Overview

This article presents nine effective strategies for affordable real estate investments that individuals can implement without delay. It highlights a range of investment methods, including:

- Real Estate Investment Trusts (REITs)

- Crowdfunding

- House hacking

- Tax lien investing

- Utilization of online platforms

Each of these approaches provides accessible and cost-effective pathways for investors to enter the real estate market, all while minimizing financial risks. By leveraging these strategies, readers can confidently navigate the landscape of real estate investment.

Introduction

In the dynamic realm of real estate investment, opportunities abound for those ready to explore innovative strategies and emerging trends. As the market continues to evolve, investors are increasingly turning to affordable avenues such as:

- real estate crowdfunding

- REITs

- house hacking

to maximize returns while minimizing risks. Insights from industry experts and data-driven analysis reveal various strategies that empower both novice and seasoned investors to navigate the complexities of the real estate landscape. By leveraging local connections and utilizing online platforms, the pathways to successful investment are diverse and accessible, ensuring participation in the lucrative world of real estate is within reach for all.

Zero Flux: Daily Insights on Affordable Real Estate Investments

Zero Flux delivers essential daily insights for investors focused on cheap real estate investments. By meticulously curating data from over 100 diverse sources, it empowers subscribers to identify emerging trends and investment options that align with their financial goals. As the property market evolves in 2025, understanding local market conditions becomes increasingly vital for informed decision-making. Zero Flux provides insights into these conditions, aiding individuals in effectively navigating the complexities of the market. The newsletter's commitment to factual reporting empowers readers, particularly in an environment where information overload can obscure the best opportunities.

As Kenon Chen, executive VP of strategy and growth at Clear Capital, observes, "Overall, home affordability remains a challenge, with mortgage rates being triple what they were a few years ago."

