Overview

Creative ways to generate income in real estate without upfront capital primarily involve leveraging financing options such as:

- Seller financing

- Engaging in house hacking

- Utilizing real estate crowdfunding platforms

These strategies allow individuals to penetrate the real estate market without significant initial investment. By emphasizing innovative approaches and partnerships, the potential for income generation and property investment becomes evident. This article outlines various methods that not only facilitate entry into the market but also highlight the opportunities that arise from such creative financing solutions.

Introduction

In the dynamic realm of real estate investing, innovative strategies are emerging that empower individuals to enter the market with minimal to no upfront capital. Techniques such as:

- no-money-down approaches

- house hacking

- seller financing

create opportunities for aspiring investors who might otherwise feel sidelined by prohibitive entry costs. As the landscape continues to evolve, grasping the various avenues available—such as:

- Real Estate Investment Trusts (REITs)

- crowdfunding platforms

- the BRRRR strategy

becomes essential. This article explores these creative methods, underscoring their potential for generating income and building wealth. Additionally, it provides valuable insights into effective networking and mentorship opportunities that can further enhance success in this lucrative field.

Understanding No-Money-Down Real Estate Investing

No-money-down real estate investing presents multiple avenues for generating income in real estate without the need for a cash down payment. This approach is particularly attractive for newcomers or those facing financial constraints, as it facilitates property ownership without the initial capital burden.

Key methods for generating income in real estate with no money include:

- Leveraging diverse financing options

- Employing creative acquisition strategies

- Remaining cognizant of associated risks

Individuals can explore various financing avenues, such as seller financing, where the seller directly finances the purchase, and lease options, which allow individuals to control a property while postponing the purchase. Additionally, forming collaborations can provide access to funding and combined resources, making property acquisition more feasible.

Current trends indicate that a substantial proportion of financiers are adopting no-money-down strategies, with many recognizing the potential for significant returns. For instance, by 2025, a considerable share of property financiers is expected to embrace these approaches, reflecting a growing interest in alternative funding options. Furthermore, it is projected that two million rentals will become available by 2028, suggesting expanding opportunities in the rental sector that can be capitalized on through no-money-down strategies.

Moreover, as of June 2024, the average property owner's home sold for $190,404 more than the acquisition cost, underscoring the lucrative potential of property investments. This underscores the importance of understanding economic dynamics and the various financing alternatives available. According to the 2024 NAR Member Profile, 91% of investors preferred communication via telephone, while 89% favored email, highlighting the importance of effective communication in investor interactions.

As the landscape of property investing evolves, expert opinions emphasize the viability of no-money-down strategies in 2025. Insights shared by NAR Chief Economist Lawrence Yun at the 2025 Real Estate Forecast Summit provide valuable predictions and understanding of future conditions that may influence these investment strategies. Furthermore, it is essential to recognize that private property returns are less swayed by sentiment, reinforcing the case for no-money-down approaches as a dependable investment strategy.

By leveraging these innovative funding options, aspiring investors can navigate the complexities of the property market and seize opportunities that align with their financial goals.

House Hacking: Live and Earn

House hacking represents a strategic approach to property investment, involving the acquisition of a multi-family building or a single-family residence with additional rooms, leasing out part of the space to occupants. This method enables homeowners to significantly offset their mortgage costs. For example, purchasing a duplex allows you to live in one unit while renting out the other, effectively reducing living expenses and generating a steady stream of income.

In 2025, house hacking has surged in popularity among real estate enthusiasts. Many individuals are leveraging this strategy to accumulate wealth and achieve financial independence. On average, house hackers can generate substantial income, with reports indicating monthly earnings that cover a significant portion of mortgage payments. This not only alleviates financial pressure but also provides invaluable hands-on experience in property management.

However, it is essential to recognize that house hacking may not suit everyone, particularly in high-cost areas or for those seeking to avoid landlord responsibilities. Successful house hackers often emphasize the importance of careful planning and a willingness to engage with tenants. Effective bookkeeping is crucial for tracking income and expenses, enabling house hackers to maximize tax deductions.

