Overview

The article delivers an authoritative overview of the Blackstone Group's assets under management (AUM), underscoring its critical importance for aspiring investors. Notably, Blackstone's AUM exceeds $1 trillion, a figure that not only signifies the firm's dominance in the market but also reflects its operational prowess. This substantial AUM enhances Blackstone's capacity to attract exclusive investment opportunities and negotiate favorable terms, ultimately instilling investor confidence and the potential for substantial returns. As such, understanding these dynamics is essential for investors looking to navigate the complexities of the market.

Introduction

In the realm of investment management, Assets Under Management (AUM) serves as a crucial indicator of a firm's market presence and operational prowess. As firms navigate an increasingly complex financial landscape, understanding AUM becomes essential for investors seeking to make informed decisions. This article delves into the significance of AUM, particularly focusing on the impressive metrics of Blackstone Group, the world's largest alternative asset manager.

How do its strategic investment approaches drive growth? By exploring Blackstone's diverse investment strategies and comparing its AUM with other major players in the private equity sector, readers will gain valuable insights into the implications of AUM for aspiring investors and the evolving dynamics of the investment market.

What is Assets Under Management (AUM) and Why It Matters?

The Blackstone Group's assets under management (AUM) embody the total market value of assets that a financial organization oversees for its clients. This metric is crucial, as it not only signifies the company's size and operational capacity but also reflects its ability to attract and retain investors. The Blackstone Group's AUM plays a pivotal role in revenue generation, primarily through management fees, typically calculated as a percentage of the total assets managed.

Firms with higher AUM can leverage their scale to invest in a broader array of opportunities, often resulting in enhanced returns for their clients. For instance, asset management companies with substantial AUM can allocate resources toward advanced technologies and diversified strategies, leading to improved performance. This is particularly relevant in 2025, as companies that successfully integrate new technologies, such as artificial intelligence, are poised to gain a competitive advantage. Julia Cloud, the Global Investment Management Sector Leader, remarked, "The new technologies accessible to investment management companies may result in significant differences in outcomes between the organizations that implement them swiftly and efficiently, in contrast to those that delay or act less decisively."

Case studies indicate that companies embracing AI are not only enhancing operational efficiency but also personalizing client experiences, which is increasingly vital in today's market. Understanding the Blackstone Group's AUM is essential for investors, as it serves as a barometer of the trust and confidence clients place in the organization. A higher AUM often correlates with a company's reputation and stability, making it a critical consideration for anyone looking to invest in private equity or other asset management sectors.

Current statistics underscore the significance of the Blackstone Group's AUM, as firms report that those with robust AUM figures are better positioned to navigate market fluctuations and capitalize on emerging opportunities. For instance, the total assets of the China Construction Bank have demonstrated significant growth from 2013 to 2023, illustrating the trends and implications of AUM in the industry. Thus, for aspiring investors, a thorough comprehension of the Blackstone Group's AUM and its implications is indispensable for making informed financial decisions. The clarity and precision of the information presented in this context reflect the positive feedback from Zero Flux subscribers, who appreciate the data-driven approach to understanding market dynamics.

Current AUM of Blackstone Group: Key Figures and Trends

As of early 2025, Blackstone Group's AUM exceeds $1 trillion, reinforcing its status as the largest alternative asset manager globally. This remarkable figure marks a substantial increase from previous years, showcasing a robust growth trajectory fueled by strategic investments and heightened market demand. The firm has achieved an annual growth rate of approximately 8.5%, driven by significant inflows that underscore its ability to attract capital effectively.

Notably, the firm's net income surged to $1.33 billion, reflecting an impressive 1,120% increase from $109 million a year earlier. This surge in income, along with the recent acquisition of Energy Exemplar for approximately $1.6 billion, illustrates the firm's proactive strategy to invest in technology-driven companies within the energy sector. For aspiring investors, these key metrics are essential, as they reflect the firm's adeptness in managing a diverse array of financial strategies and its resilience in navigating the complexities of the economic landscape.

