Overview

Central Business Districts (CBDs) play a pivotal role in urban economies, marked by a dense concentration of businesses, infrastructure, and amenities that draw in both enterprises and professionals. Understanding the evolving landscape of CBDs is essential for real estate investors.

Key trends include:

- Mixed-use developments

- The impact of remote work

These trends are reshaping these districts. By staying informed about these changes, investors can navigate market complexities effectively and capitalize on growth opportunities.

The implications of these insights are significant; they not only inform investment strategies but also enhance the potential for success in a dynamic market.

Introduction

At the core of every bustling city lies the Central Business District (CBD), a dynamic epicenter of economic activity that shapes urban landscapes and influences real estate markets. As the demand for commercial spaces evolves, CBDs are not merely adapting to changing work patterns; they are redefining what it means to be a business hub in 2025. From high-rise office buildings to vibrant retail environments, these districts are characterized by a unique blend of accessibility, infrastructure, and cultural amenities.

However, navigating the complexities of investing in CBDs necessitates a keen understanding of current trends, challenges, and opportunities that can impact both businesses and investors alike. With the landscape shifting rapidly, the future of CBDs promises to be as exciting as it is unpredictable, making it imperative for stakeholders to stay informed and engaged.

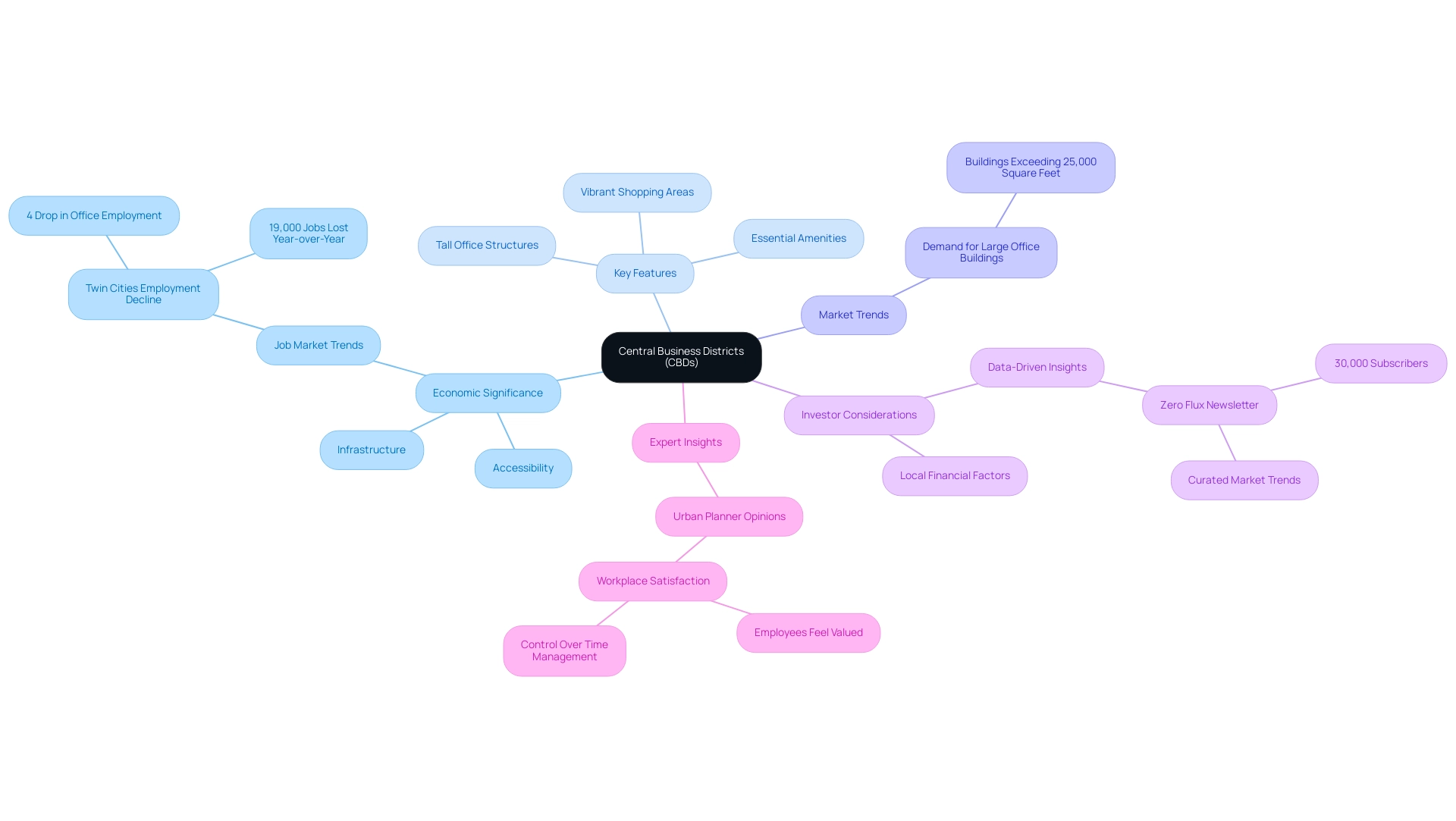

Defining Central Business Districts (CBDs): An Overview

A central business district (CBD) serves as the commercial and economic nucleus of a city, characterized by a dense concentration of retail establishments, office spaces, and cultural institutions. Typically situated in the city center, these areas are crucial to economic activity, attracting enterprises and professionals alike due to their excellent accessibility and robust infrastructure. As we look to 2025, the significance of central business districts (CBDs) in urban real estate remains paramount, evolving in response to changing market dynamics and demographic trends.

