Overview

Central business districts (CBDs) play a crucial role for real estate investors. They typically offer higher property values, superior rental income, and enhanced market stability compared to other areas. CBDs are characterized by high density and robust infrastructure, which attract both businesses and consumers. This makes them prime locations for investment opportunities, particularly during economic fluctuations. Investors should recognize the value of CBDs as they navigate the complexities of the real estate market.

Introduction

In the realm of urban development, Central Business Districts (CBDs) emerge as the pulsating heart of a city, embodying both economic vitality and cultural richness. These bustling hubs extend beyond mere clusters of office buildings and retail spaces; they serve as dynamic environments that attract businesses and professionals alike, owing to their strategic accessibility and robust infrastructure.

For real estate investors, CBDs represent a veritable goldmine of opportunities, characterized by elevated property values, increased rental rates, and a vibrant atmosphere that nurtures both work and leisure. As urban landscapes evolve, grasping the unique characteristics and investment potential of CBDs becomes paramount for navigating the complexities of the real estate market.

This article delves into the significance of CBDs, exploring their defining traits, the impact on investment strategies, and essential steps for evaluating these prime locations for lucrative opportunities.

Define Central Business Districts and Their Importance in Real Estate

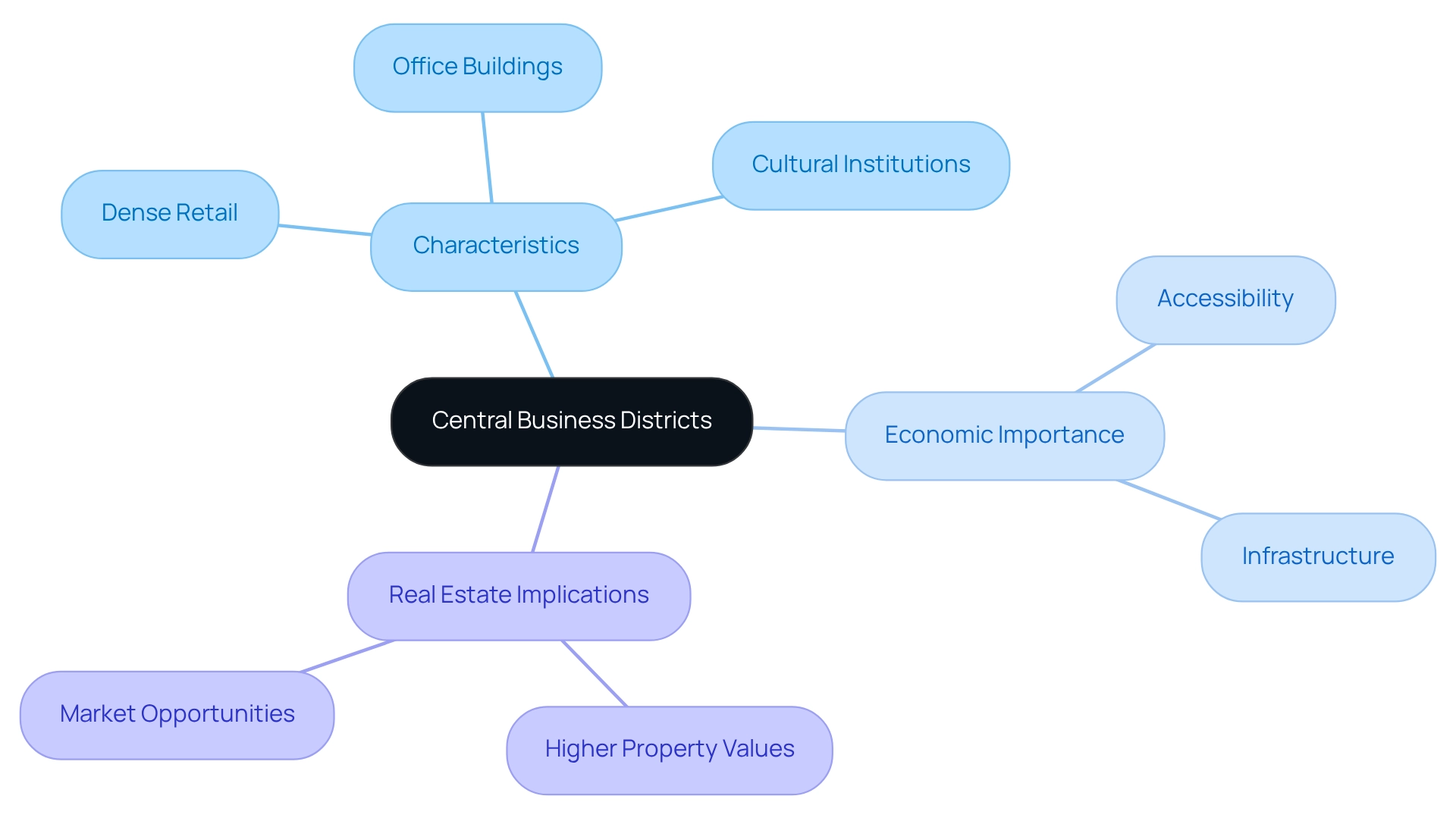

A central business district area serves as the commercial and business nucleus of a city, marked by a dense concentration of retail outlets, office buildings, and cultural institutions. These central business district areas serve as the economic engine of urban regions, attracting companies and professionals due to their superior accessibility and robust infrastructure.

For real estate stakeholders, the central business district area is indispensable, as it usually yields higher property values and rental prices compared to other locales. Understanding the dynamics of the central business district area empowers financiers to identify lucrative opportunities and navigate market fluctuations effectively.

Explore Characteristics and Functions of Central Business Districts

Central business district areas are defined by several key characteristics that underscore their importance in urban economies.

