Overview

This article elucidates the critical role of capitalization rates (cap rates) in real estate investment, offering a comprehensive overview of their calculation and significance in assessing potential returns. Understanding cap rates is essential for investors, as they encapsulate the profitability and inherent risks associated with diverse real estate assets. Supported by case studies and expert insights, the discussion highlights the influence of market dynamics and economic factors on cap rates, ultimately guiding readers in making informed investment decisions.

Introduction

Navigating the complex world of real estate investment can indeed be daunting. Understanding key metrics such as capitalization rates, or cap rates, is essential. These figures are not mere numbers; they represent the potential return on investment and are critical for making informed decisions in a fluctuating market.

As we look ahead to 2025, with homes lingering on the market longer than ever and various economic factors at play, grasping the nuances of cap rates becomes paramount for investors seeking to optimize their portfolios.

This article delves into the intricacies of cap rates, exploring their variations across property types and the economic influences that shape them. It serves as a comprehensive guide for both seasoned investors and newcomers alike, equipping you with the knowledge to navigate your investment strategies effectively.

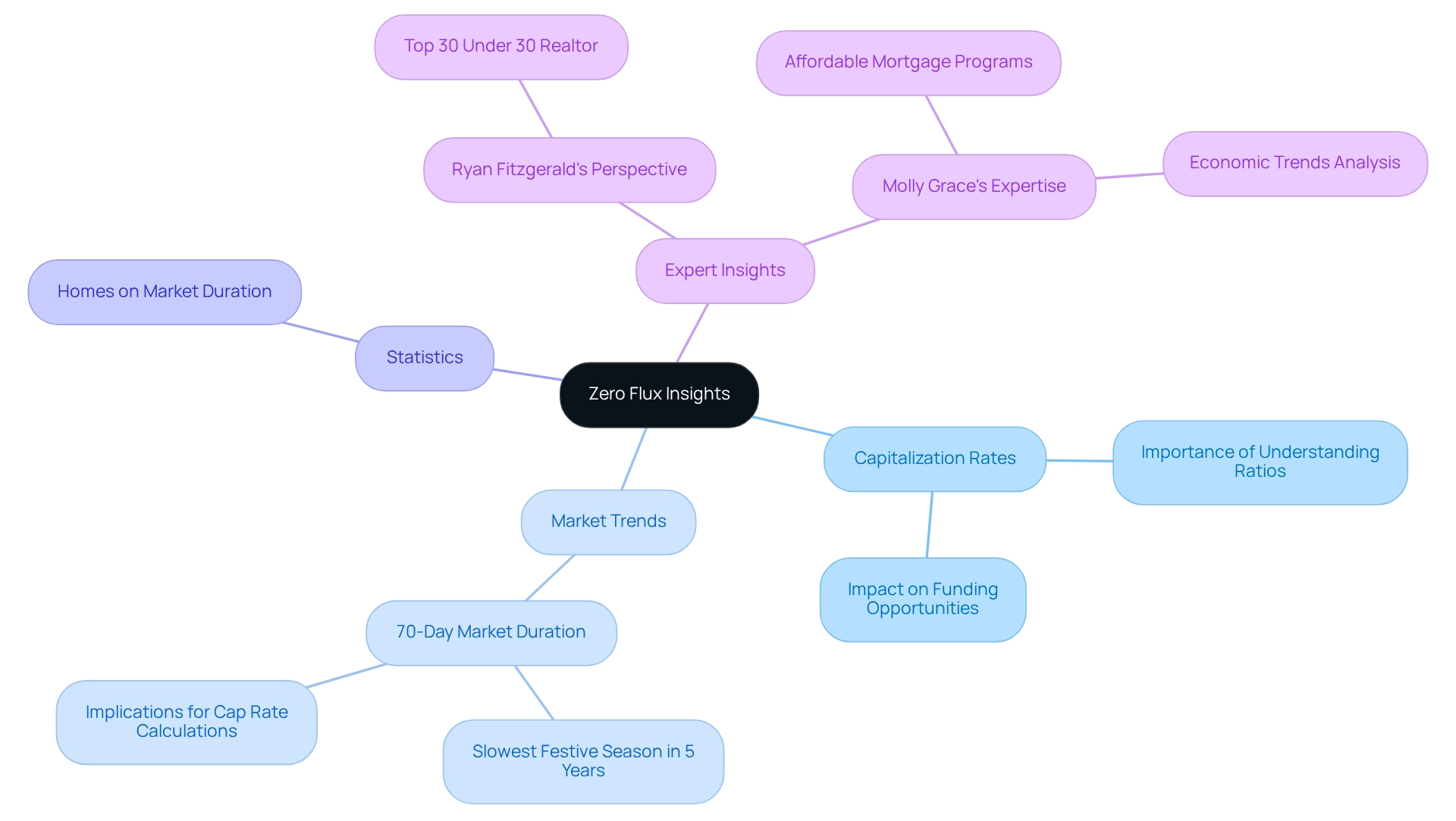

Zero Flux: Daily Insights on Cap Rates and Market Trends

Zero Flux offers daily insights specifically designed for real estate investors, focusing sharply on capitalization figures and overarching market trends. By meticulously aggregating data from over 100 diverse sources, including premium content behind paywalls, Zero Flux ensures that subscribers receive the most relevant and timely information available. This steadfast commitment to data integrity empowers investors to make informed decisions based on the latest market dynamics.