The features of central business districts encompass a blend of tall office structures, vibrant shopping areas, and essential amenities that cater to both businesses and residents. These districts often boast well-developed public transportation systems, making them attractive locations for companies aiming to enhance employee accessibility and operational efficiency. Recent data indicates that office buildings within central business districts, particularly those exceeding 25,000 square feet, are in high demand, reflecting a broader trend of urbanization and the preference for centralized workspaces.

Investors must also consider the current statistics surrounding cannabis businesses in major cities. For instance, the Twin Cities recently experienced a notable decline in office employment, with a 4% drop translating to approximately 19,000 jobs lost year-over-year. Such shifts underscore the importance of remaining aware of local market conditions and employment trends when assessing investment opportunities in central business district (CBD) areas.

This decline highlights the necessity for investors to analyze how local financial factors can influence the vitality of the central business district (CBD).

Expert opinions from urban planners emphasize that a well-defined central business district (CBD) not only enhances the economic vitality of a city but also contributes to its overall livability. As one planner noted, "A high-performing workplace makes employees feel valued and empowered," underscoring the intrinsic link between CBD characteristics and workforce satisfaction. This quote illustrates the importance of creating environments that support both business and employee needs.

Moreover, Zero Flux, a specialized daily newsletter with over 30,000 subscribers, serves as a vital resource for real estate professionals and investors. By curating essential market trends and insights from over 100 diverse sources, Zero Flux exemplifies how data-driven insights can assist investors in understanding the central business district (CBD) and making informed decisions.

In summary, grasping the definition and features of the central business district (CBD) is essential for real estate investors seeking to navigate the complexities of city markets. By leveraging data-driven insights and case studies, investors can make informed decisions that capitalize on the unique opportunities presented by the central business district (CBD) in 2025.

