Overview

To become a real estate investor without the constraints of money or credit, individuals can leverage creative financing strategies such as:

- Seller financing

- Lease options

- Partnerships

These methods empower aspiring investors to break through traditional financial barriers and enter the market. Understanding the dynamics of these strategies is crucial for success.

Networking, continuous learning, and a deep comprehension of market trends are essential components in navigating the complexities of real estate investing. By actively engaging with industry professionals and staying informed about market shifts, investors can position themselves advantageously. This proactive approach not only enhances their knowledge but also fosters valuable connections that can lead to lucrative opportunities.

In conclusion, aspiring real estate investors should embrace these creative financing options and commit to ongoing education and networking. By doing so, they can effectively overcome financial obstacles and thrive in the competitive landscape of real estate investing.

Introduction

Navigating the world of real estate investing presents a formidable challenge, particularly for individuals lacking substantial financial resources or a robust credit history. Nevertheless, this landscape is teeming with opportunities for aspiring investors who are prepared to think creatively and employ innovative strategies. This guide outlines the crucial steps necessary to embark on a successful real estate investment journey, illuminating how one can excel in this field despite financial limitations.

What are the keys to entering the realm of real estate investing without the conventional barriers of money and credit?

Understand the Basics of Real Estate Investing

To embark on your real estate investing journey, it is crucial to grasp the foundational concepts.

Types of Real Estate: Familiarize yourself with the different categories, including residential, commercial, and industrial assets. Each category presents distinct characteristics and investment potential. For instance, residential units frequently generate consistent rental revenue, with 69.4% of houses acquired by investors being single-family residences. In contrast, commercial real estate can provide higher returns but may entail increased risk.

Market Dynamics: Understanding how supply and demand influence real estate values and rental rates is vital. The U.S. housing market recorded approximately 4.1 million transactions, reflecting a growth of 0.8% from the previous year. Staying updated on local market trends can help you identify lucrative opportunities, particularly in areas experiencing significant rent growth, such as Henderson, NV, which saw a 4.5% increase.

Investment Strategies: Explore various strategies like buy-and-hold, flipping, and rental assets. Each approach requires different levels of involvement and risk tolerance. For instance, house-flipping can yield quick profits, with gross profits for investors increasing from $67,846 in 2023 to $72,000 in 2024. However, it also demands a keen understanding of market timing and renovation costs.

Financial Metrics: Familiarize yourself with key financial terms such as cash flow, ROI (Return on Investment), and cap rate. These metrics are essential for assessing potential funding opportunities. The typical return on capital for land is approximately 29.6%, emphasizing the possible profitability of well-selected assets. Additionally, the average down payment for an investment property was 27.4% in Q4 2024, providing insight into the financial commitment required for investors.

By grasping these fundamental ideas, you can understand how to become a real estate investor with no money or credit, enabling you to maneuver through the intricacies of property investing more efficiently.