In 2025, understanding capitalization ratios is vital, as they play a crucial role in evaluating funding opportunities. Recent statistics reveal that homes are remaining on the market for approximately 70 days, marking December as the slowest festive season in five years. This trend can significantly impact 8 cap rate calculations. As the real estate landscape evolves, Zero Flux continues to be an indispensable resource for investors seeking clarity and precision in their strategies.

As Ryan Fitzgerald, a leading Realtor, emphasizes, grasping market trends is essential for making informed decisions about resource allocation. Moreover, insights from specialists such as Molly Grace underline how broader market trends affect capital returns and the selection of opportunities, further highlighting the importance of staying informed.

What Is the Capitalization Rate and Its Importance?

The capitalization percentage, often known as the 8 cap rate, serves as a vital metric in real estate for evaluating potential returns on investment assets. It is calculated by dividing the asset's net operating income (NOI) by its current market value. For instance, if an asset generates $100,000 in NOI and is valued at $1,000,000, the capitalization percentage would stand at 10%. Understanding capitalization ratios, particularly the 8 cap rate, is crucial for investors, as they provide a swift method to assess the profitability of various assets and gauge the associated risks of each venture.

In 2025, understanding capitalization ratios becomes increasingly critical, especially in light of current market dynamics influenced by fluctuating interest rates and evolving tenant demand. Recent evaluations reveal that average capitalization figures across different asset categories present diverse opportunities, with the office spaces reflecting an 8 cap rate, multifamily assets averaging 6.1%, industrial assets at 7.2%, and retail at 6.9%. Additionally, a study focusing on multifamily real estate in the Southeast U.S. included 2,900 observations for high- and very high-risk assets alongside 3,100 observations for medium- and low-risk assets, underscoring the importance of an 8 cap rate in making informed investment decisions.

A practical case study illustrates the strategic use of capitalization values: an investor evaluated a duplex listed at $350,000, which had been on the market for 75 days, while comparable properties sold more quickly. By negotiating the price down to $325,000, the investor aimed for an 8 cap rate, increasing the cap from 5.8% to 6.3% and thereby enhancing their annual return. This example demonstrates how capitalization analysis can lead to successful investment outcomes.

Real estate experts emphasize that comprehending and calculating capitalization ratios is essential for investors aiming to navigate the complexities of the market effectively. By concentrating on this critical metric, investors can make data-driven decisions that align with their financial objectives.

