Overview

The article presents a compelling overview of various alternatives to traditional real estate investing that savvy investors should consider. These alternatives include real estate crowdfunding, REITs, and coworking spaces. The growing interest in these options is underscored by significant market trends, financial flexibility, and the potential for high returns. Such insights are invaluable for investors aiming to diversify their portfolios beyond conventional property investments.

As the real estate landscape evolves, understanding these alternatives becomes crucial. Investors are increasingly drawn to real estate crowdfunding due to its accessibility and the ability to invest in fractional shares of properties. REITs, on the other hand, offer a way to invest in real estate without the need for direct ownership, providing liquidity and diversification. Additionally, coworking spaces have gained traction as a response to changing work habits, presenting unique investment opportunities.

In conclusion, the shift towards these innovative investment avenues highlights the importance of adapting to market dynamics. Investors are encouraged to leverage these insights to enhance their investment strategies, ensuring they remain competitive in a rapidly changing environment.

Introduction

In the dynamic realm of real estate investment, alternative strategies are increasingly capturing the attention of discerning investors eager to diversify their portfolios. Innovative approaches, such as real estate crowdfunding and the appeal of distressed assets, are reshaping the market landscape, presenting opportunities that challenge conventional investment methods. As the appetite for flexible solutions intensifies, platforms like Zero Flux offer indispensable daily insights, empowering investors with the knowledge required to navigate this intricate terrain. With projections suggesting significant growth across various sectors, grasping these emerging trends is vital for those aiming to seize the future of real estate investing.

Zero Flux: Daily Insights on Alternative Real Estate Investments

Zero Flux delivers daily insights into alternative property opportunities by meticulously compiling data from over 100 sources, ensuring the information is both clear and accurate. This resource is essential for informed investors aiming to diversify their portfolios by exploring alternatives to real estate investing beyond traditional property options. As we look to 2025, the landscape of alternative assets is transforming, with trends indicating a rising interest in sectors such as real estate crowdfunding, REITs, and commercial property ventures. For example, the recent CBRE Asia Pacific Investor Intentions Survey reveals an increase in buying intentions across various markets, signaling a shift towards more innovative investment strategies.

Furthermore, statistics indicate that San Francisco remains the most expensive city for renters globally, with average rents for one-bedroom apartments reaching approximately $3,500 monthly. This heightened demand, driven by a robust job market and limited housing availability, underscores the necessity for individuals to explore alternatives to real estate investing that can yield significant returns. The implications of this demand suggest that participants should consider diversifying into markets or sectors that serve as alternatives to real estate investing, offering more accessible entry points and potentially higher returns.

A noteworthy case study is Mashvisor, a platform designed to assist property buyers in identifying lucrative rental options. By tackling the challenges of information overload and outdated data, Mashvisor empowers both novice and experienced investors to maximize returns and effectively diversify their portfolios.

As Akira Mori, a leading real estate developer, articulates, "In my experience, in the real-estate business, past success stories are generally not applicable to new situations. We must continually reinvent ourselves, responding to changing times with innovative new business models." This perspective highlights the importance of adapting financial strategies in a rapidly evolving market.

By focusing on data-informed insights, Zero Flux equips stakeholders with the knowledge necessary to navigate the complexities of the market and uncover promising opportunities that serve as alternatives to real estate investing. To leverage these insights effectively, stakeholders should routinely assess their portfolios and contemplate incorporating alternative assets that align with current market trends, establishing Zero Flux as an indispensable tool for those seeking to enhance their financial strategies.

