Overview

This article delineates five essential steps for mastering real estate investing in Canada:

- Understanding the basics

- Preparing for the first investment

- Identifying and evaluating properties

- Securing financing

- Effectively managing investments

Each step is bolstered by practical advice, market insights, and strategies specifically tailored to the Canadian real estate landscape. The emphasis on thorough research and strategic planning underscores their critical role in achieving success within this competitive field.

Introduction

In the dynamic realm of real estate investing, grasping the foundational principles is pivotal—it's the fine line between success and failure. With a multitude of property types, investment strategies, and market dynamics at play, aspiring investors must adeptly navigate a complex landscape brimming with opportunities and risks. As the industry undergoes transformation, particularly through technological integration and an increasing focus on sustainability, staying informed is not just beneficial; it's essential. This comprehensive guide will arm investors with vital knowledge, ranging from:

- Assessing their financial readiness

- Effectively managing their properties

Ensuring they are thoroughly equipped to embark on their real estate journey.

Understand the Basics of Real Estate Investing

Real estate investing in Canada entails the acquisition of assets aimed at generating income or profit. A solid grasp of foundational concepts is essential for achieving success in this field.

Types of Investments: It is imperative to understand the distinctions between residential, commercial, and industrial properties. Each category in real estate investing in Canada presents unique opportunities and risks that will shape your investment strategy.

Investment Strategies: Delve into various approaches such as buy-and-hold, flipping, and generating rental income. Each strategy necessitates different levels of involvement and market knowledge, making it crucial to select one that aligns with your objectives.

Market Dynamics: Comprehend how elements like supply and demand, interest rates, and economic indicators influence property values. For instance, Deloitte's recent survey of over 880 executives underscored the importance of understanding these dynamics for effectively navigating market complexities. Jeff Smith noted, "our 2025 survey demonstrated that the level of AI adoption in commercial property is still in its infancy," highlighting the ongoing technological evolution within the sector.

As the impacts of climate change intensify, the necessity for sustainability in real estate is becoming increasingly critical. A recent case study indicated that 76% of global survey respondents plan to undertake deep energy retrofits in the next 12 to 18 months, reflecting a strong commitment to enhancing energy efficiency in properties.

To establish a robust foundation, consider engaging with introductory materials or online courses that address these essential topics. As the landscape evolves, particularly in 2025, remaining informed about trends in real estate investing in Canada, whether residential or commercial, will be pivotal for making sound decisions. Remember, as John D. Rockefeller famously stated, "The major fortunes in America have been made in land," emphasizing the importance of property investing. Resources like Zero Flux serve as invaluable tools for anyone involved in the real estate industry, offering critical insights to navigate this dynamic market.