Utilizing systems like REI Hub can streamline this process, allowing users to calculate the percentage of their property used for personal versus rental purposes, thereby simplifying accounting and enhancing profitability. As Holly Akins notes, "The percentages for personal use vs. tenant space are important because some costs associated with maintaining your house are deductible for house hacks."

Success stories abound within the house hacking community, with many individuals sharing their experiences of transforming properties into income-generating assets. These narratives underscore the flexibility and potential of house hacking as a lucrative strategy for generating passive income, accelerating mortgage payoffs, and ultimately building wealth. For instance, a case study titled 'Bookkeeping for House Hacks' illustrates how effective bookkeeping can help house hackers track their income and expenses, allowing them to leverage tax deductions.

As the property market continues to evolve, house hacking remains one of the effective ways to generate income in real estate with minimal initial investment. With over 30,000 subscribers, Zero Flux offers essential insights into such strategies, ensuring its audience stays informed about the latest trends in real estate investment.

Master Leases and Lease Options

Master leases present a unique opportunity for individuals to manage property, representing a viable method to generate income in real estate without upfront capital. By leasing a property from the owner, an individual can effectively monetize it by subleasing to tenants, thereby generating cash flow while retaining the option to purchase the property later. This strategy not only facilitates immediate income but also positions the investor to capitalize on potential appreciation in property value.

In contrast, lease options provide tenants the right to purchase the property at a predetermined price after a specified period. This arrangement can be particularly beneficial in a fluctuating market, as it secures a price that may be lower than future market values. Both master leases and lease options are effective strategies for generating income in real estate without initial investment, necessitating meticulous negotiation and a comprehensive understanding of the terms to optimize profitability.

As Esteban Baez suggests, "I recommend consulting with a Lawyer, I also recommend reaching out to BiggerPocket's Members (preferably in-state [TN]) if they would like to (Partner) with you," highlighting the importance of legal counsel and networking in property investments.

Current trends indicate that master leases are increasingly favored by financiers seeking to mitigate risk while leveraging property opportunities. In 2025, statistics reveal that properties leased under master lease agreements have exhibited higher profitability rates compared to traditional rental agreements, primarily due to the flexibility they afford in managing cash flow and tenant relationships. Notably, wellness-focused buildings can enhance tenant satisfaction and retention rates, further augmenting the value of master leases.

Moreover, case studies illustrate that integrating data analytics into the management of master leases has transformed decision-making processes, enabling stakeholders to pinpoint opportunities for enhancing property performance and leasing strategies. The case study titled "Transformation through Data Analytics" demonstrates how data-driven insights improve tenant experiences and significantly boost return on investment (ROI).

As the property market evolves, understanding the nuances between master leases and lease options will be crucial for investors. By effectively leveraging these strategies and seeking tailored advice from the Onward Real Estate Team, investors can uncover pathways to generate income in real estate without initial capital while adeptly navigating market complexities and establishing sustainable income streams.

Investing in REITs for Passive Income

Real Estate Investment Trusts (REITs) are firms that possess, manage, or fund income-generating properties across various sectors, including residential, commercial, and industrial properties. By investing in REITs, individuals can earn dividends from property investments without the complexities of purchasing or managing assets directly. This investment avenue is particularly attractive for those seeking to diversify their portfolios with limited capital.

In 2025, the performance of REITs remains robust, with an average dividend yield of approximately 4.5%, making them a compelling option for passive income generation. The overall dollar worth of commercial property achieved an impressive $20.7 trillion by mid-2021, underscoring the extensive opportunities within this sector. Additionally, mortgage REITs have offered more than $1 trillion in funding, highlighting their essential role in the property sector.

Investors can easily purchase shares of publicly traded REITs through stock exchanges, which offers liquidity and accessibility. This approach provides ways to make money in real estate with no initial capital, allowing individuals to engage in the property sector without requiring significant upfront investment. Effective investment tactics frequently involve concentrating on REITs that show robust historical results and steady dividend distributions, along with those that are ideally situated to take advantage of present trends.

