Market Research and Diversification

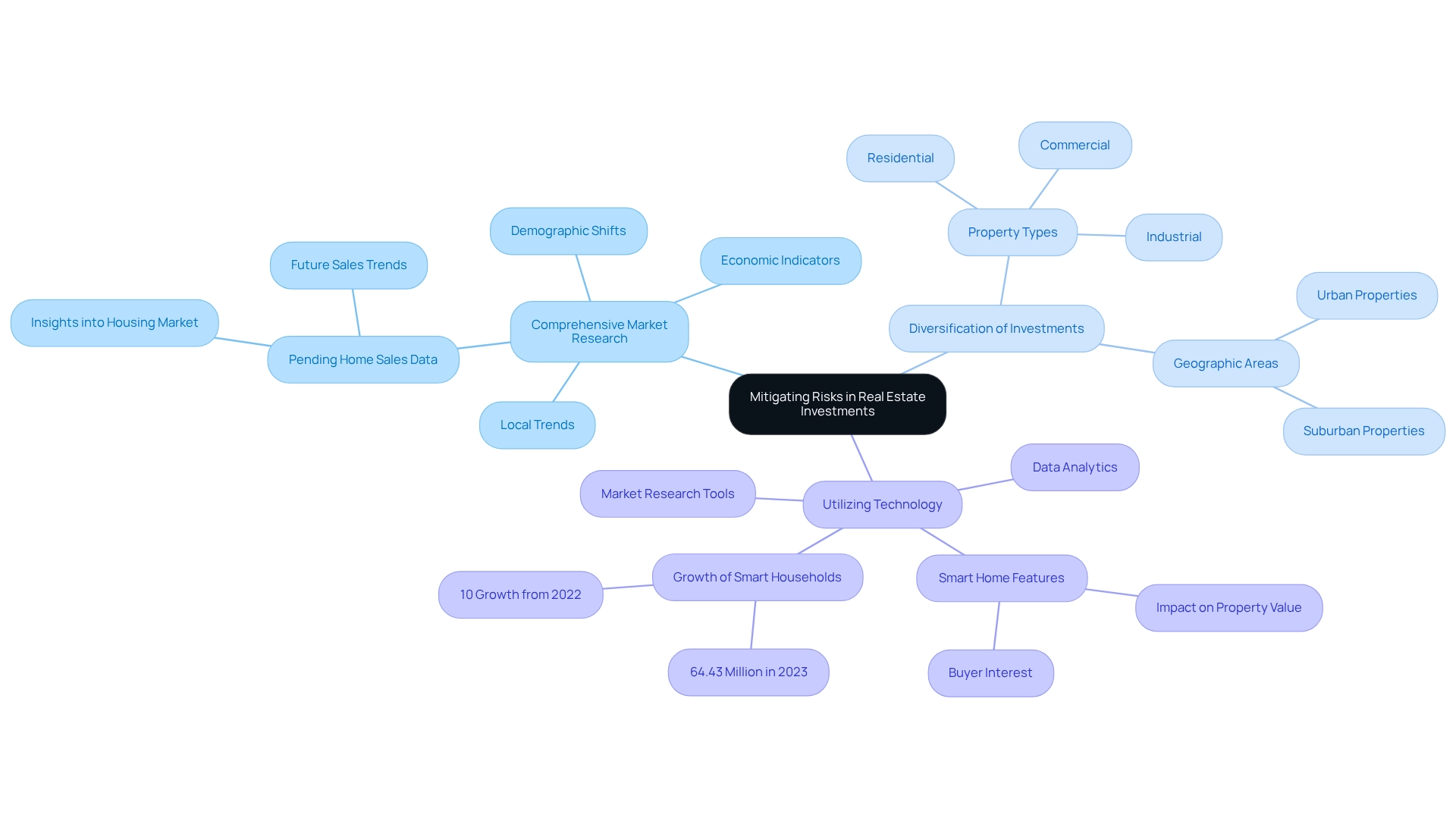

Mitigating risks in real estate investments can be effectively achieved through several key strategies:

- Comprehensive Market Research: Staying informed about local and national market trends, economic indicators, and demographic shifts is crucial. As Laura Madrigal, Home Improvement Content Specialist at Fixr.com, observes, "By collaborating with industry experts and remaining informed about the latest trends, individuals can attain their dream home." This knowledge enables individuals to recognize high-potential regions while avoiding deteriorating sectors. For instance, examining pending home sales data uncovers insights into housing trends, enabling investors to predict shifts in buyer behavior and make educated choices.

