Overview

The article titled "10 Factors Influencing Commercial Real Estate Loan Rates Today" identifies the key elements affecting loan rates in the commercial real estate market. It emphasizes that factors such as:

- The Federal Reserve's interest rate decisions

- Market demand and supply dynamics

- Property types

- Borrower creditworthiness

- Global economic conditions

significantly influence these rates. Each of these elements interplays with loan costs in the current economic landscape, providing a comprehensive overview that is crucial for informed investment decisions.

Introduction

In the dynamic world of commercial real estate, understanding loan rates is crucial for investors and professionals alike. With a myriad of factors influencing these rates—from Federal Reserve interest rate decisions to fluctuations in market demand and supply—the landscape is ever-changing. As we look ahead to 2025, insights from industry leaders and data-driven analyses reveal how elements such as borrower creditworthiness, property type, and economic indicators play pivotal roles in shaping financing options. This article delves into the complexities of commercial real estate loan rates, offering essential insights that empower stakeholders to navigate their investment strategies with confidence and clarity.

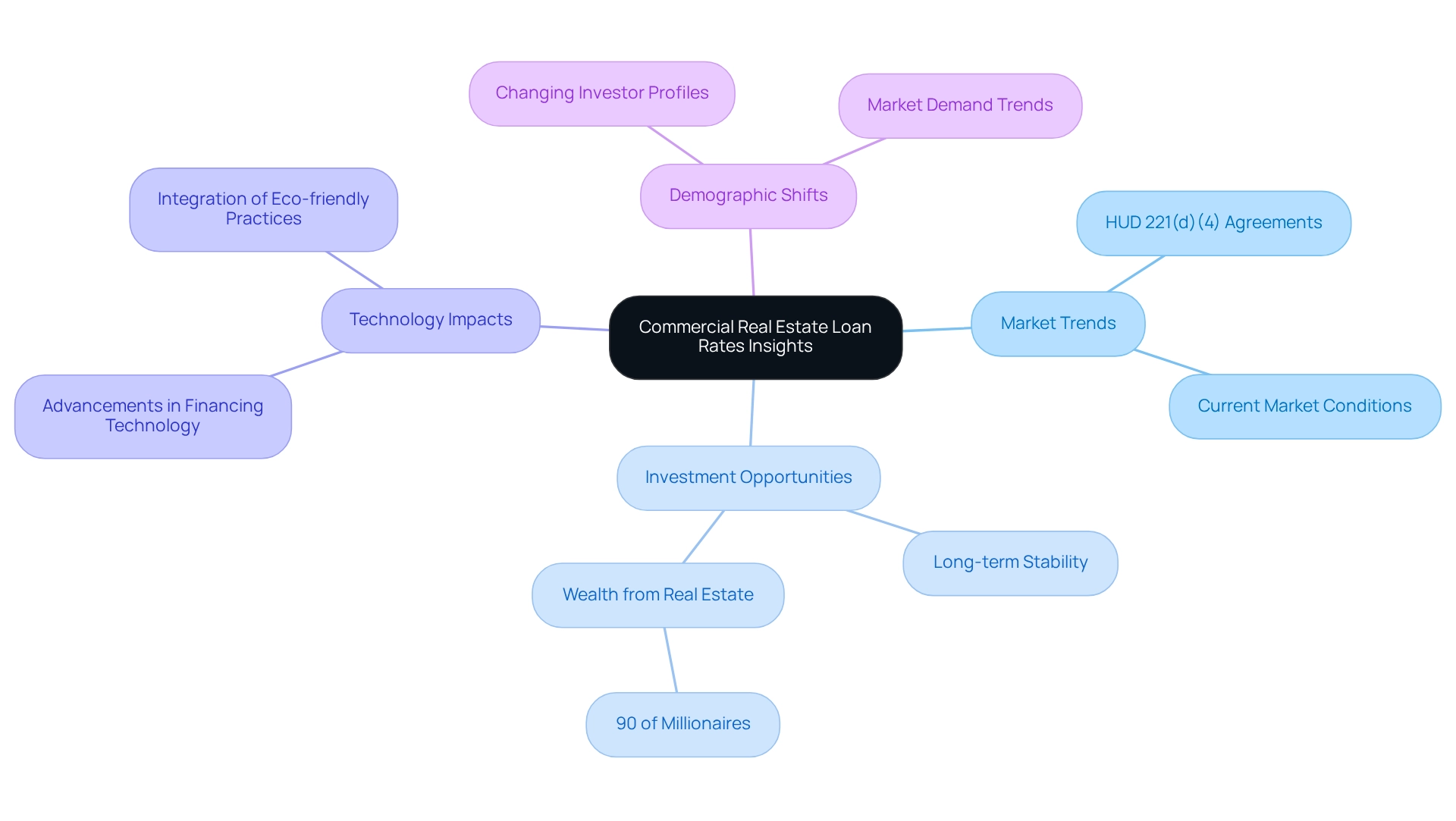

Zero Flux: Daily Insights on Commercial Real Estate Loan Rates

Zero Flux delivers daily insights on business property financing figures, meticulously gathering information from over 100 reliable sources to highlight critical market trends. This resource serves as an indispensable tool for property experts and investors navigating the complexities of financing costs with efficiency. By emphasizing factual information and steering clear of subjective opinions, Zero Flux equips its audience with clear, actionable insights—such as current market conditions, investment opportunities, and demographic shifts—that can significantly influence their investment decisions.

As of 2025, various factors shape commercial property financing costs, notably the fixed interest values of HUD 221(d)(4) agreements, which fully amortize over terms exceeding 40 years. This long-term stability is vital for investors seeking predictable financing options. Additionally, the evolving landscape of technology and sustainability is poised to impact future trends in the sector, including the integration of eco-friendly building practices and advancements in financing technology, which will subsequently affect borrowing costs and investment strategies. The commitment to data integrity that distinguishes Zero Flux enhances subscriber engagement and establishes it as a leading authority in property information distribution. In a market where 90% of millionaires attribute their wealth to property investments, access to trustworthy insights has never been more crucial for making informed choices.