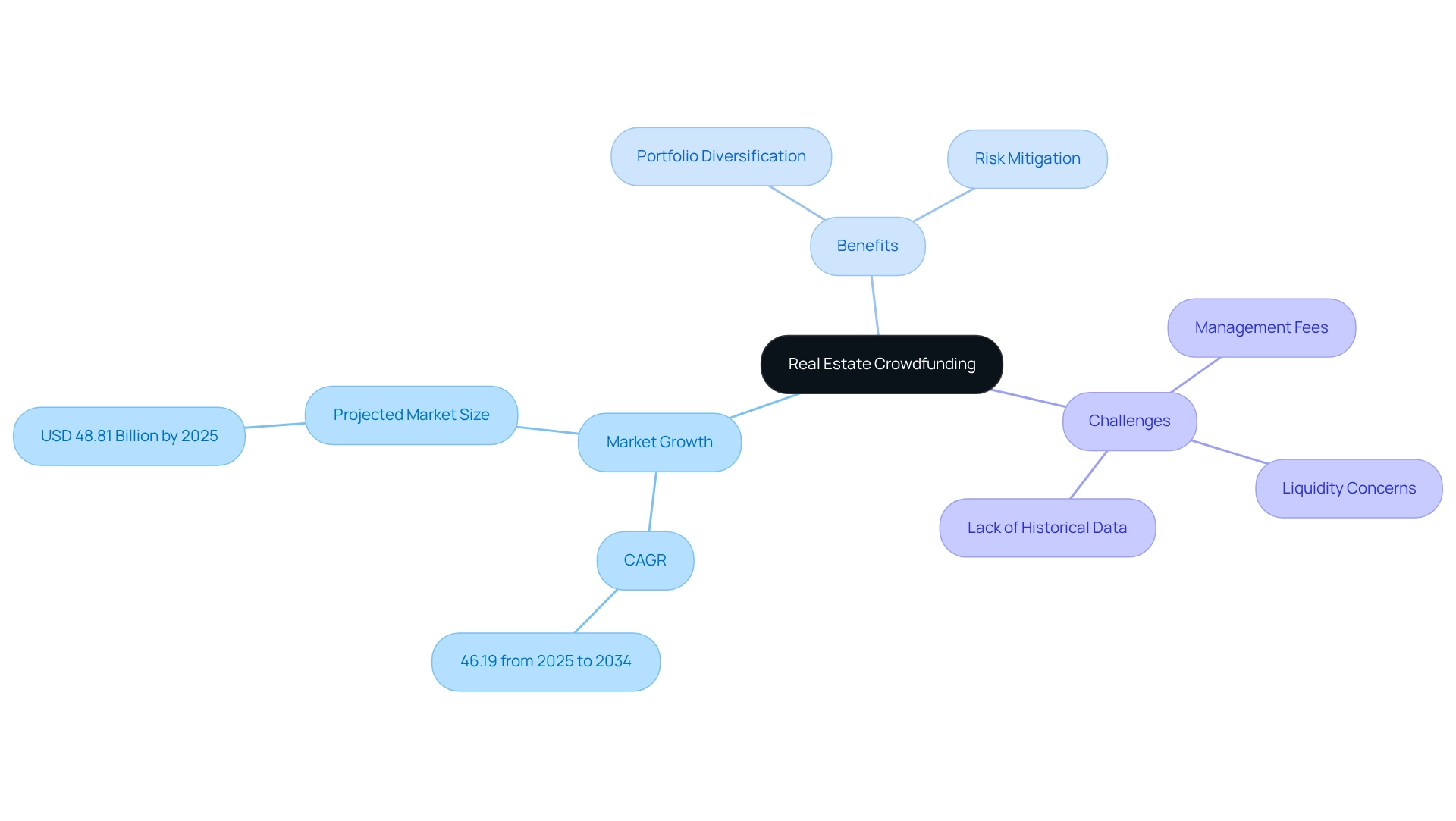

Real Estate Crowdfunding: Access to Diverse Investment Opportunities

Real property crowdfunding platforms empower investors to collaboratively fund a diverse array of property projects, spanning residential developments to commercial ventures. This innovative model significantly diminishes capital requirements, making property ownership accessible to a wider audience.

The property crowdfunding market is poised for substantial growth, with projections indicating a compound annual growth rate (CAGR) of 46.19% from 2025 to 2034. By 2025, the market size is expected to be valued at approximately USD 48.81 billion, underscoring a rising interest in this financial opportunity.

Investors benefit from the chance to diversify their portfolios through crowdfunding, which can mitigate risks associated with traditional property investments. However, it is essential to acknowledge the challenges inherent in this model, including:

- Management fees

- Liquidity concerns

- The absence of historical performance data for many platforms

Conducting thorough research and risk assessment is vital for individuals considering crowdfunding projects, as these factors can significantly impact financial stability. As the landscape of property crowdfunding evolves, staying informed about the latest advancements and expert insights will be crucial for those seeking to capitalize on new opportunities. This method of crowdfunding serves as an attractive alternative to real estate investing strategies.

Real Estate Investment Trusts (REITs): Liquid Real Estate Investment Options

Real Estate Investment Trusts (REITs) present a compelling opportunity for individuals to access a diverse array of property assets without the burdens of direct ownership. By purchasing shares in publicly traded REITs, investors can enjoy liquidity and the potential for consistent dividends, making them an appealing alternative to real estate investing.

REITs span a variety of sectors, including residential, commercial, and industrial properties, enabling investors to customize their portfolios in response to market trends and personal investment objectives. In 2025, REITs demonstrated resilience, with many funds reporting robust returns driven by high demand in the housing market and a rebound in commercial properties. Notably, the average total return for REITs in 2025 reached approximately 12%, significantly surpassing the performance of traditional equities.

Investors are increasingly acknowledging the benefits of REITs, particularly their capacity to provide liquidity within an otherwise illiquid asset class. Unlike private equity property funds, which are often illiquid and necessitate long-term commitments, publicly traded REITs can be readily bought and sold on major exchanges, offering both flexibility and ease of access.

