Overview

This article delves into the critical role of big data tools within the real estate sector, illustrating how they empower informed investment decisions. It emphasizes notable platforms like Zero Flux, Zillow, and Mashvisor, which deliver vital insights and analytics. These resources enable investors to adeptly navigate market trends, accurately assess property valuations, and identify lucrative investment opportunities.

By harnessing the power of data, investors can make strategic choices that align with market dynamics. For instance, understanding property valuation trends can significantly impact investment returns. Moreover, platforms like Zillow provide comprehensive market analysis, which is essential for making sound financial decisions.

In conclusion, leveraging big data tools is not merely advantageous; it is imperative for investors aiming to thrive in the competitive real estate landscape. As the market continues to evolve, those who utilize these insights will be better positioned to capitalize on emerging opportunities.

Introduction

In the ever-evolving landscape of real estate, staying informed about market trends and insights is crucial for both professionals and enthusiasts. With an overwhelming amount of data available, discerning valuable information can be a daunting task. Enter a new wave of innovative platforms and tools designed to empower investors and agents alike. From Zero Flux's meticulously curated daily insights to AirDNA's specialized analytics for short-term rentals, these resources provide the clarity needed to navigate complex investment decisions.

As 2025 approaches, understanding the significance of data-driven strategies will be essential for success in a competitive market. This article delves into the leading tools and platforms revolutionizing real estate investment, highlighting how they can enhance decision-making and uncover lucrative opportunities.

Zero Flux: Daily Insights on Real Estate Market Trends

Zero Flux stands out as a daily newsletter that meticulously curates essential property sector trends and insights from over 100 diverse sources. By concentrating solely on factual information, it becomes an invaluable resource for both industry professionals and enthusiasts. Subscribers receive a concise selection of 5-12 insights each day, covering critical topics such as housing trends, financial opportunities, and demographic shifts. This big data real estate approach empowers subscribers to effectively navigate the complexities of the property sector, enabling them to make informed investment decisions based on the latest developments.

The importance of big data real estate insights is paramount, particularly in 2025, when industry dynamics are shifting rapidly. A recent case study titled "44% of Home Sellers Are Giving Concessions to Buyers—Just Shy of the Highest Level on Record" reveals that nearly 44% of home sellers are now offering concessions to buyers. This trend underscores the competitive nature of the current housing market. Such insights are crucial for investors seeking to understand negotiation strategies and economic conditions. As noted by Redfin, these insights can also indicate whether homes are lingering on the market or being sold more swiftly than they are listed.

Furthermore, expert opinions consistently emphasize the significance of curated market trends. Real estate professionals recognize that newsletters like Zero Flux not only sift through big data real estate but also enhance decision-making processes by providing a focused daily collection of insights. This commitment to quality content and data integrity positions Zero Flux as a leading authority in property information dissemination, making it an essential tool for anyone engaged in the field.

Zillow: Accurate Property Valuations and Market Analysis

Zillow has positioned itself as a leader in automated home valuations by utilizing its Zestimate feature, which leverages a proprietary algorithm to analyze big data real estate. This tool proves particularly advantageous for buyers and investors seeking swift insights into property values. In 2025, Zillow's Zestimate accuracy statistics reveal that while the tool serves as a solid starting point, caution is advised, as it may overlook unique property features that can significantly impact value. Recent data shows that cash proposals are four times more likely to be accepted by sellers, underscoring the competitive dynamics of property transactions and the necessity of precise valuations.

Beyond the Zestimate, Zillow provides a comprehensive suite of market analysis tools, empowering users to track trends in home prices, sales, and rental rates across various regions. The platform's intuitive design and extensive database make it an indispensable resource for property professionals. However, it is essential to recognize that while Zestimates offer quick estimates, they cannot replace professional appraisals, which entail physical inspections and thorough evaluations of property specifics.

For example, a case study comparing professional appraisals to Zestimates illustrated that while the latter offers convenience, the former is essential for official valuations, especially in transactions such as buying, selling, or refinancing. This distinction highlights the importance of integrating digital tools with traditional methods to achieve accurate property assessments. As property analysts note, relying solely on automated evaluations can lead to misguided decisions. Kang, a seasoned agent, emphasizes, "After years in this field, I’d trust a knowledgeable agent’s CMA more than any digital appraisal," highlighting the significance of experienced agents and their comparative market analyses (CMAs) in the acquisition process.

Zillow's analytical tools have proven crucial in numerous successful property acquisitions, demonstrating how big data real estate insights can guide strategic decisions. As the real estate landscape continues to evolve, leveraging both Zillow's innovative tools and the expertise of seasoned professionals will be vital for navigating the complexities of property acquisition.