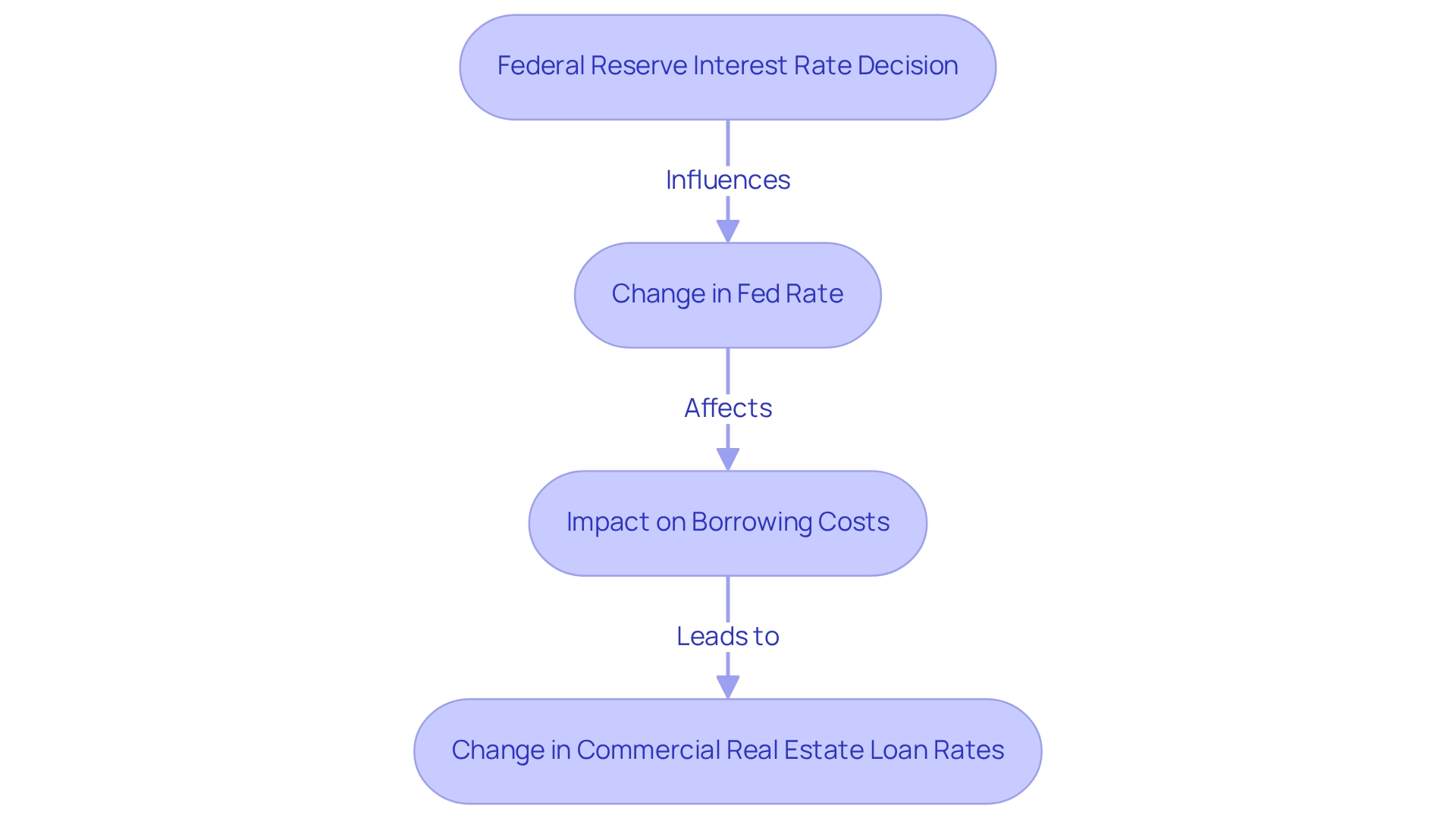

Federal Reserve Interest Rate Decisions: Impact on Loan Rates

The Federal Reserve's interest rate decisions play a crucial role in determining commercial real estate loan rates today. Typically, a rise in the Fed's rates results in increased borrowing expenses, leading to higher commercial real estate loan rates today for commercial properties. Conversely, when the Fed lowers interest levels, borrowing becomes more accessible, which facilitates loan acquisition and affects commercial real estate loan rates today. As of April 2025, the federal funds rate is set between 4.25% and 4.50%. This economic environment significantly impacts both lenders and borrowers, prompting them to adapt their strategies regarding commercial real estate loan rates today. Notably, a higher federal funds interest can lead to increased borrowing costs, making it essential for investors to understand how these changes influence their financing options, including commercial real estate loan rates today.

Experts highlight the strong correlation between mortgage costs and Treasury yields, with the 30-year mortgage often mirroring the 10-year Treasury yield. This relationship underscores the importance of monitoring Fed decisions, as shifts in the federal funds rate can lead to immediate changes in commercial real estate loan rates today. For instance, recent trends indicate that while the Fed's interest increases have pressured borrowing expenses, sectors less affected by these changes, such as technology, continue to thrive, contrasting with the asset-heavy nature of real estate.