Recent case studies underscore successful REIT allocations, exemplified by the XYZ REIT, which capitalized on emerging market trends by financing urban redevelopment projects. This approach not only maximized returns but also fostered community development. As community growth through property funding continues to gain momentum, REITs are poised to play a vital role in enhancing quality of life and reducing poverty levels.

Given the current landscape favoring REITs, financial analysts highlight their potential as an alternative to real estate investing in a diversified asset portfolio. Scott J. Bent emphasizes, "Contact Scott J. Bent to discuss your financial goals and what real estate options are a good fit." As the market evolves, remaining informed about the latest trends and performance metrics will be essential for investors aiming to leverage the advantages of REITs in their wealth-building strategies. Furthermore, sponsors focused on cost minimization may regard REITs as a viable funding alternative.

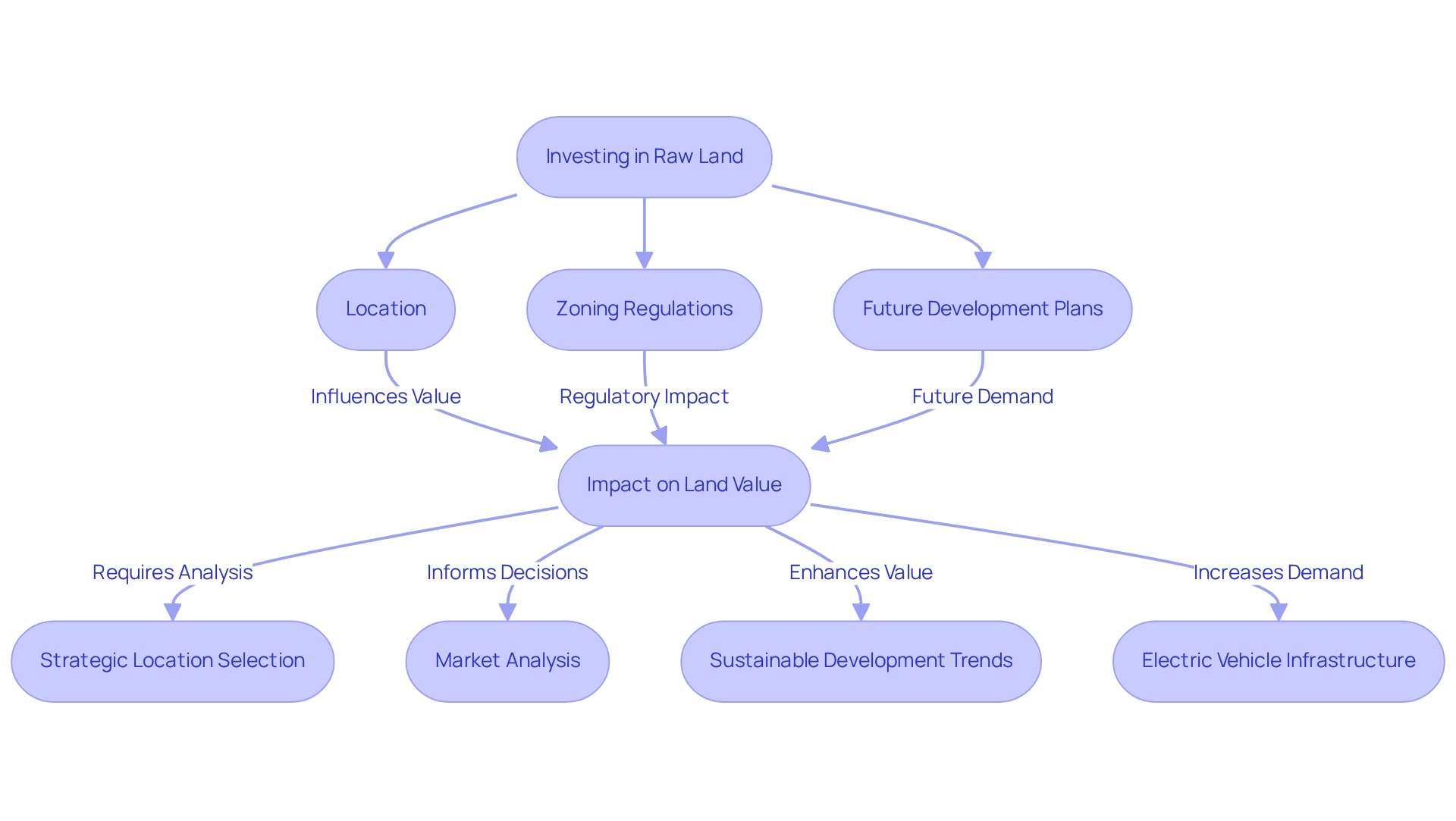

Raw Land Investments: Long-Term Appreciation Potential

Investing in raw land presents a compelling opportunity for long-term appreciation, particularly in regions poised for growth. As urban development accelerates, the value of raw land is likely to rise significantly. Key factors influencing this appreciation include:

- Location

- Zoning regulations

- Future development plans

For instance, areas designated for residential or commercial expansion often see a surge in land value as demand increases.