- Diversification of Investments: Distributing investments among various property types—such as residential, commercial, and industrial—and different geographic areas significantly decreases exposure to real estate investment risks in any single sector. A diversified portfolio that contains both urban and suburban properties can help reduce uncertainties linked to economic fluctuations, ensuring more stable returns.

- Utilizing Technology: Leveraging data analytics and advanced market research tools enhances insights into market trends and property performance. In 2023, the number of smart households in the U.S. reached 64.43 million, reflecting a 10% growth compared to the previous year. This trend highlights the significance of incorporating technology into financial strategies, as it can enhance decision-making and risk evaluation processes. Moreover, adding smart home features can affect property value and buyer interest, making it an essential factor for those financing.

By applying these strategies, individuals can maneuver through the intricacies of the real estate sector more efficiently, ultimately resulting in more secure financial results while addressing real estate investment risks. The dedication to quality content not only boosts subscriber engagement and satisfaction but also guarantees that stakeholders have access to trustworthy information essential for making informed choices.

Understanding Economic Influences on Real Estate Risks

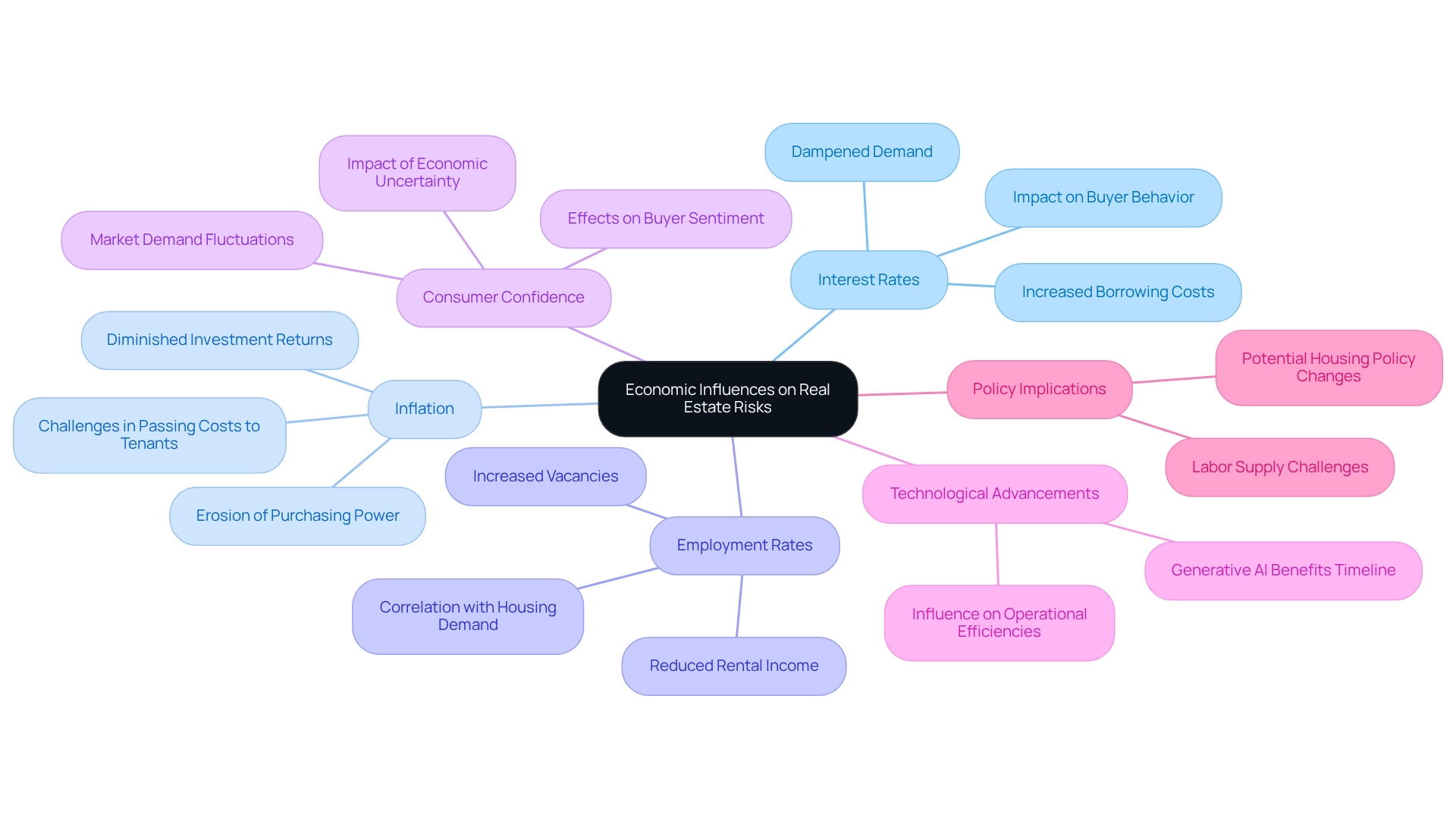

Economic factors significantly influence real estate investment risks, making it essential for investors to understand these dynamics to navigate the industry effectively. Key factors include:

- Interest Rates: Elevated interest rates can substantially increase borrowing costs, dampening demand for properties and exerting downward pressure on prices. As we approach 2025, the real estate sector is experiencing a cautious recovery; however, the lingering effects of previous rate increases continue to shape buyer behavior and funding strategies.

- Inflation: Persistent inflation erodes purchasing power, impacting consumer spending and rental income. This scenario can lead to diminished investment returns, as property owners may find it challenging to pass on increased costs to tenants. Investors must remain vigilant about inflation trends to protect their portfolios.

