Overview

This article presents four key strategies for achieving long-term success in real estate investing:

- Buy and hold

- Fix and flip

- Invest in Real Estate Investment Trusts (REITs)

- Explore short-term rentals

Each strategy is underpinned by compelling evidence of its effectiveness, including the historical appreciation of property values, potential tax benefits, and the growing profitability of short-term rental markets. These insights underscore the necessity for informed decision-making and adaptability within an ever-evolving economic landscape. By understanding and implementing these strategies, investors can position themselves for sustained success in the competitive real estate sector.

Introduction

The real estate market offers a myriad of opportunities for those prepared to navigate its complexities. Long-term investing can lead to substantial financial rewards; however, success relies on strategic planning and informed decision-making. As investors aim to expand their portfolios, they often confront a pivotal question: which strategies will yield the most favorable outcomes in an ever-evolving landscape? This article explores essential approaches for achieving long-term success in real estate investing, equipping readers with the insights necessary to excel in 2025 and beyond.

Identify Effective Investment Strategies

To achieve long-term success in real estate investing, identifying effective strategies is crucial. Here are some key approaches:

-

Buy and Hold: This strategy entails acquiring real estate and keeping it for a long duration, facilitating appreciation and rental revenue. It is especially effective in stable markets where real estate values are expected to increase. In fact, residential and diversified real estate investments have averaged returns of 10.3%, making this strategy a solid choice for wealth accumulation. Additionally, the average home value in the US has increased by over 65% in the last five years, underscoring the potential benefits of this approach. Investors can also take advantage of tax benefits such as depreciation and potential capital gains tax deferral, further enhancing the financial advantages of maintaining real estate long-term.

-

Fix and Flip: Investors obtain real estate requiring renovation, improve it, and sell for a profit. This strategy demands a keen eye for potential and a thorough understanding of renovation costs. Successful fix-and-flip investments can yield significant returns, but they require careful planning and execution. Frequent mistakes involve underestimating renovation expenses and overestimating the asset's after-repair value.

-

Real Estate Investment Trusts (REITs): For individuals choosing not to oversee real estate directly, REITs offer a chance to invest in real estate portfolios that produce income through dividends. They offer liquidity and diversification, making them an attractive option for many investors. However, it's crucial to comprehend the particular allocations within these trusts, especially those influenced by market changes, such as retail locations. Investors should also be aware of the fees and conflicts of interest associated with private placement REITs.

-

Short-Term Rentals: The rise of platforms like Airbnb has made investing in assets for short-term rentals increasingly profitable, particularly in tourist-heavy regions. This strategy can yield high returns, but it also requires effective management to handle frequent tenant turnover. Investors should be cautious of local regulations that may impact short-term rental operations.

-

Diversification: Distributing investments among different asset types and locations can reduce risks and improve overall portfolio performance. Think about putting funds into residential, commercial, and industrial properties to establish a well-rounded portfolio that can endure economic shifts. By diversifying, investors can better position themselves against economic downturns.

By implementing these strategies, investors can navigate the intricacies of the property sector and prepare themselves for sustained success. Additionally, insights from case studies, such as "Understanding the Buy-and-Hold Real Estate Strategy," can provide practical examples of how these strategies have been successfully implemented by investors.