Statistics gathered from our daily insights suggest that raw land assets have appreciated steadily, with some areas witnessing growth rates surpassing 10% each year in 2025. This trend underscores the importance of strategic location selection and thorough market analysis, which are central to the insights provided by Zero Flux.

Expert insights emphasize the necessity of patience in this investment strategy. As Barbara Corcoran aptly noted, "Buyers decide in the first eight seconds of seeing a home if they’re interested in buying it." This principle extends to raw land; the initial perception of a location can significantly impact its future value. This highlights the importance of market analysis, a focus of our newsletter, which filters through vast amounts of data to present relevant trends.

Current trends, such as the increasing interest in sustainable development and electric vehicle infrastructure, further enhance land desirability. By staying informed about these dynamics, individuals can better position themselves to capitalize on the appreciation potential of raw land.

In summary, while investing in raw land requires a long-term perspective, the potential for substantial returns makes it an appealing option as an alternative to real estate investing for knowledgeable participants. For ongoing updates on market dynamics and urban development trends, consider subscribing to Zero Flux, your trusted source for data-driven property insights.

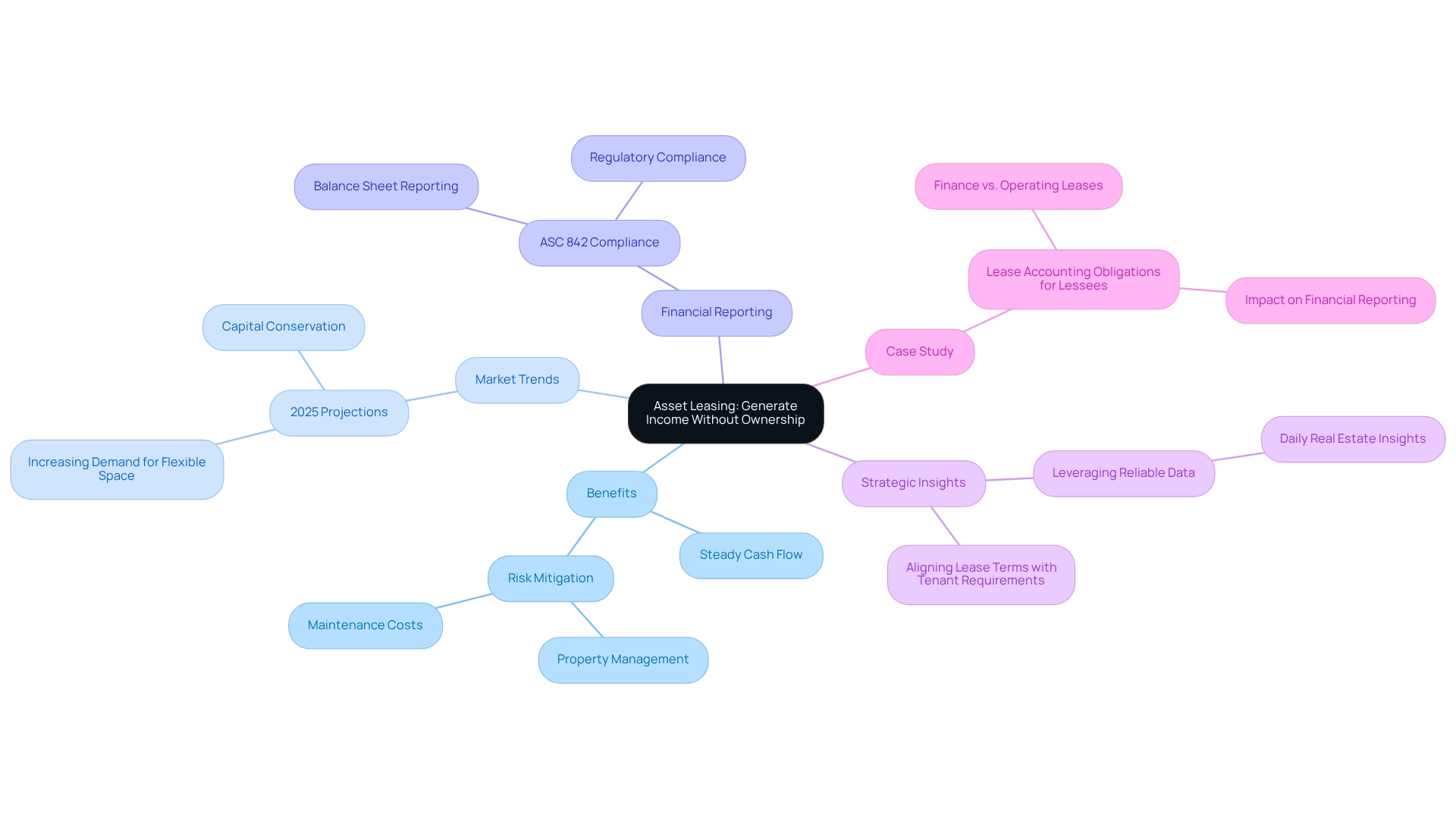

Asset Leasing: Generate Income Without Ownership

Asset leasing stands as a strategic method, empowering individuals to generate income through the rental of property or equipment, thereby sidestepping the burdens associated with ownership. This approach proves particularly advantageous in the commercial property sector, where businesses frequently prefer leasing over purchasing assets. Projections for 2025 indicate that the asset leasing market will continue its upward trajectory, driven by an escalating demand for flexible space solutions and the imperative for businesses to conserve capital.

Investors benefit from a steady cash flow while effectively mitigating risks tied to property management and maintenance. A recent case study on lease accounting obligations underscores that under ASC 842, lessees must report all leasing commitments on their balance sheets. This requirement enhances financial reporting accuracy and regulatory compliance, providing clarity that not only assists lessees but also fosters trust among stakeholders regarding the stability of income derived from leasing.