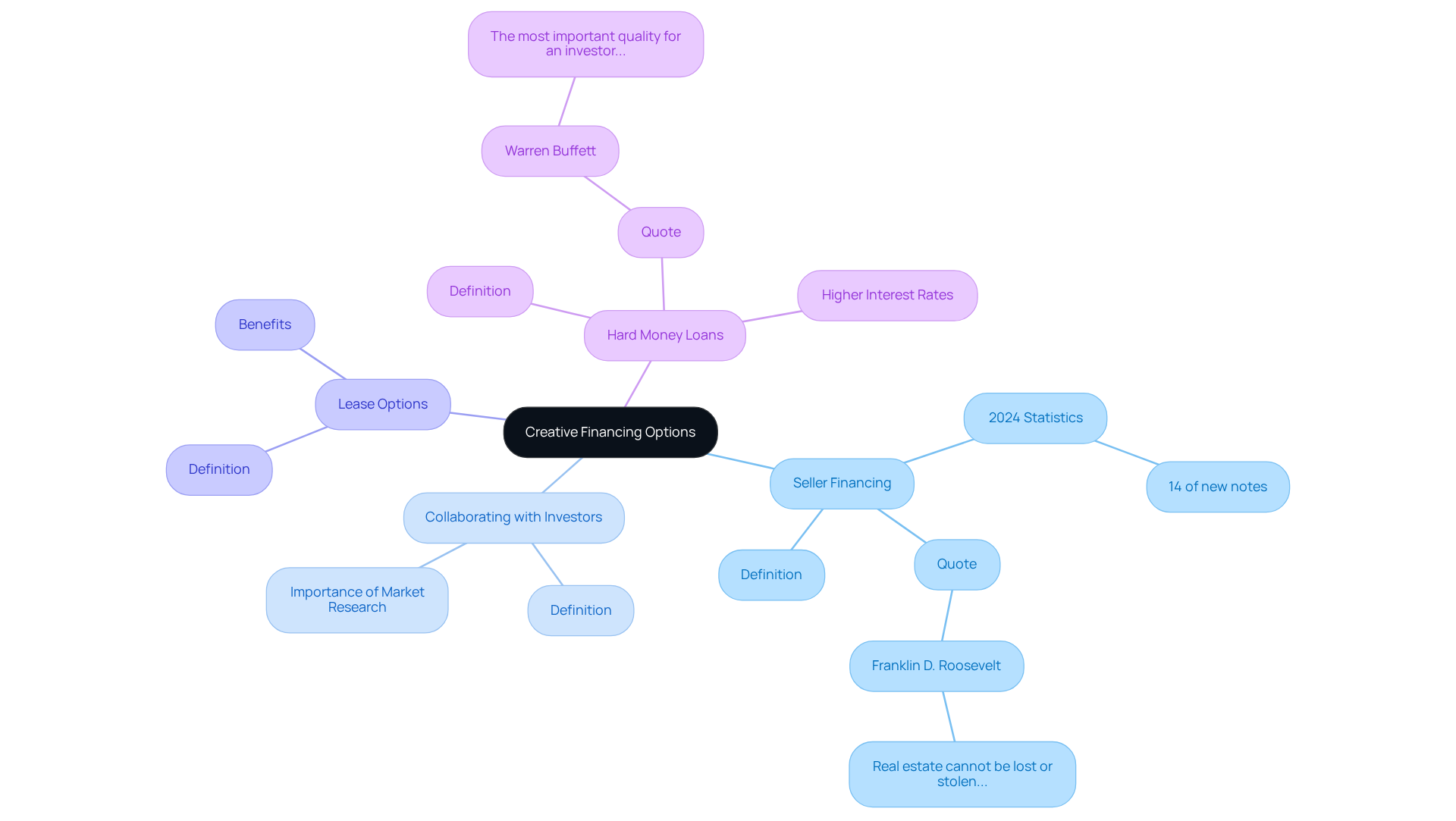

Explore Creative Financing Options

Investing in real estate without upfront capital or credit can be achieved through several creative financing strategies:

- Seller Financing: This approach involves negotiating directly with the property owner to pay them over time, bypassing traditional mortgage requirements. In 2024, 14% of new notes were created by sellers offering multiple financing options, highlighting the growing acceptance of this method. As Franklin D. Roosevelt noted, "Real estate cannot be lost or stolen, nor can it be carried away. Acquired with common sense, settled completely, and overseen with reasonable care, it is among the safest options in the world."

- Collaborating with other investors can provide the necessary capital while you manage the asset or oversee the financing process. This strategy allows you to leverage the strengths of your partners, making it a popular choice among new investors. The importance of thorough market research and analysis cannot be overstated, as it is crucial for informed investment decisions.

- Lease Options: This method enables you to rent a residence with the possibility of buying it later. It allows you to control the property without the immediate financial burden of a purchase, making it an attractive option for those looking to enter the market gradually.