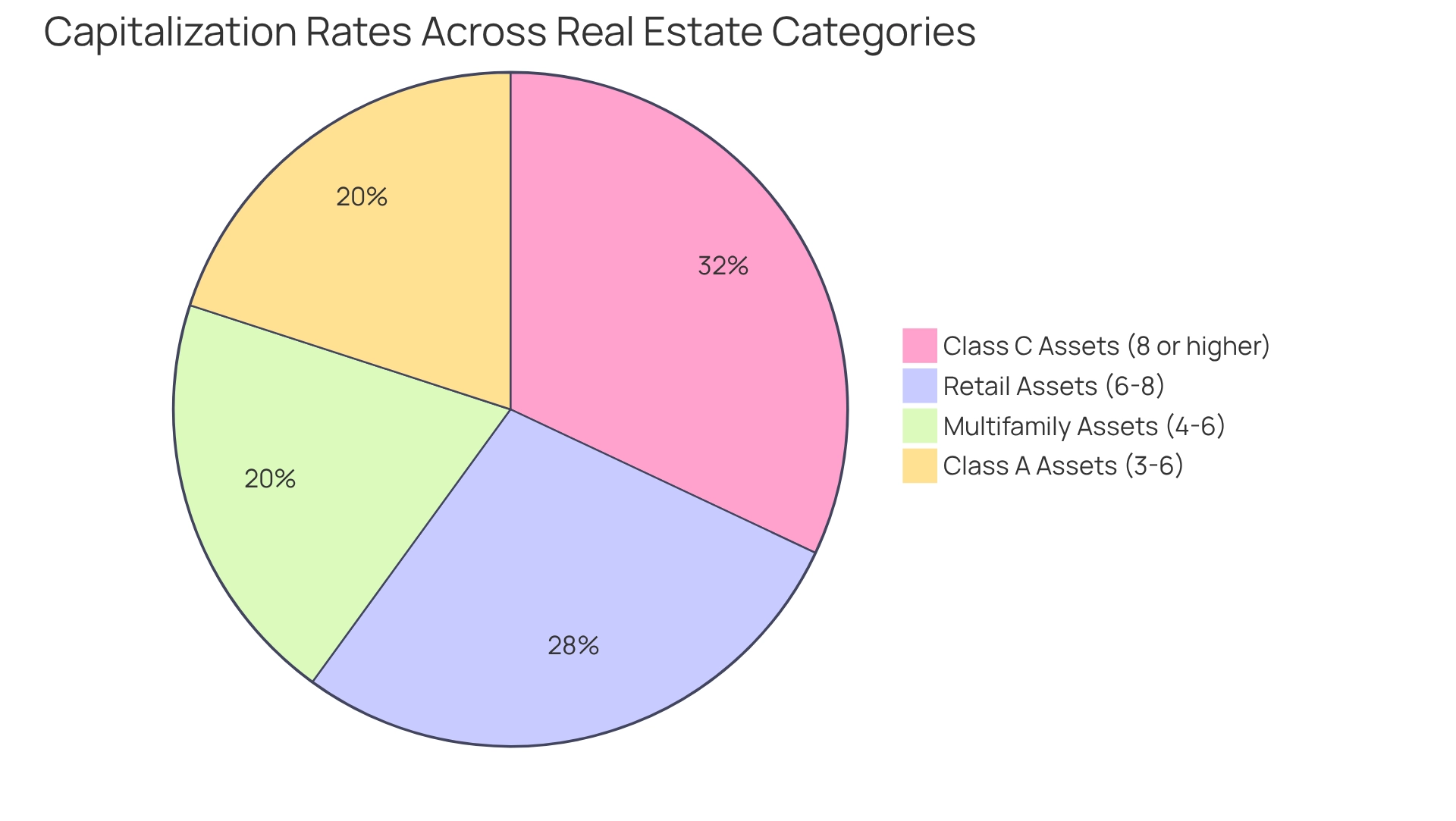

Cap Rate Variations Across Property Types

Capitalization rates can vary significantly across different categories of real estate, reflecting their unique risk profiles and earning potential. For example, multifamily assets typically demonstrate lower capitalization percentages, often ranging from 4% to 6%, due to their stable income streams and robust demand. Conversely, retail real estate tends to exhibit higher capitalization percentages, generally between 6% and 8%, as they face greater market volatility. Understanding these differences is essential for investors when evaluating potential investments and aligning them with their risk tolerance and investment objectives.

Recent statistical analyses reveal that capitalization ratios for various asset types tend to move in tandem over the long term, indicating a synchronized response to broader economic conditions. As of 2025, for instance, average capitalization rates for multifamily assets are projected to gradually decline, influenced by recent interest rate reductions, while retail assets may continue to experience fluctuations.

Professional insights underscore the significant impact of an asset's condition on its capitalization figure. Class A assets, typically newer and situated in prime locations, exhibit the lowest capitalization figures. In contrast, Class C assets, often older and located in less desirable areas, generally have capitalization figures that reflect an 8 cap rate or higher. This distinction emphasizes the importance of asset type in financial strategy.

Investors must also consider the implications of these capitalization variations on their returns. Understanding the nuances of capitalization ratios across property categories enables investors to adjust their portfolios in line with their risk appetite and financial goals, ultimately enhancing their decision-making process in the dynamic real estate market. As Erik Sherman notes, the average vacancy rate is expected to reach 4.9%, with rental growth projected at 2.6% by the end of 2025, further underscoring the necessity for investors to remain vigilant regarding changing market conditions.