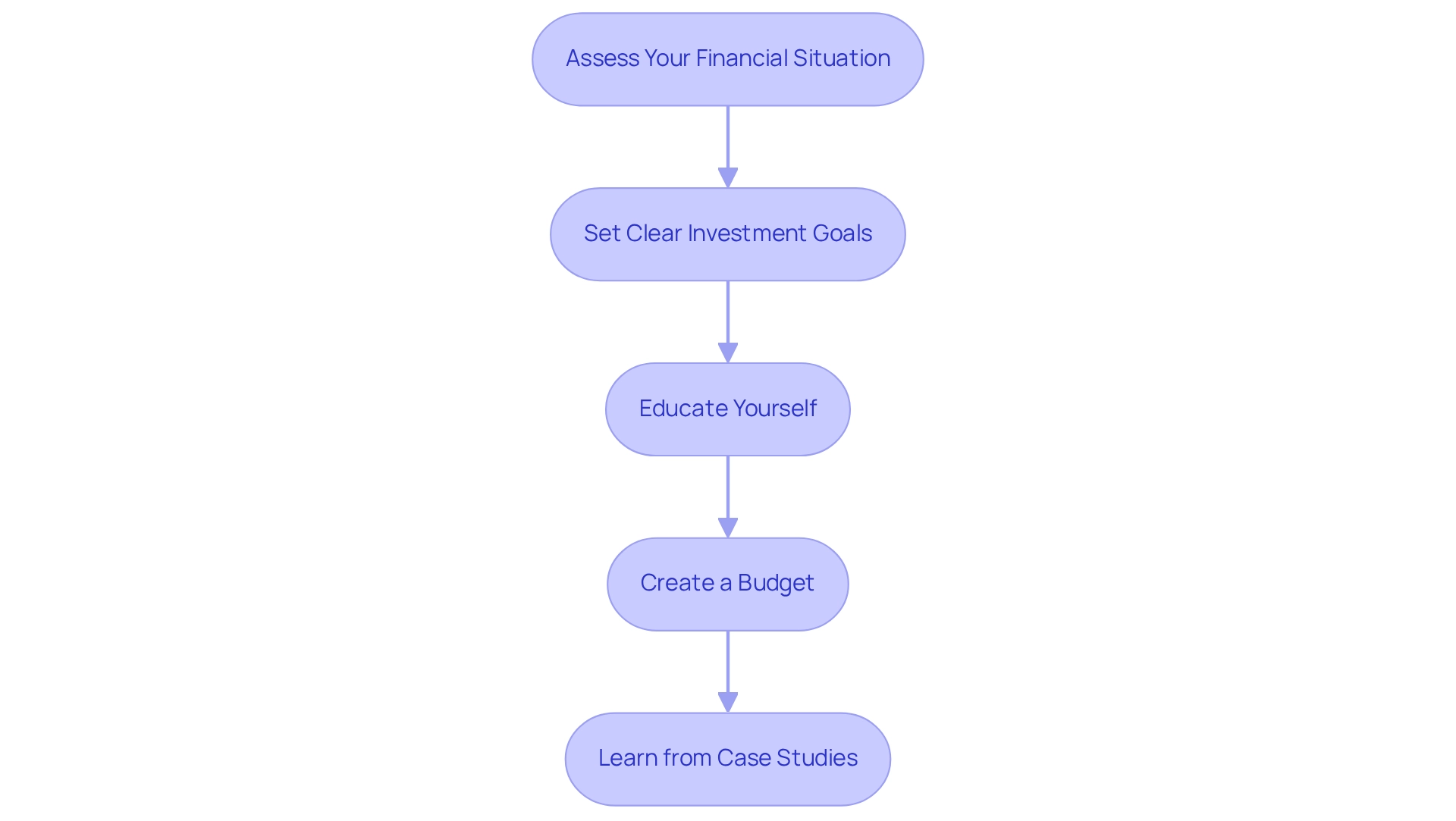

Prepare for Your First Investment

Before embarking on your first investment, it is crucial to follow these foundational steps:

- Assess Your Financial Situation: Begin by reviewing your savings, credit score, and debt-to-income ratio. This evaluation will help you understand your financial capacity and determine how much you can afford to invest.

- Set Clear Investment Goals: Clearly define your objectives—whether you aim for cash flow, property appreciation, or a blend of both. Setting particular objectives will direct your financial strategy and assist you in assessing success. As noted by industry experts, "A well-researched location can give you a competitive edge, as it helps ensure steady tenants, optimal rents, and long-term asset appreciation."

- Educate Yourself: Equip yourself with knowledge by reading relevant literature, attending workshops, or consulting seasoned investors. Understanding market dynamics is essential, especially in a landscape where Canadian investors are increasingly focused on real estate investing in Canada and strategic opportunities in 2025.

- Create a Budget: Develop a comprehensive budget that outlines your expected expenses, including down payments, closing costs, and ongoing maintenance. This financial plan will assist you in navigating the intricacies of property investing.

- Learn from case studies of first-time investors in Canada to gain insights into successful strategies and common pitfalls in real estate investing in Canada. For example, comprehending the dynamics of the Asia-Pacific region's luxury real estate market, which possesses a 19.5% share of global projects, can guide your financial choices and improve your overall strategy. This highlights the opportunity for profitable ventures despite differing local circumstances.

