Overview

The primary focus of this article is to elucidate the Debt Service Coverage Ratio (DSCR) formula in real estate and its critical role in assessing investment opportunities. The article meticulously outlines the calculation of DSCR, underscoring that a ratio exceeding 1 signifies adequate revenue to fulfill debt obligations. Furthermore, it illustrates the ratio's importance through pertinent examples and case studies, demonstrating how it impacts financing decisions and shapes investment strategies.

Introduction

In the competitive realm of real estate investment, grasping the Debt Service Coverage Ratio (DSCR) is paramount for both seasoned investors and newcomers. This vital financial metric not only assesses a property's capacity to generate sufficient income to meet its debt obligations but also acts as a crucial indicator of financial health in a constantly evolving market.

As investors strive to navigate the complexities of property financing, the importance of maintaining a robust DSCR becomes increasingly evident. With insights into calculation methods, application strategies, and the numerous factors influencing this ratio, investors can make more informed decisions, secure favorable financing, and ultimately enhance their portfolio's performance.

In an environment characterized by economic fluctuations and shifting market dynamics, mastering the intricacies of DSCR is essential for achieving long-term success in real estate.

Define Debt Service Coverage Ratio (DSCR) and Its Importance in Real Estate

The dscr formula real estate serves as a critical financial indicator, assessing a real estate asset's ability to generate sufficient revenue to meet its debt obligations. This ratio is calculated by dividing the net operating income (NOI) by the total debt service, encompassing both principal and interest payments. A DSCR above 1 signifies that the asset yields enough revenue to satisfy its financial commitments, while a ratio below 1 may indicate potential financial challenges.

Understanding the dscr formula real estate is vital for investors, as it offers valuable insights into the risks associated with financing and the overall financial health of a property. Lenders often depend on the dscr formula real estate to determine loan eligibility and terms, which makes it an essential factor in real estate investment decisions. As Scott Sage, Senior Vice President of Marketing & Customer Experience, articulates, 'Grasping and refining the dscr formula real estate can assist in obtaining improved financing and expanding a real estate portfolio more effectively.' For instance, a recent assessment revealed a DSCR of 0.95, with $500,000 in revenue against $525,000 in debt obligations, indicating that the asset is not generating adequate revenue to cover its debts. This underscores the importance of maintaining a healthy dscr formula real estate to ensure favorable financing options.

Case studies further underscore the significance of the debt service coverage ratio in real estate ventures. One study titled 'Understanding Debt Service Coverage Ratio (DSCR Formula Real Estate)' highlighted that lenders prioritize net income after expenses over mere revenue figures, emphasizing the necessity for real estate owners to enhance their DSCR formula real estate for better financing opportunities and effective portfolio management. Another case study, 'Debt Service Coverage Ratio in Real Estate and Investment Strategy,' demonstrated that incorporating the dscr formula real estate into long-term investment strategies can elevate decision-making and portfolio performance, particularly when targeting assets with high DSCR values.

As the real estate landscape evolves in 2025, staying informed about recent trends in the debt service coverage ratio will be crucial for investors. Emerging patterns indicate a growing emphasis on properties with higher DSCRs, as investors seek to mitigate risks in a competitive market, which underscores the relevance of the DSCR formula in real estate. By diligently monitoring their portfolio's DSCR and implementing risk management strategies, investors can bolster their investment resilience and overall performance.

Explain the DSCR Formula: Calculation Steps and Components

To calculate the Debt Service Coverage Ratio (DSCR), follow these essential steps:

-

Calculate Net Operating Income (NOI): This amount signifies the total revenue produced from the asset after subtracting operating expenses, excluding debt service.

- Example: If an asset generates $200,000 in rental income and incurs $50,000 in operating expenses, the NOI is calculated as $200,000 - $50,000 = $150,000.

-

Calculate Total Debt Service: This encompasses all principal and interest payments due on the property’s loans over the course of a year.

- Example: If the annual mortgage payment totals $120,000, this amount represents your total debt service.

-

The DSCR formula real estate is essential for evaluating property investments. Apply the DSCR formula real estate: The formula is expressed as Debt Service Coverage Ratio = NOI / Total Debt Service.

- Example: Utilizing the numbers from above, the computation would be Debt Service Coverage Ratio = $150,000 / $120,000 = $1.25.

A debt service coverage ratio of 1.25 suggests that the property produces 25% more revenue than needed to meet its debt responsibilities, indicating a strong opportunity for financial gain. Grasping these computations is essential for real estate experts, as a debt service coverage ratio below 1 indicates possible repayment challenges, emphasizing the significance of upholding a sound ratio for effective asset management.

Furthermore, Zero Flux acts as a crucial resource for anyone engaged in real estate, offering vital market insights that can guide financial choices. For instance, consider a case study where a company transitions from renting to owning a warehouse. In this situation, the lender must include the rent expense in the numerator when applying for a commercial mortgage to accurately represent future cash flows, which directly affects the debt service coverage ratio calculation.