Mashvisor: Big Data Analytics for Profitable Investments

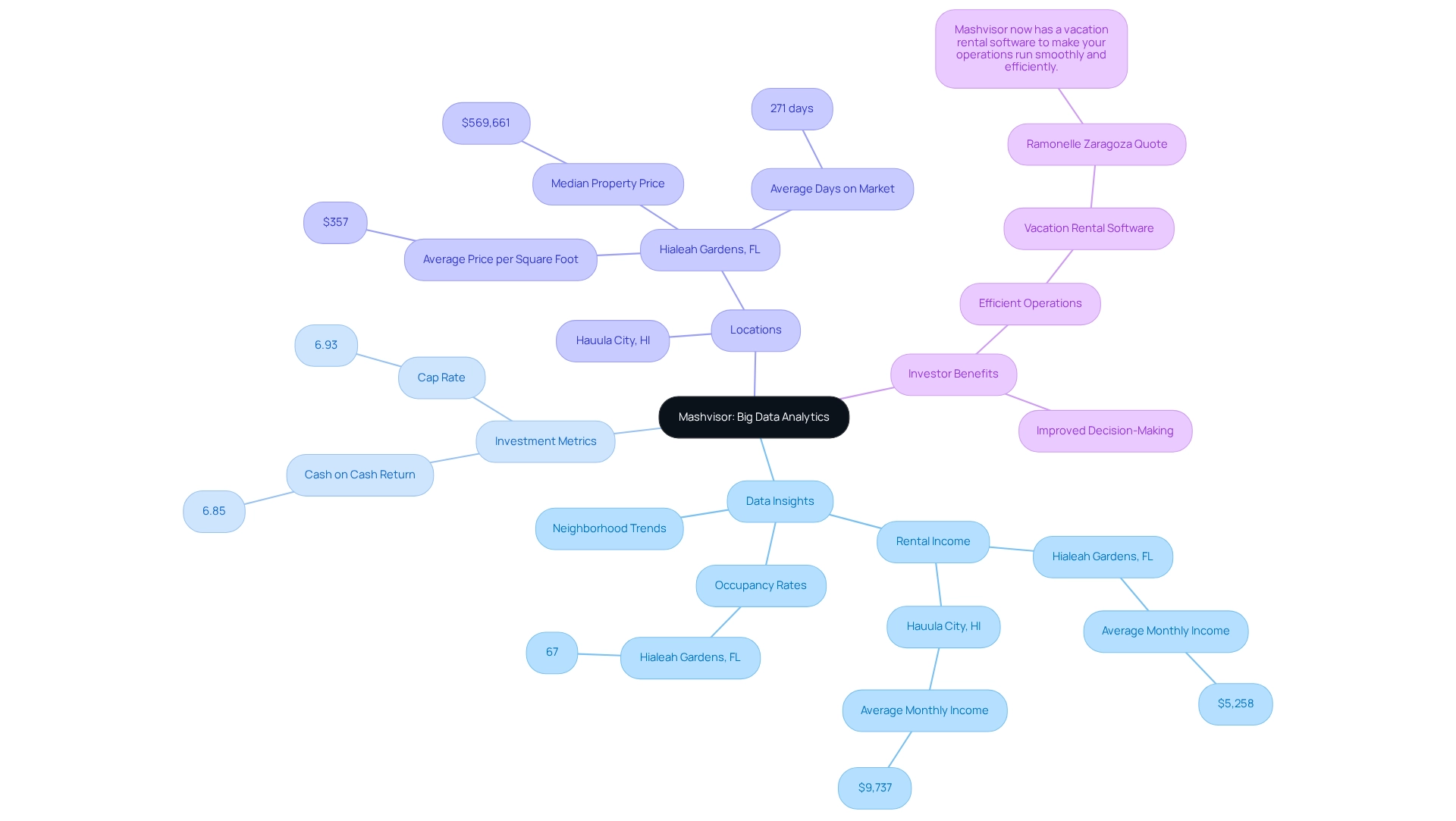

Mashvisor harnesses the power of big data real estate analytics to provide in-depth insights for both traditional and short-term rental properties. By analyzing extensive datasets, it empowers investors to pinpoint lucrative markets and properties with high potential returns. Users gain access to crucial metrics such as rental income, occupancy rates, and neighborhood trends—essential for making informed financial decisions.