Analyze Market Trends and Dynamics

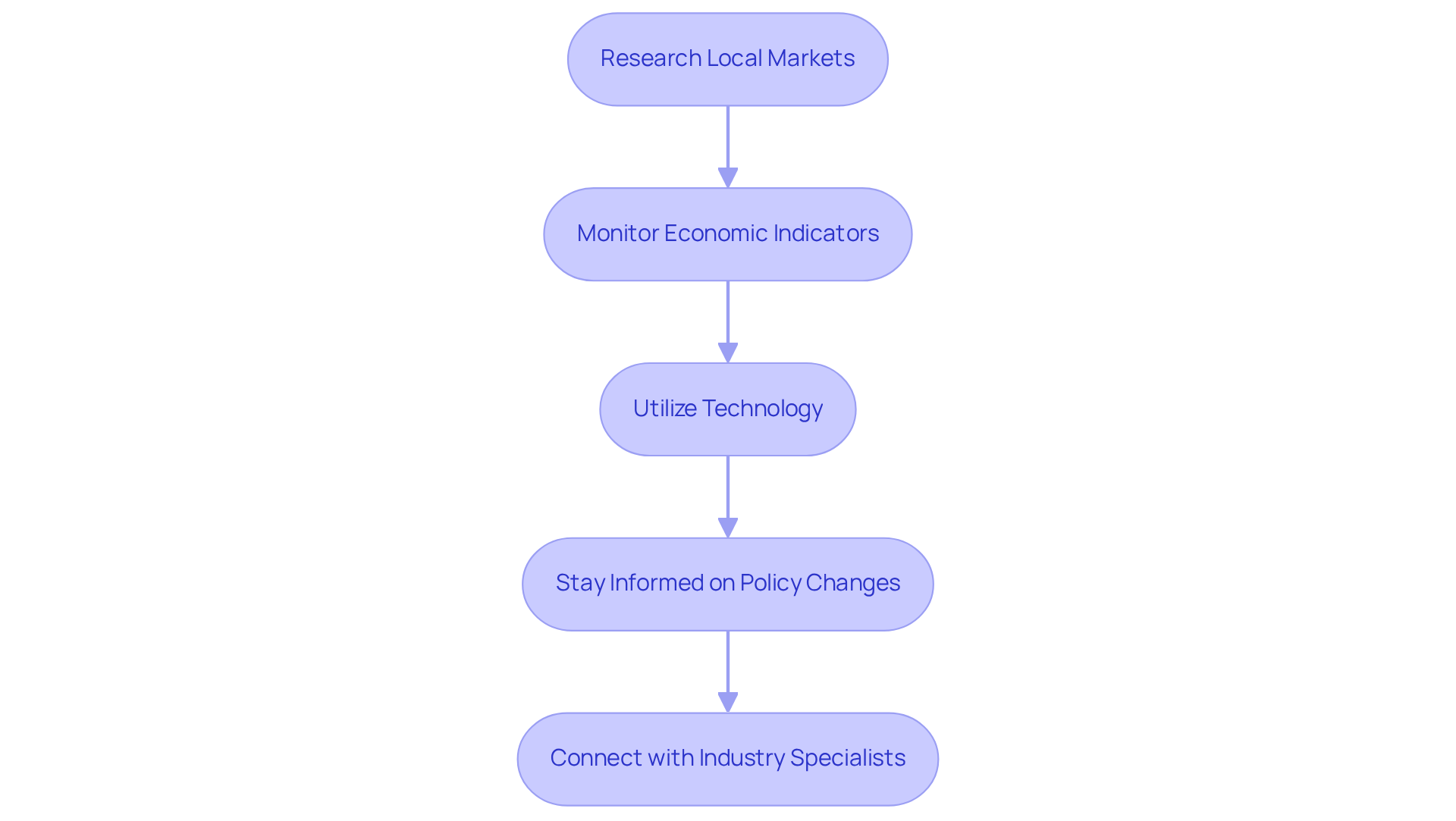

To effectively navigate the real estate sector, investors must conduct thorough analyses of trends and dynamics. Here are key strategies to consider:

- Research Local Markets: Concentrate on specific neighborhoods or regions to grasp local supply and demand dynamics. Key indicators consist of population growth, which directly affects housing demand, employment stability, and housing inventory levels. For instance, areas experiencing significant population increases often see a corresponding rise in housing demand, making them prime targets for investment.

- Monitor Economic Indicators: Broader economic factors such as interest rates, inflation, and employment rates play a crucial role in influencing real estate sectors. As of April 2025, existing-home sales decreased by 0.5% month-over-month and retreated by 2.0% year-over-year, reflecting the impact of fluctuating economic conditions on buyer behavior. Staying informed about these indicators can assist investors in predicting changes in the economy.

- Utilize Technology: Employ data analytics tools and platforms to gather insights on industry trends. Resources such as Zillow, Redfin, and local MLS databases provide valuable information on property values and activity, allowing investors to make informed choices based on current trends.