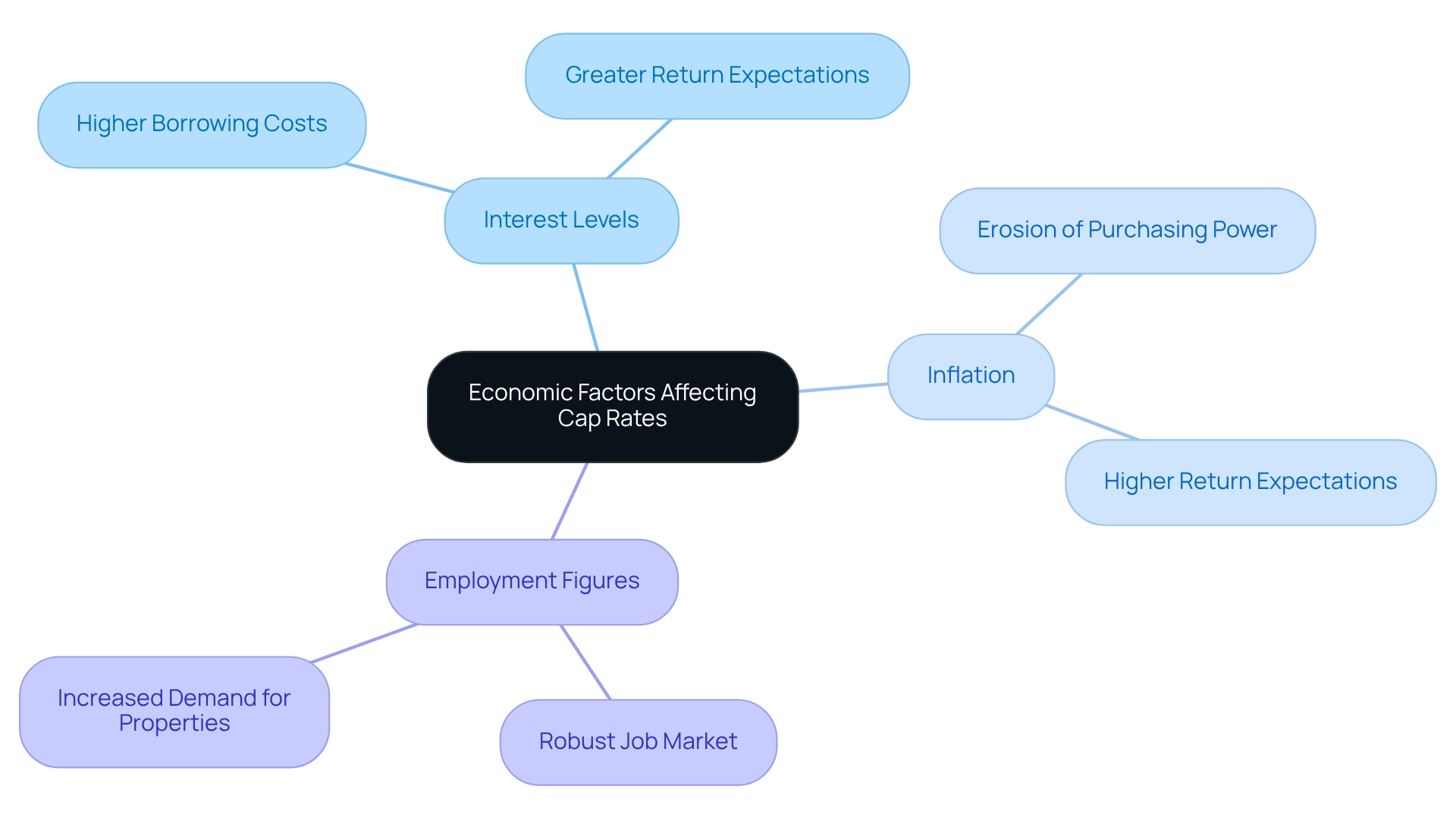

How Economic Factors Affect Cap Rates

Economic elements such as interest levels, inflation, and employment figures significantly influence capitalization values, shaping the investment landscape. When interest levels rise, borrowing costs increase, prompting investors to seek higher capitalization rates to mitigate the added risk. As highlighted by NYU, "the higher the interest level, the less debt can be provided," underscoring the importance of interest coverage ratios in assessing borrower risk. This relationship is crucial; as interest levels escalate, capitalization rates often adjust accordingly, signaling the need for greater returns. Conversely, in a low-interest environment, capitalization rates may compress, as investors are more inclined to accept lower returns due to the availability of cheaper financing options.

Inflation also plays a critical role in this equation. As inflation erodes purchasing power, investors typically pursue higher capitalization returns to safeguard their profits. For instance, in June 2025, economic indicators suggest that rising inflation levels are prompting investors to recalibrate their expectations for capitalization returns, striving to maintain profitability in a shifting market. This trend aligns with the broader pattern of investors responding to economic pressures by adjusting their return expectations.

Moreover, employment figures can indirectly impact capitalization ratios. A robust job market often leads to increased demand for commercial and residential properties, which can compress capitalization metrics as competition for these assets intensifies. In contrast, rising unemployment may elevate capitalization rates as demand wanes.

Case studies effectively illustrate these trends. For example, in managing commercial real estate syndications, understanding the nuances of how economic factors influence capitalization is vital for investors. By adhering to best practices and leveraging insights from current economic conditions, such as the implications of rising interest levels and inflation, investors can refine their financing strategies and enhance project outcomes. Additionally, higher education institutions can play a role in the development of workforce housing, benefiting both communities and institutions. This adds another layer to the economic factors influencing capitalization ratios. A comprehensive understanding of the interplay between economic elements and capitalization values is essential for making informed investment decisions.