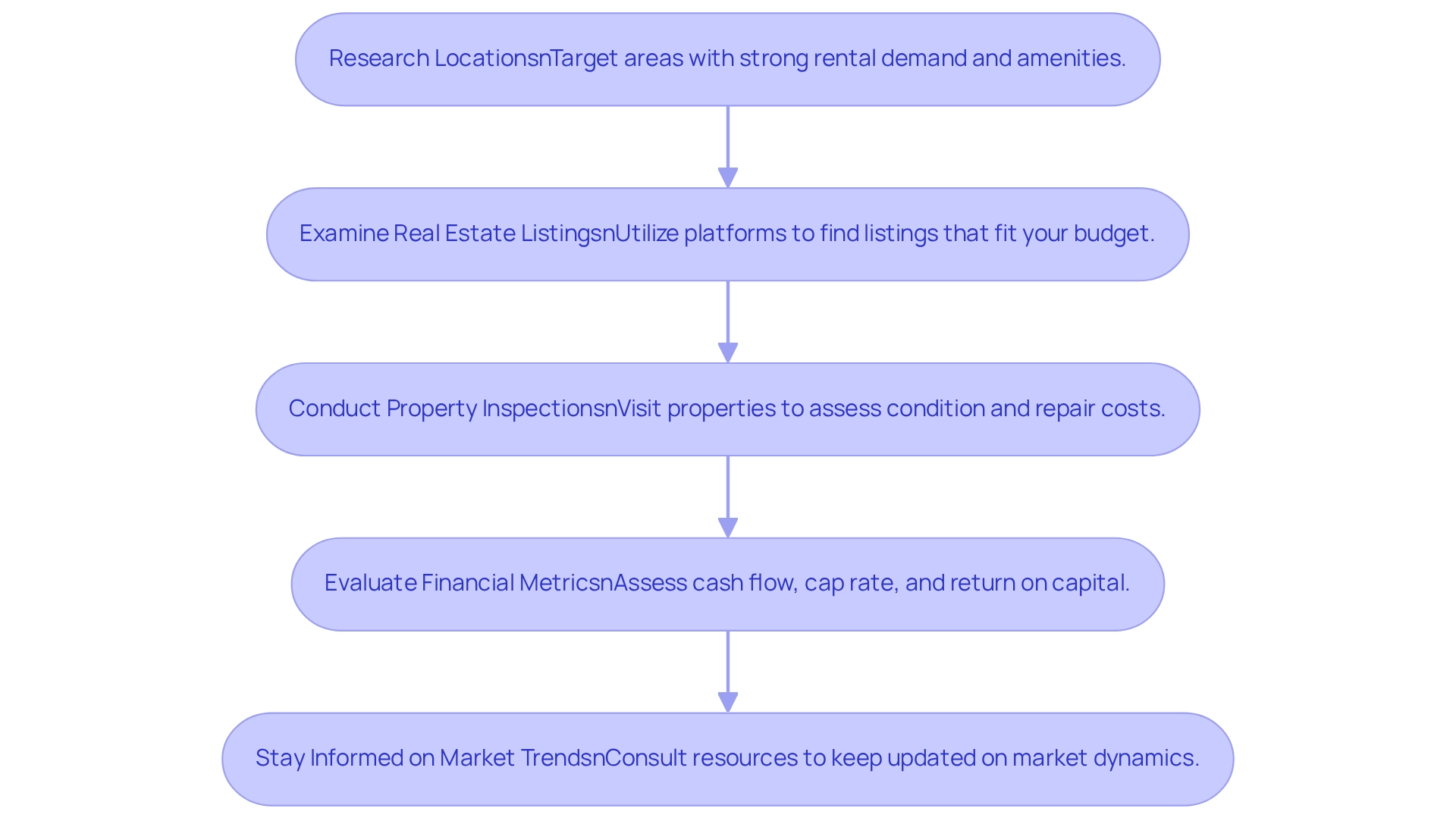

Identify and Evaluate Investment Properties

To successfully recognize and assess possible assets, consider the following steps:

- Research Locations: Target areas characterized by robust rental demand, reputable schools, and amenities that appeal to tenants. For instance, cities like Richmond Hill have demonstrated significant shifts, including a 7.6% annual rent decrease. This statistic underscores the importance of thorough location assessment, as declining rents may indicate potential challenges in attracting tenants and overall feasibility.

- Examine Real Estate Listings: Utilize online platforms to discover listings that align with your budget and financial goals. Focus on listings in areas experiencing population growth and strong rental demand, as these factors can enhance funding viability. Resources like Zero Flux can provide valuable insights into these trends, empowering you to make informed decisions.

- Conduct Property Inspections: Personally visit properties to evaluate their condition and estimate potential repair costs. This practical approach is essential for understanding the true worth of your financial commitment and ensuring that you are aware of any necessary renovations that could impact your budget.

- Evaluate Financial Metrics: Assess key financial indicators such as cash flow, cap rate, and return on capital (ROC) to gauge profitability. Understanding these metrics is crucial for making informed investment decisions in real estate investing in Canada. For instance, cash flow indicates the income generated by the property after expenses, while cap rate helps you comprehend the potential return relative to the property's value.