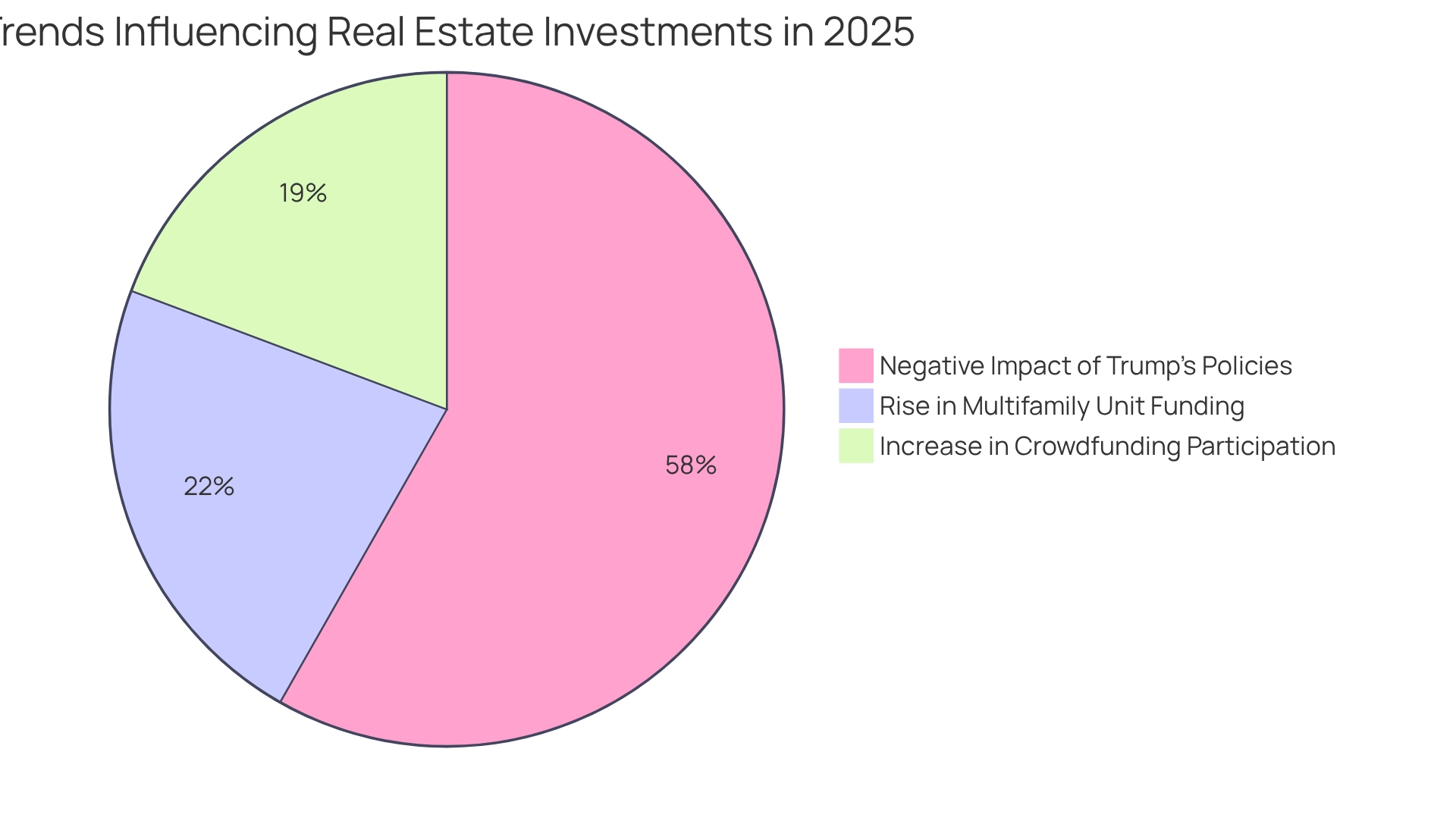

With a focus on cheap real estate investments, Zero Flux equips its audience with the latest market trends, including:

- A 12% increase in involvement in crowdfunding platforms for real assets

- A 14% rise in funding for multifamily units

This ensures they are well-prepared to capitalize on emerging trends, even as 36.25% of people believe that Trump's policies on inflation and tariffs will negatively impact market recovery in 2025.

Real Estate Investment Trusts (REITs): Accessible Investment Options

Real Estate Investment Trusts (REITs) present a compelling opportunity for individuals aiming to diversify their portfolios without the complexities of managing physical properties. With many REITs offering low minimum funding thresholds, they cater to investors with limited capital, thus facilitating cheap real estate investments and making financing more accessible. As we look ahead to 2025, the competitive minimum capital requirements for REITs will continue to empower small investors to participate in the market. Moreover, REITs typically provide dividends, creating a reliable income stream while also benefiting from potential increases in property values.

Current trends indicate that REITs are thriving, with significant funding contributions exceeding $1 trillion through investments in real property loans and mortgage-backed securities. Welltower, in particular, has showcased remarkable performance, trading at a premium of 42.2% above its estimated net asset value (NAV). This premium reflects growing confidence in REITs as a legitimate investment option, suggesting that investors are willing to pay above the underlying asset value, which speaks to a positive market sentiment. For those new to investing, REITs offer a low-risk pathway into cheap real estate investments. Since 2011, REIT leverage has remained below 40%, and the rise in fixed-rate debt has bolstered financial stability while decreasing interest expenses relative to net operating income (NOI). Financial analysts highlight that REITs not only provide economic advantages but also serve as a vehicle for wealth accumulation through property exposure. According to Nareit Research, REITs achieved impressive operational results with record high earnings in 2022, despite their lower stock market valuations. As the market evolves, REITs remain a strategic option for individuals seeking cheap real estate investments while capitalizing on real estate trends without incurring substantial initial costs. Additionally, advocates like David Sullivan underscore the importance of REIT-based assets, reinforcing their relevance within the financial community.