Case studies illustrate these dynamics effectively. Blackstone, despite experiencing record capital inflows, reported a decline in property profits in Q1 2025, attributed to geopolitical tensions and a cautious investor sentiment. This situation reflects broader market uncertainties and the challenges posed by an oversupplied sector, emphasizing the need for strategic decision-making in response to Fed interest adjustments. The decline in earnings can be linked to the increased borrowing costs resulting from the Fed's interest hikes, which influence investment decisions in the real estate market, especially regarding commercial real estate loan rates today.

Historically, fluctuations in the federal funds rate have directly impacted business financing costs, with data showing that periods of rising interest typically coincide with increased borrowing expenses. For example, during previous interest rate increase cycles, business borrowing costs, including commercial real estate loan rates today, have generally escalated alongside the federal funds rate. As the Federal Reserve navigates its monetary policy, understanding these trends is vital for property investors aiming to make informed choices in a complex market landscape.

Market Demand and Supply: Key Drivers of Loan Rate Variability

Market demand and supply are crucial elements influencing commercial real estate loan rates today. In a setting where demand for business properties rises, lenders frequently respond by increasing charges, motivated by heightened competition for funding. Conversely, an excess of properties can prompt lenders to reduce rates to entice borrowers, resulting in a dynamic relationship between supply and demand.

By 2025, the business property market is undergoing extraordinary changes across all major sectors, with significant variations in demand. For instance, despite a 12% year-over-year decline in retail foot traffic, the sector has achieved a 3.2% growth, indicating resilience and shifting consumer behaviors. This evolving environment compels lenders to modify their products, leading to fluctuations in interest rates.