To implement effective asset leasing strategies in commercial real estate, it is essential to grasp market trends and align lease terms with tenant requirements. As companies increasingly pursue flexibility, leasing emerges as an attractive alternative to real estate investing, enabling stakeholders to respond to evolving market conditions without the long-term commitments associated with property ownership. Expert insights in 2025 emphasize that leasing can yield a more stable income stream compared to ownership, which is subject to market fluctuations and maintenance costs. Industry leaders assert that strategic decision-making is crucial in asset leasing, highlighting the importance of leveraging reliable data to inform financial choices. For instance, Zero Flux compiles 5-12 curated real estate insights daily, equipping stakeholders with a wealth of information to refine their leasing strategies. In summary, leasing serves as an alternative to real estate investing, offering clear advantages such as income generation without the complexities of ownership, making it an appealing option for discerning individuals aiming to diversify their portfolios.

Coworking Spaces: Capitalizing on Flexible Work Trends

Coworking spaces have surged in popularity as businesses increasingly embrace flexible work arrangements. In 2025, Dublin leads the Irish market with 120 coworking spaces, representing over half of the country's total of 236. This trend presents lucrative investment opportunities for those seeking an alternative to real estate investing by developing or investing in coworking facilities that cater to freelancers, startups, and established companies looking for adaptable office solutions. The rise of coworking facilities is not merely a passing trend; it reflects a significant shift in how businesses operate, with many companies prioritizing cost-effective and scalable workspace solutions.

As of late 2024, WeWork's launch of a workspace affiliate program further underscores the growing demand for coworking environments, indicating a robust market trajectory. This program not only broadens WeWork's presence but also emphasizes the increasing interest in adaptable work environments, marking it a crucial moment for stakeholders.

Moreover, facilities managers can harness modern technology to increase efficiencies and savings, directly impacting the financial performance of coworking spaces. Expert insights suggest that the financial performance of coworking spaces will continue to improve, driven by increasing occupancy rates and diverse tenant profiles. Real estate analysts have noted the rise of coworking facilities as a transformative trend in the industry, emphasizing their potential for high returns.

With the right investment strategies, astute individuals can leverage this momentum, capitalizing on the financial benefits associated with coworking spaces. This changing environment positions coworking spaces as an attractive alternative to real estate investing for individuals looking to diversify their portfolios and engage with the future of work.