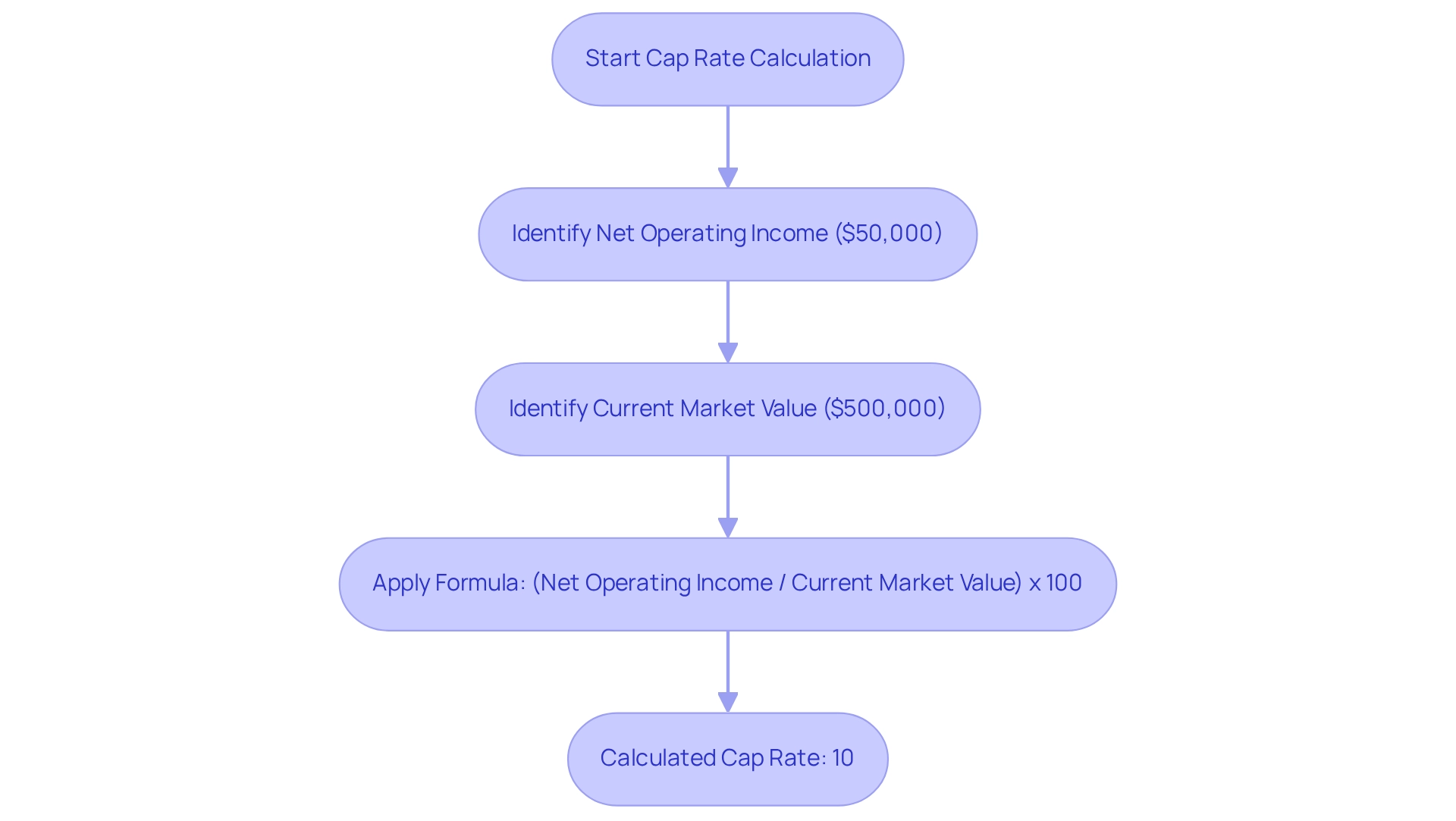

Cap Rate Calculation: Formula and Methodology

To determine the capitalization rate (cap rate), utilize the following formula:

Cap Rate (%) = (Net Operating Income / Current Market Value) x 100.

For example, if a property generates a net operating income of $50,000 and has a current market value of $500,000, the cap rate is calculated as follows:

Cap Rate = ($50,000 / $500,000) x 100 = 10%.

This straightforward yet effective calculation empowers investors to evaluate potential returns and facilitates comparisons across various assets in the market. It is crucial to understand that there are no definitive ranges for favorable or unfavorable capitalization values; these depend on the specific context of the asset and prevailing market conditions.

Grasping capitalization ratios is vital, as they indicate the risk associated with a financial venture; a higher capitalization ratio typically signifies increased risk, whereas a lower ratio suggests a more secure opportunity.

