Overview

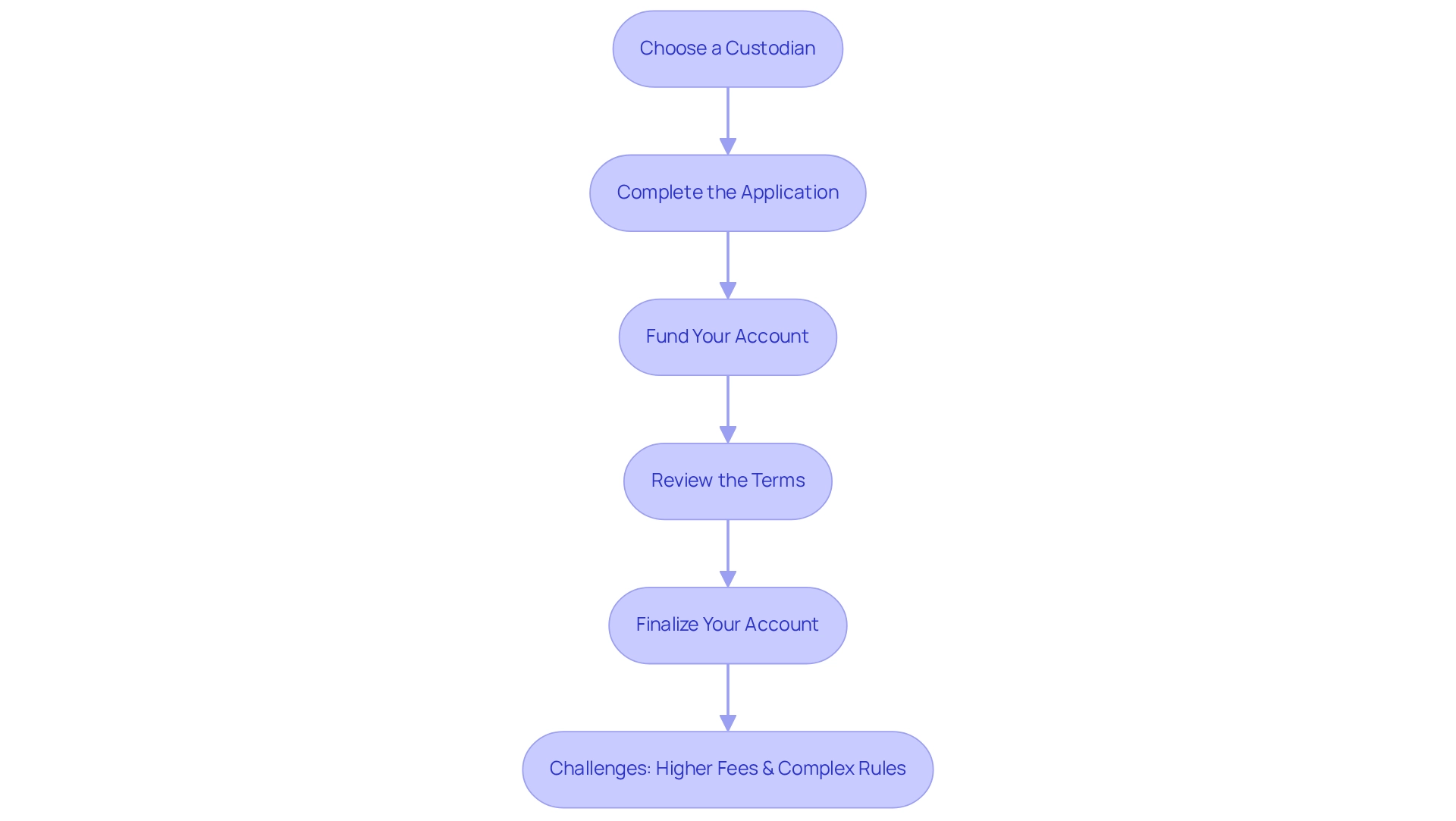

To effectively harness a self-directed Roth IRA for real estate investments, investors must adhere to five essential steps:

- Select a custodian

- Complete the application

- Fund the account

- Review the terms

- Finalize the account

Understanding IRS regulations and maintaining compliance are paramount for successful investments. These steps not only ensure the IRA is properly established but also strategically managed to maximize tax benefits while avoiding prohibited transactions.

Introduction

In the evolving landscape of retirement planning, self-directed Roth IRAs have emerged as a powerful tool for savvy investors seeking to diversify their portfolios beyond traditional assets. These specialized accounts allow investments in alternative opportunities like real estate, offering a unique blend of flexibility and tax advantages. By making contributions with after-tax dollars, investors can enjoy tax-free withdrawals during retirement, making this an appealing option for those looking to capitalize on real estate ventures.