- Hard Money Loans: These short-term loans are backed by property and are frequently utilized for swift acquisitions or improvements. While they typically come with higher interest rates, they can provide immediate funding for investors looking to capitalize on time-sensitive opportunities. As Warren Buffett wisely stated, "The most important quality for an investor is temperament, not intellect… You need a temperament that neither derives great pleasure from being with the crowd or against the crowd."

Comprehending these choices can enable aspiring investors to understand how to become a real estate investor with no money or credit while maneuvering the property market effectively. Additionally, examining case studies on partnerships and seller financing trends can provide practical insights into the effectiveness of these strategies.

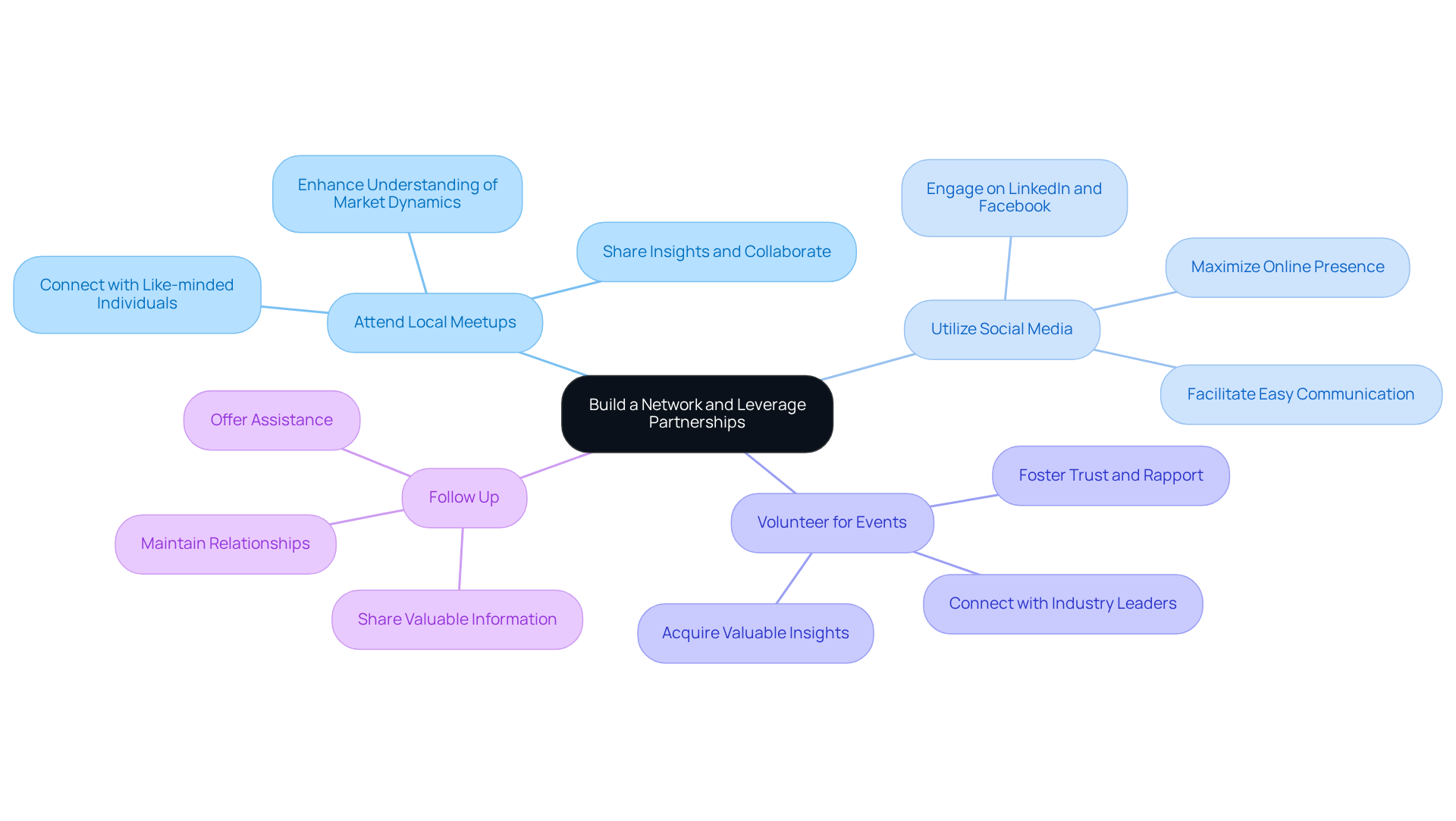

Build a Network and Leverage Partnerships

Building a strong network is essential for success in real estate investing.