- Employment Rates: High unemployment levels can lead to increased vacancies and reduced rental income, directly affecting property values. A robust employment environment typically correlates with heightened demand for housing, while economic downturns can create substantial challenges for property owners and investors alike.

- Consumer Confidence: Economic uncertainty often results in diminished consumer confidence, adversely affecting buyer sentiment and leading to reduced demand for properties. Investors should closely monitor consumer confidence indices as indicators of potential market shifts.

Looking ahead, the overall outlook for 2025 remains cautiously optimistic, with a positive trajectory tempered by significant risks such as financial uncertainties and supply chain disruptions. A recent survey revealed that 50% of respondents believe their companies are still one to three years away from fully realizing the benefits of generative AI, which could influence operational efficiencies in real estate. This technological advancement may also affect funding strategies as firms adapt to new tools and methodologies.

Furthermore, as Tom Leahy pointed out, "Office and retail have become undesirable terms for many financiers as changing preferences have resulted in significant value loss for these property types." This sentiment underscores the importance of understanding evolving investor preferences and their implications for real estate investment risks.

Case studies, such as the potential housing policy changes under the Trump administration, illustrate how economic policies can complicate the housing landscape. Proposed alterations aimed at addressing the affordable housing deficit might inadvertently exacerbate issues related to labor availability in construction, further complicating investment uncertainties.

By comprehending these economic factors, stakeholders can better anticipate shifts in the financial landscape and adjust their strategies accordingly, ultimately enhancing their ability to navigate uncertainties and manage real estate investment risks proficiently.