Expert opinions emphasize the importance of understanding the underlying assets of a REIT and the economic factors that influence their performance. David Bitton, co-founder at DoorLoop, observes, "Investing in REITs enables individuals to access the profitable property sector without the challenges of direct asset management." As the property landscape evolves, remaining knowledgeable about current trends and economic dynamics is crucial for optimizing returns.

Organizations such as NAREIT embody the global voice for REITs and property firms interested in U.S. properties, offering valuable insights into the sector. By utilizing the insights offered by platforms like Zero Flux, which compiles crucial property market trends and information, individuals can manage the complexities of REIT investments and make educated choices that align with their financial objectives.

Real Estate Crowdfunding Platforms

Property crowdfunding platforms have revolutionized the investment landscape, allowing numerous participants to pool their resources for a variety of property projects, from residential developments to commercial buildings. This innovative approach significantly lowers the barriers to entry for individual investors, presenting opportunities to earn in real estate with minimal capital while facilitating involvement in larger deals.

As we look towards 2025, platforms like Fundrise and RealtyMogul lead the charge, offering a diverse range of investment opportunities tailored to different risk appetites and financial goals. Investors can choose projects that resonate with their interests, whether they are drawn to sustainable developments or high-yield commercial properties.

The growth of property crowdfunding is noteworthy, with forecasts indicating that the sector will continue to expand, driven by increasing demand for accessible investment options. The global property sector is projected to reach approximately $5,388.87 billion by 2026, growing at a compound annual growth rate (CAGR) of 9.6%. As one source highlights, "The worldwide property sector is anticipated to attain $5,388.87 billion by 2026, expanding at a CAGR of 9.6%."

This upward trajectory emphasizes the necessity of remaining informed about market trends and adjusting investment strategies accordingly. Furthermore, the Asia Pacific region is poised to capture the largest revenue share of 48% by 2037, revealing significant regional opportunities within the crowdfunding domain.

To successfully navigate the property crowdfunding landscape, conducting thorough research on both platforms and specific projects is crucial. Understanding average investment amounts, which can vary significantly based on the platform and project type, is vital for making informed decisions. Additionally, exploring success stories from other investors can provide valuable insights into the potential benefits of crowdfunding in real estate.

With the advent of blockchain technology enhancing processes through smart contracts and secure title management, the future of property crowdfunding looks promising. This technological advancement not only streamlines transactions but also enables fractional ownership, facilitating portfolio diversification.

In conclusion, real estate crowdfunding platforms offer pathways to earn in real estate with minimal investment, presenting a viable avenue for aspiring investors to enter the sector with limited resources while providing a plethora of opportunities that cater to various investment strategies and preferences.

Short-Term Rentals: Capitalizing on Airbnb

Short-term rentals through platforms like Airbnb offer a lucrative opportunity for property owners to monetize their homes or spare rooms, especially in tourist-heavy regions. In 2022, Airbnb reported an impressive $8.4 billion in revenue, reflecting a 40% year-over-year growth. This underscores the platform's increasing popularity among travelers. Investors can embark on their journey by exploring ways to make money in real estate with no money, such as leasing a room in their main home or managing properties for others. This sector has witnessed a remarkable surge in gross revenue, escalating from $27.69 billion in 2020 to $48.9 billion in 2021—a striking 76.62% growth for Airbnb hosts worldwide.

This growth was particularly pronounced in North America, which led in dollar increase, while Latin America experienced the highest percentage growth at 80.54%. To maximize income from short-term rentals, understanding local regulations governing these rentals is essential, as compliance can significantly impact profitability. Additionally, optimizing listings with high-quality photos and competitive pricing is crucial for attracting guests. Successful Airbnb property management examples emphasize the importance of creating an inviting atmosphere and delivering excellent customer service, which can lead to higher occupancy rates and repeat bookings.

As of 2025, average occupancy rates for Airbnb rentals remain strong, buoyed by a resurgence in travel as life returns to normal. Matthew Woodward noted that Airbnb has seen an even bigger explosion in growth as life returns to 'normal'. Investors should also consider leveraging automation strategies for property management, as highlighted in the recent article 'Guest Check-In Made Easy: Automation Strategies for Property Managers,' published on March 7, 2025. This approach streamlines operations and enhances guest experiences. By adopting effective short-term rental strategies, such as dynamic pricing and targeted marketing, investors can discover ways to make money in real estate with no money, positioning themselves for success in this thriving industry and capitalizing on the growing demand for short-term accommodations.