- Stay Informed on Policy Changes: Modifications in zoning laws, tax incentives, and housing regulations can significantly influence economic dynamics. Consistently examining local government updates and property news is crucial for remaining aware of possible effects on financial opportunities.

- Connect with Industry Specialists: Building relationships with property professionals, attending workshops, and joining discussions can offer further understanding of trends and financial strategies. Engaging with experts helps investors stay ahead of emerging trends and refine their investment approaches.

By concentrating on these tactics, investors can improve their comprehension of local markets and make more knowledgeable choices, ultimately resulting in long-term success in property investing.

Implement Financial Management and Risk Assessment Practices

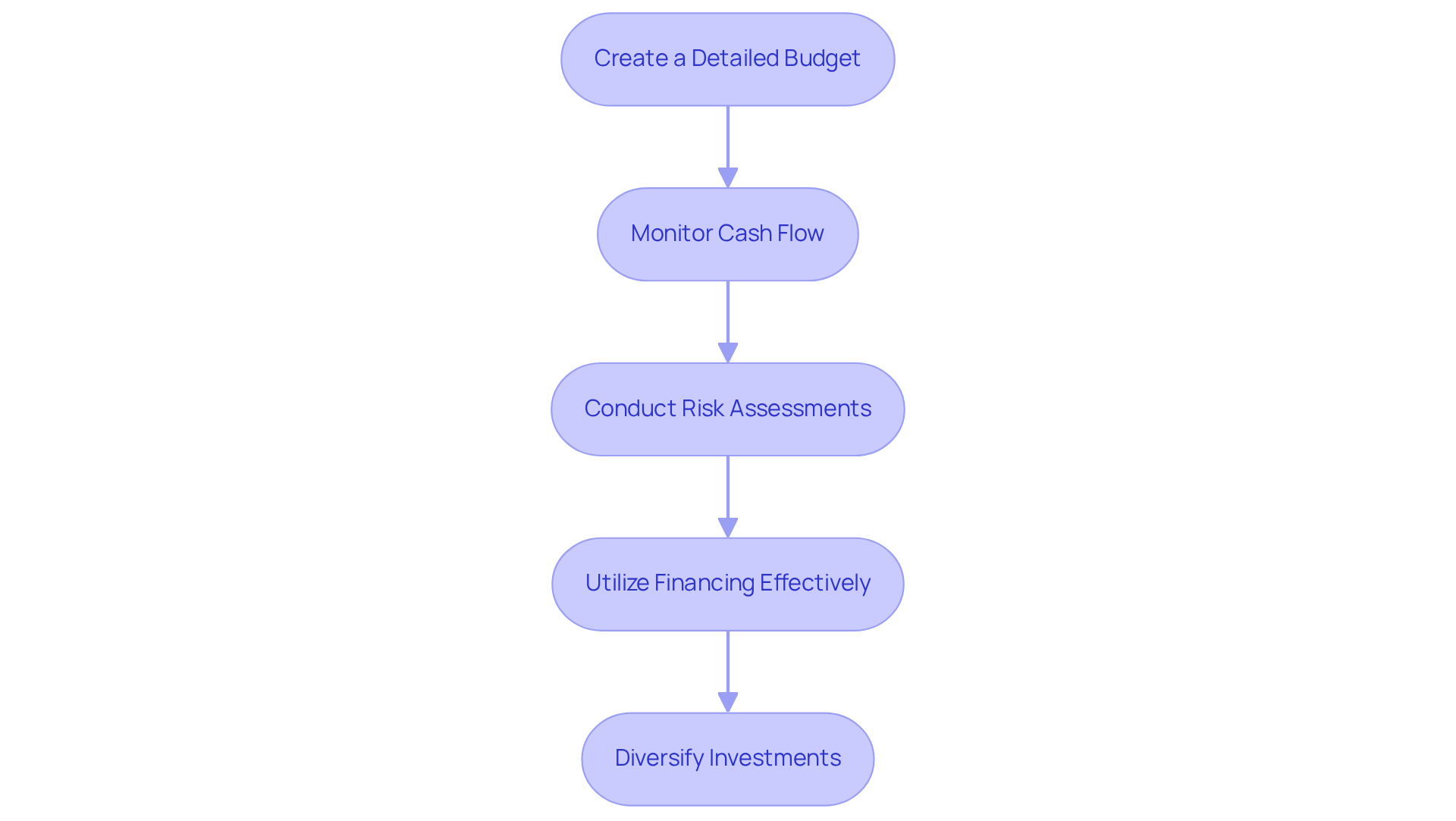

Implementing robust financial management and risk assessment practices is essential for long term real estate investing success. To achieve this, consider the following best practices:

-

Create a Detailed Budget: Outline all potential expenses, including mortgage payments, real estate taxes, maintenance costs, and insurance. A well-structured budget not only aids in tracking cash flow but also ensures profitability.

-

Monitor Cash Flow: Regularly review income and expenses to maintain a positive cash flow. Utilizing accounting software can help track financial performance and identify areas for improvement.

-

Conduct Risk Assessments: Evaluate potential risks associated with each asset, such as market volatility, real estate damage, and tenant issues. Developing contingency plans is crucial for mitigating these risks.

-

Utilize Financing Effectively: Understand various financing alternatives and select the one that aligns with your funding approach. Consider factors such as interest rates, loan terms, and their impact on cash flow.

-

Diversify Investments: Spread your investments across different property types and locations to reduce risk exposure. A varied portfolio is better equipped to endure economic fluctuations than a concentrated one.

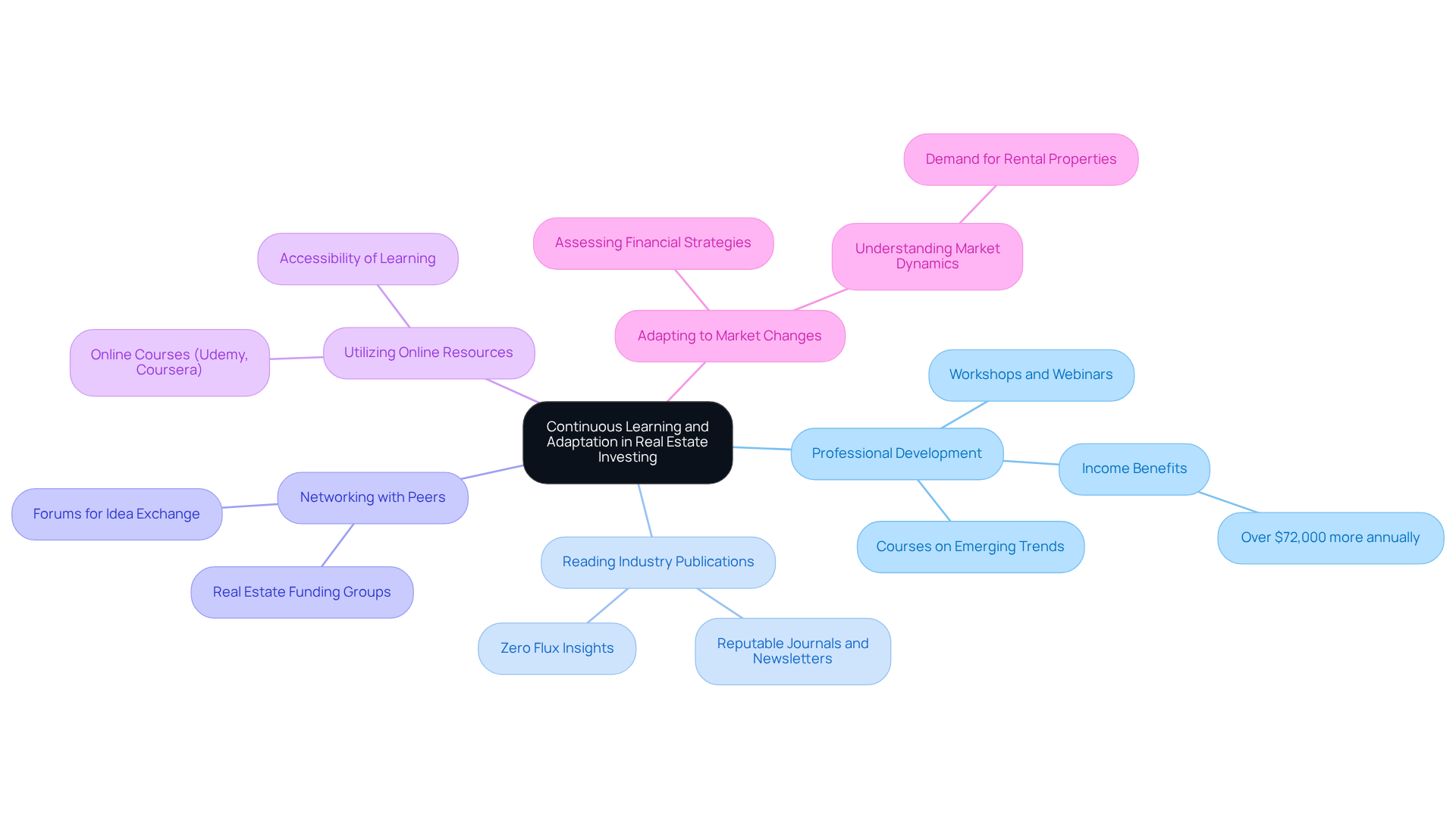

Commit to Continuous Learning and Adaptation

To thrive in the dynamic property market, investors must embrace a mindset of continuous learning and adaptation in long term real estate investing. Here are strategies to cultivate this essential approach:

-

Engage in Professional Development: Attend workshops, webinars, and conferences to enhance your knowledge and skills. Seek classes that focus on emerging trends and technologies in property. Research from the 2022 - 2023 Real Property Agent Income Guide reveals that realty professionals who invest in ongoing education earn over $72,000 more annually than those who do not. This underscores the financial benefits of professional growth, particularly during the COVID-19 pandemic.

-

Read Industry Publications: Subscribing to reputable property journals, newsletters, and blogs is vital for staying informed about sector developments and financial strategies. Publications like Zero Flux provide valuable insights into current economic trends, aiding investors in navigating complexities and making informed choices. Additionally, exploring other reputable sources ensures a well-rounded perspective.

-