High Density: CBDs are marked by a high concentration of businesses, including corporate offices, retail shops, and entertainment venues. This density in the central business district area fosters a vibrant financial environment, attracting both consumers and investors.

Accessibility in the central business district area is enhanced by well-connected public transportation systems, such as the elevated train network in Chicago's Loop, providing easy access for workers and customers alike. This connectivity enhances the attractiveness of these regions, appealing to a diverse clientele and promoting financial interactions throughout the city.

Serving as hubs of economic activity, the central business district area frequently hosts financial institutions, government offices, and cultural landmarks. This concentration of services and amenities stimulates local economies and encourages investment.

For instance, the Chicago Loop is renowned for its iconic skyscrapers, including the Willis Tower and John Hancock Center, which not only symbolize the vibrancy of the area but also attract considerable business and tourism. The array of eateries, coffee shops, and recreational areas in the central business district area contributes to a lively urban environment, making it a desirable location for both work and leisure.

These characteristics not only enhance the appeal of CBDs for businesses but also lead to increased foot traffic and elevated property values, positioning them as prime locations for real estate investment. As metropolitan areas continue to evolve, understanding these characteristics will be essential for investors seeking to capitalize on opportunities within high-density city environments.

Analyze the Impact of CBDs on Real Estate Investment Strategies

Investing in the central business district area profoundly influences real estate strategies for several key reasons.

- Higher Returns: Properties in CBDs typically generate superior rental income and appreciation rates compared to their suburban counterparts. This trend is underpinned by the ongoing demand for urban living and working spaces, often leading to increased property values. As an investor, recognizing this potential can significantly enhance your portfolio's performance.

- Market Stability: Central business districts exhibit stronger resilience during financial downturns. The national office vacancy rate currently stands at 19.7%, reflecting a slight decrease from the prior month but a rise of 140 basis points year-over-year. This stability positions the central business district area as a more secure investment option, particularly in uncertain economic climates, making it an attractive choice for cautious investors.