In 2025, the influence of big data real estate on property profitability is more pronounced than ever, with tools like Mashvisor allowing investors to enhance their rental strategies efficiently. For instance, in Hialeah Gardens, FL, the average monthly short-term rental income is $5,258, with a cash on cash return of 6.85% and a cap rate of 6.93%. These figures showcase the potential returns available when leveraging insights from big data real estate. Furthermore, Mashvisor's analytics in the realm of big data real estate have proven crucial in successful property investments, as evidenced by the increasing number of investors reporting improved decision-making abilities through its platform.

With the average price of Airbnb rentals in the U.S. climbing to over $216 per night—a $45 rise since 2020—the need for accurate analysis of the sector is essential. As Ramonelle Zaragoza noted, "Mashvisor now has a vacation rental software to make your operations run smoothly and efficiently." Mashvisor's extensive analytics not only assist in identifying lucrative rental areas but also provide the essential tools to navigate the complexities of big data real estate in 2025. This positions Mashvisor as an indispensable resource for investors aiming to maximize their returns and make strategic investment choices. Moreover, Hauula City in Hawaii distinguishes itself with the highest Airbnb rental income at $9,737, demonstrating the potential of utilizing data analytics to pinpoint profitable areas.

Reonomy: Comprehensive Commercial Real Estate Data

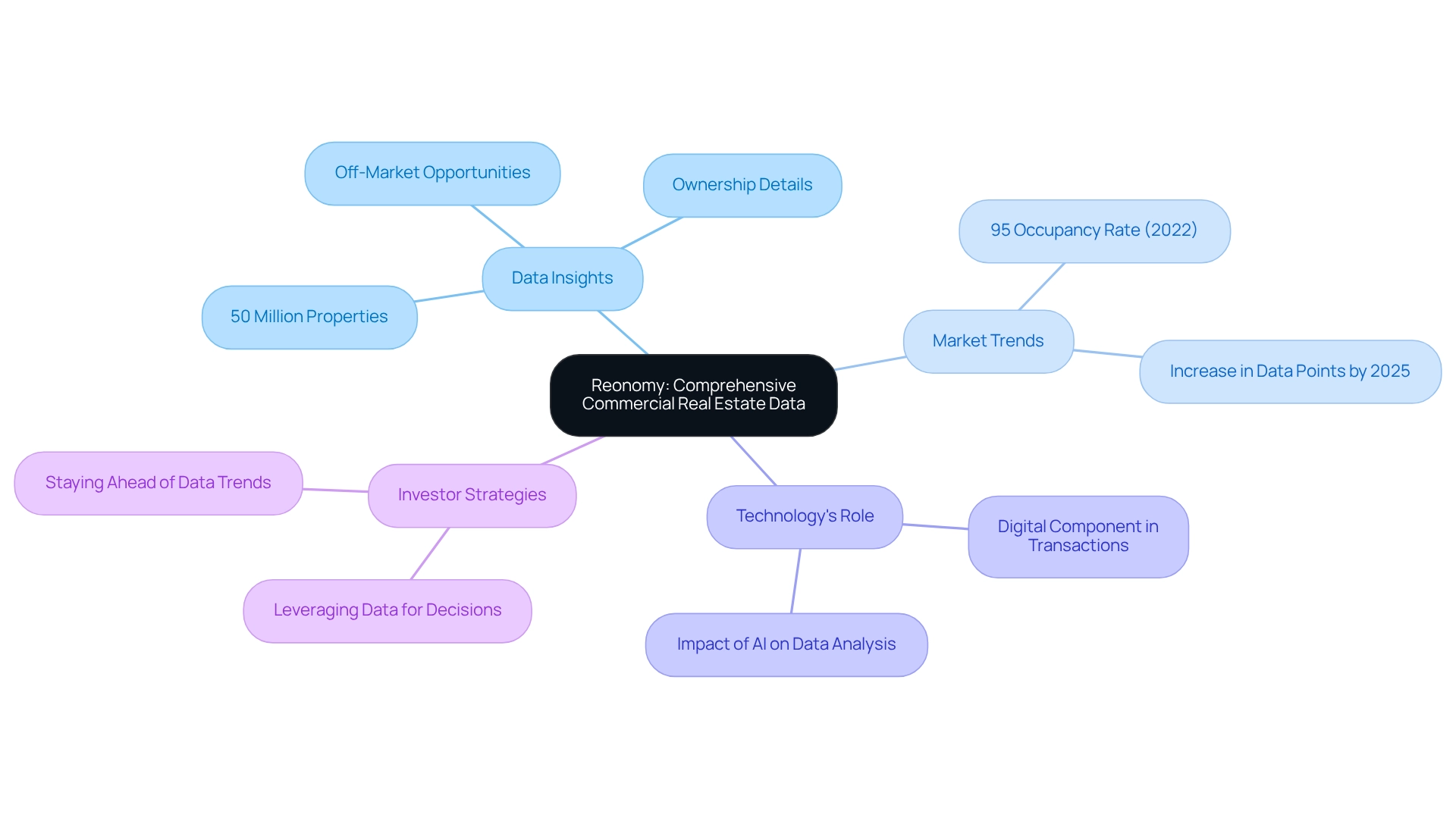

Reonomy emerges as a leading provider of big data real estate, offering insights on over 50 million properties throughout the United States. By harnessing advanced artificial intelligence, Reonomy equips users with comprehensive property information, ownership details, and market trends. This extensive data repository empowers investors to uncover off-market opportunities and make informed decisions regarding their commercial investments.