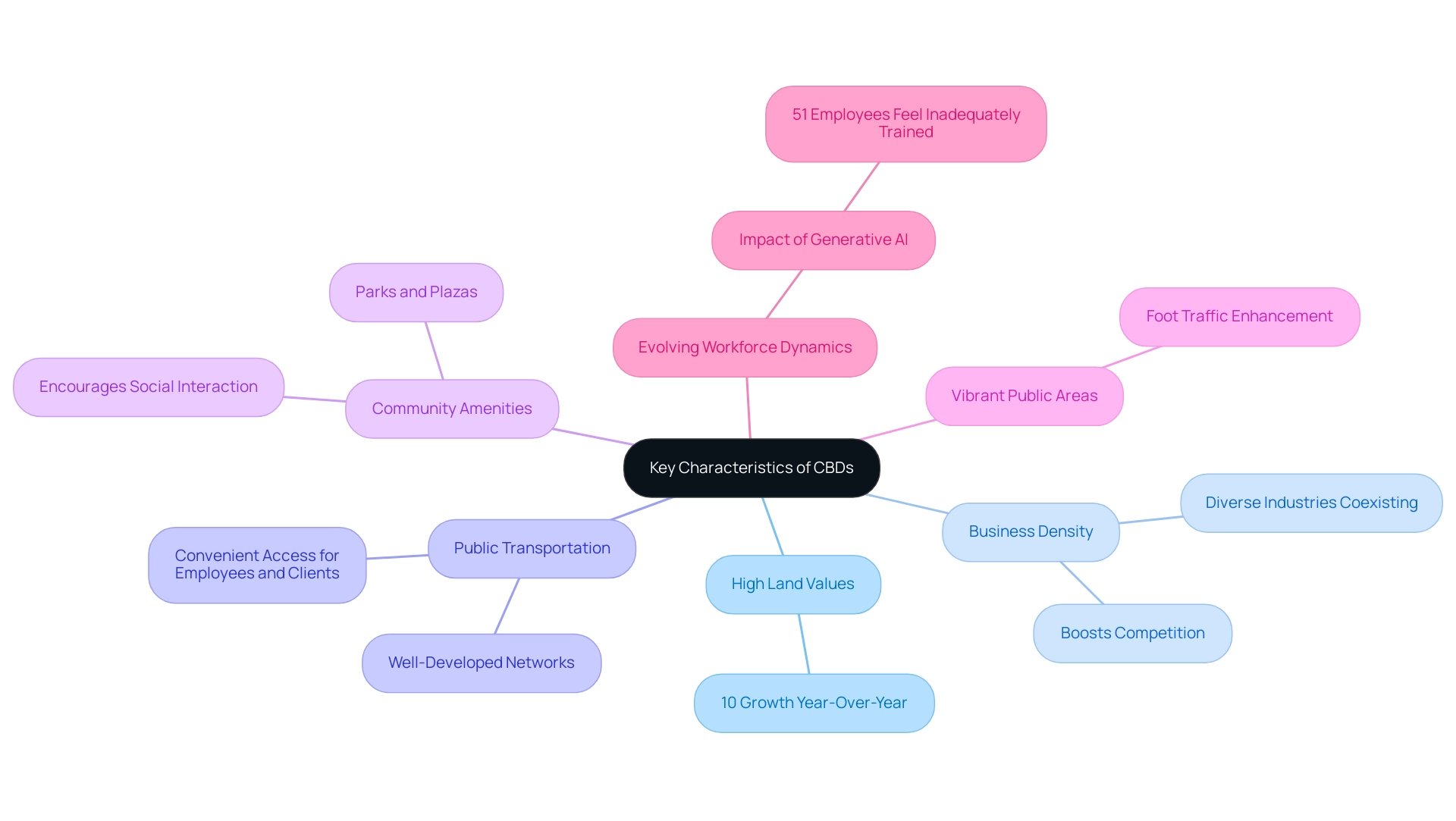

Key Characteristics and Features of CBDs

Central Business Districts (CBD) are characterized by several distinctive features that render them pivotal in urban real estate. These areas typically command high land values, reflecting their desirability and financial significance. A hallmark of the central business district (CBD) is a dense concentration of businesses, where a diverse array of industries coexists, fostering a vibrant economic ecosystem.

This concentration not only boosts competition but also cultivates an atmosphere that attracts both consumers and investors. Successful central business district (CBD) areas are often distinguished by their well-developed public transportation networks, facilitating convenient access for employees and clients alike. The presence of iconic skyscrapers, along with a blend of commercial and residential spaces, contributes to the unique skyline and city fabric of these districts.

Moreover, vibrant public areas, such as parks and plazas, encourage foot traffic and social interaction, further enhancing the appeal of the central business district (CBD). By 2025, the features that entice investors to the central business district (CBD) will include their accessibility and the potential for high returns on investment. As urban populations continue to grow, the demand for space in the central business district (CBD) is anticipated to rise, driving land values even higher.