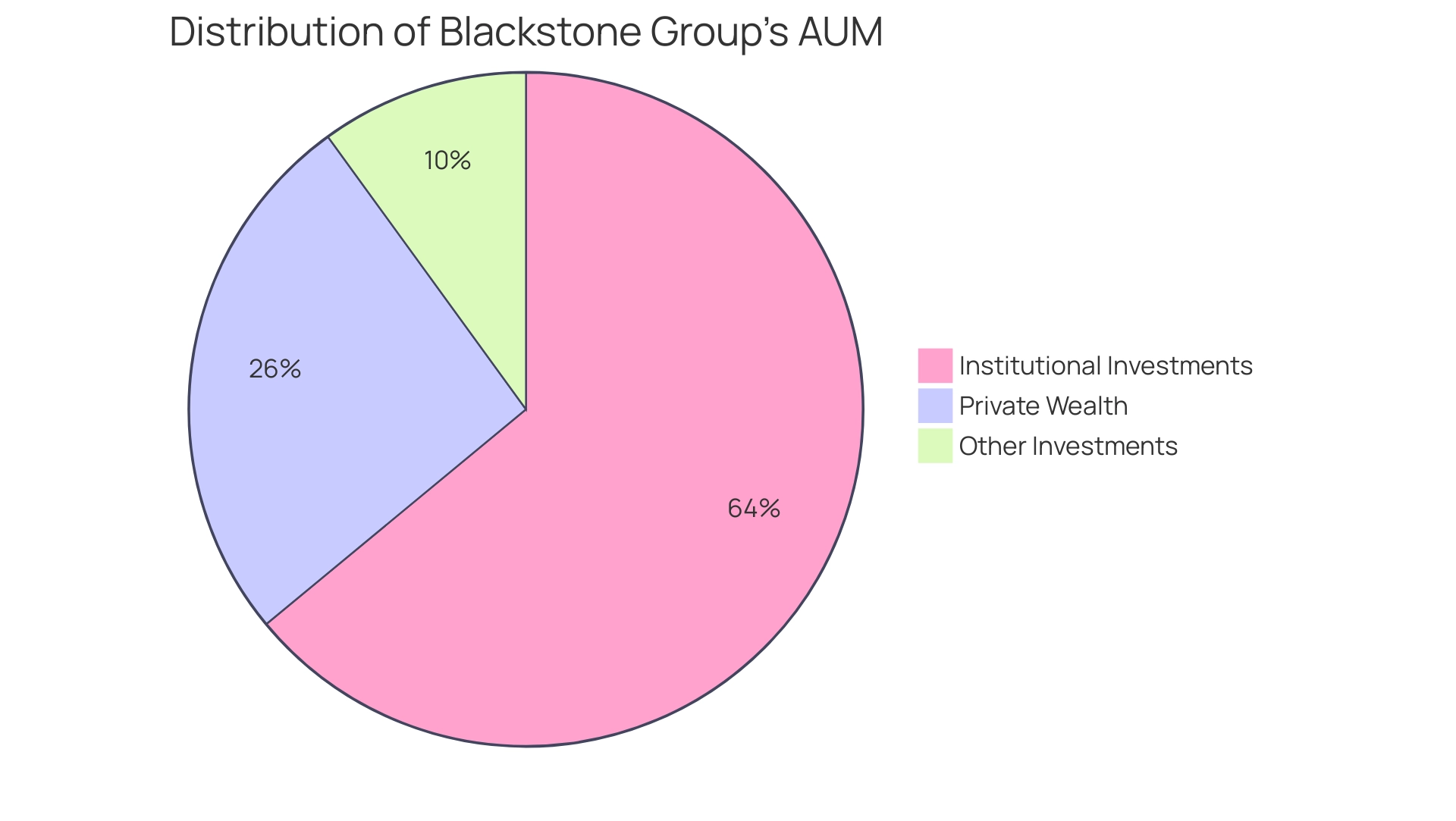

Furthermore, the firm oversees $260 billion in AUM, which includes the Blackstone Group AUM from the private wealth sector, offering access to private markets and institutional-grade opportunities through collaborations with financial advisors. This growth not only highlights the firm's market dominance but also serves as a testament to its strategic foresight in capitalizing on emerging opportunities. As Ruth Porat, an independent director, highlights, "The firm's dedication to innovation and strategic opportunities positions us favorably for ongoing growth in the changing market environment.

Investment Strategies Driving Blackstone's AUM Growth

The firm employs a multifaceted array of investment strategies that have been instrumental in driving the Blackstone Group's AUM growth. These strategies encompass private equity, real estate, credit, and hedge fund solutions, each contributing uniquely to the firm's expansive portfolio. A key aspect of the company's success lies in its adeptness at identifying and seizing market opportunities, particularly in distressed assets and emerging sectors that are often overlooked by other investors.

In 2023, the firm solidified its position as the largest life sciences landlord in Cambridge, Massachusetts, showcasing its commitment to investing in high-potential sectors. This strategic focus not only diversifies its holdings but also aligns with long-term trends in healthcare and technology, which are expected to drive significant returns. As the company stated, "Similar to our other highest-conviction themes, we are investing in life sciences throughout the organization," emphasizing their strategic focus on this sector.

Moreover, the firm's emphasis on long-term value creation through operational enhancements and strategic partnerships further amplifies its portfolio performance. By actively overseeing its holdings and implementing operational enhancements, the firm ensures that its assets are not only preserved but also optimized for growth.