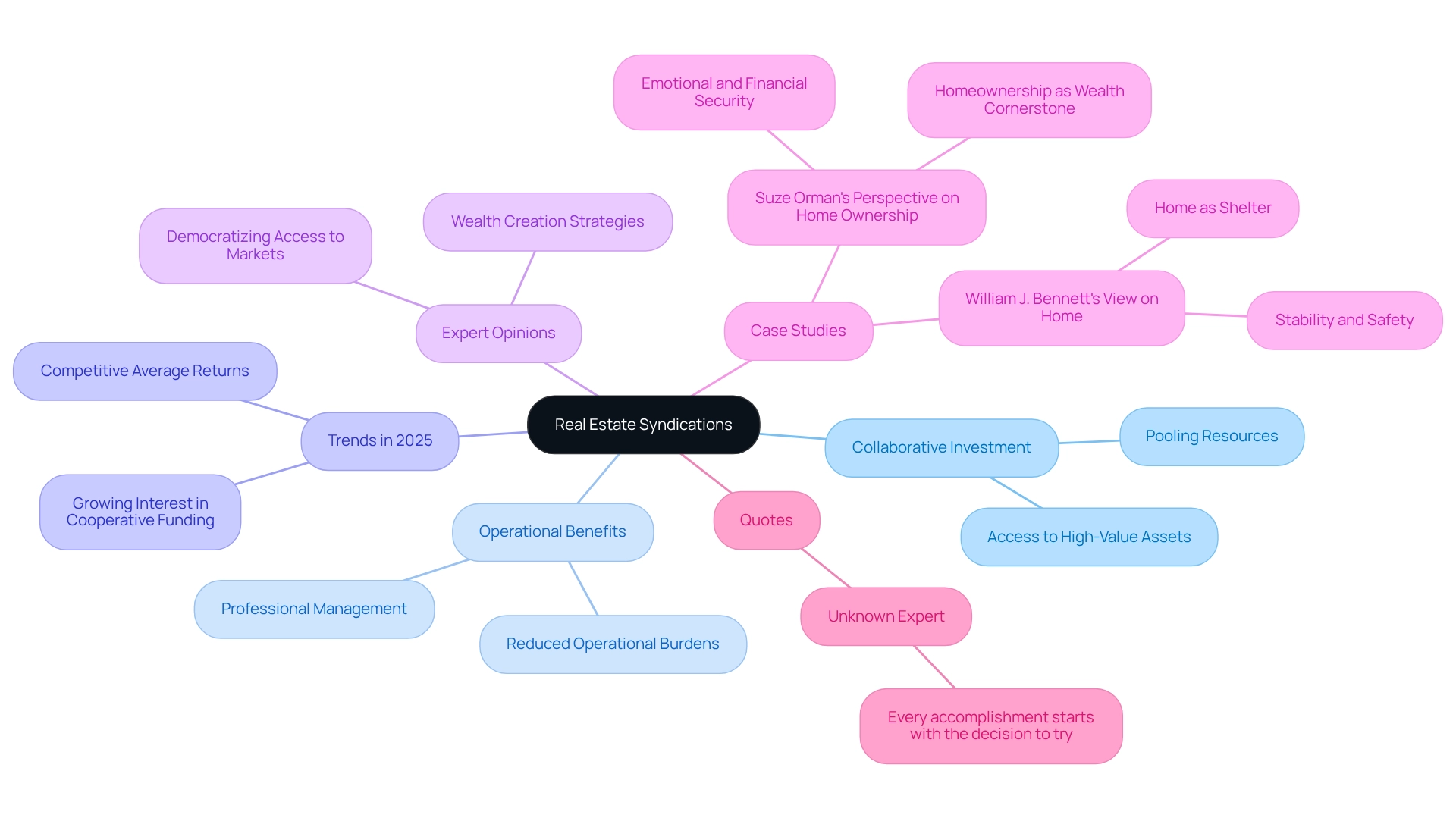

Real Estate Syndications: Collaborative Investment Opportunities

Real estate syndications represent a strategic partnership where a group of stakeholders pools their resources to finance larger properties or projects. This collaborative approach provides an alternative to real estate investing, enabling individuals to invest in high-value assets that may be challenging to manage independently. By engaging in syndications, participants gain access to institutional-grade properties, typically accompanied by professional management. This setup alleviates the operational burdens often associated with property management, allowing investors to focus on their overarching financial strategies.

In 2025, the landscape of property syndications is evolving, with trends indicating a growing interest in cooperative funding. Investors are increasingly acknowledging the potential for enhanced returns through shared resources and expertise. Average returns on property syndications are projected to remain competitive, reflecting the ongoing demand for diverse investment opportunities. The Zero Flux newsletter curates 5-12 selected property insights daily, equipping stakeholders with valuable information to navigate these prospects.

Moreover, expert opinions emphasize the advantages of syndications as an alternative to real estate investing, highlighting their role in democratizing access to lucrative property markets. As more stakeholders aim to leverage these collaborative strategies, the syndication market is expected to expand, providing innovative solutions for wealth creation as an alternative to real estate investing. As an unknown expert once stated, "Every accomplishment starts with the decision to try," a sentiment that underscores the proactive mindset investors must adopt when exploring syndications.

Case studies of successful syndications further illustrate the effectiveness of this funding model, demonstrating how collective efforts can yield substantial financial rewards. For example, Suze Orman underscores the emotional and financial security associated with homeownership, portraying it as a fundamental aspect of wealth. This viewpoint reinforces the significance of syndications as a pathway to achieving both financial success and personal fulfillment. Additionally, William J. Bennett depicted home as a sanctuary from various challenges, highlighting the importance of property acquisitions in providing stability and safety.

Impact Investing: Aligning Financial Goals with Social Responsibility

Impact investing represents a strategic approach that aims to generate positive social or environmental outcomes in tandem with financial returns. Investors are increasingly attracted to projects that align with their values, including:

- Affordable housing

- Renewable energy initiatives

- Community development efforts

This financial strategy not only addresses critical societal issues but also uncovers new opportunities in sectors that are rapidly gaining traction among socially conscious stakeholders.