However, it is important to note that the AirDNA Repeat Rent Index (RRI) is currently underperforming due to mix shift impacts, which could influence overall conditions.

Seller Financing: A Creative Acquisition Method

Seller financing represents a strategic arrangement that exemplifies a method for generating income in real estate without upfront capital. This approach enables property sellers to offer direct financing to buyers, facilitating property acquisition without dependence on traditional mortgage avenues. Such a model benefits both parties involved. For sellers, it expands access to a wider pool of potential buyers, particularly those who may find it challenging to secure conventional financing.

Buyers can negotiate terms that may prove more favorable than those typically offered by banks, such as lower interest rates or reduced down payments.

As we look toward 2025, the landscape of seller financing is evolving, with a notable increase in property transactions utilizing this method. Recent data indicates that seller financing is becoming increasingly popular, especially in competitive markets where conventional financing options may be limited. Importantly, seller financing is subject to ability-to-repay requirements only if the seller provides financing more than five times within a calendar year, as per recent regulations.

This trend highlights the necessity of mastering the art of negotiating seller financing deals. Buyers should prioritize thorough due diligence to ensure that the terms of the financing agreement are both transparent and manageable.

A case study focusing on For Sale By Owner (FSBO) transactions reveals that in 2024, FSBOs represented 6% of home sales, with the average FSBO home selling for $380,000—significantly lower than the $435,000 average for agent-assisted sales. This statistic underscores the challenges FSBO sellers encounter, such as pricing and paperwork, while simultaneously illustrating the potential for innovative financing solutions like seller financing. Additionally, it is noteworthy that 18% of members do not utilize drones, which may influence the marketing strategies employed by FSBO sellers.

Furthermore, seller financing agreements can be structured as a means to generate income in real estate without initial investment, benefiting both parties. Sellers often achieve quicker sales and potentially higher sale prices, while buyers gain access to properties that may otherwise remain unattainable. As Tracy Z states, 'Combining knowledge of property notes with the power of online marketing can help expand your business!'

As the property market continues to evolve, understanding the intricacies of seller financing will be crucial for individuals seeking to navigate this dynamic environment effectively.

Partnering with Investors for Shared Success

Collaborating with additional financiers presents significant opportunities for larger transactions and pooled assets, thereby simplifying the challenges associated with property investment. By pooling capital, skills, and networks, partners can effectively mitigate risks and enhance their investment strategies. Notably, in 2025, the average capital gathered in property investment partnerships has shown a remarkable increase, reflecting a growing trend among financiers to unite for enhanced financial leverage.

Successful property investment partnerships hinge on establishing clear roles and responsibilities while maintaining open lines of communication. This clarity not only fosters trust but also ensures that all partners remain aligned in their investment goals. Networking events and real estate investment groups serve as excellent venues for discovering potential partners, allowing participants to connect with like-minded individuals who share similar objectives.

Recent case studies underscore the benefits of such collaborations, illustrating how partnerships have led to successful ventures across various sectors. For example, in metropolitan areas like Savannah, GA, investor share surged by 8.3 percentage points, while Youngstown-Warren-Boardman, OH-PA, experienced a rise of 7.9 points. This evidence clearly demonstrates the potential for growth when investors join forces. As the market exhibits signs of recovery, characterized by increased buyer interest and a reduction in average time on the market to just 27 days, the significance of strategic partnerships becomes even more pronounced.

As Brian Baker, CFA, notes, 'A beginner’s guide to investment styles and which one works best for you' emphasizes the necessity of understanding various methods in property investing. In conclusion, the advantages of collaborating with financiers in property investment are extensive, ranging from improved access to funds to shared expertise. As the landscape continues to evolve, those who embrace collaboration are likely to find themselves at a distinct advantage.