Real Estate Crowdfunding: Pooling Resources for Affordable Investments

Real property crowdfunding platforms have revolutionized the funding landscape by allowing numerous participants to pool their resources for financing real estate projects. This collaborative model empowers individuals to engage in larger properties or developments that might otherwise remain financially out of reach. Platforms such as Fundrise and RealtyMogul cater to small investors, enabling participation with minimal funds, thereby making property financing more accessible than ever.

In 2025, the real property crowdfunding sector is projected to reach a valuation of USD 48.81 billion, highlighting a significant shift towards this funding model. This trend not only diversifies financial portfolios but also opens up opportunities for cheap real estate investments in various property sectors, including residential and commercial. Investors can mitigate their risk by spreading their investments across multiple projects, thereby enhancing their potential for returns.

As noted by industry specialists, 'The transition to crowdfunding signifies a significant alteration in the funding landscape, allowing wider public involvement. Moreover, successful case studies illustrate the effectiveness of crowdfunding in facilitating cheap real estate investments. For instance, individuals who pooled resources through crowdfunding platforms have successfully financed numerous projects, demonstrating the power of collective funding. A notable example is a community-driven initiative that transformed a dilapidated building into affordable housing, illustrating how crowdfunding can effectively address local needs.

As the market continues to expand, experts emphasize that crowdfunding is not merely a trend but a fundamental shift in how cheap real estate investments are approached, positioning it as a viable strategy for wealth creation in 2025. Additionally, understanding the investment term end processes is crucial for participants in cheap real estate investments, as it aids them in navigating the conclusion of their investment terms effectively, ensuring informed decision-making. This knowledge further empowers investors to capitalize on the opportunities presented by crowdfunding.