With more than half of property transactions now incorporating a digital element, the role of technology in the sector is undeniably significant. Notably, multifamily rental properties achieved an occupancy rate of approximately 95% in 2022, underscoring a crucial market trend for investors to consider when leveraging Reonomy's data. As projections suggest a substantial increase in available data points by 2025, the platform's robust analytics capabilities become essential for professionals seeking to navigate the evolving big data real estate landscape effectively.

The case study titled 'Future Trends in Big Data Real Estate' emphasizes the importance of staying ahead of data trends, a necessity for investors. As technology and sustainability continue to shape the industry, utilizing extensive data such as that from Reonomy will be vital for maintaining a competitive edge in financial strategies. Investors can harness Reonomy's insights to identify emerging opportunities and refine their strategies.

CoStar: Leading Provider of Commercial Real Estate Analytics

CoStar stands out as the premier source of big data real estate information and analytics, providing comprehensive insights into trends, property performance, and investment opportunities. Its extensive database includes detailed information on properties, tenants, and transactions, making it an indispensable resource in the field of big data real estate for professionals.

By 2025, CoStar's analytics capabilities have been significantly enhanced, enabling investors to navigate the complexities of big data real estate with greater precision. With a commanding market share of 62.3% and generating annual revenue of $2.1 billion from data services, CoStar's influence is profound. The analytics provided by the platform's big data real estate capabilities not only facilitate the identification of profitable opportunities but also refine strategic decision-making processes.

For instance, despite a 12% decline in retail foot traffic from the previous year, the sector has managed to achieve a 3.2% growth, underscoring the importance of big data real estate in understanding industry dynamics. Furthermore, CoStar's analytics have proven crucial in driving successful financial outcomes. A notable case study highlights how its concentration metrics have raised potential antitrust scrutiny, reflecting the company's substantial impact on the business property landscape. This examination could shape investor perceptions and operational strategies in the realm of big data real estate, reinforcing the necessity for reliable data in navigating such complexities.

With 156 research data subscriptions yielding an annual revenue effect of $287 million, CoStar remains a vital resource for investors seeking to make informed decisions based on trustworthy big data real estate, as property professionals emphasize that understanding market trends is essential for success in funding. Indeed, 90% of millionaires attribute their wealth to investments in property, illustrating the critical role of big data real estate in shaping data-informed perspectives.

CoStar's commitment to delivering accurate and actionable insights cements its status as an essential resource for anyone aspiring to thrive in big data real estate. Additionally, CoStar's cash, cash equivalents, and restricted cash at the end of Q1 2025 were reported at $4,951.6 million, further demonstrating its financial stability and operational capacity—key factors for investors.