As J. Paul Getty once remarked, "Current real estate prices aren’t high because they have been driven up by irresponsible speculation... Prices have risen because a constantly increasing population with money to invest has been created – and continues to be created."

In 2025, the cap calculation remains an indispensable tool for real estate investors, enabling informed decisions based on current market dynamics and asset performance.

Limitations of Using Cap Rates in Real Estate

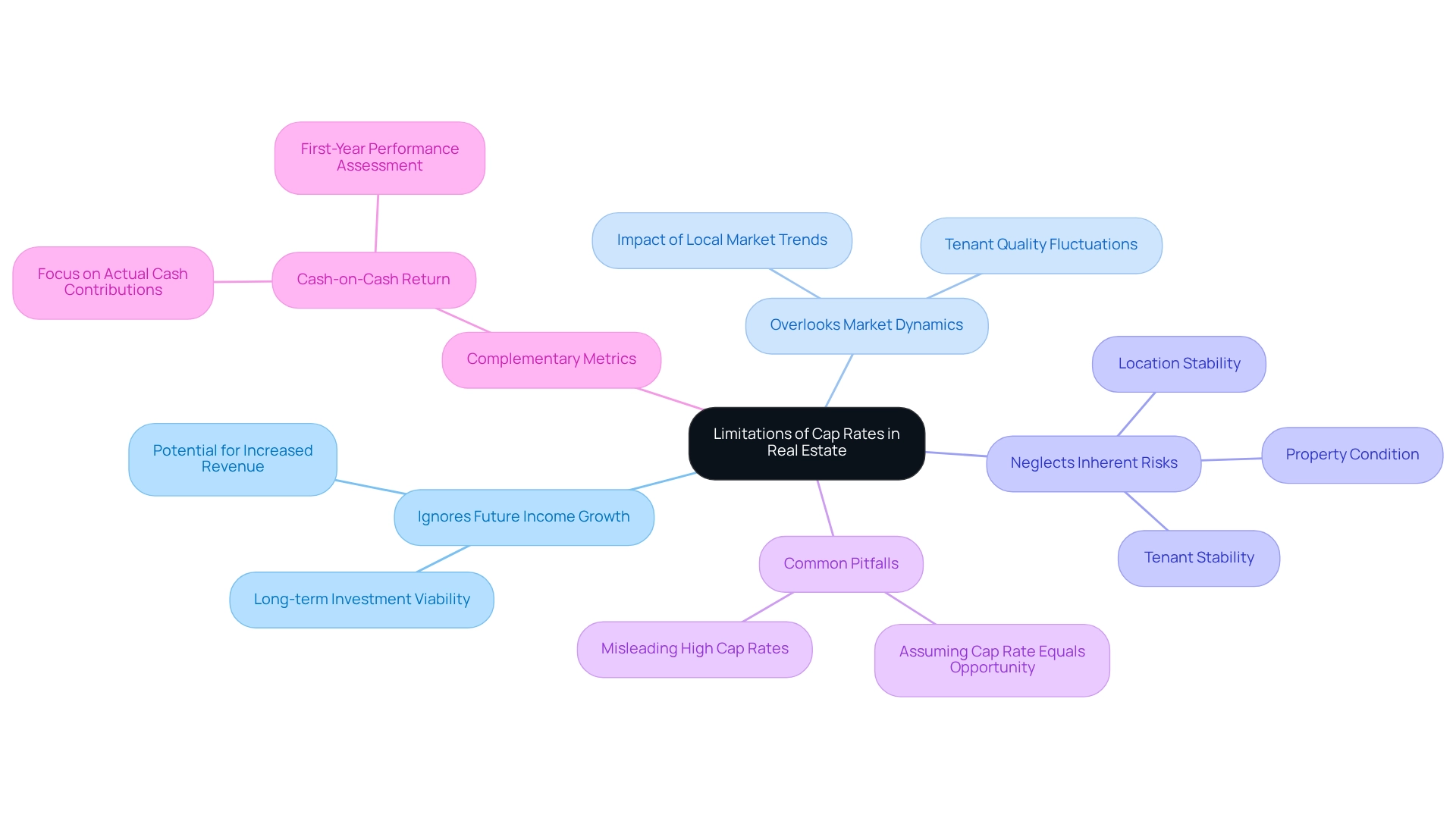

Cap values serve as a crucial metric for assessing real estate ventures; however, they come with notable limitations. Primarily, capitalization rates fail to account for future income growth, asset appreciation, or shifts in market dynamics—factors that can significantly impact an investment's overall performance. For instance, an asset might exhibit a favorable capitalization ratio today, but if the local market experiences a downturn or tenant quality declines, the anticipated returns could diminish.