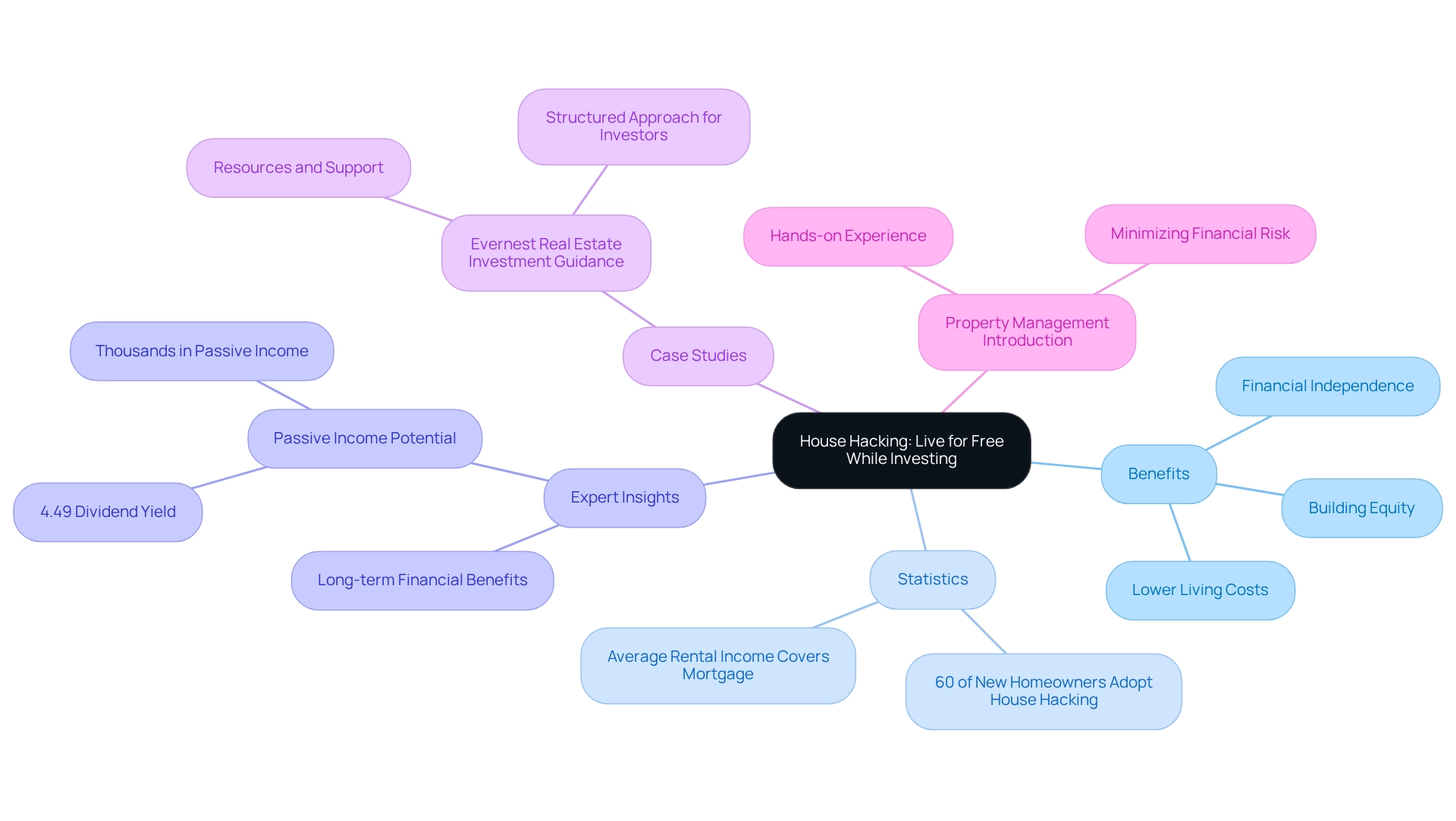

House Hacking: Live for Free While Investing

House hacking is a strategic method where homeowners lease a section of their residence to cover mortgage payments. This approach allows them to live at no cost while simultaneously building equity. Particularly advantageous for first-time buyers, especially those purchasing multi-family properties or single-family homes with additional rooms, house hacking enables individuals to significantly lower their living costs and accelerate their path toward financial independence.

In 2025, house hacking has gained popularity among first-time homebuyers, with many recognizing its potential to generate substantial passive income. Recent statistics indicate that approximately 60% of new homeowners are adopting this strategy, with average rental incomes from house hacking reaching impressive levels. Numerous individuals report producing monthly rental revenue that not only covers their mortgage but also aids in their overall financial expansion.

Moreover, house hacking serves as an excellent introduction to property management and investment for novices. It allows individuals to gain hands-on experience while minimizing financial risk. Successful case studies, like those from Evernest, demonstrate how organized support can assist both new and experienced individuals in navigating the intricacies of property investing effectively. Evernest's resources empower investors to implement house hacking strategies successfully, showcasing the benefits of this approach.

Expert insights emphasize the long-term financial benefits of house hacking. Real estate professionals highlight that this strategy can lead to significant savings and wealth accumulation over time. As Amy Legate-Wolfe notes, "Combined, you could create thousands in passive income, especially with the dividend stock holding a 4.49% dividend yield as of writing." As the market evolves, house hacking remains a viable option for those looking to maximize their investment potential while enjoying the benefits of homeownership.

Tax Lien Investing: Acquire Properties Below Market Value

Tax lien investing presents a unique opportunity to acquire the right to collect unpaid taxes from homeowners. When property owners neglect their tax obligations, municipalities sell tax lien certificates to buyers. These certificates allow stakeholders to earn interest on the owed amount, which can be substantial, with average interest rates in 2025 projected to be around 10-18%. This makes tax lien investments competitive compared to traditional investment avenues.

In states such as Florida, Arizona, Illinois, and Colorado, tax lien investing has gained traction due to favorable regulations that streamline the process and the potential for high returns. For example:

- Florida's laws permit investors to earn up to 18% interest on tax lien certificates.

- Arizona offers a competitive 16% return.