PropStream: Property Data and Analytics for Investors

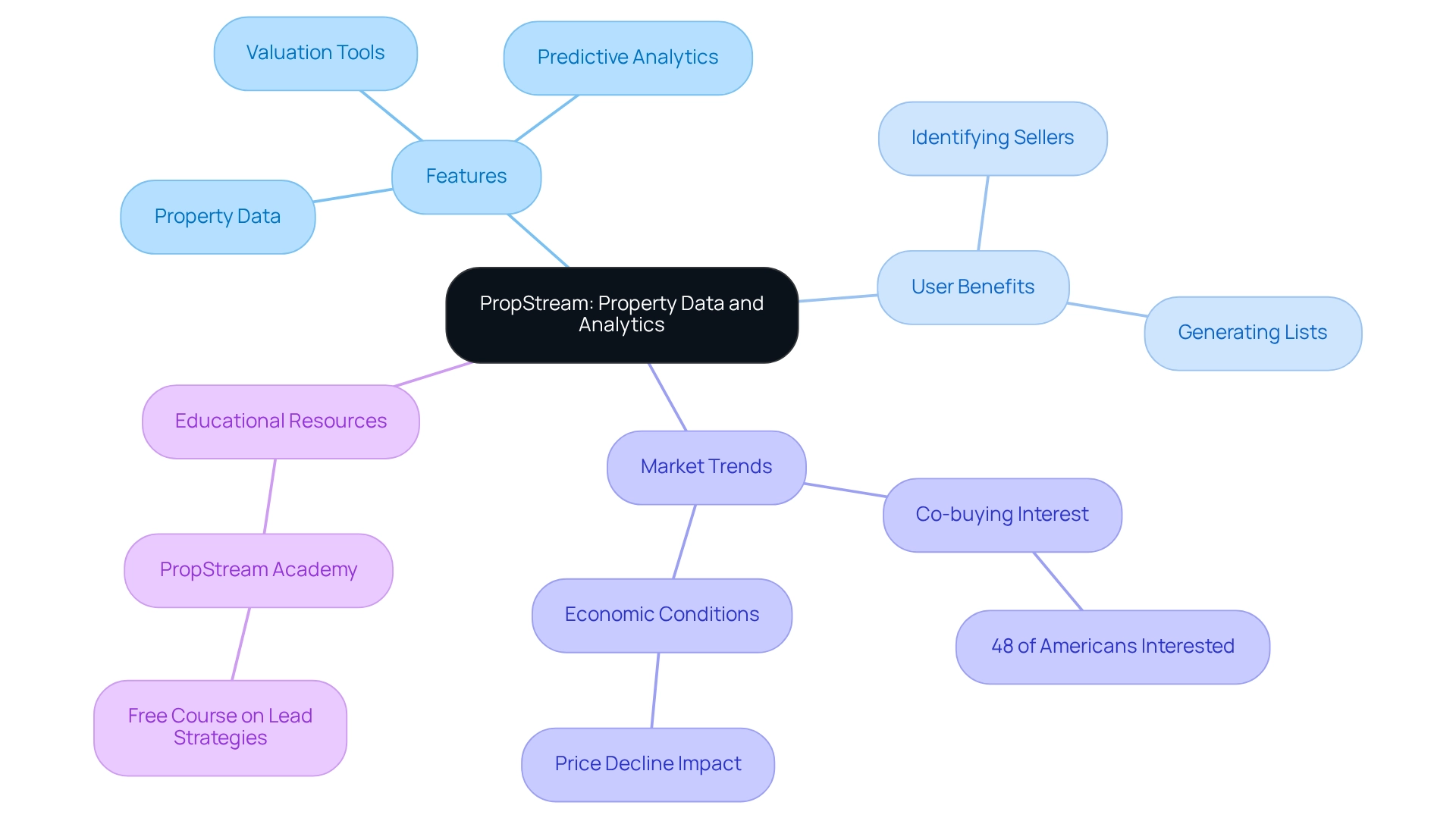

PropStream stands out as a formidable property analysis software that consolidates a wealth of property information, encompassing tax records, mortgage details, and MLS access. This platform empowers investors with essential tools to conduct comprehensive property analyses and generate targeted marketing lists. Notably, PropStream's predictive analytics and property valuation features enable users to identify motivated sellers and discover off-market properties, significantly enhancing opportunities for returns.

In 2025, property analysts have underscored the efficiency of PropStream's analytics tools, highlighting the platform's pivotal role in identifying profitable opportunities. Users have reported successful real estate ventures by leveraging PropStream's extensive data aggregation capabilities. This trend resonates with the fact that 48% of Americans are now interested in co-buying homes, reflecting a shift in buyer dynamics that investors can strategically exploit. Experts stress the importance of discussing the nuances of co-buying partnerships with clients, further reinforcing the need to understand these evolving dynamics.

Additionally, case studies showcase how PropStream's dedication to data integrity, as emphasized in the case study titled "The Importance of Data Integrity in Real Estate Insights," cultivates trust among its users. This commitment solidifies PropStream's position as a premier resource for property investors. Furthermore, current economic conditions suggest that a price decline may trigger increased interest from prospective buyers, providing further context for the opportunities that PropStream helps to unveil.

As the industry progresses, the impact of predictive analytics on investment strategies continues to grow, establishing PropStream as an indispensable tool for navigating the complexities of property investment in 2025. Moreover, PropStream Academy offers a complimentary course on lead strategies for property professionals, adding value by educating readers about additional resources available to them.

Real Capital Analytics: Tracking Commercial Real Estate Trends

Real Capital Analytics (RCA) stands at the forefront of data and analytics for commercial property transactions, overseeing an impressive $42 trillion in capital transactions. This extensive big data real estate database provides invaluable insights into economic dynamics, funding patterns, and property values. Investors can recognize emerging trends and make informed choices based on big data real estate. RCA tailors its solutions for various client categories, encompassing:

- Strategy formulation

- Opportunity identification

- Transaction implementation

- Risk evaluation

Each is vital for navigating the complexities of the commercial property landscape.