As more individuals recognize the potential of self-directed Roth IRAs, understanding how to effectively open, fund, and navigate the rules surrounding these accounts becomes essential for maximizing investment success. This article delves into the intricacies of self-directed Roth IRAs, providing a comprehensive guide for investors eager to harness their retirement savings for lucrative real estate opportunities.

Understand Self-Directed Roth IRAs

A managed retirement account stands out as a specialized investment vehicle that empowers investors to broaden their portfolios by incorporating a wider array of assets, including property, beyond the limitations of conventional IRAs. Unlike standard IRAs, which typically restrict investments to stocks, bonds, and mutual funds, a self-directed Roth IRA real estate account provides the flexibility to invest in alternative assets, such as properties and commercial ventures.

One of the significant advantages of a retirement account is that contributions are made with after-tax dollars, enabling tax-free withdrawals during retirement. This feature proves particularly beneficial for real estate investments, as any profits generated within the account are exempt from taxation upon withdrawal, provided specific conditions are met. In 2025, it is projected that approximately 30% of investors will utilize individual Roth IRAs for alternative assets, reflecting a growing trend towards more diversified investment strategies.

Recent developments highlight that 401(k) funds can be seamlessly transitioned into a managed IRA through a rollover, ensuring that the funds remain within a similar tax environment. This flexibility is crucial for investors aiming to maximize their retirement savings while capitalizing on estate opportunities.

Financial advisors stress the importance of maintaining a balanced portfolio. As industry expert Eva Roethler notes, "Maintaining the right mix of traditional and alternative assets can help you capture attractive total returns without taking on undue risk." This perspective underscores the strategic advantage of integrating self-directed Roth IRA real estate into property investment strategies.

Successful case studies illustrate the effectiveness of self-directed Roth IRA real estate in property investment. Investors have reported significant gains by leveraging these accounts to acquire rental and commercial properties, showcasing the potential for substantial returns. By understanding the fundamentals of autonomous IRAs, investors can effectively utilize their retirement funds to explore profitable property opportunities.

Open Your Self-Directed Roth IRA

To open a self-directed Roth IRA, follow these essential steps:

- Choose a Custodian: Select a financial institution that specializes in individual retirement accounts. Consider options like IRA Financial, Equity Trust, or The Entrust Group, ensuring they provide access to self-directed Roth IRA real estate investment opportunities.

- Complete the Application: Fill out the required application forms from your chosen custodian, providing necessary personal identification and financial information to facilitate the process.

- Fund Your Account: Fund your individual retirement account through contributions, rollovers from other retirement accounts, or transfers from existing IRAs, while adhering to the IRS annual contribution limits.

- Review the Terms: Familiarize yourself with the fees and terms associated with your account, including any investment restrictions that may apply. As Lyle Daly observes, "A prohibition against self-dealing is in place to prevent fraudulent transfers that are often conducted to avoid taxes," emphasizing the importance of understanding the regulations linked to individual retirement accounts.

- Finalize Your Account: After your application is approved and your account is funded, you will receive confirmation from your custodian, enabling you to begin your investment journey. For any inquiries, consider scheduling a call or sending an email to your chosen custodian for assistance.

Furthermore, be mindful of the challenges associated with self-directed Roth IRA real estate, including increased fees and complex regulations. Evaluate these challenges against the potential benefits to determine if a personal IRA aligns with your retirement strategy.

Fund Your Self-Directed Roth IRA

Funding your self-directed Roth IRA can be achieved through several effective methods that enhance your investment opportunities.

- Direct Contributions: In 2025, you can contribute up to $7,000 annually, or $8,000 if you are 50 or older. It’s essential to make these contributions with after-tax dollars to comply with IRS regulations. As the Internal Revenue Service states, "If you don't catch your excess contributions by when you file taxes, you may have to pay a 6% penalty on those contributions each year until they are removed from the account."

- Transfer from Other IRAs: If you possess funds in a traditional IRA or another similar IRA, you can transfer them into your new personal IRA. This typically requires completing a rollover request form with your custodian, ensuring a seamless transition of your retirement funds.

- Transfer from Employer Plans: Funds from a 401(k) or similar employer-sponsored plan can frequently be moved into your self-directed individual retirement account. Be sure to consult your plan administrator to understand eligibility and the necessary procedures, as this can significantly expand your investment options.

- Spousal IRA: A spousal IRA allows a nonworking spouse to contribute based on the working spouse's taxable compensation, providing an additional funding avenue for couples. This strategy not only enhances retirement savings but also fosters joint financial planning.

- Investment Income: Any income generated from investments within the individual retirement account can be reinvested, further enhancing your account's growth potential. This compounding effect can significantly increase your retirement savings over time.

- Automatic Contributions: Establishing automatic contributions can assist in synchronizing your savings with pay periods, facilitating consistent funding of your IRA. This method ensures that you are regularly investing in your future without the need for manual intervention.