Moreover, capitalization rates inadequately reflect the inherent risks associated with a real estate asset. Key elements such as location, tenant stability, and property condition are vital in evaluating a property's viability, yet they are often overlooked in capitalization calculations. This neglect can lead to misguided financial decisions, as evidenced by case studies where reliance on capitalization metrics resulted in unexpected losses.

As we approach 2025, the landscape of real estate funding is evolving, making the limitations of capitalization more apparent than ever. Investors are increasingly advised to complement cap figures with additional metrics, such as Cash-on-Cash Return, which highlights actual cash contributions and provides a more nuanced view of performance. This dual approach facilitates a more comprehensive evaluation of potential financial opportunities.

Common pitfalls include the assumption that a high capitalization figure equates to a solid financial opportunity, disregarding the inherent risks. Industry experts emphasize the importance of recognizing these limitations to make informed decisions. For example, properties with misleading capitalization figures may appear attractive but could mask more significant issues that affect long-term profitability. Consequently, a thorough examination that incorporates various metrics is essential for navigating the complexities of real estate.

As Michael D. Machen, CPA, CVA, aptly notes, "The more astute buyers and sellers comprehend the difficulties cap values, in particular, pose to finalizing transactions—it’s always advantageous to be equipped with reliable and up-to-date information." This underscores the necessity of being well-informed when evaluating financial opportunities. Furthermore, the statistic indicating a credit drop from 55 to 47 underscores the challenges present in the current investment environment, which can further complicate capital assessments. Investors must remain vigilant and consider insights from case studies comparing capitalization ratios and cash-on-cash returns to avert potential pitfalls.

Determining a Good Cap Rate for Investments

Assessing an effective cap requires a nuanced evaluation of various elements, including property type, location, and current market conditions. In 2025, typical cap percentages range from 4% to 10%. Reduced capitalization ratios often signify diminished risk, appealing to cautious investors, while elevated ratios imply increased risk, frequently attracting individuals seeking higher returns. For instance, an asset with an 8 cap rate is generally viewed as a more advantageous investment compared to one with a 6% yield, assuming all other factors remain constant.

Investment strategies significantly influence cap calculations. Investors focused on consistent income sources may prefer assets with lower capitalization percentages, as these often indicate mature markets with reliable cash flow. Conversely, those willing to accept increased risk for the potential of higher returns may concentrate on assets with elevated capitalization figures.

Expert opinions emphasize that while cap figures are a crucial metric, they represent only one facet of the investment landscape. As illustrated in the case study titled "Impact of Interest Rates on Capitalization Rates," the relationship between interest levels and capitalization rates is critical; as interest rates rise, asset values may decline, leading to wider capitalization rates. This dynamic illustrates how capitalization measures can reflect market sentiment and investor behavior in response to economic conditions.

Acceptable capitalization ranges can vary by asset type and investment strategy. For example, multifamily properties typically exhibit capitalization percentages between 5% and 8 cap rate, whereas commercial properties may range from 6% to 10%. Understanding these ranges enables investors to align their choices with their financial goals and risk tolerance.

Ultimately, identifying a suitable cap value revolves around finding a balance that aligns with the investor's objectives. As the Crowd Street Editorial Team wisely noted, "Some individuals discuss cap figures as if they're the entire narrative, but they're merely one part of the puzzle." By examining market trends and real estate specifics, investors can make informed decisions that resonate with their investment strategies.