As we look toward 2025, leveraging RCA data will be crucial for funding decisions, ensuring that investors remain aligned with the latest trends and metrics that shape the market. As real estate developer Akira Mori aptly states, "In my experience, in the real-estate business, past success stories are generally not applicable to new situations. We must continually reinvent ourselves, responding to changing times with innovative new business models." This perspective highlights the significance of big data real estate strategies in crafting successful investment decisions.

Buildium: Property Management Software Utilizing Big Data

Buildium emerges as a formidable player in the property management software landscape, leveraging big data real estate to bolster operational efficiency for property managers. Its key features, including tenant screening, lease tracking, and maintenance management, are underpinned by advanced data analytics. By providing real-time insights into property performance and tenant behavior, Buildium empowers property managers to make informed decisions that not only optimize property value but also enhance tenant satisfaction.

As the property management sector is poised for remarkable growth, projected to reach USD 78.31 billion by 2025 with a compound annual growth rate (CAGR) of 45.6%, the importance of big data real estate tools like Buildium becomes increasingly pronounced. Moreover, cloud-based property management software accounted for 58% of the revenue in 2021, underscoring the critical role of solutions like Buildium in a competitive marketplace.

This software not only streamlines operations but also equips property managers to respond adeptly to industry dynamics, ensuring they maintain their competitive edge in a rapidly evolving environment. In this context, Zero Flux stands out as an indispensable asset for professionals in the real estate industry, offering essential insights that complement the robust capabilities of Buildium.