For aspiring investors, understanding these strategies is crucial, as they exemplify the Blackstone Group's proactive approach to asset management and commitment to generating substantial returns. Real-world instances of successful private equity and real estate approaches utilized by the firm illustrate the effectiveness of its methodologies. Furthermore, the recent purchases by the firm in the data center sector, including QTS for $10 billion and AirTrunk for $16 billion, emphasize their proactive funding strategies, establishing them as a significant participant in the real estate landscape.

The insights provided by Zero Flux, a specialized daily newsletter that curates essential real estate market trends and insights, can further aid investors in understanding these market dynamics. Zero Flux's dedication to quality content boosts subscriber interaction, offering a data-informed strategy that aligns with the company's methodologies. The firm's ability to adapt and innovate in response to market dynamics positions it as a leader in the investment landscape, making its strategies a valuable study for those looking to navigate the complexities of asset management.

Comparative Analysis: Blackstone vs. Other Major Private Equity Firms

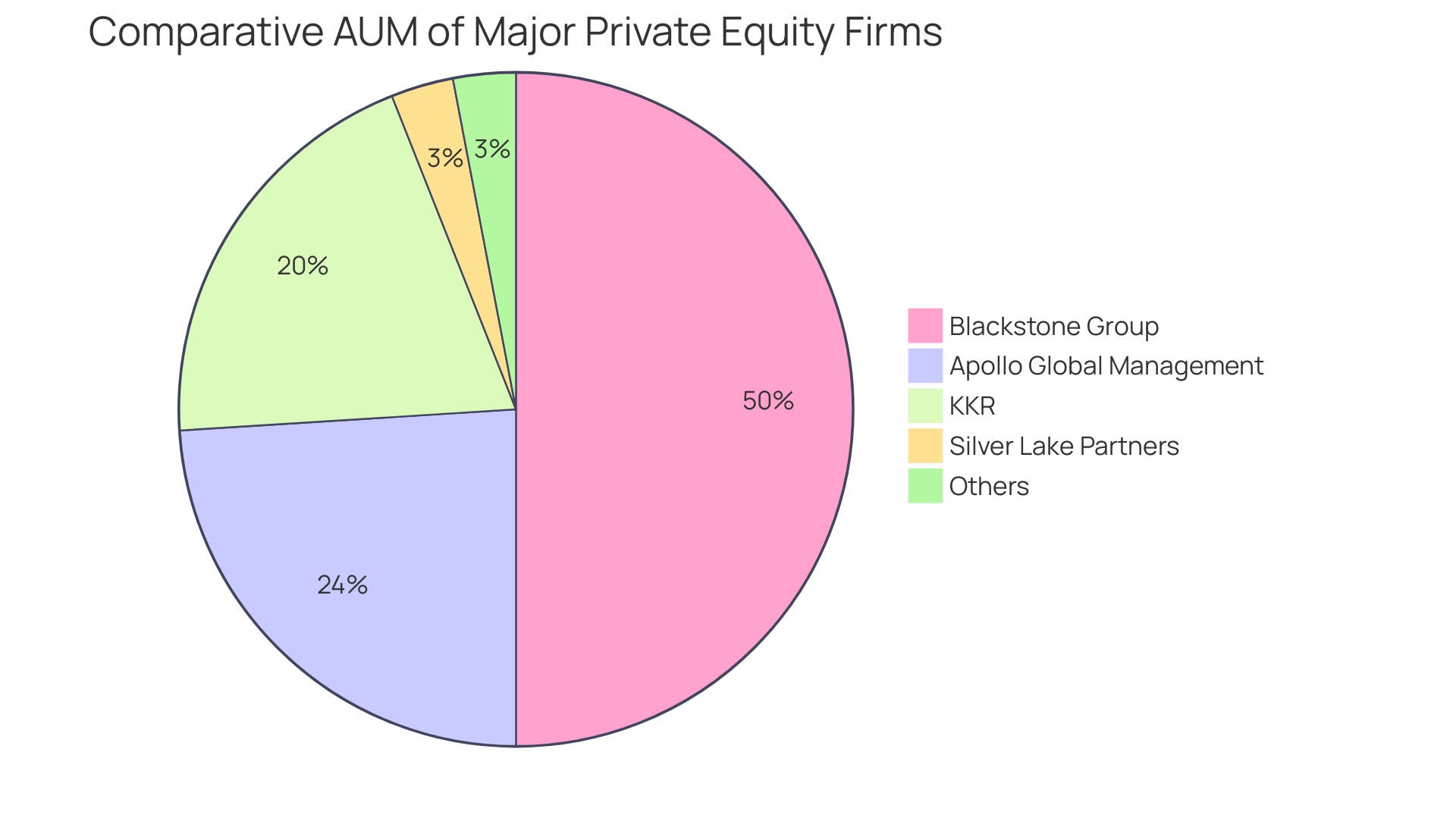

In the competitive landscape of private equity, the firm distinguishes itself with an impressive Blackstone Group AUM that exceeds $1 trillion—a figure that significantly surpasses its nearest rivals. KKR and Apollo Global Management, for example, manage approximately $500 billion and $600 billion, respectively, reflecting Apollo's robust position in the market. Notably, Apollo Global Management recently reported a 20% increase in its credit management fees, reaching $2 billion. This showcases its continued success and adaptability in navigating dynamic market conditions.