- Stay Informed on Market Trends: Regularly consult resources like Zero Flux to remain updated on market dynamics and emerging opportunities. The newsletter's commitment to data integrity ensures that you receive reliable insights, aiding you in navigating the complexities of the property market effectively. Additionally, understanding demographic trends, such as those highlighted in the case study concerning areas with economic growth and youthful populations, can further inform your financial strategy for real estate investing in Canada in 2025.

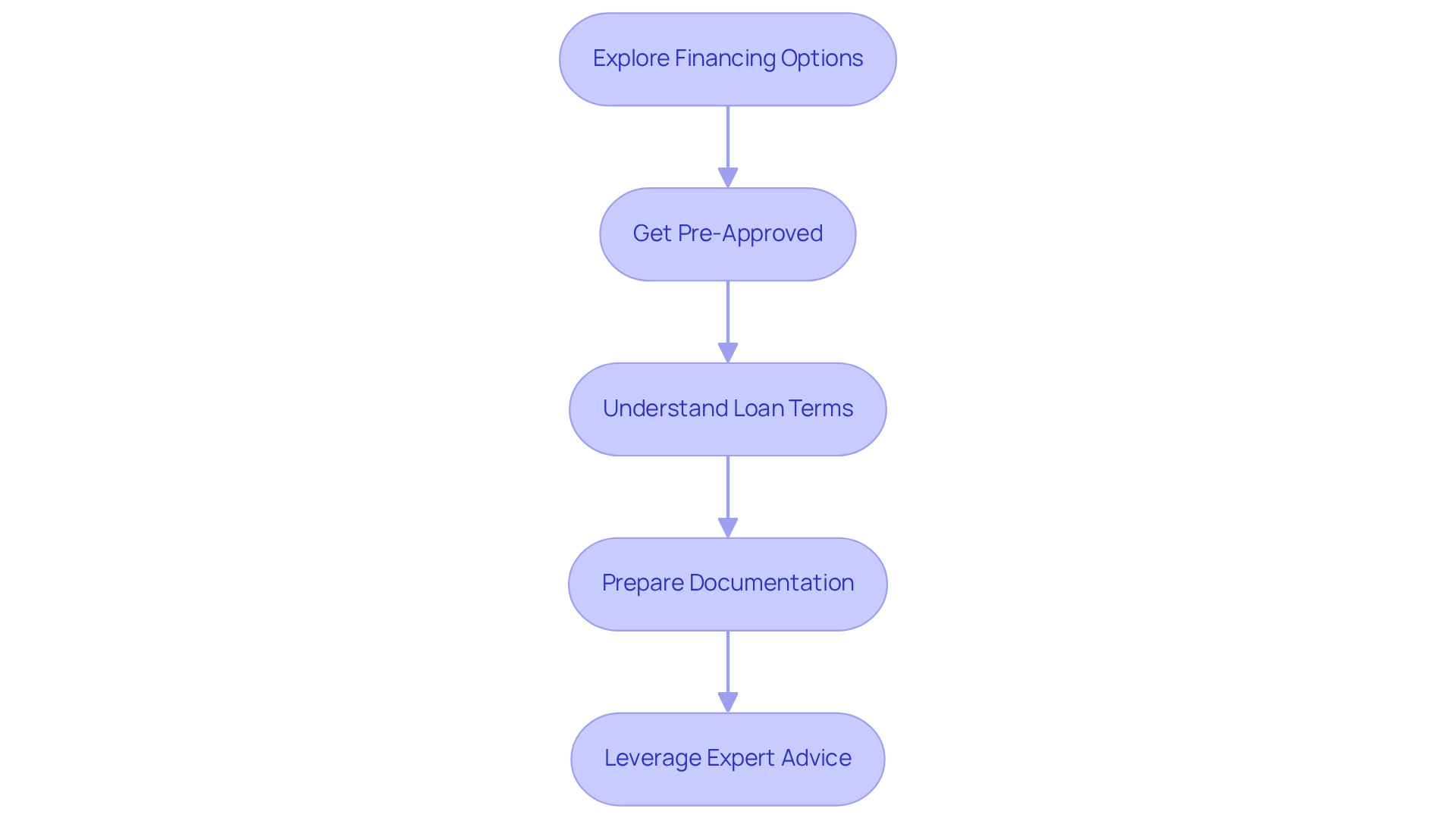

Secure Financing for Your Investment

Securing financing for real estate investments involves several essential steps:

- Explore Financing Options: Investigate various avenues such as traditional mortgages, private lenders, and alternative methods like seller financing. Understanding the landscape of financing options is crucial for making informed decisions about real estate investing in Canada.