AirDNA: Data Analytics for Short-Term Rental Investments

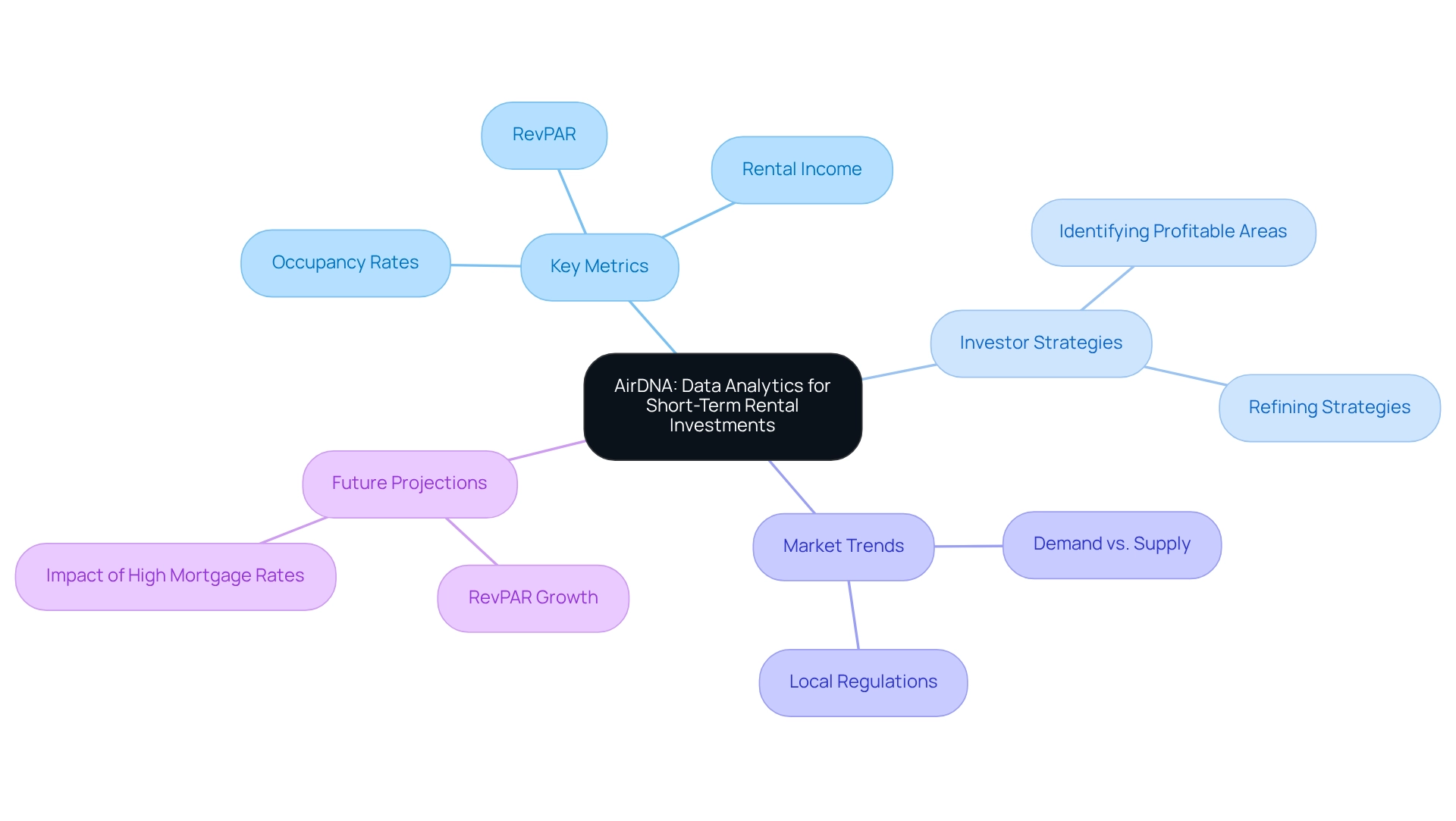

AirDNA stands as a premier provider of big data real estate analytics specifically tailored for the short-term rental sector, focusing on platforms such as Airbnb and Vrbo. Its extensive platform delivers thorough insights into vital metrics like occupancy rates, rental income, and emerging trends. This equips investors with essential resources for making informed decisions regarding short-term rental opportunities in the context of big data real estate.

By analyzing big data real estate from millions of properties, AirDNA enables users to identify profitable areas and enhance their rental strategies effectively. Looking ahead to 2025, the short-term rental landscape is poised for significant transformations, with big data real estate analysis playing a pivotal role in shaping financial strategies.

For instance, an examination of the fastest-growing short-term rental (STR) sectors reveals areas where demand exceeds supply. This underscores the importance of understanding local regulations, property characteristics, and location types in big data real estate that influence potential returns. Investors can leverage big data real estate analysis to pinpoint promising neighborhoods and submarkets for vacation rentals, thereby refining their strategies.

Moreover, as occupancy rates stabilize and begin to rise, the anticipated growth in revenue per available room (RevPAR) is projected to reach 2.9% next year. This highlights the critical role of big data real estate insights in shaping funding strategies. Investors who harness AirDNA's analytics in the big data real estate field can optimize their rental approaches, ensuring competitiveness in a dynamic market.

The effectiveness of AirDNA is exemplified by numerous investors who have successfully embraced big data real estate strategies, illustrating the platform's significance in navigating the complexities of short-term rental investments in 2025.