- Gentrification Opportunities: Investors can capitalize on city revitalization trends transforming CBDs into vibrant mixed-use destinations. As noted, "Some Central Business Districts are already beginning to embrace change by emulating the more mixed-use, human-scale and amenity-rich environment found in these rapidly growing submarkets." This shift not only enhances property values but also improves the overall quality of life in urban areas, making them more appealing to both residents and businesses.

- Diverse Investment Options: CBDs present a wide array of investment opportunities, ranging from commercial office spaces to mixed-use developments. This diversity enables individuals to customize their portfolios to align with their preferences and risk tolerances, fostering a more tailored investment approach.

Furthermore, Miami's existing pipeline has decreased from 2.9 million to 1.4 million square feet, signaling a change in market dynamics that stakeholders must consider. Understanding these dynamics empowers financiers to devise strategies that leverage the unique benefits offered by the central business district area, ultimately leading to favorable investment outcomes even during economic declines. As CBDs continue to evolve, they will increasingly serve as essential hubs for both work and leisure, reinforcing their significance in real estate investment strategies.

Evaluate Central Business Districts for Investment Opportunities

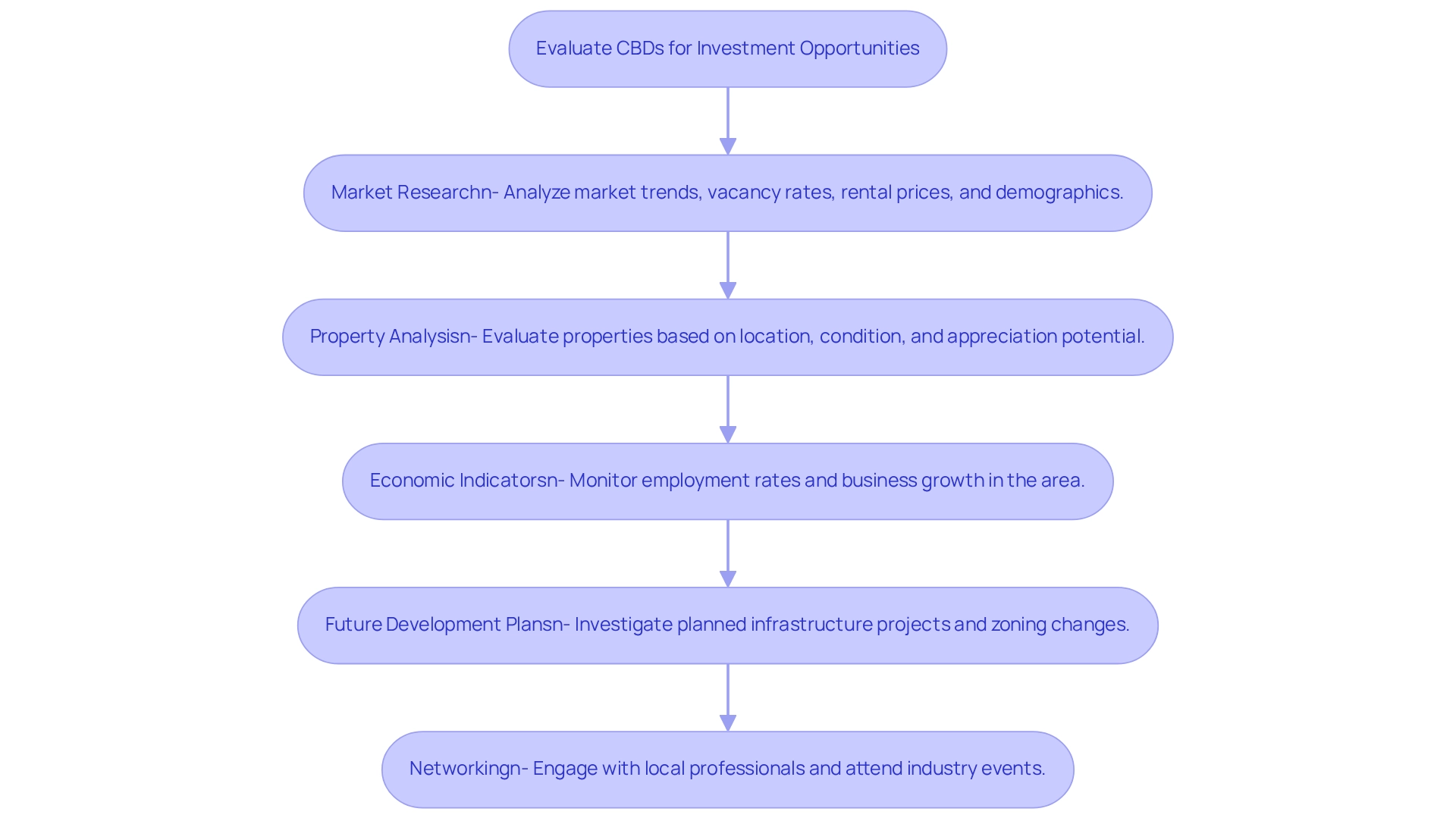

To effectively evaluate Central Business Districts (CBDs) for investment opportunities, investors should follow these essential steps:

- Market Research: Conduct a comprehensive analysis of current market trends, focusing on vacancy rates, rental prices, and demographic shifts within the CBD. As of 2025, vacancy rates in numerous city areas are varying, indicating wider financial conditions and changes in work patterns.

- Property Analysis: Evaluate individual properties by considering their location, condition, and potential for appreciation. Real estate in prime areas frequently produces greater returns, particularly in the central business district area where demand remains strong despite market fluctuations.

- Economic Indicators: Keep a close eye on economic indicators such as employment rates and business growth in the area. For instance, Seattle's office employment grew by 1.6% year-over-year, indicating a gradual recovery; however, the market still faces challenges with 17,500 fewer office jobs compared to June 2022. Additionally, San Francisco's office construction pipeline included 3.2 million square feet, second only to Boston nationally, highlighting significant market activity that can influence property demand.