Comparative Analysis of Cap Rates in Various Markets

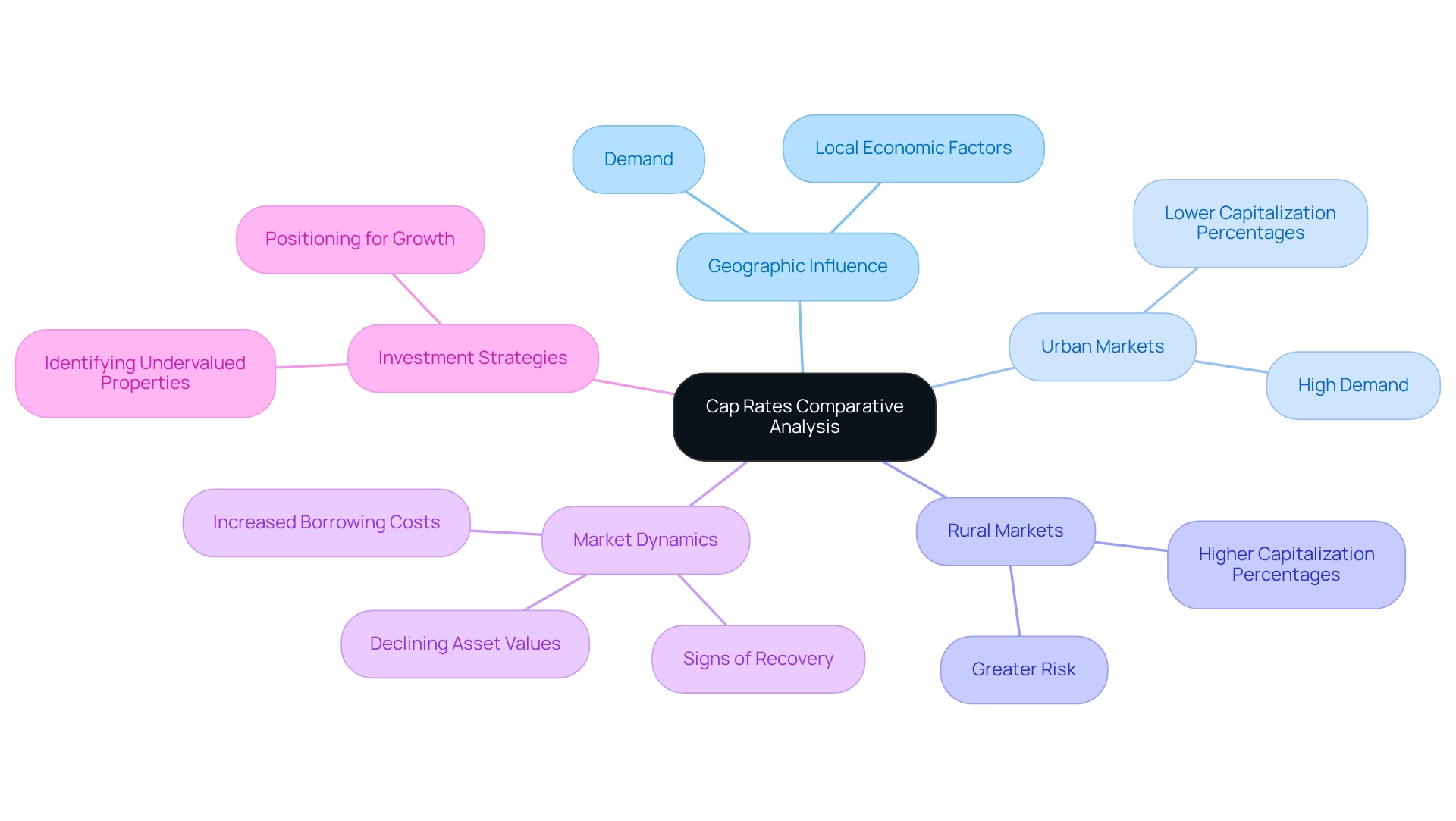

Capitalization values can vary significantly across geographic regions, influenced by local economic factors, demand, and types of real estate. Urban markets often exhibit lower capitalization percentages, driven by heightened demand and elevated real estate values. In contrast, rural regions may display higher capitalization percentages, reflecting greater risk and diminished demand. A comparative analysis of capitalization metrics across diverse markets can empower investors to identify undervalued properties or emerging areas ripe for growth.

The commercial real estate market in 2024 demonstrated signs of recovery, despite challenges posed by increased borrowing costs and declining asset values, as illustrated in the case study "The Picture on Performance | 2024 In Review." This context is crucial for understanding the overarching market dynamics that influence capitalization values. By remaining informed about regional trends, including anticipated differences in cap values between urban and rural areas for 2025, investors can strategically position themselves to take advantage of favorable market conditions.

As highlighted by Green Street, cap rates form the foundation of the Net Asset Value-based pricing approach and the return expectations that are vital for making sound financial decisions. This comprehension not only aids in pinpointing lucrative opportunities but also enhances overall investment performance.

Conclusion

Understanding capitalization rates is crucial for navigating the complexities of real estate investment, particularly as the market evolves towards 2025. This article has explored the significance of cap rates, detailing their calculation, variations across property types, and the economic factors that influence them. By grasping the nuances of cap rates, investors can effectively assess potential returns and align their strategies with prevailing market conditions.

The analysis highlights that cap rates are not a one-size-fits-all metric; they vary significantly depending on property type, location, and market dynamics. For instance, multifamily properties typically present lower cap rates due to their stable income potential, while retail properties may exhibit higher rates due to market volatility. Furthermore, understanding how economic indicators like interest rates and inflation affect cap rates is essential for making informed investment decisions.

While cap rates serve as a fundamental tool for evaluating investment opportunities, reliance solely on this metric can be misleading. The limitations of cap rates, including their inability to account for future income growth or property appreciation, underscore the importance of using a multifaceted approach to investment analysis. Investors are encouraged to consider additional metrics, such as Cash-on-Cash Return, to gain a more comprehensive view of potential investments.

Ultimately, the ability to interpret and leverage cap rates effectively can empower investors to make strategic decisions that enhance their portfolios. As the real estate landscape continues to shift, staying informed and adaptable will be key to capitalizing on emerging opportunities and optimizing investment outcomes.