Recent statistics reveal that land values in the central business district (CBD) have experienced a significant increase, with some areas reporting growth rates exceeding 10% year-over-year.

Expert insights indicate that the most successful central business district (CBD) areas are those that prioritize business density while also investing in infrastructure and community amenities. A recent survey of executives from major real estate firms highlighted that 75% believe improving public spaces and transportation options is essential for the future success of central business district (CBD) areas. This perspective aligns with the current economic context, where potential risks loom due to changing economic policies under a new presidential administration, and population migration trends favor the Sun Belt.

Furthermore, the evolving landscape of work, influenced by generative AI, is reshaping city dynamics. According to Deloitte Global, only 51% of employees feel their employers are adequately training them on the capabilities and benefits of generative AI, suggesting a shift in workforce expectations that could impact central business districts.

Additionally, case studies on recent developments in cities like Austin and Miami illustrate how strategic investments in city planning and community engagement can transform the central business district (CBD) into a thriving hub of activity. Following a notable drop in M&A activity in 2023, signs of recovery are emerging, with many executives expressing intentions to enhance M&A efforts in the upcoming year, focusing on improving organizational capabilities rather than merely enlarging property portfolios.

Understanding these traits is vital for real estate investors aiming to navigate the complexities of city markets. By recognizing the characteristics that define successful commercial districts, investors can make informed decisions that align with current trends and future growth potential.

The Economic Importance of Central Business Districts

Central Business Districts (CBD) are vital drivers of financial development in urban areas. These areas serve as lively centers for commerce, attracting a varied range of enterprises that not only generate jobs but also energize local economies. The concentration of services, amenities, and infrastructure within CBD areas significantly boosts their attractiveness, resulting in heightened property values and a wealth of investment opportunities.

In 2025, the economic importance of CBDs is underscored by their ability to adapt to changing market dynamics. Despite a notable 94.2% drop in the dollar value of IPOs in 2022, the resilience of commercial and industrial loans indicates that small businesses continue to thrive, seeking capital for growth within these districts. This trend emphasizes the ongoing significance of CBD areas as critical locations for real estate investment.

As Tess Thorman, a Research Associate at the Public Policy Institute of California, points out, comprehending the interaction of financial factors is essential for tackling problems such as poverty and inequality, which are frequently intensified in urban environments. Furthermore, the CBD is often the focal point for significant public and private investments, which stimulate further growth and revitalization efforts. Such investments not only improve the physical environment but also aid in job creation, with statistics indicating that CBDs are responsible for a significant portion of employment opportunities in urban areas.

The case study titled 'IPO Market and Loan Accessibility' illustrates that while the issuance of IPOs has faced challenges, the value of commercial and industrial loans remains strong, indicating that small businesses continue to find necessary capital for growth. As cities evolve, the role of CBDs in fostering financial vitality becomes increasingly pronounced, making them a strategic consideration for investors. Economists emphasize that the economic impact of CBDs extends beyond mere job creation; they are pivotal in shaping local economies and driving innovation.

Building flexible educational and workforce systems is critical to help Californians access valuable skills and job opportunities, further enhancing the labor market within these districts. By understanding the dynamics of CBDs, investors can better navigate the complexities of the real estate market and capitalize on the growth potential these areas offer. As the landscape continues to shift in 2025, the insights gained from analyzing CBDs will be invaluable for making informed investment decisions.

Challenges and Opportunities for Investors in CBDs

Investing in the central business district (CBD) presents a complex environment filled with both challenges and opportunities. Investors encounter significant hurdles, including market volatility, which has been exacerbated by shifting work patterns and economic fluctuations. The competition for prime locations remains fierce, particularly as the demand for office space evolves in response to remote work trends.

For instance, the migration of the entertainment industry to areas like Century City has prompted law firms and financial services to reconsider their downtown presence, further impacting traditional CBD dynamics. Notably, the General Services Administration recently reversed plans to sell nearly 80 million square feet of federal property, highlighting the ongoing shifts in market dynamics affecting the central business district (CBD). Despite these challenges, the central business district (CBD) presents lucrative opportunities for savvy investors.