- Future Development Plans: Investigate any planned infrastructure projects or zoning changes that could enhance the CBD's attractiveness. Cities that encourage multifamily development often experience better population growth and increased foot traffic, which are vital for sustaining property values. Notably, cities with higher concentrations of multifamily housing in urban cores tend to experience better population growth and foot traffic, supporting the overall health of city economies.

- Networking: Engage with local real estate professionals and attend industry events to gain insights into emerging opportunities. Building a network can provide valuable information about market dynamics and potential investment prospects.

As Will Rogers famously said, "Don’t wait to buy real estate. Buy real estate and wait." By adhering to these steps, investors can make informed decisions that align with their investment goals, ensuring they capitalize on the unique opportunities presented by the central business district area.

Conclusion

Central Business Districts (CBDs) are pivotal in the urban landscape, serving as the epicenter of economic activity and cultural vibrancy. Their high density of businesses, exceptional accessibility, and dynamic environments render them highly attractive to both investors and residents. Recognizing the characteristics and functions of CBDs is essential for identifying their potential as lucrative investment opportunities, particularly in a rapidly evolving urban context.

Investing in CBDs presents numerous advantages, such as higher returns, market stability, and the potential for gentrification. These areas exhibit resilience during economic downturns, making them a secure choice for investors seeking long-term growth. Furthermore, the diverse range of investment options available in CBDs allows for tailored strategies that align with individual risk tolerances and preferences.

To effectively navigate the complexities of investing in CBDs, a strategic approach is crucial. Conducting thorough market research, analyzing specific properties, monitoring economic indicators, and staying informed about future development plans are vital steps in identifying and capitalizing on investment opportunities. Engaging with local real estate professionals and networking within the industry can provide valuable insights that enhance decision-making processes.

In conclusion, as urban areas continue to evolve and adapt, the significance of Central Business Districts in real estate investment cannot be overstated. Their unique characteristics and enduring appeal present a wealth of opportunities for those willing to invest wisely. By understanding the dynamics of CBDs and implementing effective evaluation strategies, investors can position themselves for success in this vibrant and lucrative market.