Expert insights indicate that rivalry among lenders is intensifying, particularly as they seek to capitalize on new opportunities within the market. A recent survey of over 880 C-level executives from major business property firms reveals a growing optimism about revenue growth and transaction activity, suggesting that 2025 could mark a turning point for the industry. As one analyst noted, after several years of subdued revenue growth, there are signs that 2025 might be a year of resurgence for the global business property sector. Furthermore, anticipated demand variations are likely to significantly impact borrowing costs throughout the year. For instance, as specific property categories, such as logistics and industrial areas, gain popularity, lenders may adjust their terms accordingly, which could affect commercial real estate loan rates today, reflecting the increased interest. This trend underscores the importance of understanding how property demand directly influences borrowing cost fluctuations. In conclusion, the interplay of market demand and supply is vital in establishing business financing costs in 2025. As the real estate landscape continues to evolve, staying informed about these trends will be essential for making strategic investment decisions.

Property Type: How It Affects Commercial Loan Rates

The type of property being financed significantly influences the commercial real estate loan rates today. Multifamily properties, known for their consistent income generation, typically enjoy lower interest rates. In contrast, retail properties often encounter higher costs due to their sensitivity to market fluctuations and evolving consumer behaviors. As of April 2025, lenders are adjusting their pricing based on the perceived risks associated with different property types, which are shaped by current market dynamics and investor sentiment.

For example, the National NCREIF Property Index reported annual returns for 2024, revealing that multifamily properties achieved an average return of 8%, while retail properties lagged at 4%. This trend underscores the importance of property type in determining interest rates. Furthermore, the hospitality industry has seen average daily prices and income per available room surpass pre-pandemic levels, with a notable increase of 15% in Q1 2025. This performance not only signifies the sector's recovery but also suggests that lenders may perceive hospitality properties as less risky, potentially favoring financing conditions, which is important to consider when looking at commercial real estate loan rates today.

In 2025, average borrowing rates illustrate these distinctions:

- Multifamily properties are generally offered rates around 4.5%

- Retail properties may face rates closer to 6%

Such disparities highlight the necessity for investors to carefully consider property types when seeking commercial real estate loan rates today. As Sharad Mehta, an industry expert, emphasizes, understanding the digital economy, cloud computing, and AI's impact on commercial real estate trends is vital for assessing risk and making informed investment choices. This nuanced comprehension of property types not only aids in securing favorable financing terms but also enhances overall portfolio management. Moreover, leveraging services like Janover, which connects clients with a broad network of lenders, can help investors find optimal financing options tailored to their specific property type.

Borrower Creditworthiness: Assessing Risk and Loan Rates

Borrower creditworthiness is paramount in determining business financing costs. Lenders assess borrowers' financial stability through various metrics, including credit scores, financial statements, and overall risk profiles. In 2025, the landscape of business lending is increasingly influenced by borrower creditworthiness, with higher credit scores correlating with lower interest charges due to a reduced risk of default. For instance, borrowers with credit scores exceeding 700 are often offered significantly better terms compared to those with scores below 600, who may encounter higher charges and stricter conditions.

As lenders adopt a more cautious approach, the average credit score for commercial real estate financing is anticipated to remain above 700, signaling a shift towards super-prime borrowers. This trend underscores a preference for financially stable clients, evidenced by mortgage origination trends in 2021, where the volume reached an unprecedented $4.51 trillion, largely driven by low interest rates and refinancing opportunities. Additionally, the total number of new foreclosures in 2021 was 38,040, highlighting the risks lenders consider when evaluating borrower creditworthiness.

Insights from lenders reveal that credit scores not only affect interest rates but also shape conditions such as down payments and repayment periods. For example, a borrower with a strong credit profile may secure financing with a down payment as low as 15%, while those with weaker credit might be required to contribute 25% or more. The average down payment across the 50 largest U.S. metros is approximately $84,499, further illustrating the impact of credit scores on borrowing costs. This dynamic emphasizes the necessity of maintaining a strong credit score, as it directly influences the cost of borrowing and the overall feasibility of real estate investments. Moreover, with 174,100 new foreclosures reported in 2024, the implications of borrower creditworthiness are more critical than ever, underscoring the need for lenders to meticulously assess risk in the current market.