Investors who effectively navigate this landscape can make cheap real estate investments by acquiring assets at a fraction of their market value if homeowners default on their taxes. However, achieving success in this field requires a comprehensive understanding of local laws, particularly those surrounding lien priority. As DebtFreeDr emphasizes, "It’s essential to comprehend local regulations concerning lien priority to effectively oversee your asset."

While the potential rewards are significant, including passive income and asset acquisition, the associated risks must also be carefully evaluated. Investors should be prepared for the possibility of foreclosure and seek professional guidance, especially if they are newcomers to this investment strategy. Case studies, such as those presented by Ted Thomas, illustrate how individuals have successfully leveraged tax lien certificates to attain financial independence. For instance, Thomas outlines methods for acquiring undervalued properties through tax lien investing, enabling individuals to resell them for profit and build wealth over time.

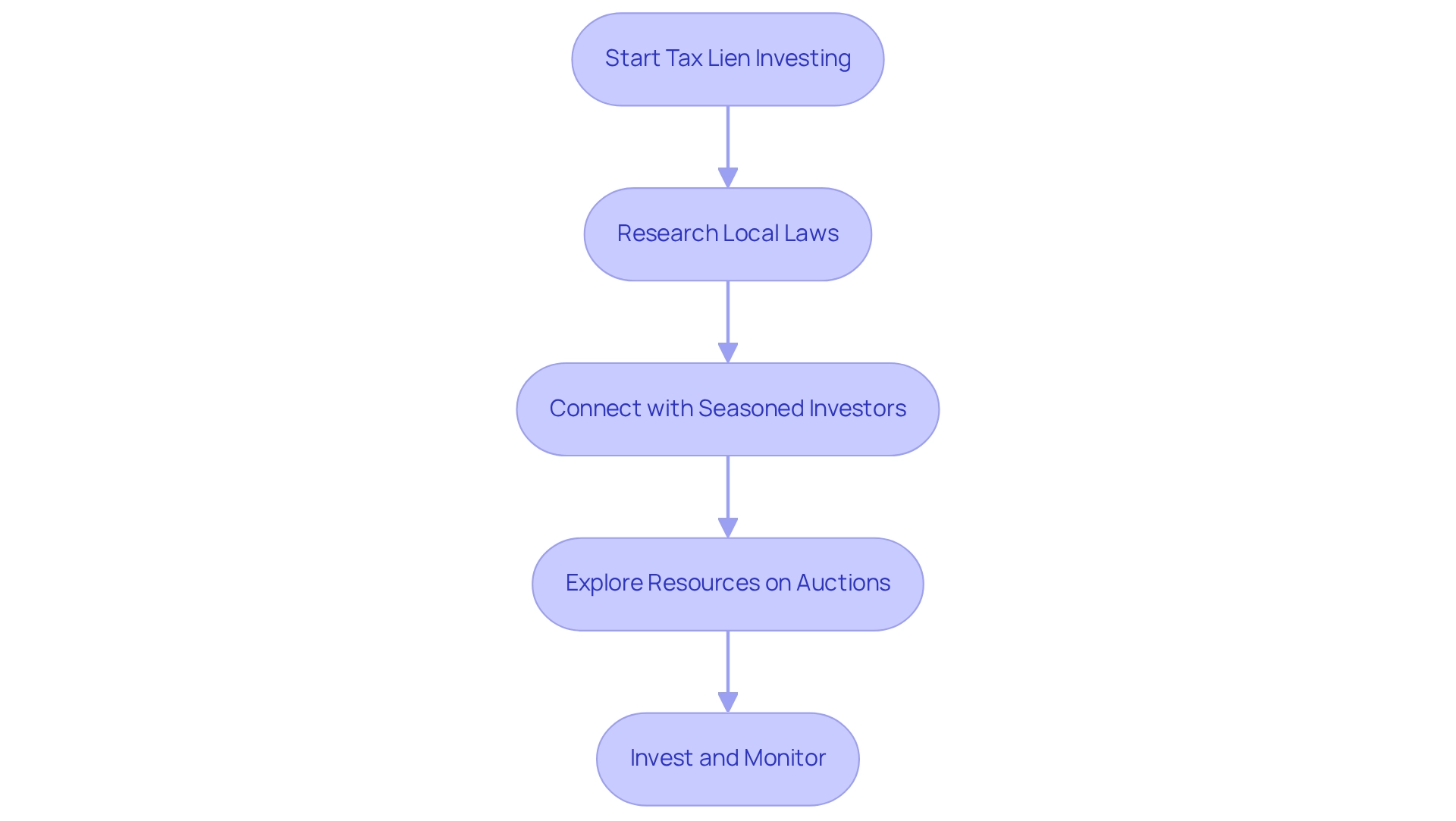

In conclusion, tax lien investing offers an attractive avenue for property buyers looking for cheap real estate investments, provided they are willing to conduct thorough research and understand the associated risks and benefits. To embark on this journey, potential investors should consider:

- Researching local laws.

- Connecting with seasoned investors.

- Exploring resources that provide insights into tax lien auctions and strategies.

With the right approach, tax lien investing can unveil lucrative opportunities in the dynamic real estate market.

Emerging Neighborhoods: Spotting Future Hot Markets

Investors should focus on cheap real estate investments in emerging neighborhoods that show distinct signs of growth, such as the establishment of new businesses, improvements in infrastructure, and significant demographic changes. Key indicators to monitor are:

- Rising property values

- Increasing rental demand

- Active community development initiatives

For example, in Green Bay, WI, the median home price reached $316,100 in Q2 2024, reflecting a 6.6% appreciation from the previous year, alongside a stable population growth of 0.2% and a robust GDP growth of 8.5% in 2022. This data underscores the potential for significant appreciation in similar markets.

Conversely, Peoria, IL, faced a population decline of -0.4% and job growth of -0.8% in Q2 2024, indicating challenges in that market. Such statistics highlight the importance of comprehensive market analysis when identifying favorable neighborhoods for cheap real estate investments. To effectively recognize these areas, individuals can leverage resources such as local market reports and demographic studies. These resources provide essential insights into neighborhood dynamics, enabling investors to make informed decisions about cheap real estate investments and asset allocation.

As Robin Young, a Senior Researcher at Buildium, emphasizes, understanding rental market trends is crucial for identifying areas poised for growth. By entering these markets early, investors position themselves to reap substantial rewards as property values increase and communities thrive.