-

Attend Local Meetups: Participate in property investment groups or local gatherings to connect with like-minded individuals and potential partners. In 2025, these gatherings are increasingly popular, providing opportunities to share insights and collaborate on projects. By engaging with others in the field, you not only expand your contacts but also enhance your understanding of market dynamics.

-

Utilize Social Media: Leverage platforms like LinkedIn and Facebook groups to discover and interact with other investors and industry professionals. These channels are effective for networking, as they facilitate easy communication and resource sharing. Are you maximizing your online presence to connect with key players in the industry?

-

Volunteer for Events: Engage in property seminars or workshops to connect with industry leaders and acquire valuable insights. Volunteering not only enhances your knowledge but also positions you as an active member of the community, fostering trust and rapport. This proactive approach can lead to significant opportunities in your investment journey.

-

Follow Up: Maintain relationships by regularly checking in with your contacts, sharing valuable information, and offering assistance when possible. Regular involvement is essential; as highlighted by industry specialists, establishing robust relationships can result in beneficial collaborations and opportunities in property.

As Loren Howard emphasizes, "Networking not only allows you to connect with potential clients but also establishes a foundation of trust." However, it's important to recognize that 49% of professionals find it challenging to network due to time constraints. Utilizing resources like Zero Flux can help you stay informed about networking opportunities and market trends, making your efforts more effective.