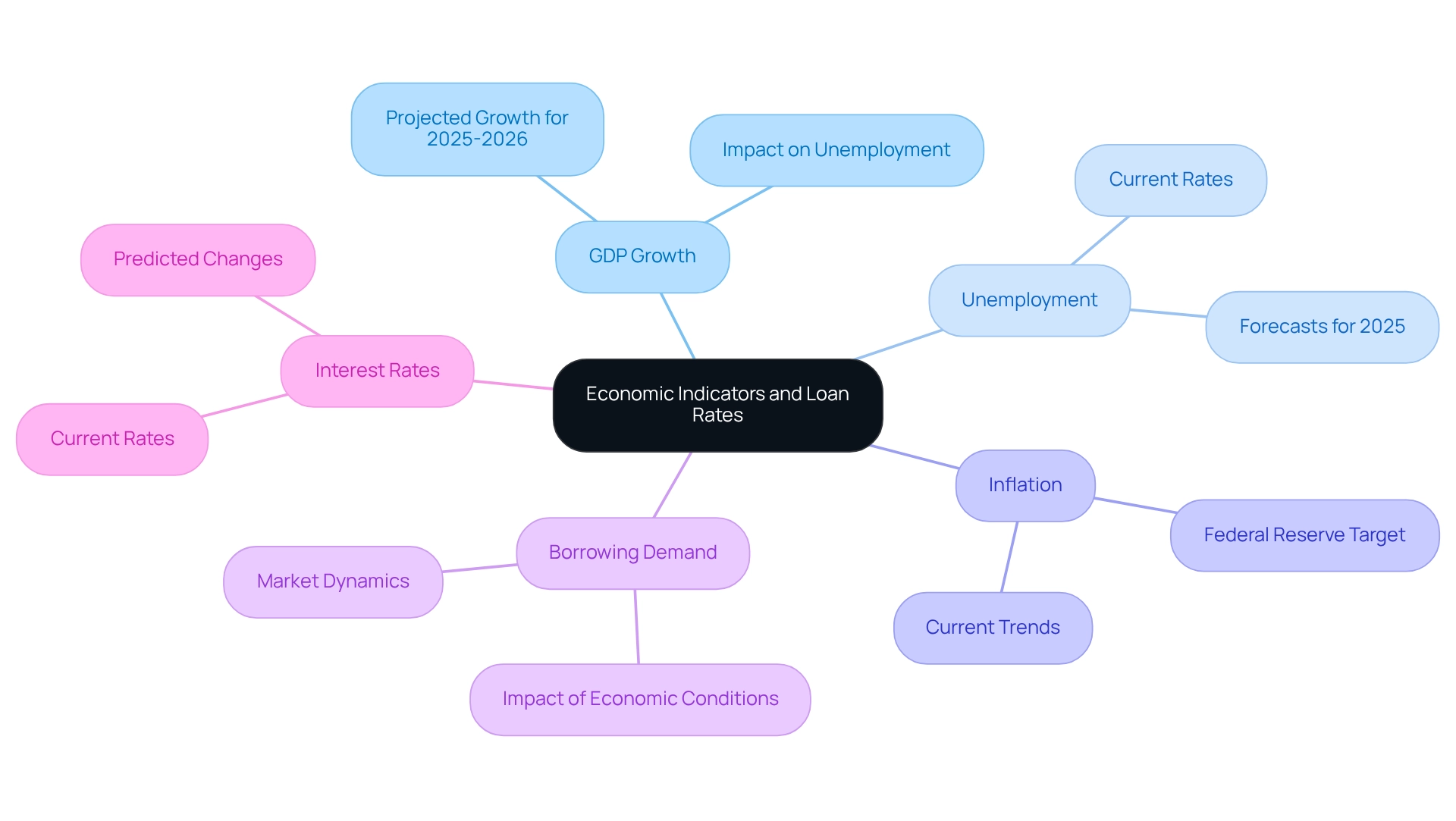

Economic Indicators: Their Role in Shaping Loan Rates

Economic indicators such as GDP growth, unemployment figures, and inflation are pivotal in determining business borrowing costs. A robust economy typically correlates with heightened borrowing demand, which can lead to increased interest charges. Conversely, during economic downturns, the demand for credit often diminishes, resulting in lower charges. As we advance through 2025, it is imperative for both borrowers and lenders to meticulously monitor these indicators, as they offer crucial insights into potential shifts in the lending landscape.