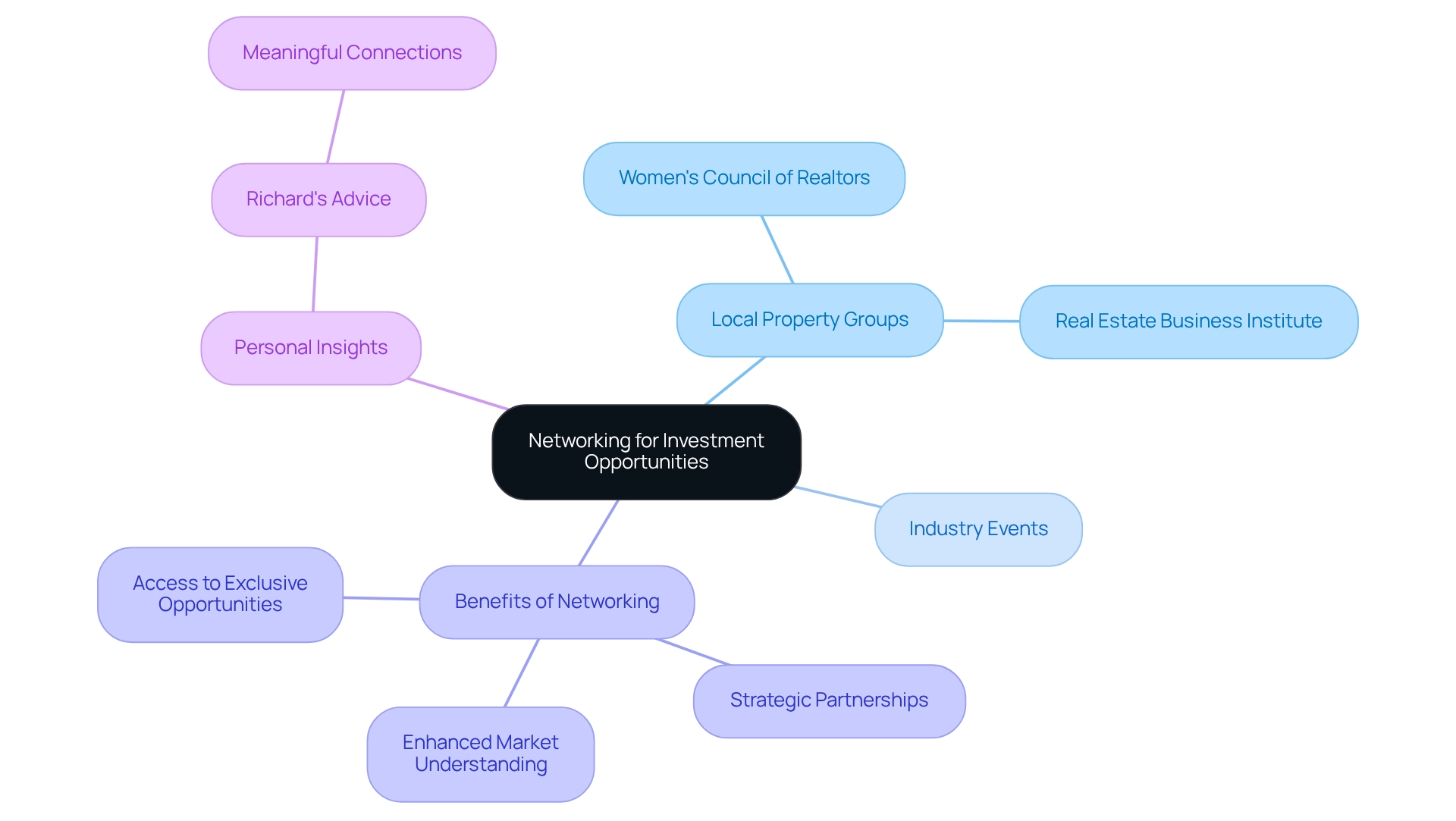

Networking: Leverage Local Connections for Investment Opportunities

Establishing a robust network within the property community is essential for individuals seeking exclusive opportunities and valuable insights. Engaging in local property groups, such as the Women's Council of Realtors and the Real Estate Business Institute, significantly enhances networking skills and access to industry knowledge. Moreover, participating in industry events and connecting with fellow financiers often leads to off-market opportunities and strategic partnerships.

As Richard, a commercial real estate professional, wisely stated, "Don’t be afraid to reach out and make meaningful connections, as they could be the key to your success in commercial real estate." Networking not only deepens one’s understanding of market trends but also fosters relationships that can be advantageous for future investments. By leveraging local connections, stakeholders can gain a competitive advantage in identifying and securing profitable properties. Many successful individuals attribute their achievements to the relationships they’ve nurtured within their communities, underscoring the importance of meaningful connections over merely collecting business cards.

The tangible benefits of networking are evident; numerous financiers have secured exclusive funding opportunities through local connections. By 2025, the impact of these relationships on investment success will be more pronounced than ever, making it imperative for investors to actively engage in their communities to unlock potential deals and insights.

Online Real Estate Platforms: Tools for Finding Deals

Online realty platforms such as Zillow, Redfin, and Realtor.com have fundamentally transformed how investors search for listings and assess market trends. These platforms offer advanced filtering options, enabling users to refine their searches based on crucial factors such as price, location, and type of residence. In 2023, a notable 41% of recent home purchasers initiated their search online, underscoring the growing reliance on digital tools in real estate transactions.