- Get Pre-Approved: Seek pre-approval from lenders to establish a clear budget. This step not only streamlines the purchasing process but also positions you as a serious buyer in a competitive market. With over 30,000 subscribers, Zero Flux emphasizes the importance of staying informed to navigate this competitive landscape effectively.

- Understand Loan Terms: Familiarize yourself with the intricacies of loan terms, including current mortgage rates in Canada, which are projected to fluctuate in 2025. Pay attention to interest rates, repayment schedules, and any associated fees to avoid surprises later.

- Prepare Documentation: Compile necessary documents such as income statements, tax returns, and credit reports. A well-organized application can significantly expedite the approval process, making it easier to secure the financing you need.

- Leverage Expert Advice: Consult with financial advisors or property professionals who can provide insights into the best financing strategies tailored to your investment objectives. As Kathy Fettke pointed out, putting money into property is wise because land is physical and there will always be a demand for housing. Their expertise can help you navigate the complexities of the market and optimize your financing options.

By following these steps, investors can improve their odds of obtaining advantageous funding, ultimately resulting in more successful property ventures. As John Stuart Mill famously stated, "Landlords grow rich in their sleep without working, risking or economizing," underscoring the long-term benefits of securing financing effectively. Moreover, the appropriate strategy and mindset, as emphasized in the case study on real estate investing in Canada, are vital for assessing risks and reaching financial goals.

Manage Your Investment Effectively

To manage your investment effectively, consider the following strategies:

- Establish a Management Plan: Decide whether you will manage the site yourself or hire a management firm. A well-organized strategy is crucial for navigating the intricacies of real estate investing in Canada.

- Screen Tenants Carefully: Implement a comprehensive tenant screening process, which typically takes about 3-5 days in Canada. This process should include background checks, credit history evaluations, and rental history verification to ensure you select reliable and responsible renters. As noted by industry specialists, prioritizing tenant screening can significantly reduce turnover and enhance asset value. Understanding platform guidelines for advertising is also crucial to avoid potential issues, as highlighted by editor Dave Spooner.

- Maintain the Property: Regular inspections and maintenance are essential to prevent costly repairs and ensure tenant satisfaction. Organizations that implement adaptable maintenance strategies, as outlined in the case study 'Management Trends: Emphasis on Flexibility and Adaptability,' are better equipped to address tenant requirements and market shifts, thereby gaining a competitive advantage in the dynamic landscape of real estate investing in Canada.

- Monitor Financial Performance: Keep a close eye on income and expenses, adjusting your strategy as necessary to optimize returns. Utilizing data-driven insights, such as those from AirDNA, which covers data from 120,000 global markets, can help identify trends and opportunities for improvement, ensuring your investment remains profitable.

- Adapt to Market Trends: Stay informed about property management trends, such as the increasing emphasis on resident experience, which experts agree is vital for enhancing property management services. By adapting to these trends, you can drive value and maintain a competitive advantage in the market.

Conclusion

Navigating the world of real estate investing requires a firm grasp of its foundational principles. Understanding the types of investments available—from residential to commercial properties—along with various strategies like buy-and-hold or flipping, is essential for any aspiring investor. By recognizing market dynamics and the importance of sustainability, investors can position themselves for success in an evolving landscape.

Before making the first investment, a thorough assessment of financial readiness is crucial. Setting clear investment goals, educating oneself, and creating a detailed budget lay the groundwork for a successful venture. Identifying and evaluating potential properties through careful research and financial analysis further enhances decision-making. Securing financing by exploring various options and understanding loan terms can facilitate the acquisition of desirable properties.

Once an investment is secured, effective management becomes paramount. Establishing a solid management plan, thoroughly screening tenants, and maintaining the property are vital steps in maximizing returns. Monitoring financial performance and adapting to market trends not only ensures profitability but also fortifies the investment against potential risks.

Ultimately, real estate investing offers a pathway to wealth-building, yet it requires diligence, education, and a proactive approach. By staying informed and making strategic decisions, investors can navigate this complex landscape and unlock the numerous opportunities it presents.