Recent forecasts from the American Bankers Association’s Economic Advisory Committee project an economic growth of 2.1% for 2025 and 2026. However, caution is warranted due to emerging risks, including a 30% likelihood of recession in the same timeframe, which could adversely affect consumer spending and capital expenditures. Such economic uncertainties can profoundly influence borrowing demand and interest levels. Additionally, the current state of the real estate market is highlighted by a notable decline in housing starts in D.C., as investors withdraw, indicating a potential decrease in borrowing demand.

Furthermore, the relationship between GDP growth and unemployment is crucial. For instance, as GDP rises, it often leads to lower unemployment rates, which can further stimulate borrowing demand. However, if inflation remains above the Federal Reserve's target of 2%, as anticipated, it may complicate the lending environment, prompting banks to adjust their charges accordingly. Notably, Blackstone's property profits fell in Q1 despite record capital inflows, illustrating broader market dynamics that could impact investor behavior and borrowing costs.

In April 2025, the connection between GDP growth and borrowing costs will be particularly significant as economic conditions evolve. Understanding these dynamics is essential for making informed decisions in the business property sector, especially as banks navigate the challenges of balancing credit and deposit levels amid macroeconomic changes. As Deloitte indicates, European banks may face even greater pressure to manage operating costs, which could further shape the lending landscape.

Loan Term Length: Impact on Interest Rates

The duration of the borrowing period significantly influences interest levels in commercial real estate. Shorter borrowing terms typically correlate with lower interest charges, yet they result in higher monthly payments. Conversely, extended terms often entail increased costs due to the heightened risk perceived by lenders. As we approach 2025, borrowers must meticulously evaluate their financing requirements, as the choice of term can profoundly impact overall borrowing expenses. For instance, a 5-year borrowing period may yield an average interest rate of approximately 4.5%, compared to around 5.5% for a 20-year term. This discrepancy can lead to thousands of dollars in additional costs over the life of the loan.

Notably, the lowest average mortgage rate in history was 2.65% during the first week of 2021, setting a benchmark for current values. Experts emphasize that borrowers should make term selections with a comprehensive understanding of their financial situation and prevailing market conditions. Sarah Foster, a U.S. Economy Reporter and Analyst, underscores the importance of considering cash flow needs and potential interest rate fluctuations when determining a borrowing period. Furthermore, case studies reveal that consumer sentiment regarding the housing market is cautiously optimistic, which may shape borrowing decisions as confidence in economic stability increases. This sentiment is crucial, as it reflects how prospective buyers perceive the market and can affect their willingness to pursue financing.

As market dynamics evolve, understanding the nuances of short versus long-term financing costs will be essential for making informed investment choices. With robust economic growth and wage increases outpacing inflation, the current landscape presents both challenges and opportunities for borrowers navigating commercial real estate financing.

Lender Competition: Driving Down Commercial Loan Rates

Lender rivalry significantly influences the terms of business loans. As various lenders compete for the same customers, they often respond by lowering costs or enhancing conditions to attract borrowers. In 2025, the lending landscape is expected to become increasingly competitive, presenting borrowers with advantageous opportunities to negotiate better rates. This is particularly true for individuals with strong credit profiles and well-organized investment strategies.

Statistics indicate that competition among lenders is on the rise, with the Mortgage Bankers Association (MBA) forecasting an increase in mortgage originations over the next two years, despite challenges posed by a substantial number of debts maturing in 2025. This competitive environment compels lenders to differentiate themselves, resulting in more attractive borrowing terms.

For example, major players in the commercial lending market are embracing innovative AI-driven solutions to enhance decision-making and risk management, further intensifying competition. Temenos AG, for instance, has introduced an AI-driven corporate lending solution aimed at optimizing credit portfolios and improving servicing capabilities for banks. Such advancements not only streamline financing processes but also enable lenders to offer more customized solutions to borrowers.

Expert opinions suggest that as lenders strive to secure business, borrowers can leverage this competition to negotiate terms that align with their financial objectives. The effects of this competitive landscape are evident across various property types, with industrial properties expected to remain resilient, while office spaces may encounter ongoing challenges. Retail properties are thriving, and emerging sectors such as data centers are gaining traction, all of which influence how lenders assess commercial real estate loan rates today. In summary, the dynamics of lender competition are set to significantly impact business financing costs in 2025, offering astute borrowers the opportunity to secure more favorable funding options. As noted by Loan Market Group (LMG), understanding this evolving competitive landscape is crucial for borrowers as they navigate their financing decisions.