Moreover, many of these platforms are equipped with sophisticated market analysis tools that empower investors to effectively evaluate potential returns and risks. Listings featuring descriptive, keyword-rich descriptions sell 23% faster, highlighting the importance of leveraging these digital resources to enhance visibility and attract buyers. Additionally, high-quality photos elevate the perceived value of a property for 83% of buyers, emphasizing the necessity for effective visual presentation on these platforms.

As technology continues to evolve, including the global adoption of the metaverse by real estate firms in 2023, the future of real estate marketing will be characterized by innovation and advanced strategies. This evolution makes it imperative for individuals to stay informed about the best online platforms available. By 2025, platforms that integrate cutting-edge features will be essential for those aiming to maximize their investment potential. Furthermore, understanding current market conditions, as illustrated in the case study titled "The State of the Market: What's Going On?"—which noted declining sales and rising rental prices—can greatly assist stakeholders in navigating the competitive landscape effectively. As Chris Heller, Chief Real Estate Officer at OJO Labs, emphasized, the reviews and insights available on these platforms can significantly aid stakeholders in making informed decisions.

Real Estate Auctions: Opportunities for Bargain Hunters

Real estate auctions present a compelling opportunity for individuals seeking assets at prices below market value. These auctions often feature foreclosures, estate sales, and properties that have lingered on the market, creating unique prospects for astute buyers. To achieve success, investors must conduct thorough research on both the assets and the auction process itself. Understanding local market dynamics and establishing a clear budget are essential steps in navigating these auctions effectively.

Statistics indicate that assets sold at auction can achieve average discounts of up to 30% compared to traditional sales, a trend supported by recent market analyses. The growing popularity of real estate auctions in the UK exemplifies this shift, as evolving buyer and seller preferences have significantly increased the movement towards auction platforms. This evolution is underscored by compelling market data, which highlights a rising demand for auction services, particularly relevant for stakeholders in 2025.

Effective bidding strategies are vital for capitalizing on these opportunities. Investors should familiarize themselves with the auction format, including bidding increments and the critical importance of timing. Additionally, understanding the nuances of the auctioneer's role can provide insights into the performance and reputation of auctioneers, aiding in informed bidding decisions.

As the auction landscape evolves in 2025, it is imperative for stakeholders to stay informed about emerging trends such as the increasing use of online auction platforms and the growing attractiveness of selling distressed assets. By leveraging expert insights and case studies of successful auction purchases, individuals can refine their approach and secure valuable properties at competitive prices. With the right preparation and strategy, real estate auctions can become a powerful tool for building a robust investment portfolio. For ongoing insights, Zero Flux offers daily updates that can assist investors in staying ahead of auction trends and strategies.

Conclusion

The landscape of real estate investment presents a myriad of opportunities tailored for both novice and seasoned investors. By delving into innovative strategies such as:

- Real estate crowdfunding

- REITs

- House hacking

- Tax lien investing

Individuals can access affordable avenues that maximize returns while minimizing risks. These strategies not only democratize the investment process but also empower investors to make informed decisions grounded in emerging trends and local market dynamics.

As the market evolves, recognizing the potential of emerging neighborhoods and leveraging local connections becomes paramount for success. Engaging in networking within the real estate community can unveil exclusive opportunities and insights, significantly enhancing the likelihood of securing profitable investments. Furthermore, the integration of online platforms and real estate auctions equips investors with valuable tools to identify and capitalize on bargains, thereby broadening the scope of investment possibilities.

In conclusion, the realm of accessible real estate investment is flourishing, driven by innovation and collaboration. With the right knowledge and strategies, investors can adeptly navigate this complex landscape and participate in a lucrative market that was once deemed out of reach. Embracing these affordable investment avenues not only paves the way for financial growth but also fosters a sense of community among investors, reinforcing the notion that success in real estate is attainable for all.