Network with Peers: Joining real estate funding groups or forums facilitates the exchange of ideas and experiences with fellow investors. Networking can offer fresh viewpoints and critical insights, which are crucial for adapting to industry shifts. Engaging with like-minded individuals enhances your understanding of market dynamics and financial opportunities.

-

Utilize Online Resources: Leverage online courses and resources that cover various aspects of real estate investing. Platforms such as Udemy and Coursera offer courses tailored to different skill levels, making it easier to find relevant educational content. The accessibility of these resources democratizes learning, allowing more individuals to enhance their financial acumen.

-

Adapt to Market Changes: Regularly assess your financial strategies and remain open to pivoting when necessary. The ability to adjust to evolving economic conditions is vital for success in long term real estate investing. For instance, the increasing demand for rental properties, driven by changing demographics and urbanization, signals a shift in focus that astute investors should consider. As noted by Lawrence Yun, Chief Economist at NAR, understanding market dynamics is crucial for making informed investment decisions.

Conclusion

Successful long-term real estate investing hinges on the implementation of effective strategies that cater to market dynamics and individual investor goals. Understanding various approaches—such as buy and hold, fix and flip, REITs, and short-term rentals—positions investors to capitalize on opportunities while mitigating risks.

Key insights discussed include:

- The importance of thorough market analysis

- Effective financial management

- A commitment to continuous learning

Investors must stay informed about local market trends, economic indicators, and policy changes to make informed decisions. Furthermore, adopting robust financial practices and diversifying investments significantly enhances portfolio resilience against economic fluctuations.

Ultimately, the journey toward long-term success in real estate investing requires adaptability and a proactive approach. By embracing ongoing education and networking within the industry, investors can refine their strategies and remain competitive in a constantly evolving market. Engaging with the latest resources and insights empowers investors to navigate challenges and seize opportunities, reinforcing the significance of a well-rounded investment strategy in achieving lasting success.