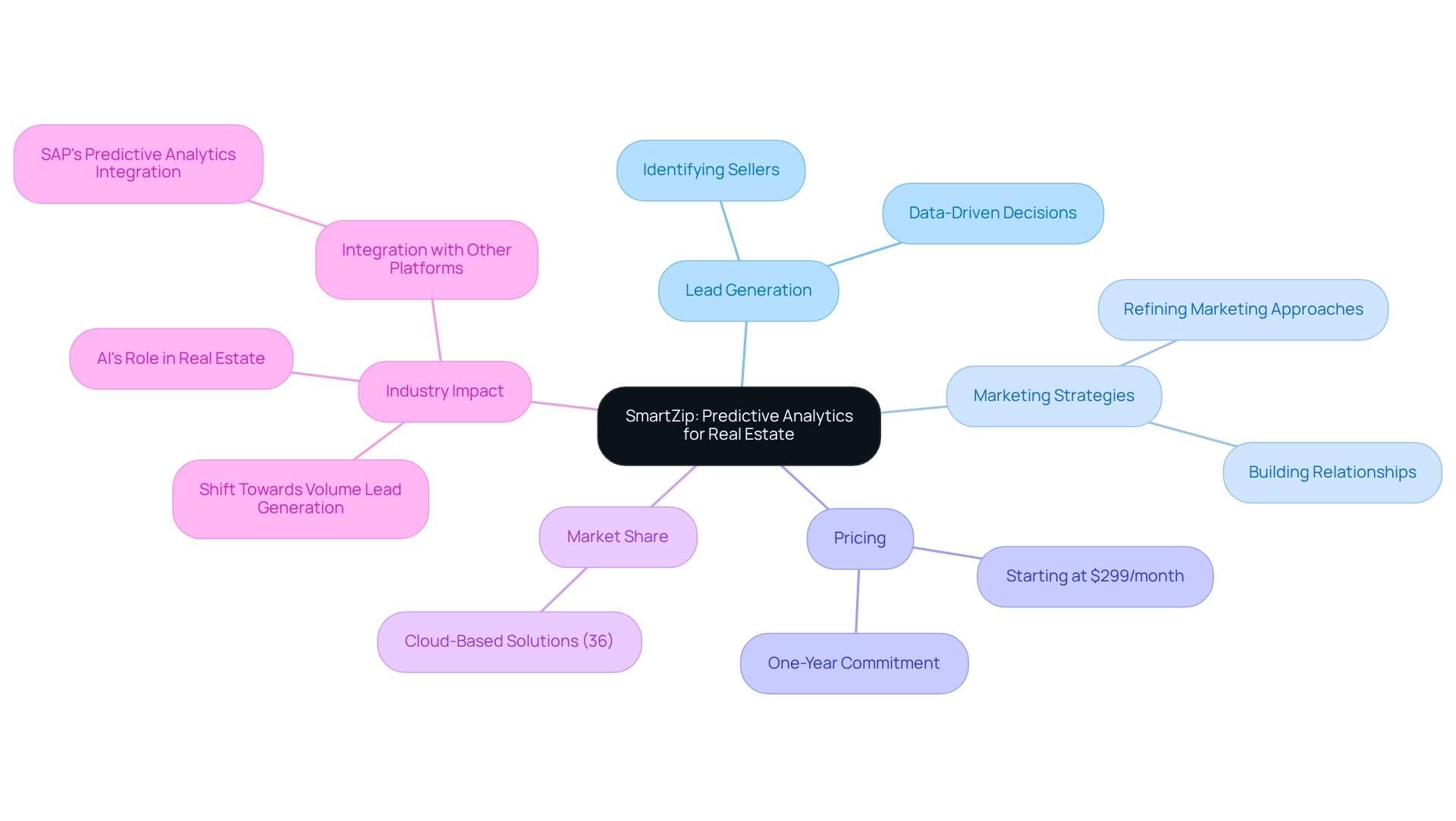

SmartZip: Predictive Analytics for Real Estate Opportunities

SmartZip stands as a pioneering predictive analytics platform tailored for property professionals. By employing advanced algorithms, it pinpoints homeowners likely to sell their properties, thus providing agents with high-quality leads. Through the analysis of numerous data points, SmartZip empowers agents to refine their marketing strategies, significantly boosting their chances of securing listings in a competitive market.

In 2025, SmartZip's predictive analytics effectiveness is highlighted by its capacity to streamline lead generation processes. Agents utilizing SmartZip's insights can cultivate relationships grounded in data-driven decisions, a crucial aspect for success in today's market. As co-founder Juefeng Ge notes, 'AI is quickly diminishing the importance of personal skill and time in property...' Converting these leads into appointments and closed deals grows easier by the day. This shift towards increased volume lead generation reflects the evolving landscape of property marketing.

SmartZip's services commence at $299 per month with a one-year commitment, offering agents a comprehensive suite of tools that enhance targeting and engagement with prospective clients. The rising popularity of predictive analytics solutions is evident, with cloud-based deployment representing 36% of the market share. This strategic application of predictive analytics within big data real estate is revolutionizing property marketing, enabling agents to operate more efficiently and effectively than ever before. Moreover, the integration of predictive analytics tools, as demonstrated by SAP's recent advancements, underscores the industry's dedication to improving business intelligence and forecasting capabilities. SmartZip not only assists in identifying potential sellers but also transforms the approach to real estate marketing, establishing itself as an indispensable resource for professionals striving to stay ahead of the curve.

Conclusion

The landscape of real estate investment is undergoing a significant transformation, primarily driven by the integration of innovative tools and platforms that provide crucial data insights. From Zero Flux's curated daily market trends to Zillow's automated property valuations, each resource enhances the decision-making capabilities of investors and agents alike. These platforms equip users with the analytical tools necessary to navigate the complexities of the market, ensuring they remain competitive in a fast-evolving environment.

As we approach 2025, reliance on data-driven strategies is becoming increasingly vital. Tools like Mashvisor, Reonomy, and CoStar not only offer comprehensive analytics but also highlight emerging market trends that can significantly impact investment outcomes. By leveraging these insights, investors can identify lucrative opportunities and make informed decisions aligned with current market dynamics. The importance of combining digital tools with traditional expertise cannot be overstated, as experienced agents play a crucial role in interpreting data and guiding investment strategies.

Ultimately, the future of real estate investment hinges on the ability to adapt to changing market conditions through informed analysis and strategic decision-making. By embracing the wealth of data available from these innovative platforms, investors can position themselves for success, maximizing their returns and navigating the complexities of the real estate landscape with confidence. As the industry continues to evolve, the emphasis on data integrity and actionable insights will be paramount for those looking to thrive in this competitive field.