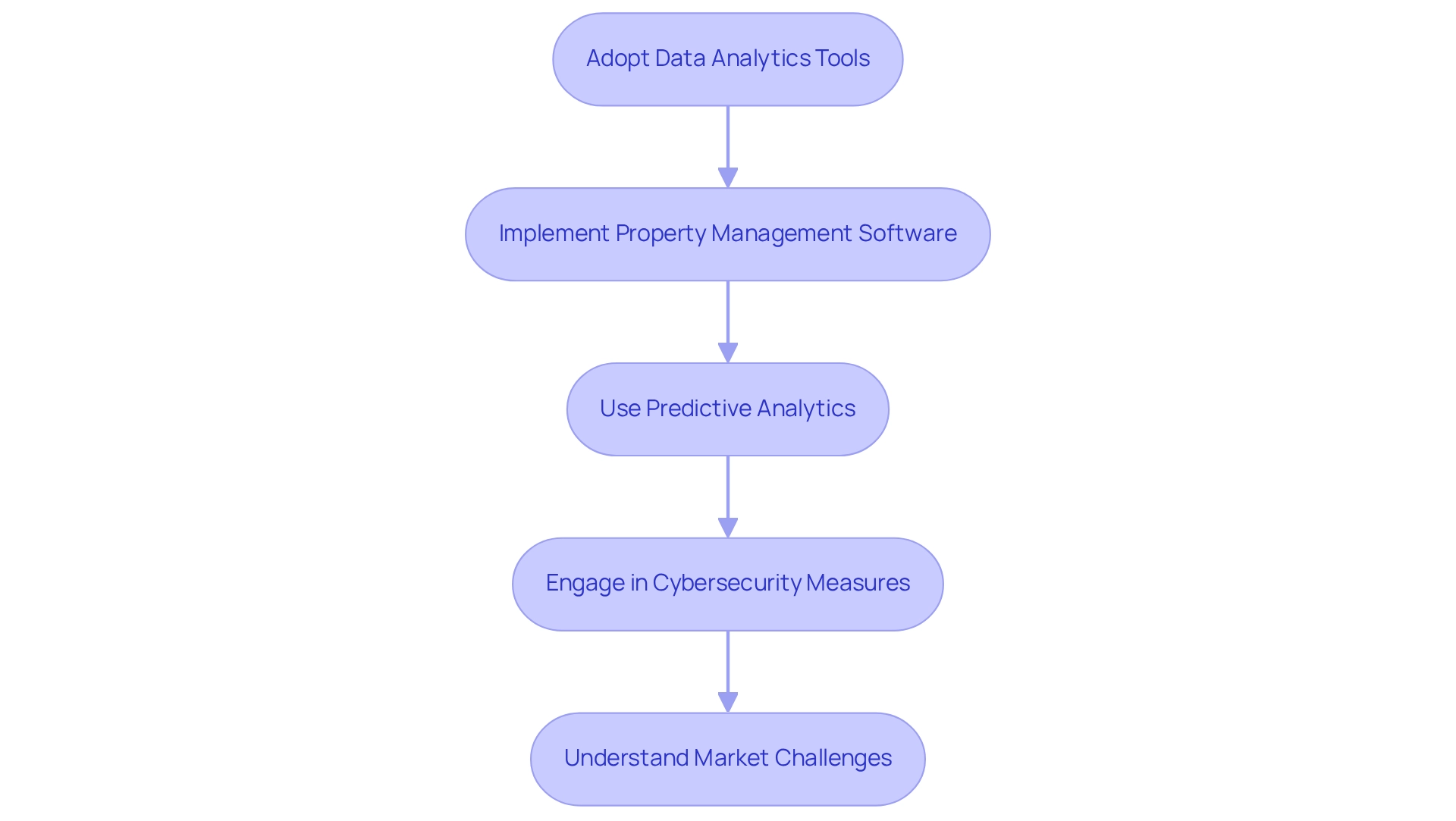

Leveraging Technology for Enhanced Risk Management

Investors can significantly enhance their risk management strategies by leveraging advanced technologies and data analytics tools.

- Adopting Data Analytics Tools: Implementing software that analyzes market trends, property performance, and economic indicators empowers investors to make informed decisions. These tools offer insights into possible challenges and prospects, enabling proactive management of assets. Notably, AI-driven analytics can increase net cash flow by 10% or more, underscoring the financial benefits of integrating technology into real estate investment strategies.

- Implementing Property Management Software: Utilizing property management software streamlines operations by tracking expenses, managing tenant relations, and automating routine tasks. This efficiency reduces operational uncertainties and enhances the overall management of real estate assets, leading to improved cash flow and tenant satisfaction.

- Using Predictive Analytics: By leveraging predictive modeling, investors can forecast trends and identify potential risks before they materialize. This forward-thinking strategy is essential, as emphasized by Michael Chen, Head of Research, who points out that "the predictive models we’ve created enable us to foresee changes in the industry 6-8 months prior to when they become evident to most rivals." This time advantage is invaluable in positioning portfolios ahead of market cycles.