As we look to 2025, the importance of impact investing in real estate is underscored by the pressing demand for affordable housing, with nearly 650,000 units at risk of losing income and rent restrictions by 2030. This alarming statistic emphasizes the urgent need to invest in resilient housing solutions, which have historically shown stability during economic downturns. Notably, affordable housing has outperformed traditional market-rate apartments in terms of rent growth and occupancy during the last three economic recessions, highlighting its essential role in the housing market.

The growth of socially responsible property ventures is evident as more investors recognize the potential to align financial goals with social responsibility. Agustín Vitórica, co-founder and co-CEO of GAWA Capital, states, "These actions collectively can build investor confidence to channel resources toward impactful projects in emerging markets." This perspective reinforces the financial viability of impact investing in affordable housing, a sentiment echoed by Nuveen Real Assets, which advocates for such investments as a means to generate income and returns for property portfolios.

Current trends indicate a robust interest in affordable housing as a source of income and returns, further solidifying its role in diversified property portfolios. Ultimately, impact investing not only fosters financial growth but also contributes to meaningful societal change, making it a crucial consideration for those looking to create an impact while achieving their financial objectives.

Hard Money Loans: Quick Financing for Real Estate Ventures

Hard money loans represent short-term financing options secured by real estate, primarily utilized by individuals seeking rapid access to capital. These loans are often more attainable than traditional financing, making them especially beneficial for property flippers and those eager to capitalize on urgent investment opportunities. In 2025, average interest rates for hard money loans typically commence at approximately 12%, with reduced costs for shorter loan terms, appealing for swift projects.

The flexibility and speed of hard money loans can prove invaluable in a competitive market, empowering individuals to act promptly on lucrative deals. A case study titled 'When a Hard Money Loan is a Good Choice' illustrates scenarios where hard money loans provide distinct advantages, such as when individuals require immediate funding, possess low credit scores, or need bridge financing. The findings indicate that while these loans are suitable for those who can manage higher interest rates, they are not advisable for long-term financing or primary residences due to the inherent risks.

Current trends reveal that large data sets are increasingly employed by hard money lenders to assess property values, After Repair Value (ARV), and associated risks more effectively, thereby enhancing the borrowing experience for stakeholders. This evolution in the lending landscape underscores the growing significance of hard money loans as an alternative to real estate investing, particularly for those who must navigate the complexities of the market swiftly and effectively. As Brad Loans aptly states, "We are your source for hard money when traditional banks say no," underscoring the crucial role these loans play in providing access to capital when other options may be limited.

