Overview

To invest $25,000 in real estate successfully, it is essential to define clear investment goals.

- Conduct thorough market research, as it allows investors to understand the landscape and identify opportunities.

- Analyze potential properties, ensuring that each option aligns with the established goals.

- Explore various financing options, as it can significantly impact the investment's profitability.

- Implement effective property management strategies, which are vital for maintaining and enhancing property value.

- Adopt a structured approach, which includes assessing risk tolerance and utilizing online tools for property analysis, as it is critical for informed decision-making and maximizing investment returns.

Introduction

Investing $25,000 in real estate may appear daunting, yet it offers a distinctive opportunity for financial growth in a dynamic market. By clearly defining investment goals and understanding market trends, aspiring investors can leverage effective management strategies to maximize their returns.

However, with various financing options and property types to consider, how can one navigate the complexities of real estate investment to ensure success? This exploration will provide insights that empower you to make informed investment decisions.

Define Your Investment Goals and Understand the Market

-

Identify Your Objectives: Clearly define your financial goals. Are you targeting long-term appreciation, steady rental income, or a quick real estate flip? Documenting these objectives will sharpen your focus and guide your investment strategy.

-

Assess Your Risk Tolerance: Evaluate your willingness to take risks, as this will significantly impact the types of properties you consider and the strategies you adopt. Comprehending your risk appetite is vital; for example, 90% of millionaires have attained their wealth through property, suggesting the possibility of substantial returns. Based on historical information, property has consistently offered a stable financial opportunity, making careful risk evaluation crucial.

-

Research the Market: Stay informed about current real estate trends, including pricing, demand, and economic indicators. The U.S. housing market recorded approximately 4.1 million transactions in 2024, reflecting a modest growth of 0.8% from the previous year. Additionally, the median homebuyer income is $106,500, significantly higher than the median household income of $80,610, which highlights the financial landscape for potential investors. Utilize resources like Zero Flux to access data-driven insights that highlight relevant market dynamics, helping you make informed decisions and navigate information overload.

-

Set a Timeline: Establish a clear timeline for your investment goals. Are you looking to invest in the short term or for the long haul? This decision will affect your selection of real estate types and locations. For instance, purchasers usually require around ten weeks to discover a residence, with the majority locating an appropriate place within eight weeks. Thus, coordinating your schedule with market conditions is crucial for achievement.