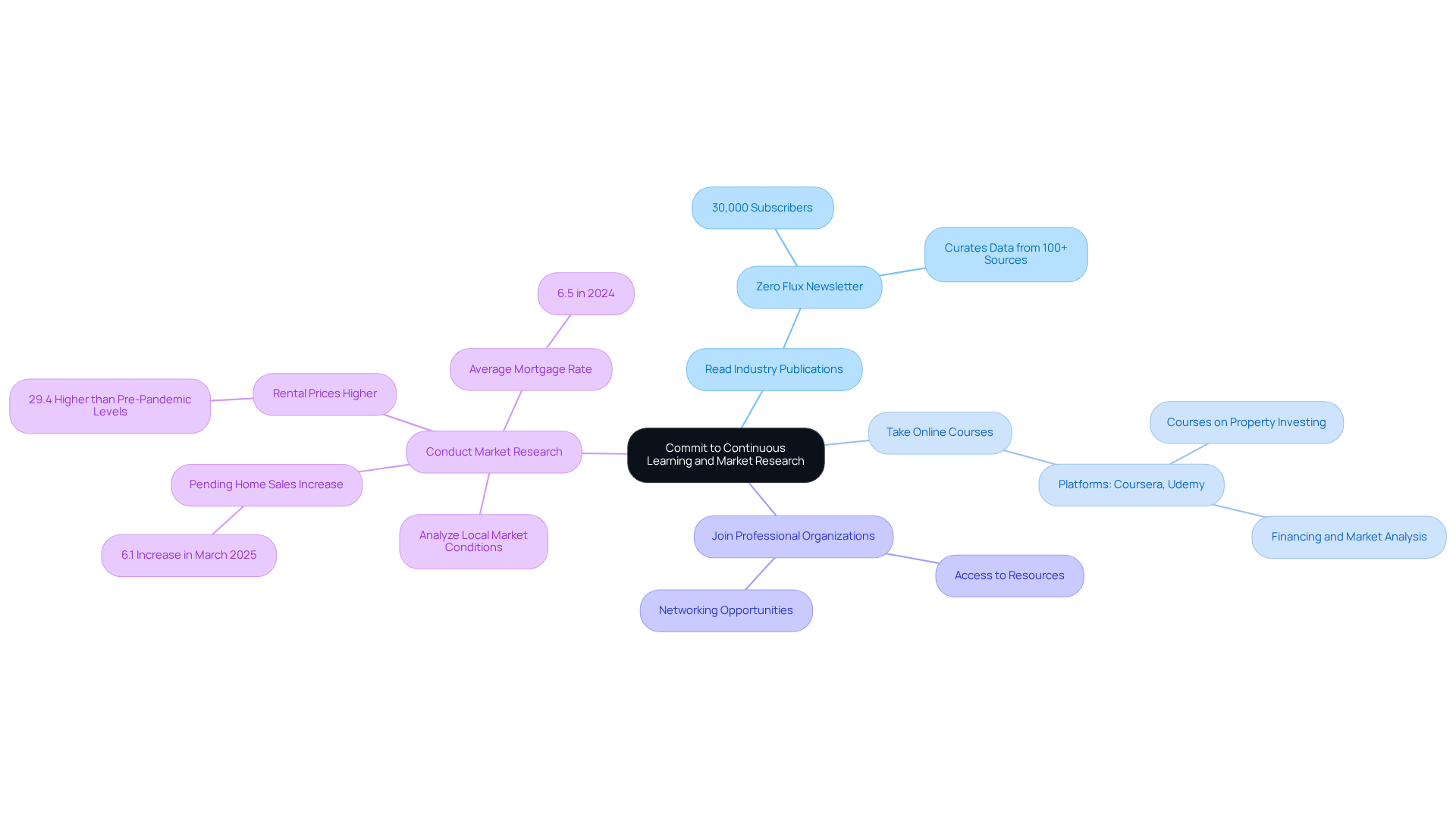

Commit to Continuous Learning and Market Research

To excel in real estate investing, a commitment to continuous learning is essential.

-

Read Industry Publications: Subscribing to property newsletters, such as Zero Flux, is crucial for staying informed on market trends and insights. With over 30,000 subscribers, Zero Flux curates vital data from more than 100 sources, aiding investors in navigating the complexities of the market.

-

Take Online Courses: Platforms like Coursera and Udemy offer a variety of courses focused on property investing, financing, and market analysis, equipping you with the knowledge necessary to make informed choices.

-

Join Professional Organizations: Membership in real estate associations provides access to valuable resources, networking opportunities, and industry insights that can enhance your financial strategies.

-

Conduct Market Research: Regularly analyzing local market conditions, property values, and economic indicators is vital. Understanding trends, such as the 6.1% increase in pending home sales in March 2025, can inform your investment choices and help identify opportunities in a competitive landscape. Additionally, with rental prices now 29.4% higher than pre-pandemic levels and the average mortgage interest rate rising to 6.5% in 2024, staying informed is more critical than ever. As Lawrence Yun noted, home sales have been at 75% of normal activity for the past three years, underscoring the necessity for investors to adapt to changing conditions.

Conclusion

Embarking on a journey into real estate investing without money or credit is not only possible; it represents an exciting opportunity for those willing to learn and adapt. By grasping the foundational concepts of real estate, exploring creative financing options, building a robust network, and committing to continuous education, aspiring investors can effectively navigate the complexities of the market.

Key insights discussed in this article underscore the importance of mastering the basics, including:

- The various types of real estate

- Market dynamics

- Investment strategies

Creative financing methods—such as:

- Seller financing

- Partnerships

- Lease options

- Hard money loans

provide viable pathways to enter the market without substantial upfront capital. Furthermore, networking and ongoing learning emerge as critical components for long-term success, enabling investors to remain informed and connected within the industry.

Ultimately, the journey to becoming a successful real estate investor demands dedication, strategic thinking, and a proactive approach to learning and networking. By leveraging the insights and strategies outlined here, individuals can take meaningful steps toward achieving their investment goals, transforming challenges into opportunities, and building a prosperous future in real estate.