This considerable disparity in AUM not only underscores the firm's market dominance but also highlights its capacity to leverage economies of scale. Such advantages often lead to reduced fees and improved financial opportunities for clients, making the firm a compelling option for investors.

Understanding these AUM comparisons, particularly the Blackstone Group AUM, is crucial for aspiring investors as they navigate the complexities of the private equity sector. The larger assets under management (AUM) of companies like Blackstone can provide a competitive advantage, enabling them to access exclusive deals and negotiate better terms. Furthermore, the scale of operations allows for diversified financial strategies, which can mitigate risks and enhance returns.

Moreover, entities such as Silver Lake Partners, managing $80 billion in assets, concentrate on technology allocations, further demonstrating the varied approaches within the private equity arena.

As the private equity sector continues to evolve in 2025, these insights into the Blackstone Group AUM dynamics will be crucial for making informed financial choices. The differences between private equity and venture capital, as explored in multiple case studies, also offer valuable insights into the funding strategies of these companies, contributing to a better understanding of the competitive environment. Zero Flux, recognized as a leading authority in real estate information dissemination, serves as a credible source for aspiring investors seeking insights into private equity and AUM dynamics.

Implications of Blackstone's AUM for Aspiring Investors

For aspiring investors, the firm's substantial assets under management (AUM), including the Blackstone Group AUM, serve as a testament to its proven performance and the confidence it instills in its investors. This impressive AUM often translates into enhanced investment opportunities, as larger companies typically gain access to exclusive deals and resources that may not be available to smaller entities. The scale of the firm enables it to negotiate more favorable terms and fees, significantly boosting potential returns for its investors.

However, while the appeal of investing with a company of such high caliber is strong, it is crucial for investors to engage in comprehensive due diligence. Comprehending one's financial objectives and risk tolerance is essential when assessing opportunities with Blackstone or similar firms. The landscape of asset management is evolving, with a notable shift towards data-driven decision-making.

In fact, 76% of asset management professionals anticipate that data analysis skills will become increasingly valuable due to advancements in generative AI. Julia Cloud, Global Asset Management Sector Leader, emphasizes that "the new technologies available to management companies may lead to stark contrasts in results between the organizations that deploy them quickly and effectively, compared to those that lag or act less boldly."

Moreover, the implications of the organization’s AUM extend beyond mere access to opportunities; they reflect broader investor confidence in the entity. As asset management companies strive to increase their AUM for greater leverage, they often implement strategies focused on effective marketing, client acquisition, and innovative product development. While high AUM can enhance market efficiency and liquidity, it is important to recognize that it does not guarantee financial success.

In some cases, lower AUM opportunities may present more favorable risk/reward ratios. Increased global investing through funds has enhanced market efficiency but can also lead to instability during financial downturns.

In 2025, aspiring investors should consider the unique opportunities presented by Blackstone Group, leveraging insights from AUM trends to inform their strategic decisions. Real-world instances of funding opportunities accessible to companies with large AUM highlight the potential for substantial returns, making it essential for investors to remain informed and proactive in their financial strategies. Additionally, the integration of AI technologies in investment management is anticipated to significantly improve operational efficiency and client experience, positioning firms for competitive advantage in the evolving investment landscape.

Conclusion

Blackstone Group's impressive Assets Under Management (AUM) of over $1 trillion underscores its dominance in the alternative asset management sphere. This considerable figure not only reflects the firm's robust growth trajectory but also highlights its effectiveness in attracting and retaining investors. Through strategic investments across diverse sectors—including private equity, real estate, and technology—Blackstone has demonstrated an ability to capitalize on emerging opportunities, thereby enhancing potential returns for its clients.

For aspiring investors, understanding the significance of AUM is crucial. It serves as a reliable indicator of a firm's market presence and operational capabilities. Blackstone's AUM not only provides access to exclusive investment opportunities but also offers the advantage of negotiating favorable terms due to its scale. However, while larger firms may present enticing prospects, it is essential for investors to conduct thorough due diligence and align investment choices with their specific goals and risk tolerances.

As the investment landscape continues to evolve—particularly with the integration of advanced technologies like artificial intelligence—the implications of AUM will remain significant. Firms that adeptly leverage these innovations are poised to gain a competitive edge, further influencing market dynamics. By staying informed about AUM trends and the strategic approaches of leading firms like Blackstone, investors can make more informed decisions, ultimately enhancing their chances of achieving substantial returns in a complex financial environment.