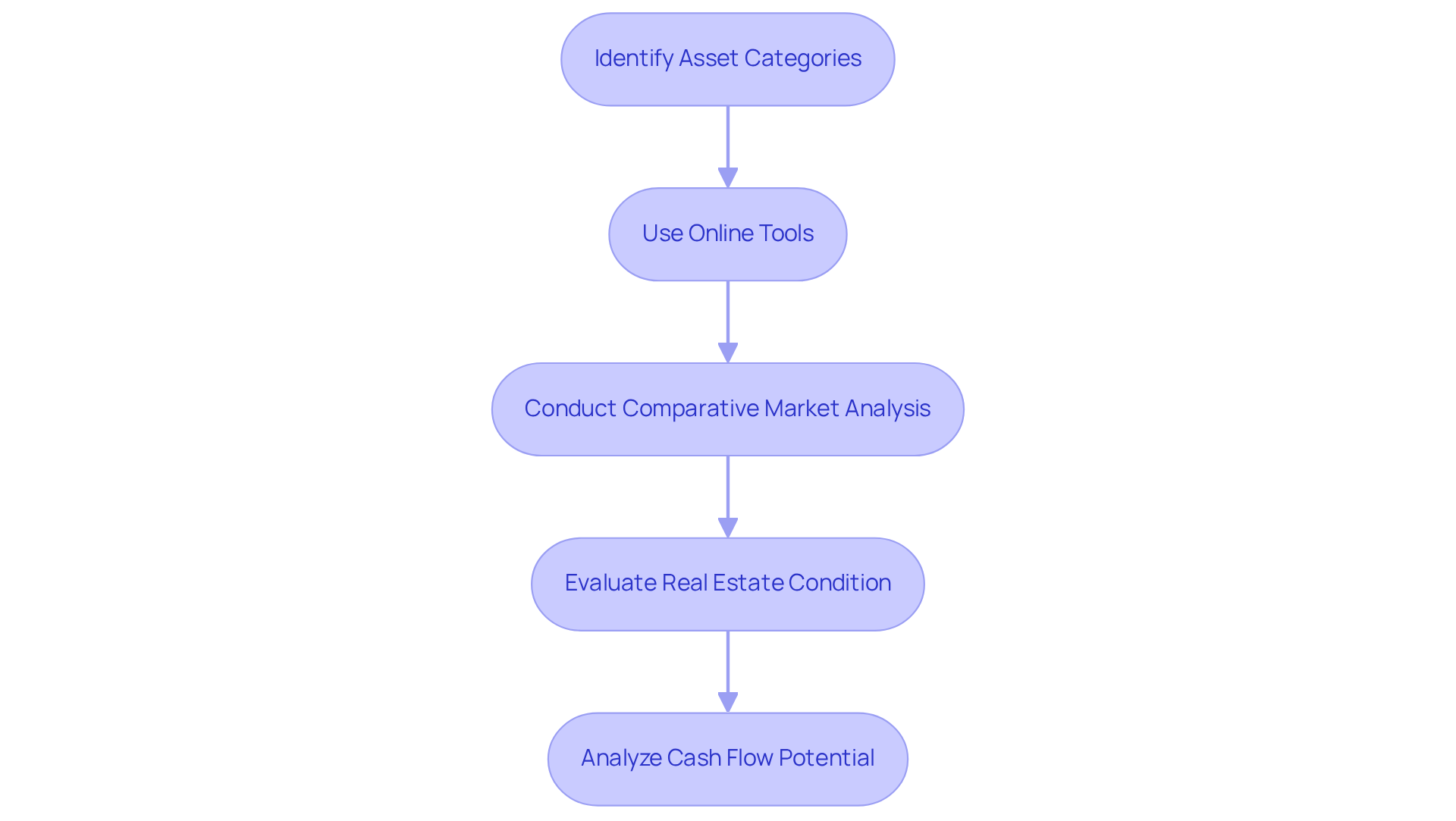

Research and Analyze Potential Investment Properties

- Identify Asset Categories: Begin by assessing the category of asset that aligns with your financial objectives. Options include single-family houses, multi-family dwellings, and commercial sites, each presenting distinct benefits and challenges. Notably, homes with green features can add up to 4% to their value, making them an attractive option for sustainability-focused investors.

- Use Online Tools: Leverage platforms such as Zillow and Realtor.com, along with specialized real estate investment software, to access listings and analyze asset values. Incorporating advanced marketing techniques, such as drone photography, can significantly enhance real estate listings; homes featuring drone photography sell 68% faster.

- Conduct Comparative Market Analysis (CMA): Execute a comparative market analysis by examining similar listings in the area. This process aids in comprehending pricing trends and determining a fair market value, which is crucial for making informed financial choices. Keep in mind that 1 in 5 listings experienced a price cut in 2024, underscoring the importance of understanding market dynamics.

- Evaluate Real Estate Condition: Assess the condition of potential real estate by inspecting them for necessary repairs or renovations. Employing a qualified inspector can provide a comprehensive assessment of structural integrity and identify any possible concerns that might impact your finances.

- Analyze Cash Flow Potential: Calculate the potential rental income against expenses, including mortgage payments, taxes, and maintenance costs. The typical initial payment for acquiring a rental asset was 27.4% in Q4 2024, which is essential for investors to consider when evaluating their overall financial strategy. This analysis is vital to ensure that the property can generate positive cash flow, a key indicator of a successful venture.