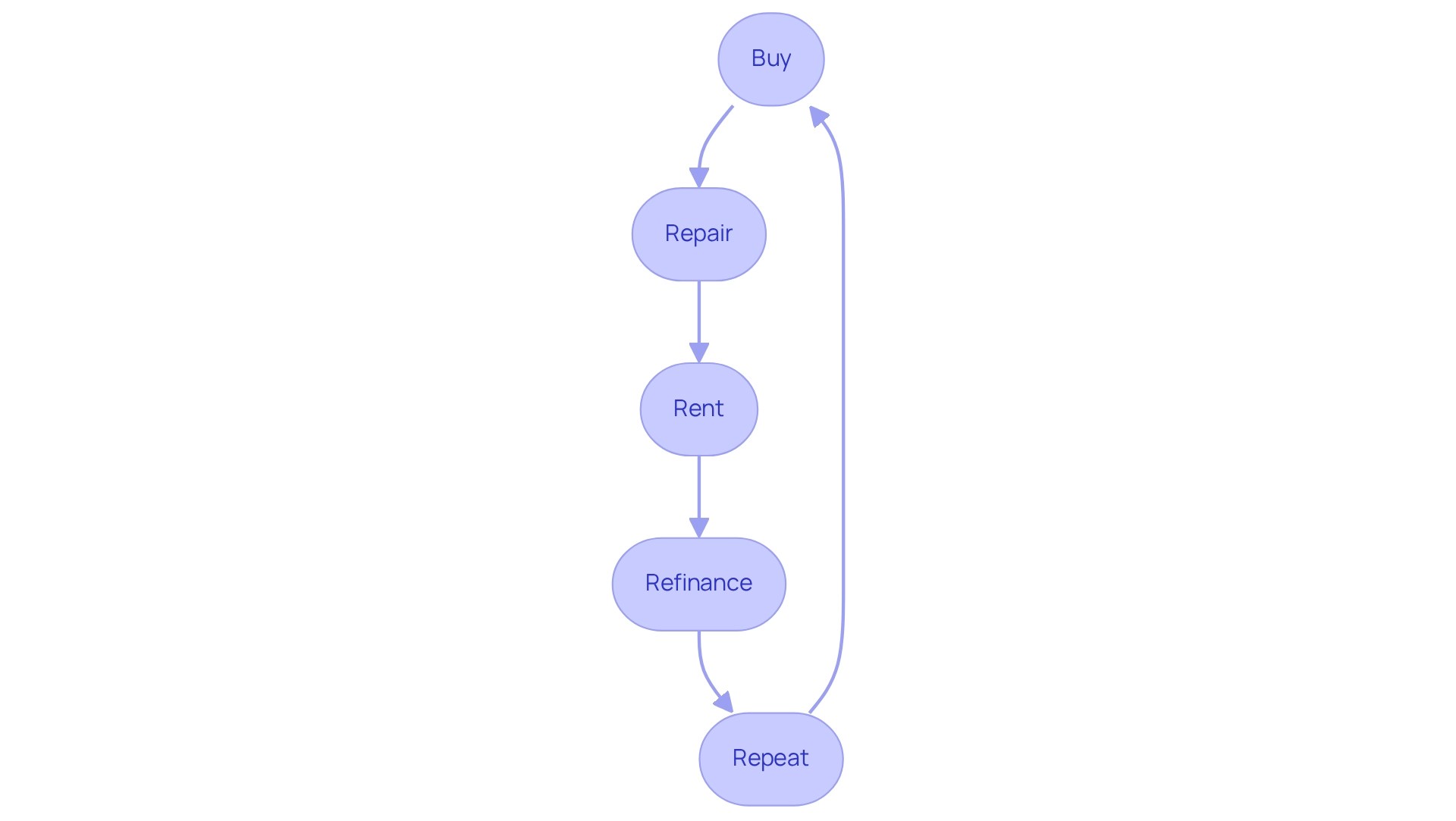

The BRRRR Strategy: Building Wealth Over Time

The BRRRR strategy—an acronym for Buy, Repair, Rent, Refinance, Repeat—illustrates effective methods for generating wealth in real estate without significant initial investment. This approach begins with acquiring undervalued properties, often at a discount, which can be enhanced through strategic renovations to significantly increase their value. For example, a recent case study highlighted a 20-unit apartment building purchased for $4 million; after $1.5 million in repairs, it was appraised at $7.5 million, demonstrating the potential for substantial equity gains.