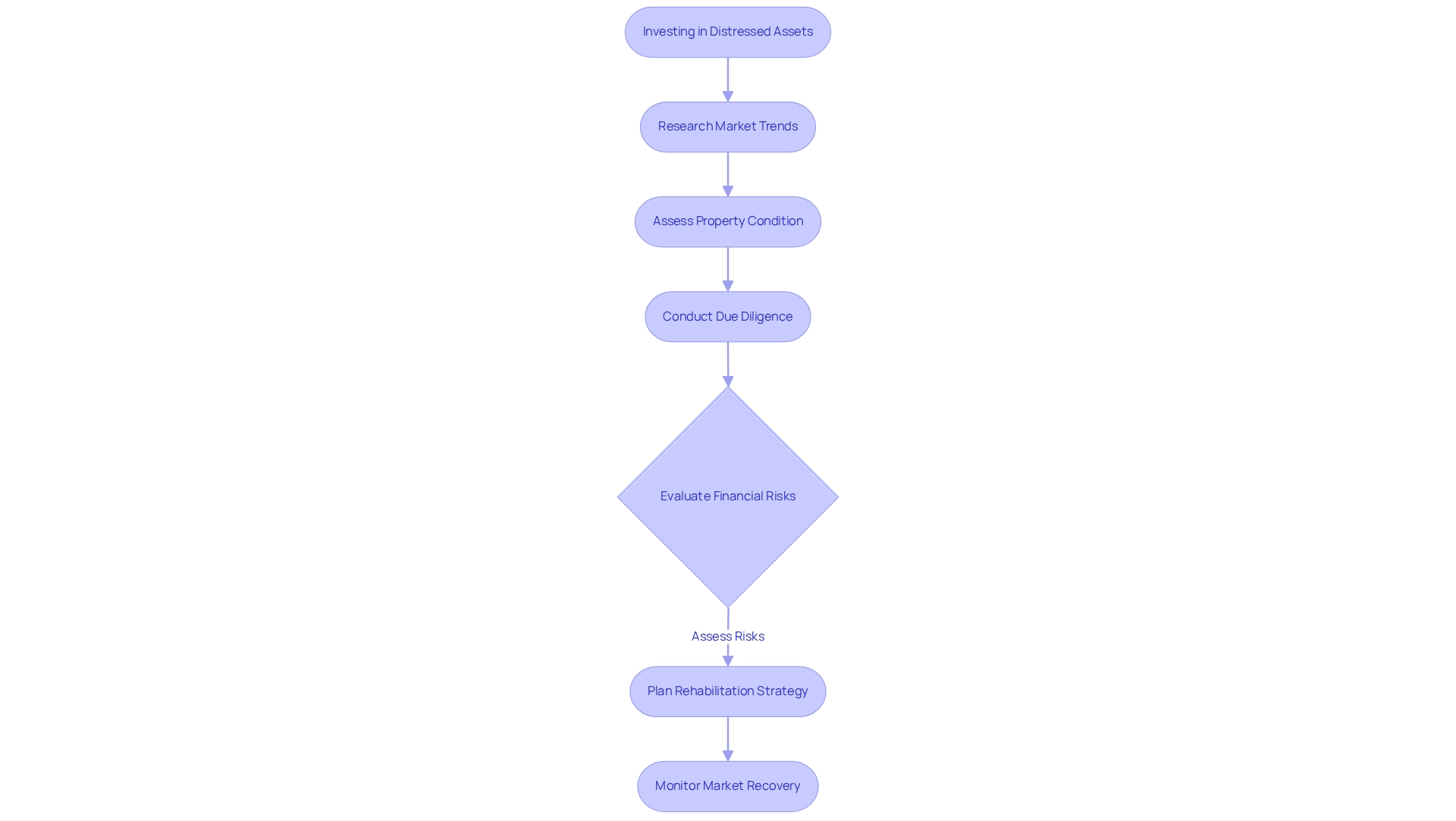

Distressed Assets: High-Risk, High-Reward Investment Strategy

Investing in distressed assets involves acquiring properties that are undervalued due to various factors, such as financial difficulties, poor physical condition, or adverse market conditions. This funding approach, while inherently risky, presents the potential for significant rewards, particularly if investors can effectively rehabilitate the property or capitalize on a market recovery. In 2025, average returns on distressed property holdings are projected to be notably higher than traditional assets, with estimates suggesting returns could exceed 15% due to increasing demand for affordable housing and a recovering economy.

Current trends reveal a growing interest in distressed assets, especially in regions experiencing overbuilding, such as the southern United States. Investors are encouraged to conduct thorough due diligence, as the complexities of managing distressed properties can present unique challenges. For example, issues with potential renters may arise with pre-foreclosure properties, necessitating eviction processes to clear current occupants, which can complicate financial strategies.

Expert insights underscore the importance of understanding the risks and benefits associated with distressed property ventures. Gatsby notes, "With a stellar track record of high returns, refreshing financial transparency, and an innovative online dashboard for tracking assets, Gatsby is among the most reputable development sponsors in the industry." This perspective highlights the possibility of substantial gains while also acknowledging the financial and operational challenges that can accompany these ventures. Successful rehabilitation of distressed properties often relies on strategic planning and effective management.

Statistics indicate that acquisitions of distressed assets are gaining traction, with a significant surge in interest from financiers in 2025, evidenced by a 20% increase in transactions compared to the previous year. Case studies, such as those analyzing the impact of Moody's EDF-X solution on credit risk metrics, emphasize the necessity of assessing credit health and market conditions when navigating distressed investments. By focusing on critical factors, including the importance of distress resolution in emerging markets like China, investors can better position themselves to capitalize on the opportunities presented by distressed assets.

Conclusion

The evolving landscape of real estate investment is replete with opportunities, particularly through alternative strategies that empower investors to diversify their portfolios. Platforms like Zero Flux provide essential insights, enabling investors to stay informed about emerging trends such as real estate crowdfunding, REITs, and distressed assets, all of which are reshaping the market. Insights gathered from various sources underscore the importance of adapting investment strategies to meet the demands of this dynamic environment, ensuring that investors can seize opportunities aligned with their financial goals.

Investing in real estate crowdfunding and syndications fosters collaborative approaches that lower capital requirements while providing access to high-value properties. Meanwhile, REITs offer liquidity and regular dividends, making them an appealing option for those seeking exposure to diversified real estate assets without direct ownership. The potential for significant returns from distressed assets and raw land investments further enhances the allure, attracting investors willing to navigate the complexities of these markets.

As the demand for innovative solutions in real estate investment continues to rise, the integration of impact investing and asset leasing presents a unique opportunity for investors to align their financial success with social responsibility. This dual focus not only fosters economic growth but also addresses critical societal challenges, positioning investors as key players in creating meaningful change.

In conclusion, the future of real estate investing lies in embracing alternative strategies and remaining agile in a rapidly changing market. By leveraging the insights offered by resources like Zero Flux, investors can make informed decisions, capitalize on emerging trends, and ultimately enhance their investment strategies for sustainable growth and success.