As Mira Norian pointed out, "The debt service coverage ratio may be a more accurate depiction of a company’s activities," highlighting the importance of this measure in assessing real estate ventures. By comprehending and utilizing the DSCR formula real estate, investors can manage the intricacies of the real estate market more effectively.

Apply DSCR in Real Estate Investment: Evaluating Properties and Securing Financing

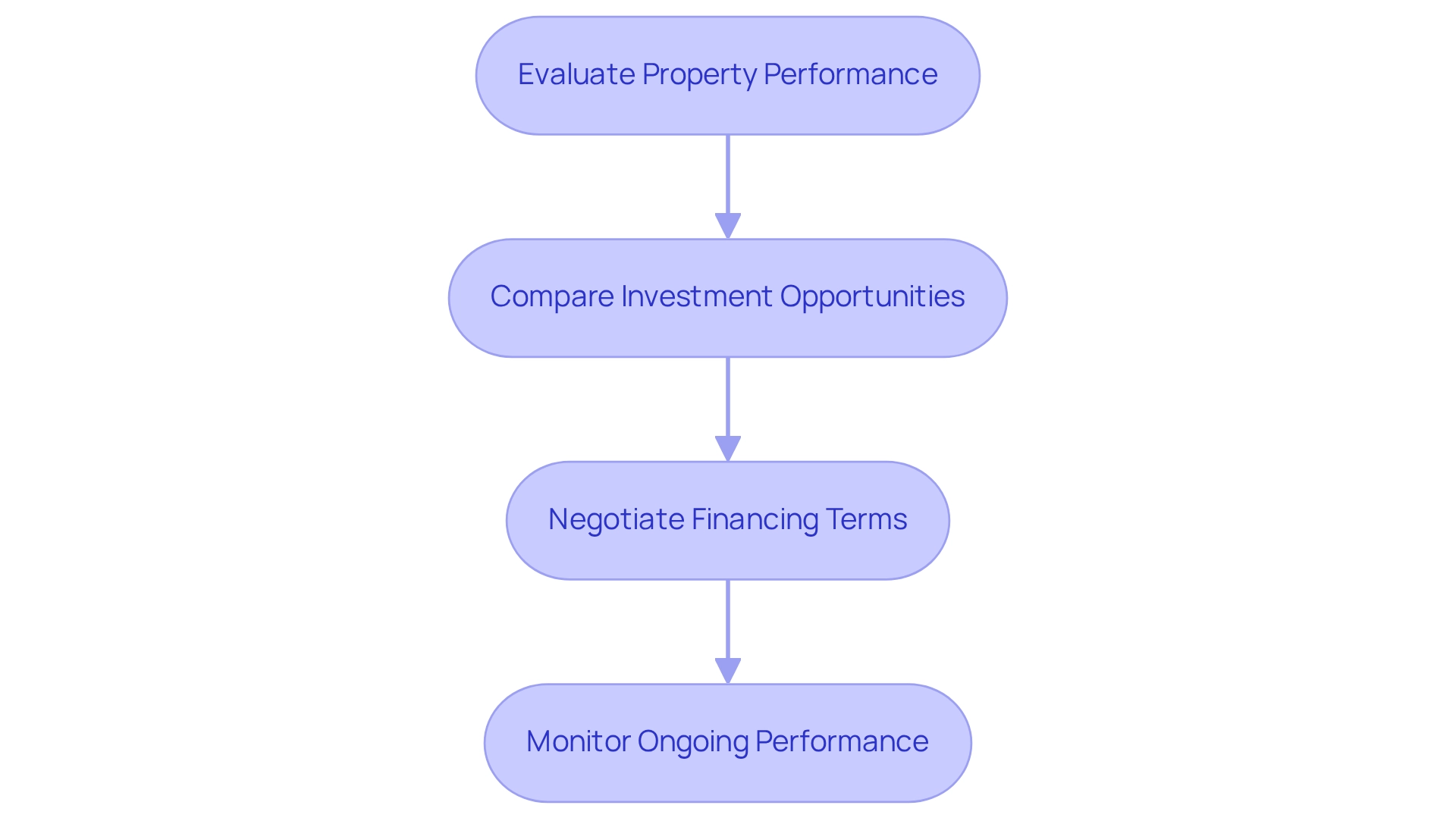

In the realm of real estate funding, the dscr formula real estate serves as a crucial metric for assessing financial viability. Here's how to apply it effectively:

- Evaluate Property Performance: Begin by calculating the debt service coverage ratio for each potential investment. A higher debt service coverage ratio, as indicated by the dscr formula real estate, signifies a lower risk of default, thereby increasing the asset's appeal to lenders. For instance, an asset generating $100,000 in annual income, with $50,000 in operating expenses and $40,000 in debt service, results in a debt service coverage ratio of 1.25, indicating robust cash flow. This metric is vital, as illustrated in the case study 'Using the DSCR formula real estate to Evaluate the Risk of Default,' which underscores the importance of this formula for lenders and investors in gauging a borrower's loan repayment capacity based on cash flow.