As Valiance Capital succinctly states, "The BRRRR method is buy, repair, rent, refinance, repeat." Once the property is renovated, it can be rented out, generating cash flow that supports ongoing investment activities. The subsequent step involves refinancing the property to extract equity, which can then be reinvested into additional properties. This effectively allows investors to scale their portfolios without the need for substantial cash reserves for each new acquisition, thus illustrating how to make money in real estate with little upfront capital.

Successful implementation of the BRRRR strategy hinges on meticulous analysis of the market and budgeting for renovations. Investors must evaluate local economic conditions, including zoning regulations, rental trends, and tax implications, as emphasized in the case study titled 'Evaluating Economic Conditions Before Repeating Investments.' This knowledge is crucial for making informed decisions that enhance profitability.

The average return on investment for the BRRRR strategy in 2025 is projected to be robust, with many participants reporting returns exceeding 20% when executed correctly.

Expert insights reinforce the effectiveness of this strategy, with industry leaders noting that the BRRRR method not only fosters portfolio growth but also mitigates financial risk by leveraging existing equity. By adhering to a disciplined approach and consistently refining their investment strategies, property buyers can adeptly navigate the complexities of the market and build lasting wealth.

Networking and Mentorship: Unlocking Opportunities

Establishing a strong network within the property sector is crucial for accessing investment opportunities, creating strategic alliances, and obtaining valuable mentorship. Participating in industry events, such as the Creative Investor Meetup, which emphasizes genuine connections without sales pitches, can significantly enhance your relationships with experienced investors and mentors. Furthermore, leveraging social media platforms like Facebook, LinkedIn, and Twitter facilitates effective networking through content sharing and engagement, allowing for connections that might otherwise be overlooked.

A mentor plays an essential role in this journey, providing guidance, sharing insights, and assisting in navigating the complexities of the property sector. Successful mentorship relationships can lead to transformative outcomes; for instance, Mike and Tom, who met at an industry conference in 2018, went on to purchase a 12-unit apartment building, resulting in increased profits within just two years. This case exemplifies how nurturing professional relationships can directly impact financial success.

Statistics underscore the importance of networking and mentorship in real estate investing. Investors who actively cultivate their networks are better positioned to adapt to market changes and seize new opportunities, significantly enhancing their chances of success. Networking not only offers access to valuable resources and support but also fosters an environment where individuals can thrive.

As one investor aptly stated, "Let your network be your net worth." This sentiment encapsulates the essence of real estate investing in 2025, where the strength of your connections can be as valuable as your financial resources. Establishing these relationships is not just beneficial; it is essential for long-term growth and success in the industry.

Conclusion

The landscape of real estate investing is evolving, presenting myriad opportunities for individuals to enter the market with minimal upfront capital. Techniques such as:

- No-money-down strategies

- House hacking

- Seller financing

empower aspiring investors to acquire properties without the traditional financial barriers. By leveraging creative financing options and innovative approaches, investors can navigate the complexities of the market while minimizing financial risk.

In addition to these strategies, real estate investment trusts (REITs) and crowdfunding platforms offer accessible avenues for generating passive income. These investment options allow individuals to diversify their portfolios and tap into the lucrative real estate sector without the burdens of direct property management. Moreover, the BRRRR strategy provides a structured framework for building wealth over time through strategic property acquisition and renovation.

Networking and mentorship also play a crucial role in the success of real estate investors. Building relationships within the industry can unlock opportunities for collaboration, knowledge sharing, and access to valuable resources. As the adage goes, "Your network is your net worth," emphasizing the importance of cultivating connections that can lead to financial growth.

Overall, the dynamic realm of real estate investing offers innovative pathways for wealth generation. By understanding and embracing these strategies, aspiring investors can position themselves for success in an ever-changing market landscape.