Regulatory Changes: Their Influence on Loan Rates

Regulatory changes significantly influence business loan costs and lending practices. Stricter lending standards and altered capital requirements directly affect the rates lenders offer to borrowers. As we progress through 2025, it is imperative for both lenders and borrowers to remain vigilant regarding these regulatory changes, as they present both challenges and opportunities within the business property financing landscape.

Recent trends indicate that banks are tightening their lending standards, particularly in consumer lending. For instance, during the fourth quarter, banks reported a modest tightening of standards on credit card financing, while criteria for auto financing remained stable. This shift reflects a broader concern regarding credit quality, especially for nonprime borrowers. Luke Morgan observed that moderate net shares of banks expect credit quality to deteriorate for these borrowers, underscoring the potential risks involved.

Moreover, the global regulatory technology (RegTech) market is projected to expand significantly, reaching $55.28 billion by 2025. This growth highlights the increasing importance of compliance and risk management in lending practices, as lenders must adapt to new regulations and technologies to remain competitive. Financial analysts suggest that these regulatory modifications will not only influence lending criteria but also transform borrower choices, making it essential for stakeholders to adjust to the evolving environment.

As business real estate lending is anticipated to reach $709 billion by 2026, with $419 billion allocated for multifamily lending, understanding the effects of regulatory changes becomes increasingly vital. The reported decline in demand for credit card financing indicates a shift in borrower behavior that could impact commercial lending dynamics. Stakeholders must navigate these shifts to optimize their financing strategies and ensure they remain competitive in a dynamic market.

Global Economic Conditions: Their Effect on Domestic Loan Rates

Global economic conditions, particularly international trade dynamics and foreign investment trends, are pivotal in shaping domestic borrowing costs. In 2025, fluctuations in global interest levels are expected to significantly impact borrowing expenses in the U.S. market. For instance, the Core Consumer Price Index (CPI) has risen at an annualized pace of 3.7% over the past six months. This inflationary pressure can lead to increased interest charges on borrowing. Moreover, deposit costs are projected to remain high at around 2.03%, further influencing financing costs.

The interplay between global commerce and U.S. borrowing costs is particularly noteworthy. As trade volumes fluctuate, they can influence the demand for capital and, in turn, borrowing costs. Recent trends indicate a rise in refinance applications, although they still trail behind the surge observed last September. This suggests that borrowers are responding to the shifting economic landscape.

Economists underscore the necessity of monitoring these global dynamics. A recent report from Deloitte asserts that "the evolving landscape of international trade significantly influences U.S. borrowing costs, as shifts in trade policies can lead to increased uncertainty in the market." Furthermore, ongoing changes to Basel III regulations require banks to adjust their lending strategies, which can also affect borrowing costs. While these regulations aim to enhance the stability of the banking sector, they may also impose stricter lending conditions, impacting the accessibility and cost of financing for business real estate.

Specific case studies, such as the recent changes in trade agreements between the U.S. and its key partners, illustrate how these shifts can directly affect domestic borrowing costs. As international trade continues to evolve, its influence on commercial real estate loan rates today in the U.S. will remain a critical consideration for borrowers navigating the financing landscape.

Conclusion

Understanding the intricacies of commercial real estate loan rates is essential for investors and professionals navigating an ever-evolving market. Key factors such as:

- Federal Reserve interest rate decisions

- Market demand and supply dynamics

- Property types

- Borrower creditworthiness

significantly shape these rates. The interplay between these elements can lead to substantial fluctuations in financing options. Therefore, it is crucial for stakeholders to remain informed and adaptable.

Looking ahead to 2025, the competitive landscape among lenders is expected to intensify, potentially offering more favorable terms for savvy borrowers. As economic conditions fluctuate, particularly with ongoing global influences, maintaining a keen awareness of both domestic and international trends will be vital. Leveraging insights from reliable sources like Zero Flux can empower real estate professionals to make informed decisions, ultimately enhancing their investment strategies.

In conclusion, the complexities surrounding commercial real estate loan rates underscore the importance of a comprehensive understanding of the factors at play. By staying informed and agile in response to market changes, investors can navigate the financing landscape with greater confidence, positioning themselves for success in an increasingly competitive environment.