- Compare Investment Opportunities: Utilize the debt service coverage ratio to assess various properties. Generally, those applying the DSCR formula real estate with a debt service coverage ratio exceeding 1.2 are deemed safer investments, allowing investors to make informed comparisons and select the most promising options.

- Negotiate Financing Terms: A strong dscr formula real estate can enhance an investor's position during financing negotiations. Presenting a robust dscr formula real estate to lenders can lead to more favorable loan terms, such as lower interest rates or reduced down payments. This showcases the property's income-generating potential, increasing the likelihood of securing advantageous financing. As Jason A. Yablon noted, active managers of listed real estate funds have historically outperformed their passive counterparts, emphasizing the relevance of metrics like the debt service coverage ratio in evaluations.

- Monitor Ongoing Performance: Post-acquisition, it is essential to continually recalculate the debt service coverage ratio to ensure it remains above the necessary threshold for meeting debt obligations. This proactive strategy enables investors to adapt their approaches as required, protecting their financial well-being. Additionally, understanding market trends, including fluctuations in interest rates, can impact the assessment of the debt service coverage ratio and overall financial strategies, as referenced in the case study 'Interest Rates and Property Values.'

By prioritizing the dscr formula real estate in investment evaluations, investors can navigate market uncertainties with greater confidence, ultimately enhancing their decision-making processes and improving their investment outcomes.

Identify Factors Impacting DSCR: Market Conditions and Financial Variables

Several critical factors influence the Debt Service Coverage Ratio (DSCR), a concept essential for real estate investors to grasp:

- Market Conditions: Economic fluctuations, including interest rate changes, asset values, and rental demand, play a pivotal role in determining both Net Operating Income (NOI) and debt service costs. For instance, rising interest rates can lead to increased debt service payments, thereby reducing the debt service coverage ratio. In 2025, the impact of these market conditions is particularly pronounced as investors navigate a landscape marked by volatility. Moreover, home equity loans and HELOCs assess the asset's income-generating capability by utilizing the dscr formula real estate metric, underscoring the importance of comprehending market dynamics.

- Asset Management: Efficient asset management can significantly enhance an asset's NOI by improving tenant retention and minimizing vacancy rates. Conversely, poor management practices can escalate costs and diminish revenue, negatively affecting the dscr formula real estate. Case studies reveal that assets with proactive management strategies consistently outperform those with neglectful oversight. Notably, overestimating rental revenue can inflate the debt service coverage ratio, masking potential cash flow issues that may lead to financial strain for investors.

- Economic Indicators: Local economic conditions, such as employment rates and population growth, directly impact rental demand and property values. A robust local economy typically correlates with increased rental revenue, thereby enhancing the dscr formula real estate. Investors should closely monitor these indicators to evaluate potential returns.

- Regulatory Changes: Changes in zoning laws, tax policies, or rental regulations can significantly affect property income and expenses, ultimately influencing the debt service coverage ratio. Staying informed about local regulatory changes is crucial for investors aiming to mitigate risks associated with their assets. Understanding how these changes can impact the dscr formula real estate metrics reinforces the necessity of being proactive in regulatory awareness.

Grasping these factors is vital for making informed investment decisions, as they collectively shape the financial landscape in which real estate operates. As Constitution Lending states, "You don't have to wait several days for a loan officer to phone you," emphasizing the importance of timely information in navigating these complexities.

Conclusion

Mastering the Debt Service Coverage Ratio (DSCR) is crucial for anyone involved in real estate investment. This vital metric not only evaluates a property's ability to meet its debt obligations but also provides insights into its overall financial health. By calculating the DSCR—through the careful assessment of net operating income and total debt service—investors can make informed decisions that significantly impact their portfolios.

The application of DSCR in evaluating properties, securing financing, and monitoring ongoing performance reinforces its importance in the investment process. Investors who prioritize a strong DSCR are better positioned to negotiate favorable loan terms, mitigate risks, and enhance their financial resilience in an ever-changing market landscape. Furthermore, understanding the various factors that influence DSCR, such as market conditions, effective property management, economic indicators, and regulatory changes, equips investors with the knowledge necessary to navigate potential challenges.

In a competitive real estate market, maintaining a robust DSCR is not just a best practice; it is a cornerstone of a successful investment strategy. By consistently monitoring this ratio and adapting to evolving market dynamics, investors can bolster their chances of long-term success and secure their financial futures in the realm of real estate.