- Engaging in Cybersecurity Measures: As real estate ventures increasingly depend on digital platforms, safeguarding sensitive data and financial information from cyber threats becomes crucial. Implementing robust cybersecurity measures protects against substantial threats that could compromise investment integrity.

- Understanding Market Challenges: Recent case studies, such as the decline in US housing starts by 9.8% in January due to rising costs and high mortgage rates, illustrate the real estate investment risks currently facing the market. This emphasizes the significance of efficient management strategies in maneuvering through the intricacies of the real estate environment.

Adopting these technological advancements not only improves management capabilities but also leads to better overall financial performance. Furthermore, referencing Moody's Analytics, recognized for its extensive research capabilities in commercial real estate, reinforces the credibility of the data sources available for property data and research.

Best Practices for Navigating Real Estate Investment Risks

To effectively navigate the complexities of real estate investment risks, investors should adopt the following best practices:

- Stay Informed: Continuously updating knowledge on market trends, economic conditions, and regulatory changes is crucial. A recent survey conducted by the Deloitte Center for Financial Services revealed that over 880 C-level executives in commercial real estate prioritize staying informed to assess growth prospects and technology plans for the next 12 to 18 months. Tim Coy, the research manager for the Commercial Real Estate sector at Deloitte, highlights that 'staying informed is crucial for making prudent choices in a swiftly changing environment.' This proactive approach not only aids in risk management but also positions investors to capitalize on emerging opportunities.

By diversifying holdings and distributing resources across different property types and geographic areas, one can significantly reduce real estate investment risks. Case studies have demonstrated that individuals who diversify their portfolios are better prepared to endure fluctuations in the financial landscape and take advantage of new opportunities. Moreover, financial backer and regulatory pressures are propelling sustainability initiatives, making a balanced approach to sustainability funding increasingly common.

- Conduct Regular Assessments: Frequently assessing investment performance and environmental conditions enables investors to adjust their strategies proactively. This practice is essential in a swiftly evolving business environment, where timely adjustments can lead to improved outcomes. Regular evaluations help identify potential risks and areas for growth, ensuring that investment strategies remain aligned with market realities.

- Engage Experts: Collaborating with real estate professionals, financial advisors, and legal experts provides valuable insights and guidance. Tim Coy's research leadership at Deloitte emphasizes how thorough industry analysis can assist in informed decision-making, underscoring the significance of involving knowledgeable individuals to manage intricate regulatory environments. Engaging experts not only enhances decision-making but also mitigates risks associated with complex regulations.

- Utilize Technology: Leveraging data analytics and property management tools can enhance operational efficiency and decision-making. The incorporation of technology in real estate ventures is becoming progressively significant, as it enables individuals to examine extensive quantities of data and recognize patterns that may not be readily visible. Utilizing technology effectively can streamline operations and provide a competitive edge in the market.

By adopting these best practices, investors can effectively manage real estate investment risks and position themselves for success in the dynamic real estate sector. Staying informed about market trends and investment strategies is not just beneficial; it is essential for making sound investment decisions in 2025 and beyond.

Conclusion

Navigating the complexities of real estate investment necessitates a comprehensive understanding of the myriad risks involved. Market fluctuations, liquidity challenges, regulatory changes, and climate threats require investors to remain vigilant and adaptable. As highlighted in the article, the landscape leading up to 2025 presents both significant risks and unique opportunities that can shape investment outcomes.

Effective risk management strategies are paramount. Diligent research, the utilization of financial models, and engagement with industry professionals equip investors with the insights needed to make informed decisions. Furthermore, embracing technology and data analytics not only enhances operational efficiency but also positions investors to foresee and mitigate potential risks before they materialize.

Ultimately, the key to successful real estate investing lies in the ability to remain informed and responsive to changing market conditions. By diversifying investments and continuously assessing performance, investors can safeguard their portfolios against uncertainties while capitalizing on growth opportunities. As the real estate market evolves, adopting a proactive approach to risk management will be essential for achieving long-term success.