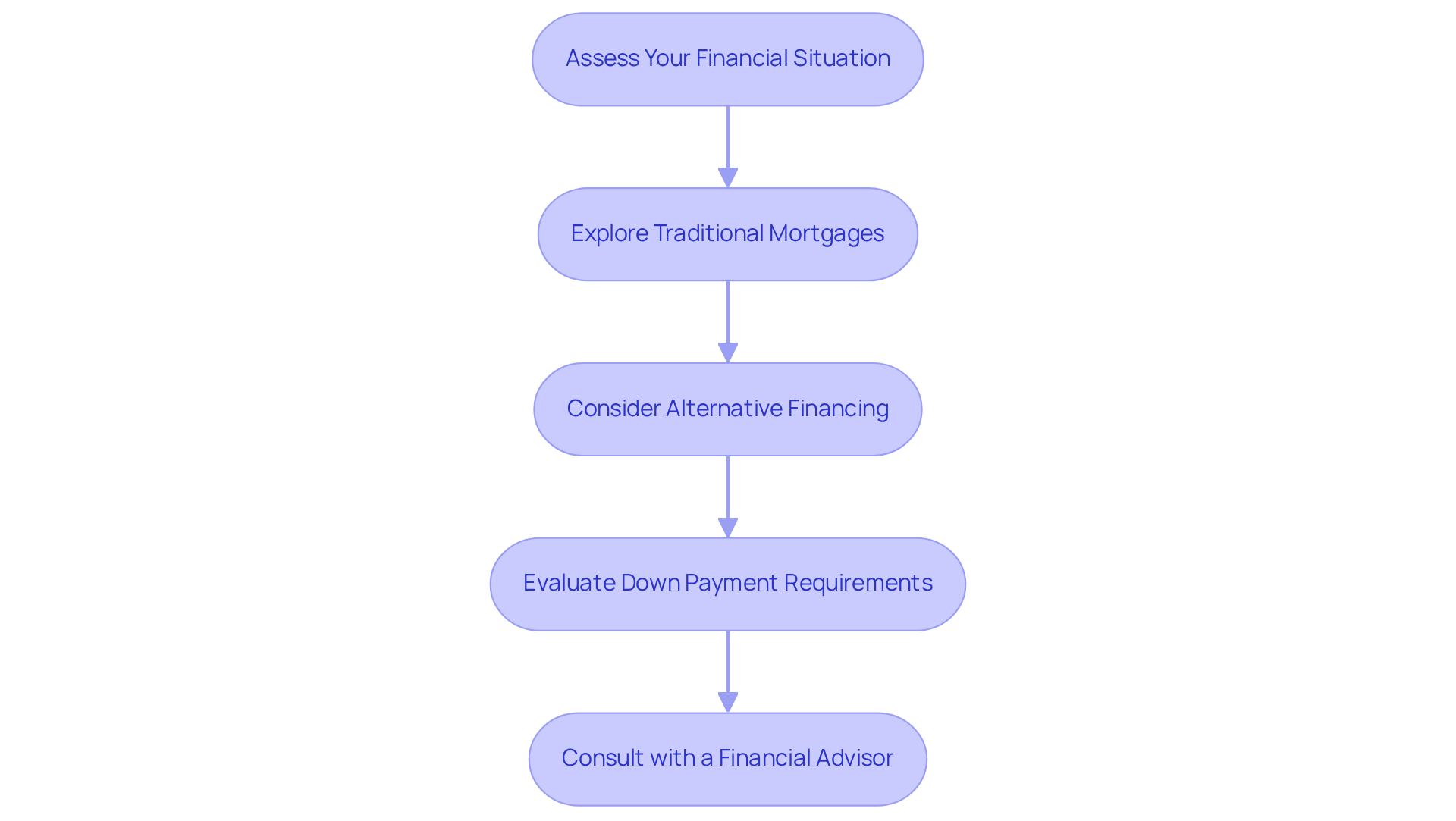

Explore Financing Options for Your Investment

-

Assess Your Financial Situation: Begin by reviewing your credit score, savings, and existing debts. This assessment will help you determine how much you can afford to borrow and set the stage for your financing journey.

-

Explore Traditional Mortgages: Investigate various mortgage options, including conventional loans, FHA loans, and VA loans. Understanding these products will enable you to identify the best fit for your property and financial circumstances.

-

Consider Alternative Financing: Expand your horizons by looking into alternative financing options such as hard money loans, private lenders, or real estate crowdfunding platforms. These alternatives may provide more flexible terms that align with your investment goals.

-

Evaluate Down Payment Requirements: Familiarize yourself with the down payment requirements associated with different financing options. This knowledge is crucial as it allows you to plan your budget and financial strategy accordingly.

-

Consult with a Financial Advisor: If you find the financing landscape complex, don’t hesitate to seek guidance from a financial advisor or mortgage broker. Their expertise can help you navigate the myriad of options available and ensure you make the best investment decision.

Implement Effective Property Management Strategies

-

Thoroughly Screen Renters: A rigorous screening process for occupants is essential to ensure reliable and responsible individuals. This process includes checking credit scores, rental history, and references. Successful case studies demonstrate that thorough screening can significantly reduce late rent payments, a challenge cited by 41% of property managers.

-

Establish Clear Lease Agreements: Drafting comprehensive lease agreements is crucial. These documents must clearly outline terms, responsibilities, and expectations for both parties. Statistics reveal that 61% of renters prefer to sign annual lease agreements for stability, underscoring the importance of clear agreements in preventing misunderstandings and disputes, which fosters a more stable rental environment.

-

Maintain Open Communication: Building strong relationships with residents through open dialogue is vital. Being responsive to their needs and concerns can prevent issues from escalating, thereby improving resident retention. Frequent check-ins also assist managers in staying updated on resident satisfaction and potential maintenance requirements.

-

Implement Regular Maintenance: Scheduling routine upkeep is key to maintaining assets in good condition. Addressing repairs promptly not only sustains resident satisfaction but also protects real estate value. Data indicates that buildings with consistent upkeep experience reduced turnover rates, as residents value well-maintained living environments.

-

Utilize Management Software: Employing management software can simplify operations, monitor expenses, and effectively handle tenant communications. With 67% of property management companies utilizing such tools, the integration of technology is becoming essential for operational success in the evolving real estate landscape.

Conclusion

Investing $25,000 in real estate represents a transformative decision, paving the way for significant financial growth and stability. By concentrating on clearly defined investment goals and possessing a thorough understanding of market conditions, investors can adeptly navigate the complexities of real estate to achieve substantial returns. This structured approach not only amplifies the potential for success but also cultivates confidence throughout the investment journey.

The article outlines essential steps, emphasizing the importance of:

- Setting clear objectives

- Assessing risk tolerance

- Conducting comprehensive market research

Furthermore, insights into financing options and effective property management strategies equip investors with the necessary tools for informed decision-making. Each of these components is vital in constructing a solid foundation for successful real estate investments.

Ultimately, the journey of investing in real estate transcends mere financial gains; it encompasses making strategic choices that align with personal goals and market dynamics. Aspiring investors are urged to take the initial step by defining their investment objectives and actively engaging with the market. Armed with the right knowledge and tools, the path to successful real estate investment is attainable, promising both financial reward and personal fulfillment.