- Document Everything: Maintaining detailed records of all transactions and contributions is crucial for ensuring compliance with IRS regulations and avoiding penalties. For instance, addressing excess contributions timely can prevent the 6% annual fee from impacting your retirement funds.

By employing these funding strategies, property investors can effectively utilize self-directed Roth IRA real estate to enhance their investment opportunities and secure a more prosperous financial future.

Learn the Rules for Real Estate Investments

Investing in property through a self directed Roth IRA real estate requires strict compliance with IRS regulations to avoid costly mistakes. With over 30,000 subscribers, Zero Flux stands as a reliable source for real estate insights. Understanding these key rules is essential:

- Prohibited Transactions: It is strictly forbidden to purchase property for personal use or acquire property from disqualified individuals, such as family members or business partners.

- Title Requirements: The property must be titled in the name of the IRA, ensuring that the IRA is recognized as the legal owner of the asset.

- Income and Expenses: All income generated from the property must be deposited back into the IRA, while all related expenses—including maintenance, taxes, and management fees—must be paid from IRA funds. As Roger Wohlner notes, "Any gains from the sale of a property can be invested in additional real estate assets or into any other type of investment inside an IRA."

- No Self-Dealing: Personal benefits from the property while it is held in the IRA are prohibited. For instance, living in or renting the property to oneself is not allowed.

- Consult a Professional: Given the intricacies surrounding these regulations, it is advisable to seek guidance from a tax advisor or financial planner specializing in individual retirement accounts to ensure compliance with all relevant rules. For additional assistance, consider exploring resources from Entrust Group, which offers guides for investors managing their self directed Roth IRA real estate.

Staying informed about market trends and IRS regulations is crucial for successful estate investments. Engaging with resources like Zero Flux empowers investors to make informed decisions and capitalize on emerging opportunities.

Identify and Purchase Real Estate

To effectively identify and purchase self directed roth ira real estate, follow these essential steps:

- Research the Market: Begin by analyzing potential markets and properties. Focus on areas exhibiting strong growth potential, favorable rental conditions, or undervalued properties that could yield significant returns.

- Network with Professionals: Establish relationships with estate agents, property managers, and other investors. Networking can uncover off-market deals that are not widely advertised, providing unique investment opportunities. In fact, effective networking can significantly enhance your chances of finding lucrative investments.

- Conduct Due Diligence: After pinpointing a property, perform comprehensive due diligence. This includes property inspections, title searches, and financial reviews to ensure the investment aligns with your financial goals and risk tolerance. Be aware of the guidelines concerning disqualified individuals when investing in property with an SDIRA, as personal use of the asset is forbidden. By adhering to these regulations, you can maintain the tax-advantaged status of your SDIRA and avoid potential penalties.

- Make an Offer: If the property aligns with your investment criteria, collaborate with your estate agent to formulate a competitive offer. It is crucial to structure the offer correctly, designating the IRA as the buyer to comply with regulations.

- Close the Deal: Once your offer is accepted, work with your custodian to facilitate the purchase. All funds must come from your individual retirement account, and the property title should be transferred to the account's name. Post-closing, manage the property in accordance with IRS regulations, ensuring that all income and expenses are processed through the self directed roth ira real estate. By following these steps, investors can navigate the complexities of self directed roth ira real estate for real estate investments while maximizing their potential for success. Remember, it takes just 10 minutes to open a self-directed IRA online, making it easier than ever to start your investment journey. As Elias Shaya, Compliance and Operations Associate, emphasizes, ensuring clarity and precision in your investment process is essential for success.

Conclusion

Self-directed Roth IRAs present a unique opportunity for investors looking to diversify their retirement portfolios by venturing into real estate and other alternative assets. This specialized account not only allows for a broader range of investment options but also offers the significant tax advantage of tax-free withdrawals during retirement. As the trend of utilizing self-directed Roth IRAs continues to gain momentum, understanding the processes of opening, funding, and adhering to IRS regulations becomes crucial for maximizing investment potential.

The steps to open and fund a self-directed Roth IRA are straightforward yet vital for ensuring compliance with IRS guidelines:

- Choosing the right custodian

- Understanding contribution limits

- Knowing the available funding methods

Moreover, being aware of the rules governing real estate investments within these accounts—such as prohibited transactions and the necessity for due diligence—is key to avoiding costly mistakes.

Ultimately, the ability to leverage self-directed Roth IRAs for real estate investments offers a compelling strategy for savvy investors. By following the outlined steps and maintaining a clear understanding of the regulations, individuals can effectively harness their retirement savings to explore lucrative opportunities in the real estate market. Embracing this approach not only fosters financial growth but also empowers investors to take control of their retirement planning in a dynamic and rewarding manner.