The potential for high rental yields is particularly appealing, especially in urban areas experiencing ongoing urbanization. Mixed-use developments are gaining traction, catering to a diverse range of tenants and enhancing the vibrancy of these districts. As cities adapt to new patterns of office use, proactive engagement with owners, developers, and city authorities becomes essential for investors looking to capitalize on emerging trends.

Moreover, the recent enhancement of leadership teams in firms like IRR underscores the importance of strategic initiatives in navigating the evolving real estate landscape. This enhancement, led by seasoned industry professionals, is expected to drive IRR's strategic initiatives and improve its service offerings in the real estate sector. With over 30,000 subscribers relying on data-driven insights from Zero Flux, investors are encouraged to conduct thorough market research and risk assessments to effectively navigate these dynamics. By staying informed about market volatility and leveraging expert opinions, investors can better position themselves to seize opportunities within commercial districts, ensuring their investments align with the latest trends and demands in the real estate sector.

Future Trends and Developments in Central Business Districts

The future of the central business district (CBD) is poised for transformation, driven by several pivotal trends. One of the most significant developments is the rise of mixed-use projects that seamlessly integrate residential, commercial, and recreational spaces. These developments not only enhance city living but also foster vibrant communities that attract diverse demographics.

As remote work continues to gain traction, the CBD is likely to adapt by enhancing its appeal through improved public spaces and amenities. This change is essential, as it enables these areas to remain significant and attractive to both companies and residents. For instance, cities are increasingly investing in green spaces and pedestrian-friendly areas, which are vital for creating a more inviting urban environment.

The U.S. Chamber of Commerce promotes policies that assist small enterprises, aiming for a minimum of 3% yearly real economic growth—essential for the continuous development of the CBD. Additionally, the number of new applications for enterprises surged to 5.2 million in 2024, underscoring the economic growth potential within the CBD and its significance to real estate investment. Sustainability and smart city initiatives are also anticipated to play a critical role in the development of CBD areas.

With a growing emphasis on eco-friendly practices, investors should recognize how these initiatives can enhance property values and attract environmentally conscious tenants. The incorporation of technology in city planning, such as smart traffic management and energy-efficient structures, will further elevate the attractiveness of the CBD.

As noted by Spotify, improving public spaces has resulted in a 20% rise in employee satisfaction and a 15% decrease in attrition rates within a year of implementation. This highlights the significance of creating appealing environments for enterprises and residents alike. Investors should closely monitor these trends to uncover new opportunities in the market. The increasing number of mixed-use projects in the CBD reflects a broader transition toward establishing multifunctional urban spaces that cater to the evolving needs of residents and enterprises.

As the landscape of the CBD continues to evolve, staying informed about these changes will be essential for making strategic investment decisions. Furthermore, transforming downtowns will help ensure they shift from traditional business districts into hubs for connectivity, recreation, and discovery.

Conclusion

Central Business Districts (CBDs) stand at the forefront of urban economic activity, evolving to meet the demands of 2025. These dynamic epicenters, as highlighted throughout the article, not only foster business growth but also enhance the quality of urban living through their unique blend of commercial, residential, and cultural spaces. Investors and businesses must navigate the complexities of market volatility and changing work patterns, which have become increasingly pronounced in recent years.

The challenges faced by CBDs—including competition for prime locations and shifts in workforce dynamics—are accompanied by significant opportunities. High rental yields, the rise of mixed-use developments, and the potential for revitalization through strategic investments offer promising avenues for savvy investors. Furthermore, the emphasis on sustainability and smart city initiatives underscores the importance of adapting to modern expectations, making CBDs attractive for both businesses and residents.

Looking ahead, the future of CBDs is not solely about economic growth; it also involves creating vibrant, inclusive communities. The integration of public spaces, green initiatives, and technology will play a critical role in shaping these districts into multifunctional hubs. As these trends unfold, staying informed and engaged will be essential for all stakeholders involved. The evolving landscape of CBDs promises to redefine urban living, making them pivotal in shaping the cities of tomorrow.